Ohhh Omicron! From Panic to Possibility

December 1, 2021 at 12:33 pm 6 comments

If you have recovered from your Thanksgiving turkey and stuffing food coma, you have probably woken up to the sound of a new health scare alarm …Omicron. Where does the name Omicron come from, and why is it named after a Greek alphabet letter? The short answer is the system was created to avoid public confusion with complicated scientific names (e.g., B.1.1.529) and also to mitigate the stigma assigned to a region of origination. Apparently, Spaniards weren’t happy with the name “Spanish Flu” and China didn’t appreciate the “Wuhan Virus” moniker. More specifically, Omicron is the new COVID variant originating from South Africa and believed to be more contagious than other forms of COVID, albeit potentially not as severe.

I am not an epidemiologist and also not a COVID expert, but I do know it is a little early to panic over something scientists have not fully researched with fewer than 100 identified cases as of last week. The good news is that early data is showing mild symptoms in infected individuals and the vast majority of these people impacted by Omicron have been unvaccinated (87%), therefore implying the vaccines are indeed providing protection.

Omicron isn’t the first COVID variant and will likely not be the last. Like the flu, which produces new strains every year, new COVID strains such as Omicron are likely to surface on a regular basis. Luckily, our country is home to the world’s most prolific vaccine makers and reformulated boosters are likely to be a common staple in our healthcare regimen. In fact, the CEO of Pfizer, Inc. (PFE) believes it’s possible to have an Omicron vaccine in 100 days, if needed.

Even if Omicron ends up spreading faster than other variants like Alpha, Beta, Gamma, Delta, Lambda, Mu, and Nu, our healthcare system is much better equipped to deal with Omicron compared to previous pandemic variants. Not only do we have access to the strongest supply of vaccines on the planet, but the United States also has built a stronger testing infrastructure (the CDC shows more than 13 million tests conducted over the last week, excluding California). What’s more, pharmaceutical companies have created very effective therapeutics, including Paxlovid, a game-changing antiviral pill manufactured by Pfizer. The recent Paxlovid trial conducted in combination with the antiviral drug ritonavir showed a reduction in hospitalization and deaths by -89%.

Another fortunate aspect to this new variant is that the rise of Omicron is occurring amidst an improving backdrop of plummeting hospitalizations and COVID-related deaths here in the U.S. (deaths after the recent surge are down more than -50%).

Markets Remain Near Record Highs

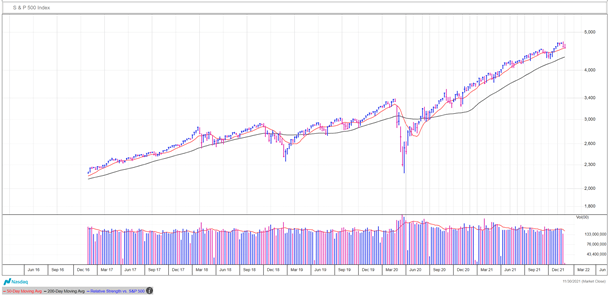

With all these scary Omicron headlines, one would expect a collapse in equity markets. Well, at least not yet. The S&P 500 was actually down less than -1% for the month and remains up a whopping +22% for 2021 (see 5-year chart above). And the tech-heavy NASDAQ index did even better, closing slightly higher for the month and up a similar amount for the year (+21%).

Driving the buoyant stock market performance this year, on the heels of a strong stock market last year (S&P 500 climbed +16%), has been the surge in corporate profits (see chart below). As I like to point out to investors, over the long-run, stock prices follow the direction of earnings, whether we are talking about the overall stock market or individual stocks. Although prices and earnings have both moved up and to the right, neither prices nor profits move in a straight line. One must assume price volatility (i.e. risk) if you want to experience the reward (i.e., long-term returns that substantially beat inflation).

Other Flies in the Ointment

Besides Omicron, there are still some prominent flies in the ointment. Federal Reserve Chairman Jerome Powell just signaled to Congress yesterday that the Fed’s reduction in its bond-buying stimulus program (i.e., “tapering”) could finish a few months early. In other words, the Fed could remove the punch bowl sooner than anticipated – perhaps by as early as this March. Subsequent to the completion of the tapering, industry observers now expect a greater than 50% probability for the first interest hike to occur by June 2022.

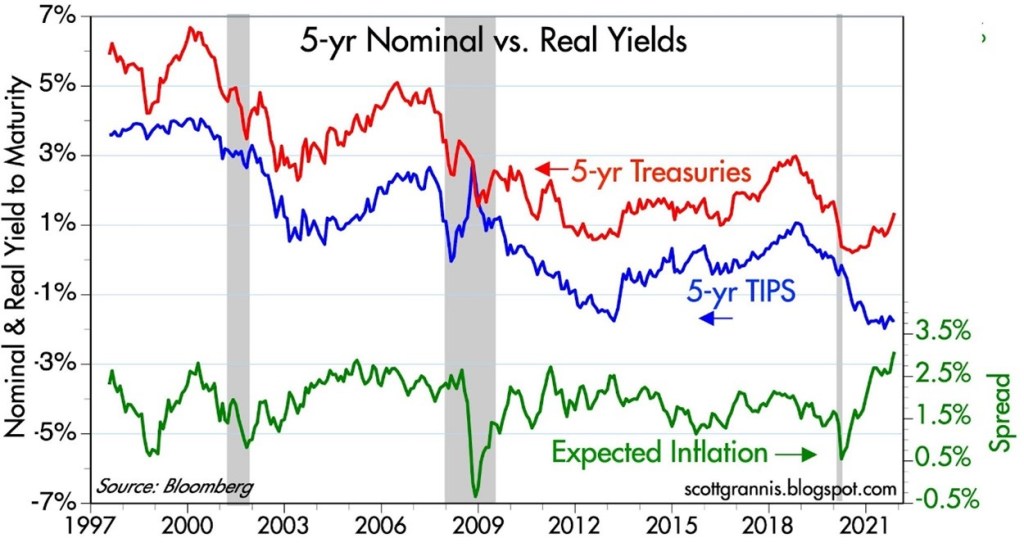

If this is not enough to ruffle your post-Thanksgiving feathers, then consider the threat of persistent inflation. Even Fed Chair Powell threw in the towel by officially removing the word “transitory” from his description of inflation. Inflation is not exploding to the double-digit extremes of the 1980s, but as you can see from the chart below (green line), five-year inflation expectations now exceed 3%.

Lastly, the other date to mark on your December calendar, besides the Christmas holiday, is the 15th because that is the date Congress could hit the debt ceiling limit. This high-stakes game of chicken occurs every year or so. This contest between Democrats and Republicans is used as a negotiating tool in the hopes of advancing political agendas. If an agreement is not reached to increase the debt limit, a government shutdown, and then ultimately a government default would transpire. History tells us this will never happen, but the mere game of political brinksmanship could rattle markets in the short-run.

All these risks and fears are nothing new. Financial markets have flourished in the face of worse crises than Omicron, monetary policy changes, inflation, and debt ceilings. The key to sustainable wealth creation is taking a long-term view and being opportunistic in the face of volatility. Shrewdly pivoting your perspective from panic to possibility is essential on the path to prosperity.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (December 1, 2021). Subscribe on the right side of the page for the complete text.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in PFE and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Entry filed under: Banking, Behavioral Finance, Earnings, economy, Financial Markets, Financial Planning, Fixed Income (Bonds), Government, Interest Rates, International, Stocks, Trading. Tags: bonds, covid, economy, Federal Reserve, interest rates, investing, omicron, Politics, Sidoxia, stock market, Stocks, Wade Slome, yields.

1. Weekend reading: First they came for the growth stocks? - Belman Partners | December 4, 2021 at 4:01 am

[…] Oh Omicron! From panic to possibility – Investing Caffeine […]

2. Weekend reading: First they came for the growth stocks? - Ubica Capital | December 4, 2021 at 4:18 am

[…] Oh Omicron! From panic to possibility – Investing Caffeine […]

3. Weekend reading: First they came for the growth stocks? - Wealthy $imple | December 4, 2021 at 4:37 am

[…] Oh Omicron! From panic to possibility – Investing Caffeine […]

4. Weekend reading: First they came for the growth stocks? - Comas Family | December 4, 2021 at 4:45 am

[…] Oh Omicron! From panic to possibility – Investing Caffeine […]

5. Weekend reading: First they came for the growth stocks? – Use Enough Agency | December 4, 2021 at 4:58 am

[…] Oh Omicron! From panic to possibility – Investing Caffeine […]

6. Ohhh Omicron! From Panic to Possibility - ReportWire | June 30, 2022 at 1:47 pm

[…] December 1, 2021 at 12:33 pm […]