Archive for July, 2015

Supply & Demand: The Key to Oil, Stocks, and Pork Bellies

Commodity prices, including oil, are “crashing” according to the pundits and fears are building that this is a precursor to another stock market collapse. Are we on an irreversible path of repeating the bloodbath carnage of the 2008-2009 Great Recession?

Fortunately for investors, markets move in cycles and the fundamental laws of supply and demand hold true in both bull and bear markets, across all financial markets. Whether we are talking about stocks, bonds, copper, gold, currencies, or pork bellies, markets persistently move like a pendulum through periods of excess supply and demand. In other words, weakness in prices create stronger demand and less supply, whereas strength in prices creates weakening demand and more supply.

Since energy makes the world go round and the vast majority of drivers are accustomed to filling up their gas tanks, the average consumer is familiar with recent negative price developments in the crude oil markets. Eighteenth-century economist Adam Smith would be proud that the laws of supply and demand have help up just as well today as they did when he wrote Wealth of Nations in 1776.

It is true that overall stagnation in global economic demand in recent years, along with the strengthening of the U.S. dollar (because of better relative growth), has contributed to downward trending oil prices. It is also true that supply factors, such as Saudi Arabia’s insistence to maintain production and the boom in U.S. oil production due to new fracking technologies (see chart below), have arguably had a larger negative impact on the more than -50% deterioration in oil prices. Fears of additional Iranian oil supply hitting the global oil markets as a result of the Iranian nuclear deal have also added to the downward pressure on prices.

What is bad for oil prices and the oil producers is good news for the rest of the economy. Transportation is the lubricant of the global economy, and therefore lower oil prices will act as a stimulant for large swaths of the global marketplace. Here in the U.S., consumer savings from lower energy prices have largely been used to pay down debt (deleverage), but eventually, the longer oil prices remain depressed, incremental savings should filter into our economy through increased consumer spending.

But prices are likely not going to stay low forever because producers are responding drastically to the price declines. All one needs to do is look at the radical falloff in the oil producer rig count (see chart below). As you can see, the rig count has fallen by more than -50% within a six month period, meaning at some point, the decline in global production will eventually provide a floor to prices and ultimately provide a tailwind.

If we broaden our perspective beyond just oil, and look at the broader commodity complex, we can see that the recent decline in commodity prices has been painful, but nowhere near the Armageddon scenario experienced during 2008-2009 (see chart below – gray areas = recessions).

Although this conversation has focused on commodities, the same supply-demand principles apply to the stock market as well. Stock market prices as measured by the S&P 500 index have remained near record levels, but as I have written in the past, the records cannot be attributed to the lackluster demand from retail investors (see ICI fund flow data).

Although U.S. stock fundamentals remain relatively strong (e.g., earnings, interest rates, valuations, psychology), much of the strength can be explained by the constrained supply of stocks. How has stock supply been constrained? Some key factors include the trillions in dollars of supply soaked up by record M&A activity (mergers and acquisition) and share buybacks.

In addition to the declining stock supply from M&A and share buybacks, there has been limited supply of new IPO issues (initial public offerings) coming to market, as evidenced by the declines in IPO dollar and unit volumes in the first half of 2015, as compared to last year. More specifically, first half IPO dollar volmes were down -41% to $19.2 billion and the number of 2015 IPOs has declined -27% to 116 from 160 for the same time period.

Price cycles vary dramatically in price and duration across all financial markets, including stocks, bonds, oil, interest rates, currencies, gold, and pork bellies, among others. Not even the smartest individual or most powerful computer on the planet can consistently time the short-term shifts in financial markets, but using the powerful economic laws of supply and demand can help you profitably make adjustments to your investment portfolio(s).

See Also – The Lesson of a Lifetime (Investing Caffeine)

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing, SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Greece: The Slow Motion, Multi-Year Train Wreck

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (July 1, 2015). Subscribe on the right side of the page for the complete text.

Watching Greece fall apart over the last five years has been like watching a slow motion train wreck. To many, this small country of 11 million people that borders the Mediterranean, Aegean, and Ionian Seas is known more for its Greek culture (including Zeus, Parthenon, Olympics) and its food (calamari, gyros, and Ouzo) than it is known for financial bailouts. Nevertheless, ever since the financial crisis of 2008-2009, observers have repeatedly predicted the debt-laden country will default on its €323 billion mountain of obligations (see chart below – approximately $350 billion in dollars) and subsequently exit the 19-member eurozone currency membership (a.k.a.,”Grexit”).

Now that Greece has failed to repay less than 1% of its full €240 billion bailout obligation – the €1.5 billion payment due to the IMF (International Monetary Fund) by June 30th – the default train is coming closer to falling off the tracks. Whether Greece will ultimately crash itself out of the eurozone will be dependent on the outcome of this week’s surprise Greek referendum (general vote by citizens) mandated by Prime Minister Alexis Tsipras, the leader of Greece’s left-wing Syriza party. By voting “No” on further bailout austerity measures recommended by the European Union Commission, including deeper tax increases and pension cuts, the Greek people would effectively be choosing a Grexit over additional painful tax increases and deeper pension cuts.

Ouch!

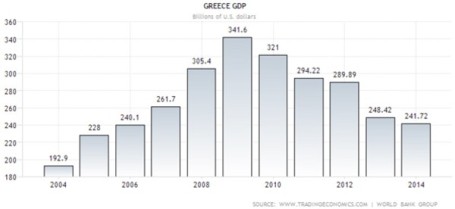

And who can blame the Greeks for being a little grouchy? You might not be too happy either if you witnessed your country experience an economic decline of greater than 25% (see Greece Gross Domestic Product chart below); 25% overall unemployment (and 50% youth unemployment); government worker cuts of greater than 20%; and stifling taxes to boot. Sure, Greeks should still shoulder much of the blame. After all, they are the ones who piled on $100s of billions of debt and overspent on the pensions of a bloated public workforce, and ran unsustainable fiscal deficits.

For any casual history observers, the current Greek financial crisis should come as no surprise, especially if you consider the Greeks have a longstanding habit of not paying their bills. Over the last two centuries or so, since the country became independent, the Greek government has spent about 90 years in default (almost 50% of the time). More specifically, the Greeks defaulted on external sovereign debt in 1826, 1843, 1860, 1894 and 1932.

The difference between now and past years can be explained by Greece now being a part of the European Union and the euro currency, which means the Greeks actually do have to pay their bills…if they want to remain a part of the common currency. During past defaults, the Greek central bank could easily devalue their currency (the drachma) and fire up the printing presses to create as much currency as needed to pay down debts. If the planned Greek referendum this week results in a “No” vote, there is a much higher probability that the Greek government will need to dust off those drachma printing presses.

“Perspective People”

Protest, riots, defaults, changing governments, and new currencies make for entertaining television viewing, but these events probably don’t hold much significance as it relates to the long-term outlook of your investments and the financial markets. In the case of Greece, I believe it is safe to say the economic bark is much worse than the bite. For starters, Greece accounts for less than 2% of Europe’s overall economy, and about 0.3% of the global economy.

Since I live out on the West Coast, the chart below caught my fancy because it also places the current Greek situation into proper proportion. Take the city of L.A. (Los Angeles – red bar) for example…this single city alone accounts for almost 3x the size of Greece’s total economy (far right on chart – blue bar).

Give Me My Money!

It hasn’t been a fun year for Greek banks. Depositors, who have been flocking to the banks, withdrew about $45 billion in cash from their accounts, over an eight month period (see chart below). Before the Greek government decided to mandatorily close the banks in recent days and implement capital controls limiting depositors to daily ATM withdrawals of only $66.

But once again, let’s put the situation into context. From an overall Greek banking sector perspective, the four largest Greek Banks (Bank of Greece, Piraeus Bank, Eurobank Ergasias, Alpha Bank) account for about 90% of all Greek banking assets. Combined, these banks currently have an equity market value of about $14 billion and assets on the balance sheets of $400 billion – these numbers are obviously in flux. For comparison purposes, Bank of America Corp. (BAC) alone has an equity market value of $179 billion and $2.1 trillion in assets.

Anxiety Remains High

Skeptical bears will occasionally acknowledge the miniscule-ness of Greece, but then quickly follow up with their conspiracy theory or domino effect hypothesis. In other words, the skeptics believe a contagion effect of an impending Grexit will ripple through larger economies, such as Italy and Spain, with crippling force. Thus far, as you can see from the chart below, Greece’s financial problems have been largely contained within its borders. In fact, weaker economies such as Spain, Portugal, Ireland, and Italy have fared much better – and actually improving in most cases. In recent days, 10-year yields on government bonds in countries like Portugal, Italy, and Spain have hovered around or below 3% – nowhere near the peak levels seen during 2008 – 2011.

Other doubting Thomases compare Greece to situations like Lehman Brothers, Long Term Capital Management, and the subprime housing market, in which underestimated situations snowballed into much worse outcomes. As I explain in one of my newer articles (see Missing the Forest for the Trees), the difference between Greece and the other financial collapses is the duration of this situation. The Greek circumstance has been a 5-year long train wreck that has allowed everyone to prepare for a possible Grexit. Rather than agonize over every news headline, if you are committed to the practice of worrying, I would recommend you focus on an alternative disaster that cannot be found on the front page of all newspapers.

There is bound to be more volatility ahead for investors, and the referendum vote later this week could provide that volatility spark. Regardless of the news story du jour, any of your concerns should be occupied by other more important worrisome issues. So, unless you are an investor in a Greek bank or a gyro restaurant in Athens, you should focus your efforts on long-term financial goals and objectives. Ignoring the noisy news flow and constructing a diversified investment portfolio across a range of asset classes will allow you to avoid the harmful consequences of the slow motion, multi-year Greek train wreck.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs) and BAC, but at the time of publishing, SCM had no direct position in Bank of Greece, Piraeus Bank, Eurobank Ergasias, Alpha Bank or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on ICContact page.