Posts tagged ‘stock market’

Dow Knocking on the Door of 40,000

The stock market rang the doorbell of the New Year with a bang during the 1st quarter. The S&P 500 index built on last year’s +24% gain with another +10% advance during the first three months of the year. And as a result of these increases, the Dow Jones Industrial Average index is knocking on the door of the 40,000 milestone – more specifically, the Dow closed the month at 39,807 (see chart below). To put his into context, when I was born more than 50 years ago, the Dow was valued at less than 1,000 – not a bad run. This is proof positive of what Einstein called the 8th Wonder of the World, “compounding”. At Sidoxia Capital Management, we view investing as a marathon, not a sprint. You cannot realize the benefits of compounding without having a long-term time horizon. The sooner you start saving and the more you save, the faster and larger your retirement nest egg will grow.

If you are one of the people who thinks the stock market is too high, then you should definitely ignore Warren Buffett, arguably the greatest investor of all-time. Buffett predicted the Dow will reach an astronomical level of one million (1,000,000) within the next 100 years. I’m not sure I will still be around to witness this momentous achievement, however, if history repeats itself, this targeted timeframe could prove conservative.

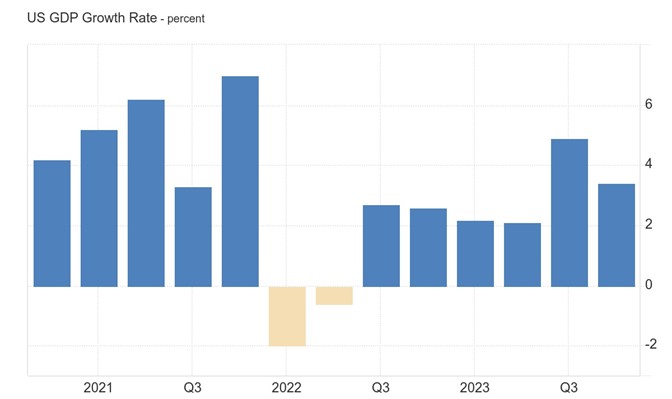

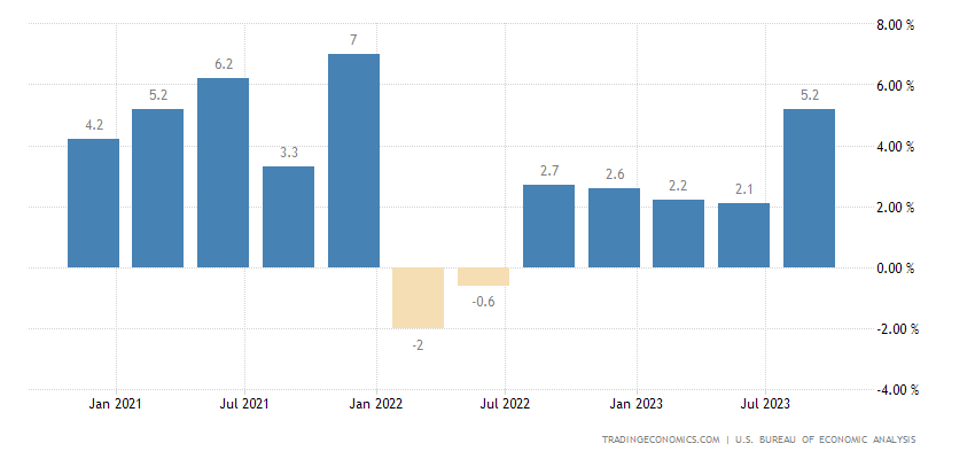

Despite the magnitude and duration of this bull market, there is still a lot of angst and anxiety over the upcoming election. Nevertheless, investors are choosing instead to focus on the strong fundamentals of the economy. Just this last week, we saw the broadest measurement of economic activity, GDP (Gross Domestic Product), get revised higher to +3.4% growth during the 4th quarter of 2023 (see chart below). On the jobs front, the unemployment picture remains healthy (3.9%), near a generational low.

Source: Trading Economics and Bureau of Economic Analysis

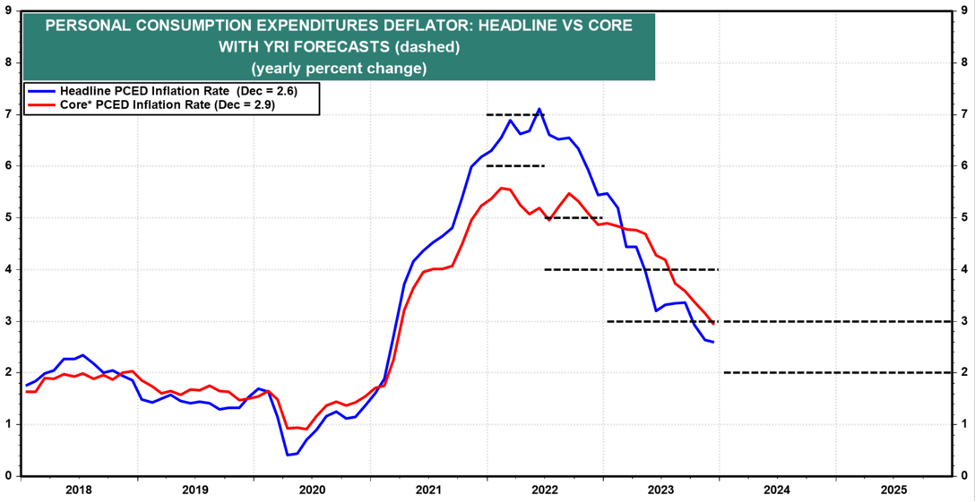

And when it comes to the all-important inflation data, the Federal Reserve’s preferred inflation measure, Core PCE index (Core Personal Consumption Expenditures), was also just released in-line with economists’ projections at 2.5% (see chart below), very near the Fed’s long-term 2.0% inflation target and well below the Core PCE’s recent peak near 6%.

Source: The Wall Street Journal and Commerce Department

This resilient economic data, when combined with the declining inflation figures, has resulted in the Federal Reserve sticking with its plan of cutting its Federal Funds interest rate target three times this year. If inflation reverses course or remains stubbornly high, then there is a higher likelihood that interest rate cuts will be delayed. On the flip side, if economic data slows significantly or the country goes into a recession, then the probability of sooner and/or more Fed interest-rate cuts will increase.

In other news, here are some of the other major financial headlines this month:

- Francis Scott Key Baltimore Bridge Collapse: Six people died when a large container ship crashed into the Francis Scott Key bridge in the Port of Baltimore. An estimated 50 million tons of goods valued at $80 billion flows through this port, making this one of the top 10 ports in the country. The auto and coal industry supply chains will be disproportionately affected, but the good news is much of these goods will be diverted to other larger ports (e.g., Port of New York and Port of New Jersey).

- DJT Debut: A lot of hype surrounded the trading debut of Trump Media & Technology Group, which began trading last week under the initials of our country’s former president, Donald J. Trump (Ticker: DJT). Despite only posting a few million in revenue and -$50 million in losses during the first nine months of 2023, the stock skyrocketed +65% in its first week of trading and attained a $9 billion valuation. Time will tell if Trump’s Truth Social media platform will gain traction and justify the stock’s price, or rather suffer the declining fate of other meme stocks like GameStop Corp. (GME) or AMC Entertainment Holdings (AMC).

- SBF Sentenced to 25 Years: The former CEO of cryptocurrency exchange company FTX, Sam Bankman-Fried (SBF), was sentenced to 25 years in prison due to his conviction on seven counts of fraud and what is believed to be $8 billion in stolen client funds. SBF didn’t help his own cause by perjuring himself, tampering with witnesses, and showing a lack of remorse, according to the judge.

We are only 25% of the way through the year, but the Dow is knocking on the 40,000-milestone door. The way things look now, investors are wiping their feet on the welcome doormat and ready to walk right in.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (April 1, 2024). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in individual stocks , certain exchange traded funds (ETFs), and notes including AMC 2026, but at the time of publishing had no direct position in DJT, GME, AMC or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

The Art of Maximizing Gains and Minimizing Taxes in a World of AI

The AI Wave

The weather may be cold during winter, but stocks were scorching hot last month, fueled in part by the surge in performance from AI (Artificial Intelligence) stocks. More specifically, the Dow Jones Industrial Average was up +2.2% to 38,996. The S&P 500 surged +5.2% to 5,096. And the AI-heavy Nasdaq index climbed the most by +6.1% to 16,092.

Leading the bull market brigade higher was NVIDIA Corp (NVDA), which saw its stock launch higher by +29% for the month after reporting eye-popping quarterly revenues of $22 billion, more than tripling versus last year’s comparable quarter. Customers of NVIDIA, like Meta Platforms, Inc. (META), are also benefiting from the rising tide of investor sentiment.

To put this AI wave into perspective, you need look no further than to the comments made by Meta CEO Mark Zuckerberg, who stated by the end of 2024, the company should have 350,000 of NVIDIA’s H100 graphics processing units (GPUs) as part of the company’s AI infrastructure. At roughly $25,000 to $30,000 per GPU, the total cost is likely approaching $10 billion for just this one NVIDIA customer. Also, Dell Technologies’ (DELL) stock price opened more than +30% higher today after reporting quarterly financial results that exceeded forecasts due to robust demand for AI servers, which led to their backlog almost doubling in three months to $2.9 billion.

When you have corporate America in addition to the large cloud data center providers (think Amazon Web Services, Microsoft Azure, and Google Cloud) all battling to secure NVIDIA chips for their generative AI, machine learning initiatives, you can understand why NVIDIA’s stock is up +250% in one year to a company value of $2 trillion.

Japan’s Nikkei & Dow Both Break 39,000 Record Concurrently

Not only did the Dow hit an all-time record high of 39,000 last month, but a stunning coincidence also occurred in Japan. The Nikkei 225, which is like the Japanese equivalent of the Dow Jones Industrial Average, also hit a record high of 39,000 last month. What’s the big difference between these two indexes simultaneously surpassing a record 39,000 in the same month?

It took the Nikkei over 34 years to surpass its previous record peak, which was last achieved in 1989 when Japan experienced a massive bursting of an asset bubble. On the other hand, it merely took the Dow just one month to break its previous record…not four decades. Worth noting, so far in 2024, the Nikkei has been the world’s best-performing major index surging 19%, almost triple the gain of the S&P 500 index.

Tax Time

April is fast approaching, which means it’s that time of the year when Uncle Sam will come knocking on your door with your tax bill. Perhaps your taxes have already been prepaid and a refund is coming your way. Regardless, the goal of long-term investing is to master the art of maximizing returns and limiting taxes subject to your risk tolerance.

How does one create an investment masterpiece? One way to maximize return is to lower costs, including lower management fees, fund fees, and transaction costs. You can think of these investment costs as a leaky faucet. In the short-run, most people do not care about or are unaware of a leak.

The same principle applies to investment fees/costs. Investors can ignore these fees in the short-term, but over months or years, these costs can become enormous and destructive. I experienced this firsthand. Recently, normal monthly water bill was $40, but one leaky toilet resulted in an $800 monthly bill…ouch! Just imagine what unknown leaky costs on your investments could mean for your retirement. Do you want high or unknown investment fees to delay your retirement by years? I think not. Focus on lower costs because quite simply, the less you pay, the more you keep, and the earlier you can retire.

Another way to maximize your investment performance is to benefit from the power of compounding. This phenomenon can only be achieved via the snowball-effect of long-term investing. This is why Albert Einstein called compounding the “8th Wonder of the World.” At Sidoxia Capital Management, we have experienced this marvel on many of our investments, including our exponential gains in Amazon.com, which we first purchased in 2008 at s split-adjusted price of about $2.95 per share. The stock price recently closed at $177, a 60-fold increase from our initial purchase.

The risk-adjusted aspect of your nest-egg is also important because most people should consider decreasing risk as you more closely approach retirement age, especially if you are planning to tap your investments for liquidity. If risk wasn’t a consideration, going to the Las Vegas roulette table and betting your life savings on black might be a good idea. Sure, you might have a chance of doubling your money instantly, but you could also lose it all in a blink of an eye.

Another way of thinking about risk, since we are in the heart of ski season, is to contemplate a ski instructor’s advice for an 80-year-old beginner vs. an experienced Olympic downhill gold medalist. It wouldn’t make sense for the 80-year-old beginner to train on the steep, advanced black diamond runs. Similarly, it wouldn’t make sense for the gold-medalist Olympian to train on the flat beginner runs. The same concept holds true for investing. Young investors generally can take on more risk, while retirees often should be more conservative in their asset allocation, especially if they need liquidity from their investments to fund their living expenses and lifestyle.

Although it would be nice to have ChatGPT create a luxurious retirement for you with a click of a button, unfortunately life is not that simple. You certainly can, and should, take advantage of the AI revolution in your investment portfolio to support your retirement goals, but successful investing requires more than that. With over 30 years of investment experience under my belt, at Sidoxia, we understand there are multiple facets to successful investing. In a diversified portfolio that that takes account of your risk tolerance, we strongly believe low-cost, tax-efficient, long-term investing is the best way to create your retirement masterpiece.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (March 1, 2024). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in individual stocks, including NVDA, META, GOOGL, AMZN, MSFT, and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in DELL or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Quickly Out of the Gate

The race into 2024 has begun, and the U.S. market is off to a quick start. The S&P 500 jumped out of the gates by +1.6%, and the technology and AI (Artificial Intelligence) – heavy NASDAQ index raced out by +1.2%. The bull market rally broadened out at the end of 2023, but 2024 returned to the leaders of last year’s pack, the Magnificent 7 (see also Mission Accomplished). Out front, in the lead of the Mag 7, is Nvidia with a +24% gain in January.

Inflation dropping (see chart below), the Federal Reserve signaling a decline in interest rates, low unemployment (3.7%), and healthy economic growth (+3.3% Q4 – GDP) have all contributed to the continuing bull market run.

Source: Yardeni.com

Consumer spending is the number one driver of economic growth, and consumers remain relatively confident about future prospects as seen in the recently released Conference Board Consumer Confidence numbers released this week (see chart below).

Source: Conference Board

But the race isn’t over yet, and there are always plenty of issues to worry about. The world is an uncertain place. Here are some of the concerns du jour:

– Red Sea conflict led by the Yemen-based, rebel group, Houthis

– Gaza war between Israel and Hamas

– Anxiety over November presidential election

– Ukraine – Russia war

Money Goes Where It is Treated Best

There are plenty of domestic concerns regarding government debt, deficit levels, and political frustrations on both sides of the partisan aisle remain elevated. When it comes to the financial markets, money continues to go where it is treated best. Sure, we have no shortage of problems or challenges, but where else are you going to put your life savings? China? Europe? Russia? Japan?

Well, as you can see in the chart below, anti-democratic, anti-American business, and confrontational military policies instituted by China have not benefitted investors – the U.S. stock market (S&P 500) has trounced the Chinese stock market (MSCI) over the last 30 years.

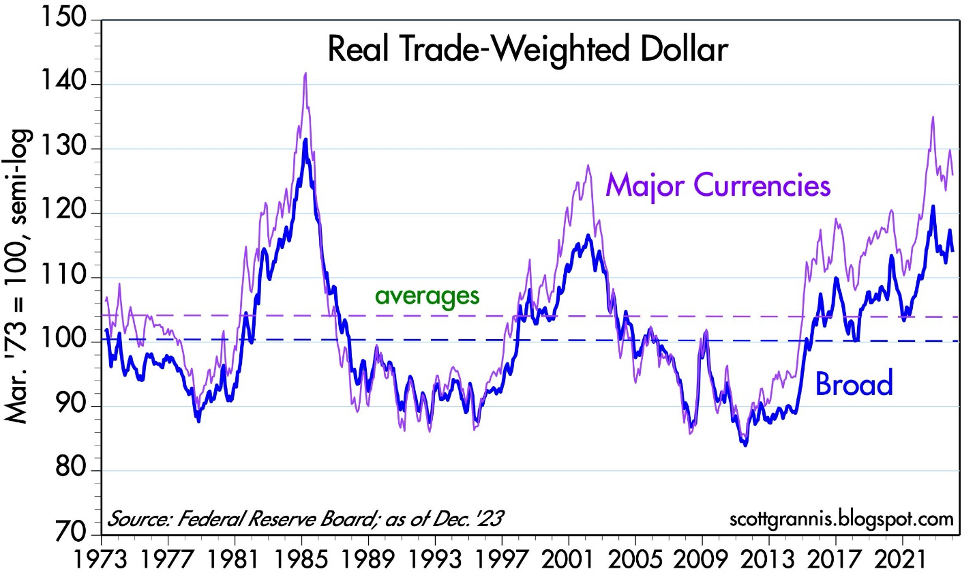

Source: Calafia Beach Pundit

For years, market critics and pessimists have been screaming doom-and-gloom as it relates to the United States. The story goes, the U.S. is falling apart, government spending and debt levels are out of control, politicians are corrupt, and we’re going into recession, thanks in part to higher interest rates and inflation. Well, if that’s the case, then why has the value of the U.S. dollar increased over the last 10 years (see chart below)? And why is the stock market at all-time record-highs?

Source: Calafia Beach Pundit

Global investors are discerning in which countries they invest their hard-earned money. Global capital will flow to those countries with a rule of law, financial transparency, prudent tax policy, lower inflation, higher profit growth, lower interest rates, sensible fiscal and monetary policies, among other pragmatic business practices. There’s a reason they call it the “American Dream” and not the “Chinese Dream.” Our capitalist economy is far from perfect, but finding another country with a better overall investing environment is nearly impossible. There’s a reason why venture capitalists, private equity managers, sovereign wealth funds, hedge funds, and foreign institutions are investing trillions of their dollars in the United States. Money goes where it is treated best!

As money sloshes around the world, the 2024 investing race has a long way before it’s over, but at least the stock market has quickly gotten out of the gate and built a small lead.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (February 1, 2024). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in NVDA, and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Sidoxia Webinar: The Keys to ’23 & What’s in Store for ’24 – Market Update

Unlock valuable insights at our upcoming webinar:

The Keys to ’23 & What’s in Store for ’24!

Tuesday, January 30th at 12:00 PM

Click the Zoom link below to register:

https://sidoxia.link/Webinar-Registration

Don’t miss out on the latest trends and expert discussions.

We will delve into a comprehensive market update. Register now!

The Douglas Coleman Show Interviews Wade Slome

Wade Slome, President and Founder of Sidoxia Capital Management, recently had the pleasure of being featured on The Douglas Coleman Show hosted by Douglas Coleman.

Drawing from professional and personal life lessons, Wade shares his knowledge about navigating market trends, building investment strategies, and also discuss the books he has authored.

If you are interested in learning more about the books Wade has authored, please visit: https://www.sidoxia.com/wades-books

My Future Business Interviews Wade Slome

Wade Slome, President and Founder of Sidoxia Capital Management, recently had the pleasure of being featured on My Future Business hosted by Rick Nuske. Wade shares his knowledge about the financial markets, his investing philosophy, and experiences that have shaped both his professional career and personal life. Tune in to the interview below!

This Baby Bull Has Time to Grow

You may have witnessed some fireworks on New Year’s Eve, but those weren’t the only fireworks exploding. The last two months of 2023 finished with a bang! More specifically, over this short period, the S&P 500 index skyrocketed +13.7%, NASDAQ +16.8%, and the Dow Jones Industrial Average +14.0%. The gains have been even more impressive for the cheaper, more interest-rate-sensitive small-cap stocks (IJR +21.8%), which I have highlighted for months (see also AI Revolution).

For the full year, the bull market was on an even bigger stampede: S&P 500 +24%, NASDAQ +43%, and Dow +14%.

Although 2023 closed with a festive explosion, 2022 ended with a bearish growl. Effectively, 2023 was a reverse mirror image of 2022. In 2022, the stock market fell -19% (S&P) due to a spike in inflation. Directionally, interest rates followed inflation higher as the Fed worked through the majority of its 0% to 5.5% Federal Funds rate hiking cycle.

To sum it up simply, the last two years have been like riding a rollercoaster. For the year just ended, much of the year felt like a party, but 2022 felt more like a funeral. When you add the two years together, it was more of a lackluster result. For 2022-2023 combined, results registered at a meager +0.1% for the S&P, +3.7% for the Dow, and -4.0% for the NASDAQ (see chart below).

For those saying the good times of 2023 cannot continue, investors should understand that history paints a different picture. As you can see from the stock market cycles chart (below) that spans back to 1962, the average bull market lasts 51 months (i.e., 4 years, 3 months), while the average bear market persists a little longer than 11 months. This data suggests the current one-year-old baby bull market has plenty of room to grow more.

Source: Visual Capitalist

Why So Bullish?

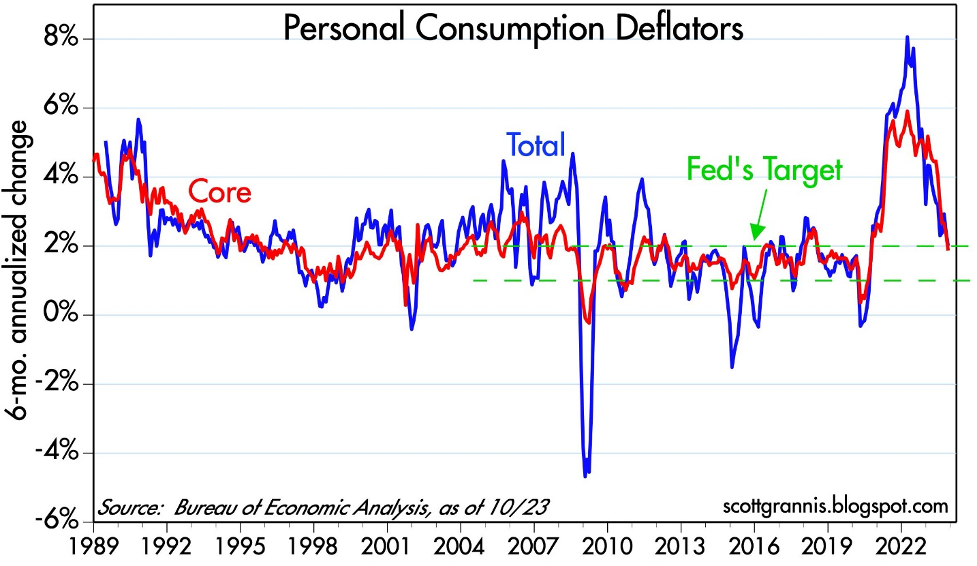

What has investors so jazzed up in recent months? For starters, inflation has been on a steady decline for many months. With China’s stagnating economy, it has helped our inflationary cause by exporting deflationary goods to our country. As you can see from the Personal Consumption Deflator chart below, this broad inflation measure has declined to the Federal Reserve’s 2% target level. Jerome Powell, the Federal Reserve Chairman has been paying attention to these statistics, as evidenced by the central bank’s forecast at the Fed’s recent policy meeting last month on December 13th for three interest rate cuts in 2024. This so-called “Powell Pivot” is a reversal in tone by the Fed, which had been on a relentless rampage of interest rate hikes, over the last two years.

Source: Calafia Beach Pundit

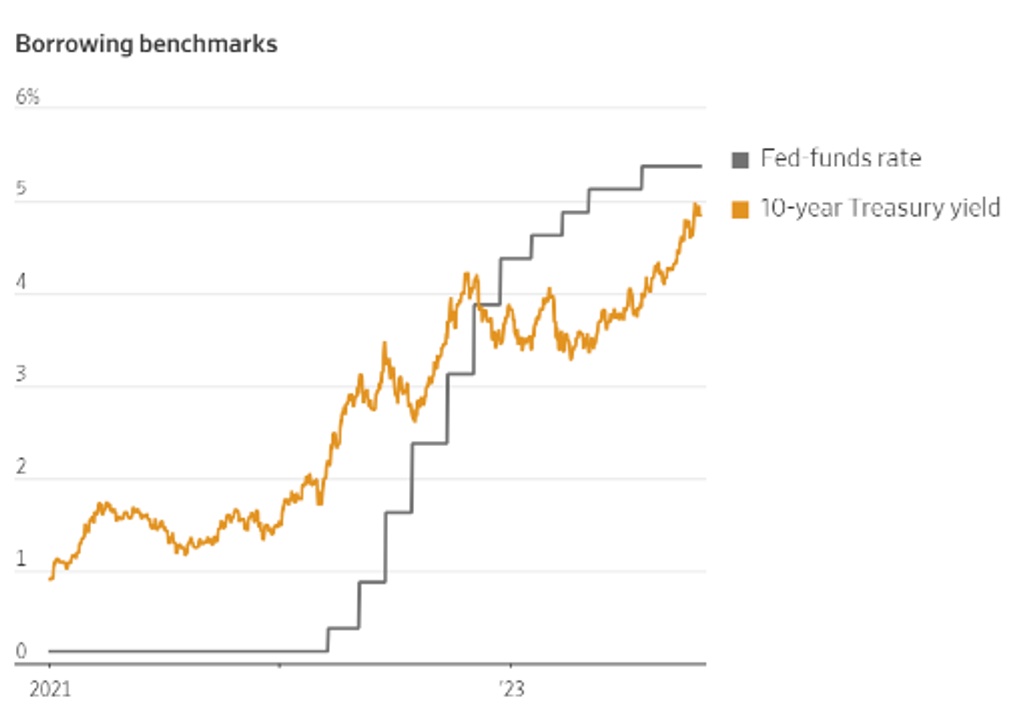

This interest rate cycle headwind has turned into a tailwind as investors now begin to discount the probability of future rate cuts in 2024. The relief of lower interest rates can be felt immediately, whether you consider declining mortgage and car loan rates for consumers, or credit line and corporate loan rates for businesses. This trend can be seen in the benchmark 10-Year Treasury Note yield, which has declined from a peak of 5.0% a few months ago to 3.9% today (see chart below).

Source: Trading Economics

Declining inflation and interest rates explain a lot of investor optimism, but there are additional reasons to be sanguine. The economy remains strong, unemployment remains low, AI (Artificial Intelligence) applications are improving worker productivity, trillions of potential stock market dollars remain on the sidelines in money market accounts, and corporate profits have resumed rising near all-time record levels (see chart below).

Source: Yardeni.com

What could go wrong? There are always plenty of unforeseen issues that could slow or reverse our economic train. Geopolitical events in Russia or the Middle East are always difficult to predict, and we have a presidential election in 2024, which could always negatively impact sentiment. This new bull market had a great start in 2023, but in historical terms, it is only a baby. Time will tell if 2024 will make this baby cry, but whatever the market faces, declining inflation and interest rates should act as a pacifier.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (January 2, 2024). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in individual stocks, and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Did Santa Claus Come Early This Year?

With all this potential recession talk that has lasted two years, you would expect a lump of coal to arrive in your Christmas stocking this year. But quite the contrary, Santa Claus appears to have arrived early this year as evidenced by the +8.9% spike in prices last month, the largest monthly increase in 10 years. The NASDAQ fared slightly better with a +10.7% rise, and the Dow Jones Industrial Average lagged by a tad with an +8.0% monthly increase.

Different prognosticators have suggested the recent surge in stock prices is a precursor for a “Santa Claus rally.” I do not consider myself a superstitious person, but many traders will act upon this Christmas holiday phase that tends to coincide with an upswing in stock prices. The only problem with this assertion is there is no clearly defined period for this so-called Santa Claus phenomenon. Some say this period occurs in the week after Christmas, while others protest this trend happens in the week before the winter holiday. Looser interpretations place the beginning of the Santa Claus rally right after Thanksgiving.

Regardless of Santa Claus’s rally timing, the gloomy sentiment that dragged the stock market down roughly -11% in recent months from its July highs quickly reversed itself higher during November. How could that be? Here are some key reasons for the latest upturn:

- Inflation is Cooling (see chart below): The Federal Reserve’s preferred measure to track the pace of inflation (Core Personal-Consumption Expenditures) was released yesterday showing inflation has decreased dramatically last month to 2.5% (on a 6-month basis), within spitting distance of the Fed’s 2% target.

Source: Wall Street Journal

- Interest Rates are Coming Down: Generally, there is a strong correlation between inflation and interest rates, so last month we also saw the yields on the 10-Year Treasury Note fall dramatically to 4.25% (4.35% yesterday) after tickling 5.0% briefly at the end of October. The downward movement in rates means lower and more attractive borrowing costs for business loans, mortgages, auto loans, credit cards and other debt vehicles.

- Economy Remains Healthy: As mentioned earlier, the constant barrage of recession calls over the last two years has been blatantly wrong. In fact, the most recent GDP (Gross Domestic Product) figure for the 3rd quarter came out at a blistering +5.2% growth rate (see chart below).

Source: Trading Economics

- Employment Strength Continues: The labor picture remains strong, as well. Even though the health of the labor market is usually gauged by the unemployment rate, which at 3.9% remains near record lows, the number of employed persons paints a similarly strong picture. As you can see, employment was on a tear pre-COVID, adding about 20 million jobs from 2010 to 2020. Then, after the COVID-low in workers, employment has exploded upward to an all-time, record high of 161 million employed persons (see chart below).

Source: Trading Economics

Cash Hoards on the Sideline

Despite the Federal Reserve signaling the Federal Funds rate could be peaking due to declining inflation and a weakening economy, overall interest rates remain relatively high. As a result, there is a powder keg of dry powder on the sidelines in the form of $6 trillion in institutional and retail money market funds (see chart below). If and when the economy weakens further, and the Federal Reserve reverses course by cutting interest rates, cash will earn less and will likely return to the stock market in droves.

Source: Ed Yardeni (Yardeni Takes)

Santa did not show up for a rally last December in 2022. The S&P 500 index fell -5.9% for the Christmas month last year and finished 2022 down -19%. So far, this year has looked like a mirror image of last year – the S&P is up +19% in the first 11 months of this year. Investors are hoping gifts keep coming in 2023 in the shape of a Santa Claus rally – let’s hope we are all on the “nice” list and not the “naughty” list.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (December 1, 2023). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in individual stocks, and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

No Market Roar Due to War

The devastating damage to humanity from the Israeli-Hamas war that is in and around the Gaza strip should not be diminished or understated – innocent lives on both sides suffer in any conflict. However, the economic impact should not be overstated either. In other words, the hundreds of billions of dollars in financial stock market losses this month are not proportional to the Mideast economic losses incurred thus far.

To put the events in perspective, the population of Israel approximates 10 million people and the population located in the Gaza Strip is about two million people. There are more than eight billion people on the planet, so Israel/Gaza represents roughly 1/7 of 1% of the global population.

From an economic standpoint, the combined economic output of Israel/Gaza Strip accounts for around ½ of 1% of global GDP (see chart below – small slivers in the blue section).

And let’s not forget, economic activity is not dropping to zero. From an economic standpoint, the war’s financial impact is even smaller – a rounding error.

Source: Visual Capitalist

However, wars do not exist in a vacuum, and tensions in the Middle East have the potential of having a ripple effect. Whenever rumblings occur in the Mideast, one of the largest global sectors to be first impacted is the oil market. Approximately 20-30% of the world’s oil is trafficked through the Strait of Hormuz in the Persian Gulf, so it was not surprising to see a short-term spike in oil prices to almost $90 per barrel in early October after the Gaza invasion of Israel. By the end of the month, oil has settled back down to about $81 per barrel, almost precisely the same price right before the war started. On a year-over-year basis, oil prices are actually down approximately -5%, thereby providing minor relief to gas-powered car drivers.

If Iran, or Iran-backed militant group Hezbollah, throws their hat into the Israel-Hamas war ring, the U.S. and other Western allies may retaliate and escalate tensions in the region, which would unlikely be received well by the financial markets.

As a result of these domino effect fears in the region, the stock market took another leg down last month with the S&P 500 index declining -2.2%, the Dow Jones Industrial Average -1.4%, and the NASDAQ index fell the most, -2.8%. The world is a dangerous place, but we have seen this movie before – this is nothing new. We would all prefer world peace, but unfortunately, wars and skirmishes have gone on for centuries.

As Interest Rates Soar, Bonds Offer More

Source: Wall Street Journal

No, TINA is not the name of my high school girlfriend or wife, but rather the acronym TINA (There Is No Alternative) existed in recent years during the Federal Reserve’s zero-interest rate policy days. More specifically, TINA referred to the lack of investment alternatives to equities (i.e., stocks) when money effectively earned 0% in the bank and close-to-0% in many fixed income securities (i.e., bonds). In fact, at one point, although it is still hard to believe, there were more than $16 trillion in bonds paying negative interest rates – pure insanity.

TINA Turns into FIONA

Given the large increase in interest rates by the Federal Reserve over two years (from 0% to 5.50%), investors have been given a short-term gift. As you can see from the chart above, yields on 10-Year Treasury Notes have risen to almost 5.0%. And believe it or not, shorter term bonds are currently providing yields even higher than this. The three-month, six-month, one-year, and two-year Treasuries are all yielding higher rates than 10-Year Treasury yields (i.e., inverted yield curve) – see table below. So, TINA has changed to FIONA – Fixed Income Opens New Alternatives. What’s more, for individuals with taxable accounts, the interest earned on Treasuries is tax-free at the state level, thereby making this short-term gift in yields even more attractive for investors.

Source: Trading Economics

Stock prices were down again for the month, and investment sentiment has been souring due to the war in the Middle East, but there is still plenty of reasons to remain constructive. Not only is the economy strong (e.g., 3rd quarter GDP of +4.9%), but the consumer also remains strong (see Consumer Wallets Strong) in large part because the unemployment rate remains near record lows (+3.8%). While anxiety rises due to the war, stock prices get cheaper, and opportunities increase. And although interest rates remain elevated, the Federal Reserve is signaling they are closer to a rate hiking end, inflation is cooling and FIONA is offering more attractive yields than during the TINA era. It’s true, this month stocks did not roar due to the war, but patient and opportunistic investors will be rewarded with more.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (November 1, 2023). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in individual stocks, and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.