Posts filed under ‘Banking’

Quickly Out of the Gate

The race into 2024 has begun, and the U.S. market is off to a quick start. The S&P 500 jumped out of the gates by +1.6%, and the technology and AI (Artificial Intelligence) – heavy NASDAQ index raced out by +1.2%. The bull market rally broadened out at the end of 2023, but 2024 returned to the leaders of last year’s pack, the Magnificent 7 (see also Mission Accomplished). Out front, in the lead of the Mag 7, is Nvidia with a +24% gain in January.

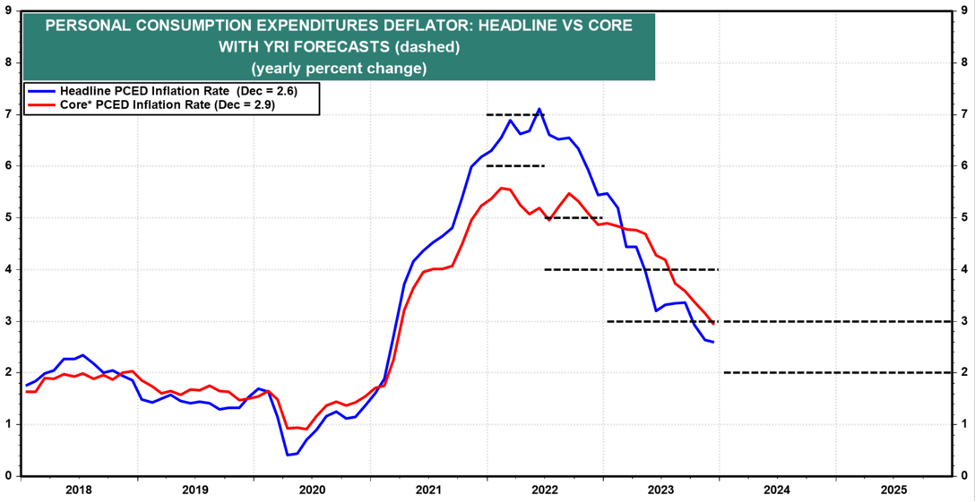

Inflation dropping (see chart below), the Federal Reserve signaling a decline in interest rates, low unemployment (3.7%), and healthy economic growth (+3.3% Q4 – GDP) have all contributed to the continuing bull market run.

Source: Yardeni.com

Consumer spending is the number one driver of economic growth, and consumers remain relatively confident about future prospects as seen in the recently released Conference Board Consumer Confidence numbers released this week (see chart below).

Source: Conference Board

But the race isn’t over yet, and there are always plenty of issues to worry about. The world is an uncertain place. Here are some of the concerns du jour:

– Red Sea conflict led by the Yemen-based, rebel group, Houthis

– Gaza war between Israel and Hamas

– Anxiety over November presidential election

– Ukraine – Russia war

Money Goes Where It is Treated Best

There are plenty of domestic concerns regarding government debt, deficit levels, and political frustrations on both sides of the partisan aisle remain elevated. When it comes to the financial markets, money continues to go where it is treated best. Sure, we have no shortage of problems or challenges, but where else are you going to put your life savings? China? Europe? Russia? Japan?

Well, as you can see in the chart below, anti-democratic, anti-American business, and confrontational military policies instituted by China have not benefitted investors – the U.S. stock market (S&P 500) has trounced the Chinese stock market (MSCI) over the last 30 years.

Source: Calafia Beach Pundit

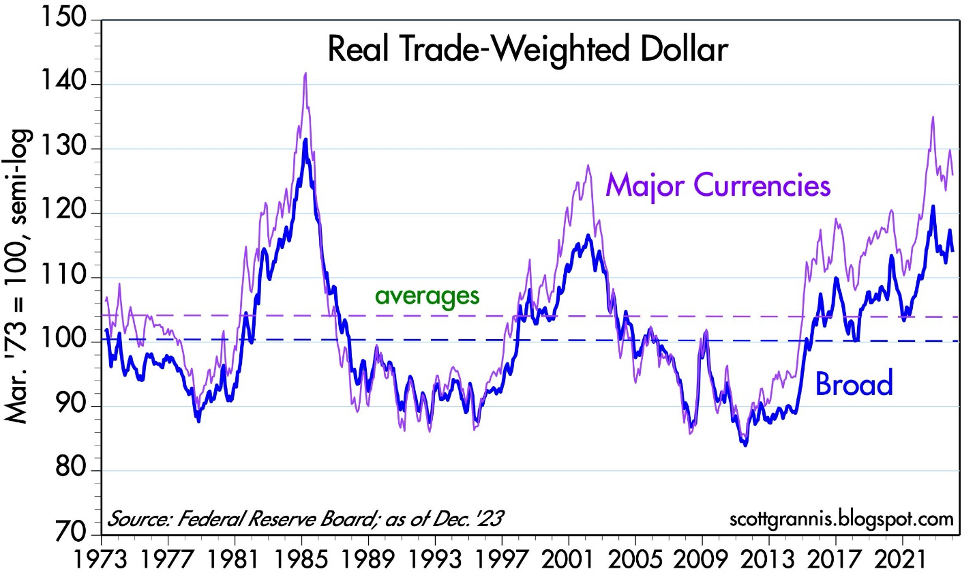

For years, market critics and pessimists have been screaming doom-and-gloom as it relates to the United States. The story goes, the U.S. is falling apart, government spending and debt levels are out of control, politicians are corrupt, and we’re going into recession, thanks in part to higher interest rates and inflation. Well, if that’s the case, then why has the value of the U.S. dollar increased over the last 10 years (see chart below)? And why is the stock market at all-time record-highs?

Source: Calafia Beach Pundit

Global investors are discerning in which countries they invest their hard-earned money. Global capital will flow to those countries with a rule of law, financial transparency, prudent tax policy, lower inflation, higher profit growth, lower interest rates, sensible fiscal and monetary policies, among other pragmatic business practices. There’s a reason they call it the “American Dream” and not the “Chinese Dream.” Our capitalist economy is far from perfect, but finding another country with a better overall investing environment is nearly impossible. There’s a reason why venture capitalists, private equity managers, sovereign wealth funds, hedge funds, and foreign institutions are investing trillions of their dollars in the United States. Money goes where it is treated best!

As money sloshes around the world, the 2024 investing race has a long way before it’s over, but at least the stock market has quickly gotten out of the gate and built a small lead.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (February 1, 2024). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in NVDA, and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Sidoxia Webinar: The Keys to ’23 & What’s in Store for ’24 – Market Update

Unlock valuable insights at our upcoming webinar:

The Keys to ’23 & What’s in Store for ’24!

Tuesday, January 30th at 12:00 PM

Click the Zoom link below to register:

https://sidoxia.link/Webinar-Registration

Don’t miss out on the latest trends and expert discussions.

We will delve into a comprehensive market update. Register now!

The Douglas Coleman Show Interviews Wade Slome

Wade Slome, President and Founder of Sidoxia Capital Management, recently had the pleasure of being featured on The Douglas Coleman Show hosted by Douglas Coleman.

Drawing from professional and personal life lessons, Wade shares his knowledge about navigating market trends, building investment strategies, and also discuss the books he has authored.

If you are interested in learning more about the books Wade has authored, please visit: https://www.sidoxia.com/wades-books

This Baby Bull Has Time to Grow

You may have witnessed some fireworks on New Year’s Eve, but those weren’t the only fireworks exploding. The last two months of 2023 finished with a bang! More specifically, over this short period, the S&P 500 index skyrocketed +13.7%, NASDAQ +16.8%, and the Dow Jones Industrial Average +14.0%. The gains have been even more impressive for the cheaper, more interest-rate-sensitive small-cap stocks (IJR +21.8%), which I have highlighted for months (see also AI Revolution).

For the full year, the bull market was on an even bigger stampede: S&P 500 +24%, NASDAQ +43%, and Dow +14%.

Although 2023 closed with a festive explosion, 2022 ended with a bearish growl. Effectively, 2023 was a reverse mirror image of 2022. In 2022, the stock market fell -19% (S&P) due to a spike in inflation. Directionally, interest rates followed inflation higher as the Fed worked through the majority of its 0% to 5.5% Federal Funds rate hiking cycle.

To sum it up simply, the last two years have been like riding a rollercoaster. For the year just ended, much of the year felt like a party, but 2022 felt more like a funeral. When you add the two years together, it was more of a lackluster result. For 2022-2023 combined, results registered at a meager +0.1% for the S&P, +3.7% for the Dow, and -4.0% for the NASDAQ (see chart below).

For those saying the good times of 2023 cannot continue, investors should understand that history paints a different picture. As you can see from the stock market cycles chart (below) that spans back to 1962, the average bull market lasts 51 months (i.e., 4 years, 3 months), while the average bear market persists a little longer than 11 months. This data suggests the current one-year-old baby bull market has plenty of room to grow more.

Source: Visual Capitalist

Why So Bullish?

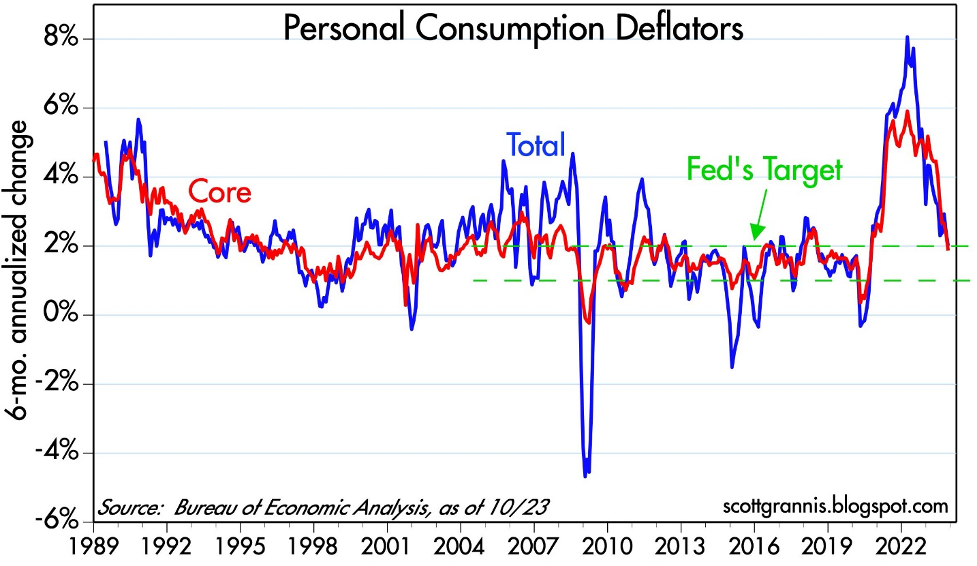

What has investors so jazzed up in recent months? For starters, inflation has been on a steady decline for many months. With China’s stagnating economy, it has helped our inflationary cause by exporting deflationary goods to our country. As you can see from the Personal Consumption Deflator chart below, this broad inflation measure has declined to the Federal Reserve’s 2% target level. Jerome Powell, the Federal Reserve Chairman has been paying attention to these statistics, as evidenced by the central bank’s forecast at the Fed’s recent policy meeting last month on December 13th for three interest rate cuts in 2024. This so-called “Powell Pivot” is a reversal in tone by the Fed, which had been on a relentless rampage of interest rate hikes, over the last two years.

Source: Calafia Beach Pundit

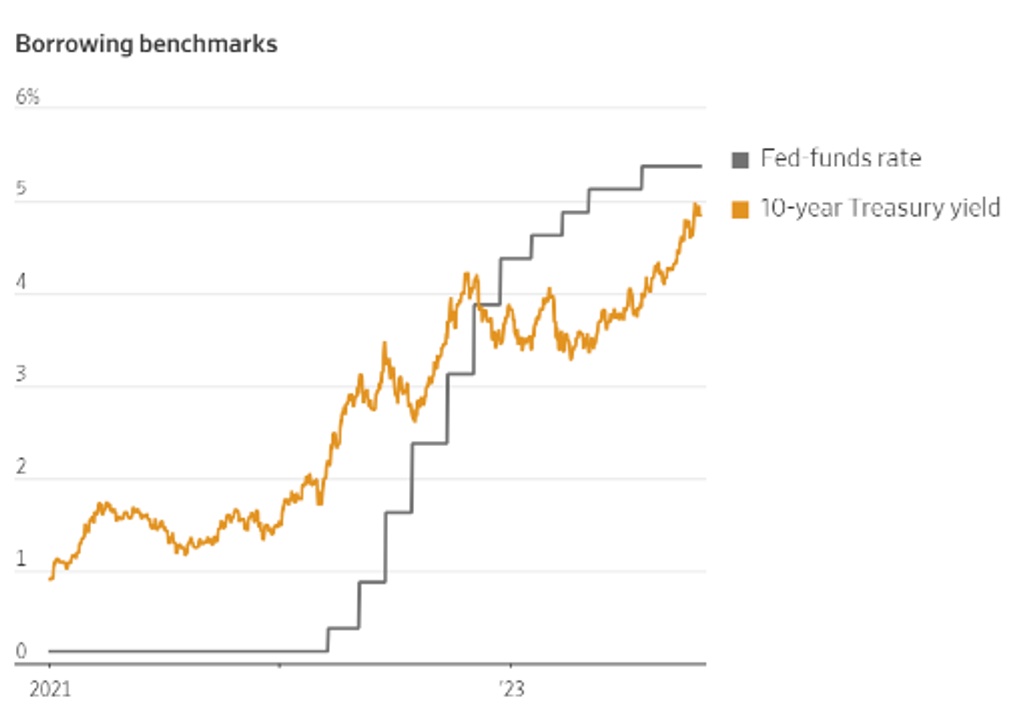

This interest rate cycle headwind has turned into a tailwind as investors now begin to discount the probability of future rate cuts in 2024. The relief of lower interest rates can be felt immediately, whether you consider declining mortgage and car loan rates for consumers, or credit line and corporate loan rates for businesses. This trend can be seen in the benchmark 10-Year Treasury Note yield, which has declined from a peak of 5.0% a few months ago to 3.9% today (see chart below).

Source: Trading Economics

Declining inflation and interest rates explain a lot of investor optimism, but there are additional reasons to be sanguine. The economy remains strong, unemployment remains low, AI (Artificial Intelligence) applications are improving worker productivity, trillions of potential stock market dollars remain on the sidelines in money market accounts, and corporate profits have resumed rising near all-time record levels (see chart below).

Source: Yardeni.com

What could go wrong? There are always plenty of unforeseen issues that could slow or reverse our economic train. Geopolitical events in Russia or the Middle East are always difficult to predict, and we have a presidential election in 2024, which could always negatively impact sentiment. This new bull market had a great start in 2023, but in historical terms, it is only a baby. Time will tell if 2024 will make this baby cry, but whatever the market faces, declining inflation and interest rates should act as a pacifier.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (January 2, 2024). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in individual stocks, and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

No Market Roar Due to War

The devastating damage to humanity from the Israeli-Hamas war that is in and around the Gaza strip should not be diminished or understated – innocent lives on both sides suffer in any conflict. However, the economic impact should not be overstated either. In other words, the hundreds of billions of dollars in financial stock market losses this month are not proportional to the Mideast economic losses incurred thus far.

To put the events in perspective, the population of Israel approximates 10 million people and the population located in the Gaza Strip is about two million people. There are more than eight billion people on the planet, so Israel/Gaza represents roughly 1/7 of 1% of the global population.

From an economic standpoint, the combined economic output of Israel/Gaza Strip accounts for around ½ of 1% of global GDP (see chart below – small slivers in the blue section).

And let’s not forget, economic activity is not dropping to zero. From an economic standpoint, the war’s financial impact is even smaller – a rounding error.

Source: Visual Capitalist

However, wars do not exist in a vacuum, and tensions in the Middle East have the potential of having a ripple effect. Whenever rumblings occur in the Mideast, one of the largest global sectors to be first impacted is the oil market. Approximately 20-30% of the world’s oil is trafficked through the Strait of Hormuz in the Persian Gulf, so it was not surprising to see a short-term spike in oil prices to almost $90 per barrel in early October after the Gaza invasion of Israel. By the end of the month, oil has settled back down to about $81 per barrel, almost precisely the same price right before the war started. On a year-over-year basis, oil prices are actually down approximately -5%, thereby providing minor relief to gas-powered car drivers.

If Iran, or Iran-backed militant group Hezbollah, throws their hat into the Israel-Hamas war ring, the U.S. and other Western allies may retaliate and escalate tensions in the region, which would unlikely be received well by the financial markets.

As a result of these domino effect fears in the region, the stock market took another leg down last month with the S&P 500 index declining -2.2%, the Dow Jones Industrial Average -1.4%, and the NASDAQ index fell the most, -2.8%. The world is a dangerous place, but we have seen this movie before – this is nothing new. We would all prefer world peace, but unfortunately, wars and skirmishes have gone on for centuries.

As Interest Rates Soar, Bonds Offer More

Source: Wall Street Journal

No, TINA is not the name of my high school girlfriend or wife, but rather the acronym TINA (There Is No Alternative) existed in recent years during the Federal Reserve’s zero-interest rate policy days. More specifically, TINA referred to the lack of investment alternatives to equities (i.e., stocks) when money effectively earned 0% in the bank and close-to-0% in many fixed income securities (i.e., bonds). In fact, at one point, although it is still hard to believe, there were more than $16 trillion in bonds paying negative interest rates – pure insanity.

TINA Turns into FIONA

Given the large increase in interest rates by the Federal Reserve over two years (from 0% to 5.50%), investors have been given a short-term gift. As you can see from the chart above, yields on 10-Year Treasury Notes have risen to almost 5.0%. And believe it or not, shorter term bonds are currently providing yields even higher than this. The three-month, six-month, one-year, and two-year Treasuries are all yielding higher rates than 10-Year Treasury yields (i.e., inverted yield curve) – see table below. So, TINA has changed to FIONA – Fixed Income Opens New Alternatives. What’s more, for individuals with taxable accounts, the interest earned on Treasuries is tax-free at the state level, thereby making this short-term gift in yields even more attractive for investors.

Source: Trading Economics

Stock prices were down again for the month, and investment sentiment has been souring due to the war in the Middle East, but there is still plenty of reasons to remain constructive. Not only is the economy strong (e.g., 3rd quarter GDP of +4.9%), but the consumer also remains strong (see Consumer Wallets Strong) in large part because the unemployment rate remains near record lows (+3.8%). While anxiety rises due to the war, stock prices get cheaper, and opportunities increase. And although interest rates remain elevated, the Federal Reserve is signaling they are closer to a rate hiking end, inflation is cooling and FIONA is offering more attractive yields than during the TINA era. It’s true, this month stocks did not roar due to the war, but patient and opportunistic investors will be rewarded with more.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (November 1, 2023). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in individual stocks, and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Consumer Wallets Strong, Rate Hikes Long, What Could Go Wrong?

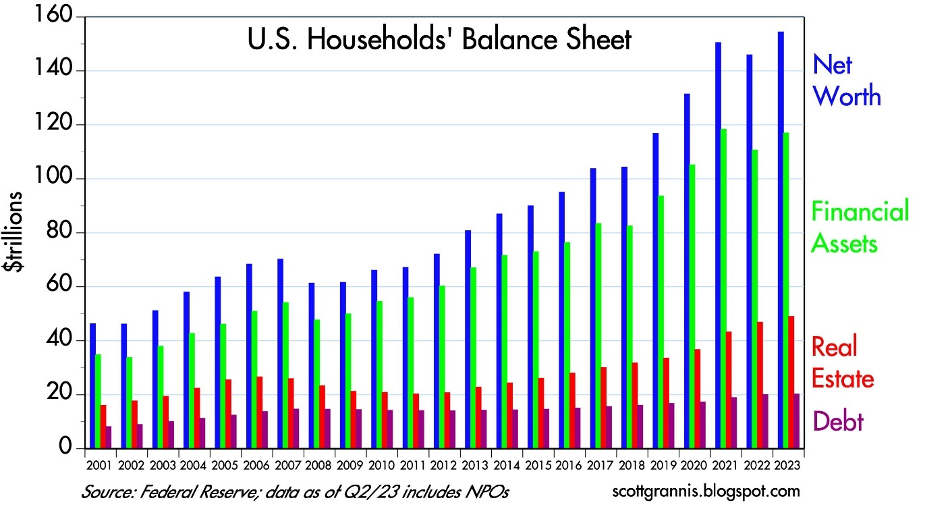

Consumer wallets and balance sheets remain flush with cash as employment remains near record-high levels. Cash in consumer wallets and money in the bank help the economy keep chugging along at a healthy clip. More specifically, as you can see in the chart below, the net worth of U.S. households has reached a record $154.3 trillion dollars in the most recent month, thanks to appreciation in stocks, gains in real estate, and relatively stable levels of debt.

Source: Calafia Beach Pundit

Unemployment Remains Low

In addition, the unemployment rate is sitting at 3.8%, near multi-decade lows (see chart below).

Source: Trading Economics

As long as consumers continue to hold a job, they will continue spending to buoy economic activity – remember, consumer spending accounts for roughly 70% of our country’s economic activity. Case in point are the most recently released GDP (Gross Domestic Product) forecasts by the Atlanta Federal Reserve, which show 3rd quarter GDP growth estimated at a 4.9% rate (see chart below).

Rates Up, Housing Prices Up?

Yes, it’s true, despite a dramatic surge in mortgage rates over the last few years, the housing market remains strong due to a very tight supply of homes available for sale. Most homeowners with a mortgage have refinanced to a rate in the range of 3% (or in some cases even lower), so selling and moving into a new home with a mortgage at current rates of 7.3% is not that appealing. In other words, if you decide to move, your monthly mortgage payment could potentially go up by more > 50%, which could equate to thousands of dollars per month. Under this scenario, you are likely to stay put and not sell your home.

Source: Trading Economics

The embedded economic disincentive of selling a home with a mortgage has really put a real crimp on the supply of homes available for sale (chart below). As you can see, the inventory of homes has dramatically collapsed from a peak of about four million homes, circa the 2008 Financial Crisis, to around one million homes today.

Source: Trading Economics

In the face of this mixed data, the stock market finished a hot summer with a cool whimper last month, in large part due to a 0.49% increase in the 10-Year Treasury Note yield to 4.58% (see chart below). The S&P 500 index fell -4.9% for the month, the technology-heavy NASDAQ index dropped even further by -5.8%, while the Dow Jones Industrial Average outperformed, down -3.5% for the month. Worth noting, however, the Dow has significantly underperformed the other indexes so far this year.

Source: Trading Economics

Inflation on the Mend

The Fed continues to talk tough about fighting inflation after taking interest rates from 0% to 5.5% over the last two years, nevertheless inflation continues to come down. The Fed’s go-to Core PCE inflation datapoint that came out last Friday at +0.1% is consistent with the downward inflation trend we have been witnessing for many months now (see chart below). As you can see, inflation on annualized basis has reached 2.2%, nearly achieving the Federal Reserve’s target of 2.0%.

Source: The Wall Street Journal and Commerce Department

There is never a shortage of investor concerns. Today, worries include Federal Reserve policy; restarting of school loan repayments (after a three-year hiatus); a potential government shutdown; an auto and Hollywood strike; higher oil prices; and a presidential election that is heating up. Many of these worries are nothing new. The bull market took a pause for the month, but consumer wallets remain fat, the economy keeps chugging, the employment picture remains strong, and stock prices remain up +12% for the year (S&P 500). For the time being, betting on a soft economic landing over an imminent recession could be a winning use for that cash in your wallet.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (October 2, 2023). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in individual stocks, and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Fight the Fed… Or Risk Your Account Going Dead!

Throughout history the prominent Wall Street mantra has been, “Don’t fight the Fed.” In essence, the credo instructs investors to sell stocks when the Federal Reserve increases its Federal Funds interest rate target and buy stocks when the Fed cuts its benchmark objective. The pace of interest rate increases since early 2022 has increased at the fastest rate in over four decades (see chart below). Unfortunately for those following this overly simplistic guidance of not opposing the Fed, investor portfolio balances have been harmed dramatically during 2023 by missing a large bull market run. Despite this year’s three interest rate hikes and an 87% probability of another increase next month by the Federal Reserve, the S&P 500 index surged +6.5% last month and has soared +15.9% for 2023, thus far.

Source: TradingEconomics.com

The technology-heavy NASDAQ index has skyrocketed even more by +31.7% this year, thanks in part to Apple Inc. (AAPL) surpassing the $3 trillion market value (+49.3%), thereby exceeding the total gross domestic product (GDP) of many large individual countries like France, Italy, Canada, Brazil, Russia, South Korea, Australia, Mexico, and Spain.

But Apple’s strong performance only explains part of the technology sector’s impact on stock returns this year. The lopsided influence of technology stocks can be seen through the performance of the largest seven mega-stocks in the S&P 500 (a.k.a., The Magnificent 7), which have averaged an eye-popping return of +89%. Artificial intelligence (AI) juggernaut, NVIDIA Corporation (NVDA), has led the way by almost tripling in value in the first six months of the year from $146 per share to $423.

GDP & Profits Growing

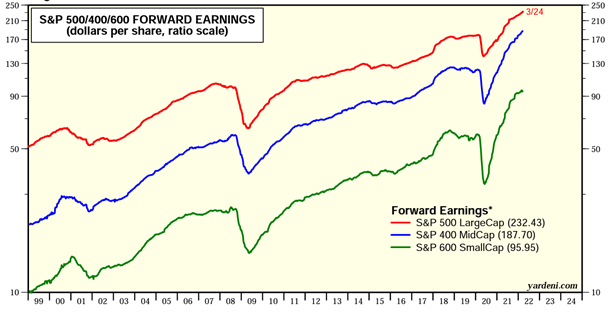

Economists and skeptical investors have been calling for a recession for well over a year now, however GDP growth and forecasts remain positive, unemployment remains near generationally low levels (below 4%), and corporate profit forecasts are beginning to creep higher (see chart below – red line). You can see, unlike previous recessions, profits have not collapsed and actually have reversed course upwards.

Source: Yardeni.com

These factors, coupled with the cooling of inflation pressures have contributed to this bull market in stocks that has soared +27% higher since the October 2022 bottom in the S&P 500. With this advance in stock prices, we have also seen green shoots sprout in the Initial Public Offering (IPO) market for new publicly traded companies (see chart below) like Mediterranean fast-casual restaurant chain CAVA Group, Inc. (CAVA), which has catapulted +86% in its opening month and thrift store company Savers Value Village, Inc. (SVV) which just recently climbed over +31% in its debut week.

Source: The Financial Times (FT)

Dumb Rules of Thumb

Wall Street is notorious for providing rules of thumb and shortcuts for the masses, but if investing was that easy, I’d be retired on my private island consuming copious amounts of coconut drinks with tiny umbrellas. Case in point, following the guideline to “sell in May and go away” would have cost you dearly last month with prices gushing higher. And although the “January Effect” has been documented by academics as a great period to buy stocks, this so-called phenomenon has failed in three of the last four years. Which brings us back to the Fed. It is true that “not fighting the Fed” worked well last year, given the shellacking stocks took after a steep string of Fed interest rate increases, but following the same strategy this year would have only resulted in a large bath of tears. As is the case with most things investing related, there are no cheap and easy rules to follow that will lead you to financial prosperity. The best recommendation I can provide when it comes to investing advice squawked by the media masses is that the true path to wealth creation often comes from ignoring or disobeying these unreliable and inconsistent rules of thumb. Therefore, contrary to popular belief, fighting the Fed may actually lead to knockout returns for investors.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (July 3, 2023). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in NVDA, AAPL, and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in CAVA, SVV, or anyother security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Air Bags Deployed to Cushion Bank Crashes

In recent years, COVID and a ZIRP (Zero Interest Rate Policy) caused out-of-control inflation to swerve the economy in the wrong direction. However, the Federal Reserve and its Chairman, Jerome Powell, slammed on the brakes last year by instituting the most aggressive interest rate hiking policy in over four decades.

At the beginning of last year, interest rates (Federal Funds Rate target) stood at 0% (at the low end of the target), and today the benchmark interest rate stands at 5.0% (at the upper-end of the target) – see chart below.

Source: Trading Economics

Unfortunately, this unparalleled spike in interest rates contributed to the 2nd and 3rd largest bank failures in American history, both occurring in March. The good news is the Federal Reserve and banking regulators (the Treasury and FDIC – Federal Deposit Insurance Corporation) deployed some safety airbags last month. Most notably, the Fed, FDIC, and Treasury jointly announced the guarantee of all deposits at SVB, shortly after the bank failure. Moreover, the Fed and Treasury also revealed a broader emergency-lending program to make more funds available for a large swath of banks to meet withdrawal demands, and ultimately prevent additional runs on other banks.

Investors were generally relieved by the government’s response, and the financial markets reacted accordingly. The S&P 500 rose +3.5% last month, and the technology-heavy NASDAQ index catapulted even more (+6.7%). But not everyone escaped unscathed. The KBW Bank Index got pummeled by -25.2%, which also injured the small-cap and mid-cap stock indexes, which declined -5.6% (IJR) and -3.5% (IJH), respectively.

Nevertheless, as mentioned earlier, slamming on the economic brakes too hard can lead to unintended consequences, for example, a bank failure or two. Well, that’s exactly what happened in the case of Silicon Valley Bank (SVB), the 2nd largest bank failure in history ($209 billion in assets), and cryptocurrency-heavy Signature Bank, the 3rd largest banking collapse in history – $110 billion in assets (see below).

Source: The Wall Street Journal

How did this Silicon Valley Bank failure happen? In short, SVB suffered a bank run, meaning bank customers pulled out money faster than the bank could meet withdrawal requests. Why did this happen? For starters, SVB had a concentrated customer base of financially frail technology start-ups. With a weak stock market last year, many of the start-ups were bleeding cash (i.e., shrinking their bank deposits) and were unable to raise additional funds from investors.

As bank customers began to lose confidence in the liquidity of SVB, depositors began to accelerate withdrawals. SVB executives added gasoline to the fire by making risky investments long-term dated government bonds. Essentially, SVB was making speculative bets on the direction of future interest rates and suffered dramatic losses when the Federal Reserve hiked interest rates last year at an unprecedented rate. This unexpected outcome meant SVB had to sell many of its government bond investments at steep losses in order to meet customer withdrawal requests.

It wasn’t only the large size of this bank failure that made it notable, but it was also the speed of its demise. It was only three and a half weeks ago that SVB announced a $1.8 billion loss on their risky investment portfolio and the subsequent necessity to raise $2.3 billion to fill the hole of withdrawals and losses. The capital raise announcement only heightened depositor and investor anxiety, which led to accelerated bank withdrawals. Within a mere 24-hour period, SVB depositors attempted to withdraw a whopping $42 billion.

Other banks, such as First Republic Bank (FRB), and a European investment bank, Credit Suisse Group (CS), also collapsed on the bank crashing fears potentially rippling through other financial institutions around the globe. Fortunately, a consortium of 11 banks provided a lifeline to First Republic with a $30 billion loan. And Credit Suisse was effectively bailed out by the Swiss central bank when Credit Suisse borrowed $53 billion to bolster its liquidity.

While stockholders and bondholders lost billions of dollars in this mini-banking crisis, financial vultures swirled around the remains of the banking sector. More specifically, First Citizens BancShares (FCNA) acquired the majority of Silicon Valley Bank’s assets with the assistance of the FDIC, and UBS Group (UBS) acquired Credit Suisse for more than $3 billion, thereby providing some stability to the banking sector during a volatile period.

Many pundits have been predicting the U.S. economy to crash into a recession as a result of the aggressive, interest rate tightening policy of the Federal Reserve. So far, Mark Twain would probably agree that the death of the U.S. economy has been greatly exaggerated. Currently, the first quarter measurement of economic activity, GDP (Gross Domestic Product), is estimated to measure approximately +2.0% after closing 2022’s fourth quarter at +2.6% (see chart below). As you probably know, a definition of a recession is two consecutive quarters of negative GDP growth.

Source: Trading Economics

Regardless of the economic outcome, investors are now predicting the Federal Reserve to be at the end or near the end of its interest rate hiking cycle. Presently, there is roughly a 50/50 chance of one last 0.25% interest rate increase in May (see chart below), and then investors expect at least one interest rate cut by year-end.

Source: CME Group

Last year was a painful year for most investors, but stocks as measured by the S&P 500 have bounced approximately +18% since the October 2022 lows. Market participants are still worried about a possible recession crashing the economy later this year, but hopefully last year’s stock market collision and subsequent banking airbag protections put in place will protect against any further financial pain.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (Apr. 3, 2023). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing had no direct position in SIVB, FCNA, UBS, FRB, CS, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Insane Gain After Fed & Ukraine Pain

After a painful start to 2022, the stock market surged last month, with the S&P 500 index gaining a respectable +3.6%, while the technology-heavy NASDAQ index rose by +3.4%. With volatility on the rise, getting caught up in the emotions of the headlines can be challenging for some investors. At Sidoxia, we are determined to objectively stick to the facts and migrate investments to the areas of the market that provide the best risk-reward opportunities to our clients, based on their unique objectives and constraints. There certainly are some headwinds for investors to contend with, but for long-term investors, it’s also important to recognize the positive tailwinds and not miss the forest for the trees.

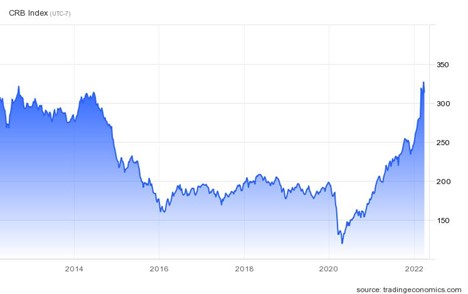

As I pointed out last month, we are coming off a heroic advance over the last three years (2019/2020/2021) with the S&P 500 soaring +90%. The hangover from COVID has created significant supply chain disruptions and widespread economic shortages. Adding the Russian invasion of Ukraine to the mix has been like pouring gasoline on the flames of inflation, especially when it comes to the energy and food sectors. As you can see from the CRB index below (a basket of 19 commodities ranging from aluminum to orange juice and live cattle to wheat), in recent years the index has been highly volatile in both directions, but is up +27% this year. Since the COVID-driven trough, prices have about tripled over the last two years, but that does not mean prices will fly to the moon forever.

Many traders have short-term memories. People forget that commodity prices approximately doubled after the 2008 Financial Crisis, only to experience a subsequent slow bleed over the next decade until prices were essentially chopped in half. As the saying goes, “price cures price.” In other words, as prices skyrocket, greedy capitalists and businesses then decide to take advantage of the high pricing environment by investing to produce more supply, which eventually leads to deflation. This supply expansion process takes time and will not happen overnight.

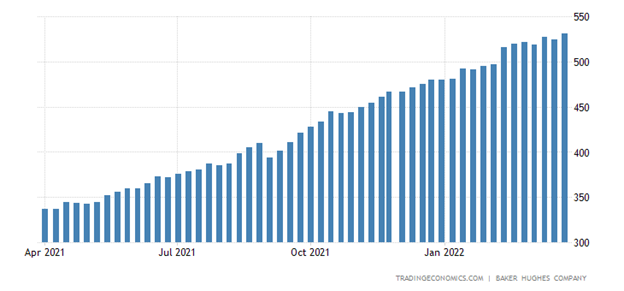

With gasoline prices exceeding $4/gallon nationally, and breaching $6/gallon in my Southern California backyard (see chart below), it should come as no surprise that oil companies are taking advantage of the lucrative environment by drilling for more oil.

The rising Baker Hughes drilling rig count below reflects the miracle of supply-demand economics operating in full force. As prices rise and accelerate during geopolitical shocks like we have experienced in Ukraine, naturally supply rises, which eventually depresses prices until an equilibrium is reached. Even our government is now attempting to increase supply by releasing up to 180 million barrels of oil from our country’s Strategic Petroleum Reserve (the largest release in the almost 50-year history of the reserve), while also pushing for penalties on those energy companies sitting on unused permits (i.e., not producing oil on leased oil land). High energy prices will most certainly become a hot-button political issue in the upcoming midterm elections.

Adding to investor anxiety, our Federal Reserve is embarking on an interest rate hiking cycle that is expected to take the targeted Federal Funds interest rate from effectively 0% to a range around 2.5% over the next couple of years. The Fed’s goal is to increase the cost of borrowing, thereby slowing down the economy and reducing inflation. On the surface this sounds scary, but do you remember what happened the last time the Fed tapped the interest rate brakes during 2015 – 2018? Despite the Fed raising interest rates from 0% to 2.5%, the stock market increased dramatically over that timeframe. The current Fed interest rate cycle may more closely resemble 1994 when the Fed aggressively hiked rates from 3% to 6%. Similar to now, back then stock prices swung wildly throughout the year to eventually finish the year flattish.

If Things Are So Bad, Why Are Prices Going Up?

In the face of such horrible and scary headlines, how can prices still go up? The short answer is that companies are making money hand over fist and the economy remains strong (3.6% unemployment rate; record 11.3m job openings; 3% forecasted growth in 2022 GDP) in a post-COVID recovery world, where consumers remain financially healthy and are now looking to spend their shelter-in-place savings on vacations, houses, and cars (all healthy industries).

Not only are corporate profits at record levels, they are also expected to grow at a healthy rate (+10% in 2022, +10% in 2023) after mind-boggling growth of +50% in 2021 (see chart below).

Could the headwinds previously described cause prices to go lower? They certainly could, but valuations remain attractive given where interest rates currently stand. If interest rates rise dramatically, all else equal, then that will be challenging for all asset pricing. Moreover, discounting or forecasting future Russian military actions is a difficult chore as well, which could also potentially throw a curve ball at investors.

In the meantime, what are companies doing with this flood of growing cash? Well, besides combing the job boards in search of hiring a scarce number of qualified workers, investing in technology to improve productivity, and expanding geographically to grow revenues, companies are also returning gobs of cash to investors in the form of record, swelling dividends and share buybacks (see charts below).

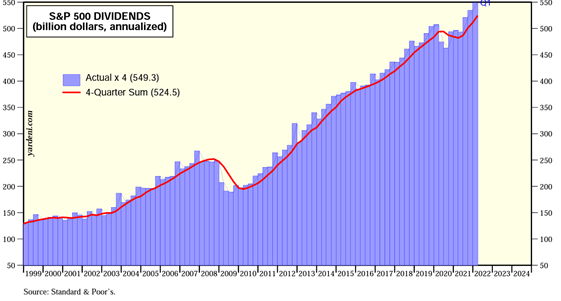

Darling Dividends

The gift that keeps on giving. Dividends now amount to more than half a trillion dollars and they are still growing.

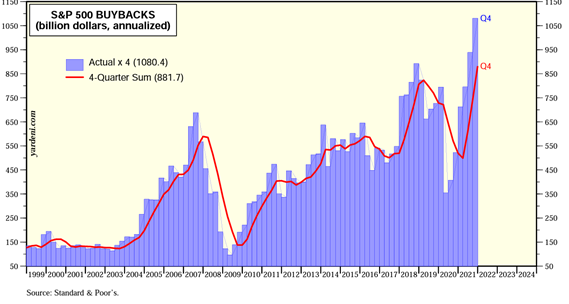

Beautiful Buybacks

As you can see, the trajectory of buybacks are more volatile and discretionary than dividends, but record profits are driving more than $1 trillion in share buybacks on an annualized basis – not too shabby.

Although there are plenty of reasons for investors to rationalize a run for the hills, there remains some extraordinarily strong fundamental tailwinds intact. In spite of the economic pain caused by Ukraine, the Fed, and inflation, there are plenty of reasons to remain optimistic. The strong economy, impressive profit growth, historically low interest rates (even though slowly rising), cash-rich corporations, and attractive valuations mean there is still ample room for future market gains.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (April 1, 2022). Subscribe on the right side of the page for the complete text.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

From Rocket Ship to Roller Coaster

The stock market has been like a rocket ship over the last three years 2019/2020/2021, advancing +90% as measured by the S&P 500 index, and +136% for the NASDAQ. After this meteoric multi-year rise, stock values started to come back to earth in 2022, and the rocket ship turned into a roller coaster during January. More specifically, the S&P 500 fell -5% for the month and the NASDAQ -9%. Yes, it’s true volatility has increased, and your blood pressure may have risen with all the ups and downs. However, the fact remains the economy remains strong, corporate profits are at record levels, unemployment is low, and interest rates remain at attractive levels despite nagging inflation (see chart below) and the removal of accommodative monetary policies by the Federal Reserve.

Math Matters

I did okay in school and was educated on many different topics, including the basic principle that math matters. This notion rings especially true when it comes to finance and investing. As I have discussed numerous times in the past, money goes where it is treated best, which is why interest rates, cash flows, and valuations play such a key role in ultimately determining long-term values across all asset classes. This concept of money seeking the best home applies equally to stocks, bonds, real estate, commodities, crypto-currencies, and any other asset class you can imagine because interest rates help determine the cost of holding and using money.

Normally, mathematics teaches us the lesson that more is better when discussing financial matters. And currently the stock market is compensating investors significantly more for investing in stocks relative to investing in bonds – I have reviewed this concept repeatedly on my Investing Caffeine blog (see Going Shopping: Chicken vs. Beef ). Currently, investors are getting paid about +5% to hold stocks based on the forward earnings yield (i.e., the inverse of the stock market’s Price-Earnings ratio of 20x) vs. the +2% yield on the 10-Year Treasury Note (1.78% more precisely on 1/31/22). What’s more, historically speaking, stock investors typically get rewarded with an earnings yield that doubles about every 10 years, whereas bond yields usually remain stagnantly flat, if bonds are held until maturity.

With that said, I am always quick to point out that diversification in a portfolio is important (i.e., most people should at least own some bonds), even if bonds are currently very expensive relative to other asset classes (see Sleeping on Expensive Financial Pillows). If bond yields climb significantly to the point where returns are more competitive with stocks, I will likely be buying significantly more bonds for me and my Sidoxia (www.sidoxia.com) clients.

Fed Jitters

The recent stock market volatility is reinforcing the idea that the Federal Reserve’s more aggressive stance regarding hiking interest rates is making many investors very anxious – just not me. I have lived through many tightening cycles in my lifetime and lived to tell the tale. It is true that all else equal, higher interest rates generally depress asset values, but it is also important to place the current interest rate environment in historical context. Although the Federal Funds interest rate target is expected to increase to 2.5% over the next few years (currently at 0%), this forecast is nothing new and there is no guarantee the Fed can successfully pull off this feat. Many people have short memories and forget the Fed hiked interest rates 10 times from the end of 2015 through 2018. In the face of this scary period, the stock market (S&P 500) still managed to approximately climb a respectable +22% (albeit with some volatility). Furthermore, if you give the Fed the benefit of the doubt of achieving this uncertain target, this 2.5% level is very appealing and still extremely low, historically speaking (see chart below).

When discussing interest rates and inflation, investors should also expand their views globally to the other 95% of the world’s population. Many investors are very myopic in their focus on U.S. interest rates. It is important to understand that rates are not just low here in the United States, but also low almost everywhere else as well. While international interest rates have bounced marginally higher in recent months, those countries’ long-term international rates, by and large, remain tremendously low too – in most cases even lower than rates in the U.S. (see chart below). Yes, the Fed has some control over short-term interest rates in the U.S., but considering other crucial forces that are depressing long-term global rates is worth pondering. Factors such as globalization and the pervading expansion of deflationary technology into our personal and work lives are contributing to disinflation. Valuable conclusions can be synthesized beyond digesting the pessimistic and nauseating analysis of Jerome Powell’s Congressional testimony, along with the needless wordsmithing of recent Fed minutes.

In order to earn above-average, financial returns in your portfolio over the long-run, experiencing unsettling volatility and corrections is the price of doing business. Flying on rocket ships might be fun, but sometimes the rocket can run out of gas, and you are forced to jump on a roller coaster. The ups-and-downs can be frustrating at times, but if you stay on for the full ride, you will almost always end with a smile on your face when it’s over.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (February 1, 2022). Subscribe on the right side of the page for the complete text.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in PFE and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.