Siegel & Co. See “Bubblicious” Bonds

August 20, 2010 at 2:02 am 10 comments

Siegel compares 1999 stock prices with 2010 bonds

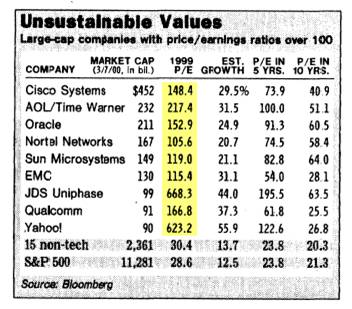

Unlike a lot of economists, Jeremy Siegel, Professor at the Wharton School of Business, is not bashful about making contrarian calls (see other Siegel article). Just days after the Nasdaq index peaked 10 years ago at a level above 5,000 (below 2,200 today), Siegel called the large capitalization technology market a “Sucker’s Bet” in a Wall Street Journal article dated March 14, 2000. Investors were smitten with large-cap technology stocks at the time, paying balloon-like P/E (Price-Earnings) ratios in excess of 100 times trailing earnings (see table above).

Bubblicious Boom

Today, Siegel has now switched his focus from overpriced tech-stock bubbles to “Bubblicious” bonds, which may burst at any moment. Bolstering his view of the current “Great American Bond Bubble” is the fact that average investors are wheelbarrowing money into bond funds. Siegel highlights recent Investment Company Institute data to make his point:

“From January 2008 through June 2010, outflows from equity funds totaled $232 billion while bond funds have seen a massive $559 billion of inflows.”

The professor goes on to make the stretch that some government bonds (i.e., 10-year Treasury Inflation-Protected Securities or TIPS) are priced so egregiously that the 1% TIPS yield (or 100 times the payout ratio) equates to the crazy tech stock valuations 10 years earlier. Conceptually the comparison of old stock and new bond bubbles may make some sense, but let’s not lose sight of the fact that tech stocks virtually had a 0% payout (no dividends). The risk of permanent investment loss is much lower with a bond as compared to a 100-plus multiple tech stock.

Making Rate History No Mystery

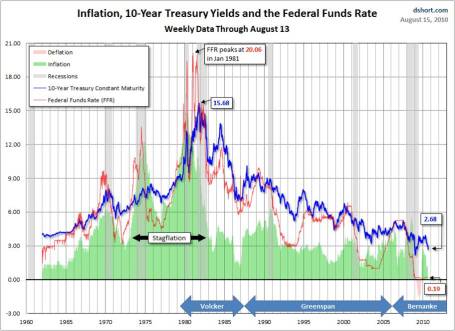

What makes Siegel so nervous about bonds? Well for one thing, take a look at what interest rates have done over the last 30 years, with the Federal Funds rate cresting over 20%+ in 1981 (View RED LINE & BLUE LINE or click to enlarge):

As I have commented before, there is only one real direction for interest rates to go, since we currently sit watching rates at a generational low. Rates have a minute amount of wiggle room, but Siegel rightfully understands there is very little wiggle room for rates to go lower. How bad could the pain be? Siegel outlines the following scenario:

“If over the next year, 10-year interest rates, which are now 2.8%, rise to 3.15%, bondholders will suffer a capital loss equal to the current yield. If rates rise to 4% as they did last spring, the capital loss will be more than three times the current yield.”

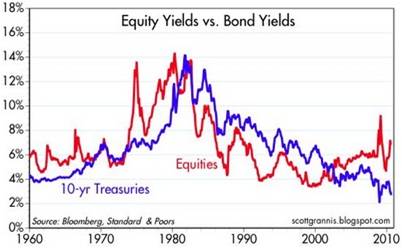

Siegel is not the only observer who sees relatively less value in bonds (especially government bonds) versus stocks. Scott Grannis, author of the Calafia Report artfully shows the comparisons of the 10-Year Treasury Note yield relative to the earnings yield on the S&P 500 index:

As you can see, rarely have there been periods over the last five decades where bonds were so poorly attractive relative to equities.

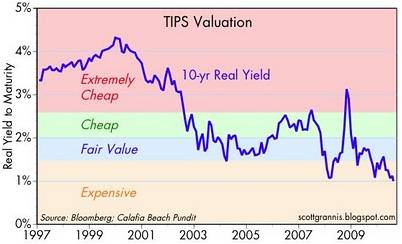

Grannis mirrors Siegel’s view on government bond prices through his chart on TIPS pricing:

Pricey Treasuries is not a new unearthed theme, however, Siegel and Grannis make compelling points to highlight bond risks. Certainly, the economy could soften further, and trying to time the bottom to a multi-decade bond bubble can be hazardous to your investing health. Having said that, effectively everyone should desire some exposure to fixed income securities, depending on their objectives and constraints (retirees obviously more). The key is managing duration and the risk of inflation in a prudent fashion. If you believe Siegel is correct about an impending bond bubble bursting, you may consider lightening your Treasury bond load. Otherwise, don’t be surprised if you do not collect on another “sucker’s bet.”

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

*DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds (including TIP and other fixed income ETFs), but at the time of publishing SCM had no direct position in any security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Entry filed under: Fixed Income (Bonds), Profiles. Tags: bonds, bubble, fixed income, inflation, interest rates, Jeremy Siegel, Scott Grannis, TIPS, valuation.

10 Comments Add your own

Leave a reply to PIMCO – The Downhill Marathon Machine « Investing Caffeine Cancel reply

Trackback this post | Subscribe to the comments via RSS Feed

1. Weekend reading: Not so grande edition | August 21, 2010 at 12:32 am

[…] Bubblicious bonds – Investing Caffeine […]

2. Skiing Portfolios Down Bunny Slopes « Investing Caffeine | September 22, 2010 at 1:24 am

Skiing Portfolios Down Bunny Slopes « Investing Caffeine | September 22, 2010 at 1:24 am

[…] and in 2010, Treasury bonds and gold are currently being touted as sure bets and safe havens (read Bubblicious Bonds and Shiny Metal Shopping) You guess how the next story […]

3. Why it’s NOT Different This Time « Investing Caffeine | September 29, 2010 at 12:09 am

Why it’s NOT Different This Time « Investing Caffeine | September 29, 2010 at 12:09 am

[…] the “New Economy” cheerleaders in 1999 when everyone was piling into dot-com stocks (see Bubblicious technology table […]

4. September Surge: Stop, Go, or Proceed Cautiously? « Investing Caffeine | October 1, 2010 at 12:33 am

September Surge: Stop, Go, or Proceed Cautiously? « Investing Caffeine | October 1, 2010 at 12:33 am

[…] above, equity market prices remain attractive relative to the broader fixed-income markets (see Bubblicious Bonds) . More specifically, the S&P 500 is priced at about a 25% discount to historic valuation […]

5. PIMCO – The Downhill Marathon Machine « Investing Caffeine | October 25, 2010 at 1:30 am

PIMCO – The Downhill Marathon Machine « Investing Caffeine | October 25, 2010 at 1:30 am

[…] west-coast beach loving bond gurus are not the sole beneficiary in this “bond bubble” (see Bubblicious Bonds story), PIMCO has separated itself from the competition with its shrewd world-class marketing […]

6. Jeff | October 26, 2010 at 4:01 am

Jeff | October 26, 2010 at 4:01 am

The “Equity Yields vs. Bond Yields” chart is completely oblivious to the source of those yields. Bond yields are guaranteed (assuming the issuer’s solvency), but euity yields have been artificially propped up for the past 18 months by decreasingly solvent governments.

Karl Denninger has a nice chart to show what’s going on:

http://market-ticker.org/akcs-www?singlepost=2139562

7. QE2 Drowning TIPS Yields Below Water « Investing Caffeine | October 26, 2010 at 10:55 pm

QE2 Drowning TIPS Yields Below Water « Investing Caffeine | October 26, 2010 at 10:55 pm

[…] times have created an unprecedented appetite for bonds (see Bubblicious Bonds), and as a result, we just witnessed a historic $10 billion TIPS auction this week producing an […]

8. TIPS’ Defense Against an Inflationary or Deflationary Economy « raywatkins.com | October 27, 2010 at 3:04 pm

[…] times have created an unprecedented appetite for bonds (see Bubblicious Bonds), and as a result, we just witnessed a historic $10 billion TIPS auction this week producing an […]

9. Bond-Choking Central Banks Expand Investment Menu | Investing Caffeine | April 28, 2013 at 11:31 am

Bond-Choking Central Banks Expand Investment Menu | Investing Caffeine | April 28, 2013 at 11:31 am

[…] I may agree that stocks generally are a more attractive asset class than bubblicious bonds right now, I may draw the line once the Fed starts buying houses, gasoline, and groceries for all […]

10. Time To Get Out Of Stocks? | June 25, 2014 at 8:18 pm

[…] allocation should remain in stocks. Despite record low yields and record high bond prices (see Bubblicious Bonds and Weak Competition, it is perfectly rational for a Baby-Boomer or retiree to periodically ring […]