Posts tagged ‘inflation’

Hollywood Shuts Down & Market Goes Uptown

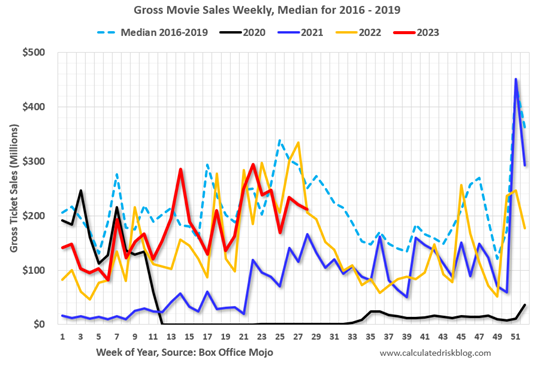

According to scientists, July set a record as the hottest month in 120,000 years. In order to beat the scorching heat, millions of Americans made the pilgrimage to their local air-conditioned movie theaters to watch the combo-blockbuster “Barbenheimer” (Barbie and Oppenheimer), which has raked in sales of more than $1 billion globally in the first two weeks of its release. Thankfully, in the short-run, Barbenheimer has given a shot in the arm to the beleaguered movie industry that suffered dramatically during the pandemic. The chart below (before Barbenheimer) shows industry sales have recovered (red line) somewhat, almost to pre-pandemic averages (dashed light blue line), but still has some ground to gain before industry sales consistently outpaces pre-pandemic levels.

Source: Calculated Risk

Movie Strike Explained

If movies are your gig, you better race to the theaters now because Hollywood has come to a grinding halt, thanks to a dual strike of Hollywood acting unions (SAG-AFTRA) and the Writers Guild of America (WGA) union. The feud between the unions and the movie/television studios centers around demands for higher pay, better working conditions, and protections from AI (Artificial Intelligence) technologies, which could theoretically replace actors and writers. Combined, the unions almost carry an estimated 200,000 members, which means a broad strike like equals no new movies, tv shows, or streaming content. The last time there was a “double strike” like this occurred in 1960 when former President Ronald Reagan was running SAG. Until the dispute is resolved, you better pace your media binging consumption habits because with no new content currently being created, the dispute may begin to eat into your show backlog on Netflix and disrupt your happy couch-streaming time.

Stocks on Fire

But scorching heat and red-hot popular movies were not the only things on fire last month. The stock market continued its fiery, blistering pace with the S&P 500 boiling higher by +3.1%, making the seven-month total gain of 2023 a spicy +20% (see chart below). The Dow Jones Industrial Average joined in on the fun too. Not only did the Dow increase by +3.4% for the month, the index rose for 13 consecutive days, the longest streak of daily advances since 1987. Bubbling up to the top of the performance table, however, is the technology-heavy NASDAQ index (home of the largest Magnificent 7 technology stocks – see also Fight the Fed) with a sizzling +4.1% return for the month, and a scalding +37% rise for the year, so far. The pace of gains is not sustainable forever, so it’s important to have a disciplined process in place to manage the risk of over-extended, over-valued investments, which is exactly what we do at Sidoxia Capital Management.

Source: TradingEconomics.com

Inflation Moving in the Right Direction

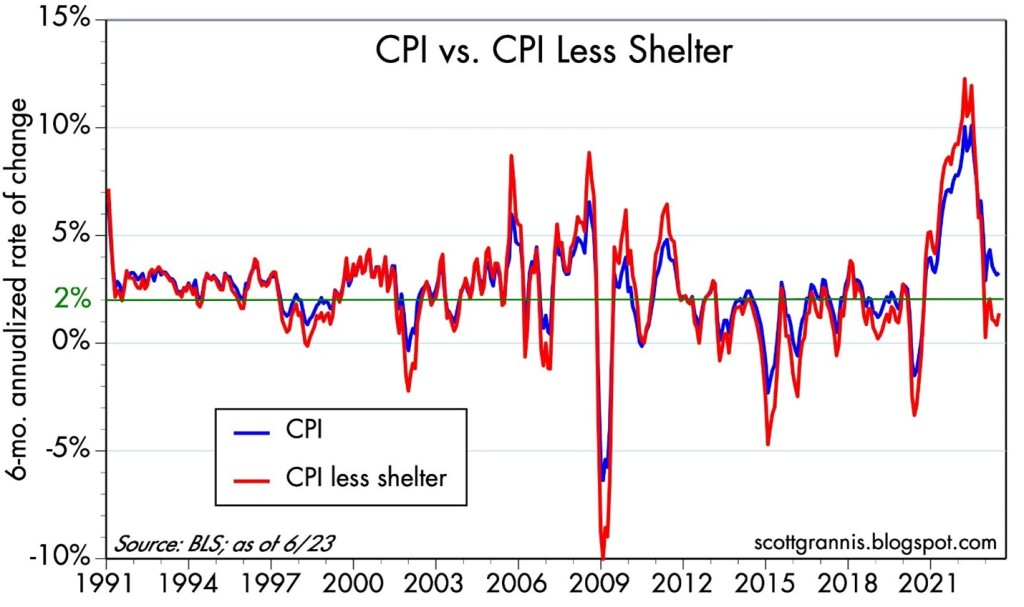

After such a lousy 2022 in the financial markets, why such a searing return for 2023? The biggest reason can be summed up with three words: inflation, inflation, and inflation. More specifically, it’s the pace of “disinflation” we are witnessing that is getting people so excited. As you can see from the chart below, annualized inflation as measured by the Consumer Price Index (CPI) has declined dramatically to 3.3% (blue line), while CPI less shelter (red line) has dropped to 1.4%, which is below the Federal Reserve’s 2% target (green line). These trends have gotten investors excited because they believe Jerome Powell, the Fed Chairman, is closer to ending this year-and-a-half long interest rate hiking cycle. In fact, investors are currently betting for multiple interest rate cuts in 2024.

Source: Calafia Beach Pundit

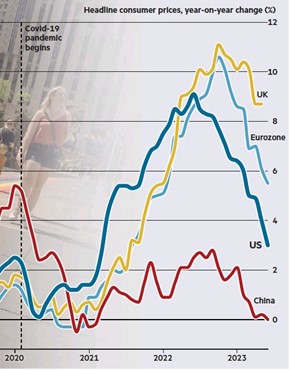

And the disinflation phenomenon is just not limited to U.S. borders – we are witnessing the same disinflationary trends across our borders (see chart below).

Source: The Financial Time (FT)

Confident Consumers

While many economists and traders have incorrectly been calling for a recession for some two years, a more resilient U.S. economy just reported better-than-expected growth for the 2nd quarter (+2.4% – Gross Domestic Product [GDP] growth). The stronger economy along with the improving inflation dynamics mentioned previously have buoyed Consumer Confidence too, as you can see from the chart below.

Source: Calafia Beach Pundit

Everything isn’t perfect (it never is). We continue to experience geopolitical risk as a result of the destabilized war between Russia and Ukraine; growth in China has stalled and not recovered from the pandemic; complacency is beginning to filter into investor attitudes; and we live with a dysfunctional Washington political process. But the economy remains strong, inflation appears to be cooling, and short-term interest rates could be close to peaking. Your air-conditioning bill may be going up this summer, but so will your stock market portfolio, if your investments are being properly managed.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (August 1, 2023). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Air Bags Deployed to Cushion Bank Crashes

In recent years, COVID and a ZIRP (Zero Interest Rate Policy) caused out-of-control inflation to swerve the economy in the wrong direction. However, the Federal Reserve and its Chairman, Jerome Powell, slammed on the brakes last year by instituting the most aggressive interest rate hiking policy in over four decades.

At the beginning of last year, interest rates (Federal Funds Rate target) stood at 0% (at the low end of the target), and today the benchmark interest rate stands at 5.0% (at the upper-end of the target) – see chart below.

Source: Trading Economics

Unfortunately, this unparalleled spike in interest rates contributed to the 2nd and 3rd largest bank failures in American history, both occurring in March. The good news is the Federal Reserve and banking regulators (the Treasury and FDIC – Federal Deposit Insurance Corporation) deployed some safety airbags last month. Most notably, the Fed, FDIC, and Treasury jointly announced the guarantee of all deposits at SVB, shortly after the bank failure. Moreover, the Fed and Treasury also revealed a broader emergency-lending program to make more funds available for a large swath of banks to meet withdrawal demands, and ultimately prevent additional runs on other banks.

Investors were generally relieved by the government’s response, and the financial markets reacted accordingly. The S&P 500 rose +3.5% last month, and the technology-heavy NASDAQ index catapulted even more (+6.7%). But not everyone escaped unscathed. The KBW Bank Index got pummeled by -25.2%, which also injured the small-cap and mid-cap stock indexes, which declined -5.6% (IJR) and -3.5% (IJH), respectively.

Nevertheless, as mentioned earlier, slamming on the economic brakes too hard can lead to unintended consequences, for example, a bank failure or two. Well, that’s exactly what happened in the case of Silicon Valley Bank (SVB), the 2nd largest bank failure in history ($209 billion in assets), and cryptocurrency-heavy Signature Bank, the 3rd largest banking collapse in history – $110 billion in assets (see below).

Source: The Wall Street Journal

How did this Silicon Valley Bank failure happen? In short, SVB suffered a bank run, meaning bank customers pulled out money faster than the bank could meet withdrawal requests. Why did this happen? For starters, SVB had a concentrated customer base of financially frail technology start-ups. With a weak stock market last year, many of the start-ups were bleeding cash (i.e., shrinking their bank deposits) and were unable to raise additional funds from investors.

As bank customers began to lose confidence in the liquidity of SVB, depositors began to accelerate withdrawals. SVB executives added gasoline to the fire by making risky investments long-term dated government bonds. Essentially, SVB was making speculative bets on the direction of future interest rates and suffered dramatic losses when the Federal Reserve hiked interest rates last year at an unprecedented rate. This unexpected outcome meant SVB had to sell many of its government bond investments at steep losses in order to meet customer withdrawal requests.

It wasn’t only the large size of this bank failure that made it notable, but it was also the speed of its demise. It was only three and a half weeks ago that SVB announced a $1.8 billion loss on their risky investment portfolio and the subsequent necessity to raise $2.3 billion to fill the hole of withdrawals and losses. The capital raise announcement only heightened depositor and investor anxiety, which led to accelerated bank withdrawals. Within a mere 24-hour period, SVB depositors attempted to withdraw a whopping $42 billion.

Other banks, such as First Republic Bank (FRB), and a European investment bank, Credit Suisse Group (CS), also collapsed on the bank crashing fears potentially rippling through other financial institutions around the globe. Fortunately, a consortium of 11 banks provided a lifeline to First Republic with a $30 billion loan. And Credit Suisse was effectively bailed out by the Swiss central bank when Credit Suisse borrowed $53 billion to bolster its liquidity.

While stockholders and bondholders lost billions of dollars in this mini-banking crisis, financial vultures swirled around the remains of the banking sector. More specifically, First Citizens BancShares (FCNA) acquired the majority of Silicon Valley Bank’s assets with the assistance of the FDIC, and UBS Group (UBS) acquired Credit Suisse for more than $3 billion, thereby providing some stability to the banking sector during a volatile period.

Many pundits have been predicting the U.S. economy to crash into a recession as a result of the aggressive, interest rate tightening policy of the Federal Reserve. So far, Mark Twain would probably agree that the death of the U.S. economy has been greatly exaggerated. Currently, the first quarter measurement of economic activity, GDP (Gross Domestic Product), is estimated to measure approximately +2.0% after closing 2022’s fourth quarter at +2.6% (see chart below). As you probably know, a definition of a recession is two consecutive quarters of negative GDP growth.

Source: Trading Economics

Regardless of the economic outcome, investors are now predicting the Federal Reserve to be at the end or near the end of its interest rate hiking cycle. Presently, there is roughly a 50/50 chance of one last 0.25% interest rate increase in May (see chart below), and then investors expect at least one interest rate cut by year-end.

Source: CME Group

Last year was a painful year for most investors, but stocks as measured by the S&P 500 have bounced approximately +18% since the October 2022 lows. Market participants are still worried about a possible recession crashing the economy later this year, but hopefully last year’s stock market collision and subsequent banking airbag protections put in place will protect against any further financial pain.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (Apr. 3, 2023). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing had no direct position in SIVB, FCNA, UBS, FRB, CS, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

New Year, New Clean Slate

Stock and bond market returns in 2022 were disappointing, but we now get to start 2023 with a clean slate. Before we turned the page on another annual chapter, Santa Claus chose to finish last year by placing a lump of coal in investor stockings, as evidenced by the S&P 500 index decline of -5.9% during December.

Good News & Bad News

There is some good news and bad news as it relates to this year’s underwhelming stock market results (-19.4%). The bad news is last year turned out to be the 4th worst year in the stock market since World War II (1945) and also marked the worst year since 2008. Here’s a summary of the S&P 500’s worst years over the last eight decades:

2008: -38.5%

1974: -29.7%

2002: -23.4%

2022: -19.4%

Source: CNBC (Bob Pisani)

The good news is that the stock market is up 81% of the time in subsequent years following down years. The average increase in bounce-back years is +14%. In another study of down years, the analysis showed that after the stock market has fallen -20% or more, stock prices were higher on average by +15% one year later, +26% two years later, and +29% three years later. Nothing is guaranteed in life, but as Mark Twain famously stated, “History does not repeat itself, but it often rhymes.”

2022: The Year of No Shock Absorbers (Worst Bond Market Ever)

The stock market receives most of the media glory and reporting, however the bond market is the Rodney Dangerfield of asset classes, it “gets no respect.” Typically, during weak stock markets (i.e., “bear markets”), the bond or fixed income investments in a diversified portfolio act as shock absorbers to cushion the blow of volatile stock prices. More specifically, in a typical bear market, the economy generally slows down causing demand to decelerate, and interest rates to decline, which causes the values of bonds to increase. Therefore, as stock prices decline, the gains from bonds in your portfolio usually help offset stock losses. Unfortunately, this scenario didn’t happen in 2022, but rather investors experienced a double negative whammy. Not only did stocks experience one of its worst years in decades, the bond market also suffered what many pundits are describing as the “Worst Bond Market Ever” – see chart below.

Why in particular did bonds perform so poorly this year, when they commonly outperform in slow or recessionary economic conditions? For starters, interest rates spent most of 2022 increasing at the fastest pace in more than four decades (see chart below). An unanticipated rise in inflation was the main culprit, which was caused by spiking energy prices from Russia’s invasion of Ukraine; COVID-related supply chain disruptions; unprecedented fiscal stimulus (trillions of dollars in infrastructure spending and incentives); record monetary stimulus (QE – Quantitative Easing); and extended years of ZIRP (Zero Interest Rate Policy). For these reasons, and others, bonds collapsed in sympathy with deteriorating stock prices.

Room for Optimism in 2023

Last year was challenging, however, not all is lost. The Federal Reserve, inflation, interest rates, Ukraine, and cryptocurrency volatility (e.g., Bitcoin down -64% in 2022) dominated headlines this year, but many of these headwinds could abate or reverse in 2023. For example, there are numerous indicators pointing to peaking and/or declining inflation, which, if true, could create a tailwind for investors this year. Bolstering this argument are the current weakening trends we are witnessing in the housing market, which should ripple through the economy to cool inflation (see chart below).

And if it’s not declining home prices, lower energy prices have also filtered through the global economy to lower transportation and shipping costs (e.g., freight rates from China to West Coast are down -90%). What’s more, a stronger dollar has contributed to declining commodity prices as well.

Although inflation still has a long way to go before reaching the Federal Reserve’s 2% target rate, broad inflation measures, such as the GDP Deflator, are showing a significant decrease in inflation (see chart below). By analyzing the various disinflationary tea leave markers, we can gain some confidence regarding future interest rates. Observing the fastest rate hike cycle by the Fed in decades informs us that we are likely closer to an end of rate hikes (i.e., pause or cut), rather than the beginning. If correct, tamer inflation means 2023 could prove to be a better environment for both stock and bond investors.

In summary, last year was painful across the board, but investors are starting this year with a clean slate and signs are pointing to a potential reversal in inflation and interest rate headwinds. With the change of the calendar, a messy 2022 could turn into a spick-and-span 2023.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (Jan. 3, 2023). Subscribe on the right side of the page for the complete text.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Fed Ripping Off the Inflation Band-Aid

Inflation rates have been running near 40-year highs, and as a result, the Federal Reserve is doing everything in its power to rip off the Band-Aid of insidious high price levels in a swift manner. The Fed’s goal is to inflict quick, near-term pain on the economy in exchange for long-term price stability and future economic gains. How quickly has the Fed been hiking interest rates? The short answer is the rate of increases has been the fastest in decades (see chart below). Essentially, the Federal Reserve has pushed the targeted benchmark Federal Funds target rate from 0% at the beginning of this year to 3.25% today. Going forward, the goal is to lift rates to 4.4% by year-end, and then to 4.6% by next year (see Fed’s “dot plot” chart).

How should one interpret all of this? Well, if the Fed is right about their interest rate forecasts, the Band-Aid is being ripped off very quickly, and 95% of the pain should be felt by December. In other words, there should be a light at the end of the tunnel, soon.

The Good News on Inflation

When it comes to inflation, the good news is that it appears to be peaking (see chart below), and many economists see the declining inflation trend continuing in the coming months. Why do pundits see inflation peaking? For starters, a broad list of commodity prices have declined significantly in recent months, including gasoline, crude oil, steel, copper, and gold, among many others.

Outside of commodities, investors have seen prices drop in other areas of the economy as well, including housing prices, which recently experienced the fastest monthly price drop in 11 years, and rent prices as well (see chart below).

Anybody who was shopping for a car during the pandemic knows what happened to pricing – it exploded higher. But even in this area, we are seeing prices coming down (see chart below), and CarMax Inc. (KMX), the national used car retail chain confirmed the softening price trend last week.

Pain Spread Broadly

When interest rates increase at the fastest pace in 40 years, pain is felt across almost all asset classes. It’s not just U.S. stocks, which declined -9.3% last month (S&P 500), but it’s also housing -8.5% (XHB), real estate investment trusts -13.8% (VNQ), bonds -4.4% (BND), Bitcoin -3.1%, European stocks -10.1% (VGK), Chinese stocks -14.4% (FXI), and Agriculture -3.0% (DBA). The +17% increase in the value of the U.S. dollar this year against a basket of foreign currencies is substantially pressuring cross-border business for larger multi-national companies too – Microsoft Corp. (MSFT), for example, blamed U.S. dollar strength as the primary reason to cut earnings several months ago. Like Hurricane Ian, large interest rate increases have caused significant damage across a wide swath of areas.

But for those following the communication of Federal Reserve Chairman, Jerome Powell, in recent months, they should not be surprised. Chairman Powell has signaled on numerous occasions, including last month at a key economic conference in Jackson Hole, Wyoming, that the Fed’s war path to curb inflation by increasing interest rates will inflict wide-ranging “pain” on Americans. Some of that pain can be seen in mortgage rates, which have more than doubled in 2022 and last week eclipsed 7.0% (see chart below), the highest level in 20 years.

Now is Not the Time to Panic

There is a lot of uncertainty out in the world currently (i.e., inflation, the Fed, Russia-Ukraine, strong dollar, elections, recession fears, etc.), but that is always the case. There is never a period when there is nothing to be concerned about. With the S&P 500 down more than -25% from its peak (and the NASDAQ down approximately -35%), now is not the right time to panic. Knee-jerk emotional decisions during stressful times are very rarely the right response. With these kind of drops, a mild-to-moderate recession is already baked into the cake, even though the economy is expected to grow for the next four quarters and for all of 2023 (see GDP forecasts below). Stated differently, it’s quite possible that even if the economy deteriorates into a recession, stock prices could rebound smartly higher because any potential future bad news has already been anticipated in the current price drops.

Worth noting, as I have pointed out previously, numerous data points are indicating inflation is peaking, if not already coming down. Inflation expectations have already dropped to about 2%, if you consider the spread between the yield on the 5-Year Note (4%) and the yield on the 5-Year TIP-Treasury Inflation Protected Note (2%). If the economy continues to slow down, and inflation has stabilized or declined, the Federal Reserve will likely pivot to decreasing interest rates, which should act like a tailwind for financial markets, unlike the headwind of rising rates this year.

Ripping off the Band-Aid can be painful in the short-run, but the long-term gains achieved during the healing process can be much more pleasurable.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in MSFT, BND and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in KMX, XHB, VNQ, VGK, FXI, DBA or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Heartburn Pains After Digesting Market Gains

After gorging on +9% gains in the stock market (S&P 500 index) during July, investors suffered some heartburn pain in August (-4%). The indigestion really kicked in after Federal Reserve Chairman, Jerome Powell, gave a frank and candid outlook during his annual monetary policy speech at Jackson Hole, Wyoming. His key takeaways were that further interest rate increases are necessary to control and bring down inflation. And these economically-slowing measures, coupled with the Fed’s $95 billion in quantitative tightening policies (QT), will according to the Fed Chairman, “bring some pain to households and businesses. These are the unfortunate costs of reducing inflation. But a failure to restore price stability would mean far greater pain.”

But not everything is causing stomach pains. Yes, inflation is elevated (the rate declined to 8.5% in July from 9.1%), but there are multiple signs that overall prices are peaking. For example, gasoline prices have declined for 11 consecutive weeks to pre Russia-Ukraine invasion levels around $3.81/gallon nationally. There are also signs that housing prices, rent, used car prices, and other commodities like wheat, beef, and copper are all declining in price, as well. Even Bitcoin and other cryptocurrencies are joining in the deflation parade.

And while the Fed is doing its darnedest to bring a halt to gut-wrenching inflation, the job market remains on fire (see chart below). The unemployment rate registered in at a near a generational-low of 3.5% last month, but we will receive a fresh, new figure this week to see if this trend continues.

The economy’s ravenous appetite for workers can also be found in the just-released JOLTS job opening data (see chart below), which shows there are 11.2 million job openings, a total that is almost double the number of available workers (5.7 million).

Stimulus – Trillion Style

The subject of politics is not my strong suit, so perhaps only time will tell whether the net result of two large pieces of government legislation totaling more than $1 trillion (Inflation Reduction Act and Student Loan Forgiveness) will accelerate growth in the economy (Real GDP) or hasten the pace of inflation.

More specifically, the $565 billion Inflation Reduction Act is designed with the intent of investing in clean energy and healthcare initiatives, while negotiating lower pharmaceutical prices with drug companies, and raising tax revenues. The key measures planned in the legislation to fund the spending and forecasted deficit reduction are a minimum corporate tax, the termination of the carried interest tax loophole, and a doubling of the IRS (Internal Revenue Service) budget to hunt down tax dodgers.

With respect to the Student Loan Forgiveness Plan, the cost of the bill is estimated to be between $469 billion to $519 billion over a 10-year budget window, according to the University of Pennsylvania. The debt cancellation will apply to lower income individuals (earning less than $125,000 annually) with the potential of erasing debt of $10,000 – $20,000 per eligible person.

While the government passes various investing, spending, and tax-raising initiatives, corporations continue to crank out record results (see profit charts below), despite talks of an impending recession (see last month’s article, Recession or Mental Depression?).

Pessimists point to the economic strength as only temporary, as they brace for the Fed’s interest rate hiking medicine to take larger effect on the patient. Optimists point to the durability of corporate profits, relatively low interest rates (3.13% yield on the 10-Year Treasury Note), positive Q3 – GDP growth estimates of +1.6%, and reasonable valuations (17x Forward Price/Earnings ratio), given the evidence of peaking and declining inflation.

In view of all the current countervailing factors, the near-term volatility will likely create a lot of stomach-churning uneasiness. However, in the coming months, if it becomes clearer the Fed is closer to the end of its rate-hiking cycle and inflation subsides, you might be gleefully enjoying your tasty gains rather than complaining of financial heartburn and headache pains.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in BRKA/B or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact Page.

Bad Weather Coming: Hurricane or Drizzle?

It was a stormy month in the stock market, but the sun eventually came out and the Dow Jones Industrial Average rallied more than 2,300+ points before eking out a small gain (up +0.04%) and the S&P 500 index also posted an incremental increase (+0.005%). But there are clouds on the horizon. Although the economy is currently very strong (i.e., record corporate profits and a generationally low unemployment rate of 3.6% – see chart below), some forecasters are predicting a recession during 2023 as a result of the Federal Reserve pumping the brakes on the economy by increasing interest rates, in addition to elevated inflation, supply chain disruptions, COVID lockdowns in China, and a war between Russia and Ukraine.

UNEMPLOYMENT RATE (1997 – 2022)

But like weather forecasters, economists are perpetually unreliable. While some doomsday-er economists are expecting a deeply destructive hurricane (deep recession), others are only seeing a mild drizzle (soft landing) developing. The truth is, nobody knows for certain at this point, but what we do know is that the correction in stock prices this year (-13% now and -20% two weeks ago) has already significantly discounted (factored in) a mild recession. In other words, even if a mild recession were to occur in the coming months or quarters, there may be very little reaction or negative consequences for investors. Similarly, if inflation begins to be peaking as it appears to be doing (see chart below), and the Fed can orchestrate a soft landing (i.e., raise interest rates and reduce balance sheet debt without crippling the economy), then substantial rewards could accrue to stock market investors. On the flip side, if the economy were to go into a deep recession, history would suggest this stormy forecast might result in another -10% to -15% of chilliness.

INFLATION RATE (%)

Due to trillions of dollars in increased stimulus spending and Federal Reserve Quantitative Easing (bond buying), we experienced an explosion in the government deficit and surge in money supply growth (i.e., the root cause for swelling inflation). Arguably, some or all of these accommodations were useful in surviving through the worst parts of the COVID pandemic, however, we are paying the price now in sky-high food costs, explosive gasoline prices, and expanding credit card bills. The good news is the deficit is plummeting (see chart below) due to a reduction in spending (due in part to no Build Back Better infrastructure spending legislation) and soaring income tax receipts from a strengthening economy and capital gains in the stock market.

MONEY SUPPLY GROWTH% (M2) VS. GOVERNMENT DEFICIT

For many investors, getting used to large multi-year gains has been very comfortable, but interpreting downward gyrations in the stock market can be very confusing and counterintuitive. In short, attempting to decipher the reasons behind the short-term zigs and zags of the market is a fool’s errand. Not many people predicted a +48% gain in the stock market during a global pandemic (2020-2021), just like not many people predicted a short-lived -20% reduction in the stock market during 2022 as we witnessed record-high corporate profits and unemployment rates hovering near generational lows (3.6%).

Stock market veterans understand that stock prices can go down when current economic news is sunny but future expectations are too high. Experienced investors also understand stock prices can go up when the current economic news may be getting too cloudy but future expectations are too low.

Apparently, the world’s greatest investor of all-time thinks that all this gloomy recession talk is creating lots of stock market bargains, which explains why Buffett has invested $51 billion of his cash at Berkshire Hathaway as the stock market has gotten a lot more inexpensive this year. So, while the economy will likely face a number of headwinds going into 2023, it doesn’t mean a hurricane is coming and you need to hide in a bunker. If you pull out your umbrella and rain gear, just like smart investors do during all previous challenging economic cycles, the drizzle from the storm clouds will eventually pass and blue skies shall reappear.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (June 1, 2022). Subscribe on the right side of the page for the complete text.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in BRK.B/A or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

No Red Blood, Just Green Flood

Normally, investors equate the month of October with scary, blood-curdling screams because horrifying losses during the 1929 and 1987 crashes occurred during this month. Fortunately, for those invested in stocks, they experienced the opposite this last month – a flood of green (new all-time record highs), despite a whole host of frightening factors, including the following:

· Inflation

· Supply chain disruptions

· Federal Reserve monetary policy

· COVID variants

· Evergrande’s impact on China and commercial real estate

· Cryptocurrency volatility

· Expanding government deficits and debt (stimulus/infrastructure)

· Government debt ceiling negotiations

· Declining corporate profit margins

· Meme stocks

· And more…boo!

Even though this Halloween season has introduced these many spooky fears, investors still experienced a sugar-high during October. More specifically, the S&P 500 catapulted +6.9% this month (+22.6% Year-to-Date), Dow Jones Industrial Average +5.8% (+17.0% YTD); and NASDAQ +7.3% (+20.3% YTD). With the COVID Delta variant subsiding (see chart below), economic activity rising (Q4 GDP is estimated at +4.8%), and corporate profits going gang busters (33% growth and 84% of corporations are beating Q3 estimates), it should come as no surprise that stock market values continue to rise.

As I mention regularly to my readers, there is never a shortage of things to worry about when it comes to your investments, money, and savings. Emotions tend to highjack rational reasoning as non-existent boogeymen scare people into do-nothing decision-making or suboptimal choices. Investing for the long-run requires dedication and discipline, and if you do not have the time and fortitude to do so, it behooves you to find an experienced, independent professional to assist you.

Rather than getting spooked by supply chain fears and inflation plastered all over the newspapers and media outlets, the real way to compound wealth over the long-term is to do what Warren Buffett says, and that is “buy fear, and sell greed.” Unfortunately, our Darwinian instincts embedded in our DNA are naturally designed to do the contrary…”buy greed, and sell fear.” The goal is to buy low and sell high (not buy high and sell low).

Yes, it’s true that over the last year, semiconductor lead times have almost doubled to 22 weeks, and Chinese container shipping costs have about increased 10-fold to over $20,000 (see charts below). However, the economic laws of supply and demand remain just as true today as they did in 1776 when Adam Smith wrote Wealth of Nations (see also Pins, Cars, Coconuts & Chips). Chip makers are building new fabs (i.e., manufacturing plants) and worker shortages at the ports and truck driver deficiencies are slowly improving. Supply scarcity and higher prices may be with us for a while, but history tells us betting against capitalism isn’t a wise decision.

Not worrying about all the economic goblins and witches can be difficult when contemplating your investments and savings. Nevertheless, as I have consistently reminded my investors and readers, the key pillars to understanding the health of the investment environment are the following (see also The Stool):

· Interest rates

· Earnings (Corporate profits)

· Valuations (How cheap or expensive is the market?)

· Sentiment (How greedy or fearful are investors?)

The good news is that a) interest rates are near historically low levels; b) corporate profits are on a tear (+33% as mentioned above); c) valuations have come down because profits have grown faster than stock price appreciation; and d) sentiment remains nervous (a good thing) as measured by the massive inflows going into low (negative) yielding bonds. If you consider all these elements, one should not be surprised that we are at-or-near all-time record highs. Obviously, these investment pillars can reverse directions and create headwinds for investors. Until then, don’t be startled if there is more green flood rather than red blood.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (November 1, 2021). Subscribe on the right side of the page for the complete text.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Cash Is Trash

The S&P 500 stock market index took a breather and ended its six-month winning streak, declining -4.8% for the month. Even after this brief pause, the S&P has registered a very respectable +14.7% gain for 2021, excluding dividends. Nevertheless, even though the major stock market indexes are roaming near all-time record highs, FUD remains rampant (Fear, Uncertainty, Doubt).

As the 10-Year Treasury Note yield has moved up to a still-paltry 1.5% level this month, the talking heads and peanut gallery bloggers are still fretting over the feared Federal Reserve looming “tapering”. More specifically, Jerome Powell, the Fed Chairman and the remainder of those on the FOMC (Federal Open Market Committee) are quickly approaching the decision to reduce monthly bond purchases (i.e., “tapering”). The so-called, quantitative easing (QE) program is currently running at about $120 billion per month, which was established with the aim to lower interest rates and stimulate the economy. Now that the COVID recovery is well on its way, the Fed is effectively trying to decrease the size of the current, unruly punch-keg down to the volume of a more manageable punch bowl.

Stated differently, even when the arguably overly-stimulative current bond buying slows or stops, the Federal Funds Rate is still effectively set at 0% today, a level that still offers plenty of accommodative fuel to our economy. Although interest rates will not stay at 0% forever, many people forget that between 2008 and 2015, the Fed Funds Rate stubbornly stayed sticky at 0% (i.e., a full punch bowl) for seven years, even without any spike in inflation.

Because the economy continues to improve, current consensus projections by economists show the first interest rate increase of this cycle (i.e., “liftoff”) to occur sometime in 2022 and subsequently climb to a still extraordinarily low level of 2.0% by 2024 (see “Dot Plot” below). For reference, the projected 2.0% figure would still be significantly below the 6.5% Fed Funds Rate we saw in the year 2000, the 5.3% in 2007, or the 2.4% in 2019. If history is any guide, under almost any scenario, Chairman Powell is very much a dove and is likely to tap the interest rate hike brakes very gently.

Low But Not the Lowest

In a world of generationally low interest rates, what I describe as our low bond yields here in the United States are actually relatively high, if you consider rates in other major industrialized economies and the trillions of negative-interest-rate bonds littered all over the rest of the world (see August’s article, $16.5 Trillion in Negative-Yielding Debt). Although our benchmark government rates are hovering around 1.5%, as you can see from the chart below, Germany is sitting considerably lower at -0.2%, Japan at 0.1%, France at 0.2%, and the United Kingdom at 1.0%.

Taper Schmaper

As with many government related policies, the Federal Reserve often gets too much credit for successes and too much blame for failures, as it relates to our economy. I have illustrated the extent of how globally interconnected our world of interest rates is, and one taper announcement is unlikely to reverse a four-decade disinflationary declining trend in interest rates.

Back in 2013, after of five years of quantitative easing (QE) that began in 2008, investors were terrified that interest rates were artificially being depressed by a money-printing Fed that had gone hog-wild in bond buying. At that time, pundits feared an imminent explosion higher in interest rates once the Fed began tapering. So, what happened after Federal Reserve Chairman Ben Bernanke broached the subject of tapering on June 19, 2013? The opposite occurred. Although 10-Year yields jumped 0.1% to 2.3% on the day of the announcement, interest rates spent the majority of the next six years declining to 1.6% in 2019, pre-COVID. As COVID began to spread globally, rates declined further to 0.95% in March of 2020, the day before Jerome Powell announced a fresh new round of quantitative easing (see chart below).

Obviously, every economic period is different from previous ones, and fearing to fall off the floor to lower interest rate levels is likely misplaced at such minimal current rates (1.5%). However, panicking over potential exploding interest rates, as in 2013 (which did not happen), again may not be the most rational behavior either.

What to Do?

If interest rates are low, and inflation is high (see chart below), then what should you do with your money? Currently, if your money is sitting in cash, it is losing 4-5% in purchasing power due to inflation. If your money is sitting in the bank earning minimal interest, you are not going to be doing much better than that. Everybody’s time horizon and risk tolerance is different, but regardless of your age or anxiety level, you need to efficiently invest your money in a diversified portfolio to counter the insidious, degrading effects of inflation and generationally low interest rates. The “do-nothing” strategy will only turn your cash into trash, while eroding the value of your savings and retirement assets.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (October 1, 2021). Subscribe on the right side of the page for the complete text.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.