Posts tagged ‘Sidoxia’

Sports, Stocks, & the Magic Quadrants

Picking stocks is a tricky game and so is sports betting. With the NFL and NCAA football seasons swinging into full gear, understanding the complexity of making money in the stock market can be explained in terms of professional sports-betting. Anybody who has traveled to Las Vegas and bet on a sporting event, understands that choosing a winner of a game simply is not enough…you also need to forecast how many points you think a certain team will win by (see also What Happens in Vegas, Stays on Wall Street). In the world of sports, winning/losing is measured by point spreads. In the world of stocks, winning/losing is measured by valuation (e.g., Price/Earnings ratios).

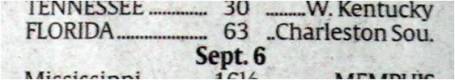

To make my point, here is a sports betting example from a handful years back:

Florida Gators vs. Charleston Southern Buccaneers (September 2009): Without knowing a lot about the powerhouse Southern Buccaneers squad from South Carolina, 99% of respondents, when asked before the game who would win, would unanimously select Florida – a consistently dominant, national franchise, powerhouse program. The question becomes a little trickier when participants are asked, “Will the Florida Gators win by more than 63 points?” Needless to say, although the Buccs kept it close in the first half, and only trailed by 42-3 at halftime, the Gators still managed to squeak by with a 62-3 victory. Worth noting, had you selected Florida, the overwhelming favorite, the 59 point margin of victory would have resulted in a losing wager (see picture below).

If investing and sports betting were easy, everybody would do it. The reason sports betting is so challenging is due to very intelligent statisticians and odds-makers that create very accurate point spreads. In the investing world, a broad swath of traders, market makers, speculators, investment bankers, and institutional/individual investors set equally efficient valuations.

The goal in investing is very similar to sports betting. Successful professionals in both industries are able to consistently identify inefficiencies and then exploit them. Inefficiencies occur for a bettor when point spreads are too high or low, while investors identify inefficient prices in the marketplace (undervalued or overvalued).

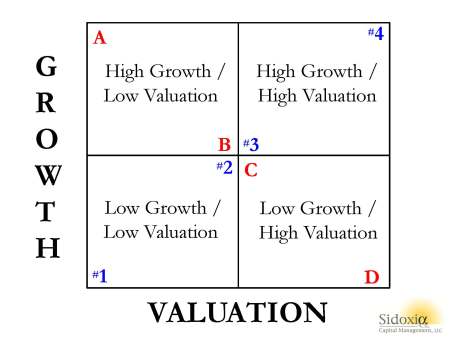

To illustrate my point, let’s take a look at Sidoxia’s “Magic Quadrant“:

What Sidoxia’s “Magic Quadrant” demonstrates is a framework for evaluating stocks. By devoting a short period of time reviewing the quadrants, it becomes apparent fairly quickly that Stock A is preferred over Stock B, which is preferred over Stock C, which is preferred over Stock D. In each comparison, the former is preferred over the latter because the earlier letters all have higher growth, and lower (cheaper) valuations. The same relative attractive relationships cannot be applied to stocks #1, #2, #3, and #4. Each successive numbered stock has higher growth, but in order to obtain that higher growth, investors must pay a higher valuation. In other words, Stock #1 has an extremely low valuation with low growth, while Stock #4 has high growth, but an investor must pay an extremely high valuation to own it.

While debating the efficiency of the stock market can escalate into a religious argument, I would argue the majority of stocks fall in the camp of #1, #2, #3, or #4. Or stated differently, you get what you pay for. For example, investors are paying a much higher valuation (~100x 2014 P/E) for Tesla Motors, Inc (TSLA) for its rapid electric car growth vs. paying a much lower valuation (~10x 2014 P/E) for Pitney Bowes Inc (PBI) for its mature mail equipment business.

The real opportunities occur for those investors capable of identifying companies in the upper-left quadrant (i.e., Stock A) and lower-right quadrant (i.e., Stock D). If the analysis is done correctly, investors will load up on the undervalued Stock A and aggressively short the expensive Stock D. Sidoxia has its own proprietary valuation model (Sidoxia Holy Grail Ranking – SHGR or a.k.a. “SUGAR”) designed specifically to identify these profitable opportunities.

The professions of investing and sports betting are extremely challenging, however establishing a framework like Sidoxia’s “Magic Quadrants” can help guide you to find inefficient and profitable investment opportunities.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing, SCM had no direct position in TSLA, PBI, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is the information to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Confessions of a Bond Hater

Hi my name is Wade, and I’m a bond hater. Generally, the first step in addressing any type of personal problem is admitting you actually have a problem. While I am not proud of being a bond hater, I have been called many worse things during my life. But as we have learned from the George Zimmerman / Trayvon Martin case, not every situation is clear-cut, whether we are talking about social issues or bond investing. For starters, let me be clear to everyone, including all my detractors, that I do not hate all bonds. In fact, my Sidoxia clients own many types of fixed income securities. What I do hate however are low yielding, long duration bonds.

Duration…huh? Most people understand what “low yielding” means, when it comes to bonds (i.e., low interest, low coupon, low return, etc.), but when the word duration is uttered, the conversation is usually accompanied by a blank stare. The word “duration” may sound like a fancy word, but in reality it is a fairly simple concept. Essentially, high-duration bonds are those fixed income securities with the highest sensitivity to changes in interest rates, meaning these bonds will go down most in price as interest rates rise.

When it comes to equity markets, many investors understand the concept of high beta stocks, which can be used to further explain duration. There are many complicated definitions for beta, but the basic principle explains why high-beta stock prices generally go up the most during bull markets, and go down the most during bear markets. In plain terms, high beta equals high octane.

If we switch the subject back to bonds, long duration equals high octane too. Or stated differently, long duration bond prices generally go down the most during bear markets and go up the most during bull markets. For years, grasping the risk of a bond bear market caused by rising rates has been difficult for many investors to comprehend, especially after witnessing a three-decade long Federal Funds tailwind taking the rates from about 20% to about 0% (see Fed Fatigue Setting In).

The recent interest rate spike that coincided with the Federal Reserve’s Ben Bernanke’s comments on QE3 bond purchase tapering has caught the attention of bond addicts. Nobody knows for certain whether this short-term bond price decline is the start of an extended bear market in bonds, but mathematics would dictate that there is only really one direction for interest rates to go…and that is up. It is true that rates could remain low for an indefinite period of time, but neither scenario of flat to down rates is a great outcome for bond holders.

Fixes to Fixed-Income Failings

Even though I may be a “bond hater” of low yield, high duration bonds, currently I still understand the critical importance and necessity of a fixed income portfolio for not only retirees, but also for the diversification benefits needed by a broader set of investors. So how does a bond hater reconcile investing in bonds? Easy. Rather than focusing on lower yielding, longer duration bonds, I invest more client assets in shorter duration and/or higher yielding bonds. If you harbor similar beliefs as I do, and believe there will be an upward bias to the trajectory of long-term interest rates, then there are two routes to go. Investors can either get compensated with a higher yield to counter the increased interest rate risk, and/or they can shorten duration of bond holdings to minimize capital losses.

Worth noting, there is an alternative strategy for low yielding, long duration bond lovers. In order to minimize interest rate risk, these bond lovers may accept sub-optimal yields and hold bonds to maturity. This strategy may be associated with short-term price volatility, but if the bond issuer does not default, at least the bond investor will get the full principal at maturity to help relieve the pain of meager yields.

Now that you’ve survived all this bond babbling, let me cut to the chase and explain a few ways Sidoxia is taking advantage of the recent interest rate volatility for our clients:

Floating Rate Bonds: Duration of these bonds is by definition low, or near zero, because as interest rates rise, coupons/interest payments are advantageously reset for investors at higher rates. So if interest rates jump from 2% to 3%, the investor will receive +50% higher periodic payments.

Inflation Protection Bonds: These bonds come in long and short duration flavors, but if interest rates/inflation rise higher than expected, investors will be compensated with higher periodic coupons and principal payments.

Shorter Duration: One definition of duration is the weighted average of time until a bond’s fixed cash flows are received. A way of shortening the duration of your bond portfolio is through the purchase of shorter maturity bonds (e.g., buying 3-year bonds rather than 30-year bonds).

High Yield Bonds: Investing in the high yield bond category is not limited to domestic junk bond purchases, but higher yields can also be earned by investing in international and/or emerging market bonds.

Investment Grade Corporate Bonds: Similar to high yield bonds, investment grade bonds offer the potential of capital appreciation via credit improvement. For instance, credit rating upgrades can provide gains to help offset price declines caused by rising interest rates.

Despite my bond hater status, the recent taper tantrum and interest rate spike, highlight some advantages bonds have over stocks. Even though prices declined, bonds by and large still have lower volatility than stocks; provide a steady stream of income; and provide diversification benefits.

To the extent investors have, or should have, a longer-term time horizon, I still am advocating a stock bias to client portfolios, subject to each investor’s risk tolerance. For example, an older retired couple with a conservative target allocation of 20%/80% (equity/fixed income) may consider a 25% – 30% allocation. A shift in this direction may still meet the retirees’ income needs (especially if dividend-paying stocks are incorporated), while simultaneously acknowledging the inflation and interest rate risks impacting bond positions. It’s important to realize one size doesn’t fit all.

Higher Volatility, Higher Reward

Frequent readers of Investing Caffeine have known about my bond hating tendencies for quite some time (see my 2009 article Treasury Bubble has not Burst…Yet), but the bond baby shouldn’t be thrown out with the bath water. For those investors who thought bonds were as safe as CDs, the recent -6% drop in the iShares Aggregate Bond Index (AGG) didn’t feel comfortable for most. Although I am still an enthusiastic stock cheerleader (less so as valuation multiples expand), there has been a cost for the gargantuan outperformance of stocks since March of ’09. While stocks have outperformed bonds (S&P vs. AGG) by more than +140%, equity investors have had to endure two -10% corrections and two -20% corrections (e.g.,Flash Crash, Debt Ceiling Debate, European Financial Crisis, and Sequestration/Elections). If investors want to earn higher long-term equity returns, this desire will translate into more volatility than bonds…and more Tums.

I may still be a bond hater, and the general public remains firm stock haters, but at some point in the multi-year future, I will not be surprised to hear myself say, “Hi my name is Wade, and I am addicted to bonds.” In the mean time, Sidoxia will continue to optimize its client bond portfolios for a rising interest rate environment, while also investing in attractive equity securities and ETFs. There’s nothing to hate about that.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), including floating rate bonds/loan funds, inflation-protection funds, corporate bond ETF, high-yield bond ETFs, and other bond ETFs, but at the time of publishing, SCM had no direct position in AGG or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Women & Bosoms on Wall Street According to Jones

Billionaire hedge fund manager of Tudor Investment Corporation, Paul Tudor Jones, recently suffered from a case of foot-in-mouth disease when he addressed a sensitive subject – the lack of female traders and investors on Wall Street. Rather than provide a diplomatic response to the mixed audience at a recent University of Virginia symposium, Tudor Jones went on an unambiguous rant. Here’s an excerpt:

“You will never see as many great women investors or traders as men. Period, end of story….As soon as that baby’s lips touch that girl’s bosom, forget it. Every single investment idea, every desire to understand what’s going to make this go up or gonna go down is going to be overwhelmed by the most beautiful experience, which a man will never share of that emotive connection between that mother and baby.”

A more complete review of his unfiltered response can be found in this video:

Clearly there is a massive minority of females on Wall Street, but why such an under-representation in this field relative to other female-heavy professional industries such as advertising, nursing, and teaching? I addressed this controversial subject in an earlier article (see Females in Finance)

If there are 155.8 million females in the United States and 151.8 million males (Census Bureau: October 2009), then how come only 6% of hedge fund managers (BusinessWeek), 8% of venture capitalists, and 15% of investment bankers are female (Harvard Magazine)? Is the finance field just an ol’ boys network of chauvinist pig-headed males who only hire their own? Maybe cultural factors such as upbringing and education are other factors that make math-related jobs more appealing to men? Or do the severe time-demands of the field force females to opt-out of the industry due to family priorities?

Although I’m sure family choices and quality of life are factors that play into the decision of entering the demanding finance industry, from my experience I would argue women are notoriously underrepresented even at younger ages. For example, anecdotal evidence coming from my investment management firm (Sidoxia Capital Management – www.Sidoxia.com) clearly shows a preponderance of internship applications coming from males, even though it is premature for these students to fully contemplate family considerations at this young age.

If under-representation in the finance field is not caused by female choice, then perhaps the male dominated industry is merely a function of more men opting into the field (i.e., men are better suited for the industry)? More specifically, perhaps male brains are just wired differently? Some make the argument that all the testosterone permeating through male bodies leads them to positions involving more risk. If you look at other risk related fields like gambling, women too are dramatic minorities, making up about 1/3 of total compulsive gamblers.

Women Better than Men?

The funny part about the under-representation of females in finance is that one study actually shows female hedge fund managers outperforming their male counterparts. Here’s what a BusinessWeek article had to say about female hedge fund managers:

A new study by Hedge Fund Research found that, from January 2000 through May 31, 2009, hedge funds run by women delivered nearly double the investment performance of those managed by men. Female managers produced average annual returns of 9%, versus 5.82% for men and, in 2008, when financial markets were cratering, funds run by women were down 9.6%, compared with a 19% decline for men.

The article goes onto to theorize that women may not be afraid of risk, but actually are better able to manage risk. A UC Davis study found that male managers traded 45% more than female managers, thereby reducing returns by -2.65% (about 1% more than females).

Regardless of the theories or studies used to explain gender risk appetite, the relative under-representation of females in finance is a fact. Many theories exist but further thought and research need to be conducted on the subject.

However, before Paul Tudor Jones is completely demonized or sent to the guillotine, let’s not forget Tudor Jones is obviously not your ordinary, heartless, cold-blooded Wall Street type, as evidenced by his recent philanthropic profile on 60 Minutes. Thanks to his generous efforts, Tudor Jones and his Robin Hood Foundation charity have raised more than $400 million for worthy causes since 1988.

While Paul Tudor Jones may not have harbored any malicious intent with regards to his comments, it may make sense for Tudor Jones to take a course on gender sensitivity. Bosoms and women may be an interesting subject for many, however he might consider filtering his commentary the next time he speaks to a large symposium recorded on the internet.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

See also:

BusinessWeek article on female fund managers

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Fine Tuning Your Stock Fishing Skills

If you are one of those fishing hobbyists crowded among a large group while hunting for a big fish, mathematics dictates your odds of reeling in a grand prize are significantly diminished. Expert fishermen are generally the first to arrive because they understand once the masses appear the opportunities will disappear. Like big fish, colossal stocks are rarely discovered by a large herd of investors. Financial bubbles occur in this manner, however these periods are usually short-lived and the investor pack often ends up losing more money on the way down relative to the profits earned on the way up. Successful investors are usually the ones following a disciplined systematic approach that is often contrarian in nature. In other words, not chasing performance requires patience, an elusive quality in these fast-paced, frenetic financial markets.

More prevalent in these markets are impulsive day-traders, unruly high frequency traders, and tempestuous hedge funds. Why own stocks, if you can rent them? Like a fisherman who constantly casts his/her bait in and out of the water, a short-sighted investor cannot realize outsized gains, unless the bait is given sufficient time to lure (find) the next winning idea.

Like many professions, experts often optimally mix the quantitative science and behavioral art of their craft. Whether it’s a teacher, doctor, accountant, attorney, or bus driver, the people who excel in their profession are the ones who move beyond the statistical and procedural basics of their trade. Practicing and understanding the nuts and bolts of your job is important, but developing those intangible, artistic skills only comes with experience. Unfortunately, many investing hobbyists don’t appreciate these artistic nuances and as a result go on destroying their portfolios, even though they act as if they were experts.

On the flip-side, decisions purely based on gut instincts will also lead to sub-par outcomes. The fisherman who does not account for the wind, temperature, geography, light, and seasonal differences will be at a distinct disadvantage to those who have studied these scientific factors.

In the fishing world, there is no miracle GPS device that will guide fish onto your hook, and the same is true for stocks. No software package or technical pattern will be a panacea for profits, however having some type of scientific tool to assist in the identification of investment opportunities should be exploited to its fullest. For us at Sidoxia Capital Management (www.Sidoxia.com), our tool is called SHGR (pronounced “SUGAR”), or Sidoxia Holy Grail Ranking. The name was created tongue-in-cheek; however its purpose is crucial. Following a quantitative system like SHGR ensures that a healthy dosage of discipline and objectivity is factored into our investment decisions, so inherent biases do not creep into our process and detract from performance. Specifically, our proprietary SHGR model incorporates multiple factors, including valuation, growth, sentiment indicators, profitability, and other qualitative measurements.

Although we use a “Holy Grail” ranking system, the fact of the matter is there are none in existence – for fishermen or investors. Experience teaches us the best opportunities are found where few are looking, and if proper quantitative tools are integrated into a multi-pronged process, then you will be uniquely positioned to catch a big fish.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs) and CMCSA, but at the time of publishing SCM had no direct position in BRKB, HNZ, HRL, UL, T, VZ, CAR, ZIP, AMR, LCC, ORCL, APKT, DELL, MSFT, RDSA, Repsol, ODP, OMX, HLF, BUD, STZ, GE, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Sidoxia’s Investor Hall of Fame

Investing Caffeine has profiled many great investors over the months and years, so I thought now would be a great time to compile a “Hall of Fame” summarizing some of the greatest of all-time. Nothing can replace experience, but learning from the greats can only improve your investing results – I’ve benefitted firsthand and so have Sidoxia’s clients. Here is a partial list from the Pantheon of investing greats along with links to the complete articles (special thanks to Kevin Weaver for helping compile):

Phillip Fisher – Author of the must-read classic Common Stocks and Uncommon Profits, he enrolled in college at age 15 and started graduate school at Stanford a few years later, before he dropped out and started his own investment firm in 1931. “If the job has been correctly done when a common stock is purchased, the time to sell it is – almost never.” Not every investment idea made the cut, however he is known to have bought Motorola (MOT) stock in 1955 and held it until his death in 2004 for a massive gain. (READ COMPLETE ARTICLE)

Phillip Fisher – Author of the must-read classic Common Stocks and Uncommon Profits, he enrolled in college at age 15 and started graduate school at Stanford a few years later, before he dropped out and started his own investment firm in 1931. “If the job has been correctly done when a common stock is purchased, the time to sell it is – almost never.” Not every investment idea made the cut, however he is known to have bought Motorola (MOT) stock in 1955 and held it until his death in 2004 for a massive gain. (READ COMPLETE ARTICLE)

Peter Lynch – Lynch graduated from Boston College in 1965 and earned a Master of Business Administration from the Wharton School of the University of Pennsylvania in 1968. Lynch’s Magellan fund averaged +29% per year from 1977 – 1990 (almost doubling the return of the S&P 500). In 1977, the obscure Magellan Fund started with about $20 million, and by his retirement the fund grew to approximately $14 billion (700x’s larger). Magellan outperformed 99.5% of all other funds, according to Barron’s. (READ COMPLETE ARTICLE)

Peter Lynch – Lynch graduated from Boston College in 1965 and earned a Master of Business Administration from the Wharton School of the University of Pennsylvania in 1968. Lynch’s Magellan fund averaged +29% per year from 1977 – 1990 (almost doubling the return of the S&P 500). In 1977, the obscure Magellan Fund started with about $20 million, and by his retirement the fund grew to approximately $14 billion (700x’s larger). Magellan outperformed 99.5% of all other funds, according to Barron’s. (READ COMPLETE ARTICLE)

William O’Neil – After graduating from Southern Methodist University, O’Neil started his career as a stock broker. Soon thereafter, at the ripe young age of 30, O’Neil purchased a seat on the New York Stock Exchange and started his own company, William O’Neil + Co. Incorporated. Following the creation of his firm, O’Neil went on to pioneer the field of computerized investment databases. He used his unique proprietary data as a foundation to unveil his next entrepreneurial baby, Investor’s Business Daily, in 1984. (READ COMPLETE ARTICLE)

Sir John Templeton – After Yale and Oxford, Templeton moved onto Wall Street, borrowed $10,000 to purchase more than 100 stocks trading at less than $1 per share (34 of the companies were in bankruptcy). Only four of the investments became worthless and Templeton made a boatload of money. Templeton bought an investment firm in 1940, leading to the Templeton Growth Fund in 1954. A $10,000 investment made at the fund’s 1954 inception would have compounded into $2 million in 1992 (translating into a +14.5% annual return). (READ COMPLETE ARTICLE)

Charles Ellis – He has authored 12 books, founded institutional consulting firm Greenwich Associates, a degree from Yale, an MBA from Harvard, and a PhD from New York University. A director at the Vanguard Group and Investment Committee chair at Yale, Ellis details that many more investors and speculators lose than win. Following his philosophy will not only help increase the odds of your portfolio winning, but will also limit your losses in sleep hours. (READ COMPLETE ARTICLE)

Charles Ellis – He has authored 12 books, founded institutional consulting firm Greenwich Associates, a degree from Yale, an MBA from Harvard, and a PhD from New York University. A director at the Vanguard Group and Investment Committee chair at Yale, Ellis details that many more investors and speculators lose than win. Following his philosophy will not only help increase the odds of your portfolio winning, but will also limit your losses in sleep hours. (READ COMPLETE ARTICLE)

Seth Klarman – President of The Baupost Group, which manages about $22 billion, he worked for famed value investors Max Heine and Michael Price of the Mutual Shares. Klarman published a classic book on investing, Margin of Safety, Risk Averse Investing Strategies for the Thoughtful Investor, which is now out of print and has fetched upwards of $1,000-2,000 per copy in used markets. From it’s 1983 inception through 2008 his Limited partnership averaged 16.5% net annually, vs. 10.1% for the S&P 500. During the “lost decade” he crushed the S&P, returning 14.8% and 15.9% for the 5 and 10-year periods vs. -2.2% and -1.4%. (READ COMPLETE ARTICLE)

Seth Klarman – President of The Baupost Group, which manages about $22 billion, he worked for famed value investors Max Heine and Michael Price of the Mutual Shares. Klarman published a classic book on investing, Margin of Safety, Risk Averse Investing Strategies for the Thoughtful Investor, which is now out of print and has fetched upwards of $1,000-2,000 per copy in used markets. From it’s 1983 inception through 2008 his Limited partnership averaged 16.5% net annually, vs. 10.1% for the S&P 500. During the “lost decade” he crushed the S&P, returning 14.8% and 15.9% for the 5 and 10-year periods vs. -2.2% and -1.4%. (READ COMPLETE ARTICLE)

George Soros – Escaping Hungary in 1947, Soros immigrated to the U.S. in 1956 and held analyst and management positions for the next 20 years. Known as the “The man who broke the Bank of England,” he risked $10 billion against the British pound in 1992 in a risky trade and won. Soros also gained notoriety for running the Quantum Fund, which generated an average annual return of more than 30%. (READ COMPLETE ARTICLE)

George Soros – Escaping Hungary in 1947, Soros immigrated to the U.S. in 1956 and held analyst and management positions for the next 20 years. Known as the “The man who broke the Bank of England,” he risked $10 billion against the British pound in 1992 in a risky trade and won. Soros also gained notoriety for running the Quantum Fund, which generated an average annual return of more than 30%. (READ COMPLETE ARTICLE)

Bruce Berkowitz -Bruce Berkowitz has not exactly been a household name. With his boyish looks, nasally voice, and slicked-back hair, one might mistake him for a grad student. However, his results are more than academic, which explains why this invisible giant was recently named the equity fund manager of the decade by Morningstar. The Fairholme Fund (FAIRX) fund earned a 13% annualized return over the ten-year period ending in 2009, beating the S&P 500 by an impressive 14%. (READ COMPLETE ARTICLE)

Thomas Rowe Price, Jr. – Known as the “Father of Growth Investing,” in 1937 he founded T. Rowe Price Associates (TROW) and successfully ramped up the company before the launch of the T. Rowe Price Growth Stock Fund in 1950. Expansion ensued until he made a timely sale of his company in the late 1960s. His Buy and Hold strategy proved successful. For example, in the early 1970s, Price had accumulated gains of +6,184% in Xerox (XRX), which he held for 12 years, and gains of +23,666% in Merck (MRK), which he held for 31 years. (READ COMPLETE ARTICLE)

There you have it. Keep investing and continue reading about investing legends at Investing Caffeine, and who knows, maybe you too can join Sidoxia’s Hall of Fame?!

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds and WMT, but at the time of publishing SCM had no direct position in MOT, TROW, XRX, MRK, FAIRX, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

2011 Sidoxia – IC Greatest Hits

There was some entertaining dancing going on early in 2011, but for the most part, the year brought a lot of rock ‘n’ roll on its way to what looks like a flattish year on a return basis. Sidoxia Capital Management and Investing Caffeine (IC) followed everything from the Royal Wedding and Charlie Sheen to the debt ceiling debate and the Arab Spring. Amongst all the celebration and chaos, IC pounded away at the keyboard and reported on the financial markets and the virtues of investing. Out of the 80 or so postings at IC this year, here are my top 11 favorites of 2011:

• Spoonfuls of Investment Knowledge: Classic investment quotes and tenets.

• 10 Ways to Destroy Your Portfolio: Investment mistakes to avoid.

• Solving Europe and Your Deadbeat Cousin: Putting the European financial crisis in context.

• A Serious Situation in Jackson Hole: The “Situation” meets Ben Bernanke.

• It’s the Earnings, Stupid: Stock prices and the inextricable ties with earnings.

• Innovative Bird Keeps All the Worms: Innovative not first mover gains the prize.

• Snoozing Your Way to Investment Prosperity: How to invest and sleep well during financial market mayhem.

• The Fallacy of High P/E’s: Sustainably high earnings growth can trump high P/E ratios.

• Gospel from 20th Century Investment King: Investment maxims from legend Sir John Templeton.

• The 10 Investment Commandments: Charles Ellis passes down key laws to investment disciples.

• Share Buybacks and Bathroom Violators: Pet peeves in the bathroom and share repurchase.

Happy Holidays and Happy New Year from Investing Caffeine and Sidoxia Capital Management!

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Fear & Greed Occupy Wall Street in October

Excerpt from Free November Sidoxia Monthly Newsletter (Subscribe on right-side of page)

Fear and frustration dominated investor psyches during August and September as backlash from political gridlock in the U.S. and worries of European contagion dominated action in volatile investment portfolios. Elevated 9.1% unemployment and a sluggish recovery in the U.S. also led populist Occupy Wall Street protesters to flood our nation’s streets, blaming the bankers and the wealthy as the cause for personal misfortunes and the widening gap between rich and poor. However, in the face of the palpable pessimism, economic Halloween treats and greedy corporate profits scared away bearish naysayers like invisible ghosts during the month of October.

While many investors stayed home for Halloween in the supposed comfort of their inflation-losing savings accounts and bonds, those investors choosing to brave the chilling elements in the frightening equity markets were handsomely rewarded. Stockholders tasted the sweet pleasure of a +11% October return in the S&P 500 index, the largest monthly advance in 20 years.

Of course, as I always advise, investors should not load themselves to the gills in stocks just to chase performance. Rather, investors should construct a diversified portfolio designed to meet one’s objectives, constraints, risk tolerance, and liquidity needs. Within that context, a portfolio should also periodically rebalance by selling pricey investments (i.e., Treasuries) and redeploy those proceeds into unloved investments (i.e., equities).

Glass Half Full

There is never a shortage of reasons to be fearful and a one-month rally in equities is not reason enough to blindly pile on risk, but there are plenty of reasons to counter the endless pessimism pornography peddled by media outlets on a continuous basis. Here are some of the “half-full” reasons:

- Euro Plan in Place: After months of conflicting headlines, European leaders reached an agreement to increase the European Union’s bailout fund to one trillion euros ($1.4 trillion) and negotiated a -50% debt reduction deal with Greek bondholders. In addition, European officials agreed on a plan to increase bank reserves by 106 billion euros to support potential bank losses due to European debt defaults. This plan is not a silver bullet, but it is a start.

- Bulging Corporate Profits: With the majority of S&P 500 companies now having reported their actual third quarter results, profit growth is estimated to exceed +16% for the three month period ending in September. Expectations for fourth quarter earnings are currently forecasted to top a respectable +11% growth rate (Data from Thomson Reuters).

- Tortoise-Like Growth Continues: Even though it’s Halloween, the double-dip recession boogeyman is still hiding. U.S. economic growth actually accelerated its growth to +2.5% in the third quarter on a year-over-year basis, up from +1.3% last quarter. The growth in Gross Domestic Product (GDP) was primarily driven by consumer and business spending.

- Jobs Still on the Rise: The unemployment rate remains stubbornly high, but offsetting the ongoing decline in government jobs has been a 19 consecutive month spurt in private job creation activity, resulting in +2.6 million jobs being added to the economy over the period. This doesn’t make up for the 8 million+ jobs lost during the 2008-2009 recession, but the economy is moving in the right direction.

- Consumers Opening Wallet: Consumers can be like cockroaches in that they are difficult to kill off when it comes to spending. Consumers whipped out their wallets in September as retail sales advanced at a brisk +7.9% pace (+7.8% excluding auto sales).

- Dividends on the Rise: While nervous Nellies park money in money losing cash and Treasuries (on an inflation-adjusted basis), corporations flush with cash are increasing dividends at a rapid clip. According to Standard & Poor’s rating agency, dividend increases rose over +17% during the third quarter of 2011. As of October 25th, the indicated dividend for the S&P stood at a decent +2.20% rate.

I am fully aware that equity investors are not out of the woods yet, as the European debt crisis has not been resolved, and the structural deficit/debt issues we face in the U.S. still have a long way to go before becoming disentangled. As a matter of fact, fear is building as we approach the looming deficit reduction Super Committee resolution (or lack thereof) later this month – I can hardly wait. If a $1.5 trillion bipartisan debt reduction agreement can’t be reached, some bored Occupy Wall Street protesters can shift priorities and take a tour bus to Washington D.C. to demonstrate. Regardless of the potential grand European or Washington debt plans that may or may not transpire, observers can rest assured fear and greed are two emotions that will remain alive and well when it comes to Wall Street and “Main Street” portfolios.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Stay Tuned…

As I sift through the flood of corporate profit reports and finish up my quarterly client responsibilities, I’ve now carved out some to time to focus on writing. For anyone waiting in line for my next piece, please come back late Monday or early Tuesday for my monthly review (or sign up on right side of page). Stay tuned…

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

WEBINAR: Panic or Attack?! Preserving Your Financial Future (8/26/11)

Webinar Details:

—August 26, 2011 (Friday) at 11:30 a.m. – 12:30 p.m. (Pacific Standard Time)

CLICK HERE TO CONNECT TO WEBINAR

Toll Free # (if not using PC): 1-877-669-3239

Access Code 808 610 841

The financial markets are experiencing historic extremes in volatility. Fears of a European financial contagion are spreading and frustrations with Washington politicians are reaching a feverish pitch. What should investors and retirees do now?

Is now the time to cut losses, or are opportunities of a lifetime developing?

Tune in for this timely review of the financial markets and listen-in to valuable advice on how to preserve your financial future.

CLICK HERE TO CONNECT TO WEBINAR

Toll Free # (if not using PC): 1-877-669-3239

Access Code 808 610 841

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in any security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

“1001 Truths about Investing” Released!

Hot off the printing presses, the much anticipated follow-up book, 1001 Truths about Investing, from Sidoxia Capital Management President and hedge fund manager Wade Slome has arrived.

With Valentine’s Day around the corner, what better way to tell your loved one or special friend that you truly care for them than by purchasing a copy of 1001 Truths. Okay, maybe the purchase wouldn’t be the most romantic gift, but investment portfolios need love too, and adding this to your book collection may be exactly what the investment doctor ordered.

Click Here for the 1001 Truths Press Release

Click Here to Purchase Book on Amazon.com

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds and AMZN, but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.