Fed Fatigue Setting In

June 22, 2013 at 11:08 am 8 comments

Uncle…uncle! There you have it – I have finally cried “uncle” because I cannot take it anymore. I don’t think I can listen to another panel or read another story debating about the timing of Fed “tapering”, or heaven forbid the Fed actually “tighten” the Federal Funds rate (i.e., increasing the targeted rate for inter-bank lending). Type in the words “Bernanke” and “tapering” into Google and you will get back more than 41,000,000 results. The build up to the 600-word FOMC (Federal Open Market Committee) statement was almost deafening, so much so that live coverage of Federal Reserve Chairman Ben Bernanke was available at your fingertips:

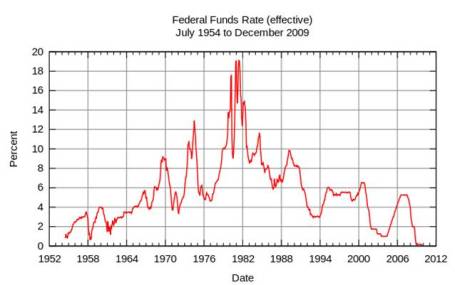

Like a toddler (or a California-based, investment blog writer) going to the doctor’s office to receive an inoculation, the anxiety and mental anguish caused in anticipation of the event is often more painful than the actual injection. As I highlighted in a previous Investing Caffeine article, the 1994 interest rate cycle wasn’t Armageddon for equity markets, and the same can be said for the rate hikes from 1.0% to 5.25% in the 2004-20006 period (see chart below). Even if QE3 ends in mid-2014 and the new Federal Reserve Chairman (thank you President Obama) raises rates in 2015, this scenario would not be the first (or last) time the Federal Reserve has tightened monetary policy.

Short Memories – What Have You Done for Me Lately?

People are quick to point out the one-day -350 Dow point loss earlier this week, but many of them forget about the +3,000 point moon shot in the Dow Jones Industrial index that occurred in six short months (November 2012 – May 2013). The same foggy recollection principle applies to interest rates. The recent rout in 10-year Treasury prices is easily recalled as rates have jumped from 1.5% to 2.5% over the last year, however amnesia often sets in for others if you ask them where rates were a few years ago. It’s easy to forget that 30-year fixed rate mortgages exceeded 5% and the 10-year reached 4% just three short years ago.

Bernanke: The Center of the Universe?

Does Ben Bernanke deserve credit for implementing extraordinary measures during extraordinary times during the 2008-09 financial crisis? Absolutely. But should every man, women, and child wait with bated breath to see if a word change or tonal adjustment is made in the eight annual FOMC meetings?

Like the public judging Ben Bernanke, my Sidoxia clients probably give me too much credit when things go well and too much blame when things don’t. I love how Bernanke gets blamed/credited for the generational low interest rates caused by his money printing ways and QE punch bowl tactics. Last I checked, the interest rate downtrend has been firmly in place over the last three decades, well before Bernanke came into the Fed and worked his monetary magic. How much credit/blame are we forgetting to give former Federal Reserve Chairmen Paul Volcker, Alan Greenspan, and other government policy-makers? Regardless of what happens economically for the remainder of 2013, Bernanke will do whatever he can to solidify his legacy in the waning sunset months of his term.

Another forgotten fact I like to point out: There is more than one central banker living on this planet. If you haven’t been asleep over the last few decades, our financial markets have increasingly become globally interconnected with the assistance of technology. I know our 10-year Treasury rates are hovering around 2.50%, and our egotistical patriotism leads us to hail Bernanke as a monetary god, but don’t any other central bankers or government officials around the world deserve any recognition for achieving yields even lower than ours? Here’s a partial list (June 22, 2013 – Financial Times):

- Japan – 0.86%

- Germany – 1.67%

- Canada – 2.33%

- U.K. – 2.31%

- France – 2.27%

- Sweden – 2.15%

- Austria – 2.09%

- Switzerland – 0.92%

- Netherlands – 2.07%

Although it may be fun to look at Ben Bernanke as our country’s financial Superman who is there to save the day, there are a lot more important factors to consider than the 47 words added and 19 subtracted from the latest FOMC statement. If investing was as easy as following central bank monetary policy, everyone would be continually jet setting to their private islands. Rather than wasting your time listening to speculative blathering about direction of Fed monetary policy, why not focus on finding solid investment ideas and putting a long-term investment plan in place. Now please excuse me – Fed fatigue has set in and I need to take a nap.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs) and GOOG, but at the time of publishing, SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Entry filed under: economy, Financial Markets, Themes - Trends. Tags: Alan Greenspan, Ben Bernanke, Fed Funds rate, Federal Reserve, FOMC, interest rates, Qe3, tapering, tightening.

8 Comments Add your own

Leave a comment

Trackback this post | Subscribe to the comments via RSS Feed

1. Bernanke: Santa Claus or Grinch? | Investing Caffeine | December 22, 2013 at 1:45 am

Bernanke: Santa Claus or Grinch? | Investing Caffeine | December 22, 2013 at 1:45 am

[…] written plenty about my thoughts on the Fed (see Fed Fatigue) and all the blathering from the media talking heads. Debates about the timing and probability of a […]

2. Bernanke: Santa Claus or Grinch? | December 26, 2013 at 6:24 am

[…] written plenty about my thoughts on the Fed and all the blathering from the media talking heads. Debates about the timing and probability of a […]

3. The Buyback Bonanza Boost | March 23, 2014 at 4:27 am

[…] been on the distorted monetary policies instituted by the Federal Reserve, but as I pointed out in Fed Fatigue is Setting In, QE and tapering talk are not the end-all, be-all of global financial markets. One need not look […]

4. Pulling The Band-Aid Off Slowly – Investor Maven | May 22, 2016 at 8:06 am

[…] in about a 26% probability of a rate increase in June. As I have been saying for years (see “Fed Fatigue“), there has, and will likely continue to be, an overly, hyper-sensitive focus on monetary […]

5. Pulling The Band-Aid Off Slowly - Seeking Alpha - Subicevac | May 22, 2016 at 9:01 am

[…] in about a 26% probability of a rate increase in June. As I have been saying for years (see “Fed Fatigue“), there has, and will likely continue to be, an overly, hyper-sensitive focus on monetary […]

6. Pulling The Band-Aid Off Slowly - Seeking Alpha - SFO Advisors | May 22, 2016 at 9:35 am

[…] in about a 26% probability of a rate increase in June. As I have been saying for years (see “Fed Fatigue“), there has, and will likely continue to be, an overly, hyper-sensitive focus on monetary […]

7. Pulling The Band-Aid Off Slowly - Seeking Alpha - Posts ABC | May 22, 2016 at 1:59 pm

[…] in about a 26% probability of a rate increase in June. As I have been saying for years (see “Fed Fatigue“), there has, and will likely continue to be, an overly, hyper-sensitive focus on monetary […]

8. The Fed: Myths Vs. Reality – Seeking Alpha – Tradersville | August 28, 2016 at 8:17 am

[…] one rate increase 0f 0.25% over the last decade. As I point out in one of my previous articles (see Fed Fatigue), stock prices increased during the last rate hike cycle (2004 – 2006) when the Fed raised […]