Posts tagged ‘bonds’

The Pleasure/Pain Principle

The financial crisis of 2008-2009 was painful, not to mention the Flash Crash of 2010; the Debt Ceiling / Credit Downgrade of 2011; and the never-ending European saga. Needless to say, these and other events have caused pain akin to burning one’s hand on the stove. This unpleasant effect has rubbed off on investors.

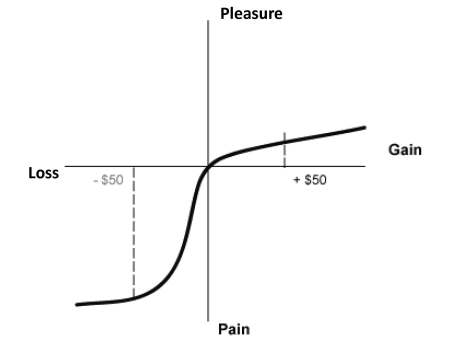

Admitting one has a problem is half the battle of conquering a challenge. A key challenge for many investors is understanding the crippling effects fear can have on personal investment decisions. While there are certainly investors who constantly see financial markets through rose-colored glasses (my glasses I argue are only slightly tinted), Nobel Prize winner Daniel Kahneman and his partner Amos Tversky understand the pain of losses can be twice as painful as the pleasure experienced through gains (see diagram below).

Said a little differently, faced with sure gain, most investors are risk-averse, but faced with sure loss, investors prefer risk-taking. Don’t believe me? Well, let’s take a look at some of Kahneman and Tversky’s behavioral finance work on what they called “Prospect Theory” (1979) – the analysis of decisions made under various risk scenarios.

In one specific experiment, Kahneman and Tversky presented groups of subjects with a number of problems. One group of subjects was presented with this problem:

Problem #1: In addition to whatever you own, you have been given $1,000. You are now asked to choose between:

A. A sure gain of $500

B. A 50% change to gain $1,000 and a 50% chance to gain nothing.

Another group of subjects was presented with this problem:

Problem #2: In addition to whatever you own, you have been given $2,000. You are now asked to choose between:

A. A sure loss of $500

B. A 50% chance to lose $1,000 and a 50% chance to lose nothing.

In the first group, 84% of the respondents chose A and in the second group, 69% of the respondents chose B. Both problems are identical in terms of the net cash outcomes ($1,500 for Answer A, and 50% chance of $1,000 or $2,000 for Answer B). Nonetheless, due the different “loss phrasing” in each question, Answer A sounds more appealing in Question #1, and Answer B sounds more appealing in Question #2. The results are irrational, but investors have been known to be illogical too.

In practical trading terms, the application of “Prospect Theory” often manifests itself via the pain principle. Due to loss aversion, investors tend to cash in gains too early and fail to allow their winning stocks to run higher for a long enough period.

The framing of the Kahneman and Tversky’s questions is no different than the framing of political and economic issues by the various media outlets (see Pessimism Porn). Fear can generate advertising revenue and fear can also push investors into paralysis (see the equity fund flow data in Fund Flows Paradox).

Greed can sell in the financial markets too. The main sources of financial market greed have been primarily limited to bonds, cash, and gold. If you caught those trends early enough, you are happy as a clam, but like most things in life, nothing lasts forever. The same principle applies to financial markets, and over time, capital in today’s winners will slowly transition into today’s losers (i.e., tomorrow’s winners).

A healthy amount of fear is healthy, but correctly understanding the dynamics of the “Pleasure/Pain Principle” can turn those fearful tears into profitable pleasure.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds (including fixed income ETFs), but at the time of publishing SCM had no direct position in GLD, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

The Rule of 20 Can Make You Plenty

There is an endless debate over whether the equity markets are overvalued or undervalued, and at some point the discussion eventually transitions to what the market’s appropriate P/E (Price-Earnings) level should be. There are several standard definitions used for P/Es, but typically a 12-month trailing earnings, 12-month forward earnings (using earnings forecasts), and multi-year average earnings (e.g., Shiller 10-year inflation adjusted P/E – see Foggy P/E Rearview Mirror) are used in the calculations. Don Hays at Hays Advisory (www.haysadvisory.com) provides an excellent 30+ year view of the historical P/E ratio on a forward basis (see chart below).

If you listen to Peter Lynch, investor extraordinaire, his “Rule of 20” states a market equilibrium P/E ratio should equal 20 minus the inflation rate. This rule would imply an equilibrium P/E ratio of approximately 18x times earnings when the current 2011 P/E multiple implies a value slightly above 11x times earnings. The bears may claim victory if the earnings denominator collapses, but if earnings, on the contrary, continue coming in better than expected, then the sun might break through the clouds in the form of significant price appreciation.

Just because prices have been chopped in half, doesn’t mean they can’t go lower. From 1966 – 1982 the Dow Jones Industrial index traded at around 800 and P/E multiples contracted to single digits. That rubber band eventually snapped and the index catapulted 17-fold from about 800 to almost 14,000 in 25 years. Even though equities have struggled at the start of this century, a few things have changed from the market lows of 30 years ago. For starters, we have not hit an inflation rate of 13% or a Federal Funds rate of 20% (~3.5% and 0% today, respectively), so we have some headroom before the single digit P/E apocalypse descends upon us.

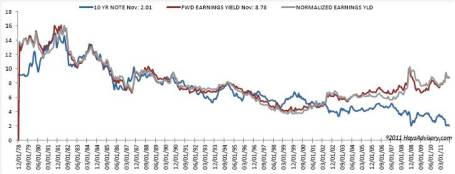

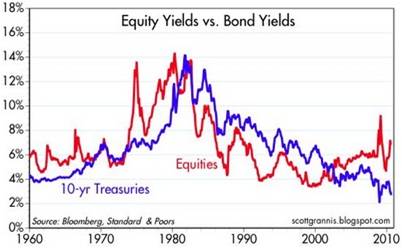

Fed Model Implies Equity Throttle

Hays Advisory exhibits another key valuation measurement of the equity market (the so-called “Fed Model”), which compares the Treasury yield of the 10-year Note with the earnings yield of stocks (see chart below).

Regardless of your perspective, the divergence will eventually take care of it in one of three ways:

1.) Bond prices collapse, and Treasury yields spike up to catch up with equity yields.

2.) Forward earnings collapse (e.g., global recession/depression), and equity yields plummet down to the low Treasury yield levels.

AND/OR

3.) Stock prices catapult higher (lower earnings yield) to converge.

At the end of the day, money goes where it is treated best, and at least today, bonds are expected to treat investors substantially worse than the unfaithful treatment of Demi Moore by Ashton Kutcher. The Super Committee may not have its act together, and Europe is a mess, but the significant earnings yield of the equity markets are factoring in a great deal of pessimism.

The holidays are rapidly approaching. If for some reason the auspice of gifts is looking scarce, then review the Fed Model and Rule of 20, these techniques may make you plenty.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Winning Coaches Telling Players to Quit

How would you feel if your coach told you not only are you going to lose, but you should quit and join the other team? Effectively, that is what Loomis Sayles bond legend Dan Fuss (read Fuss Making a Fuss), and fellow colleagues Margie Patel (Wells Fargo Advantage Funds), and Anthony Crescenzi (PIMCO) had to say about the chances of bonds winning at the recent Advisors’ Money Show.

This is what Fuss said regarding “statistically cheap” equities:

“I’ve never seen it this good in half a century.”

Patel went on to add:

“By any measure you want to look at, free cash flow, dividend yield, P/E ratio – stocks look relatively cheap for the level of interest rates.” Stock offer a “once-in-a-decade opportunity to buy and make some real capital appreciation.”

Crescenzi included the following comments about stocks:

“Valuations are not risky…P/E ratios have been fine for a decade, in part because of the two shocks that drove investors away from equities and compressed P/E ratios.”

Bonds Dynasty Coming to End

The bond team has been winning for three decades (see Bubblicious Bonds), but its players are getting tired and old. Crescenzi concedes the “30-year journey on rates is near its ending point” and that “we are at the end of the duration tailwind.” Even though it is fairly apparent to some that the golden bond era is coming to a close, there are ways for the bond team to draft new players to manage duration (interest rate/price sensitivity) and protect oneself against inflation (read Drowning TIPS).

Equities on the other hand have had a massive losing streak relative to bonds, especially over the last decade. The equity team had over-priced player positions that exceeded their salary cap and the old market leaders became tired and old. Nothing energizes a new team better than new blood and new talent at a much more attractive price, which leaves room in the salary cap to get the quality players to win. There is always a possibility that bonds will outperform in the short-run despite sky-high prices, and the introduction of any material, detrimental exogenous variable (large country bailout, terrorist attack, etc.) could extend bonds’ outperformance. Regardless, investors will find it difficult to dispute the relative attractiveness of equities relative to prices a decade ago (read Marathon Investing: Genesis of Cheap Stocks).

As I have repeated in the past, bonds and cash are essential in any portfolio, but excessively gorging on a buffet of bonds for breakfast, lunch, and dinner can be hazardous for your long-term financial health. Maximizing the bang for your investment buck means not neglecting volatile equity opportunities due to disproportionate conservatism and scary economic media headlines.

There are bond coaches and teams that believe the winning streak will continue despite the 30-year duration of victories. Fear, especially in this environment, is often used as a tactic to sell bonds. Conflicts of interest may cloud the advice of these bond coaches, but the successful experienced coaches like Dan Fuss, Margie Patel, Anthony Crescenzi are the ones to listen to – even if they tell you to quit their team and join a different one.

Read Full Advisor Perspectives Article

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds (including TIP), but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

QE2 Drowning TIPS Yields Below Water

The holiday season is creeping up on us, and the only question building up more anticipation than what gift kids are going to get from Santa Claus is what investors are going to get from Federal Reserve Chairman Ben Bernanke – in the form of QE2 (Quantitative Easing Part II)? The inevitable QE2 program is an effort designed by the Fed to keep interest rates low and reduce the threat of deflation. In addition, QE2 is structured to stimulate the meager 0.8% core inflation experienced over the last 12 months (Bloomberg) to a Goldilocks level – not too hot and not too cold. Some pundits suggest the Fed should target a 2% inflation rate. QE2 asset purchase estimates are all over the map, but I can safely guess somewhere between a few hundred billion and $2 trillion (very brave of me).

Treasuries Weigh Down TIPS Yields

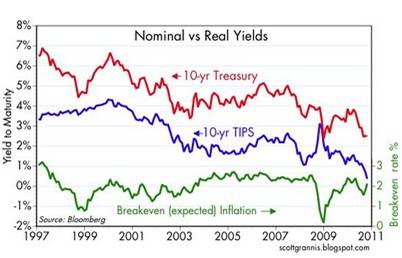

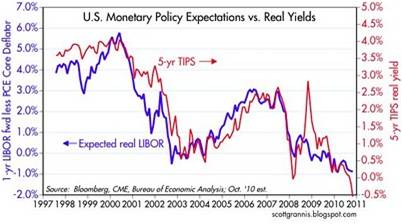

Ever since QE1 expired in the March timeframe, speculation began about the next potential slug of Treasuries and mortgage backed securities to be purchased by the Fed. As a consequence, this speculation became a contributing factor to 10-Year Treasury yields plummeting from around 4.0% to around 2.5%. Simultaneously, 5-Year TIPS (Treasury Inflation Protection Securities) yields have moved to negative territory.

Scott Grannis at Calafia Beach Pundit has a great chart showing the relationship between nominal Treasury yields, real TIPS yields, and expected inflation for 10-year maturities. As you can see below, over the last ten years there has been a tight correlation between the 10-year Treasury bond versus TIPS, with the former 10-year declining yield acting as a weight drowning the latter TIPS yield:

Worth noting, absent the brief period in late-2008 and early-2009, inflation expectations have been remarkably stable in that 1.5% – 2.5% range.

Negative Yields…Who Cares?!

Unprecedented times have created an unprecedented appetite for bonds (see Bubblicious Bonds), and as a result, we just witnessed a historic $10 billion TIPS auction this week producing an eye-catching negative -0.55% yield. Sensationalist commentators characterize the negative yield dynamic as a money losing proposition, whereby investors are forced to pay the government. This assertion is quite a distortion and not quite true – we will review the mechanics of TIPS later.

If we’re not back to a panic filled environment of soup kitchen lines and bank runs, then why are TIPS paying a negative yield?

- QE2: As mentioned above, investor expectations are that Uncle Sam will come to the rescue and deliver lower interest rates (higher prices) through purchases of Treasuries and mortgage-backed securities.

- Rising Inflation Expectations: As fears surrounding future inflation increase, the price of TIPS will rise, and yields will fall.

- Sluggish Economy: Lackluster growth and fear of double dips have pressured rates lower as debates still linger about whether or not the U.S. will follow Japan (see Lost Decade).

Nuts & Bolts of TIPS

TIPS maturities come in terms of 5 years, 10 years and 30 years. Per the Treasury, 5-year TIPS are auctioned in April and October; 10-year TIPS in January, March, May (beginning in 2011), July, September, and November; and 30-year TIPS in February and August.

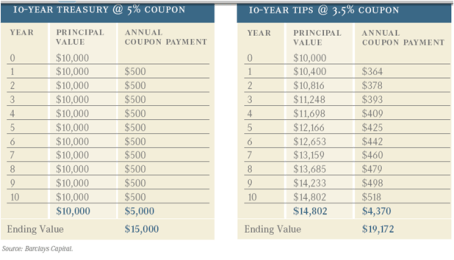

This table from Barclays Capital below does an excellent job of conceptually displaying the differences between vanilla Treasuries and TIPS.

Some Observations:

1) As you can see, the principal value of the TIPS security adjusts with inflation (Consumer Price Index). The price of the TIPS security, which we cannot see in the example, adjusts upwards (or downwards) with inflation expectations.

2) The TIPS security pays a lower coupon (3.5% vs. 5.0%), but you can see that under a 4% annual inflation assumption (principal value adjusts from $10,000 in Year 0 to $10,400 in Year 1), the ending value of the TIPS comes up significantly higher ($19,172 vs. $15,000).

3) The break-even inflation expectation rate is 1.5% (derived from 5% coupon minus 3.5% coupon). If you think inflation will average more than 1.5%, then buy the TIPS security. If you think inflation will average less than 1.5%, then buy the 10-year Treasury.

TIPS Advantages

- Inflation Protection: At the risk of stating the obvious, if you expect long-term inflation to average substantially more than about 2% (current inflation expectations), then TIPS are a great way of protecting your purchasing power.

- Deflation Protection: Perhaps TIPS should be called DIPS (Deflation Income Protection Securities)? What some investors do not realize is that even if our country were to spiral into long-term deflationary crisis, TIPS investors are guaranteed the original amount of principal. Yes, that’s right…guaranteed. Interest payments could conceivably decline to zero and the principal value could temporarily fall below par, but the government guarantees the original principal regardless of the scenario.

- No Credit or Default Risk: The advantage of the government owning its own printing press is that there is very little risk of default, so preservation of capital is not much of a risk.

TIPS Disadvantages

- Interest Rate Risk: It’s great to be indexed to inflation, but because TIPS include long-range maturities, investors face a significant amount of interest rate risk if the TIPS are not held until maturity. TIPS will likely outperform Treasuries under a rising rate scenario, but will be impacted nonetheless.

- CPI Risk: Even if you are not a conspiracy theorist who believes government CPI figures are artificially depressed, it is still quite possible your personal baskets of purchases do not perfectly align with the arbitrary CPI basket of goods.

- Negative Deflation Adjustments: Although a TIPS investor has an embedded “deflation floor” equivalent to original principal value, interest payments will be negatively impacted by declines in principal value during deflationary periods. Also, previously issued TIPS with accumulated principal values from inflationary adjustments run larger principal loss risks as compared to newly issued TIPS.

Although 5-year TIPS yields may have dunked below water into negative territory, the headline bark is much worse than the bite. There has been a massive rally in bond prices in front of the QE2 bond binge by the Fed. Nevertheless, inflation expectations have remained fairly stable and TIPS still provide defensive characteristics under both a future inflationary or deflationary scenario. If the Fed is indeed successful in manufacturing a reasonable Goldilocks range of inflation then TIPS yields should once again be able to come up for air.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds (including TIP), but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

PIMCO – The Downhill Marathon Machine

How would you like to run a marathon? How about a marathon that is prearranged all downhill? How about a downhill marathon with the wind at your back? How about a downhill marathon with the wind at your back in a wheelchair? Effectively, that is what a 30-year bull market has meant for PIMCO (Pacific Investment Management Co.) and the “New Normal” brothers (Co-Chairman Bill Gross and Mohamed El-Erian) who are commanding the bond behemoth (read also New Normal is Old Normal). Bill Gross can appreciate a thing or two about running marathons since he once ran six marathons in six consecutive days.

This perseverance also assisted Gross in co-founding PIMCO in 1971 with $12 million in assets under management. Since then, the company has managed to add five more zeroes to that figure (today assets exceed $1.2 trillion). In the first 10 years of the company’s existence, as interest rates were climbing, PIMCO managed to layer on a relatively thin amount of assets (approximately $1 billion). But with the tailwind of declining rates throughout the 1980s, PIMCO’s growth began to accelerate, thereby facilitating the addition of more than $25 billion in assets during the decade.

The PIMCO Machine

For the time-being, PIMCO can do no wrong. As the endless list of media commentators and journalists bow to kiss the feet of the immortal bond kings, the blinded reporters seem to forget the old time-tested Wall Street maxim:

“Never confuse genius with a bull market.”

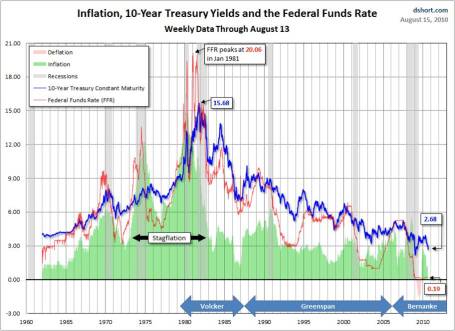

The gargantuan multi-decade move in interest rates, the fuel used to drive bond prices to the moon, might have something to do with the company’s success too? PIMCO is not exactly selling ice to the Eskimos – many investors are scooping up PIMCO’s bond products as they wait in their bunkers for Armageddon to arrive. Thanks to former Federal Reserve Chairman Paul Volcker (appointed in 1979), the runaway inflation of the early 1980s was tamed by hikes he made in the key benchmark Federal Funds Rate (the targeted rate that banks lend to each other). From a peak of around 20% in 1980-1981 the Fed Funds rate has plummeted to effectively 0% today with the most recent assistance coming from current Fed Chairman Ben Bernanke.

Although these west-coast beach loving bond gurus are not the sole beneficiary in this “bond bubble” (see Bubblicious Bonds story), PIMCO has separated itself from the competition with its shrewd world-class marketing capabilities. A day can hardly go by without seeing one of the bond brothers on CNBC or Bloomberg, spouting on about interest rates, inflation, and global bond markets. As PIMCO has been stepping on fruit in the process of collecting the low-hanging fruit, the firm has not been shy about talking its own book. Subtlety is not a strength of El-Erian – here’s what he had to pimp to the USA Today a few months ago as bond prices were continuing to inflate: “Simply put, investors should own less equities, more bonds, more global investments, more cash and more dry ammunition.”

If selling a tide of fear resulted in a continual funnel of new customers into your net, wouldn’t you do the same thing? Fearing people into bonds is something El-Erian is good at: “In the New Normal you are more worried about the return of your capital, not return on your capital.” Beyond alarm, accuracy is a trivial matter, as long as you can scare people into your doomsday way of thinking. The fact Bill Gross’s infamous Dow 5,000 call never came close to fruition is not a concern – even if the forecast overlapped with the worst crisis in seven decades.

Mohamed Speak

Mohamed El-Erian is a fresher face to the PIMCO scene and will be tougher to pin down on his forecasts. He arrived at the company in early 2008 after shuffling over from Harvard’s endowment fund. El-Erian has a gift for cryptically speaking in an enigmatic language that could only make former Federal Reserve Chairman Alan Greenspan proud. Like many economists, El-Erian laces his commentary with many caveats, hedges, and generalities – concrete predictions are not a strength of his. Here are a few of my favorite El-Erian obscurities:

- “ongoing paradigm shift”

- “endogenous liquidity”

- “tail hedging”

- “deglobalization”

- “post-realignment”

- “socialization losses”

Excuse me while I grab my shovel – stuff is starting to pile up here.

Don’t get me wrong…plenty of my client portfolios hold bonds, with some senior retiree portfolios carrying upwards of 80% in fixed income securities. This positioning is more a function of necessity rather than preference, and requires much more creative hand-holding in managing interest-rate risk (duration), yield, and credit risk. At the margin, unloved equities, including high dividend paying Blue Chip stocks, provide a much better risk-adjusted return for those investors that have the risk tolerance and time-horizon threshold to absorb higher volatility.

PIMCO has traveled along a long prosperous road over the last 30 years with the benefit of a historic decline in interest rates. While PIMCO may have coasted downhill in a wheelchair for the last few decades, this behemoth may be forced to crawl uphill on its hands and knees for the next few decades, as interest rates inevitably rise. Now that is a “New Normal” scenario Bill Gross and Mohamed El-Erian have not forecasted.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in PIMCO/Allianz, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

September Surge: Stop, Go, or Proceed Cautiously?

The stock market just posted its strongest September and third quarter performance in more than seven decades (S&P 500 +8.8% and +10.7%, respectively), yet people are still waiting for a clear green light to signal blue investment skies ahead. Well of course, once it is apparent to everyone that the economy is obviously back on track, the opportunities persisting today will either be gone or vastly diminished. I’m not a blind optimist, but a sober realist that understands, like Warren Buffett, that it pays to “buy fear and sell greed.” And fear is exactly what we are witnessing today. The $2.6 trillion sitting in CDs earning a horrendously low 1% is simple proof (Huffington Post).

Like the fresh memory of a recent hand burned on the stove, the broader general public is still feeling the pain and recovering from the financial crisis. Each gloomy real estate or unemployment headline triggers agonizing flashbacks (read Unemployment Hypochondria) of the 2008-2009 financial collapse and leads to harmful emotional investment decisions. However, for some of us finance geeks that have cut through the monotony of “pessimism porn” blasted over the airwaves, we have discovered plenty of positive leading economic indicators bubbling up below the surface, like the following:

- Continued Economic Growth: Gross Domestic Product (GDP) grew +1.7% in the second quarter and current estimates stand in the +2.0% to +2.5% range for third quarter GDP, which will mark the fifth consecutive quarter of growth.

- Growing Corporate Profits: S&P 500 earnings are estimated to expand by +45.6% in 2010 and are estimated to grow by another +15% or so next year (Standard & Poor’s September 2010).

- Escalating M&A: Mergers and acquisitions activity increased to $566.5 billion in the third quarter. The value of announced transactions is up +60% from a year ago according to Bloomberg. If you have a tough time comprehending the pickup in M&A, then take a peek here.

- Record Cash Piles: The top 1,000 largest global corporations held a whopping $2.87 trillion in cash (Bloomberg).

- Accelerating Share Buybacks: Share buybacks totaled $77.6 billion in the second quarter, up +221% from a record low last year – Barron’s).

- Dividends Galore: S&P 500 companies have lifted their payouts by $15 billion so far this year versus a reduction of $40 billion for the same period last year (The Wall Street Journal). Tech giant Cisco Systems Inc. (CSCO) announced the pending initiation of a dividend, while Microsoft Corp. (MSFT) increased its dividend by a significant +23%.

I’m not naïve enough to believe choppy waters will disappear for good, but despite the depressing headlines there are constructive undercurrents. Beyond the points above, equity market prices remain attractive relative to the broader fixed-income markets (see Bubblicious Bonds) . More specifically, the S&P 500 is priced at about a 25% discount to historic valuation averages over the last 55 years (currently trading at about 12.5 Price/Earnings ratio vs 16.5x historic Price/Earnings ratio – Bloomberg). Now may not be the time to recklessly run a red light, but if you fearfully remain halted in front of the green light then prepare to receive a pricey ticket.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds and CSCO, but at the time of publishing SCM had no direct position in MSFT, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Siegel & Co. See “Bubblicious” Bonds

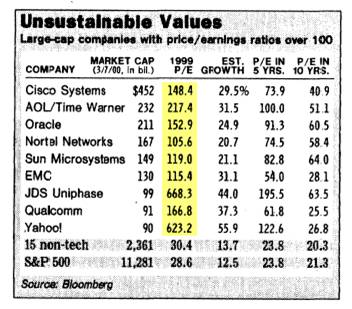

Siegel compares 1999 stock prices with 2010 bonds

Unlike a lot of economists, Jeremy Siegel, Professor at the Wharton School of Business, is not bashful about making contrarian calls (see other Siegel article). Just days after the Nasdaq index peaked 10 years ago at a level above 5,000 (below 2,200 today), Siegel called the large capitalization technology market a “Sucker’s Bet” in a Wall Street Journal article dated March 14, 2000. Investors were smitten with large-cap technology stocks at the time, paying balloon-like P/E (Price-Earnings) ratios in excess of 100 times trailing earnings (see table above).

Bubblicious Boom

Today, Siegel has now switched his focus from overpriced tech-stock bubbles to “Bubblicious” bonds, which may burst at any moment. Bolstering his view of the current “Great American Bond Bubble” is the fact that average investors are wheelbarrowing money into bond funds. Siegel highlights recent Investment Company Institute data to make his point:

“From January 2008 through June 2010, outflows from equity funds totaled $232 billion while bond funds have seen a massive $559 billion of inflows.”

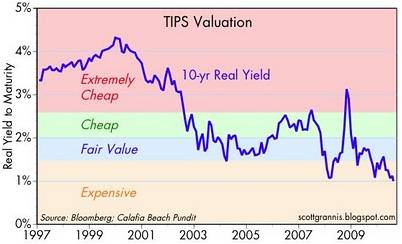

The professor goes on to make the stretch that some government bonds (i.e., 10-year Treasury Inflation-Protected Securities or TIPS) are priced so egregiously that the 1% TIPS yield (or 100 times the payout ratio) equates to the crazy tech stock valuations 10 years earlier. Conceptually the comparison of old stock and new bond bubbles may make some sense, but let’s not lose sight of the fact that tech stocks virtually had a 0% payout (no dividends). The risk of permanent investment loss is much lower with a bond as compared to a 100-plus multiple tech stock.

Making Rate History No Mystery

What makes Siegel so nervous about bonds? Well for one thing, take a look at what interest rates have done over the last 30 years, with the Federal Funds rate cresting over 20%+ in 1981 (View RED LINE & BLUE LINE or click to enlarge):

As I have commented before, there is only one real direction for interest rates to go, since we currently sit watching rates at a generational low. Rates have a minute amount of wiggle room, but Siegel rightfully understands there is very little wiggle room for rates to go lower. How bad could the pain be? Siegel outlines the following scenario:

“If over the next year, 10-year interest rates, which are now 2.8%, rise to 3.15%, bondholders will suffer a capital loss equal to the current yield. If rates rise to 4% as they did last spring, the capital loss will be more than three times the current yield.”

Siegel is not the only observer who sees relatively less value in bonds (especially government bonds) versus stocks. Scott Grannis, author of the Calafia Report artfully shows the comparisons of the 10-Year Treasury Note yield relative to the earnings yield on the S&P 500 index:

As you can see, rarely have there been periods over the last five decades where bonds were so poorly attractive relative to equities.

Grannis mirrors Siegel’s view on government bond prices through his chart on TIPS pricing:

Pricey Treasuries is not a new unearthed theme, however, Siegel and Grannis make compelling points to highlight bond risks. Certainly, the economy could soften further, and trying to time the bottom to a multi-decade bond bubble can be hazardous to your investing health. Having said that, effectively everyone should desire some exposure to fixed income securities, depending on their objectives and constraints (retirees obviously more). The key is managing duration and the risk of inflation in a prudent fashion. If you believe Siegel is correct about an impending bond bubble bursting, you may consider lightening your Treasury bond load. Otherwise, don’t be surprised if you do not collect on another “sucker’s bet.”

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

*DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds (including TIP and other fixed income ETFs), but at the time of publishing SCM had no direct position in any security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Baseball, Hot Dogs, and Fixed Income Securities

Having just celebrated another 4th of July holiday, I reflected on the historical importance of our country’s independence finalized 234 years ago, the defining birthday of our great country that permanently marked the separation of our nation from Great Britain. In honor of this revolutionary milestone, our culture has added a few American traditions over the centuries, including watching baseball, and gorging ourselves on hot dogs, and apple pie.There is no better symbol of the importance our culture places on overindulgence than Nathan’s International Hot Dog Eating Contest, held each year on July 4th in Coney Island, Brooklyn, New York. The 95th annual contest winner was Joey Chestnut with a total of 54 HDBs (Hot Dogs & Buns) consumed, but not without some controversy thanks to the arrest of former Nathan’s champ Takeru Kobayashi, who watched from the sidelines this year due to a contract dispute with event organizers. Chestnut holds the world record set in 2009 with 68 HDBs, equivalent to about 20,000 calories. In setting the unmatched record, the winner of wiener eating contest inhaled in 10 minutes what an average human should consume in 10 days.

Bond Binge

In the financial markets, Americans have been pigging out on something else over the last few decades, and that is bonds. The craving for bonds has not changed since the end of the financial crisis either. According to Morningstar, since the end of 2008, investors have placed a net $390 billion into taxable bond funds and withdrawn -$45 billion out of U.S. stock funds. A continuation of these trends can be seen in the latest ICI (Investment Company Institute) fund flow data, in which we saw a +$6.3 billion inflow into bonds and a -$1.3 billion abandonment of stocks from the hands of jittery stock investors.

Beyond the endless checklist of worries (Europe default, China slowing, twin deficits, elections, etc.), there has been a consistent exodus of capital from money market funds due to the ridiculously low yields – the seven-day yield on taxable money-market funds, as measured by IMoneyNet, has recently held steady around 0.04%. For yield-hungry investors, bondholders are not getting a lot of bang for their buck if you consider the 10-Year Treasury Note is trading at 2.98%. Nothing in life comes for free, so in the case of Treasuries, bond investors are predominantly swapping market risk for interest rate risk. As I have repeatedly stated in the past, bonds are not evil, however fixed income exposure in a portfolio should be customized for an individual in the context of a diversified portfolio that meets investors’ objectives and risk tolerance.

Although the inflation skies are sunny now, there are clouds on the horizon and the stimulative monetary policies conducted over the last few years do not augur well for a likely climb in future interest rates.

Reversal of Fortune

In the competitive eating world, there is a so-called “reversal of fortune” that disqualifies eaters. At some point, you can only consume so much before the forces of nature take over.

I don’t know when the day of regurgitation will come for many fixed income securities, but managing your consumption of bonds, and the associated duration, becomes crucial as bond bellies continue to bulge. Takeru Kobayashi discovered this first hand at the Nathan’s 2007 championship event.

Baseball, hot dogs, and apple pie have been essential components to the unique aspects of the great American culture. In the world of investing, we have witnessed an acceleration in investors’ appetite for bonds – I just hope for the sake of overzealous bond investors, they will not suffer a reversal of fortune.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

*DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds (including fixed income ETFs), but at the time of publishing SCM had no direct positions in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Stocks…Bonds on Steroids

With all the spooky headlines in the news today, it’s no wonder everyone is piling into bonds. The Investment Company Institute (ICI), which tracks mutual fund data, showed -88% of the $14 billion in weekly outflows came from equity funds relative to bonds and hybrid securities. With the masses flocking to bonds, it’s no wonder yields are hovering near multi-decade historical lows. Stocks on the other hand are the Rodney Dangerfield (see Doug Kass’s Triple Lindy attempt) of the investment world – they get “no respect.” By flipping stock metrics upside down, we will explore how hated stocks can become the beloved on steroids, if viewed in the proper context.

Davis on Debt Discomfort

Chris Davis, head of the $65 billion in assets at the Davis Funds, believes like I do that navigating the “bubblicious” bond market will be a treacherous task in the coming years. Davis directly states, “The only real bubble in the world is bonds. When you look out over a 10-year period, people are going to get killed.” In the short-run, inflation is not a real worry, but it if you consider the exploding deficits coupled with the exceedingly low interest rates, bond investors are faced with a potential recipe for disaster. Propping up the value of the dollar due to sovereign debt concerns in Greece (and greater Europe) has contributed to lower Treasury rates too. There’s only one direction for interest rates to go, and that’s up. Since the direction of bond prices moves the opposite way of interest rates, mean reversion does not bode well for long-term bond holders.

Earnings Yield: The Winning Formula

Average investors are freaked out about the equity markets and are unknowingly underestimating the risk of bonds. Investors would be in a better frame of mind if they listened to Chris Davis. In comparing stocks and bonds, Davis says, “If people got their statement and looked at the dividend yield and earnings yield, they might do things differently right now. But you have to be able to numb yourself to changes in stock prices, and most people can’t do that.” Humans are emotional creatures and can find this a difficult chore.

What us finance nerds learn through instruction is that a price of a bond can be derived by discounting future interest payments and principle back to today. The same concept applies for dividend paying stocks – the value of a stock can be determined by discounting future dividends back to today.

A favorite metric for stock jocks is the P/E (Price-Earnings) ratio, but what many investors fail to realize is that if this common ratio is flipped over (E/P) then one can arrive at an earnings yield, which is directly comparable to dividend yields (annual dividend per share/price per share) and bond yields (annual interest/bond price).

Earnings are the fuel for future dividends, and dividend yields are a way of comparing stocks with the fixed income yields of bonds. Unlike virtually all bonds, stocks have the ability to increase dividends (the payout) over time – an extremely attractive aspect of stocks. For example, Procter & Gamble (PG) has increased its dividend for 54 consecutive years and Wal-Mart (WMT) 37 years – that assertion cannot be made for bonds.

As stock prices drop, the dividend yields rise – the bond dynamics have been developing in reverse (prices up, yields down). With S&P 500 earnings catapulting upwards +84% in Q1 and the index trading at a very reasonable 13x’s 2010 operating earnings estimates, stocks should be able to outmuscle bonds in the medium to long-term (with or without steroids). There certainly is a spot for bonds in a portfolio, and there are ways to manage interest rate sensitivity (duration), but bonds will have difficulty flexing their biceps in the coming quarters.

Read the full article on Chris Davis’s bond and earnings yield comments

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

*DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds and WMT, but at the time of publishing SCM had no direct positions in PG, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Seesawing Through Organized Chaos

Still fresh in the minds of investors are the open wounds created by the incredible volatility that peaked just a little over a year ago, when the price of insurance sky-rocketed as measured by the Volatility Index (VIX). Even though equity markets troughed in March of 2009, earlier the VIX reached a climax over 80 in November 2008. With financial institutions falling like flies and toxic assets clogging up the lending pipelines, virtually all asset classes moved downwards in unison during the frefall of 2008 and early 2009. The traditional teeter-totter phenomenon of some asset classes rising simultaneously while others were falling did not hold. With the recent turmoil in Greece coupled with the “Flash Crash” (read making $$$ trading article) and spooky headline du jour, the markets have temporarily reverted back to organized chaos. What I mean by that is even though the market recently dove about +8% in 8 days, we saw the teeter-totter benefits of diversification kick in over the last month.

Seesaw Success

While the S&P fell about -4.5% over the studied period below, the alternate highlighted asset classes managed to grind out positive returns.

While traditional volatility has returned after a meteoric bounce in 2009, there should be more investment opportunities to invest around. With the VIX hovering in the mid-30s after a brief stay above 40 a few weeks ago, I would not be surprised to see a reversion to a more normalized fear gauge in the 20s – although my game plan is not dependent on this occurring.

Regardless of the direction of volatility, I’m encouraged that even during periods of mini-panics, there are hopeful signs that investors are able to seesaw through periods of organized chaos with the assistance of good old diversification.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

*DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds (including AGG, BND, VNQ, IJR and TIP), but at the time of publishing SCM had no direct positions in VXX, GLD, or any security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.