The Pleasure/Pain Principle

May 12, 2012 at 6:13 pm Leave a comment

The financial crisis of 2008-2009 was painful, not to mention the Flash Crash of 2010; the Debt Ceiling / Credit Downgrade of 2011; and the never-ending European saga. Needless to say, these and other events have caused pain akin to burning one’s hand on the stove. This unpleasant effect has rubbed off on investors.

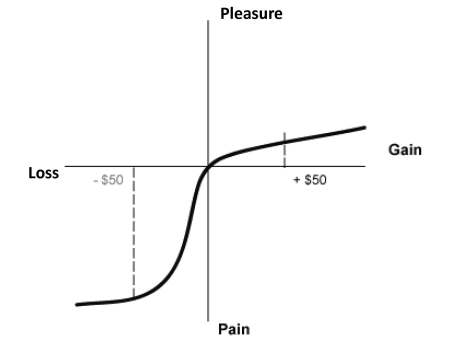

Admitting one has a problem is half the battle of conquering a challenge. A key challenge for many investors is understanding the crippling effects fear can have on personal investment decisions. While there are certainly investors who constantly see financial markets through rose-colored glasses (my glasses I argue are only slightly tinted), Nobel Prize winner Daniel Kahneman and his partner Amos Tversky understand the pain of losses can be twice as painful as the pleasure experienced through gains (see diagram below).

Said a little differently, faced with sure gain, most investors are risk-averse, but faced with sure loss, investors prefer risk-taking. Don’t believe me? Well, let’s take a look at some of Kahneman and Tversky’s behavioral finance work on what they called “Prospect Theory” (1979) – the analysis of decisions made under various risk scenarios.

In one specific experiment, Kahneman and Tversky presented groups of subjects with a number of problems. One group of subjects was presented with this problem:

Problem #1: In addition to whatever you own, you have been given $1,000. You are now asked to choose between:

A. A sure gain of $500

B. A 50% change to gain $1,000 and a 50% chance to gain nothing.

Another group of subjects was presented with this problem:

Problem #2: In addition to whatever you own, you have been given $2,000. You are now asked to choose between:

A. A sure loss of $500

B. A 50% chance to lose $1,000 and a 50% chance to lose nothing.

In the first group, 84% of the respondents chose A and in the second group, 69% of the respondents chose B. Both problems are identical in terms of the net cash outcomes ($1,500 for Answer A, and 50% chance of $1,000 or $2,000 for Answer B). Nonetheless, due the different “loss phrasing” in each question, Answer A sounds more appealing in Question #1, and Answer B sounds more appealing in Question #2. The results are irrational, but investors have been known to be illogical too.

In practical trading terms, the application of “Prospect Theory” often manifests itself via the pain principle. Due to loss aversion, investors tend to cash in gains too early and fail to allow their winning stocks to run higher for a long enough period.

The framing of the Kahneman and Tversky’s questions is no different than the framing of political and economic issues by the various media outlets (see Pessimism Porn). Fear can generate advertising revenue and fear can also push investors into paralysis (see the equity fund flow data in Fund Flows Paradox).

Greed can sell in the financial markets too. The main sources of financial market greed have been primarily limited to bonds, cash, and gold. If you caught those trends early enough, you are happy as a clam, but like most things in life, nothing lasts forever. The same principle applies to financial markets, and over time, capital in today’s winners will slowly transition into today’s losers (i.e., tomorrow’s winners).

A healthy amount of fear is healthy, but correctly understanding the dynamics of the “Pleasure/Pain Principle” can turn those fearful tears into profitable pleasure.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds (including fixed income ETFs), but at the time of publishing SCM had no direct position in GLD, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Entry filed under: Behavioral Finance, Education. Tags: Amos Tversky, behavioral finance, bonds, Cash, Daniel Kahneman, debt ceiling debate, fixed income, flash crash, Prospect Theory.

Trackback this post | Subscribe to the comments via RSS Feed