Earnings Coma: Digesting the Gains

Over the last five years, the stock market has been an all-you-can-eat buffet of gains for investors. It has been almost two years since the spring of 2012 when the Arab Spring and potential exit of Greece from the EU caused a -10% correction in the S&P 500 index (see Series of Unfortunate Events). Indigestion of this 10% variety is typically on the menu and ordered at least once per year. With stocks up about +50% over the last two years, performance has tasted sweet. But even binging on your favorite entrée or dessert will eventually lead to a food coma. At that bloated point, a digestion phase is required before another meal of gains can be consumed.

So far investors haven’t been compelled to expel their meals quite yet, but it’s clear to me the rate of appreciation is not sustainable over the long-term. Could the incredible returns continue in the short-run during 2014? Certainly. As I’ve written before, the masses remain skeptical of the recovery/rally and any definitive acceleration in economic growth could spark the powder-keg of skeptics to come join the party (see Here Comes the Dumb Money). If and when that happens, I will be gladly there to systematically ring the register of profits I’ve consumed, by locking in gains and reallocating to less loved areas (i.e., go on a stock diet).

Q4 Appetizers Here, Main Course Not Yet

The 4th quarter earnings appetizers have been served, evidenced by the 50-odd S&P 500 corporations that have reported their financial results, and thus far some Tums may be needed to relieve some heartburn. Although about half of those companies reporting have beat Wall Street estimates, 37% of the group have missed expectations, according to Thomson Reuters. It’s still early in the earnings season, but as of now, the ratio of companies beating Wall Street forecasts is below historical averages.

We can put a little meat on the earnings bone by highlighting the disappointing profit warnings and lackluster results from bellwether companies like United Parcel Service (UPS), Intel Corp (INTC), General Electric (GE), CSX Corp (CSX), and Royal Dutch Shell (RDSA), to name a few. Is it time to panic and run for the restroom (or exits)? Probably not. About 90% of the S&P 500 companies still need to give their Q4 profitability state of the union. What’s more, another reason to not throw in the white towel yet is the global economic environment looks significantly better in areas like Europe, China, and other emerging markets.

Worth remembering, the stock market is a discounting mechanism. The market pays much more attention to the future versus the past. So, even if the early earnings read doesn’t look so great now, the fact that the S&P 500 is down less than -1% off of its all-time, record highs may be an indication of better things ahead.

Recipe for a Pullback?

If earnings continue to drag on in a disappointing fashion, and political brinkmanship materializes surrounding the debt ceiling, it could easily be enough to spark some profit-taking in stocks. While Sidoxia is finding no shortage of opportunities, it has become apparent some speculative pockets of euphoria have developed. Areas like social media and biotech are ripe for corrections.

While the gains over the last few years have been tantalizing, investors must be reminded to not overindulge. Carefully selecting stocks to chew and digest is a better strategy than recklessly binging on everything in the buffet line. There are plenty of healthy areas of the market to choose from, so it’s important to be discriminating…or your portfolio could end up in a coma.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing SCM had no direct position in UPS, INTC, GE, CSX, RDSA, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Controlling the Investment Lizard Brain

“Normal fear protects us; abnormal fear paralyses us.”

– Martin Luther King, Jr.

Investing is challenging enough without bringing emotions into the equation. Unfortunately, humans are emotional, and as a result investors often place too much reliance on their feelings, rather than using objective information to drive rational decision making.

What causes investors to make irrational decisions? The short answer: our “amygdala.” Author and marketer Seth Godin calls this almond-shaped tissue in the middle of our head, at the end of the brain stem, the “lizard brain” (video below). Evolution created the amygdala’s instinctual survival flight response for lizards to avoid hungry hawks and humans to flee ferocious lions.

Over time, the threat of lions eating people in our modern lives has dramatically declined, but the human’s “lizard brain” is still running in full gear, worrying about other fear-inducing warnings like Iran, Syria, Obamacare, government shutdowns, taxes, Cyprus, sequestration, etc. (see Series of Unfortunate Events)

When the brain in functioning properly, the prefrontal cortex (the front part of the brain in charge of reasoning) is actively communicating with the amygdala. Sadly, for many people, and investors, the emotional response from the amygdala dominates the rational reasoning portion of the prefrontal cortex. The best investors and traders have developed the ability of separating emotions from rational decision making, by keeping the amygdala in check.

With this genetically programmed tendency of constantly fearing the next lion or stock market crash, how does one control their lizard brain from making sub-optimal, rash investment decisions? Well, the first thing you should do is turn off the TV. And by turning off the TV, I mean stop listening to talking head commentators, economists, strategists, analysts, neighbors, co-workers, blogger hacks, newsletter writers, journalists, and other investing “wannabes”. Sure, you could throw my name into the list of people to ignore if you wanted to, but the difference is, at least I have actually invested real money for over 20 years (see How I Managed $20,000,000,000.00), whereas the vast majority of those I listed have not. But don’t take my word for it…listen or read the words of other experienced investors Warren Buffett, Peter Lynch, Ron Baron, John Bogle, Phil Fisher, and other investment titans (see also Sidoxia Hall of Fame). These investment legends have successful long-term investment track records and they lived through wars, recessions, financial crises, and other calamities…and still managed to generate incredible returns.

Another famed investor, William O’Neil, summed this idea nicely by adding the following:

“Since the market tends to go in the opposite direction of what the majority of people think, I would say 95% of all these people you hear on TV shows are giving you their personal opinion. And personal opinions are almost always worthless … facts and markets are far more reliable.”

The Harmful Consequence of Brain on Pain

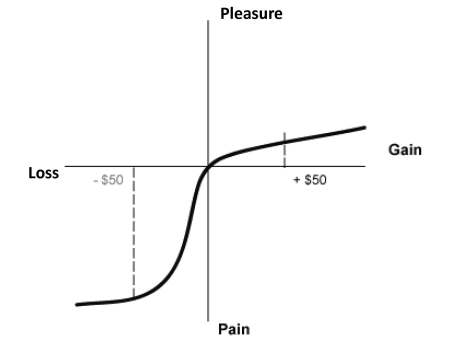

Besides forcing damaging decisions, another consequence of our lizard brain is its ability to distort reality. Behavioral economists Daniel Kahneman (Nobel Prize winner) and Amos Tversky through their research demonstrated the pain of $50 loss is more than twice as painful as the pleasure from $50 gain (see Pleasure/Pain Principle). Common sense would dictate our brains would treat equivalent scenarios in a proportional manner, but as the chart below shows, that is not the case:

Kahneman adds to the decision-making relationship of the amygdala and prefrontal cortex by describing the concepts of instinctual and deliberative choices in his most recent book, Thinking Fast and Slow (see Decision Making on Freeways).

Optimizing Risk

Taking excessive risks in technology stocks in the 1990s or in housing in the mid-2000s was very damaging to many investors, but as we have seen, our lizard brains can cause investors to become overly risk averse. Over the last five years, many people have personally experienced the ill effects of unwarranted conservatism. Investment great Sir John Templeton summed up this risk by stating, “The only way to avoid mistakes is not to invest – which is the biggest mistake of all.”

Every person has a different perception and appetite for risk. The optimal amount of risk taken by any one investor should be driven by their unique liquidity needs and time horizon…not a perceived risk appetite. Typically risk appetites go up as markets peak, and conservatism reaches a fearful apex near market bottoms – the opposite tendency of rational decision making. Besides liquidity and time horizon, a focus on valuation coupled with diversification across asset class (stocks/bonds), geography (domestic/international), size (small/large), style (value/growth) is critical in controlling risk. If you can’t determine your personal, optimal risk profile, then find an experienced and knowledgeable investment advisor to assist you.

With the advent of the internet and mobile communication, our brains and amygdala continually get bombarded with fearful stimuli, leading to disastrous decision-making and damaging portfolio outcomes. Turning off the TV and selectively choosing the proper investment advice is paramount in keeping your amygdala in check. Your lizard brain may protect you from getting eaten by a lion, but falling prey to this structural brain flaw may eat your investment portfolio alive.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

The Ski Slope Market: What’s Next in 2014?

This article is an excerpt from a previously released Sidoxia Capital Management complementary newsletter (January 2, 2014). Subscribe on the right side of the page for the complete text.

Skiing, or snowboarding in my case, is a lot like investing in the stock market…a bumpy ride. Snow, wind, ice, and moguls are common for seasoned skiers, and interest rate fluctuations, commodity price spikes, geopolitical turmoil, and -10% corrections are ordinary occurrences for veteran equity investors. However, in 2013 stock investors enjoyed pristine conditions, resulting in the best year for the Dow Jones Industrial Average since 1996. Individuals owning stocks witnessed their portfolios smoothly race to sunny, powder-like returns. More specifically, a December Santa Claus rally (S&P +2.4% for the month) capped off a spectacular year, which resulted in the S&P 500 Index soaring +30%, the NASDAQ Composite Index +38%, and the Dow +26%.

Despite the meteoric move in stocks this year, many observers missed the excitement of the equity ski slopes in exchange for lounging in the comfort of the deceivingly risky but warm lodge. In the lodge, these stock-frightened individuals sipped hot cocoa with wads of inflation-losing cash, bonds, and gold. As a result, these perceived safe assets have now become symbolic relics of the 2008-2009 financial crisis. In the short-run, the risk-averse coziness of the lodge may feel wonderful, but before the lounging observers can say “bull market,” the overpriced cocoas and holiday drinks will eat holes through retirement wallets and purses.

As you can see from the chart below, it is easy for the nervous lodge loungers to vividly remember the scary collapse of 2008-09 (point A to B). Surprisingly, many of these same skeptics are able to ignore or discount the explosive move of 2009-13 (point B to C). There’s another way of looking at this volatile time period. Had an investor fallen into a coma six years ago and then awakened today, an S&P portfolio would still have risen a respectable +26% (point A to C), plus more than +10% or so from dividends.

Turbulent Times on Back-Country Bond & Gold Trails

While stockholders have thoroughly enjoyed the recent climate, the 2013 weather conditions haven’t been as ideal for gold and bond investors. Gold investors felt less-than-precious in 2013 as they went flying off a cliff and broke a leg. In fact, the shiny metal suffered its worst performance in 30 years and underperformed stocks by a whopping -58%. With this year’s -28% loss (GLD), gold has underperformed stocks over the last six years, after including the impact of dividends.

Like gold traders, most bondholders were wounded in 2013 as well, but they did not get completely buried in an avalanche. Nevertheless, 2013 was a rocky ride overall for the bond haven hunters, as evidenced by the iShares Barclays Aggregate Bond composite (AGG), which fell -4%. As I’ve discussed previously, in Confessions of a Bond Hater, not all bonds are created equally, and actually many Sidoxia client portfolios include shorter-duration bonds, inflation protection bonds, convertible bonds, floating rate bonds, and high-yield bonds. Structured correctly, a thoughtfully constructed bond portfolio can outperform in a rising rate environment like we experienced in 2013.

Although bonds as a broad category may not currently offer great risk-reward characteristics, individuals in the mid-to-latter part of retirement need less volatility and more income – attributes bonds (not stocks) can offer. In other words, certain people are better served by snow-shoeing, or going on sleigh rides rather than risking a wipeout or tree collision on a downhill ski adventure. By owning the right types of bonds, your portfolio can avoid a severe investment crash.

Positive 2014 Outlook but Helmet Advised

With the NASDAQ index having more than tripled to over 4,176 from the 2009 lows, napping spectators are beginning to wake up and take notice. After money hemorrhaged out of the stock market for years (despite positive total returns in 2009, 2010, 2011, 2012), the fear trend began to reverse itself in 2013 and investment capital began returning to stock funds (see Here Comes the Dumb Money).

Adding fuel to the bull market fire, the International Monetary Fund (IMF) head Christine Lagarde recently signaled an increase in economic growth forecasts for the U.S. in 2014, thanks to an improving employment picture, successful Congressional budget negotiations, and actions by the Federal Reserve to unwind unprecedented monetary stimulus. If you consider the added factors of rising corporate profits, improving CEO confidence (e.g., Ford expansion), the shale energy boom, an expanding housing market, and our technology leadership position, one can paint a reasonably optimistic picture for the upcoming years.

Nonetheless, I am quick to remind investors and clients that the pace of the +30% appreciation in 2013 is unsustainable, and we are still overdue for a -10% correction in the major stock indexes.

The fundamental outlook for the economy may be improving, but there are still plenty of clouds on the horizon that could create a short-term market snowstorm. Domestically, we have the upcoming 2014 mid-term elections; debt ceiling negotiations; and a likely continuation of the Federal Reserve tapering program. Abroad, there are Iranian nuclear program talks; instability in Syria; meager and uncertain growth in Europe; and volatile economic climates in emerging markets like China, Brazil and India. After such a large advance this year, any one of these concerns (or some other unforeseen event) could provide an ample excuse to sell stocks and take some profits.

Since wipeouts are common, a protective helmet in the form of a valuation-oriented, globally diversified portfolio is strongly advised. For seasoned skiers and long-term investors, experiencing the never-ending ups and downs of skiing (investing) is a necessity to reach a desired destination. If you have trouble controlling your skis (money/emotions), it’s wise to seek the assistance of an experienced instructor (investment advisor) so your investment portfolio doesn’t crash.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing SCM had no direct position in AGG, GLD, F, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

2013 Investing Caffeine Greatest Hits

From the Boston bombings and Detroit’s bankruptcy to Pope Francis and Nelson Mandela, there were many attention grabbing headlines in 2013. Investing Caffeine made its own headlines after 4 1/2 years of blogging, including Sidoxia Capital Management’s media expansion (see Twitter & Media pages).

Thank you to all the readers who inspire me to spew out my random but impassioned thoughts on a somewhat regular basis. Investing Caffeine and Sidoxia Capital Management wish you a healthy, happy, and prosperous New Year in 2014!

Here are some of the most popular Investing Caffeine postings over the year:

10) Confessions of a Bond Hater

9) What’s Going On With This Crazy Market?

8) Information Choking Your Money

7) Beware: El-Erian & Gross Selling Buicks…Not Chevys

6) The Central Bank Dog Ate My Homework

5) Confusing Fear Bubbles with Stock Bubbles

4) Vice Tightens for Those Who Missed the Pre-Party

3) Sitting on the Sidelines: Fear & Selective Memory

2) The Most Hated Bull Market Ever

1) 2014: Here Comes the Dumb Money!

Happy New Year’s!

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page. Special editorial thanks to Lt. Andrew A. Pierce for his contributions on this article.

Bernanke: Santa Claus or Grinch?

I’ve written plenty about my thoughts on the Fed (see Fed Fatigue) and all the blathering from the media talking heads. Debates about the timing and probability of a Fed “taper” decision came to a crescendo in the recent week. As is often the case, the exact opposite of what the pundits expected actually happened. It was not a huge surprise the Federal Reserve initiated a $10 billion tapering of its $85 billion monthly bond buying program, but going into this week’s announcement, the betting money was putting their dollars on the status quo.

With the holiday season upon us, investors must determine whether the tapered QE1/QE2/QE3 gifts delivered by Bernanke are a cause for concern. So the key question is, will this Santa Claus rally prance into 2014, or will the Grinch use the taper as an excuse to steal this multi-year bull market gift away?

Regardless of your viewpoint, what we did learn from this week’s Fed announcement is that this initial move by the Fed will be a baby step, reducing mortgage-backed and Treasury security purchases by a measly $5 billion each. I say that tongue in cheek because the total global bond market has been estimated at about $80,000,000,000,000 (that’s $80 trillion).

As I’ve pointed out in the past, the Fed gets way too much credit (blame) for their impact on interest rates (see Interest Rates: Perception vs Reality). Interest rates even before this announcement were as high/higher than when QE1 was instituted. What’s more, if the Fed has such artificial influence over interest rates, then why do Austria, Belgium, Canada, Denmark, Finland, France, Germany, Japan, Netherlands, Sweden, and Switzerland all have lower 10-year yields than the U.S.? Maybe their central banks are just more powerful than our Fed? Unlikely.

Dow 128,000 in 2053

Readers of Investing Caffeine know I have followed the lead of investing greats like Warren Buffett and Peter Lynch, who believe trying to time the markets is a waste of your time. In a recent Lynch interview, earlier this month, Charlie Rose asked for Lynch’s opinion regarding the stock market, given the current record high levels. Here’s what he had to say:

“I think the market is fairly priced on what is happening right now. You have to say to yourself, is five years from now, 10 years from now, corporate profits are growing about 7 or 8% a year. That means they double, including dividends, about every 10 years, quadruple every 20, go up 8-fold every 40. That’s the kind of numbers you are interested in. The 10-year bond today is a little over 2%. So I think the stock market is the best place to be for the next 10, 20, 30 years. The next two years? No idea. I’ve never known what the next two years are going to bring.”

READ MORE ABOUT PETER LYNCH HERE

Guessing is Fun but Fruitless

I freely admit it. I’m a stock-a-holic and member of S.A. (Stock-a-holic’s Anonymous). I enjoy debating the future direction of the economy and financial markets, not only because it is fun, but also because without these topics my blog would likely go extinct. The reality of the situation is that my hobby of thinking and writing about the financial markets has no direct impact on my investment decisions for me or my clients.

There is no question that stocks go down during recessions, and an average investor will likely live through at least another half-dozen recessions in their lifetime. Unfortunately, speculators have learned firsthand about the dangers of trading based on economic and/or political headlines during volatile cycles. That doesn’t mean everyone should buy and do nothing. If done properly, it can be quite advantageous to periodically rebalance your portfolio through the use of various valuation and macro metrics as a means to objectively protect/enhance your portfolio’s performance. For example, cutting exposure to cyclical and debt-laden companies going into an economic downturn is probably wise. Reducing long-term Treasury positions during a period of near-record low interest rates (see Confessions of a Bond Hater) as the economy strengthens is also likely a shrewd move.

As we have seen over the last five years, the net result of investor portfolio shuffling has been a lot of pain. The acts of panic-selling caused damaging losses for numerous reasons, including a combination of agonizing transactions costs; increased inflation-decaying cash positions; burdensome taxes; and a mass migration into low-yielding bonds. After major indexes have virtually tripled from the 2009 lows, many investors are now left with the gut-wrenching decision of whether to get back into stocks as the markets reach new highs.

As the bulls continue to point to the scores of gifts still lying under the Christmas tree, the bears are left hoping that new Fed Grinch Yellen will come and steal all the presents, trees, and food from the planned 2014 economic feast. There are still six trading days left in the year, so Santa Bernanke cannot finish wrapping up his +30% S&P 500 total return gift quite yet. Nevertheless, ever since the initial taper announcement, stocks have moved higher and Bernanke has equity investors singing “Joy to the World!”

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

2014: Here Comes the Dumb Money!

Before this year’s gigantic rally, I wrote about the unexpected risk of a Double Rip. At that time, all the talk and concern was over the likelihood of a “Double Dip” recession due to the sequestration, tax increases, Obamacare, and an endless list of other politically charged worries.

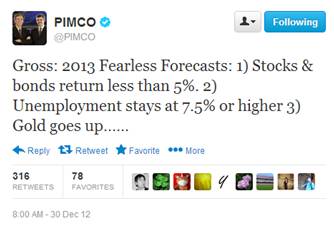

Perma-bear Nouriel Roubini has already incorrectly forecasted a double-dip in 2009, 2010, 2011, and 2012, and bond maven Bill Gross at PIMCO has fallen flat on his face with his “2013 Fearless Forecasts”: 1) Stocks & bonds return less than 5%. 2) Unemployment stays at 7.5% or higher 3) Gold goes up.

Well at least Bill was correct on 1 of his 4 predictions that bonds would suck wind, although achieving a 25% success rate would have earned him an “F” at Duke. The bears’ worst nightmares have come to reality in 2013 with the S&P up +25% and the NASDAQ climbing +33%, but there still are 11 trading days left in the year and a Hail Mary taper-driven collapse is in bears’ dreams.

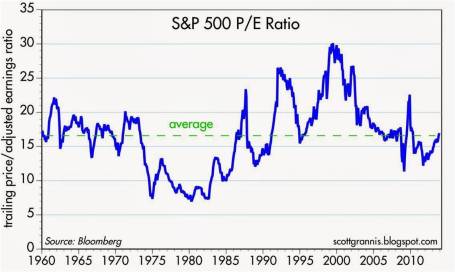

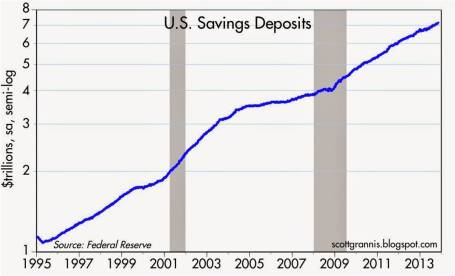

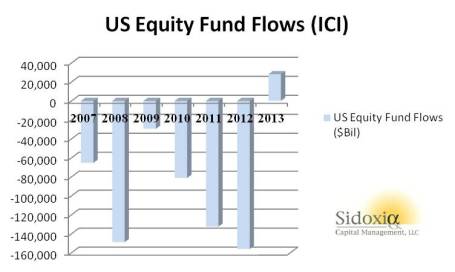

For bulls, the year has brought a double dosage of GDP and job expansion, topped with a cherry of multiple expansion on corporate profit growth. As we head into 2014, at historically reasonable price-earnings valuations (P/E of ~16x – see chart above), the new risk is no longer about Double-Dip/Rip, but rather the arrival of the “dumb money.” You know, the trillions of fear capital (see chart below) parked in low-yielding, inflation-losing accounts such as savings accounts, CDs, and Treasuries that has missed out on the more than doubling and tripling of the S&P and NASDAQ, respectively (from the 2009 lows).

The fear money was emboldened in 2009-2012 because fixed income performed admirably under the umbrella of declining interest rates, albeit less robustly than stocks. The panic trade wasn’t rewarded in 2013, and the dumb money trade may prove challenging for the bears in 2014 as well.

Despite the call for the “great rotation” out of bonds into stocks earlier this year, the reality is it never happened. I will however concede, a “great toe-dip” did occur, as investor panic turned to merely investor skepticism. If you consider the domestic fund flows data from ICI (see chart below), the modest +$28 billion inflow this year is a drop in the bucket vis-à-vis the hemorrhaging of -$613 billion out of equities from 2007-2012.

Will I be talking about the multi-year great rotation finally coming to an end in 2018? Perhaps, but despite an impressive stock rally over the previous five years in the face of a wall of worry, I wonder what a half trillion dollar rotation out of bonds into stocks would mean for the major indexes? While a period of multi-year stock buying would likely be good for retirement portfolios, people always find it much easier to imagine potentially scary downside scenarios.

It’s true that once the taper begins, the economy gains more steam, and interest rates begin rising to a more sustainable level, the pace of this stock market recovery is likely to lose steam. The multiple expansion we’ve enjoyed over the last few years will eventually peak, and future market returns will be more reliant on the lifeblood of stock-price appreciation…earnings growth (a metric near and dear to my heart).

The smart money has enjoyed another year of strong returns, but the party may not quite be over in 2014 (see Missing the Pre-Party). Taper is the talk of the day, but investors might pull out the hats and horns this New Year, especially if the dumb money comes to join the fun.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Can Good News be Good News?

There has been a lot of hyper-taper sensitivity of late, ever since Fed Chairman Ben Bernanke broached the subject of reducing the monthly $85 billion bond buying stimulus program during the spring. With a better than expected ADP jobs report on Wednesday and a weekly jobless claims figure on Thursday, everyone (myself) included was nervously bracing for hot November jobs number on Friday. Why fret about potentially good economic numbers? Firstly, as a money manager my primary job is to fret, and secondarily, stronger than forecasted job additions in November would likely feed the fear monster with inflation and taper alarm, thus resulting in a triple digit Dow decline and a 20 basis point spike in 10-year Treasury rates. Right?

Well, the triple digit Dow move indeed came to fruition…but in the wrong direction. Rather than cratering, the Dow exploded higher by +200 points above 16,000 once again. Any worry of a potential bond market thrashing fizzled out to a flattish whimper in the 10-year Treasury yield (to approximately 2.86%). You certainly should not extrapolate one data point or one day of trading as a guaranteed indicator of future price directions. But, in the coming weeks and months, if the economic recovery gains steam I will be paying attention to how the market reacts to an inevitable Fed tapering and likely rise in interest rates.

The Expectations Game

Interpreting the correlation between the tone of news and stock direction is a challenging endeavor for most (see Circular Conversations & Tweet), but stock prices going up on bad news has not a been a new phenomenon. Many will argue the economy has been limp and the news flow extremely weak since stock prices bottomed in early 2009 (i.e., Europe, Iran, Syria, deficits, debt downgrade, unemployment, government shutdown, sequestration, taxes, etc.), yet actual stock prices have chugged higher, nearly tripling in value. There is one word that reconciles the counterintuitive link between ugly news and handsome gains…EXPECTATIONS. When expectations in 2009 were rapidly shifting towards a Great Depression and/or Armageddon scenario, it didn’t take much to move stock prices higher. In fact, sluggish growth coupled with historically low interest rates were enough to catapult equity indices upwards – even after factoring in a dysfunctional, ineffectual political backdrop.

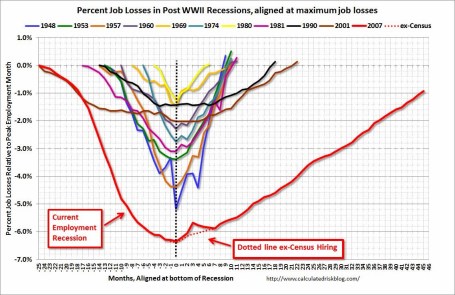

From a longer term economic cycle perspective, this recovery, as measured by job creation, has been the slowest since World War II (see Calculated Risk chart below). However, if you consider other major garden variety historical global banking crises, our crisis is not much different (see Oregon economic study).

While it’s true that stock prices can go up on bad news (and go down on good news), it is also possible for prices to go up on good news. Friday’s trading action after the jobs report is the proof of concept. As I’ve stated before, with the meteoric rise in stock prices, it’s my view the low hanging profitable fruit has been plucked, but there is still plenty of fruit on the trees (see Missing the Pre-Party). I am not the only person who shares this view.

Recently, legendary investor Warren Buffett had this to say about stocks (Source: Louis Navellier):

“I don’t have concerns about this market.” Buffet said stocks are “in a zone of reasonableness. Five years ago,” Buffett said, “I wrote an article for The New York Times that said they were very cheap. And every now and then, you can see that that they’re very overpriced or very underpriced.” Today, “they’re definitely not way overpriced. They’re definitely not underpriced.” “If you live long enough,” Buffett said, “you’ll see a lot higher prices. I don’t know what stocks will do next week or next month or next year, but five or 10 years from now, they are very likely to be higher.”

However, up cycles eventually run their course. As stocks continue to go up on good news, ultimately they begin to go down on good news. Expectations in time tend to get too lofty, and the market begins to anticipate a downturn. Stock prices are continually incorporating information that reflects the direction of future earnings and cash flow prospects. Looking into the rearview mirror at historical results may have some value, but gazing through the windshield and anticipating what’s around the corner is more important.

Rather than getting caught up with the daily mental somersault exercises of interpreting what the tone of news headlines means to the stock market (see Sentiment Pendulum), it’s better to take a longer-term cyclical sentiment gauge. As you can see from the chart below, waiting for the bad news to end can mean missing half of the upward cycle. And the same principle applies to good news.

Bad news can be good news for stock prices, and good news can be bad for stock prices. With the spate of recent positive results (i.e., accelerating purchasing manager data, robust auto sales, improving GDP, better job growth, and more new-home sales), perhaps good news will be good news for stock prices?

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Investors Feast While Bears Get Cooked

This article is an excerpt from a previously released Sidoxia Capital Management complementary newsletter (December 2, 2013). Subscribe on the right side of the page for the complete text.

As I ponder this year’s events with a notch-loosened belt after a belly-busting Thanksgiving gorging, I give thanks for my many blessings this year (see my last year’s Top 10). Investors in the stock market have had quite a feast in 2013 as well, while pessimistic bears have gotten cooked. Just this month, stock indexes reached all-time record highs (16,000 for the Dow Jones Industrial average and 1,800 for the S&P 500). Even the tech-heavy NASDAQ index surpassed 4,000 – a level not seen since 1999. How does this translate in percentage terms? Here’s what the stellar 2013 numbers looks like so far:

- Dow Jones: +22.8%

- S&P 500: +26.6%

- NASDAQ: +34.5%

These results demolish the near 0.0% returns earned on the sidelines, sitting on cash. And worth noting, these gains become even more impressive once you add dividends to the mix. To put these numbers into better perspective, it would take you more than a few decades of your lifetime to achieve this year’s stock gains, if your cash was invested at today’s CD and savings account rates.

For the bears, the indigestion has become even more unbearable if you consider the 2013 bloodbath in gold. The endless mantra of unsustainable QE (Quantitative Easing) hasn’t played out quite as the cynics planned this year (see also QE – Greatest Thing Since Sliced Bread):

- CBOE Gold Index (GOX): -51.5%

- SPDR Gold Shares (GLD): -25.5%

Bonds have been challenging too. Investors and Nervous Nellies have not been able to hide in longer-term Treasury bonds or broader bond indexes without some pain during 2013:

- iShares 20-Year Treasury Bond (TLT): -13.8%

- iShares Total U.S. Bond Market (AGG): -3.3%

As I’ve preached in the past, bonds have a place in most portfolios for income and diversification purposes, and many of my clients own them in their portfolios. But not all bonds are created equally. At Sidoxia (Sidoxia.com), we’ve smoothed out interest rate volatility and even recorded some gains by investing in specific classes of bonds such as short duration, floating rate, and convertible securities.

Why the Turkey High?

Since I invest professionally, inevitably the dinner table conversation switches from stuffing to stock market, or from pumpkin pie to politics. More often than not, the discussion reflects a tone such as, “This market is crazy! We’re due for a crash aren’t we?”

Without coming off as Pollyannaish, or offending anyone, I am quick to acknowledge I too am unhappy with Obamacare (my health insurance coverage was recently dropped due to the Affordable Care Act) and recognize that most politicians are bottom-feeders. Objectively, an argument can also be made by the doubters that a bubble is forming in a sub-segment of the market (see also Confusing Stock Bubbles). While the Yelps (YELP), Twitters (TWTR), and Teslas (TSLA) of the world may be dramatically inflated in price, there are plenty of attractively and reasonably priced areas of the market to opportunistically exploit.

Unfortunately, many people fail to recognize there are other factors besides politics and fad stocks that drive financial markets higher or lower. As the chart below shows (see also Conquering Politics & Hurricanes), the stock market has gone up and down regardless of party politics.

Source: Yardeni.com

Besides politics, there is an infinite number of other factors affecting financial markets. While Obamacare, Iran, Syria, 2014 elections, Federal Reserve QE tapering, etc. may account for many of the concerns du jour, there are other important factors driving stock prices higher.

Here are but a few:

- Record corporate profits

- Near record-low interest rates

- Improving fiscal deficit / debt situation relative to our economy

- Improving housing and jobs picture

- Reasonable stock valuations

- Low inflation / declining oil prices

The stock market feast has been exceptional, but even I acknowledge the pace of this year’s advance is not sustainable. Like an overloading of pie or an unnecessary, extra drumstick, we’re bound to experience another -10% correction, just like a common case of heartburn. For long-term investors however, fear of a temporary upset stomach is no reason to leave the investing dining table. Focusing only on the negatives and ignoring the positives may result in your investment portfolio getting cooked…just like the poor Thanksgiving turkey.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), Yelp (YELP), Twitter (TWTR), and Tesla (TSLA), but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Confusing Fear Bubbles with Stock Bubbles

With the Dow Jones Industrial Average approaching and now breaking the 16,000 level, there has been a lot of discussion about whether the stock market is an inflating bubble about to burst due to excessive price appreciation? The reality is a fear bubble exists…not a valuation bubble. This fear phenomenon became abundantly clear from 2008 – 2012 when $100s of billions flowed out of stocks into bonds and trillions in cash got stuffed under the mattress earning near 0% (see Take Me Out to the Stock Game). The tide has modestly turned in 2013 but as I’ve written over the last six months, investor skepticism has reigned supreme (see Most Hated Bull Market Ever & Investors Snore).

Volatility in stocks will always exist, but standard ups-and-downs don’t equate to a bubble. The fact of the matter is if you are reading about bubble headlines in prominent newspapers and magazines, or listening to bubble talk on the TV or radio, then those particular bubbles likely do not exist. Or as strategist and investor Jim Stack has stated, “Bubbles, for the most part, are invisible to those trapped inside the bubble.”

All the recent bubble talk scattered over all the media outlets only bolsters my fear case more. If we actually were in a stock bubble, you wouldn’t be reading headlines like these:

From 1,300 Bubble to 5,000

If you think identifying financial bubbles is easy, then you should buy former Federal Reserve Chairman Alan Greenspan a drink and ask him how easy it is? During his chairmanship in late-1996, he successfully managed to identify the existence of an expanding technology bubble when he delivered his infamous “irrational exuberance” speech. The only problem was he failed miserably on his timing. From the timing of his alarming speech to the ultimate pricking of the bubble in 2000, the NASDAQ index proceeded to more than triple in value (from about 1,300 to over 5,000).

Current Fed Chairman Ben Bernanke was no better in identifying the housing bubble. In his remarks made before the Federal Reserve Board of Chicago in May 2007, Bernanke had this to say:

“…We believe the effect of the troubles in the subprime sector on the broader housing market will likely be limited, and we do not expect significant spillovers from the subprime market to the rest of the economy or to the financial system. The vast majority of mortgages, including even subprime mortgages, continue to perform well.”

If the most powerful people in finance are horrible at timing financial market bubbles, then perhaps you shouldn’t stake your life’s savings on that endeavor either.

Bubbles History 101

Each bubble is unique in its own way, but analyzing previous historic bubbles can help understand future ones (see Sleeping Through Bubbles):

• Dutch Tulip-Mania: About 400 years ago in the 1630s, rather than buying a new house, Dutch natives were paying over $60,000 for tulip bulbs.

• British Railroad Mania: The overbuilding of railways in Britain during the 1840s.

• Roaring 20s: Preceding the Wall Street Crash of 1929 (-90% plunge in the Dow Jones Industrial average) and Great Depression, the U.S. economy experienced an extraordinary boom during the 1920s.

• Nifty Fifty: During the early 1970s, investors and traders piled into a set of glamour stocks or “Blue Chips” that eventually came crashing down about -90%.

• Japan’s Nikkei: The value of the Nikkei index increased over 450% in the eight years leading up to the peak of 38,957 in December 1989. Today, almost 25 years later, the index stands at about 15,382.

• Tech Bubble: Near the peak of the technology bubble in 2000, stocks like JDS Uniphase Corp (JDSU) and Yahoo! Inc (YHOO) traded for over 600x’s earnings. Needless to say, things ended pretty badly once the bubble burst.

As long as humans breathe, and fear and greed exist (i.e., forever), then we will continue to encounter bubbles. Unfortunately, we are unlikely to be notified of future bubbles in mainstream headlines. The objective way to unearth true economic bubbles is by focusing on excessive valuations. While stock prices are nowhere near the towering valuations of the technology and Japanese bubbles of the late 20th century, the bubble of fear originating from the 2008-2009 financial crisis has pushed many long-term bond prices to ridiculously high levels. As a result, these and other bonds are particularly vulnerable to spikes in interest rates (see Confessions of a Bond Hater).

Rather than chasing bubbles and nervously fretting over sensationalistic headlines, you will be better served by devoting your attention to the creation of a globally diversified investment portfolio. Own a portfolio that integrates a wide range of asset classes, and steers clear of popularly overpriced investments that the masses are talking about. When fear disappears and everyone is clamoring to buy stocks, you can be confident the stock bubble is ready to burst.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing SCM had no direct position in TWTR, JDSU, YHOO or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Surviving a Series of Unfortunate Events

My children grew up reading a Series of Unfortunate Events by Lemony Snicket’s (the pseudonym for Daniel Handler). The award winning 13 book series began at the turn of the century (1999) with the Bad Beginning and seven years later, Handler ended the stories with The End (2006). The books chronicle the stories of three orphaned children (Violet, Klaus, and Sunny Baudelaire) who experience increasingly terrible events after the alleged death of their parents and burning of their house by a man named Count Olaf.

Crime, violence and hardships not only occur in novels, but also in real life. Stock market investors are no strangers to unfortunate events either. Within the last five years alone, investors have endured an endless stream of bad news, including the following:

- Flash Crash

- Debt Ceiling Debate

- U.S. Debt Downgrade

- European Recession

- Arab Spring

- Potential Greek Exit from EU

- Uncertain U.S. Presidential Elections

- Sequestration

- Cyprus Financial Crisis

- Tax Increases

- Fed Talks of Stimulus Tapering

- Syrian Civil War / Military Threat

- Gov. Shutdown

- Obamacare Rollout Glitches

- Iranian Nuclear Threat

This is only a partial list, but wow, this never ending crises list sounds pretty ominous, right? I wonder how stocks have fared amidst this horrendous avalanche of negative headlines? The short answer is stocks are up a whopping +170% since the March 2009 lows as measured by the S&P 500 index, and would be significantly higher once accounting for reinvested dividends. A bit higher return than your CD, money market, or savings account rate.

As you can see from the chart above, the gargantuan returns achieved over this period have not occurred without some volatility. Investors have consumed massive quantities of Tums during the five highlighted corrections (averaging -13%) to counteract all the heartburn. As I’ve written in the past, with higher risk comes higher rewards. Those investors who cannot stomach the volatility shouldn’t go cold turkey on stocks though, but rather diversify their holdings and reduce the portfolio equity allocation to a more palatable level.

Doubting Thomases

Many people I bump into remain “Doubting Thomases” as it relates to the stock market recovery and they expect an imminent crash. Certainly, the rocket-like trajectory of the last year (and five years) is not sustainable, and historically stocks correct significantly twice a decade – equal to the number of recessions occurring each decade. There is no denying that this economic recovery has been the slowest since World War II, but could this be good news? From the half-full glass lens, a slower recovery may actually equate to a longer recovery.

Just like skeptical investors, business executives have been slow to hire and slow to accelerate spending as well. Typically business cycles come to an end when overinvestment happens – recall the 2000 tech bubble and 2007 housing bubble. There may be pockets of investment bubbles (e.g., Twitter Inc [TWTR] and other money-losing speculative stocks), but as you can see from the chart below, corporate profits have skyrocketed and are at record highs. It should therefore come as no surprise that record profits have coincided with record stock prices (see also It’s the Earnings Stupid)

Over the period of 2003-2013 stock prices largely followed the slope of earnings, and excluding the enormous losses in the banking sector, non-financial stocks suffered much less.

History is on Your Side

If you are in the camp that says this last five years has been an anomaly, history may beg to differ. Over the last 50 years we have experienced wars, assassinations, currency crises, banking crises, terrorist attacks, recessions, SARs, mad cow disease, military engagements, tax hikes, Fed rate hikes, and yes, even political gridlock. As the chart below shows, the stock market is volatile over the short-run, but quite resilient and lucrative over the long-run (+6,863% over 49 years). In fact, from January 1960 to October 2013 the S&P 500 index has catapulted +14,658%, including reinvested dividends (Source: DQYDJ.net).

Rather than getting caught up in the political or CNBC headline du jour, investors will be better served by creating a customized, long-term diversified portfolio that can meet long-standing goals and objectives. If you don’t have the discipline, interest, or time to properly create a personalized investment plan, then find an independent investment advisor like Sidoxia Capital Management (www.Sidoxia.com), so you can experience a series of fortunate (not unfortunate) events.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing SCM had no direct position in TWTR, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page. Chart construction done by Kevin D. Weaver.