History Never Repeats Itself, But It Often Rhymes

September 16, 2009 at 4:00 am 10 comments

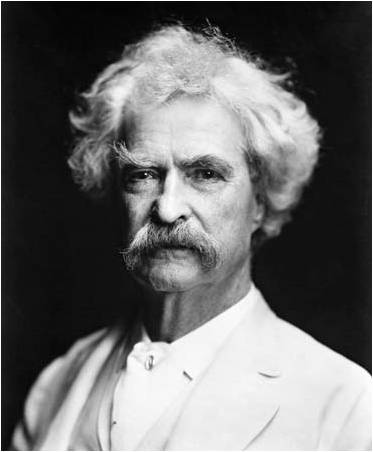

As Mark Twain said, “History never repeats itself, but it often rhymes.” There are many bear markets with which to compare the current financial crisis we are working through. By studying the past we can understand the repeated mistakes of others (caused by fear and greed), and avoid making similar emotional errors.

Do you want an example? Here you go:

“Today there are thoughtful, experienced, respected economists, bankers, investors and businessmen who can give you well-reasoned, logical, documented arguments why this bear market is different; why this time the economic problems are different; why this time things are going to get worse — and hence, why this is not a good time to invest in common stocks, even though they may appear low.”– Jim Fullerton, former chairman of the Capital Group of the American Funds (written November 7, 1974)

Although the quote above seems appropriate for 2009, it actually is reflective of the bearish mood felt in most bear markets. We have been through wars, assassinations, banking crises, currency crises, terrorist attacks, mad-cow disease, swine flu, and yes, even recessions. And through it all, most have managed to survive in decent shape. Let’s take a deeper look.

1973-1974 Case Study:

For those of you familiar with this period, recall the prevailing circumstances:

- Exiting Vietnam War

- Undergoing a recession

- 9% unemployment

- Arab Oil Embargo

- Watergate: Presidential resignation

- Collapse of the Nifty Fifty stocks

- Rising inflation

Not too rosy a scenario, yet here’s what happened:

S&P 500 Price (12/1974): 69

S&P 500 Price (8/2009): 1,021

That is a whopping +1,380% increase, excluding dividends.

What Investors Should Do:

- Avoid Knee-Jerk Reactions to Media Reports: Whether it’s radio, television, newspapers, or now blogs, the headlines should not emotionally control your investment decisions. Historically, media venues are lousy at identifying changes in price direction. Reporters are excellent at telling you what is happening or what just happened – not what is going to happen.

- Save and Invest: Regardless of the market direction, entitlements like Medicare and social security are under stress, and life expectancies are increasing (despite the sad state of our healthcare system), therefore investing is even more important today than ever.

- Create a Systematic, Disciplined Investment Plan: I recommend a plan that takes advantage of passive, low-cost, tax-efficient investment strategies (e.g. exchange-traded and index funds) across a diversified portfolio. Rather than capitulating in response to market volatility, have a systematic process that can rebalance periodically to take advantage of these circumstances.

For DIY-ers (Do-It-Yourselfers), I suggest opening a low-cost discount brokerage account and research firms like Vanguard Group, iShares, or Select Sector SPDRs. If you choose to outsource to a professional advisor, I recommend interviewing several fee-only* advisers – focusing on experience, investment philosophy, and potential compensation conflicts of interest.

If you believe, like some economists, CEOs, and investors, we have suffered through the worst of the current “Great Recession” and you are sitting on the sidelines, then it might make sense to heed the following advice: “Some people say they want to wait for a clearer view of the future. But when the future is again clear, the present bargains will have vanished.” Dean Witter made those comments 77 years ago – a few weeks before the end of worst bear market in history. The market has bounced quite a bit since March of this year, but if history is on our side, there might be more room to go.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

*For disclosure purposes: Wade W. Slome, CFA, CFP is President & Founder of Sidoxia Capital Management, LLC, a fee-only investment adviser based in Newport Beach, California.

Entry filed under: Education, Stocks. Tags: 1973, 1974, American Funds, bear market, Dean Witter, fee-only, history, investing, Jim Fullerton, Mark Twain, Nifty Fifty, Vanguard, Vietnam, Watergate.

10 Comments Add your own

Leave a reply to Hordac Cancel reply

Trackback this post | Subscribe to the comments via RSS Feed

1. RD | October 24, 2009 at 9:12 am

RD | October 24, 2009 at 9:12 am

This sounds as if it was written for me as I have been more of what you shouldn’t do, namely listen to the CNBC, other bone-head media and making many knee-jerk decisions.

I am now invested in 20% large caps or S&P fund, 20% International, 16% bonds, and 44% Nasdaq or small cap fund.

I also get Social Security and a retirement pension.

What am I doing wrong?

2. sidoxia | October 24, 2009 at 12:36 pm

sidoxia | October 24, 2009 at 12:36 pm

Sounds like you’re learning from your past mistakes, and all the great investors I follow do the same. I do my best to not repeat previous blunders, but even the best like Warren Buffett suffer from mistakes (e.g. his investments in newspapers like Washington Post, COP when oil prices peaked, Irish banks that lost -89% of their value). Regarding your allocation, unfortunately my answer is, “it depends.” A lot will depend upon many factors, including your age, how much you have saved, estate planning goals, liquidity needs, risk tolerance, tax situation, etc. Regardless, I view investing as a religion, in that many individuals have similar goals in achieving some type of higher spirituality. Well, in investing, investors can make profits following different styles. My investing religion is long-term, low-cost, tax-efficient, diversified portfolios/strategies and I customize portfolios to each individual’s situation. Hope that helps…WS

3. Back to the Future: Mag Covers (Part I) « Investing Caffeine | November 11, 2009 at 2:08 am

Back to the Future: Mag Covers (Part I) « Investing Caffeine | November 11, 2009 at 2:08 am

[…] to realize as Mark Twain famously stated, “History never repeats itself, but it often rhymes” (read previous market history article). In that vein, let us take a look at a few covers from the […]

4. Hordac | November 12, 2009 at 6:50 pm

Hordac | November 12, 2009 at 6:50 pm

You must have an exit plan. I’m not smart enough to know what is going to happen over the next several years. However ,there are lots of smart people that say we will move on and up (ie: the economy and the markets) and there are a lot of smart/unbiased people who say this is it.. We will be bottom out over the next several years where we once started this great bull market back ito 1991 levels. My advice- employ risk management have an exit plan.

5. Banking Crisis Broken Record (1907 vs. 2007) « Investing Caffeine | February 11, 2010 at 11:02 pm

Banking Crisis Broken Record (1907 vs. 2007) « Investing Caffeine | February 11, 2010 at 11:02 pm

[…] crises. And unfortunately, the financial crisis of 2008-2009 will not be our last (read more about rhyming history). Robert F. Bruner, professor and Dean at the Darden Graduate School of Business Administration, […]

6. Banking Crisis Broken Record: 1907 vs. 2007 | Reaction Radio | February 12, 2010 at 3:58 am

[…] crises. And unfortunately, the financial crisis of 2008-2009 will not be our last (read more about rhyming history). Robert F. Bruner, professor and Dean at the Darden Graduate School of Business Administration, […]

7. Banking Crisis Broken Record: 1907 vs. 2007 | Stocks and Sectors | February 12, 2010 at 5:01 am

[…] crises. And unfortunately, the financial crisis of 2008-2009 will not be our last (read more about rhyming history). Robert F. Bruner, professor and Dean at the Darden Graduate School of Business Administration, […]

8. crisismaven | February 12, 2010 at 10:50 am

crisismaven | February 12, 2010 at 10:50 am

These are all very valid observations, however, there is one thing that sets this market and crisis apart from all (!) its predecessors: only since 1971 we have this extreme inflation of the monetary base (see statistics). then only since 1998 (LTCM) 2000/2001 (dotcom buble) and finally 2007/2008 (housing crisis) have we seen the monetary base explode at ever faster rates, this last time twenty fold. This is the end game, when now the ARM tsunami hits followed by sure sovereign default in, at the latest, a few years.

9. Happy Birthday Investing Caffeine! « Investing Caffeine | June 2, 2010 at 2:16 am

Happy Birthday Investing Caffeine! « Investing Caffeine | June 2, 2010 at 2:16 am

[…] History Never Repeats Itself, But It Often Rhymes […]

10. What to Do Now? Time to Get Your House in Order « Investing Caffeine | October 4, 2010 at 12:07 pm

What to Do Now? Time to Get Your House in Order « Investing Caffeine | October 4, 2010 at 12:07 pm

[…] It has been an incredible roller coaster ride over the last two years, both on the way down, and for those still in the game…on the way up. Most prospects I come across are perplexed with how quickly their portfolios unraveled in 2008 and are scratching their heads with respect to how quickly markets have bounced back in 2009. Am I surprised? Certainly the speed and degree was surprising, but we’ve seen these cycles many times (see earlier story: History Never Repeats Itself, But It Often Rhymes). […]