Action Dan (Poker King) and Professional Investing

September 17, 2009 at 4:00 am 3 comments

As I write in my book (How I Managed $20,000,000,000.00 by Age 32), successful investing requires skillful use of both art and science. What I find so fascinating is that the same principles apply to poker playing. Like investing, poker is also a game of skill that rewards a player who adequately understands the mathematical probabilities (science) while still able to appropriately read the behavior of his or her opponents (art). Take for example professional poker player and 1995 WSOP champ Dan Harrington. In 2003 he finished 3rd at the World Series of Poker Main Event (the Super Bowl of poker) out of a pool of 839 players. In 2004, the following year, despite the pool more than tripling to 2,576 participants, Mr. Harrington managed to finish 4th and take home a cool $1.5 million in prize money. Did luck account for this success? I think not. Odds, if left to chance, would be 1 in 25,000 for repeating this feat, according to the Economist.

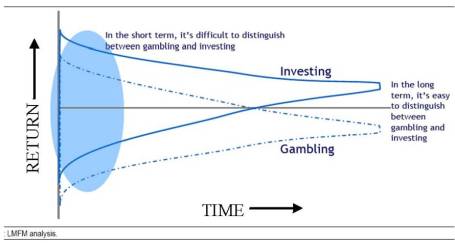

In the short-run, random volatility and luck can make the average investor look like Warren Buffett, but because of the efficiency of the market, that same average investor will look like a schmuck over the long-run. Legg Mason Funds Management put out an incredible chart that I believe so elegantly captures the incoherent and meaningless, short-term noise that the media attempts to interpret daily. What appears like outperformance in the short-run may merely be the lucky performance of a reckless speculator.

Dan Harrington, and so many other talented professionals know this fact all too well when an inexperienced “donkey” over-bets a clearly inferior hand, only to nail an inside-straight card on the “river” (last card of the round) out of pure luck – thereby knocking out a superior professional player. Over the long-run these out-of-control players end up losing all their money and professionals relish the opportunity of playing against them.

Talk to professionals and ask them what the biggest mistake new players make? The predominate answer: novices simply play too many hands. In the world of investing, the same can be said for excessive trading. Commissions, transactions costs, taxes and most importantly, ill-timed, emotionally driven trades lead the average investor to significantly underperform. I’ve referenced it before, and I’ll reference it again, John Bogle’s 1984-2002 study shows the significant drag the aforementioned costs have on professionals’ performance, and especially the average fund investor that underperformed the passive (a.k.a., “Do Nothing” strategy) S&P 500 return by more than a whopping 10% annually!

I consider myself an above average player, and I’ve won a few small tournaments, but match me up against a professional like “Action Dan” Harrington and I’ll get destroyed in the long-run. Investing, like professional poker, can lead to excess returns with the proper integration of patience and a disciplined systematic approach. I strongly believe that all great long-term investors successfully implement a strategy that marries the art and science aspects of investing. Don’t hold your breath if you expect to see me on ESPN, it may be a while before you see me at the Final Table with Dan Harrington at the World Series of Poker.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, and at the time of publishing had no direct positions in LM, DIS, or BRKA/B. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Entry filed under: Profiles, Trading. Tags: Action Dan, Dan Harrington, How I Managed 20000000000.00 by Age 32, investing, John Bogle, Legg Mason, poker, Warren Buffett, World Series of Poker, WSOP.

3 Comments Add your own

Leave a comment

Trackback this post | Subscribe to the comments via RSS Feed

1. What to Do Now? Time to Get Your House in Order « Investing Caffeine | October 21, 2009 at 8:43 am

What to Do Now? Time to Get Your House in Order « Investing Caffeine | October 21, 2009 at 8:43 am

[…] believe me, check out an 18 year study compiled by legendary Vanguard Group founder, John Bogle (see chart in article here). Plain and simply, the average investor gets destroyed not only by fees, taxes and transactions […]

2. cheat on poker stars legally | November 8, 2009 at 12:04 pm

cheat on poker stars legally | November 8, 2009 at 12:04 pm

During my student years, I played in three games that were considered among the best in New England, and there were a few others I didn’t play that were at the same level. But there weren’t 20 games in New England of this quality. Also, there was no single, universally acknowledged, best game, nor did people argue much about whether one game was better than another. There were enough players in common among the games to make it clear that consistent winners in one could hold their own in the others. Similarly, players (including Las Vegas professionals) would visit from out of town, and players from New England games would visit other places, enough to be confident that the top players in different places could sit at the same table without mismatch.

3. sidoxia | November 22, 2010 at 1:19 pm

sidoxia | November 22, 2010 at 1:19 pm

Hedge fund manager David Einhorn at Greenlight Capital finished 18th at the 2006 WSOP. He too understands the similarities between poker and investing. Here are his thoughts straight from the horse’s mouth:

Click to access einhornspeech200611.pdf