Posts tagged ‘Warren Buffett’

From Gloom to Boom

Gloomy clouds rolled in late last year in the form of a government shutdown; U.S. – China trade war tensions; hawkish Federal Reserve interest rate policies; a continued special counsel investigation by Robert Mueller into potential Russian election interference; a change in the Congressional balance of power; Brexit deal uncertainty; and U.S. recession concerns, among other worries. These fear factors contributed to a thundering collapse in stock prices during the September to December time frame of approximately -20% in the S&P 500 index (from the September 21st peak until the December 24th trough).

However, the dark storm clouds quickly lifted once Santa Claus delivered post-Christmas stock price gains that have continued through February. More specifically, since Christmas Eve, U.S. stocks have rebounded a whopping +18%. On a shorter term basis, the S&P 500 index and the Dow Jones Industrial Average have both jumped +11.1% in 2019. January showed spectacular gains, but last month was impressive as well with the Dow climbing +3.7% and the S&P +3.0%.

The rapid rise and reversal in negative sentiment over the last few months have been aided by a few positive developments.

- Strong Earnings Growth: For starters, 2018 earnings growth finished strong with an increase of roughly +13% in Q4-2018, thereby bringing the full year profit surge of roughly +20%. All else equal, over the long run, stock prices generally follow the path of earnings growth (more on that later).

- Solid Economic Growth: If you shift the analysis from the operations of companies to the overall performance of the economy, the results in Q4 – 2018 also came in better than anticipated (see chart below). For the last three months of the year, the U.S. economy grew at a pace of +2.6% (higher than the +2.2% GDP [Gross Domestic Product] growth forecast), despite headwinds introduced by the temporary U.S. federal government shutdown and the lingering Chinese trade spat. For the full-year, GDP growth came in very respectably at +2.9%, but critics are dissecting this rate because it was a hair below the coveted 3%+ target of the White House.

Source: The Wall Street Journal

- A More Accommodative Federal Reserve: As mentioned earlier, a major contributing factor to the late-2018 declines was driven by a stubborn Federal Reserve that was consistently raising their interest rate target (an economic-slowing program that is generally bad for stocks and bonds), which started back in late 2015 when the Federal Funds interest rate target was effectively 0%. Over the last three years, the Fed has raised its target rate range from 0% to 2.50% (see chart below), while also bleeding off assets from its multi-trillion dollar balance sheet (primarily U.S. Treasury and mortgage-backed securities). The combination of these anti-stimulative policies, coupled with slowing growth in major economic regions like China and Europe, stoked fears of an impending recession here in the U.S. Fortunately for investors, however, the Federal Reserve Chairman, Jerome Powell, came to the rescue by essentially implementing a more “patient” approach with interest rate increases (i.e., no rate increases expected in the foreseeable future), while simultaneously signaling a more flexible approach to ending the balance sheet runoff (take the program off “autopilot).

Source: Dr. Ed’s Blog

The Stock Market Tailwinds

For those of you loyal followers of my newsletter articles and blog articles over the last 10+ years, you understand that my generally positive stance on stocks has been driven in large part by a couple of large tailwinds (see also Don’t Be a Fool, Follow the Stool):

#1) Low Interest Rates – Yes, it’s true that interest rates have inched higher from “massively low” levels to “really low” levels, but nevertheless interest rates act as the cost of holding money. Therefore, when inflation is this low, and interest rates are this low, stocks look very attractive. If you don’t believe me, then perhaps you should just listen to the smartest investor of all-time, Warren Buffett. Just this week the sage billionaire reiterated his positive views regarding the stock market during a two hour television interview, when he once again echoed his bullish stance on stocks. Buffett noted, “If you tell me that 3% long bonds will prevail over the next 30 years, stocks are incredibly cheap… if I had a choice today for a ten-year purchase of a ten-year bond at whatever it is or ten years, or– or buying the S&P 500 and holding it for ten years, I’d buy the S&P in a second.”

#2) Rising Profits – In the short-run, the direction of profits (orange line) and stock prices (blue line) may not be correlated (see chart below), but over the long-run, the correlation is amazingly high. For example, you can see this as the S&P 500 has risen from 666 in 2009 to 2,784 today (+318%). More recently, profits rose about +20% during 2018, yet stock prices declined. Moreover, profits at the beginning of 2019 (Q1) are forecasted to be flat/down, yet stock prices are up +11% in the first two months of the year. In other words, the short-term stock market is schizophrenic, so focus on the key long-term trends when planning for your investments.

Source: Macrotrends

Although 2018 ended with a gloomy storm, history tells us that sunny conditions have a way of eventually returning unexpectedly with a boom. Rather than knee-jerk reacting to volatile financial market conditions after-the-fact, do yourself a favor and create a more versatile plan that deals with many different weather conditions.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (March 1, 2018). Subscribe on the right side of the page for the complete text.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

P.S.

Wade’s Investing Caffeine Podcast Has Arrived!

Wade Slome, founder of Sidoxia Capital Management, author of How I Managed $20 Billion Dollars by Age 32, and lead editor of the Investing Caffeine blog has launched the Caffeine Corner investment podcast.

The Investing Caffeine podcast is designed to wake up your investment brain with weekly overviews of financial markets and other economic-related topics.

Don’t miss out! Follow us on either SoundCloud or PodBean to get a new episode each week. Or follow our InvestingCaffeine.com blog and watch for new podcast updates each week.

The Scary Blip

I hated it when my mom reminded me when I was a younger, but now that I’ve survived into middle-aged adulthood, I will give you the same medicine she gave me:

“I told you so.”

As I cautioned in last month’s newsletter, “It’s important for investors to remember this pace of gains cannot be sustainable forever.” I added that there were a whole bunch of scenarios for stock prices to go down or “stock prices could simply go down due to profit-taking.”

And that is exactly what we saw. From the peak achieved in late January, stock prices quickly dropped by -12% at the low in early February, with little-to-no explanation other than a vague blame-game on rising interest rates – the 2018 yield on the 10-Year Treasury Note rose from 2.4% to 2.9%. This explanation holds little water if you take into account interest rates on the 10-Year increased from roughly 1.5% to 3.0% in 2013 (“Taper Tantrum”), yet stock prices still rose +20%. The good news, at least for now, is the stock correction has been contained or mitigated. A significant chunk of the latest double-digit loss has been recovered, resulting in stock prices declining by a more manageable -3.9% for the month. Despite the monthly loss, the subsequent rebound in late February has still left investors with a gain of 1.5% for 2018. Not too shabby, especially considering this modest return comes on the heels of a heroic +19.4% gain in 2017.

As you can see at from the 22-year stock market chart below for the S&P 500, the brief but painful drop was merely a scary blip in the long-term scheme of things.

Whenever the market drops significantly over a short period of time, as it did this month, conspiracy theories usually come out of the woodwork in an attempt to explain the unexplainable. When human behavior is involved, rationalizing a true root cause can be very challenging, to say the least. It is certainly possible that technical factors contributed to the pace and scale of the recent decline, as has been the case in the past. Currently no smoking gun or fat finger has been discovered, however some pundits are arguing the popular usage of leveraged ETFs (Exchange Traded Funds) has contributed to the accelerated downdraft last month. Leveraged ETFs are special, extra-volatile trading funds that will move at amplified degrees – you can think of them as speculative trading vehicles on steroids. The low-cost nature, diversification benefits, and ability for traders to speculate on market swings and sector movements have led to an explosion in ETF assets to an estimated $4.6 trillion.

Regardless of the cause for the market drop, long-term investors have experienced these types of crashes in the past. Do you remember the 2010 Flash Crash (down -17%) or the October 1987 Crash (-23% one-day drop in the Dow Jones Industrial Average index)? Technology, or the lack thereof (circuit breakers), helped contribute to these past crashes. Since 1987, the networking and trading technologies have definitely become much more sophisticated, but so have the traders and their strategies.

Another risk I highlighted last month, which remains true today, is the potential for the new Federal Reserve chief, Jerome Powell, to institute a too aggressive monetary policy. During his recent testimony and answers to Congress, Powell dismissed the risks of an imminent recession. He blamed past recessions on previous Fed Chairmen who over enthusiastically increased interest rate targets too quickly. Powell’s comments should provide comfort to nervous investors. Regardless of short-term inflation fears, common sense dictates Powell will not want to crater the economy and his legacy by slamming the economic brakes via excessive rate hikes early during his Fed chief tenure.

Tax Cuts = Profit Gains

Despite the heightened volatility experienced in February, I remain fairly constructive on the equity investment outlook overall. The recently passed tax legislation (Tax Cuts and Job Act of 2017) has had an undeniably positive impact on corporate profits (see chart below of record profit forecasts – blue line). More specifically, approximately 75% of corporations (S&P 500 companies) have reported better-than-expected results for the past quarter ending December 31st. On an aggregate basis, quarterly profits have also risen an impressive +15% compared to last year. When you marry these stellar earnings results with the latest correction in stock prices, historically this combination of factors has proven to be a positive omen for investors.

Source: Dr. Ed’s Blog

Despite the rosy profit projections and recent economic strength, there is always an endless debate regarding the future direction of the economy and interest rates. This economic cycle is no different. When fundamentals are strong, stories of spiking inflation and overly aggressive interest rate hikes by the Fed rule the media airwaves. On the other hand, when fundamentals deteriorate or slow down, fears of a 2008-2009 financial crisis enter the zeitgeist. The same tug-of-war fundamental debate exists today. The stimulative impacts of tax cuts on corporate profits are undeniable, but investors remain anxious that the negative inflationary side-effects from a potential overheating economy could outweigh the positive economic momentum of a near full-employment economy gaining steam.

Rather than playing Goldilocks with your investment portfolio by trying to figure out whether the short-term stock market is too hot or too cold, you would be better served by focusing on your long-term asset allocation, and low-cost, tax-efficient investment strategy. If you don’t believe me, you should listen to the wealthiest, most successful investor of all-time, Warren Buffett (The Oracle of Omaha), who just published his annual shareholder letter. In his widely followed letter, Buffett stated, “Performance comes, performance goes. Fees never falter.” To emphasize his point, Buffett made a 10-year, $1 million bet for charity with a high-fee hedge fund manager (Protégé Partners). As part of the bet, Buffett claimed an investment in a low-fee S&P 500 index fund would outperform a selection of high-fee, hot-shot hedge fund managers. Unsurprisingly, the low-cost index fund trounced the hedge fund managers. From 2008-2017, Buffett’s index fund averaged +8.5% per year vs. +3.0% for the hedge fund managers.

During scary blips like the one experienced recently, lessons can be learned from successful, long-term billionaire investors like Warren Buffett, but lessons can also be learned from my mother. Do yourself a favor by getting your investment portfolio in order, so my mother won’t have to say, “I told you so.”

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (March 1, 2018). Subscribe on the right side of the page for the complete text.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Glass Moving from Half-Empty to Half-Full

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (February 1, 2018). Subscribe on the right side of the page for the complete text.

Economic growth accelerated in 2017, the unemployment rate is sitting at a 17-year low, housing prices are up significantly, Consumer Confidence is near the highs of 2000, corporations are doing cartwheels thanks to tax cut legislation, and the stock market has recently set new records. Not a bad start to the year, eh?

Fat Wallets & Stuffed Purses

The strength of the economy, coupled with the optimism of business and consumers, has resulted in a financial boon for Americans, as shown in the chart below. Not only have financial assets and real estate gone up significantly since the 2008-2009 Financial Crisis, but household debt has also remained relatively stable. The combination of these factors have American households sitting on almost $1 trillion in household value, a new record.

Source: Calafia Beach Pundit

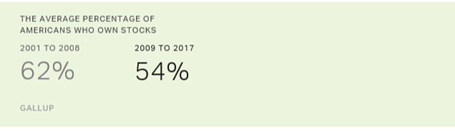

As we move ahead through the first month of 2018, the +5.8% gain in the Dow Jones Industrial Average, and the +5.6% advance in the S&P 500 index have further fattened wallets and stuffed the purses of equity investors. On an annual basis, the results only look even better, with the Dow up +32% and the S&P +24%. Given the sharp appreciation in value, casual observers might expect a flood of new investors to pile into stocks and equity mutual funds…not true. Actually, this buying phenomenon has yet to occur. However, it is true investor sentiment has begun shifting to a “glass half-full” perspective due to the vast number of positive economic headlines. Nevertheless, it’s important for investors to remember this pace of gains cannot be sustainable forever.

There is no theoretical limit on the number of potential market moving events. The stock market could temporarily get rattled by another North Korean nuclear test, a terrorist attack, a geopolitical standoff, an inflammatory tweet, an infinite number of other unforeseen events, or stock prices could simply go down due to profit-taking (i.e., investors sell to lock-in gains). Regardless, the economic momentum is palpable and the president did not waste any time at the recent State of the Union address to remind Americans.

Currently, there are limited signs of euphoric stock buying, but there will be a point in time, as in all economic cycles, when investment excesses will overwhelm demand and will therefore lead to a recession. Let’s not forget, an overzealous monetary policy (i.e., too many rate increases), led by a new Federal Reserve chief (Jerome Powell), is another scenario which could slam the breaks on an overheated economy.

Follow the Money

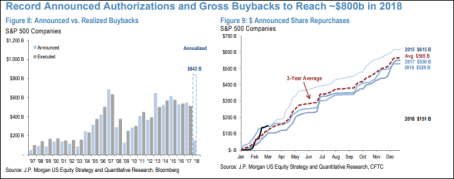

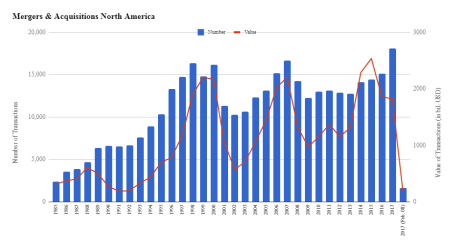

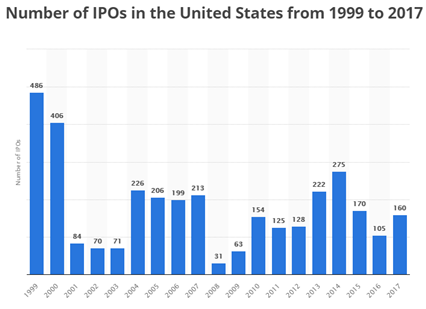

In attempting to read the tea leaves about the future direction of the stock market, we are inspired by the famous quote from the 1976 film All the President’s Men, “Follow the money.” Actions speak louder than words in our book, which is why at Sidoxia Capital Management (www.Sidoxia.com), we track the money buying and selling actions of investors. There is never a shortage of information, and the professionals at the ICI (Investment Company Institute) are kind enough to publish the Weekly Fund Flows data (see chart below), which details the amount of dollars funneling in and out of stock and bond funds. Despite the stock market more than tripling in value, and contrary to common belief, more than -$200 billion has poured out of domestic stock funds and ETFs (Exchange Traded Funds) from 2015 through early 2018.

Source: ICI through 1-17-18

How can this counterintuitive money exodus transpire during a bull market? Quite simply, corporations have been using record piles of cash to buy trillions of dollars in stock through “stock buybacks” and “mergers & acquisitions” activity. All this corporate stock purchase activity has offset the money flowing out of funds, which has helped catapult stock prices higher. History tells us, that before this long-term bull market that started in 2009 ends, flows into U.S. stock mutual funds and ETFs will turn significantly positive after years of hemorrhaging.

Many speculators and traders waste time on a plethora of unreliable sentiment surveys and indicators (e.g., CBOE Volatility Index, AAII Sentiment Survey, Put-Call Ratio, etc), but my 25+ years of investment experience tells me the fund flows data works much better as a longer-term contrarian indicator. To put “contrarian” investing in English, famed billionaire investor, Warren Buffett, summed it up best when he said, “Be fearful when others are greedy and greedy when others are fearful.”

Sharing the Wealth

Speaking of greed, corporations have been greedy capitalists as they have watched profits surge to record levels. Yet many of these greedy corporations have decided to share some of the spoils garnered from the recent tax legislation with rank and file employees. For instance, consider the small sampling of the following large corporations that have decided to pay their employees bonuses:

Overall, even though trillions of savings remain in cash and money is still flowing out of US stock funds, the investment glass is shifting from a glass half-empty perception to a glass half-full impression. A time will come when the masses will believe the glass half-full will turn to a glass over-flowing. I don’t think anyone can predict with any certainty when that time will arrive, but I will continue doing my best to drink as much water as possible before it spills.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in T, CMCSA, DIS, and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in AAL, BAC, JBLU, LUV, USB, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Political Showers Bring Record May Stock Flowers

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (June 1, 2017). Subscribe on the right side of the page for the complete text.

There has been a massive storm of political rain that has blanketed the media airwaves and internet last month, however, the stock market ignored the deluge of headlines and focused on more important factors, as prices once again pushed to new record highs. Over the eight-year bull market, the old adage to “sell in May, and go away,” once again was not a very successful strategy. Had investors heeded this advice, they would have missed out on a +1.2% gain in the S&P 500 index during May (up +7.7% for 2017) and a +2.5% surge in the technology-driven NASDAQ index (+15.1% in 2017).

Keeping track of the relentless political storm of new headlines and tweets almost requires a full-time staff person, but nevertheless we have summarized some of the political downpour here:

French Elections: In the wake of last year’s U.K. “Brexit”, fears of an imminent “Frexit” (French Exit) resurfaced ahead of the French presidential. Emmanuel Macron, a 39-year-old former investment banker, swept to a decisive victory over National Front candidate Marine Le Pen by a margin of 66% to 34%.

Firing of FBI Director: President Trump fired FBI Director James Comey based on the recommendation of deputy attorney general Rod Rosenstein, who cited Comey’s mishandling of Hillary Clinton’s private email server investigation. The president’s critics claim Trump was frustrated with the FBI’s investigation into the administration’s potential ties with Russian officials in relation to the 2016 presidential elections. Comey is expected to testify next week to Congress, where he will likely address reports that President Trump asked him to drop the FBI’s investigation into former National Security Advisor Michael Flynn during a February meeting.

Trump Classified Leak to Russians: Reports show that President Trump revealed classified information regarding the Islamic State (ISIS) to the Russian foreign minister during an Oval Office meeting. The ISIS related information emanating from Syria reportedly had been passed to the U.S. from Israel, with the provision that it not be shared.

Impeachment Talk and Appointment of Independent Special Prosecutor: Heightened reports of Russian intervention coupled with impeachment cries from the Democratic opposition coincided with Deputy Attorney General Rod Rosenstein’s announcement that former FBI director Robert Mueller III would take on the role as an independent special counsel in the investigation of Russian interference in the 2016 election. Rosenstein had the authority to make the appointment after Attorney General Jeff Sessions recused himself after admitting contacts with Russian officials. The White House, which has denied colluding with the Russians, issued a statement from President Donald Trump looking forward “to this matter concluding quickly.”

Kushner Under Back Channel Investigation: President Trump’s son-in-law and senior advisor, Jared Kushner, is under investigation over discussions to set up a back channel of communication with Russian officials. At the heart of the probe is a December meeting Kushner held with Sergey Gorkov, an associate of Russian President Vladimir Putin and the head of the state-owned Vnesheconombank, a Russian bank subject to sanctions imposed by President Obama. Back channels have been legally implemented by other administrations, but the timing and nature of the discussions could make the legal interpretation more difficult.

Trump’s First Foreign Trip: A whirlwind trip by President Trump through the Middle East and Europe, resulted in commitments to Middle East peace, multi-billion contract signings with the Saudis, pledges to fight Muslims extremism, calls for NATO members to pay their “fair share,” and demands for German President Angela Merkel to address the elevated trade deficit with the U.S.

Subpoenas Issued to Trump Advisors: The House Intelligence Committee issued subpoenas to ousted National Security Adviser Michael Flynn and President Trump’s personal attorney, Michael Cohen, as it relates to potential Russian interference in the presidential campaign. Flynn reportedly plans to invoke his Fifth Amendment rights in response to a separate subpoena issued by the Senate Intelligence Committee.

Repeal and Replace Healthcare: The Republican-controlled House of Representatives narrowly passed a vote to repeal and replace the Affordable Care Act after prior failed attempts. The bill, which allows states to apply for a waiver on certain aspects of coverage, including pre-existing conditions, received no Democratic votes. While the House passage represents a legislative victory for President Trump, Senate Republicans must now take up the legislation that addresses conclusions by the nonpartisan Congressional Budget Office (CBO). More specifically, the CBO found the revised House health care bill could leave 23 million more Americans uninsured while reducing the federal deficit by $119 billion in the next decade.

North Korea Missile Tests: If domestic political turmoil wasn’t enough, North Korea conducted an unprecedented number of medium-to-long-range missile tests in an effort to develop an intercontinental ballistic missile (ICBM) capable of hitting the mainland United States. Due to the rising tensions, the U.S. and South Korea have been planning nuclear carrier drills off the coast of the Korean peninsula.

Wow, that was a mouthful. While all these politics may be provocative and stimulating, long-time followers of mine understand my position…politics are meaningless (see Politics-Schmolitics). While a terrorist or military attack on U.S. soil would undoubtedly have an immediate and negative impact, 99% of daily politics should be ignored by investors. If you don’t believe me, just take a look at the stock market, which continues to make new record highs in the face of a hurricane of negative political headlines. What the stock market really cares most about are profits, interest rates, and valuations:

- Record Profits: Stock prices follow the direction of earnings over the long-run. As you can see below, profits vacillate year-to-year. However, profits are currently surging, and therefore, so are stock prices – despite the negative political headlines.

Source: Dr. Ed’s Blog

- Near Generationally Low Interest Rates: Generally speaking, most asset classes, including real estate, commodities, and stock prices are worth more when interest rates are low. When you could earn 15% on a bank CD in the early 1980s, stocks were much less attractive. Currently, bank CDs almost pay nothing, and as you can see from the chart below, interest rates are near a generational low – this makes stock prices more attractive.

- Attractive Valuations: The price you pay for an asset is always an important factor, and the same principle applies to your investments. If you can buy a $1.00 for $0.90, you want to take advantage of that opportunity. Unfortunately, the value of stocks is not measured by a simple explicit price, like you see at a grocery store. Rather, stock values are measured by a ratio (comparing an investment’s price relative to profits/cash flows generated). Even though the stock market has surged this year, stock values have gotten cheaper. How is that possible? Stock prices have risen about +8% in the first quarter, while profits have jumped +15%. When profits rise faster than prices appreciate, that means stocks have gotten cheaper. From a multi-year standpoint, I agree with Warren Buffett that prices remain attractive given the current interest rate environment. To read more about valuations, check out Ed Yardeni’s recent article on valuations.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

You Can’t Kiss All the Beauties

When I was in high school and college, kissing all the pretty girls was not a realistic goal. The same principle applies to stock picking – you can’t buy all the outperforming stocks. As far as I’m concerned, there will always be some people who are smarter, better looking, and wealthier than I am, but that has little to do with whether I can continue to outperform, if I stick to my systematic, disciplined process. In fact, many smart people are horrible investors because they overthink the investing process or suffer from “paralysis by analysis.” When it comes to investing, the behavioral ability to maintain independence is more important than being a genius. If you don’t believe me, just listen to arguably the smartest investor of all-time, Warren Buffett:

“Success in investing doesn’t correlate with I.Q. once you’re above the level of 125. Once you have ordinary intelligence, what you need is the temperament to control the urges that get other people into trouble in investing.”

Even the best investors and stock pickers of all-time are consistently wrong. When selecting stocks, a worthy objective is to correctly pick three outperforming stocks out of five stocks. And out of the three winning stocks, the rationale behind the outperformance should be correct in two out of those three stocks. In other words, you can be right for the wrong reason in one out of three outperforming stocks. The legendary investor Peter Lynch summed it up when he stated, “If you’re terrific in this business you’re right six times out of 10.”

Yes, it’s true, luck does play a role in stock selection. You just don’t want luck being the major driving force behind your success because luck cannot be replicated consistently over the long-run. There are so many unpredictable variables that in the short-run can work for or against the performance of your stock. Consider factors like politics, monetary policy, weather, interest rates, terrorist attacks, regulations, tax policy, and many other influences that are challenging or impossible to forecast. Over the long-run, these uncontrollable and unpredictable factors should balance out, thereby allowing your investing edge to shine.

Although I have missed some supermodel stocks, I have kissed some pretty stocks in my career too. I wish I could have invested in more stocks like Amazon.com Inc. (AMZN) that have increased more than 10x-fold, but other beauties like Apple Inc. (AAPL), Alphabet Inc. (GOOG), and Facebook Inc. (FB), haven’t hurt my long-term performance either. As is the case for most successful long-term investors, winning stocks generally more than compensate for the stinkers, if you can have the wherewithal to hold onto the multi-baggers (i.e., stocks that more than double), which admittedly is much easier said than done. Peter Lynch emphasized this point by stressing a focus on the long-term:

“You don’t need a lot of good hits every day. All you need is two to three goods stocks a decade.”

Sticking to a process of identifying and investing in well-managed companies at attractive valuations is a much better approach to investing than chasing every beauty you see or read about. If you stick to this simple formula, you can experience lovely, long-term results.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in AAPL, FB, GOOG, AMZN, and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

No April Fool’s Joke – Another Record

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (April 3, 2017). Subscribe on the right side of the page for the complete text.

Having children is great, but a disadvantage to having younger kids are the April Fool’s jokes they like to play on parents. Fortunately, this year was fairly benign as I only suffered a nail-polish covered bar of soap in the shower. However, what has not been a joke has been the serious series of new record highs achieved in the stock market. While it is true the S&P 500 index finished roughly flat for the month (-0.0%) after hitting new highs earlier in March, the technology-laden NASDAQ index continued its dominating run, advancing +1.5% in March contributing to the impressive +10% jump in the first quarter. For 2017, the NASDAQ supremacy has been aided by the stalwart gains realized by leaders like Apple Inc. (up +24%), Facebook Inc. (up +23%), and Amazon.com Inc. (up +18%). The surprising fact to many is that these records have come in the face of immense political turmoil – most recently President Trump’s failure to deliver on a campaign promise to repeal and replace the Obamacare healthcare system.

Like a broken record, I’ve repeated there are much more important factors impacting investment portfolios and the stock market other than politics (see also Politics Schmolitics). In fact, many casual observers of the stock market don’t realize we have been in the midst of a synchronized, global economic expansion, helped in part by the stabilization in the value of the U.S. dollar over the last couple of years.

Source: Investing.com

As you can see above, there was an approximate +25% appreciation in the value of the dollar in late-2014, early-2015. This spike in the value of the dollar suddenly made U.S. goods sold abroad +25% more expensive, resulting in U.S. multinational companies experiencing a dramatic profitability squeeze over a short period of time. The good news is that over the last two years the dollar has stabilized around an index value of 100. What does this mean? In short, this has provided U.S. multinational companies time to adjust operations, thereby neutralizing the currency headwinds and allowing the companies to return to profitability growth.

Source: Calafia Beach Pundit

And profits are back on the rise indeed. The six decade long chart above shows there is a significant correlation between the stock market (red line – S&P 500) and corporate profits (blue line). The skeptics and naysayers have been out in full force ever since the 2008-2009 financial crisis – I profiled these so-called “sideliners” in Get out of Stocks!.

As the stock market continues to hit new record highs, the doubters continue to scream danger. There will always be volatility, but when the richest investor of all-time, Warren Buffett, continues to say that stocks are still attractively priced, given the current interest rate environment, that goes a long way to assuage investor concerns.

Politically, a lot could still go wrong as it relates to healthcare, tax reform, and infrastructure spending, to name a few issues. However, it’s still early, and it’s possible positive surprises could also occur. More importantly, as I’ve noted before, corporate profits, interest rates, valuations, and investor sentiment are much more important factors than politics, and on balance these factors are on the favorable side of the ledger. These factors will have a larger impact on the long-term direction of stock prices.

With approval ratings of Congress and the President at low levels, investors have had trouble finding humor in politics, even on April Fool’s Day. Another significant factor more important than politics is the issue of retirement savings by Americans, which is no joke. As you finalize your tax returns in the coming weeks, it behooves you to revisit your retirement plan and investment portfolio. Inefficiently investing your money or outliving your savings is no laughing matter. I’ll continue with my disciplined financial plan and leave the laughing to my kids, as they enjoy planning their next April Fool’s Day prank.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in AAPL, FB, AMZN, and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Munger: Buffett’s Wingman & the Art of Stock Picking

Simon had Garfunkel, Batman had Robin, Hall had Oates, Dr. Evil had Mini Me, Sonny had Cher, and Malone had Stockton. In the investing world, Buffett has Munger. Charlie Munger is one of the most successful and famous wingmen of all-time – evidenced by Berkshire Hathaway Corporation’s (BRKA/B) outperformance of the S&P 500 index by approximately +624% from 1977 – 2009, according to MarketWatch. Munger not only provides critical insights to his legendary billionaire boss, Warren Buffett, but he was also Chairman of Berkshire’s insurance subsidiary, Wesco Financial Corporation from 1984 until 2011. The magic of this dynamic duo began when they met at a dinner party 58 years ago (1959).

In an article he published in 2006, the magnificent Munger describes the “Art of Stock Picking” in a thorough review about the secrets of equity investing. We’ll now explore some of the 93-year-old’s sage advice and wisdom.

Model Building

Charlie Munger believes an individual needs a solid general education before becoming a successful investor, and in order to do that one needs to study and understand multiple “models.”

“You’ve got to have models in your head. And you’ve got to array your experience both vicarious and direct on this latticework of models. You may have noticed students who just try to remember and pound back what is remembered. Well, they fail in school and in life. You’ve got to hang experience on a latticework of models in your head.”

Although Munger indicates there are 80 or 90 important models, the examples he provides include mathematics, accounting, biology, physiology, psychology, and microeconomics.

Advantages of Scale

Great businesses in many cases enjoy the benefits of scale, and Munger devotes a good amount of time to this subject. Scale advantages can be realized through advertising, information, psychological “social proofing,” and structural factors.

The newspaper industry is an example of a structural scale business in which a “winner takes all” phenomenon applies. Munger aptly points out, “There’s practically no city left in the U.S., aside from a few very big ones, where there’s more than one daily newspaper.”

General Electric Co. (GE) is another example of a company that uses scale to its advantage. Jack Welch, the former General Electric CEO, learned an early lesson. If the GE division is not large enough to be a leader in a particular industry, then they should exit. Or as Welch put it, “To hell with it. We’re either going to be # 1 or #2 in every field we’re in or we’re going to be out. I don’t care how many people I have to fire and what I have to sell. We’re going to be #1 or #2 or out.”

Bigger Not Always Better

Scale comes with its advantages, but if not managed correctly, size can weigh on a company like an anchor. Munger highlights the tendency of large corporations to become “big, fat, dumb, unmotivated bureaucracies.” An implicit corruption also leads to “layers of management and associated costs that nobody needs. Then, while people are justifying all these layers, it takes forever to get anything done. They’re too slow to make decisions and nimbler people run circles around them.”

Becoming too large can also create group-think, or what Munger calls “Pavlovian Association.” Munger goes onto add, “If people tell you what you really don’t want to hear what’s unpleasant there’s an almost automatic reaction of antipathy…You can get severe malfunction in the high ranks of business. And of course, if you’re investing, it can make a lot of difference.”

Technology: Benefit or Burden?

Munger recognizes that technology lowers costs for companies, but the important question that many managers fail to ask themselves is whether the benefits from technology investments accrue to the company or to the customer? Munger summed it up here:

“There are all kinds of wonderful new inventions that give you nothing as owners except the opportunity to spend a lot more money in a business that’s still going to be lousy. The money still won’t come to you. All of the advantages from great improvements are going to flow through to the customers.”

Buffett and Munger realized this lesson early on when productivity improvements gained from technology investments in the textile business all went to the buyers.

Surfing the Wave

When looking for good businesses, Munger and Buffett are looking to “surf” waves or trends that will generate healthy returns for an extended period of time. “When a surfer gets up and catches the wave and just stays there, he can go a long, long time. But if he gets off the wave, he becomes mired in shallows,” states Munger. He notes that it’s the “early bird,” or company that identifies a big trend before others that enjoys the spoils. Examples Munger uses to illustrate this point are Microsoft Corp. (MSFT), Intel Corp. (INTC), and National Cash Register from the old days.

Large profits will be collected by those investors that can identify and surf those rare large waves. Unfortunately, taking advantage of these rare circumstances becomes tougher and tougher for larger investors like Berkshire. If you’re an elephant trying to surf a wave, you need to find larger and larger waves, and even then, due to your size, you will be unable to surf as long as small investors.

Circle of Competence

Circle of competence is not a new subject discussed by Buffett and Munger, but it is always worth reviewing. Here’s how Munger describes the concept:

“You have to figure out what your own aptitudes are. If you play games where other people have the aptitudes and you don’t, you’re going to lose. And that’s as close to certain as any prediction that you can make. You have to figure out where you’ve got an edge. And you’ve got to play within your own circle of competence.”

For Munger and Buffett, sticking to their circle of competence means staying away from high-technology companies, although more recently they have expanded this view to include International Business Machines (IBM), which they are now a large investor.

Market Efficiency or Lack Thereof

Munger acknowledges that financial markets are quite difficult to beat. Since the markets are “partly efficient and partly inefficient,” he believes there is a minority of individuals who can outperform the markets. To expand on this idea, he compares stock investing to the pari-mutuel system at the racetrack, which despite the odds stacked against the bettor (17% in fees going to the racetrack), there are a few individuals who can still make decent money.

The transactional costs are much lower for stocks, but success for an investor still requires discipline and patience. As Munger declares, “The way to win is to work, work, work, work and hope to have a few insights.”

Winning the Game – 10 Insights / 20 Punches

As the previous section implies, outperformance requires patience and a discriminating eye, which has allowed Berkshire to create the bulk of its wealth from a relatively small number of investment insights. Here’s Munger’s explanation on this matter:

“How many insights do you need? Well, I’d argue: that you don’t need many in a lifetime. If you look at Berkshire Hathaway and all of its accumulated billions, the top ten insights account for most of it….I don’t mean to say that [Warren] only had ten insights. I’m just saying, that most of the money came from ten insights.”

Chasing performance, trading too much, being too timid, and paying too high a price are not recipes for success. Independent thought accompanied with selective, bold decisions is the way to go. Munger’s solution to these problems is to provide investors with a Buffett 20-punch ticket:

“I could improve your ultimate financial welfare by giving you a ticket with only 20 slots in it so that you had 20 punches ‑ representing all the investments that you got to make in a lifetime. And once you’d punched through the card, you couldn’t make any more investments at all.”

The great thing about Munger and Buffett’s advice is that it is digestible by the masses. Like dieting, investing can be very simple to understand, but difficult to execute, and legends like these always remind us of the important investing basics. Even though Charlie Munger may be slowing down a tad at 93-years-old, Warren Buffett and investors everywhere are blessed to have this wingman around spreading his knowledge about investing and the art of stock picking.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, BRKA/B, GE, MSFT, INTC, IBM but at the time of this 3/12/17 updated publishing, SCM had no direct position in National Cash Register, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

March Madness or Retirement Sadness?

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (March 1, 2017). Subscribe on the right side of the page for the complete text.

“March Madness” begins in a few weeks with a start of the 68-team NCAA college basketball tournament, but there has also been plenty of other economic and political madness going on in the background. As it relates to the stock market, the Dow Jones Industrial Average index reached a new, all-time record high last month, exceeding the psychologically prominent level of 20,000 (closing the month at 20,812). For the month, the Dow rose an impressive +4.8%, and since November’s presidential election it catapulted an even more remarkable +13.5%.

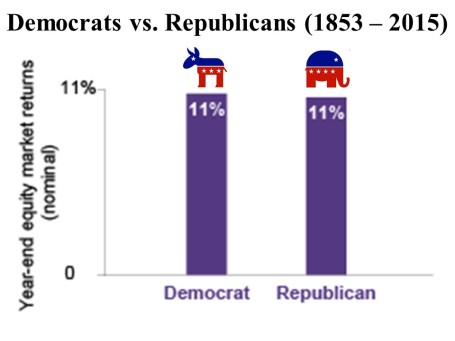

Despite our 45th president just completing his first State of the Union address to the nation, American voters remain sharply divided across political lines, and that bias is not likely to change any time soon. Fortunately, as I’ve written on numerous occasions (see Politics & Your Money), politics have no long-term impact on your finances and retirement. Sure, in the short-run, legislative policies can create winners and losers across particular companies and industries, but history is firmly on your side if you consider the positive track record of stocks over the last couple of centuries. As the chart below demonstrates, over the last 150 years or so, stock performance is roughly the same across parties (up +11% annually), whether you identify with a red elephant or a blue donkey.

Nevertheless, political rants flooding our Facebook news feeds can confuse investors and scare people into inaction. Pervasive fake news stories regarding the supposed policy benefits and shortcomings of immigration, tax reform, terrorism, entitlements, foreign policy, and economic issues often result in heightened misperception and anxiety.

More important than reading Facebook political rants, watching March Madness basketball, or drinking green beer on St. Patrick’s Day, is saving money for retirement. While some of these diversions can be temporarily satisfying and entertaining, lost in the daily shuffle is the retirement epidemic quietly lurking in the background. Managing money makes people nervous even though it is an essential part of life. Retirement planning is critical because a mountain of the 76 million Baby Boomers born between 1946 – 1964 have already reached retirement age and are not ready (see chart below).

The critical problem is most Americans are ill-prepared financially for retirement, and many of them run the risk of outliving their savings. A recent study conducted by the Economic Policy Institute (EPI) shows that nearly half of families have no retirement account savings at all. The findings go on to highlight that the median U.S. family only has $5,000 in savings (see also Getting to Your Number). Even after considering my tight-fisted habits, that kind of money wouldn’t be enough cash for me to survive on.

Saving and investing have never been more important. It doesn’t take a genius to understand that government entitlements like Social Security and Medicare are at risk for millions of Americans. While I am definitely not sounding the alarm for current retirees who have secure benefits, there are millions of others whose retirement benefits are in jeopardy.

Missing the 20,000 Point Boat? Dow 100,000

Making matters worse, saving and investing has never been more challenging. If you thought handling all of life’s responsibilities was tough enough already, try the impossible task of interpreting the avalanche of instantaneous political and economic headlines pouring over our electronic devices at lighting speed.

Knee-jerk reactions to headlines might give investors a false sense of security, but the near-impossibility of consistently timing the stock market has not stopped people from attempting to do so. For example, recently I have been bombarded with the same question, “Wade, don’t you think the stock market is overpriced now that we have eclipsed 20,000?” The short answer is “no,” given the current factors (see Don’t Be a Fool). Thankfully, I’m not alone in this response. Warren Buffett, the wealthiest billionaire investor on the planet, answered the same question this week after investing $20,000,000,000 more in stocks post the election:

“People talk about 20,000 being high. Well, I remember when it hit 200 and that was supposedly high….You know, you’re going to see a Dow [in your lifetime] that certainly approaches 100,000 and that doesn’t require any miracles, that just requires the American system continuing to function pretty much as it has.”

Like a deer in headlights, many Americans have been scared into complacency. To their detriment, many savers have sat silently on the sidelines earning near-0% returns on their savings, while the stock market has reached new all-time record highs. While Dow 20,000 might be new news for some, the reality is new all-time record highs have repeatedly been achieved in 2013, 2014, 2015, 2016, and now 2017 (see chart below).

While I am not advocating for all people to throw their entire savings into stocks, it is vitally important for individuals to construct diversified portfolios across a wide range of asset classes, subject to each person’s unique objectives, constraints, risk tolerance, and time horizon. The risk of outliving your savings is real, so if you need assistance, seek out an experienced professional. March Madness may be here, but don’t get distracted. Make investing a priority, so your daily madness doesn’t turn into retirement sadness.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in FB and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.