Posts tagged ‘Wade Slome’

Sidoxia Adds 25-Year Veteran to Team

NEWPORT BEACH, CA – (Wire-Business) – Keith C. Bong, CFA, CPA, has recently joined Sidoxia Capital Management, LLC (“Sidoxia”) as Vice President of Investments and Financial Planning. Keith brings over 25 years of experience to Sidoxia’s investment team, having worked as a Financial Consultant with Merrill Lynch, before founding the investment firm Topper Capital Management in Irvine, California.

“We are truly excited to bring such a high caliber individual like Keith on board,” stated Wade W. Slome, CFA, CFP®, President and Founder of Sidoxia Capital Management. “We’re confident that Keith’s unique experience and knowledge will bring tremendous value to Sidoxia’s clients as our firm continues to expand.”

For over a decade, while managing his former advisory firm, Keith has worked closely with business owners, corporations, and individuals, assisting these clients with critical investment planning, tax planning, and financial planning goals.

“I believe my experience in building corporate retirement plan solutions meshes well with Sidoxia’s successful investment platform,” noted Keith. “I’m thrilled to join an independent firm like Sidoxia that places clients’ needs first, unlike some other financial institutions.”

To learn more about Sidoxia and Keith Bong’s background, please visit http://www.Sidoxia.com and reference the “Investment Team” section.

Click here to download a copy of the press release.

Plan. Invest. Prosper.

DISCLOSURE: No information provided here constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Controlling the Investment Lizard Brain

“Normal fear protects us; abnormal fear paralyses us.”

– Martin Luther King, Jr.

Investing is challenging enough without bringing emotions into the equation. Unfortunately, humans are emotional, and as a result investors often place too much reliance on their feelings, rather than using objective information to drive rational decision making.

What causes investors to make irrational decisions? The short answer: our “amygdala.” Author and marketer Seth Godin calls this almond-shaped tissue in the middle of our head, at the end of the brain stem, the “lizard brain” (video below). Evolution created the amygdala’s instinctual survival flight response for lizards to avoid hungry hawks and humans to flee ferocious lions.

Over time, the threat of lions eating people in our modern lives has dramatically declined, but the human’s “lizard brain” is still running in full gear, worrying about other fear-inducing warnings like Iran, Syria, Obamacare, government shutdowns, taxes, Cyprus, sequestration, etc. (see Series of Unfortunate Events)

When the brain in functioning properly, the prefrontal cortex (the front part of the brain in charge of reasoning) is actively communicating with the amygdala. Sadly, for many people, and investors, the emotional response from the amygdala dominates the rational reasoning portion of the prefrontal cortex. The best investors and traders have developed the ability of separating emotions from rational decision making, by keeping the amygdala in check.

With this genetically programmed tendency of constantly fearing the next lion or stock market crash, how does one control their lizard brain from making sub-optimal, rash investment decisions? Well, the first thing you should do is turn off the TV. And by turning off the TV, I mean stop listening to talking head commentators, economists, strategists, analysts, neighbors, co-workers, blogger hacks, newsletter writers, journalists, and other investing “wannabes”. Sure, you could throw my name into the list of people to ignore if you wanted to, but the difference is, at least I have actually invested real money for over 20 years (see How I Managed $20,000,000,000.00), whereas the vast majority of those I listed have not. But don’t take my word for it…listen or read the words of other experienced investors Warren Buffett, Peter Lynch, Ron Baron, John Bogle, Phil Fisher, and other investment titans (see also Sidoxia Hall of Fame). These investment legends have successful long-term investment track records and they lived through wars, recessions, financial crises, and other calamities…and still managed to generate incredible returns.

Another famed investor, William O’Neil, summed this idea nicely by adding the following:

“Since the market tends to go in the opposite direction of what the majority of people think, I would say 95% of all these people you hear on TV shows are giving you their personal opinion. And personal opinions are almost always worthless … facts and markets are far more reliable.”

The Harmful Consequence of Brain on Pain

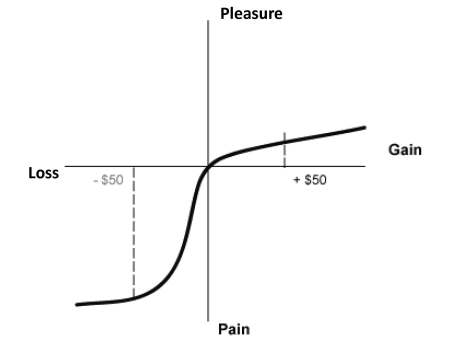

Besides forcing damaging decisions, another consequence of our lizard brain is its ability to distort reality. Behavioral economists Daniel Kahneman (Nobel Prize winner) and Amos Tversky through their research demonstrated the pain of $50 loss is more than twice as painful as the pleasure from $50 gain (see Pleasure/Pain Principle). Common sense would dictate our brains would treat equivalent scenarios in a proportional manner, but as the chart below shows, that is not the case:

Kahneman adds to the decision-making relationship of the amygdala and prefrontal cortex by describing the concepts of instinctual and deliberative choices in his most recent book, Thinking Fast and Slow (see Decision Making on Freeways).

Optimizing Risk

Taking excessive risks in technology stocks in the 1990s or in housing in the mid-2000s was very damaging to many investors, but as we have seen, our lizard brains can cause investors to become overly risk averse. Over the last five years, many people have personally experienced the ill effects of unwarranted conservatism. Investment great Sir John Templeton summed up this risk by stating, “The only way to avoid mistakes is not to invest – which is the biggest mistake of all.”

Every person has a different perception and appetite for risk. The optimal amount of risk taken by any one investor should be driven by their unique liquidity needs and time horizon…not a perceived risk appetite. Typically risk appetites go up as markets peak, and conservatism reaches a fearful apex near market bottoms – the opposite tendency of rational decision making. Besides liquidity and time horizon, a focus on valuation coupled with diversification across asset class (stocks/bonds), geography (domestic/international), size (small/large), style (value/growth) is critical in controlling risk. If you can’t determine your personal, optimal risk profile, then find an experienced and knowledgeable investment advisor to assist you.

With the advent of the internet and mobile communication, our brains and amygdala continually get bombarded with fearful stimuli, leading to disastrous decision-making and damaging portfolio outcomes. Turning off the TV and selectively choosing the proper investment advice is paramount in keeping your amygdala in check. Your lizard brain may protect you from getting eaten by a lion, but falling prey to this structural brain flaw may eat your investment portfolio alive.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

2013 Investing Caffeine Greatest Hits

From the Boston bombings and Detroit’s bankruptcy to Pope Francis and Nelson Mandela, there were many attention grabbing headlines in 2013. Investing Caffeine made its own headlines after 4 1/2 years of blogging, including Sidoxia Capital Management’s media expansion (see Twitter & Media pages).

Thank you to all the readers who inspire me to spew out my random but impassioned thoughts on a somewhat regular basis. Investing Caffeine and Sidoxia Capital Management wish you a healthy, happy, and prosperous New Year in 2014!

Here are some of the most popular Investing Caffeine postings over the year:

10) Confessions of a Bond Hater

9) What’s Going On With This Crazy Market?

8) Information Choking Your Money

7) Beware: El-Erian & Gross Selling Buicks…Not Chevys

6) The Central Bank Dog Ate My Homework

5) Confusing Fear Bubbles with Stock Bubbles

4) Vice Tightens for Those Who Missed the Pre-Party

3) Sitting on the Sidelines: Fear & Selective Memory

2) The Most Hated Bull Market Ever

1) 2014: Here Comes the Dumb Money!

Happy New Year’s!

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page. Special editorial thanks to Lt. Andrew A. Pierce for his contributions on this article.

Top 10 (or so) Things I’m Thankful For

With the holidays now upon us, this period provides me the opportunity to briefly escape the daily investment rat race, and reflect on the numerous aspects of my life for which I am grateful. There is so much to be thankful for, but it’s easy to lose sight of what’s important, especially when time is flying by in the blink of an eye. As the old saying goes, “Life is like a roll of toilet paper. The closer you get to the end, the faster it goes.” The proliferation of gray hair, coupled with my sprouting kids, is a constant reminder that life is not slowing down for me, but actually speeding up.

As I lay here like a slug on the couch, which is slowly absorbing me, I take no shame in unbuttoning my top pant button to relieve the belly-busting pressure of excessive turkey and mash potato consumption. The cranberry sauce on my chin and pumpkin pie crust on my shirt does not distract me from the football game or prevent me from reflecting upon my life’s gifts.

In that vein, here is a list of my top 10 things for which I am grateful:

10. Sugar: Without sweets, being relegated to a life of bread, water, and broccoli would be a boring challenge. Thankfully, once I became a grown adult earning a paycheck, I also earned the right to eat Cap’n Crunch (with Crunch Berries) for breakfast; peanut butter-Nutella & banana sandwich for lunch; apple fritter & milk for dinner; and some Double Stuf Oreos for dessert (yes, only one ‘f’ in Stuf!).

9. College Sports: Watching professional sports is fun, but when A-Rod earns $275 million for the NY Yankees and rides the pine during the playoffs, the business aspects take a little allure away from the sport. Although college athletes may sneak a few bucks under the table, they are nonetheless a lot less corrupted, and the electric atmosphere of a live college event cannot be replicated. The opportunities are fewer due to adult responsibilities, but nothing beats a crisp fall afternoon on the couch with a bowl of hot chili, a frosty beverage, and a remote control, while flipping through a series of college football games.

8. Gadgets: Seems like yesterday when I was introduced to my first computer, a 1983 Compaq Portable computer that weighed 28 pounds; had a 9 inch green screen; integrated two 320k drives; and retailed originally for about $3,500….ouch! Today, my iPhone 5 is more than 99% lighter, stores 100,000 times more information, and costs a fraction of the price. If you add my iPad, Kindle, Roku video streaming box, my DVR set-top box, my GPS, and other electronic gadgets, it’s hard to imagine how I could have lived a life without these luxuries five years ago.

7. Cards: I analyze numbers, probabilities, and emotions in my day job every day, it’s no wonder that I somehow need to do the same thing in my leisure time. No-Limit Texas Hold ‘Em is the name of the game, and I was introduced to it by world champion “poker brat” Phil Helmuth when he personally taught a group of us at an investment conference in 2003. I haven’t entered the $10,000 World Series of Poker in Las Vegas yet, but it’s on my bucket list.

6. Challenges: I’m a washed up basketball hack after an insignificant high school career and about 12 years of old-man basketball leagues, but my competitive juices keep flowing today. In hopes of not turning to a fully gelatinous blob, I have periodically pushed myself to some competitive athletic challenges, including a hike to the peak of Mt. Whitney; a couple half marathons; a sprint triathlon; a Colorado bike trip; and a few seasons of indoor co-ed soccer. Next up, I’m training for a “century” bike ride – a 100 mile race in early 2013 near Santa Barbara. I guess I better work off some of that stuffing, mash potatoes, and gravy.

5. Good Books: I pretty much read for a living on average 8-12 hours per day, but I suppose I’m a glutton for punishment. Given all my other interests and responsibilities, it’s tough to find the free time to curl up to a good book, but if I can squeeze in a book every quarter, I give myself a pat on the back. Nothing beats true, real-life experiences, but I’ve learned a tremendous amount through all the books I’ve read (for leisure and schooling). Regrettably diversity has gotten the short end of the stick, since about half the books I read are investment related, including a few that I’ve reviewed here on my blog like The Big Short, Too Big to Fail, The Greatest Trade Ever, and Winning the Loser’s Game (to name a few). Currently, I’m reading a fascinating New York Times Bestseller on world religions, called Religious Literacy, which leads me to my next Top 10 item…

4. Spirituality: While I am probably a lot more apathetic and ignorant in the area of religion as compared to the average person, nevertheless I have learned to appreciate the importance and benefits of religion and spirituality through my life experiences. From Judaism to Islam, and Buddhism to Christianity, there is no denying the moral lessons and spiritual balance these religions provide billions of people around the globe. I have a long way to go on my spiritual journey, but I’m slowly learning and progressing. On days where the Dow plummets a few hundred points or when the share price of a top holding tanks, I’m quickly reminded of the importance of spiritual balance.

3. Travel: While many people have hardly ventured from their hometown during their lifetime, I have been blessed with the fortune of seeing many places around the world. Not only have I lived on the East Coast, West Coast, and in the Midwest, but I have also traveled to five different continents. Appreciating different cultures and viewpoints is what truly makes life more interesting for me.

2. Friends: The digital age has not only brought friends closer together through social networks like Facebook (FB) and LinkedIn (LNKD), but has also pushed us further apart because vicariously spying on someone online is much easier than calling someone or grabbing coffee with them. Thankfully, I have a core set of friends that I can share my life’s ups and downs.

1a. Investing: Enough said. I’ve been investing for close to 20 years, and this blog is evidence of the blood, sweat, and tears I’ve dedicated to this endeavor. Various investments will go in and out of favor, and economic cycles will go up and down, but one trend that I know will persist is that I will be investing for the rest of my life.

1b. Health: It goes without saying, but if I don’t have my own good health, then very little on my top 10 list is possible. I’ve outlived two close family members of mine, so needless to say, I am very thankful to be breathing and living.

1c. Family: Having all these great experiences, including al the highs and lows, means absolutely nothing, if you have nobody to share them with. My family means the world to me, and days like Thanksgiving remind me of how lucky I really am.

Although this list was originally scheduled for 10 items, it looks like it has unintentionally expanded to a few more. But how can you blame me? I’ve had some tough times like everyone, but it is virtually impossible to not be thankful for the life I get to live now. Not only do I get to do what I love, but I also get paid to do it.

Last but not least, a special thanks needs to also go out to you, my devoted blog reader. I know you’re devoted, because you have made it to the end of this lengthy article. Without you, I wouldn’t have the motivation to continually scribble down my random thoughts.

Happy Thanksgiving and happy holidays!

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold long positions in certain exchange traded funds (ETFs), AMZN, and AAPL, and a short position in NFLX. At the time of publishing SCM had no direct positions in LNKD, FB, HPQ or any security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Investing Holy Grail: Brain or Machine?

Paul Meehl was a versatile academic who held numerous faculty positions, covering the diverse disciplines of psychology, law, psychiatry, neurology, and yes, even philosophy. The crux of his research was focused on how well clinical analysis fared versus statistical analysis. Or in other words, he looked to answer the controversial question, “What is a better predictor of outcomes, a brain or an equation?” His conclusion was straightforward – mechanical methods using quantitative measures are much more efficient than the professional judgments of humans in coming to more accurate predictions.

Those who have read my book, How I Managed $20,000,000,000.00 by Age 32 know where I stand on this topic – I firmly believe successful investing requires a healthy balance between both art and science (i.e., “brain and equation”). A trader who only relies on intuition and his gut to make all of his/her decisions is likely to fall on their face. On the other hand, a quantitative engineer’s sole dependence on a robotic multi-factor model to make trades is likely to fail too. My skepticism is adequately outlined in my Butter in Bangladesh article, which describes how irrational statistical games can be misleading and overused.

As much as I would like to attribute all of my investment success to my brain, the emotion-controlling power of numbers has played an important role in my investment accomplishments as well. The power of numbers simply cannot be ignored. More than 50 years after Paul Meehl’s seminal research was published, about two hundred studies comparing brain power versus statistical power have shown that machines beat brains in predictive accuracy in the majority of cases. Even when expert judgments have won over formulas, human consistency and reliability have muddied the accuracy of predictions.

Daniel Kahneman, a Nobel Prize winner in Economics, highlights another important decision making researcher, Robyn Dawes. What Dawes discovers in her research is that the fancy and complex multiple regression methods used in conventional software adds little to no value in the predictive decision-making process. Kahneman describes Dawes’s findings more specifically here:

“A formula that combines these predictors with equal weights is likely to be just as accurate in predicting new cases as the multiple-regression formula…Formulas that assign equal weights to all the predictors are often superior, because they are not affected by accidents of sampling…It is possible to develop useful algorithms without any prior statistical research. Simple equally weighted formulas based on existing statistics or on common sense are often very good predictors of significant outcomes.”

The results of Dawes’s classic research have significant application to the field of stock picking. As a matter of fact, this type of research has had a significant impact on Sidoxia’s stock selection process.

How Sweet It Is!

In the emotional roller-coaster equity markets we’ve experienced over the last decade or two, overreliance on gut-driven sentiments in the investment process has left masses of casualties in the wake of losses. If you doubt the destructive after-effects on investors’ psyches, then I urge you to check out my Fund Flow Paradox article that shows the debilitating effects of volatility on investors’ behavior.

In order to more objectively exploit investment opportunities, the Sidoxia Capital Management investment team has successfully formed and utilized our own proprietary quantitative tool. The results were so sweet, we decided to call it SHGR (pronounced “S-U-G-A-R”), or Sidoxia Holy Grail Ranking.

My close to two decades of experience at William O’Neil & Co., Nicholas Applegate, American Century Investments, and now Sidoxia Capital Management has allowed me to build a firm foundation of growth investing competency – however understanding growth alone is not sufficient to succeed. In fact, growth investing can be hazardous to your investment health if not kept properly in check with other key factors.

Here are some of the key factors in our Sidoxia SHGR ranking system:

Valuation:

- Free cash flow yield

- Price/earnings ratio

- PEG ratio

- Dividend yield

Quality:

- Financials: Profit margin trends; balance sheet leverage

- Management Team: Track record; capital stewardship

- Market Share: Industry position; runway for growth

Contrarian Sentiment Indicators:

- Analyst ratings

- Short interest

Growth:

- Earnings growth

- Sales growth

Our proprietary SHGR ranking system not only allows us to prioritize our asset allocation on existing stock holdings, but it also serves as an efficient tool to screen new ideas for client portfolio additions. Most importantly, having a quantitative model like Sidoxia’s Holy Grail Ranking system allows investors to objectively implement a disciplined investment process, whether there is a presidential election, Fiscal Cliff, international fiscal crisis, slowing growth in China, and/or uncertain tax legislation. At Sidoxia we have managed to create a Holy Grail machine, but like other quantitative tools it cannot replace the artistic powers of the brain.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Stay Tuned…

As I sift through the flood of quarterly corporate profit reports and finish up my quarterly client responsibilities, I’ve now carved out some to time to focus on writing. For anyone waiting in line for the next Investing Caffeine piece, please come back late Monday or early Tuesday for my monthly review (or sign up for my complementary newsletter on the right side of page). Stay tuned…

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Sidoxia’s Investor Hall of Fame

Investing Caffeine has profiled many great investors over the months and years, so I thought now would be a great time to compile a “Hall of Fame” summarizing some of the greatest of all-time. Nothing can replace experience, but learning from the greats can only improve your investing results – I’ve benefitted firsthand and so have Sidoxia’s clients. Here is a partial list from the Pantheon of investing greats along with links to the complete articles (special thanks to Kevin Weaver for helping compile):

Phillip Fisher – Author of the must-read classic Common Stocks and Uncommon Profits, he enrolled in college at age 15 and started graduate school at Stanford a few years later, before he dropped out and started his own investment firm in 1931. “If the job has been correctly done when a common stock is purchased, the time to sell it is – almost never.” Not every investment idea made the cut, however he is known to have bought Motorola (MOT) stock in 1955 and held it until his death in 2004 for a massive gain. (READ COMPLETE ARTICLE)

Phillip Fisher – Author of the must-read classic Common Stocks and Uncommon Profits, he enrolled in college at age 15 and started graduate school at Stanford a few years later, before he dropped out and started his own investment firm in 1931. “If the job has been correctly done when a common stock is purchased, the time to sell it is – almost never.” Not every investment idea made the cut, however he is known to have bought Motorola (MOT) stock in 1955 and held it until his death in 2004 for a massive gain. (READ COMPLETE ARTICLE)

Peter Lynch – Lynch graduated from Boston College in 1965 and earned a Master of Business Administration from the Wharton School of the University of Pennsylvania in 1968. Lynch’s Magellan fund averaged +29% per year from 1977 – 1990 (almost doubling the return of the S&P 500). In 1977, the obscure Magellan Fund started with about $20 million, and by his retirement the fund grew to approximately $14 billion (700x’s larger). Magellan outperformed 99.5% of all other funds, according to Barron’s. (READ COMPLETE ARTICLE)

Peter Lynch – Lynch graduated from Boston College in 1965 and earned a Master of Business Administration from the Wharton School of the University of Pennsylvania in 1968. Lynch’s Magellan fund averaged +29% per year from 1977 – 1990 (almost doubling the return of the S&P 500). In 1977, the obscure Magellan Fund started with about $20 million, and by his retirement the fund grew to approximately $14 billion (700x’s larger). Magellan outperformed 99.5% of all other funds, according to Barron’s. (READ COMPLETE ARTICLE)

William O’Neil – After graduating from Southern Methodist University, O’Neil started his career as a stock broker. Soon thereafter, at the ripe young age of 30, O’Neil purchased a seat on the New York Stock Exchange and started his own company, William O’Neil + Co. Incorporated. Following the creation of his firm, O’Neil went on to pioneer the field of computerized investment databases. He used his unique proprietary data as a foundation to unveil his next entrepreneurial baby, Investor’s Business Daily, in 1984. (READ COMPLETE ARTICLE)

Sir John Templeton – After Yale and Oxford, Templeton moved onto Wall Street, borrowed $10,000 to purchase more than 100 stocks trading at less than $1 per share (34 of the companies were in bankruptcy). Only four of the investments became worthless and Templeton made a boatload of money. Templeton bought an investment firm in 1940, leading to the Templeton Growth Fund in 1954. A $10,000 investment made at the fund’s 1954 inception would have compounded into $2 million in 1992 (translating into a +14.5% annual return). (READ COMPLETE ARTICLE)

Charles Ellis – He has authored 12 books, founded institutional consulting firm Greenwich Associates, a degree from Yale, an MBA from Harvard, and a PhD from New York University. A director at the Vanguard Group and Investment Committee chair at Yale, Ellis details that many more investors and speculators lose than win. Following his philosophy will not only help increase the odds of your portfolio winning, but will also limit your losses in sleep hours. (READ COMPLETE ARTICLE)

Charles Ellis – He has authored 12 books, founded institutional consulting firm Greenwich Associates, a degree from Yale, an MBA from Harvard, and a PhD from New York University. A director at the Vanguard Group and Investment Committee chair at Yale, Ellis details that many more investors and speculators lose than win. Following his philosophy will not only help increase the odds of your portfolio winning, but will also limit your losses in sleep hours. (READ COMPLETE ARTICLE)

Seth Klarman – President of The Baupost Group, which manages about $22 billion, he worked for famed value investors Max Heine and Michael Price of the Mutual Shares. Klarman published a classic book on investing, Margin of Safety, Risk Averse Investing Strategies for the Thoughtful Investor, which is now out of print and has fetched upwards of $1,000-2,000 per copy in used markets. From it’s 1983 inception through 2008 his Limited partnership averaged 16.5% net annually, vs. 10.1% for the S&P 500. During the “lost decade” he crushed the S&P, returning 14.8% and 15.9% for the 5 and 10-year periods vs. -2.2% and -1.4%. (READ COMPLETE ARTICLE)

Seth Klarman – President of The Baupost Group, which manages about $22 billion, he worked for famed value investors Max Heine and Michael Price of the Mutual Shares. Klarman published a classic book on investing, Margin of Safety, Risk Averse Investing Strategies for the Thoughtful Investor, which is now out of print and has fetched upwards of $1,000-2,000 per copy in used markets. From it’s 1983 inception through 2008 his Limited partnership averaged 16.5% net annually, vs. 10.1% for the S&P 500. During the “lost decade” he crushed the S&P, returning 14.8% and 15.9% for the 5 and 10-year periods vs. -2.2% and -1.4%. (READ COMPLETE ARTICLE)

George Soros – Escaping Hungary in 1947, Soros immigrated to the U.S. in 1956 and held analyst and management positions for the next 20 years. Known as the “The man who broke the Bank of England,” he risked $10 billion against the British pound in 1992 in a risky trade and won. Soros also gained notoriety for running the Quantum Fund, which generated an average annual return of more than 30%. (READ COMPLETE ARTICLE)

George Soros – Escaping Hungary in 1947, Soros immigrated to the U.S. in 1956 and held analyst and management positions for the next 20 years. Known as the “The man who broke the Bank of England,” he risked $10 billion against the British pound in 1992 in a risky trade and won. Soros also gained notoriety for running the Quantum Fund, which generated an average annual return of more than 30%. (READ COMPLETE ARTICLE)

Bruce Berkowitz -Bruce Berkowitz has not exactly been a household name. With his boyish looks, nasally voice, and slicked-back hair, one might mistake him for a grad student. However, his results are more than academic, which explains why this invisible giant was recently named the equity fund manager of the decade by Morningstar. The Fairholme Fund (FAIRX) fund earned a 13% annualized return over the ten-year period ending in 2009, beating the S&P 500 by an impressive 14%. (READ COMPLETE ARTICLE)

Thomas Rowe Price, Jr. – Known as the “Father of Growth Investing,” in 1937 he founded T. Rowe Price Associates (TROW) and successfully ramped up the company before the launch of the T. Rowe Price Growth Stock Fund in 1950. Expansion ensued until he made a timely sale of his company in the late 1960s. His Buy and Hold strategy proved successful. For example, in the early 1970s, Price had accumulated gains of +6,184% in Xerox (XRX), which he held for 12 years, and gains of +23,666% in Merck (MRK), which he held for 31 years. (READ COMPLETE ARTICLE)

There you have it. Keep investing and continue reading about investing legends at Investing Caffeine, and who knows, maybe you too can join Sidoxia’s Hall of Fame?!

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds and WMT, but at the time of publishing SCM had no direct position in MOT, TROW, XRX, MRK, FAIRX, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

2011 Sidoxia – IC Greatest Hits

There was some entertaining dancing going on early in 2011, but for the most part, the year brought a lot of rock ‘n’ roll on its way to what looks like a flattish year on a return basis. Sidoxia Capital Management and Investing Caffeine (IC) followed everything from the Royal Wedding and Charlie Sheen to the debt ceiling debate and the Arab Spring. Amongst all the celebration and chaos, IC pounded away at the keyboard and reported on the financial markets and the virtues of investing. Out of the 80 or so postings at IC this year, here are my top 11 favorites of 2011:

• Spoonfuls of Investment Knowledge: Classic investment quotes and tenets.

• 10 Ways to Destroy Your Portfolio: Investment mistakes to avoid.

• Solving Europe and Your Deadbeat Cousin: Putting the European financial crisis in context.

• A Serious Situation in Jackson Hole: The “Situation” meets Ben Bernanke.

• It’s the Earnings, Stupid: Stock prices and the inextricable ties with earnings.

• Innovative Bird Keeps All the Worms: Innovative not first mover gains the prize.

• Snoozing Your Way to Investment Prosperity: How to invest and sleep well during financial market mayhem.

• The Fallacy of High P/E’s: Sustainably high earnings growth can trump high P/E ratios.

• Gospel from 20th Century Investment King: Investment maxims from legend Sir John Templeton.

• The 10 Investment Commandments: Charles Ellis passes down key laws to investment disciples.

• Share Buybacks and Bathroom Violators: Pet peeves in the bathroom and share repurchase.

Happy Holidays and Happy New Year from Investing Caffeine and Sidoxia Capital Management!

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Stay Tuned…

As I sift through the flood of corporate profit reports and finish up my quarterly client responsibilities, I’ve now carved out some to time to focus on writing. For anyone waiting in line for my next piece, please come back late Monday or early Tuesday for my monthly review (or sign up on right side of page). Stay tuned…

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

WEBINAR: Panic or Attack?! Preserving Your Financial Future (8/26/11)

Webinar Details:

—August 26, 2011 (Friday) at 11:30 a.m. – 12:30 p.m. (Pacific Standard Time)

CLICK HERE TO CONNECT TO WEBINAR

Toll Free # (if not using PC): 1-877-669-3239

Access Code 808 610 841

The financial markets are experiencing historic extremes in volatility. Fears of a European financial contagion are spreading and frustrations with Washington politicians are reaching a feverish pitch. What should investors and retirees do now?

Is now the time to cut losses, or are opportunities of a lifetime developing?

Tune in for this timely review of the financial markets and listen-in to valuable advice on how to preserve your financial future.

CLICK HERE TO CONNECT TO WEBINAR

Toll Free # (if not using PC): 1-877-669-3239

Access Code 808 610 841

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in any security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.