Posts tagged ‘fixed income’

March Madness or Retirement Sadness?

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (March 1, 2017). Subscribe on the right side of the page for the complete text.

“March Madness” begins in a few weeks with a start of the 68-team NCAA college basketball tournament, but there has also been plenty of other economic and political madness going on in the background. As it relates to the stock market, the Dow Jones Industrial Average index reached a new, all-time record high last month, exceeding the psychologically prominent level of 20,000 (closing the month at 20,812). For the month, the Dow rose an impressive +4.8%, and since November’s presidential election it catapulted an even more remarkable +13.5%.

Despite our 45th president just completing his first State of the Union address to the nation, American voters remain sharply divided across political lines, and that bias is not likely to change any time soon. Fortunately, as I’ve written on numerous occasions (see Politics & Your Money), politics have no long-term impact on your finances and retirement. Sure, in the short-run, legislative policies can create winners and losers across particular companies and industries, but history is firmly on your side if you consider the positive track record of stocks over the last couple of centuries. As the chart below demonstrates, over the last 150 years or so, stock performance is roughly the same across parties (up +11% annually), whether you identify with a red elephant or a blue donkey.

Nevertheless, political rants flooding our Facebook news feeds can confuse investors and scare people into inaction. Pervasive fake news stories regarding the supposed policy benefits and shortcomings of immigration, tax reform, terrorism, entitlements, foreign policy, and economic issues often result in heightened misperception and anxiety.

More important than reading Facebook political rants, watching March Madness basketball, or drinking green beer on St. Patrick’s Day, is saving money for retirement. While some of these diversions can be temporarily satisfying and entertaining, lost in the daily shuffle is the retirement epidemic quietly lurking in the background. Managing money makes people nervous even though it is an essential part of life. Retirement planning is critical because a mountain of the 76 million Baby Boomers born between 1946 – 1964 have already reached retirement age and are not ready (see chart below).

The critical problem is most Americans are ill-prepared financially for retirement, and many of them run the risk of outliving their savings. A recent study conducted by the Economic Policy Institute (EPI) shows that nearly half of families have no retirement account savings at all. The findings go on to highlight that the median U.S. family only has $5,000 in savings (see also Getting to Your Number). Even after considering my tight-fisted habits, that kind of money wouldn’t be enough cash for me to survive on.

Saving and investing have never been more important. It doesn’t take a genius to understand that government entitlements like Social Security and Medicare are at risk for millions of Americans. While I am definitely not sounding the alarm for current retirees who have secure benefits, there are millions of others whose retirement benefits are in jeopardy.

Missing the 20,000 Point Boat? Dow 100,000

Making matters worse, saving and investing has never been more challenging. If you thought handling all of life’s responsibilities was tough enough already, try the impossible task of interpreting the avalanche of instantaneous political and economic headlines pouring over our electronic devices at lighting speed.

Knee-jerk reactions to headlines might give investors a false sense of security, but the near-impossibility of consistently timing the stock market has not stopped people from attempting to do so. For example, recently I have been bombarded with the same question, “Wade, don’t you think the stock market is overpriced now that we have eclipsed 20,000?” The short answer is “no,” given the current factors (see Don’t Be a Fool). Thankfully, I’m not alone in this response. Warren Buffett, the wealthiest billionaire investor on the planet, answered the same question this week after investing $20,000,000,000 more in stocks post the election:

“People talk about 20,000 being high. Well, I remember when it hit 200 and that was supposedly high….You know, you’re going to see a Dow [in your lifetime] that certainly approaches 100,000 and that doesn’t require any miracles, that just requires the American system continuing to function pretty much as it has.”

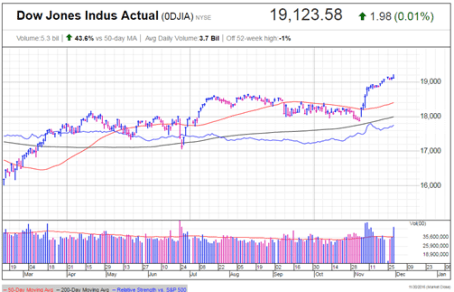

Like a deer in headlights, many Americans have been scared into complacency. To their detriment, many savers have sat silently on the sidelines earning near-0% returns on their savings, while the stock market has reached new all-time record highs. While Dow 20,000 might be new news for some, the reality is new all-time record highs have repeatedly been achieved in 2013, 2014, 2015, 2016, and now 2017 (see chart below).

While I am not advocating for all people to throw their entire savings into stocks, it is vitally important for individuals to construct diversified portfolios across a wide range of asset classes, subject to each person’s unique objectives, constraints, risk tolerance, and time horizon. The risk of outliving your savings is real, so if you need assistance, seek out an experienced professional. March Madness may be here, but don’t get distracted. Make investing a priority, so your daily madness doesn’t turn into retirement sadness.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in FB and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Half Trump Empty, or Half Trump Full?

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (December 1, 2016). Subscribe on the right side of the page for the complete text.

It was a bitter U.S. presidential election, but fortunately, the nastiest election mudslinging has come to an end…at least until the next political contest. Unfortunately, like most elections, even after the president-elect has been selected, almost half the country remains divided and the challenges facing the president-elect have not disappeared.

While some non-Trump voters have looked at the glass as half empty, since the national elections, the stock market glass has been overflowing to new record highs. Similar to the unforeseen British Brexit outcome in which virtually all pollsters and pundits got the results wrong, U.S. experts and investors also initially took a brief half-glass full view of the populist victory of Donald Trump. More specifically, for a few hours on Election Day, stock values tied to the Dow Jones Industrial Average index collapsed by approximately -5%.

It didn’t take long for stock prices to quickly reverse course, and when all was said and done, the Dow Jones Industrial Average finished the month higher by almost +1,000 points (+5.4%) to finish at 19,124 – a new all-time record high (see chart below). Worth noting, stocks have registered a very respectable +10% return during 2016, and the year still isn’t over.

Source: Investors.com (IBD)

Drinking the Trump Egg Nog

Why are investors so cheery? The proof will be in the pudding, but current optimism is stemming from a fairly broad list of anticipated pro-growth policies.

At the heart of the reform is the largest expected tax reform since Ronald Reagan’s landmark legislation three decades ago. Not only is Trump proposing stimulative tax cuts for corporations, but also individual tax reductions targeted at low-to-middle income taxpayers. Other facets of the tax plan include simplification of the tax code; removal of tax loopholes; and repatriation of foreign cash parked abroad. Combined, these measures are designed to increase profits, wages, investment spending, productivity, and jobs.

On the regulatory front, the President-elect has promised to repeal the Obamacare healthcare system and also overhaul the Dodd-Frank financial legislation. These initiatives, along with talk of dialing back other regulatory burdensome laws and agencies have many onlookers hopeful such policies could aid economic growth.

Fueling further optimism is the prospect of a trillion dollar infrastructure spending program created to fix our crumbling roads and bridges, while simultaneously increasing jobs.

No Free Lunch

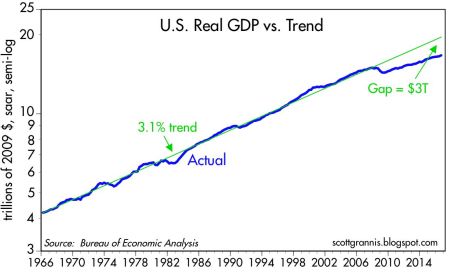

As is the case with any economic plan, there is never a free lunch. Every cost has a benefit, and every benefit has a cost. The cost of the 2008-2009 Financial crisis is reflected in the sluggish economic growth seen in the weak GDP (Gross Domestic Product) statistics, which have averaged a modest +1.6% growth rate over the last year. Scott Grannis points out how the slowest recovery since World War II has resulted in a $3 trillion economic gap (see chart below).

Source: Calafia Beach Pundit

The silver lining benefit to weak growth has been tame inflation and the lowest interest rate levels experienced in a generation. Notwithstanding the recent rate rise, this low rate phenomenon has spurred borrowing, and improved housing affordability. The sub-par inflation trends have also better preserved the spending power of American consumers on fixed incomes.

If executed properly, the benefits of pro-growth policies are obvious. Lower taxes should mean more money in the pockets of individuals and businesses to spend and invest on the economy. This in turn should create more jobs and growth. Regulatory reform and infrastructure spending should have similarly positive effects. However, there are some potential downside costs to the benefits of faster growth, including the following:

- Higher interest rates

- Rising inflation

- Stronger dollar

- Greater amount of debt

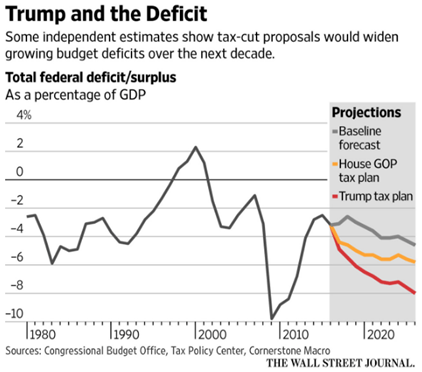

- Larger deficits (see chart below)

Source: The Wall Street Journal

Even though President-elect Trump has not even stepped foot into the Oval Office yet, signs are already emerging that we could face some or all of the previously mentioned headwinds. For example, just since the election, the yield on 10-Year Treasury Notes have spiked +0.5% to 2.37%, and 30-Year Fixed Rate mortgages are flirting with 4.0%. Social and economic issues relating to immigration legislation and Supreme Court nominations are likely to raise additional uncertainties in the coming months and years.

Attempting to anticipate and forecast pending changes makes perfect sense, but before you turn your whole investment portfolio upside down, it’s important to realize that actions speak louder than words. Even though Republicans have control over the three branches of government (Executive, Legislative, Judicial), the amount of control is narrow (i.e., the Senate), and the nature of control is splintered. In other words, Trump will still have to institute the “art of the deal” to persuade all factions of the Republicans (including establishment, Tea-Party, and rural) and Democrats to follow along and pass his pro-growth policies.

Although I do not agree with all of Trump’s policies, including his rhetoric on trade (see Free Trade Boogeyman), I will continue paying closer attention to his current actions rather than his past words. Until proven otherwise, I will keep on my rose colored glasses and remain optimistic that the Trump glass is half full, not half empty.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Cleaning Out Your Investment Fridge

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (June 1, 2016). Subscribe on the right side of the page for the complete text.

Summer is quickly approaching, but it’s not too late to do some spring cleaning. This principle not only applies to your cluttered refrigerator with stale foods but also your investment portfolio with moldy investments. In both cases, you want to get rid of the spoiled goods. It’s never fun discovering a science experiment growing in your fridge.

Over the last three months, the stock market has been replenished after a rotten first two months of the year (S&P 500 index was down -5.5% January through February). The +1.5% increase in May added to a +6.6% and +0.3% increase in March and April (respectively), resulting in a three month total advance in stock prices of +8.5%. Not surprisingly, the advance in the stock market is mirroring the recovery we have seen in recent economic data.

After digesting a foul 1st quarter economic Gross Domestic Product (GDP) reading of only +0.8%, activity has been smelling better in the 2nd quarter. A recent wholesome +3.4% increase in April durable goods orders, among other data points, has caused the Atlanta Federal Reserve Bank to raise its 2nd quarter GDP estimate to a healthier +2.9% growth rate (from its prior +2.5% forecast).

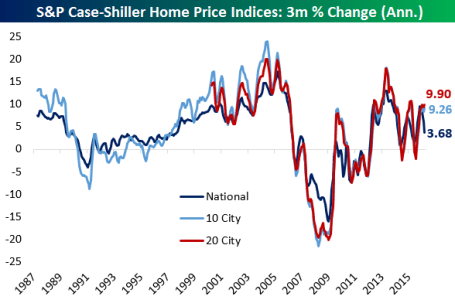

Consumer spending, which accounts for roughly 70% of our country’s economic activity, has been on the rise as well. The improving employment picture (5.0% unemployment rate last month) means consumers are increasingly opening their wallets and purses. In addition to spending more on cars, clothing, movies, and vacations, consumers are also doling out a growing portion of their income on housing. Housing developers have cautiously kept a lid on expansion, which has translated into limited supply and higher home prices, as evidenced by the Case-Shiller indices charted below.

Source: Bespoke

Spoiling the Fun?

While the fridge may look like it’s fully stocked with fresh produce, meat, and dairy, it doesn’t take long for the strawberries to get moldy and the milk to sour. Investor moods can sour quickly too, especially as they fret over the impending “Brexit” (British Exit) referendum on June 23rd when British voters will decide whether they want to leave the European Union. A “yes” exit vote has the potential of roiling the financial markets and causing lots of upset stomachs.

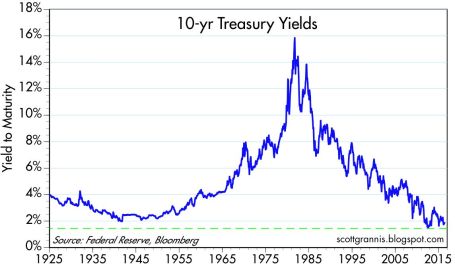

Another financial area to monitor relates to the Federal Reserve’s monetary policy and its decision when to further increase the Federal Funds interest rate target at its June 14th – 15th meeting. With the target currently set at an almost insignificantly small level of 0.25% – 0.50%, it really should not matter whether Chair Janet Yellen decides to increase rates in June, July, September and/or November. Considering interest rates are at/near generational lows (see chart below), a ¼ point or ½ point percentage increase in short-term interest rates should have no meaningfully negative impact on the economy. If your fridge was at record freezing levels, increasing the temperature by a ¼ or ½ degree wouldn’t have a major effect either. If and when short-term interest rates increase by 2.0%, 3.0%, or 4.0% in a relatively short period will be the time to be concerned.

Source: Scott Grannis

Keep a Fresh Financial Plan

As mentioned earlier, your investments can get stale too. Excess cash sitting idly earning next-to-nothing in checking, savings, CDs, or in traditional low-yielding bonds is only going to spoil rapidly to inflation as your savings get eaten away. In the short-run, stock prices will move up and down based on frightening but insignificant headlines. However, in the long-run, the more important issues are determining how you are going to reach your retirement goals and whether you are going to outlive your savings. This mindset requires you to properly assess your time horizon, risk tolerance, income needs, tax situation, estate plan, and other unique circumstances. Like a balanced diet of various food groups in your refrigerator, your key personal financial planning factors are dependent upon you maintaining a properly diversified asset allocation that is periodically rebalanced to meet your long-term financial goals.

Whether you are managing your life savings, or your life-sustaining food supply, it’s always best to act now and not be a couch potato. The consequences of sitting idle and letting your investments spoil away are a lot worse than letting the food in your refrigerator rot away.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Get Out of Stocks!*

Get out of stocks!* Why the asterisk mark (*)? The short answer is there is a certain population of people who are looking at alluring record equity prices, but are better off not touching stocks – I like to call these individuals the “sideliners”. The sideliners are a group of investors who may have owned stocks during the 2006-2008 timeframe, but due to the subsequent recession, capitulated out of stocks into gold, cash, and/or bonds.

The risk for the sideliners getting back into stocks now is straightforward. Sideliners have a history of being too emotional (see Controlling the Investment Lizard Brain), which leads to disastrous financial decisions. So, even if stocks outperform in the coming months and years, the sideliners will most likely be slow in getting back in, and wrongfully knee-jerk sell at the hint of an accelerated taper, rate-hike, or geopolitical sneeze. Rather than chase a stock market at all-time record highs, the sideliners would be better served by clipping coupons, saving, and/or finish that bunker digging project.

The fact is, if you can’t stomach a -20% decline in the stock market, you shouldn’t be investing in stocks. In a recent presentation, Barry Ritholtz, editor of The Big Picture and CIO of Ritholtz Wealth Management, beautifully displayed the 20 times over the last 85 years that the stocks have declined -20% or more (see chart below). This equates to a large decline every four or so years.

Strategist Dr. Ed Yardeni hammers home a similar point over a shorter duration (2008-2014) by also highlighting the inherent volatility of stocks (see chart below).

Stated differently, if you can’t handle the heat in the stock kitchen, it’s probably best to keep out.

It’s a Balancing Act

For the rest of us, the vast majority of investors, the question should not be whether to get out of stocks, it should revolve around what percentage of your portfolio allocation should remain in stocks. Despite record low yields and record high bond prices (see Bubblicious Bonds and Weak Competition, it is perfectly rational for a Baby-Boomer or retiree to periodically ring their stock-profit cash register, and reallocate more dollars toward bonds. Even if you forget about the 30%+ stock return achieved last year and the ~6% return this year, becoming more conservative in (or near) retirement with a larger bond allocation still makes sense. For some of our clients, buying and holding individual bonds until maturity reduces the risky outcome associated with a potential of interest rates spiking.

With all of that said, our current stance at Sidoxia doesn’t mean stocks don’t offer good value today (see Buy in May). For those readers who have followed Investing Caffeine for a while, they will understand I have been relatively sanguine about the prospects of equities for some time, even through a host of scary periods. Whether it was my attack of bears Peter Schiff, Nouriel Roubini, or John Mauldin in 2009-2010, or optimistic articles written during the summer crash of 2011 when the S&P 500 index declined -22% (see Stocks Get No Respect or Rubber Band Stretching), our positioning did not waver. However, as stock values have virtually tripled in value from the 2009 lows, more recently I have consistently stated the game has gotten a lot tougher with the low-hanging fruit having already been picked (earnings have recovered from the recession and P/E multiples have expanded). In other words, the trajectory of the last five years is unsustainable.

Fortunately for us, at Sidoxia we’re not hostage to the upward or downward direction of a narrow universe of large cap U.S. domestic stock market indices. We can scour the globe across geographies and capital structure. What does that mean? That means we are investing client assets (and my personal assets) into innovative companies covering various growth themes (robotics, alternative energy, mobile devices, nanotechnology, oil sands, electric cars, medical devices, e-commerce, 3-D printing, smart grid, obesity, globalization, and others) along with various other asset classes and capital structures, including real estate, MLPs, municipal bonds, commodities, emerging markets, high-yield, preferred securities, convertible bonds, private equity, floating rate bonds, and TIPs as well. Therefore, if various markets are imploding, we have the nimble ability to mitigate or avoid that volatility by identifying appropriate individual companies and alternative asset classes.

Irrespective of my shaky short-term forecasting abilities, I am confident people will continue to ask me my opinion about the direction of the stock market. My best advice remains to get out of stocks*…for the “sideliners”. However, the asterisk still signifies there are plenty of opportunities for attractive returns to be had for the rest of us investors, as long as you can stomach the inevitable volatility.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold long positions in certain exchange traded funds, but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Confessions of a Bond Hater

Hi my name is Wade, and I’m a bond hater. Generally, the first step in addressing any type of personal problem is admitting you actually have a problem. While I am not proud of being a bond hater, I have been called many worse things during my life. But as we have learned from the George Zimmerman / Trayvon Martin case, not every situation is clear-cut, whether we are talking about social issues or bond investing. For starters, let me be clear to everyone, including all my detractors, that I do not hate all bonds. In fact, my Sidoxia clients own many types of fixed income securities. What I do hate however are low yielding, long duration bonds.

Duration…huh? Most people understand what “low yielding” means, when it comes to bonds (i.e., low interest, low coupon, low return, etc.), but when the word duration is uttered, the conversation is usually accompanied by a blank stare. The word “duration” may sound like a fancy word, but in reality it is a fairly simple concept. Essentially, high-duration bonds are those fixed income securities with the highest sensitivity to changes in interest rates, meaning these bonds will go down most in price as interest rates rise.

When it comes to equity markets, many investors understand the concept of high beta stocks, which can be used to further explain duration. There are many complicated definitions for beta, but the basic principle explains why high-beta stock prices generally go up the most during bull markets, and go down the most during bear markets. In plain terms, high beta equals high octane.

If we switch the subject back to bonds, long duration equals high octane too. Or stated differently, long duration bond prices generally go down the most during bear markets and go up the most during bull markets. For years, grasping the risk of a bond bear market caused by rising rates has been difficult for many investors to comprehend, especially after witnessing a three-decade long Federal Funds tailwind taking the rates from about 20% to about 0% (see Fed Fatigue Setting In).

The recent interest rate spike that coincided with the Federal Reserve’s Ben Bernanke’s comments on QE3 bond purchase tapering has caught the attention of bond addicts. Nobody knows for certain whether this short-term bond price decline is the start of an extended bear market in bonds, but mathematics would dictate that there is only really one direction for interest rates to go…and that is up. It is true that rates could remain low for an indefinite period of time, but neither scenario of flat to down rates is a great outcome for bond holders.

Fixes to Fixed-Income Failings

Even though I may be a “bond hater” of low yield, high duration bonds, currently I still understand the critical importance and necessity of a fixed income portfolio for not only retirees, but also for the diversification benefits needed by a broader set of investors. So how does a bond hater reconcile investing in bonds? Easy. Rather than focusing on lower yielding, longer duration bonds, I invest more client assets in shorter duration and/or higher yielding bonds. If you harbor similar beliefs as I do, and believe there will be an upward bias to the trajectory of long-term interest rates, then there are two routes to go. Investors can either get compensated with a higher yield to counter the increased interest rate risk, and/or they can shorten duration of bond holdings to minimize capital losses.

Worth noting, there is an alternative strategy for low yielding, long duration bond lovers. In order to minimize interest rate risk, these bond lovers may accept sub-optimal yields and hold bonds to maturity. This strategy may be associated with short-term price volatility, but if the bond issuer does not default, at least the bond investor will get the full principal at maturity to help relieve the pain of meager yields.

Now that you’ve survived all this bond babbling, let me cut to the chase and explain a few ways Sidoxia is taking advantage of the recent interest rate volatility for our clients:

Floating Rate Bonds: Duration of these bonds is by definition low, or near zero, because as interest rates rise, coupons/interest payments are advantageously reset for investors at higher rates. So if interest rates jump from 2% to 3%, the investor will receive +50% higher periodic payments.

Inflation Protection Bonds: These bonds come in long and short duration flavors, but if interest rates/inflation rise higher than expected, investors will be compensated with higher periodic coupons and principal payments.

Shorter Duration: One definition of duration is the weighted average of time until a bond’s fixed cash flows are received. A way of shortening the duration of your bond portfolio is through the purchase of shorter maturity bonds (e.g., buying 3-year bonds rather than 30-year bonds).

High Yield Bonds: Investing in the high yield bond category is not limited to domestic junk bond purchases, but higher yields can also be earned by investing in international and/or emerging market bonds.

Investment Grade Corporate Bonds: Similar to high yield bonds, investment grade bonds offer the potential of capital appreciation via credit improvement. For instance, credit rating upgrades can provide gains to help offset price declines caused by rising interest rates.

Despite my bond hater status, the recent taper tantrum and interest rate spike, highlight some advantages bonds have over stocks. Even though prices declined, bonds by and large still have lower volatility than stocks; provide a steady stream of income; and provide diversification benefits.

To the extent investors have, or should have, a longer-term time horizon, I still am advocating a stock bias to client portfolios, subject to each investor’s risk tolerance. For example, an older retired couple with a conservative target allocation of 20%/80% (equity/fixed income) may consider a 25% – 30% allocation. A shift in this direction may still meet the retirees’ income needs (especially if dividend-paying stocks are incorporated), while simultaneously acknowledging the inflation and interest rate risks impacting bond positions. It’s important to realize one size doesn’t fit all.

Higher Volatility, Higher Reward

Frequent readers of Investing Caffeine have known about my bond hating tendencies for quite some time (see my 2009 article Treasury Bubble has not Burst…Yet), but the bond baby shouldn’t be thrown out with the bath water. For those investors who thought bonds were as safe as CDs, the recent -6% drop in the iShares Aggregate Bond Index (AGG) didn’t feel comfortable for most. Although I am still an enthusiastic stock cheerleader (less so as valuation multiples expand), there has been a cost for the gargantuan outperformance of stocks since March of ’09. While stocks have outperformed bonds (S&P vs. AGG) by more than +140%, equity investors have had to endure two -10% corrections and two -20% corrections (e.g.,Flash Crash, Debt Ceiling Debate, European Financial Crisis, and Sequestration/Elections). If investors want to earn higher long-term equity returns, this desire will translate into more volatility than bonds…and more Tums.

I may still be a bond hater, and the general public remains firm stock haters, but at some point in the multi-year future, I will not be surprised to hear myself say, “Hi my name is Wade, and I am addicted to bonds.” In the mean time, Sidoxia will continue to optimize its client bond portfolios for a rising interest rate environment, while also investing in attractive equity securities and ETFs. There’s nothing to hate about that.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), including floating rate bonds/loan funds, inflation-protection funds, corporate bond ETF, high-yield bond ETFs, and other bond ETFs, but at the time of publishing, SCM had no direct position in AGG or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Beware: El-Erian & Gross Selling Buicks…Not Chevys

As my grandmother always told me, “Be careful where you get your advice!” Or as renowned Wall Street trader Gerald Loeb once said, “The Buick salesman is not going to tell you a Chevrolet will fit your needs.” In other words, when it comes to investment advice, it is important to realize that opinions and recommendations are often biased and steeped with inherent conflicts of interest. Having worked in the financial industry over several decades, I have effectively seen it all.

However, one unique aspect I have grown accustomed to is the nauseating and fatiguing over-exposure of PIMCO’s dynamic bond duo, CEO Mohamed El-Erian and founder Bill Gross. Over the last four years and 13 consecutive quarters of GDP growth (likely 14 after Q4 revisions), I and fellow CNBC viewers have been forced to endure the incessant talk of the “New Normal” of weak economic growth to infinity. Actual results have turned out quite differently than the duet’s cryptic and verbose predictions, which have piled up over their seemingly non-stop media interview schedule. Despite the doomsday rhetoric from the bond brothers, El-Erian and Gross have witnessed a more than doubling in equity prices, which has soundly trounced the performance of bonds over the last four years.

After being mistaken for such a long period, certainly the PIMCO marketing machine would revise their pessimistic outlook, right? Wrong. In true biased fashion, El-Erian cannot admit defeat. Just this week, El-Erian argues stocks are artificially high due to excessive liquidity pumped into the financial system by central banks (see video below). I’m the first one to admit Federal Reserve Chairman Ben Bernanke is explicitly doing his best to force investors into risky assets, but doesn’t generational low interest rates help bond prices too? Apparently that mathematical fact has escaped El-Erian’s bond script.

El-Erian’s buddy, Bill Gross, can’t help himself from jumping on the stock rain parade either. Just six weeks ago Gross followed the bond-pumping playbook by making another dour prediction that the market would rise less than 5% in 2013. Unfortunately for Gross, his crystal ball has also been a little cloudy of late, with the S&P 500 index already up more than +6.5% this year. Since doomsday outlooks are what keeps the $2 trillion PIMCO machined primed, it’s no surprise we hear about the never-ending gloom. For those keeping score at home, let’s please not forget Bill Gross’s infamously wrong Dow 5,000 prediction (see article).

PIMCO Smoke & Mirrors: Stock Funds with NO Stocks

Just when I thought I had seen it all, I came across PIMCO’s Equity-Related funds. Never in my career have I seen “equity” mutual funds that invest solely in “bonds.” Well, apparently PIMCO has somehow creatively figured out how to create stock funds without investing in stocks. I guess that is one strategy for a bond-centric company of getting into the equity fund market? This is either ingenious or bordering on the line of criminal. I fall into the latter camp. How the SEC allows the world’s largest bond company to deceivingly market billions in bond-filled stock funds to individual investors is beyond me. After innocent people got fleeced by unscrupulous mortgage brokers and greedy lenders, in this Dodd-Frank day and age, I can’t help but wonder how PIMCO is able to solicit a StockPlus Fund that has 0% invested in common stocks. You can judge for yourself by reviewing their equity-related funds on their website (see also chart below):

PIMCO Active Equity Funds Struggle

With more than 99% of PIMCO’s $2 trillion in assets under management locked into bonds, company executives have made a half-hearted effort of getting into the equity markets, even though they’ve enjoyed high-fiving each other during the three-decade-long bond bull market (see Downhill Marathon Machine). In hopes of diversifying their bond-heavy revenue stream, in 2009 they hired the head of the high-profile $700 billion, government TARP program (Neil Kashkari). Subsequently, PIMCO opened its first set of actively managed funds in 2010. Regrettably for PIMCO, the sledding has been quite tough. In 2012, all six actively managed equity funds lagged their benchmarks. Moreover, just a few weeks ago, Kashkari their rock star hire decided to quit and pursue a return to politics.

Mohamed El-Erian and Bill Gross have never been camera shy or bashful about bashing stocks. PIMCO has virtually all their bond eggs in one basket and their leaderless equity division is struggling. What’s more, like some car salesmen, they have had a creative way of describing the facts. If it’s a Chevy or unbiased advice you’re looking for, I recommend you steer clear from Buick salesmen and PIMCO headquarters.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing SCM had no direct position in PIMCO funds, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Uncertainty: Love It or Hate It?

Uncertainty is like a fin you see cutting through the water – many people are uncertain whether the fin sticking out of the water is a great white shark or a dolphin? Uncertainty generates fear, and fear often produces paralysis. This financially unproductive phenomenon has also reared its ugly fin in the investment world, which has led to low-yield apathy, and desensitization to both interest rate and inflation risks.

The mass exodus out of stocks into bonds worked well for the very few that timed an early 2008 exit out of equities, but since early 2009, the performance of stocks has handily trounced bonds (the S&P has outperformed the bond market (BND) by almost 100% since the beginning of March 2009, if you exclude dividends and interest). While the cozy comfort of bonds has suited investors over the last five years, a rude awakening awaits the bond-heavy masses when the uncertain economic clouds surrounding us eventually lift.

The Certainty of Uncertainty

What do we know about uncertainty? Well for starters, we know that uncertainty cannot be avoided. Or as former Secretary of the Treasury Robert Rubin stated so aptly, “Nothing is certain – except uncertainty.”

Why in the world would one of the world’s richest and most successful investors like Warren Buffett embrace uncertainty by imploring investors to “buy fear, and sell greed?” How can Buffett’s statement be valid when the mantra we continually hear spewed over the airwaves is that “investors hate uncertainty and love clarity?” The short answer is that clarity is costly (i.e., investors are forced to pay a cherry price for certainty). Dean Witter, the founder of his namesake brokerage firm in 1924, addressed the issue of certainty in these shrewd comments he made some 78 years ago, right before the end of worst bear market in history:

“Some people say they want to wait for a clearer view of the future. But when the future is again clear, the present bargains will have vanished.”

Undoubtedly, some investors hate uncertainty, but I think there needs to be a distinction between good investors and bad investors. Don Hays, the strategist at Hays Advisory, straightforwardly notes, “Good investors love uncertainty.”

When everything is clear to everyone, including the novice investing cab driver and hairdresser, like in the late 1990s technology bubble, the actual risk is in fact far greater than the perceived risk. Or as Morgan Housel from Motley Fool sarcastically points out, “Someone remind me when economic uncertainty didn’t exist. 2000? 2007?”

What’s There to Worry About?

I’ve heard financial bears argue a lot of things, but I haven’t heard any make the case there is little uncertainty currently. I’ll let you be the judge by listing these following issues I read and listen to on a daily basis:

- Fiscal cliff induced recession risks

- Syria’s potential use of chemical weapons

- Iran’s destabilizing nuclear program

- North Korean missile tests by questionable new regime

- Potential Greek debt default and exit from the eurozone

- QE3 (Quantitative Easing) and looming inflation and asset bubble(s)

- Higher taxes

- Lower entitlements

- Fear of the collapse in the U.S. dollar’s value

- Rigged Wall Street game

- Excessive Dodd-Frank financial regulation

- Obamacare

- High Frequency Trading / Flash Crash

- Unsustainably growing healthcare costs

- Exploding college tuition rates

- Global warming and superstorms

- Etc.

- Etc.

- Etc.

I could go on for another page or two, but I think you get the gist. While I freely admit there is much less uncertainty than we experienced in the 2008-2009 timeframe, investors’ still remain very cautious. The trillions of dollars hemorrhaging out of stocks into bonds helps make my case fairly clear.

As investors plan for a future entitlement-light world, nobody can confidently count on Social Security and Medicare to help fund our umbrella-drink-filled vacations and senior tour golf outings. Today, the risk of parking your life savings in low-rate wealth destroying investment vehicles should be a major concern for all long-term investors. As I continually remind Investing Caffeine readers, bonds have a place in all portfolios, especially for income dependent retirees. However, any truly diversified portfolio will have exposure to equities, as long as the allocation in the investment plan meshes with the individual’s risk tolerance and liquidity needs.

Given all the uncertain floating fins lurking in the economic background, what would I tell investors to do with their hard-earned money? I simply defer to my pal (figuratively speaking), Warren Buffett, who recently said in a Charlie Rose interview, “Overwhelmingly, for people that can invest over time, equities are the best place to put their money.” For the vast majority of investors who should have an investment time horizon of more than 10 years, that is a question I can answer with certainty.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs) including BND, but at the time of publishing SCM had no direct positions in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Rates Dance their Way to a Floor

The globe is awash in debt, deficits are exploding, and the Euro is about to collapse…right? Well, then why in the heck are six countries out of the G-7 seeing their 10-year sovereign debt trade at 2.5% or lower on a consistent downward long-term trajectory? What’s more, three of the six countries witnessing their rates plummet are from Europe, despite pundits continually calling for the demise of the eurozone.

Here is a snapshot of 10-year sovereign debt yields for the majority of the G-7 countries over the last few decades:

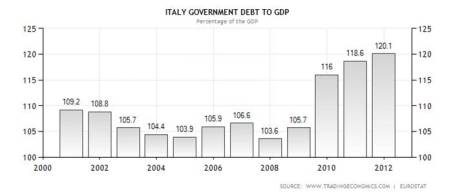

The sole G-7 member missing from the bond yield charts above? Italy. Although Italy’s deficits are not massive (Italy actually has a smaller deficit than U.S. as % of GDP: 3.9% in 2011), its Debt/GDP ratio has been large and rising (see chart below):

As the globe has plodded through the financial crisis of 2008-2009, investors have flocked to the perceived stability of these larger developed countries’ bonds, even if they are merely better homes in a bad neighborhood right now. PIMCO likes to call these popular sovereign bonds, “cleaner dirty shirts.” Buying sovereign debt from these less dirty shirt countries, without sensitivity to price or yield, has been a lucrative trade that has worked consistently for quite some time. Now, however, with sovereign bond yields rapidly approaching 0%, it becomes mathematically impossible to fall lower than the bottom rate floor that developed countries are standing on.

Bond bears have been wrong about the timing of the inevitable bond price reversal, myself included, but the bulls are skating on thinner and thinner ice as rates continue moving lower. The bears may prolong their bragging rights if interest rates continue downward, or persist at these lower levels for extended periods of time. Eventually the “buy the dips” mentality dies, as we so poignantly experienced in 2000 when the technology dips turned into outright collapse.

The Flies in the Bond Binging Ointment

As long as equities remain in a trading range, the “risk-off” bond binging arguments will continue holding water. If corporate earnings remain elevated and stock buybacks carry on, the pain of deflating real returns will eventually become too unbearable for investors. As the insidious rising prices of energy, healthcare, food, leisure, and general costs keep eating away everyone’s purchasing power, even the skeptics will become more impatient with the paltry returns they are currently earning. Earning negative real returns in Treasuries, CDs, money market accounts, and other conservative investments, is not going to help millions of Americans meet their future financial goals. Due to the laundry list of global economic concerns, large swaths of investors are still running and hiding, but this is not a sustainable strategy longer term. The danger from these so-called “safe,” low-yielding asset classes is actually riskier than the perceived risk, in my view.

With that said, I’ve consistently held there are a subset of investors, including a significant number of my Sidoxia Capital Management clients, who are in the later stage of retirement and have a rational need for capital preservation and income generating assets (albeit low yielding). For this investor segment, portfolio construction is not executed due to an opportunistic urge of chasing potential outsized rates of return, but more-so out of necessity. Shorter time horizons eliminate the prudence of additional equity exposure because of the extra associated volatility. Unfortunately, many of the 76 million Baby Boomers will statistically live another 20 – 30 years based on actuarial life expectations and under-save, so the risks of being too conservative can dramatically outweigh the risks of increasing equity exposure. This is all stated in the context of stocks paying a higher yield than long-term Treasuries – the first time in a generation.

Short-term risks and uncertainties remain high, with Greek election outcomes unknown; a U.S. Presidential election in flux; and an impending domestic fiscal cliff that needs to be addressed. But with interest rates accelerating towards 0% and investors’ fright-filled buying of pricey, low-yielding asset classes, many of these risks are already factored into current valuations. As it turns out, the pain of panic can be more detrimental than being stuck in over-priced assets, driven by rates dancing near an absolute floor.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

The Pleasure/Pain Principle

The financial crisis of 2008-2009 was painful, not to mention the Flash Crash of 2010; the Debt Ceiling / Credit Downgrade of 2011; and the never-ending European saga. Needless to say, these and other events have caused pain akin to burning one’s hand on the stove. This unpleasant effect has rubbed off on investors.

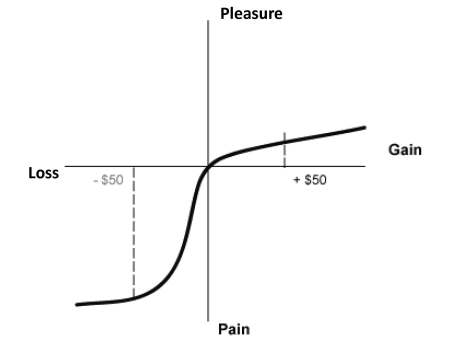

Admitting one has a problem is half the battle of conquering a challenge. A key challenge for many investors is understanding the crippling effects fear can have on personal investment decisions. While there are certainly investors who constantly see financial markets through rose-colored glasses (my glasses I argue are only slightly tinted), Nobel Prize winner Daniel Kahneman and his partner Amos Tversky understand the pain of losses can be twice as painful as the pleasure experienced through gains (see diagram below).

Said a little differently, faced with sure gain, most investors are risk-averse, but faced with sure loss, investors prefer risk-taking. Don’t believe me? Well, let’s take a look at some of Kahneman and Tversky’s behavioral finance work on what they called “Prospect Theory” (1979) – the analysis of decisions made under various risk scenarios.

In one specific experiment, Kahneman and Tversky presented groups of subjects with a number of problems. One group of subjects was presented with this problem:

Problem #1: In addition to whatever you own, you have been given $1,000. You are now asked to choose between:

A. A sure gain of $500

B. A 50% change to gain $1,000 and a 50% chance to gain nothing.

Another group of subjects was presented with this problem:

Problem #2: In addition to whatever you own, you have been given $2,000. You are now asked to choose between:

A. A sure loss of $500

B. A 50% chance to lose $1,000 and a 50% chance to lose nothing.

In the first group, 84% of the respondents chose A and in the second group, 69% of the respondents chose B. Both problems are identical in terms of the net cash outcomes ($1,500 for Answer A, and 50% chance of $1,000 or $2,000 for Answer B). Nonetheless, due the different “loss phrasing” in each question, Answer A sounds more appealing in Question #1, and Answer B sounds more appealing in Question #2. The results are irrational, but investors have been known to be illogical too.

In practical trading terms, the application of “Prospect Theory” often manifests itself via the pain principle. Due to loss aversion, investors tend to cash in gains too early and fail to allow their winning stocks to run higher for a long enough period.

The framing of the Kahneman and Tversky’s questions is no different than the framing of political and economic issues by the various media outlets (see Pessimism Porn). Fear can generate advertising revenue and fear can also push investors into paralysis (see the equity fund flow data in Fund Flows Paradox).

Greed can sell in the financial markets too. The main sources of financial market greed have been primarily limited to bonds, cash, and gold. If you caught those trends early enough, you are happy as a clam, but like most things in life, nothing lasts forever. The same principle applies to financial markets, and over time, capital in today’s winners will slowly transition into today’s losers (i.e., tomorrow’s winners).

A healthy amount of fear is healthy, but correctly understanding the dynamics of the “Pleasure/Pain Principle” can turn those fearful tears into profitable pleasure.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds (including fixed income ETFs), but at the time of publishing SCM had no direct position in GLD, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Cash Security Blanket Turns Into Tourniquet

Article is an excerpt from Sidoxia Capital Management’s April 2012 newsletter. Subscribe on right side of page.

That warm safety blanket of cash that millions of Americans have clutched on to during the 2008-09 financial crisis; the 2010 “Flash Crash”; and the 2011 U.S. credit downgrade felt cozy during the bumpy ride we experienced over the last three years. Now with domestic stocks (S&P 500) up +12% in the first quarter of 2012, that same comfy blanket of CDs, money market, and checking accounts is switching into a painful tourniquet, cutting off the lucrative blood and oxygen supply to millions of Americans’ future retirement plans.

Earning next to nothing by stuffing your money under the mattress (0.7% average CD rate – Bankrate.com) isn’t going to make many financial dreams a reality. The truth of the matter is that due to inflation (running +2% to +3% per year), blanket holders are losing about -2% per year in the true value of their savings.

Your Choice: 3 Years or 107 years?

If you like to accumulate money, would you prefer doubling your money in 3 years or 107 years? Although the S&P 500 has more than doubled over the last three years, based on fund flows data and cash balances at the banks, apparently more individuals prefer waiting until the year 2119 (107 years from now) for their money to double – SEE CHART BELOW.

Obviously the massive underperformance of CDs cherry picks the time-period a bit, given the superb performance of stocks from 2009 – 2012 year-to-date. Over 1999-2012 stock performance hasn’t been as spectacular, but what we do know is that despite the lackluster performance of stocks over the last 12 years, corporate profits have about doubled in a similar timeframe, making equity prices that much more attractive relative to 1999.

With the economy and employment picture improving, some doomsday scenarios have temporarily been put on the backburner. As the recovery has gained some steam, many people are opening their bank statements with the painful realization, “I just made $31.49 on my checking maximizer account last year! Wow, how incredible…I can now go out and buy a half-tank of gas.” Never mind that healthcare premiums are exploding, food costs are skyrocketing, and that vacation you were planning is now out of reach. If you’re a mega-millionaire, perhaps you can make these stingy rates work for you, but for most of the other people, successful retirements will require more efficient use of their investment dollars. Or of course you can always work at Wal-Mart (WMT) as a greeter in your 80s.

Rationalizing with a Teen

Some people get it and some don’t. Trying to time the market, by getting in and out at the right times is a losing battle (see Getting Off the Market Timing Treadmill). Even the smartest professionals in the industry have little accuracy and cannot consistently predict the direction of the markets. Rationalizing the ups and downs of the financial markets is equivalent to rationalizing the actions of a teenager. Sometimes the outcomes are explainable, but most of the times they are not.

What an astute investor does know is that higher long-term returns come with higher volatility. So while the last four years have been a bumpy ride for investors, this is nothing new for an experienced investor who has studied the history of financial markets. There have been a dozen or so recessions since World War II, and we’ll have a dozen or so more over the next 50-60 years. Wars, banking crises, currency crises, and political turmoil have been a constant over history. Despite all these setbacks, the equity markets have climbed over +1,300% over the last 30 years or so. The smartest financial minds on the planet (e.g., the Ben Bernankes and Alan Greenspans of the world) haven’t been able to figure it out, so if they couldn’t do it, how is an average Joe supposed to be able to time the market? The answer is nobody can predict the direction of the market reliably.

As my clients and Investing Caffeine followers know, for those individuals with adequate savings and shorter time horizons, much of this conversation is irrelevant. However, based on our country’s low savings rate and the demographics of longer Baby Boomer life expectancies, most individuals can’t afford to stuff all their money under the mattress. As famous investor Sir John Templeton stated, “The only way to avoid mistakes is not to invest – which is the biggest mistake of all.” Earning 0.7% on your nest egg is difficult to call investing.

Ignoring the Experts

Why is the investing game so difficult? For starters, individuals are constantly bombarded by so-called experts through television, radio, and newspapers. Not only did Federal Reserve Chairmen Alan Greenspan and Ben Bernanke get the economy, financial markets, and housing markets wrong, the most powerful and smart financial institution CEOs were dead wrong as well. Look no further than Lehman Brothers (Dick Fuld), Citigroup Inc. (Chuck Prince), and American International Group (Martin Sullivan), which were believed to house some of the shrewdest executives – they too completely missed the financial crisis.

Rather than listening to shoddy predictions from pundits who have little to no investing experience, it makes more sense to listen to successful long-term investors who have survived multiple investment cycles and lived to tell the tale. Those people include the great fund manager Peter Lynch who said it is better to “assume the market is going nowhere and invest accordingly,” rather than try to time the market.

What You Hear

As the market has more than doubled over the last 37 months, here are some clouds of pessimism that these same shoddy economists, strategists, and analysts have described for investors:

* Europe and Greece’s impending fiscal domino collapse

* Excessive money printing at the Federal Reserve through quantitative easing and other programs

* Imminent government disintegration due to unresolved structural debts and deficits

* Elevated unemployment rates and pathetic job creation statistics

* Rigged high frequency trading and “Flash Crash”

* Credit downgrade and political turmoil in Washington

* Looming Chinese real estate bubble and subsequent hard economic landing

Unfortunately, many investors got sucked up in these ominous warnings and missed most, if not all, of the recent doubling in equity markets.

What You Don’t Hear

What you haven’t heard from the popular press are the following headlines:

* 10 consecutive quarters of GDP growth

* Record corporate profits and profit margins

* Equity valuations attractively priced below 50-year average (14.4 < 16.6 via Calafia Beach Pundit)

* Rising dividends with yields approaching 3%, if you consider recent bank announcements

* Record low interest rates and moderate inflation make earnings streams and dividends that much more valuable

* Four million new jobs created over the last three years

* S&P Smallcap near all-time highs (21 years); S&P Midcap index near all-time highs (20 years); NASDAQ is at 11-year highs; Dow Jones Industrials and S&P 500 near 4-year-highs.

* Record retail sales with a consumer that has reduced household debt

Given the massive upward run in the stock market over the last few years (and a complacent short-term VIX reading of 15), stocks are ripe for a breather. With that said, I would advise any blanket holders to not get too comfy with that money decaying away in a CD, money market, or savings account. Waiting too long may turn that security blanket into a tourniquet – forcing investors to amputate a portion of their future retirement savings.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds and WMT, but at the time of publishing SCM had no direct position in C, AIG, RATE, Lehman Brothers, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.