Don’t Fear the Free Trade Boogeyman

Are you having trouble falling asleep because of a ghostly nightmare? Donald Trump, along with a wide range of pundits and investors have been afraid of globalization and the free trade boogeyman. Donald Trump may or may not win the presidential election, but regardless, his inflammatory rhetoric regarding trade is way off base.

Free trade has been demonized as a job destroyer, however history paints a different picture. I have written on the subject before (see also Invisible Benefits of Free Trade), but with Americans digesting the current debates and the election only a month away, let me make a couple of key points.

Standard of Living Benefits: For centuries, the advantages of free trade and globalization have lifted the standards of living for billions of people. There is a reason the World Trade Organization (WTO) has united more than 160 countries without one country exiting since the global trade group began in 1948. Trade did not suddenly stop working when the Donald began lashing out against NAFTA, TPP and Oreo cookies. Trump rails against trade despite Trump ties being made in China.

Job losses are easy to identify (like the Oreo jobs moved to Mexico from Chicago), but most trade benefits are often invisible to the untrained eye. As Dan Ikenson of the Cato Institute explains, if low-wage labor was not used offshore to manufacture products sold to Americans, many amazing and spectacular products and services would become unaffordable for the U.S. mass markets. Thanks to cheaper foreign imports, not only can a wider population buy iPhones and use services like Uber and Airbnb, but consumers will have extra discretionary income resources that can be redeployed into savings. Alternatively, the extra savings could be spent on other goods and services to help spur U.S. economic growth in various sectors of our nation.

It doesn’t make for a nice, quick political soundbite, but Ikenson highlights,

“The benefits of trade come from imports, which deliver more competition, greater variety, lower prices, better quality, and new incentives for innovation.”

Strong Companies Hire and Grow: Plain and simply, profitable businesses hire employees, and money-losing companies fire employees. Business success boils down to competitiveness. If your product is not better and/or cheaper than competitors, then you will lose money and be forced into stagnation, or worse, be forced to fire employees or shut down your business. Free trade affords businesses the opportunity to improve the cost or quality of a product. Take Apple Inc. (AAPL) for example, the company’s ability to build a global supply chain has allowed the company to offer products and services to more than 1 billion users. If Apple was forced to manufacture exclusively in the U.S., the company’s sales and profits would be lower, and so too would the number of U.S. Apple employees.

Fortunately, no matter who gets elected president, if the rhetoric against free trade reaches a feverish pitch, investors can rest assured that the president’s powers to implement widespread tariffs and rip up longstanding trade deals is limited. He/she will still be forced to follow the authority of Congress, which still controls the nuts and bolts of our economy’s trade policies. In other words, there is nothing to fear…even not the free trade boogeyman.

Other Trade Related Articles on Investing Caffeine:

Jumping on the Globalization Train

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs) and AAPL, MDLZ, but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Fall is Here: Change is Near

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (October 1, 2016). Subscribe on the right side of the page for the complete text.

Although the fall season is here and the leaf colors are changing, there are a number of other transforming dynamics occurring this economic season as well. The S&P 500 index may not have changed much this past month (down -0.1%), but the technology-laden NASDAQ index catapulted higher (+1.9% for the month and +6.0% for 2016).

With three quarters of the year now behind us, beyond experiencing a shift in seasonal weather, a number of other changes are also coming. For starters, there’s no ignoring the elephant in the room, and that is the presidential election, which is only weeks away from determining our country’s new Commander in Chief. Besides religion, there are very few topics more emotionally charged than politics – whether you are a Republican, Democrat, Independent, Libertarian, or some combination thereof. Even though the first presidential debate is behind us, a majority of voters are already set on their candidate choice. In other words, open-minded debate on this topic can be challenging.

Hearing critical comments regarding your favorite candidate are often interpreted in the same manner as receiving critical comments about a personal family member – people often become defensive. The good news, despite the massive political divide currently occurring in the country and near-record low politician approval ratings in Congress , politics mean almost nothing when it comes to your money and retirement (see also Politics & Your Money). Regardless of what politicians might accomplish (not much), individuals actually have much more control over their personal financial future than politicians.

While inaction may rule the day currently, more action generally occurs during a crisis – we witnessed this firsthand during the 2008-2009 financial meltdown. As Winston Churchill famously stated,

“You can always count on Americans to do the right thing – after they’ve tried everything else.”

Political discourse and gridlock are frustrating to almost everyone from a practical standpoint (i.e., “Why can’t these idiots get something done in Washington?!”), however from an economic standpoint, gridlock is good (see also Who Said Gridlock is Bad?) because it can keep a responsible lid on frivolous spending. Educated individuals can debate about the proper priorities of government spending, but most voters agree, maintaining a sensible level of spending and debt should be a bipartisan issue.

From roughly 2009 – 2014, you can see how political gridlock has led to a massive narrowing in our government’s deficit levels (chart below) – back to more historical levels.This occurred just as rising frustration with Washington has been on the rise.

The Fed: Rate Revolution or Evolution?

Besides the changing season of politics, the other major area of change is Federal Reserve monetary policy. Even though the Fed has only increased interest rates once over the last 10 years, and interest rates are at near-generational lows, investors remain fearful. There is bound to be some short-term volatility if interest rates rise to 0.50% – 0.75% in December, as currently expected. However, if the Fed continues at its current snail’s pace, it won’t be until 2032 before they complete their rate hike cycles.

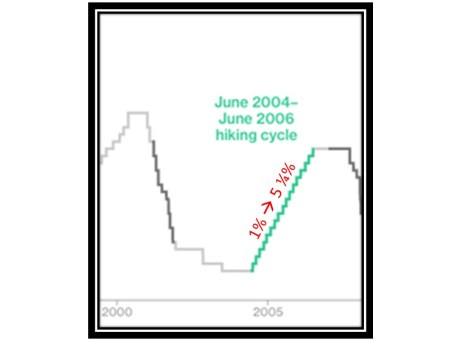

We can put the next rate increase into perspective by studying history. More specifically, the Fed raised interest rates 17 times from 2004 – 2006 (see chart below). Fortunately over this same time period, the world didn’t end as the Fed increased interest rates from 1.00% to 5.25% (stocks prices actually rose around +11%). The same can be said today – the world won’t likely end, if interest rates rise from 0.50% to 0.75% in a few months.

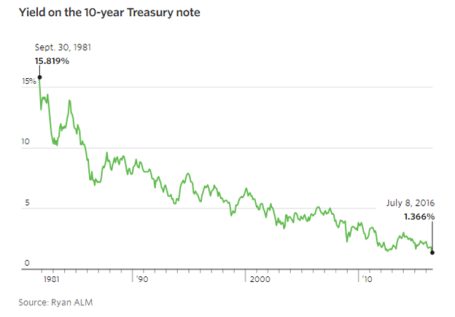

The next question becomes, why are interest rates so low? There are many reasons and theories, but a few of the key drivers behind low rates include, slower global economic growth, low inflation, high demand for low-risk assets, technology, and demographics. I could devote a whole article to each of these factors, and indeed in many cases I have, but suffice it to say that there are many reasons beyond the oversimplified explanation that artificial central bank intervention has led to a 35 year decline in interest rates (see chart below).

Change is a constant, and with fall arriving, some changes are more predictable than others. The timing of the U.S. presidential election outcome is very predictable but the same cannot be said for the timing of future interest rate increases. Irrespective of the coming changes and the related timing, history reminds us that concerns over politics and interest rates often are overblown. Many individuals remain overly-pessimistic due to excessive, daily attention to gloomy and irrelevant news headlines. Thankfully, stock prices are paying attention to more important factors (see Don’t Be a Fool) and long-term investors are being rewarded with record high stock prices in recent weeks. That’s the type of change I love.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Invest or Die

Seventy-six million Baby Boomers are earning near 0% (or negative rates) and aren’t getting any younger in the process, which is forcing them and others to decide…invest or die. The risk of outliving your savings is becoming a larger reality these days. Demographics and economics are dictating that our aging population is living longer and earning less due to generationally low interest rates.

Richard Fisher, the former Dallas Federal Reserve president, understands these looming dynamics. Fisher has identified how low-interest rates are increasing investor discontent by pushing consumers to save more in order to meet retirement needs. The unintended consequence from low rates, he said, is “you’re going to have to save a hell of a lot more before you consume.”

Besides saving, the other option investors have is to lower your standard of living. For example, you could continually eat mac & cheese and sleep in a tent – that is indeed one way you could save money. However, your kids and/or desired lifestyle may make this way of life unpalatable for all. Rather, the proper approach to achieving a comfortable standard of living requires you to invest more efficiently and prudently.

What a lot of individuals fail to understand is that accepting too much risk can be just as dangerous as being too conservative, over the long run. Case in point, depositing your savings into a CD at current interest rates (near 0%) is the equivalent of burning your cash, as any income produced is overwhelmed by the deleterious effects of inflation. It would take more than a lifetime of CD interest income to equal equity returns earned over the last seven years. Since early 2009, stocks have more than tripled in value.

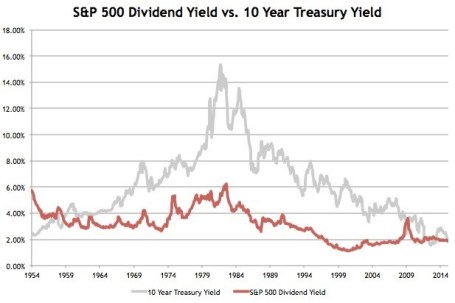

Given the prevailing economic and demographic trends, investors are slowly realizing the attractive income-producing nature of stocks relative to bonds. It has been a rare occurrence, but stocks, as measured by the S&P 500, continue to yield more than 10-Year Treasury Notes (2.0% vs. 1.6%, respectively) – see chart below. The picture for bonds looks even worse in many international markets, where $13 trillion in bonds are yielding negative interest rates. Unlike bonds, which generally pay fixed coupon payments for years at a time, stocks overall have historically increased their dividend payouts by approximately 6% annually.

Source: Avondale Asset Management

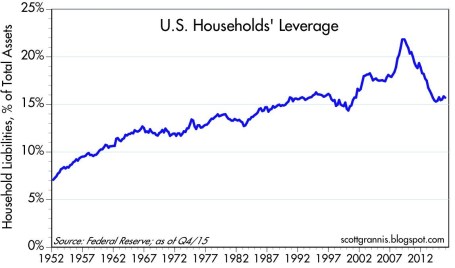

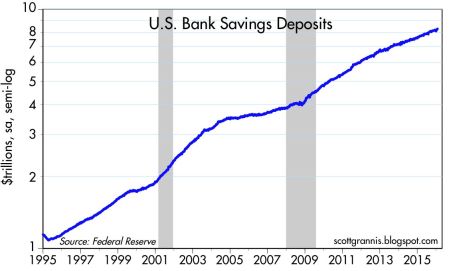

With a scarcity of attractive investment alternatives available, investors will eventually be forced to adopt higher levels of equity risk, like it or not. However, this dynamic has yet to happen. Currently, actions are speaking louder than words, and as you can see, risk aversion reigns supreme with Americans tucking over $8 trillion dollars under their mattress (see chart below), in the form of savings accounts, earning next to nothing and jeopardizing retirements.

Source: Calafia Beach Pundit

Even if you fall into the camp that believes rates are artificially low by central bank printing presses, that doesn’t mean every company is recklessly leveraging their balance sheets up to the hilt. Many companies are still scared silly from the financial crisis and conservatively managing every penny of expense, like a stingy retiree living on a fixed income. Thanks to this reluctance to spend and hire aggressively, profit margins are at/near record highs. This financial stewardship has freed up corporations’ ability to pay higher dividends and implement discretionary stock buybacks as means to return capital to shareholders.

With the dovish Fed judiciously raising interest rates – only one rate hike of 0.25% over a decade (2006 – 2016) – there are no signs this ultra-low interest rate environment is going to turn aggressively higher anytime soon. Until economic growth, inflation, and interest rates return with a vengeance, and the persistent investor risk aversion abates, it behooves all the cash hoarders to….invest or die!

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

EBITDA: Sniffing Out the Truth

Financial analysts are constantly seeking the Holy Grail when it comes to financial metrics, and to some financial number crunchers, EBITDA (Earnings Before Interest Taxes Depreciation and Amortization – pronounced “eebit-dah”) fits the bill. On the flip side, Warren Buffett’s right hand man Charlie Munger advises investors to replace EBITDA with the words “bullsh*t earnings” every time you encounter this earnings metric. We’ll explore the good, bad, and ugly attributes of this somewhat controversial financial metric.

The Genesis of EBITDA

The origin of the EBITDA measure can be traced back many years, and rose in popularity during the technology boom of the 1990s. “New Economy” companies were producing very little income, so investment bankers became creative in how they defined profits. Under the guise of comparability, a company with debt (Company X) that was paying high interest expenses could not be compared on an operational profit basis with a closely related company that operated with NO debt (Company Z). In other words, two identical companies could be selling the same number of widgets at the same prices and have the same cost structure and operating income, but the company with debt on their balance sheet would have a different (lower) net income. The investment banker and company X’s answer to this apparent conundrum was to simply compare the operating earnings or EBIT (Earnings Before Interest and Taxes) of each company (X and Z), rather than the disparate net incomes.

The Advantages of EBITDA

Although there is no silver bullet metric in financial statement analysis, nevertheless there are numerous benefits to using EBITDA. Here are a few:

- Operational Comparability: As implied above, EBITDA allows comparability across a wide swath of companies. Accounting standards provide leniency in the application of financial statements, therefore using EBITDA allows apples-to-apples comparisons and relieves accounting discrepancies on items such as depreciation, tax rates, and financing choice.

- Cash Flow Proxy:Since the income statement traditionally is the financial statement of choice, EBITDA can be easily derived from this statement and provides a simple proxy for cash generation in the absence of other data.

- Debt Coverage Ratios:In many lender contracts, certain debt provisions require specific levels of income cushion above the required interest expense payments. Evaluating EBITDA coverage ratios across companies assists analysts in determining which businesses are more likely to default on their debt obligations.

The Disadvantages of EBITDA

While EBITDA offers some benefits in comparing a broader set of companies across industries, the metric also carries some drawbacks.

- Overstates Income: To Charlie Munger’s point about the B.S. factor, EBITDA distorts reality by measuring income before a bunch of expenses. From an equity holder’s standpoint, in most instances, investors are most concerned about the level of income and cash flow available AFTERaccounting for all expenses, including interest expense, depreciation expense, and income tax expense.

- Neglects Working Capital Requirements: EBITDA may actually be a decent proxy for cash flows for many companies, however this profit measure does not account for the working capital needs of a business. For example, companies reporting high EBITDA figures may actually have dramatically lower cash flows once working capital requirements (i.e., inventories, receivables, payables) are tabulated.

- Poor for Valuation: Investment bankers push for more generous EBITDA valuation multiples because it serves the bankers’ and clients’ best interests. However, the fact of the matter is that companies with debt or aggressive depreciation schedules do deserve lower valuations compared to debt-free counterparts (assuming all else equal).

Wading through the treacherous waters of accounting metrics can be a dangerous game. Despite some of EBITDA’s comparability benefits, and as much as bankers and analysts would like to use this very forgiving income metric, beware of EBITDA’s shortcomings. Although most analysts are looking for the one-size-fits-all number, the reality of the situation is a variety of methods need to be used to gain a more accurate financial picture of a company. If EBITDA is the only calculation driving your analysis, I urge you to follow Charlie Munger’s advice and plug your nose.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

The Sky is Falling?

Investors reacted like the sky was falling on Friday. Commentators mostly blamed the -400 point decline in the Dow on heightened probabilities for a September rate hike by Janet Yellen and her fellow Federal Reserve colleagues. Geopolitical concerns over a crazy dictator in North Korea with nuclear weapons were identified as contributing factors to frazzled nerves.

The real question should be, “Are these stories complete noise, or should I pay close attention?” For the vast majority of times, the response to questions like these should be “yes”, the media headlines are mere distractions and you should simply ignore them. During the last rate hike cycle from mid-2004 to mid-2006, guess how many times the Fed raised rates? Seventeen times! And over those 17 rate hikes, stocks managed to respectably rise over 11%.

So far this cycle, Yellen and the Fed have raised interest rates one time, and the one and only hike was the first increase in a decade. Given all this data, does it really make sense to run in a panic to a bunker or cave? Whether the Fed increases rates by 0.25% during September or Decemberis completely irrelevant.

If we look at the current situation from a slightly different angle, you can quickly realize that making critical investment decisions based on short-term Federal Reserve actions would be foolish. Would you buy or sell a house based solely on this month’s Fed policy? For most, the answer is an emphatic “no”. The same response should hold true for stocks as well. The real reason anyone should consider buying any type of asset, including stocks, is because you believe you are paying a fair or discounted price for a stream of adequate future cash flows (distributions) and/or price appreciation in the asset value over the long-term.

The problem today for many investors is “short-termism.” This is what Jack Gray of Grantham, Mayo, Van Otterloo and Company had to say on the subject, “Excessive short-termism results in permanent destruction of wealth, or at least permanent transfer of wealth.” I couldn’t agree more.

Many people like to speculate or trade stocks like they are gambling in Las Vegas. One day, when the market is up, they buy. And the other day, when the market is down, they sell. However, those same people don’t wildly speculate with short-term decision-making when they buy larger ticket items like a lawn-mower, couch, refrigerator, car, or a house. They rationally buy with the intention of owning for years.

Yes, it’s true appliances, vehicles, and homes have utility characteristics different from other assets, but stocks have unique utility characteristics too. You can’t place leftovers, drive inside, or sit on a stock, but the long-term earnings and dividend growth of a diversified stock portfolio provides plenty of distinctive income and/or retirement utility benefits to a long-term investor.

You don’t have to believe me – just listen to investing greats like Warren Buffett:

“If you aren’t willing to own a stock for ten years, don’t even think about owning it for ten minutes. Put together a portfolio of companies whose aggregate earnings march upward over the years, and so also will the portfolio’s market value.”

The common sense test can also shed some light on the subject. If short-term trading, based on the temperature of headlines, was indeed a lucrative strategy, then the wealthiest traders in the world would be littered all over the Forbes 100 list. There are many reasons that is not the case.

Even though the Volatility Index (aka, “Fear Gauge” – VIX) spiked +40% in a single day, that does not necessarily mean stock investors are out of the woods yet. We saw similar volatility occur last August and during January and June of this year. At the same time, there is no need to purchase a helmet and run to a bunker…the sky is not falling.

Other related article: Invest with a Telescope…Not a Microscope

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Huh… Stocks Reach a Record High?

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (September 1, 2016). Subscribe on the right side of the page for the complete text.

The stock market hit all-time record highs again in August, but despite the +6.2% move in 2016 S&P 500 stock prices (and +225% since early 2009), investors continue to scratch their heads in confusion. Individuals continue to ask, “Huh, how can stocks be trading at or near record levels (+6% for the year) when Brexit remains a looming overhang, uncertainty surrounds the U.S. presidential election, global terrorist attacks are on the rise, negative interest rates are ruling the day, and central banks around the globe are artificially propping up financial markets (see also Fed Myths vs. Reality)? Does this laundry list of concerns stress you out? If you said “yes”, you are not alone.

As I’ve pointed out in the past, we live in a different world today. In the olden days, terrorist attacks, natural disasters, currency crises, car chases, bank failures, celebrity DUIs, and wars happened all the time. However, before the internet existed, people either never heard about these worries, or they just didn’t care (or both). Today, we live in a Twitter, Facebook, Instagram, Snapchat, society with 500+ cable channels, and supercomputers in the palm of our hands (i.e., smartphones) with more computing power than existed on the Apollo mission to the moon. In short, doom-and-gloom captures human attention and sells advertising, the status quo does not.

- Record corporate profits are on the rise

- Stabilizing value of the dollar

- Stabilizing energy and commodity prices

- Record low interest rates

- Skeptical investing public

Fortunately, the stock market pays more attention to these important dynamics, rather than the F.U.D. (Fear, Uncertainty, Doubt) peddled by the pundits, bloggers, and TV talking heads. Certainly, any or all of the previously mentioned positive factors could change or deteriorate over time, but for the time being, the bulls are winning.

Let’s take a closer look at the influencing components that are driving stock prices higher:

Record Corporate Profits

Source: Yardeni.com

Profits are the mother’s milk that feeds the stock market. During recessions, profits are starved and stock prices decline. On the flip side, economic expansions feed profits and cause share prices to rise. As you can see from the chart above, there was a meteoric rise in corporate income from 2009 – 2014 before a leveling off occurred from 2015 going into 2016. The major headwinds causing profits to flatten was a spike of 25% in the value of the U.S. dollar relative to the value of other global currencies, all within a relatively short time span of about nine months (see chart below).

Why is this large currency shift important? The answer is that approximately 40% of multinational profits derived by S&P 500 companies come from international markets. Therefore, when the value of the dollar rose 25%, the cost to purchase U.S. products and services by foreign buyers became 25% costlier. Selling dramatically higher cost goods abroad squeezed exports, which in turn led to a flattening of profits. Time will tell, but as I showed in the first chart, the slope of the profit line has resumed its upwards trajectory, which helps explain why stock prices have been advancing in recent months.

Besides a strong dollar, another negative factor that temporarily weakened earnings was the dramatic decline in oil prices (see chart below) Two years ago, WTI oil prices were above $100 per barrel. Today, prices are hovering around $45 per barrel. As you can imagine, this tremendous price decline has had a destructive impact on the profits of the energy sector in general. The good news is that after watching prices plummet below $30 earlier this year, prices have since stabilized at higher levels. In other words, the profits headwind has been neutralized, and if global economic growth recovers further, the energy headwind could turn into an energy tailwind.

Record Low Interest Rates

Stocks were not popular during the early 1980s. In fact, the Dow Jones Industrial Average traded at 2,600 in 1980 vs 18,400 today. The economy was much smaller back then, but another significant overhang to lower stock prices was higher interest rates (and inflation). Back in 1980, the Federal Funds target rate set by the Federal Reserve reached a whopping 20.0% versus today the same rate sits at < 0.5%.

Why is this data important? When you can earn a 16.99% yield in a one-year bank CD (see advertisement below), generally there is a much smaller appetite to invest in riskier, more volatile stocks. Another way to think about rates is to equate interest rates to the cost of owning stocks. When interest rates were high, the relative cost to own stocks was also high, so many investors liquidated stocks. It makes perfect sense that stocks in that high interest rate environment of 1980 would be a lot less attractive compared to a relatively safe CD that paid 17% over a 12-month period.

On the other hand, when interest rates are low, the relative cost of owning stocks is low, so it makes sense that stock prices are rising in this environment. Just like profits, interest rates are not static, and they too can change rapidly. But as long as rates remain near record lows, and profits remain healthy, stocks should remain an appealing asset class, especially given the scarcity of strong alternatives.

Skeptical Investing Public

The last piece of the puzzle to examine in order to help explain the head-scratching record stock prices is the pervasive skepticism present in the current stock market. How can Brexit, presidential election, terrorism, negative interest rates, and uncertain Federal Reserve policies be good for stock prices? Investing in many respects can be like navigating through traffic. When everyone wants to drive on the freeway, it becomes congested and a bad option, therefore taking side-streets or detours is a better strategy. The same principle applies to the stock market. When everyone wants to invest in the stock market (like during the late 1990s) or buy housing (mid-2000s), prices are usually too inflated, and shrewd investors decide to choose a different route by selling.

The same holds true in reverse. When nobody is interested in investing (see also, 18-year low in stock ownership and two trillion of stocks sold), then generally that is a strong sign that it is a good time to buy. Currently, skepticism is plentiful, for all the reasons cited above, which is a healthy investment indicator. Many individuals continue reading the ominous headlines and scratching their heads in confusion over today’s record stock prices. In contrast, at Sidoxia, we have opportunistically benefited from investors’ skepticism by discovering plenty of attractive opportunities for our clients. There’s no confusion about that.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs) and FB, but at the time of publishing had no direct position in TWTR or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

The Fed: Myths vs. Reality

Traders, bloggers, media talking heads, and pundits of all stripes went into a feverish sweat as they anticipated the comments of Federal Reserve Chairman Janet Yellen at the annual economic summit held in Jackson Hole, Wyoming. When Yellen, arguably the most dovish Fed Chairman in history, uttered, “I believe the case for an increase in the federal funds rate has strengthened in recent months,” an endless stream of commentators used this opportunity to spout out a never-ending stream of predictions describing the looming consequences of such a potential rate increase.

As I’ve stated before, the Fed receives both too much blame and too much credit for basically doing nothing except moving short-term interest rates up or down (and most of the time they do nothing). However, until the next Fed meeting in September (or later), we all will be placed in purgatory with non-stop speculation regarding the timing of the next rate increase.

The ludicrous and myopic analysis can be encapsulated by the recent article written by Pulitzer Prize-winning Fed writer Jon Hilsenrath, in his piece titled, The Great Unraveling: Fed Missteps Fueled 2016 Populist Revolt. Somehow, Hilsenrath is making the case that a group of 12 older, white people that meet eight times per year in Washington to discuss interest rate policy based on inflation and employment trends has singlehandedly created income inequality, and a populist movement leading to the rise of Donald Trump and Bernie Sanders.

While this Fed scapegoat explanation is quite convenient for the doom-and-gloomers (see The Fed Ate My Homework), it is way off base. I hate to break it to Mr. Hilsenrath, or other conspiracy theorists and perma-bears, but blaming a small group of boring bankers is an overly-simplistic “straw man” argument that does not address the infinite number of other factors contributing to our nation’s social and economic problems.

Ever since the bull market began in 2009, a pervasive skepticism and mistrust have kept the bull market climbing a wall of worry to all-time record levels. In the process, Hilsenrath et. al. have proliferated an inexhaustible list of myths about the Fed and its powers. Here are some of them:

Myth #1: The printing of money by the Fed has led to an artificially inflated stock market bubble and Ponzi Scheme.

- As stock prices have more than tripled over the last eight years to record levels, I’ve reveled in the hypocrisy of the “money printers” contention. First of all, the money printing derived from Quantitative Easing (QE) was originally cited as the sole reason for low, declining interest rates and the rising stock market. The money printing community vociferously predicted once QE ended, as it eventually did in 2014, interest rates would explode higher and stock market prices would collapse. What happened? The exact opposite occurred. Interest rates have gone to record low levels, and stock prices have advanced to all-time record highs.

Myth #2: The Fed controls all interest rates.

- Yes, the Fed can influence short-term interest rates through bond purchases and the targeting of the Federal Funds rate. However, the Fed has little-to-no influence on longer-term interest rates. The massive global bond market dwarfs the size of the Fed and U.S. stock market, and as such, large global financial institutions, pensions, hedge funds, and millions of other investors around the world have more influence on longer-term interest rates. The relationship between the 10-Year Treasury Note yield and the Fed’s monetary policy is loose at best.

Myth #3: The stock market will crash when the Fed raises interest rates.

- Well, we can see that logic is already wrong because the stock market is up significantly since the Fed raised interest rates in mid-December 2015. It is true that additional interest rate hikes are likely to occur in our future, but that does not necessarily mean stock prices are going to plummet. Commentators and bloggers are already panicking about a potential rate hike in September. Before you go jump out a window, let’s put this potential rate hike into context. For starters, let’s not forget the “dove of all doves,” Janet Yellen, is in charge and there has only been one rate increase 0f 0.25% over the last decade. As I point out in one of my previous articles (see Fed Fatigue), stock prices increased during the last rate hike cycle (2004 – 2006) when the Fed raised interest rates from 1.0% to 5.25% (the equivalent of another 16 rate hikes of 0.25%). The world didn’t end in 1994 either, when the Fed Funds rate increased from 3% to 6% over a short time frame, and stocks finished roughly flat for the period. Inflation levels remain at relatively low levels, and the Fed has moved less than 10% of recent hike cycles, so now is not the time to panic. Regardless of what the fear mongers say, the Fed and the bull market fairy godmother (Janet Yellen) will be measured and deliberate in its policies and will verify that any policy action is made into a healthy, strengthening economy.

Myth #4: Stimulative monetary policies instituted by the Fed and other central banks will lead to hyperinflation.

- Japan has done QE for decades, and QE efforts in the U.S. and Europe have also disproved the hyperinflation myth. While commentators, pundits, and journalists like to all point and blame Janet Yellen and the Fed for today’s so-called artificially low interest rates, one does not need to be a genius to realize there are other factors contributing to low rates and inflation. Declining interest rates and inflation are nothing new…this has been going on for over 35 years! (see chart below) As I have discussed previously the larger contributors to declining interest rates and disinflation are technology, globalization, and emerging markets (see Why 0% Interest Rates?). By next year, over one-third of the world’s population is expected to own a smartphone (2.6 billion people), the equivalent of a supercomputer in the palm of their hands. Mobile communication, robotics, self-driving cars, virtual & augmented reality, drones, artificial intelligence, drones, biotechnology, and other technologies are dramatically impacting productivity (i.e., downward pressure on prices and interest rates). These advancements, combined with the billions of low-priced workers in emerging markets, who are lifting themselves out of poverty, are contributing to the declining rate/inflation trend.

Source: Calafia Beach Pundit

As the next Fed meeting approaches, there is no doubt the airwaves and internet will be filled with alarmist calls from the likes of Jon Hilsenrath and other Fed-haters. Fortunately, more informed financial market observers will be able to filter out this noise and be able to separate out the many Fed and interest rate myths from the reality.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

The Invisible Benefits of Trade

Before the Brexit, 28 countries joined the European Union since its inception in 1957, without a single country leaving. The story is similar if you look at the World Trade Organization (WTO), which has witnessed more than 160 countries unite, without one country exiting since it began in 1948. Are the leaders of these countries idiots and blind to the benefits of trade and globalization? I think not.

For centuries, the advantages of free trade and globalization have lifted the standards of living for billions of people. However, pinpointing the timing or attributing the precise actions leading to these tremendous economic advantages is difficult to do because most trade benefits are often invisible to the naked eye.

Today, populist sentiment on both sides of the political aisle has demonized trade, whether referring to TPP (Trans-Pacific Partnership), NAFTA (North America Free Trade Agreement), trade with China, or announcements by corporations to manufacture goods internationally.

Although it would be naïve to adopt a stance that there are no negative consequences to globalization (e.g., lost American jobs due to offshoring), myopically focusing on job displacement is only half the equation.

While I can attempt to articulate the economic costs and benefits of free trade, and I’ve tried (see Productivity & Trade), Dan Ikenson of the Cato Institute explains it much better than I can. Here is a more eloquent synopsis of free trade (hat-tip: Scott Grannis):

“The case for free trade is not obvious. The benefits of trade are dispersed and accrue over time, while the adjustment costs tend to be concentrated and immediate. To synthesize Schumpeter and Bastiat, the “destruction” caused by trade is “seen,” while the “creation” of its benefits goes “unseen.” We note and lament the effects of the clothing factory that shutters because it couldn’t compete with lower-priced imports. The lost factory jobs, the nearby businesses on Main Street that fail, and the blighted landscape are all obvious. What is not so easily noticed is the increased spending power of the divorced mother who has to feed and clothe her three children. Not only can she buy cheaper clothing, but she has more resources to save or spend on other goods and services, which undergirds growth elsewhere in the economy.

Consider Apple. By availing itself of lowskilled, low-wage labor in China to produce small plastic components and to assemble its products, Apple may have deprived U.S. workers of the opportunity to perform that low-end function in the supply chain. But at the same time, that decision enabled iPods and then iPhones and then iPads to be priced within the budgets of a large swath of consumers. Had all of the components been produced and all of the assembly performed in the United States — as President Obama once requested of Steve Jobs — the higher prices would have prevented those devices from becoming quite so ubiquitous, and the incentives for the emergence of spin-off industries, such as apps, accessories, Uber, and AirBnb, would have been muted or absent.

But these kinds of examples don’t lend themselves to the political stump, especially when the campaigns put a premium on simple messages. This is the burden of free traders: Making the unseen seen. It is this asymmetry that explains much of the popular skepticism about trade, as well as the persistence of often repeated fallacies.

The benefits of trade come from imports, which deliver more competition, greater variety, lower prices, better quality, and new incentives for innovation. Arguably, opening foreign markets should be an aim of trade policy because larger markets allow for greater specialization and economies of scale, but real free trade requires liberalization at home. The real benefits of trade are measured by the value of imports that can be purchased with a unit of exports — our purchasing power or the so-called terms of trade. Trade barriers at home raise the costs and reduce the amount of imports that can be purchased with a unit of exports.

Protectionism benefits producers over consumers; it favors big business over small business because the cost of protectionism is relatively small to a bigger company; and, it hurts lower-income more than higher-income Americans because the former spend a higher proportion of their resources on imported goods.

…Even if there were a President Trump or President Sanders, rest assured that the Congress still has authority over the nuts and bolts of trade policy. The scope for presidential mischief, such as unilaterally raising tariffs, or suspending or amending the terms of trade agreements, is limited. But it would be more reassuring still if the intellectual consensus for free trade were also the popular consensus.”

Fortunately, Ikenson supports the case I’ve made repeatedly. The power of presidential politics is limited by the Congress (see Politics and Your Money). Frustration with politics has never been higher, but in many cases, gridlock is a good thing.

The destructive impacts of protectionist, anti-trade policies is unambiguous – just consider what happened from the implementation of Smoot-Hawley tariffs in 1930 around the time of the Great Depression. U.S. imports decreased 66% from $4.4 billion (1929) to $1.5 billion (1933), and exports decreased 61% from $5.4 billion to $2.1 billion. GNP fell from $103.1 billion in 1929 to $75.8 billion in 1931 and bottomed out at $55.6 billion in 1933.

It’s important to remember, any harmful downside to trade is overwhelmed by the upside of growth. Greg Ip of the WSJ used Doug Irwin, a trade historian at Dartmouth College, to make this pro-growth point:

“If two million American workers lose $15,000 in annual income forever—an extreme estimate of the impact of trade with China—while 320 million American consumers gain just $100 from trade, the benefits to all of society still exceed the costs.”

The benefits of free trade may be invisible in the short run, but over the long-run, the growth advantages of free trade are perfectly visible, despite protectionist, anti-trade rhetoric and propaganda dominating the presidential election conversation.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), and AAPL, but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Growth Stocks – Cheaper by the Day

Are you a value investor? If you said “yes,” how would you feel about buying an $18 stock with a P/E (Price/Earnings) ratio of greater than 100x and a Price/Sales ratio of 14x for a company that three years earlier was started in a garage? This may not sound like a value stock, but had you bought this stock at the initial public offering (IPO), it would have been a screaming bargain – priced at less than 1x P/E ratio, based on this year’s earnings estimates.

You may be surprised to know, this company with a meager $18 IPO share price is now worth $9,192 per share today (if you adjust for three stock splits)! Yes, that’s correct, a +50,900% return. If you are wondering to which stock I’m referring, I am talking about Amazon.com Inc. (AMZN). Incredibly, ever since Amazon went public in 1997, the CEO Jeff Bezos has managed to command the start-up e-commerce company from $31 million in revenues to $121 billion (with a “b”) on an annual basis in 2016 (a +389,000% increase).

Discovering the next IPO that turns into a $363 billion behemoth is easier said than done, and unfortunately these types of companies are a rare breed. Even if you are lucky enough to identify these diamonds-in-the-rough, early in their growth cycle, very few investors have the fortitude and discipline to continually own the stocks through the perpetual volatility (i.e., peaks and valleys).

The good news is, although you may be unable to find every unicorn out there, you can still apply the same principles and characteristics to any growth stock you invest in. In order to prudently achieve outsized returns, one must identify innovative market leaders that have gained some type of sustainable competitive advantage, which will serve as the profit and cash flow growth engine for the stock over the long-term.

If a company does not have a unique advantage over industry competitors, they will likely be unable to compound earnings growth – the key to becoming a big winner. Albert Einstein, Nobel Prize winner is credited with identifying compounding as the “eighth wonder of the world,” and without compounding there will be no gigantic results.

Amazon may be a rare breed, but there are plenty of other examples of so-called “expensive” stocks that get dismissed or fall through the cracks as they explode in value to the stratosphere. Consider Starbucks Corp. (SBUX), which at the time of its IPO in 1992 was priced at a very rich P/E of 52x. Sound expensive? Actually, this was a greatest offer in a generation. Adjusted for stock splits, the IPO shares were valued at $0.27 – in the most recent trading session Starbucks shares closed at $55.90, a +20,600% increase. Similar to Amazon, had you purchased Starbucks shares at the IPO price, you would have been paying less than a measly, eye-popping 1x P/E ratio based on 2016 earnings.

Alphabet Inc. (GOOGL), formerly Google Inc., is another case of growth stock appearing pricey on the outside, but really a value of a lifetime on the inside. The hype surrounding the Google IPO was so palpable in 2004, the stock priced at a relatively nose-bleed level of 60x P/E level, approximately. The unconventional auction bidding method to buy the initial shares made investors even more skeptical. Suffice it to say, the greater than +1,600% gain has once again shown that investors can reap handsome rewards, if they do thorough enough due diligence and ignore the illusory big ticket IPO prices.

What most investors fail to realize is that P/E ratios are temporary. By purchasing a growth stock, the numerator of the P/E ratio (price) becomes static or fixed. As earnings of a growth company expand, the stock becomes cheaper by the day. More specifically, the numerator of the P/E (price) is flat, while the denominator (earnings) grows, thereby making the P/E ratio smaller (cheaper). And as you can see from the few previous examples I have provided, if you are able to identify winners, and hold them long enough, you will eventually realize the initial hefty price tag at purchase will be considered almost free after all the earnings compounding.

Legendary growth investor Peter Lynch summed it up concisely when he noted, “People concentrate too much on the P, but the E really makes the difference.” Lynch goes on to highlight the importance of patience in growth investing because stocks often go down or move sideways for long periods of time before dramatic increases occur:

“My best stocks performed in the 3rd year, 4th year, 5th year, not in the 3rd week or 4th week.”

I’ve illustrated a few successful examples of meteoric growth stocks, but more importantly the misconception many investors place on the current P/E ratio. There still is no substitute for hard-nosed, detailed fundamental research for finding big growth winners, because true growth stocks bought and held for a long enough period, will become cheaper by the day. If you don’t have the time, discipline, or patience to execute this winning strategy, find and hire an experienced investment manager who understands these concepts.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), AMZN, and GOOGL, but at the time of publishing had no direct position in SBUX, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.