Posts filed under ‘Themes – Trends’

Stretching the High Yield Rubber Band

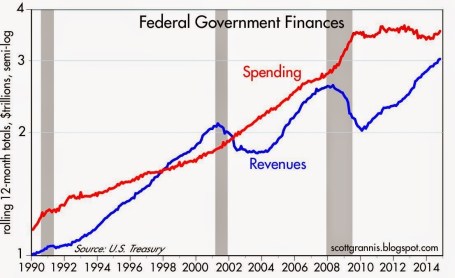

The 10-Year Treasury note recently pierced below the all-important psychological 2% level (1.97%), which has confounded many investors, especially if you consider these same rates were around 4% before the latest mega-financial crisis hit the globe. Some of the rate plunge can be explained by sluggish global growth, but the U.S. just logged a respectable +5.0% GDP growth quarter; corporate profits are effectively at all-time record highs; and the economy has added about 11 million private sector jobs over the last five years (unemployment rate of 10.0% has dropped to 5.6%). So what gives…why such low interest rates? Well, as I noted in a recent article (Why 0% Rates?), there is a whole host of countries with lower rates, which acts like an anchor dragging down our rates with them. Scott Grannis encapsulates this multi-decade, worldwide rate decline in the chart below:

It should come as no surprise to many that these abnormally low rates have had a massive ripple effect on other asset classes… including of course high-yield bonds (aka “junk bonds”). It doesn’t take a genius or rocket scientist to discern the effects of an ultra-low interest rate environment. Quite simply, investors are forced to hunt for yield. When a Bank of America (BAC) customer is forced into earning less than 1/10th of 1 cent for every dollar invested in a CD, you can easily understand why the smile in their CD advertisement looks more like a grimace. Rather than accept $8 in annual interest on a $10,000 investment, post-crisis investors frightened by the stock market have piled into junk bonds. If you don’t believe me, check out the analysis provided by the Financial Times (data from Dealogic) in the chart below, which shows about $1 trillion in U.S. high-yield debt issuance over the last three years. Europe has experienced an even more dramatic growth rate in junk issuance compared to the U.S.

Stretching High-Yield Band

A rubber band can only stretch so far before the elasticity forces it too snap. We are getting closer to the snapping point, as more complacent investors lend money to riskier borrowers and also accept more lenient terms from issuers (e.g., cov-lite loans). Although default rates on high yield bonds remain near decade lows (1.1% through November 2014), high-yield investors keep on inching towards an ultimate day of reckoning. Thanks to a continually improving economy, Fitch Ratings is still projecting a benign default rate environment for high-yield bonds in 2015 – somewhere in the 1.5% – 2.0% range (see chart below). However, high-yield credit spreads did widen in 2014 with the help of crude oil prices getting chopped by more than -50% over the last year. Given the energy sector accounts for about 17% of the high-yield market (Barron’s), it would be natural to expect a larger number of energy company defaults to occur over the next 12-18 months, especially if crude oil prices remain depressed.

While it makes sense for you to hold a portion of your portfolio in high-yield bonds, especially for diversification purposes, don’t forget the power of mean reversion. The uncharacteristically low default rates will eventually revert towards historical averages. Stated differently, the increased risk profile of the high-yield bond market continues to stretch, so make sure you are not overly exposed to the sector because this segment will eventually snap.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own a range of positions, including positions in certain exchange traded funds positions (JNK, HYG), and BAC, but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

After 2014 Stock Party, Will Investors Have a 2015 Hangover?

This article is an excerpt from a previously released Sidoxia Capital Management complementary newsletter (January 2, 2015). Subscribe on the right side of the page for the complete text.

Investors in the U.S. stock market partied their way to a sixth consecutive year of gains during 2014 (S&P 500 +11.4%; Dow Jones Industrial Average +7.5%; and NASDAQ +13.4%). From early 2009, at the worst levels of the crisis, the S&P 500 has more than tripled – not too shabby. But similar to recent years, this year’s stock bubbly did not flow uninterrupted. Several times during the party, neighbors and other non-participants at the stock party complained about numerous concerns, including the Fed Tapering of bond purchases; the spread of the deadly Ebola virus; tensions in Ukraine; the rise of ISIS; continued economic weakness across the eurozone; the decline of “The Fragile Five” emerging markets (Brazil, India, Indonesia, Turkey and South Africa), and other headline grabbing stories to name just a few. In fact, the S&P 500 briefly fell -10% from its mid-September level to mid-October before a Santa Claus rally pushed the index higher by +4% in the last quarter of the year.

Even though the U.S. was partying hardy in 2014, it was not all hats and horns across all segments of the market. Given all the geopolitical trepidation and sluggish economic growth abroad, international markets as measured by the Total World Stock ETF (VT) gained a paltry +1.2% for the year. This dramatic underperformance was also seen in small capitalization stocks (Russell 2000 Index ETF – IWM), which only rose +3.7% last year, and the Total Bond Market (BND), which increased +2.9%.

Despite these anxieties and the new Federal Reserve Chairwoman Janet Yellen removing the Quantitative Easing (QE) punchbowl in 2014, there were still plenty of festive factors that contributed to gains last year, which should prevent any hangover for stocks going into 2015. As I wrote in Don’t Be a Fool, corporate profits are the lifeblood for stock prices. Fortunately for investors, the news on this front remains positive (see chart below). As strategist Dr. Ed Yardeni pointed out a few weeks ago, profit growth is still expected to accelerate to +9.3% in 2015, despite the recent drag from plummeting oil prices on the energy sector.

While a -50% decline in oil prices may depress profits for some energy companies, the extra discretionary spending earned by consumers from $2.24 per gallon gasoline at the pump has been a cheery surprise. This consumer spending tailwind, coupled with the flow-through effect to businesses, should provide added stimulative benefit to the economy in 2015 too. Let’s not forget, this economic energy boost comes on the heels of the best economic growth experienced in the U.S. in over a decade. More specifically, the recently reported third quarter U.S. GDP (Gross Domestic Product) statistics showed growth accelerating to +5%, the highest rate seen since 2003.

Another point to remember about lower energy prices is how this phenomenon positively circulates into lower inflation and lower interest rate expectations. If energy prices remain low, this only provides additional flexibility to the Federal Reserve’s monetary policy decisions. With the absence of any substantive inflation data, Chairwoman Yellen can remain “patient” in hitting the interest rate brakes (i.e., raising the Federal Funds rate) in 2015.

Geographically, our financial markets continue to highlight our country’s standing as one of the best houses in a sluggish global growth neighborhood. Not only do we see this trend in our outperforming stock indexes, relative to other countries, but we also see this in the rising value of the U.S. dollar. It is true that American exports become less competitive internationally in a strong dollar environment, but from an investment standpoint, a rising dollar makes U.S. stock markets that much more attractive to foreign investors. To place this dynamic into better perspective, I would note the U.S. Dollar index rose by approximately +13% in 2014 against a broad basket of currencies (including the basket case Russian Rouble). With the increasing likelihood of eurozone Quantitative Easing to take place, in conjunction with loose monetary policies in large developed markets like Japan, there is a good chance the dollar will continue its appreciation in the upcoming year.

On the political front, despite the Republicans winning a clean sweep in the midterm elections, we should still continue to expect Washington gridlock, considering a Democrat president still holds the all-important veto power. But as I have written in the past (see Who Said Gridlock is Bad?), gridlock has resulted in our country sitting on a sounder financial footing (i.e., we have significantly lower deficits now), which in turn has contributed to the U.S. dollar’s strength. At the margin however, one can expect any legislation that does happen to get passed by the Republican majority led Congress will likely be advantageous for businesses and the stock market.

When Will the Party End?

What could cause the party to come to a screeching halt? While I can certainly point out some obvious potential negative scenarios (e.g., European financial mayhem, China economic speed bump, interest rate spike), history shows us it is usually unforeseen events (surprises) that cause significant downdrafts in stock market prices. The declines rarely come from factors you read in current newspaper headlines or hear on television.

Just like any party, this year is likely to include high points and low points in the financial markets – and of course some lull periods mixed in as well. However, with the economy improving and risk appetites increasing, we are bound to see more party poopers on the sidelines come join the celebration in 2015. It will be a while before the cops arrive and stop the party, so there should be plenty of time to prepare for any hypothetical hangover.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own a range of positions, including positions in certain exchange traded funds positions (including BND), but at the time of publishing SCM had no direct position in VT, IWM or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Why 0% Rates? Tech, Globalization & EM (Not QE)

Recently I have written about the head-scratching, never-ending, multi-decade decline in long-term interest rates (see chart below). Who should care? Well, just about anybody, if you bear in mind the structure of interests rates impacts the cost of borrowing on mortgages, credit cards, automobiles, corporate bonds, savings accounts, and practically every other financial instrument you can possibly think of. Simplistic conventional thinking explains the race to 0% global interest rates by the loose monetary Quantitative Easing (QE) policies of the Federal Reserve. But validating that line of thinking becomes more challenging once you consider QE ended months ago. What’s more, contrary to common belief, rates declined further rather than climb higher after QE’s completion.

Source: Calafia Beach Pundit

More specifically, if you look at rates during this same time last year, the yield on the 10-Year Treasury Note had more than doubled in the preceding 18 months to a level above 3.0%. The consensus view then was that the eventual wind-down of QE would only add gasoline to the fire, causing bond prices to decline and rates to extend an indefinite upwards march. Outside of bond guru Jeff Gundlach, and a small minority of prognosticators, the herd was largely wrong – as is usually the case. As we sit here today, the 10-Year Note currently yields a paltry 2.26%, which has led to the long-bond iShares 20-Year Treasury ETF (TLT) jumping +22% year-to-date (contrary to most expectations).

The American Ostrich

Like an ostrich sticking its head in the sand, us egocentric Americans tend to ignore details relating to others, especially if the analyzed data is occurring outside the borders of our own soil. Unbeknownst to many, here are some key country interest rates below U.S. yields:

- Switzerland: 0.33%

- Japan: 0.34%

- Germany: 0.60%

- Finland: 0.70%

- Austria: 0.75%

- France: 0.88%

- Denmark: 0.89%

- Sweden: 0.98%

- Ireland: 1.29%

- Spain: 1.69%

- Canada 1.80%

- U.K: 1.85%

- Italy: 1.93%

- U.S.: 2.26% (are our rates really that low?)

Outside of Japan, these listed countries are not implementing QE (i.e., “Quantitative Easing”) as did the United States. Rather than QE being the main driver behind the multi-decade secular decline in interest rates, there are other more important disinflationary forces at work driving interest rates lower.

Technology, Globalization, and Emerging Market Competition (T.G.E.M.)

While tracking the endless monthly inflation statistics is a useful exercise to understand the tangible underlying pricing components of various industry segments (e.g., see 20 pages of CPI statistics), the larger and more important factors can be attributed to the somewhat more invisible elements of technology, globalization, and emerging market competition (T.G.E.M).

Starting with technology, to put these dynamics into perspective, consider the number of transistors, or the effective horsepower, on a semiconductor (a.k.a. computer “chip”) today. The overall impact on global standards of living is nothing short of astounding. Take an Intel chip for example – it had approximately 2,000 transistors in 1971. Today, semiconductors can cram over 10,000,000,000 (yes billions – 5 million times more) transistors onto a single semiconductor. Any individual can look no further than their smartphone to understand the profound implications this has not only on pricing in general, but society overall. To illustrate this point, I would direct you to a post highlighted by Professor Mark J. Perry, who observed the cost to duplicate an iPhone during 1991 would have been more than $3,500,000!

There are an infinite number of examples depicting how technology has accelerated the adoption of globalization. More recently, events such as the Arab Spring point out how Twitter (TWTR) displaced costly military engagement alternatives. The latest mega-Chinese IPO of Alibaba (BABA) was also emblematic of the hunger experienced in emerging markets to join the highly effective economic system of global capitalism.

I think New York Times journalist Tom Friedman said it best in his book, The World is Flat, when he made the following observations about the dynamics occurring in emerging markets:

“My mom told me to eat my dinner because there are starving children in China and India – I tell my kids to do their homework because Chinese and Indians are starving for their jobs”.

“France wants a 35 hour work week, India wants a 35 hour work day.”

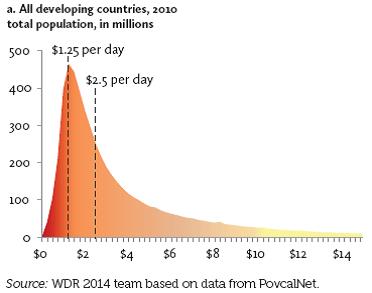

There may be a widening gap between rich and poor in the United States, but technology and globalization is narrowing the gap across the rest of the world. Consider nearly half of the world’s population (3 billion+ people) live in poverty, earning less than $2.50 a day (see chart below). Technology and globalization is allowing this emerging middle class climb the global economic ladder.

These impoverished individuals may not be imminently stealing our current jobs and driving general prices lower, but their children, and the countless educated millions in other international markets are striving for the same economic security and prosperity we have. The educated individuals in the emerging markets that have tasted capitalism are giving new meaning to the word “urgency”, which is only accelerating competition and global pricing pressures. It comes as no surprise to me that this generational migration from the poor to the middle class is putting a lid on inflation and interest rates around the world.

Declining costs of human labor from emerging markets however is not the only issue putting a ceiling on general prices. Robotics, an area in which Sidoxia holds significant investments, continues to be an area of fascination for me. With human labor accounting for the majority of business costs, it’s no wonder the C-suite is devoting more investment dollars towards automation. Rather than hire and train expensive workers, why not just buy a robot? This is not just happening in the U.S. – in fact the Chinese purchased more robots than Americans last year. And why not? An employer does not have to pay a robot overtime compensation; a robot never shows up late; robots never sue for discrimination or harassment; robots receive no healthcare or retirement benefits; and robots work 24 hours/day, 7 days/week, and 365 days/year.

While newspapers, bloggers, and talking heads like to point to the simplistic explanation of loose, irresponsible monetary policies of global central banks as the reason behind a four decade drop in interest rates that is only a small part of the story. Investors and policy makers alike should be paying closer attention to the factors of technology, globalization, and emerging market competition as the more impactful dynamics systematically driving down long term interest rates and inflation.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own a range of positions, including long positions in certain exchange traded fund positions and INTC (short position in TLT), but at the time of publishing SCM had no direct position in BABA, TWTR or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Santa and the Rate-Hike Boogeyman

Boo! … Rates are about to go up. Or are they? We’re in the fourth decade of a declining interest rate environment (see Don’t be a Fool), but every time the Federal Reserve Chairman speaks or monetary policies are discussed, investors nervously look over their shoulder or under their bed for the “Rate Hike Boogeyman.” While this nail-biting mentality has resulted in lost sleep for many, this mindset has also unfortunately led to a horrible forecasting batting average for economists. Santa and many equity investors have ignored the rate noise and have been singing Ho Ho Ho as stock prices hover near record highs.

A recent Deutsche Bank report describes the prognostication challenges here:

i.) For the last 10 years, professional forecasters have consistently been wrong on their predictions of rising interest rates.

ii.) For the last five years, investors haven’t fared any better. As you can see, they too have been continually wrong about their expectations for rising interest rates.

I’m the first to admit that rates have remained “lower for longer” than I guessed, but unlike many, I do not pretend to predict the exact timing of future rate increases. I strongly believe inevitable interest rate rises are not a matter of “if” but rather “when”. However, trying to forecast the timing of a rate increase can be a fool’s errand. Japan is a great case in point. If you take a look at the country’s interest rates on their long-term 10-year government bonds (see chart below), the yields have also been declining over the last quarter century. While the yield on the 10-Year U.S. Treasury Note is near all-time historic lows at 2.18%, that rate pales in comparison to the current 10-Year Japanese Bond which is yielding a minuscule 0.36%. While here in the states our long-term rates only briefly pierced below the 2% threshold, as you can see, Japanese rates have remained below 2% for a jaw-dropping duration of about 15 years.

There are plenty of reasons to explain the differences in the economic situation of the U.S. and Japan (see Japan Lost Decades), but despite the loose monetary policies of global central banks, history has proven that interest rates and inflation can remain stubbornly low for longer than expected.

The current pundit thinking has Federal Reserve Chairwoman Yellen leading the brigade towards a rate hike during mid-calendar 2015. Even if the forecasters finally get the interest rate right for once, the end-outcome is not going to be catastrophic for equity markets. One need look no further than 1994 when Federal Reserve Chairman Greenspan increased the benchmark federal funds rate by a hefty +2.5%. (see 1994 Bond Repeat?). Rather than widespread financial carnage in the equity markets, the S&P 500 finished roughly flat in 1994 and resumed the decade-long bull market run in the following year.

Currently 15 of the 17 Fed policy makers see 2015 median short-term rates settling at 1.125% from the current level of 0-0.25%. This hardly qualifies as interest rate Armageddon. With a highly transparent and dovish Janet Yellen at the helm, I feel perfectly comfortable the markets can digest the inevitable Fed rate hikes. Will (could) there be volatility around changes in Fed monetary policy during 2015? Certainly – no different than we experienced during the “taper tantrum” response to Chairman Ben Bernanke’s rate rise threats in 2013 (see Fed Fatigue).

As 2014 comes to an end, Santa has wrapped investor portfolios with a generous bow of returns in the fifth year of this historic bull market. Not everyone, however, has been on Santa’s “nice” list. Regrettably, many sideliners have received no presents because they incorrectly assessed the elimination impact of Quantitative Easing (QE). If you prefer presents over a lump of coal in your stocking, it will be in your best interest to ignore the Rate Hike Boogeyman and jump on Santa’s sleigh.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own a range of positions, including certain exchange traded fund positions, but at the time of publishing SCM had no direct position in DB or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

The Gift that Keeps on Giving

There have been numerous factors contributing to this bull market, even in the face of a slew of daunting and exhausting headlines. Contributing to the advance has been a steady stream of rising earnings; a flood of price buoying stock buybacks; and the all-important gift of growing dividends that keep on giving. Bonds have benefited to a lesser extent than stocks over the last five years in part because bonds lack the gift of rising dividend payouts. Life would be grander for bondholders, if the issuers had the heart to share generous news like this:

“Good day Mr. & Mrs. Jones. As your bond issuer, we value our mutually beneficial relationship so much that we would like to reward you as a bond investor. In addition to the 2.5% we are paying you now, we have decided to increase your annual payments by 6% per year for the next 20 years. In other words, we will increase your $2,500 in annual interest payments to over $8,000 per year. But wait…there’s more! You are such great people, we are going to increase the value of your initial $100,000 investment to $450,000.”

Does this sound too good to be true? Well, it’s not…sort of. However, the scenario is absolutely true, if you invested $100,000 in S&P 500 stocks during 1993 and held that investment until today. Unfortunately, the gift giving conversation above would be unattainable and the furthest from the truth, if you invested $100,000 into bonds. Today, if you decided to invest $100,000 in 20-year government bonds paying 2.5%, your $2,500 in annual payments will never increase over the next two decades. What’s more, by 2034 your initial principal of $100,000 won’t increase by a penny, while inflation slowly but surely crushes your investment’s purchasing power.

To illustrate the magical power of dividend compounding at a 6% CAGR, here is a chart of the S&P 500 dividend stream over the 21-year period of 1993 – 2014:

The trend of increasing dividends doesn’t appear to be slowing either. Here is a table showing the number of S&P 500 companies increasing their dividend payouts:

| COUNT OF DIVIDEND ACTIONS YEAR-TO-DATE | INCREASING THEIR DIVIDEND |

| 2014 YTD | 292 |

| 2013 | 366 |

| 2012 | 333 |

| 2011 | 320 |

| 2010 | 243 |

| 2009 | 151 |

Source: Standard and Poor’s

As I mentioned before, while dividends have more than tripled over the last twenty years, stock prices have gone up even more – appreciating about 4.5x’s (see chart below):

With aging demographics increasing retirement income needs, it comes as no surprise to me that the percentage of S&P 500 companies paying dividends has increased from 71% (351 companies) in 2001 to 84% (423 companies) at the end of Q3 – 2014. Interestingly, all 30 members of the Dow Jones Industrial Average currently pay a dividend. If you broaden out the perspective to all S&P Dow Jones Indices, you will discover the strength of dividends is particularly evident over the last 12 months. During this period, dividends increased by a whopping +27%, or $55 billion.

This trend in increasing dividends can also be seen through the lens of the dividend payout ratio. It is true that over longer timeframes the dividend payout ratio has been coming down (see Dividend Floodgates Widen) because of share buyback tax efficiency. Nevertheless, more recently the dividend payout ratio has drifted upwards to a range of about 32% of profits since 2011 (see chart below):

There’s no disputing the benefit of rising stock dividends. Baby Boomers, retirees, and other long-term investors are increasingly reaping the rewards of these dividend gifts that keep on giving.

Other Investing Caffeine articles on dividends:

Dividends: From Sapling to Abundant Fruit Tree

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs) including SPY, but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

The Pain of Diversification

The oft-quoted tenet that diversification should be the cornerstone of any investment strategy has come under assault in the third quarter. As you can see from the chart below, investors could run, but they couldn’t hide. The Large Cap Growth category was the major exception, thanks in large part to Apple Inc.’s (AAPL) +8% appreciation. More specifically, seven out of the nine Russell Investments style boxes were in negative territory for the three month period. The benefits of diversification look even worse, if you consider other large asset classes and sectors such as the Gold/Gold Miners were down about -14% (GDX/GLD); Energy -9% (XLE); Europe-EAFE -6% (EFA); Utilities -5% (XLU); and Emerging Markets -4% (EEM).

On the surface, everything looks peachy keen with all three major indices posting positive Q3 appreciation of +1.3% for the Dow, +0.6% for S&P 500, and +1.9% for the NASDAQ. It’s true that over the long-run diversification acts like shock absorbers for economic potholes and speed bumps, but in the short-run, all investors can hit a stretch of rough road in which shock absorbers may seem like they are missing. Over the long-run, you can’t live without diversification shocks because your financial car will eventually breakdown and the ride will become unbearable.

What has caused all this underlying underperformance over the last month and a half? The headlines and concerns change daily, but the -5% to -6% pullback in the market has catapulted the Volatility Index (VIX or “Fear Gauge”) by +85%. The surge can be attributed to any or all of the following: a slowing Chinese economy, stagnant eurozone, ISIS in Iraq, bombings in Syria, end of Quantitative Easing (QE), impending interest rate hikes, mid-term elections, Hong Kong protests, proposed tax inversion changes, security hacks, rising U.S. dollar, PIMCO’s Bill Gross departure, and a half dozen other concerns.

In general, pullbacks and corrections are healthy because shares get transferred out of weak hands into stronger hands. However, one risk associated with these 100 day floods (see also 100-Year Flood ≠ 100-Day Flood) is that a chain reaction of perceptions can eventually become reality. Or in other words, due to the ever-changing laundry list of concerns, confidence in the recovery can get shaken, which in turn impacts CEO’s confidence in spending, and ultimately trickles down to employees, consumers, and the broader economy. In that same vein, George Soros, the legendary arbitrageur and hedge fund manager, has famously written about his law of reflexivity (see also Reflexivity Tail Wags Dog). Reflexivity is based on the premise that financial markets continually trend towards disequilibrium, which is evidenced by repeated boom and bust cycles.

While, at Sidoxia, we’re still finding more equity opportunities amidst these volatile markets, what this environment shows us is conventional wisdom is rarely correct. Going into this year, the consensus view regarding interest rates was the economy is improving, and the tapering of QE would cause interest rates to go significantly higher. Instead, the yield on the 10-Year Treasury Note has gone down significantly from 3.0% to 2.3%. The performance contrast can be especially seen with small cap stocks being down-10% for the year and the overall Bond Market (BND) is up +3.1% (and closer to +5% if you include interest payments). Despite interest rates fluctuating near generational lows with paltry yields, the power of diversification has proved its value.

While there are multiple dynamics transpiring around the financial markets, the losses across most equity categories and asset classes during Q3 have been bloody. Nonetheless, investing across the broad bond market and certain large cap stock segments is evidence that diversification is a valuable time-tested principle. Times like these highlight the necessity of diversification gain to offset the current equity pain.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in AAPL, BND, and certain exchange traded funds (ETFs), but at the time of publishing SCM had no direct position in EEM, GDX, GLD, EFA, XLE, XLU, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.