Posts filed under ‘Fixed Income (Bonds)’

Stocks…Bonds on Steroids

With all the spooky headlines in the news today, it’s no wonder everyone is piling into bonds. The Investment Company Institute (ICI), which tracks mutual fund data, showed -88% of the $14 billion in weekly outflows came from equity funds relative to bonds and hybrid securities. With the masses flocking to bonds, it’s no wonder yields are hovering near multi-decade historical lows. Stocks on the other hand are the Rodney Dangerfield (see Doug Kass’s Triple Lindy attempt) of the investment world – they get “no respect.” By flipping stock metrics upside down, we will explore how hated stocks can become the beloved on steroids, if viewed in the proper context.

Davis on Debt Discomfort

Chris Davis, head of the $65 billion in assets at the Davis Funds, believes like I do that navigating the “bubblicious” bond market will be a treacherous task in the coming years. Davis directly states, “The only real bubble in the world is bonds. When you look out over a 10-year period, people are going to get killed.” In the short-run, inflation is not a real worry, but it if you consider the exploding deficits coupled with the exceedingly low interest rates, bond investors are faced with a potential recipe for disaster. Propping up the value of the dollar due to sovereign debt concerns in Greece (and greater Europe) has contributed to lower Treasury rates too. There’s only one direction for interest rates to go, and that’s up. Since the direction of bond prices moves the opposite way of interest rates, mean reversion does not bode well for long-term bond holders.

Earnings Yield: The Winning Formula

Average investors are freaked out about the equity markets and are unknowingly underestimating the risk of bonds. Investors would be in a better frame of mind if they listened to Chris Davis. In comparing stocks and bonds, Davis says, “If people got their statement and looked at the dividend yield and earnings yield, they might do things differently right now. But you have to be able to numb yourself to changes in stock prices, and most people can’t do that.” Humans are emotional creatures and can find this a difficult chore.

What us finance nerds learn through instruction is that a price of a bond can be derived by discounting future interest payments and principle back to today. The same concept applies for dividend paying stocks – the value of a stock can be determined by discounting future dividends back to today.

A favorite metric for stock jocks is the P/E (Price-Earnings) ratio, but what many investors fail to realize is that if this common ratio is flipped over (E/P) then one can arrive at an earnings yield, which is directly comparable to dividend yields (annual dividend per share/price per share) and bond yields (annual interest/bond price).

Earnings are the fuel for future dividends, and dividend yields are a way of comparing stocks with the fixed income yields of bonds. Unlike virtually all bonds, stocks have the ability to increase dividends (the payout) over time – an extremely attractive aspect of stocks. For example, Procter & Gamble (PG) has increased its dividend for 54 consecutive years and Wal-Mart (WMT) 37 years – that assertion cannot be made for bonds.

As stock prices drop, the dividend yields rise – the bond dynamics have been developing in reverse (prices up, yields down). With S&P 500 earnings catapulting upwards +84% in Q1 and the index trading at a very reasonable 13x’s 2010 operating earnings estimates, stocks should be able to outmuscle bonds in the medium to long-term (with or without steroids). There certainly is a spot for bonds in a portfolio, and there are ways to manage interest rate sensitivity (duration), but bonds will have difficulty flexing their biceps in the coming quarters.

Read the full article on Chris Davis’s bond and earnings yield comments

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

*DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds and WMT, but at the time of publishing SCM had no direct positions in PG, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

California Checking Under the Derivatives Hood

[tweetmeme source=”WadeSlome” only_single=false https://investingcaffeine.com/2010/04/11/california-checking-under-the-derivatives-hood/%5D

Bill Lockyer, California’s State Treasurer, is in charge of driving “The Golden State’s” budget, but as he maneuvers the finances, he is hearing some strange knocks and pings as it relates to the pricing of Credit Default Swaps (CDS) on California debt obligations. CDSs, like virtually all derivatives, can either be used to speculate or hedge (see also, Einhorn CDS and Financial Engineering articles), so the existence of strange noises does not necessarily indicate foul play or problems that cannot be fixed.

Checking Under the Banks’ Hoods

At the heart of the CDS markets lie the major investment banks, so that is where Lockyer is looking under the hood and requesting information on the role the banks are playing in the municipal bond CDS market. Specifically, Lockyer has sent letters requesting information from Bank of America – Merrill Lynch (BAC), Barclays, Citigroup (C), Goldman Sachs (GS), JP Morgan (JPM),and Morgan Stanley (MS). California pays the banks millions of dollars every year to market bonds on behalf of the state. The I-banks operate in some way like a car dealership – the state produces the cars (bonds) and the banks buy the bonds and resell them to buyers/investors.

The financial transaction doesn’t necessarily stop there, because the banks can further pad their profits by selling and making markets in credit default swaps. After the state issues bonds, speculators can then pay the banks to place bets on whether the cars (bonds) fail (default), or investors can also buy insurance from the banks in the form of swaps. As you can probably surmise, there is the potential for conflicts of interest between the state and the banks, which partly explains why Lockyer is conducting his due diligence.

California…the Next Greece or Kazakhstan?

As the housing market came crashing down, credit default swaps were at the center of financial institution collapses and the billions made by John Paulson (see also the Gutsiest Trade Ever). More recently, CDSs were cited as negative contributors to the Greek financial crisis. Lockyer tries to deflect California comparisons with Greece by stating the European country’s budget deficit is 13 times larger than California’s (as % of GDP) and the foreign country’s accumulated debt is 25 times larger on GDP basis as well (read California’s Debt Hole story).

Beyond making sure the profit rules of the game are not stacked against California, Lockyer wants to understand what he perceives as a mispricing in the default risk of California debt obligations. He is worried that the state’s borrowing costs on future bond issues could be artificially escalated because he says the credit default swaps “wrongly brand our bonds as a greater risk than those issued by such nations as Kazakhstan, Croatia, Bulgaria and Thailand.”

Clarity on these issues is important because the state is exploring the expansion into taxable municipal bonds. The government has been subsidizing taxable munis, termed Build America Bonds (BABs), to stimulate the economy and bring down borrowing costs for municipalities. According to Thomson Reuters, BABS accounted for approximately 26% of overall muni bond issuance ($25.8 billion) in the first quarter.

If California were a car, I’m not sure how much cash they would get for their clunker ($16 billion budget deficit), but I tip my hat to State Treasurer Lockyer for holding the investment banks’ feet to the fire. All investors and financial product consumers stand to benefit by looking under the hood of their financial institution and asking tough questions.

Read Full Financial Times Article on California CDS Market

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

*DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct positions in BAC, C, GS, JPM, and MS or any security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Digging a Debt Hole

Little did I know when I signed up for a recent “distressed” debt summit (see previous article) that a federal official and state treasurer would be presenting as keynote speakers? After all, this conference was supposed to be catering to those professionals interested in high risk securities. Technically, California and the U.S. government are not classified as distressed yet, but nonetheless government heavy-hitters Matthew Rutherford (Deputy Assistant Secretary, Federal Finance at the U.S. Department of Treasury), and Bill Lockyer (Treasurer for the State of California) shared their perspectives on government debt and associated economic factors.

Why have government officials present at a distressed debt conference? After questioning a few organizers and attendees, I was relieved to discover the keynote speaker selections were made more as a function as a sign of challenging economic times, rather than to panic participants toward debt default expectations. As it turns out, the conference organizers packaged three separate conferences into one event – presumably for cost efficiencies (Distressed Investments Summit + Public Funds Summit + California Municipal Finance Conference).

The U.S. Treasury Balancing Act

Effectively operating as the country’s piggy bank, the Treasury has a very complex job of constantly filling the bank to meet our country’s expenditures. Deputy Assistant Secretary Matthew Rutherford launched the event by speaking to domestic debt levels and deficits along with some the global economic trends impacting the U.S.

- Task at Hand: Rutherford spoke to the Treasury’s three main goals as part of its debt management strategy, which includes: 1) Cash management (to pay the government bills); 2) Attempt to secure low cost financing; and 3) Promote efficient markets. With more than a few hundred auctions held each year, the Treasury manages an extremely difficult balancing act.

- Debt Limit Increased: The recent $1.9 trillion ballooning in the U.S. debt ceiling to $14.3 trillion gives the Treasury some flexibility in meeting the country’s near-term funding needs. The Treasury expects to raise another $1.5 trillion in debt in 2010 (from $1.3 trillion in ’09) to fund our government initiatives, but that number is expected to decline to $1.0 – $1.1 trillion in 2011.

- Funding Trillions at 0.16%: Thanks to abnormally low interest rates, an investor shift to short-term safety (liquidity), and a temporary rush to the dollar, the U.S. Treasury was able to finance their borrowing needs at a mere 16 basis points. Clearly, servicing the U.S.’ massive debt load at these extremely attractive rates is not sustainable forever, and the Treasury is doing its best to move out on the yield curve (extend auctions to lengthier maturities) to lock in lower rates and limit the government’s funding risk should short-term rates spike.

- Chinese Demand Not Waning: Contrary to recent TIC (Treasury International Capital) data that showed Japan jumping to the #1 spot of U.S. treasury holders, Rutherford firmly asserted that China remains at the top by a significant margin of $140 billion, if you adjust certain appropriate benchmarks. He believes foreign ownership at over 50% (June 2009) remains healthy and steady despite our country’s fiscal problems.

- TIPS Demand on the Rise: Appetite for Treasury Inflation Protection Securities is on the rise, therefore the Treasury has its eye on expanding its TIP offerings into longer maturities, just last week they handled their first 3-year TIPS auction.

There is no “CA” in Greece

State of California Treasurer Bill Lockyer did not sugarcoat California’s fiscal problems, but he was quick to defend some of the comparisons made between Greece and California. First of all, California’s budget deficit represents less than 1% of the state’s GDP (Gross Domestic Product) versus 13% for Greece. Greece’s accumulated debt stands at 109% of GDP – for California debt only represents 4% of the state’s GDP. What’s more, since 1800 Greece has arguably been in default more than not, where as California has never in its history defaulted on an obligation.

The current California picture isn’t pretty though. This year’s fiscal budget deficit is estimated at $6 billion, leaping to $12 billion next year, and soaring to $20 billion per year longer term.

Legislative political bickering is at the core of the problem due to the constitutional inflexibility of a 2/3 majority vote requirement to get state laws passed. The vast bulk of states require a simple majority vote (> than 50%) – California holds the unique super-majority honor with only Arkansas and Rhode Island. Beyond mitigating partisan bickering, Lockyer made it clear no real progress would be made in budget cuts until core expenditures like education, healthcare, and prisons are attacked.

On the subject of bloatedness, depending on how you define government spending per capita, California ranks #2 or #4 lowest out of all states. Economies of scale help in a state representing 13% of the U.S.’ GDP, but Lockyer acknowledged the state could just be less fat than the other inefficient states.

Lockyer also tried to defend the state’s 10.5% blended tax rate (versus the national median of 9.8%), saying the disparity is not as severe as characterized by the media. He even implied there could be a little room to creep that rate upwards.

Finishing on an upbeat note, Lockyer recognized the January state revenues came in above expectations, but did not concede victory until a multi-month trend is established.

After filtering through several days of meetings regarding debt, you quickly realize how the debt culture (see D-E-B-T article), thanks to cheap money, led to a glut across federal governments, state governments, corporations, and consumers. Hopefully we have learned our lesson, and we are ready to climb out of this self created hole…before we get buried alive with risky debt.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds (including CMF and TIP), but at time of publishing had no direct position on any security referenced. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Getting Distressed can be a Beach

It was just another 65 degree winter day on the sunny shores of Huntington Beach at the 2nd Annual Distressed Investment Summit (March 1st through 3rd) when I entered the conference premises. Before digging into the minutiae of the distressed markets, a broad set of industry experts spoke to a diverse crowd including, pension fund managers, consultants, and hedge fund managers at the Hyatt Regency Huntington Beach Resort and Spa. The tone was somewhat restrained given the gargantuan price rebounds and tightening spreads (the premium paid on credit instruments above government securities) in the credit markets, nonetheless the tenor was fairly upbeat thanks to opportunities emanating from the still larger than average historical spreads.

Topics varied, but several speakers gave their views on the financial crisis, macroeconomic outlooks, general debt/credit trends, and areas of distressed credit opportunity. Like investors across all asset classes, many professionals tried to put the puzzle pieces together over the last few years, in order to provide a clearer outlook for the future of distressed markets. To put the addressable market in context, James Perry, Conference Chair and Investment Officer at the San Bernadino County Employees Retirement Association, described the opportunity set as a $2.5 trillion non-investment grade market, with $250-$400 billion in less liquid securities. Typically distressed securities consist of investments like bonds, bank debt, and/or CLOs (collateralized loan obligations), which frequently carry CCC or lower ratings from agencies such as Standard & Poors, Moodys, and Fitch.

As mentioned previously, since the audience came from a diverse set of constituencies, a broad set of topics and themes were presented:

- Beta Bounce is Gone: The collapse of debt prices and massive widening of debt spreads in 2008 and 2009 have improved dramatically over the last twelve months, meaning the low hanging fruit has already been picked for the most part. Last year was the finest hour for distressed investors because price dislocations caused by factors such as forced selling, technical idiosyncracies, and credit downgrades created a large host of compelling prospects. For many companies, long-term business fundamentals were little changed by the liquidity crunch. As anecdotal evidence for the death of the beta bounce, one speaker observed CLOs trading at 30-35 cents during the March 2009 lows. Those same CLOs are now trading at about 80 cents. Simple math tells us, by definition, there is less upside to par (the bond principal value = 100 cents on dollar).

- Distressed Defaults: Default rates are expected to rise in the coming months and years because of record credit issuance in the 2006-2007 timeframe. The glut of questionable buy-outs completed at the peak of the financial markets driven by private equity and other entities has created a sizeable inventory of debt that has a higher than average chance of becoming distressed. One panel member explained that CCC credit ratings experience a 40% default within 5 years, meaning the worst is ahead of us. The artificially depressed 4-7% current default rates are now expected to rise, but below the 12% default rate encountered in 2009.

- Wall of Maturities: Although the outlook for distressed investments look pretty attractive for the next few years, a majority of professionals speaking on the topic felt a wave of $1 trillion in maturities would roll through the market in the 2012-2014, leading to the escalating default rates mentioned above. CLOs related to many of the previously mentioned ill-timed buyouts will be a significant component of the pending debt wall. Whether the banks will bite the bullet and allow borrowers to extend maturities is still an open topic of debate.

- Mid Market Sweet Spot: Larger profitable companies are having little trouble tapping the financial markets to access capital at reasonable rates. With limited capital made available for middle market companies, there are plenty of opportunistic investments to sift through. With the banks generally hoarding capital and not lending, distressed debt investments are currently offering yields in the mid-to-high teens. Borrowers are effectively beggars, so they cannot be choosers. The investor, on the other hand, is currently in a much stronger position to negotiate first lien secured positions on the debt, which allows a “Plan B,” if the underlying company defaults. Theoretically, investors defaulting into an ownership position can potentially generate higher returns due forced restructuring and management of company operations. Of course, managing the day-to-day operations of many companies is much easier said than done.

- Is Diversification Dead? This question is relevant to all investors but was primarily directed at the fiduciaries responsible for managing and overseeing pension funds. The simultaneous collapse of prices across asset classes during the financial crisis has professionals in a tizzy. Several diversification attacks were directed at David Swensen’s strategy (see Super Swensen article) implemented at Yale’s endowment. Although Swensen’s approach covered a broad swath of alternative investments, the strategy was attacked as merely diversified across illiquid equity asset classes – not a good place to be at the beginning of 2008 and 2009. The basic rebuttal to the “diversification is dead mantra” came in the form of a rhetorical question: “What better alternative is there to diversification?” One other participant was quick to point out that asset allocation drives 85% of portfolio performance.

- Transparency & Regulation: In a post-Bernie Madoff world, even attending hedge fund managers conceded a certain amount of adequate transparency is necessary to make informed decisions. Understanding the strategy and where the returns are coming from is critical component of hiring and maintaining an investment manager.

- Distressed Real Estate Mixed Bag: Surprisingly, the prices and cap rates (see my article on real estate and stocks) on quality properties has not dramatically changed from a few years ago, meaning some areas of the real estate market appear to be less appealing . Better opportunities are generally more tenant specific and require a healthy dosage of creativity to make the deal economics work. Adjunct professor from Columbia University, Michael G. Clark, had a sobering view with respect to the residential real estate market home ownership rates, which he continues to see declining from a peak of 70% to 62% (currently 67%) over time. Clark sees a slow digestion process occurring in the housing market as banks use improved profits to shore up reserves and slowly bleed off toxic assets. He believes job security/mobility, financing, and immigration demographics are a few reasons we will witness a large increase in renters in coming periods. Also driving home ownership down is the increased density of youngsters living at home post-graduation. Clark pointed out the 20% of 26-year olds currently living at home with their parents, a marked increase from times past.

Overall, I found the 2nd Annual Distressed Investment Summit a very informative event, especially from an equity investor’s standpoint, since many stock jocks spend very little time exploring this part of the capital structure. Devoting a few days at the IMN sponsored event taught me that life does not have to be a beach if you mix some distress with a little sun, sand, and fun.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at time of publishing had no direct position on any security referenced. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Can the Lost Decade Strike Twice?

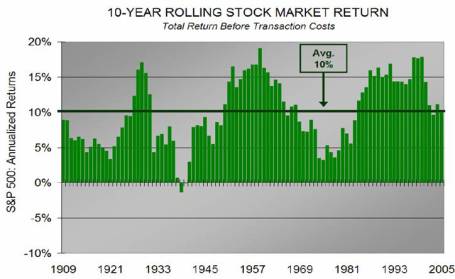

There is an old saying that lightning does not strike twice in the same place. I firmly believe this principle will apply to stock returns over the next decade. Josh Brown, investor and writer for The Reformed Broker highlighted a chart published by Bloomberg showing the 10-year return for various asset classes. Statisticians and market commentators have been quick to point out that stocks, as measured by various benchmarks, have not only underperformed bonds for the last 10 years, but stock performance has actually also been negative for the trailing decade.

Will this trend persist during the next decade? Will the lost decade in stocks be repeated again, similar to the deflation death spiral experienced by the Japanese? (Read more regarding Japanese market on IC). With the Fed Funds rate at effectively zero, is it possible bonds can pull off a miracle over the next 10 years? I suppose anything is possible, but I seriously doubt it.

Let’s not forget that the P/E ratio (Price-Earnings) pegged by some to be at about 14-15x’s 2010 expected earnings – nestled comfortably within historical bands. Granted, financials and some other sectors were overheated (e.g. certain Consumer industries), but based on next year’s estimates, some industries are already expected to exceed the peak earnings achieved during 2007 (e.g., Technology).

History on Our Side

Source: Crestmont Research. Dated graph over the last century showing stock returns rarely result in negative returns over a rolling 10 year period.

For the trailing decade using December 20, 2009 as an end point, I arrive at a marginally negative return for the S&P 500 index assuming an average dividend yield of 2.5% for the period. Certainly the negative return would be pronounced by any fees, commissions or taxes related to a 10-year buy-and-hold strategy of the broad market index. This chart gets chopped off in 2005, nonetheless history is on our side, lending support that stock returns have a good chance of improving on the results over the last 10 years.

Equity Risk Premium

The bubbles and scandals that have blanketed corporate America over the last 10 years have made the average investor extremely skeptical. What does this mean for the pricing of risk? Well, if you rewind to the year 2000 when technology exceeded 50% of some indexes, and many investors thought technology was a low risk endeavor, there was virtually no equity risk premium discounted into many stock prices. If you fast forward to today, the reverse is occurring. Investors despise market volatility and arguably demand a much higher risk premium for taking on the instability of stocks. This is the exact environment investors should desire – lots of skepticism and money piled into bonds (See IC article on investor queasiness). As Warren Buffett says, “Be fearful when others are greedy and greedy when others are fearful.” I believe the next 10 years will be a time to be greedy.

The analysis above is obviously very narrow in scope, since we are only discussing domestic stock markets. In my client portfolios I advocate a broadly diversified portfolio across asset classes (including bonds), geographies, and styles. However, in managing bonds across portfolios, I am forced to tactfully include strategies such as inflation protection and shorter duration techniques. With the year-end fast approaching, now is a good time to review your financial goals and asset allocation.

Lightning definitely negatively impacted stocks this decade, but betting for lightning to strike twice this decade could very well turn out to be a losing wager.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at time of publishing had no direct positions in BRKA. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

New Normal is the Old Normal

By Bruce Wimberly (Contributing Writer to Investing Caffeine)

Pimco bond gurus love to talk about the “new normal” as if there is such a thing in financial markets. The problem with promoting such a view is that it assumes markets are static. Ask John Meriwether and his pack of Nobel Prize winning colleagues at LTCM how static the markets are? The point is nothing is normal about the markets or the economy for that matter. No one has a magic crystal ball that can predict the future and if you did you would certainly not promote it on CNBC. Mohamed El-Erian and his bond fund mavens (see also article on Bill Gross) are the poster children for the “new normal.” I will give them credit it is a great marketing gimmick. Not only does it sound cool but it covers just about everything while packaging it into a nice neat sound bite. Talk about media hounds –does El-Erian actually have time to run Pimco after spending hours getting his make-up ready for the countless interviews he gives each day? And what is up with the 1970ʼs mustache?

In the world according to Pimco the new normal, “reflects a growing realization that some of the recent abrupt changes to markets, households, institutions, and government policies are unlikely to be reversed in the next few years. Global growth will be subdued for a while and unemployment high; a heavy hand of government will be evident in several sectors…. But, hold on, I am getting ahead of myself here. I still have a few more preambles”! Iʼll bet he does.

El-Erian is never short on opinions. As an investor all I really care about is what does this mean for asset prices? Ok, so global GDP is going to slow as consumers and institutions repair balance sheets, government policies are becoming more burdensome, and unemployment stays high. Check. Got it. While I am not El-Erain I think what he really meant to say is, “We have already established our bond positions and if you want to help our shareholders you should follow our example and invest on the short end of the curve and be wary of inflation. The Fed is printing money and history suggests this will end badly.”

El-Erian is never short on opinions. As an investor all I really care about is what does this mean for asset prices? Ok, so global GDP is going to slow as consumers and institutions repair balance sheets, government policies are becoming more burdensome, and unemployment stays high. Check. Got it. While I am not El-Erain I think what he really meant to say is, “We have already established our bond positions and if you want to help our shareholders you should follow our example and invest on the short end of the curve and be wary of inflation. The Fed is printing money and history suggests this will end badly.”

As a formal multi-billion dollar fund manager, I happen to agree with the guy. While I think he could have been more direct with his message, there is no way the fed can inflate us out of this mess without their being some pain down the road. The United States cannot print its way to a recovery. Todayʼs long bond auction is just the first shot against the bow. The 4 3/8% coupon went off at a price of $97.6276 for a 4.52% yield versus a 4.49% prior. In other words, the so-called “new normal” really is the old normal and rates are heading higher my friends.

In this so- called “new normal” of higher rates what should an investor do? First, avoid the treasury bubble like the plague. This is where irrational exuberance is occurring the most. Wake-up people. What Pimco bond managers should be telling you is, “Donʼt buy our funds” (except Reits, Tips and Commodities). Bonds are going to get killed. That is the “new normal”. The “new normal” is inflation is your worst nightmare for bonds and bond buyers. Yes, bonds had a great run the last decade and that is the point! History will not repeat itself. The “new normal” is stocks will outperform bonds over the next ten years handily. Yes, stocks might get hit in the short run as rates rise but in the long run they are a far better asset class to weather inflation. The simple truth is businesses can raise prices. That is all you need to know. Donʼt anchor to the last ten years, as Pimco would like you to do. Donʼt worry about slick slogans – like the “new normal”. Just think about all the assets that have poured into Pimcoʼs funds over the last 10-15 and ask yourself “is this likely to continue?”

To paraphrase Wayne Gretzky great investors “skate to where the puck will be”. In my opinion, that leads you away from the mutual fund behemoth that is Pimco and the safe haven of bonds and back into equities. Yes, the S&P 500 has gone nowhere the last 11 years and that is my point…. the “new normal” is the old normal and equities regain their long term return advantage over other asset classes.

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds and equity securities in client and personal portfolios at the time of publishing. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Fuss Making a Fuss About Bonds

Dan Fuss has been managing bond investments since 1958, longer than many of his competing managers have lived on this planet. At 75 years old, he is as sharp, if not sharper, than ever as he manages the flagship $18.7 billion Loomis Sayles Bond Fund (LSBRX). Over his 33-year tenure at Loomis, Sayles & Company (he started in 1976), he has virtually seen it all. After a challenging 2008, which saw his bond fund fall -22%, the bond markets have been kinder to him this year – Fuss’s fund performance registers in the top quartile on a 1-year, 5-year, and 10-year basis, according to Morningstar.com (through 12/3/09). With a track record like that, investors are listening. Unfortunately, based on his outlook, he now is making a loud fuss about the dreadful potential for bonds.

Rising Yields, Declining Prices

Fuss sees the bond market at the beginning stages of a rate-increase cycle. In his Barron’s interview earlier this year, Fuss made a forecast that the 10-Year Treasury Note yield will reach 6.25% in the next 4-5 years (the yield currently is at 3.38%). Not mincing words when describing the current dynamics of the federal and municipal bond markets, Fuss calls the fundamentals “absolutely awful.” Driving the lousy environment is a massive budget deficit that Fuss does not foresee declining below 4.5% of (GDP) Gross Domestic Product – approximately two times the historical average. Making matters worse, our massive debt loads will require an ever increasing supply of U.S. issuance, which is unsustainable in light of the aggressive domestic expansion plans in emerging markets. This issuance pace cannot be maintained because the emerging markets will eventually need to fund their development plans with excess reserves. Those foreign reserves are currently funding our deficits and Fuss believes our days of going to the foreign financing “well” are numbered.

Fuss also doesn’t see true economic expansion materializing from the 2007 peak for another four years due to lackluster employment trends and excess capacity in our economy. What does a bond guru do in a situation like this? Well, if you follow Fuss’ lead, then you need to shorten the duration of your bond portfolio and focus on individual bond selection. In July 2009, the average maturity of Fuss’ portfolio was 12.8 years (versus 13.8 years in the previous year) and he expects it to go lower as his thesis of higher future interest rates plays out. Under optimistic expectations of declining rates, Fuss would normally carry a portfolio with an average maturity of about 20 years. In Barron’s, he also discussed selling longer maturity, high-grade corporate bonds and buying shorter duration high-yield bonds because he expects spreads to narrow selectively in this area of the market.

Unwinding Carry Trade – Pricking the Bubble

How does Fuss envisage the bond bubble bursting? Quite simply, the carry trade ending. In trading stocks, the goal is to buy low and sell high. In executing a bond carry trade, you borrow at low rates (yields), and invest at high rates (yields). This playbook looks terrific on paper, especially when money is essentially free (short-term interest rates in the U.S. are near 0%). Unfortunately, just like a stock-based margin accounts, when investment prices start moving south, the vicious cycle of debt repayment (i.e., margin call) and cratering asset prices builds on itself. Most investors think they can escape before the unwind occurs, but Fuss intelligently underscores, “Markets have a ferocious tendency to get there before you think they should.” This can happen in a so-called “crowded trade” when there are, what Fuss points out, “so many people doing this.”

The Pro Predictor

Mr. Fuss spoke to an audience at Marquette University within three days of the market bottom (March 12, 2009), and he had these prescient remarks to make:

“I’ve never seen markets so cheap…stocks and bonds…not Treasury bonds.”

He goes on to rhetorically ask the audience:

“Is there good value in my personal opinion? You darn bethcha!”

Bill Gross, the “Bond King” of Newport Beach (read more) receives most of the media accolades in major bond circles for his thoughtful and witty commentary on the markets, but investors should start making a larger fuss about the 75 year-old I like to call the “Leader of Loomis!”

Adviser Perspectives Article on Dan Fuss and Interest Rates

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds (including fixed-income) and is short TLT. At time of publishing, SCM had no positions in LSBRX. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Sukuk: Islamic Loophole for Dubai Debt Debacle

Islamic followers can be capitalists too. Although oil prices (currently around $77 per barrel) have fallen from the peak near $150 per barrel in 2008, oil rich nations have gotten creative in how they raise debt-like financing. Critical to fueling the speculative expansion in some oil rich areas has been the growth in sukuk bonds, which have been created as a function of an exploited loophole embedded in Islamic finance principles.

U.S. Does Not Have Monopoly on Debt Driven Greed

The pricked debt bubble that spanned a range of entities, from Icelandic banks to Donald Trump’s empire (read more), has now spread to Dubai commercial real estate. At the center of the storm is Dubai World, a quasi-government owned conglomerate of Dubai, which is in the process of negotiating a $26 billion debt restructuring with the government and sukuk bondholders. The overleveraged Dubai market ($80 billion in total debt) is home to the tallest building in the world, largest man-made islands, and a ski-resort based in the desert – all projects built with the help of debt in the face of collapsing real estate prices. Critical to Dubai World’s debt restructuring is a $3.5 billion sukuk bond issued by its commercial real estate subsidiary Nakheel Development (“Nakheel”). So what exactly is a sukuk (plural of sakk)?

Investopedia lists the following definition for sukuk:

“An Islamic financial certificate, similar to a bond in Western finance, that complies with Sharia, Islamic religious law. Because the traditional Western interest paying bond structure is not permissible, the issuer of a sukuk sells an investor group the certificate, who then rents it back to the issuer for a predetermined rental fee. The issuer also makes a contractual promise to buy back the bonds at a future date at par value.”

Sukuk “No-No”s

The generation of money on top of money – interest payments or what’s called “Riba” – is strictly forbidden by Shari’ah law. As a result, issuers must issue and repurchase sukuk at par (original value), not at a discount or a premium. Shari’ah law encompasses more than Islamic law, it also covers the amorphous spiritual and moral obligations demanded from the religious practitioners. In order to ensure compliance with Islamic principles, many financial institutions and funds typically have a Shari’ah Board monitoring the details of the sukuk. Shari’ah law is very consistent with the teachings in the Quran (the Western version of the Bible). Mixing finance and religion may seem strange on the surface, but I guess if we use world history as a proxy, we shouldn’t be surprised that money and Muhammad somehow find a way to coexist.

Click Here to View CNBC Interview on Sukuk Bonds

Sukuk Structure & Market

The core Islamic finance principles underpinning the sukuk market have been around for more than 1,500 years, but the actual sukuk market was actually introduced in Malaysia around 1990. Since then, the market has been on a continual uptrend. What makes this $1 trillion Islamic debt market (HSBC estimate) even fuzzier is the scores of sukuk structures (See Ijara Sukuk chart below – very similar to a sale-leaseback arrangement), and the diverse geographic issuer/investor base. For example, greater than 60% of Nakheel’s investors are based outside the Middle East (a large portion in Malaysia). Making matters as clear as mud, each geographic region and structure has its own interpretation of legal rights and Shari’ah law. Layer on issues such as derivatives, bankruptcy rights, and penalty fees and you end up with only more complexity. What’s more, many of these sukuk bonds involve Special Purpose Vehicles (SPVs) – made famous by the off-balance sheet variety used by Enron Corp. – in order to get around the Islamic issuance loopholes.

Sukuk Liquidity

The illiquidity of sukuk market hasn’t made resolving the Dubai debt restructuring any easier. The sukuk market doesn’t come close to matching the liquidity of traditional corporate and sovereign debt markets. Little trading is done in secondary markets because most investors in sukuk bonds follow a buy and hold strategy. The lion’s share of trading in this immature market gets completed through inter-institution, over-the-counter transactions. A recent $500 million sukuk deal issued by General Electric (GE) last month has only raised awareness for the financing structure (pre-Nakheel restructuring). As oil rich states strive to diversify their economic bases, I would expect more deals to get done, in spite of the recent Dubai mess. How severe the recent Dubai sukuk black eye will be depends on how Nakheel, the United Arab Emirates (UAE), Abu Dhabi, bondholders, and other constituents restructure the pending sukuk obligations by the December 14th deadline.

The recent debt restructuring talks in Dubai highlight the complexity of this relatively new Islamic financing structure. With very few sukuk bankruptcy cases in existence, the structures remain largely untested and uncertain. How the Dubai debt debacle ultimately gets resolved will have a significant impact on this nascent, but rapidly growing market. Until the sukuk restructuring is settled, Dubai may just need to put the construction of that next man-made island on hold.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Information and data from Moody’s Investor Service (Shari’ah and Sukuk: A Moody’s Primer 5/31/2006), CNBC interview 12/2/09, Financial Times 12/1/09, and other articles. Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at time of publishing had no direct positions in GE. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Equities Up, But Investors Queasy

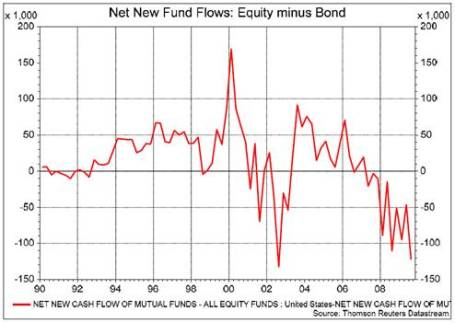

The market may have recovered partially from its illness over the last two years, but investors are still queasy when it comes to equities. The market is up by more than +60% since the March 2009 lows despite the unemployment rate continuing to tick higher, reaching 10.2% in October. Even though equity markets have rebounded, recovering investors have flocked to the drug store with their prescriptions for bonds. Mark Dodson, CFA, from Hays Advisory published a telling chart that highlights the extreme aversion savers have shown towards stocks.

Dodson adds:

“Net new fund mutual fund flows favor bonds over stocks dramatically, so much so that flows are on the cusp of breaking into record territory, with the previous record occurring back in the doldrums of the 2002 bear market. Given nothing but the chart (above), we would never in a million years guess that the stock market has rallied 50-60% off the March lows. It looks more like what you would see right in the throes of a nasty stock market decline.”

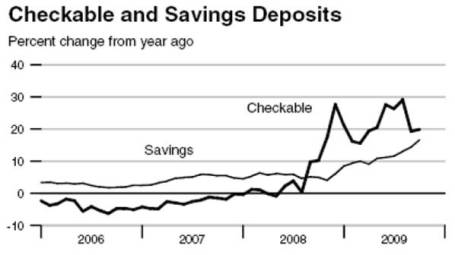

Checking and savings data from the Federal Reserve Bank of Saint Louis further corroborates the mood of the general public as the nausea of the last two years has yet to wear off. The mountains of cash on the sidelines have the potential of fueling further gains under the right conditions (see also Dry Powder Piled High story).

As Dodson notes in the Hays Advisory note, not everything is doom and gloom when it comes to stocks. For one, insider purchases according to the Emergent Financial Gambill Ratio is the highest since the recent bear market came to a halt. This trend is important, because as Peter Lynch emphasizes, “There are many reasons insiders sell shares but only one reason they buy, they feel the price is going up.”

What’s more, the yield curve is the steepest it has been in the last 25 years. This opposing signal should provide comfort to those blue investors that cried through inverted yield curves (T-Bill yields higher than 10-Year Notes) that preceded the recessions of 2000 and 2008.

Equity investors are still feeling ill, but time will tell if a dose of bond selling and a prescription for “cash-into-stocks” will make the queasy patient feel better?

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Drought in Higher Rates May Be Over

The drought in higher interest rates may be nearing an end? Ever since the global financial crisis accelerated into full force in the fall of 2008, there were a constant flow of coordinated interest rate cuts triggered around the world with the aim of stimulating global GDP (Gross Domestic Product) and improving credit flow through the clogged financial pipes. Central banks across the world cut key benchmark interest rate levels and the impact of these reductions has a direct influence on what consumers pay for their financial products and services. More recently, we have begun to see the reversal of previous cuts with rate hikes witnessed in several international markets. Last week we saw Norway become the first western European country to raise rates, following an earlier October rate lift by Australia and another by Israel in August. For some countries, the sentiment has switched from global collapse fears to a stabilization posture coupled with future inflation concerns. In the U.S., the data has been more mixed (read article here) and the Federal Reserve has been clear on its intention to keep short-term rates at abnormally low levels for an extended period of time. That stance would likely change with evidence of inflationary pressures or improved job market conditions.

What Does This Mean for Consumers?

Prior to the financial crisis, credit availability flourished at affordably low rates. Now, with signs of a potential global recovery matched with regulatory overhauls, consumers may be impacted in several financial areas:

1) Credit Card Rates: Beyond regulatory changes in Washington (read more), the interest rate charged on unpaid credit card balances may be on the rise. When the Federal Reserve inevitably raises the targeted Federal Funds Rate (the interest rate for loans made between banks) from the current target rate range of 0.00% and 0.25%, this action will likely have direct upward pressure on consumer credit card rates. The associated increase in key benchmark rates such as the Prime Rate (the rate charged to a bank’s most creditworthy customers) and LIBOR (London Interbank Offer Rate) would result in higher monthly interest payments for consumers.

2) Other Consumer Loans: Many of the same forces impacting credit card rates will also impact other consumer loans, like home mortgages and auto loans. Pull out your loan documents – if you have floating or variable rate loans then you may be exposed to future hikes in interest rates.

3) Business Loans / Lines of Credit: Business owners -not just consumers – can also be impacted by rising rates. When the cost of funding goes up (.i.e., interest rates), the banks look to pass on those higher costs to the customer so the account profitability can be maintained.

4) Dollar & Import Prices: To the extent subsequent United States rate hikes lag other countries around the world, our dollar runs the risk of depreciating more in value (currency investors, all else equal, prefer currencies earning higher interest rates). A weaker dollar translates into foreign goods and services costing more. If international central banks continue to raise rates faster than the U.S., then imported good inflation could become a larger reality.

5) Hit to Bond Prices: Higher interest rates can also result in a negative hit to your bond portfolio. Higher duration bonds, those typically with longer maturities and lower relative coupon payments, are the most vulnerable to a rise in interest rates. Consider shortening the duration of your portfolio and even contemplate floating rate bonds.

Interest rates are the cost for borrowed money and even with the recent increase in consumers’ savings rate, consumers generally are still saddled with a lot of debt. Do yourself a favor and review any of your credit card agreements, loan documents, and bond portfolio so you will be prepared for any future interest rate increases. Shopping around for better rates and/or consolidating high interest rate debt into cheaper alternatives are good strategies as we face the inevitable end in the drought of higher global interest rates.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.