Strong Advice from Super Swensen

October 2, 2009 at 12:59 am 2 comments

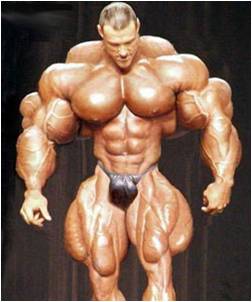

Playing the financial markets is a challenging game, and over the last decade we’ve witnessed events we will never see again in our lifetimes. Through these muscle aches and pains, listening and paying attention to powerful, seasoned industry veterans, like David Swensen, becomes paramount. Mr. Swensen has proven his durability – he has managed the Yale endowment for 24 years and has overseen the growth of the university’s portfolio from $1 billion to $17 billion. For the decade ending in June 2008, the Yale portfolio averaged an incredible 16.3% annual return.

So what commanding advice does Mr. Swensen have to share? Here are a few nuggets regarding equities as discussed in his May interview published in The Guru Investor (TGI):

“With a long time horizon you should have an equity orientation, because over longer periods of time, equities are going to deliver better results,” he says. “If they don’t, then capitalism isn’t working. And we could well be at a point where investments in equities are going to produce returns going forward that are higher than what we’ve seen in the past five or ten years.”

I find it difficult to argue with him. Perhaps we still have a ways to go, but the equity markets had an explosion after the 1966-1982 hiatus. Perhaps the 2000-2009 period isn’t long enough to mark bottom, but at a minimum, the spring is coiling based on history.

When it comes to diversification, TGI summarized Swensen’s asset allocation as follows:

“He recommends that investors have 30% of their funds in U.S. stocks, 15% in Treasury bonds, 15% in Treasury Inflation-Protected Securities, 15% in Real Estate Investment Trusts, 15% in foreign developed market equities, and 10% in emerging market equities. As investors get older, they should keep this type of allotment for a portion of their portfolio but begin to decrease the size of that portion, putting part of their portfolios into less risky assets like cash or Treasuries.”

Many investors were taking excessive risk in 2008 (within their asset allocations), and they were not even aware. Let’s hope valuable lessons have been learned and investors adjust the risk levels of their portfolios as they age.

Mr. Swensen has some choice words for the mutual fund management industry as well:

“The problem is that the quality of the management in the mutual fund industry is not particularly high, and you pay an extraordinarily high price for that not-very-good management,” he says. Swensen cites one study performed by Rob Arnott that measured mutual fund performance over a two-decade period. The study found that you’d have had a 15% chance of beating market after fees and taxes by investing in mutual funds — and that includes only funds that were around for the entire period; many other weaker funds didn’t last, meaning the results have a survivorship bias.

Tough to disagree, and as I’ve written in the past, I believe there are only so many .300 hitters in baseball (a study in 2007 showed only 12 active career .300 hitters in the Major Leagues – highlighted in my previous Ron Baron article). Outside of baseball, there are consistent alpha generators in the market too. However, I’d make the case that identifying the alpha generators in the financial markets is much more difficult because of the extreme fund performance volatility. Even the best managers can string some bad years together.

Swensen doesn’t stop there. He expands on the reasons behind mutual fund manager underperformance:

Taxes and fees are the big culprits, Swensen says: “Why are the tax bills so high? Because turnover’s too high. The mutual fund managers are trading the portfolios as if taxes don’t matter, and taxes do matter. And they’re trading the portfolios as if transactions cost and market impact don’t matter, and they do matter. And as they trade the portfolios, basically what’s happening is Wall Street is siphoning off its slice of the pie … and that’s at the expense of the investor.”

One thing we learned from the real estate and financial bubble that burst over the last few years is that incentive structures were misaligned. Manager compensation, whether you are talking hedge funds or mutual funds, is based on too short a time horizon, and therefore incentive structures encourage abnormal risk-taking. In baseball terms, you have those that take excessive risk and swing for the mega-bucks fences (loose cannons) and the bunters (benchmark huggers) who seek the comfort of “lower” mega-bucks. Swensen is a much bigger believer in passive strategies (as am I), using passive investment vehicles like ETFs (Exchange Traded Funds).

Mr. Swensen continues his critical perspective by targeting investors too:

Individuals and institutions who buy mutual funds “take this mutual fund industry which produces a bunch of products that are not great to start with, and then they screw it up by chasing hot performance and selling after things turn cold.”

The 1984-2002 John Bogle data (Vanguard) included in my “Action Dan” article hammers that point home.

Where should investors go now?

Asked what the one recommendation he has right now for investors is, Swensen cited TIPS. “We’ve had this massive fiscal stimulus, massive monetary stimulus, and it’s hard to see how that doesn’t translate into pretty substantial inflation, or at least pretty substantial risk of inflation … down the road at some point,” he said.

Ditto, once again – I’m a believer in having some inflation protection in your portfolio. Of course there is no free lunch in the investment world, and so there are certainly some risk factors in Swensen’s alternative investment strategy (e.g. hedge funds, private equity, and real estate). Certainly, due to significant illiquidity and other factors, many of these areas got absolutely hammered in 2008.

The best investors prepare their portfolios for these strenuous times. Do yourself a favor and work on your muscle tone too – and listen to the strong advice of David Swensen.

Read the Full TGI Article Here

Wade W. Slome, CFA, CFP

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management and client accounts do have direct long positions in TIP at the time article was originally posted. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Entry filed under: Profiles. Tags: active, alternative investments, David Swensen, endowment, etf, hedge fund, inflation, passive, TIP, Yale.

2 Comments Add your own

Leave a comment

Trackback this post | Subscribe to the comments via RSS Feed

1. Getting Distressed can be a Beach « Investing Caffeine | March 3, 2010 at 2:14 am

Getting Distressed can be a Beach « Investing Caffeine | March 3, 2010 at 2:14 am

[…] in a tizzy. Several diversification attacks were directed at David Swensen’s strategy (see Super Swensen article) implemented at Yale’s endowment. Although Swensen’s approach covered a broad swath of […]

2. Private Equity Sitting on Stuffed Wallet « Investing Caffeine | June 16, 2010 at 12:04 am

Private Equity Sitting on Stuffed Wallet « Investing Caffeine | June 16, 2010 at 12:04 am

[…] and tribulations, but PE’s diversification benefits should not be forgotten. The success of the “Yale Model,” implemented by David Swensen, has come under attack with the recent bursting of the credit bubble, but with the ever-swinging […]