Posts tagged ‘Warren Buffett’

Investing with Crayons

At one level, investing can be extremely challenging if you consider the plethora of diverse and unpredictable factors such as monetary policy, fiscal policy, wars, banking crises, natural disasters, currency crises, geopolitical turmoil, Ebola, Scottish referendums, etc. On the other hand, investing (not trading or speculating) should be quite simple…like drawing stick figures with a crayon. However, simplicity does not mean laziness. Successful stock research requires rigorous due diligence without cutting corners. Once the heavy research lifting is completed, concise communication is always preferred.

In order to be succinct, investors need to understand the key drivers of stock performance. In the short run, investors may not be able to draw the directional path of stock prices, but over the long run, Peter Lynch described stock predictions best (see Inside the Investing Genius) when he stated:

“People may bet on hourly wiggles of the market but it’s the earnings that waggle the wiggle long term.”

In other words, if revenues, earnings, and most importantly cash flows go up over the long-term, then it is highly likely that stock prices will follow. Besides profits, interest rates and sentiment are other key contributing factors affecting the trajectory of future stock prices.

In high school and college, students often cram as much information into a paper with the goal of layering pages as high as possible. Typically, the heaviest papers got A’s and the lightest papers got C’s or D’s. However, as it relates to stock analysis, the opposite holds true – brevity reigns supreme.

American psychologist and philosopher William James noted, “The art of being wise is the art of knowing what to overlook.”

In our digital world of informational overload, knowing what to overlook is quite a challenge. I experienced this dynamic firsthand early on in my professional career when I was an investment analyst. When asked to research a new stock by my portfolio manager, often my inclination was to throw in the data kitchen sink into my report. Rather than boil down the report to three or four critical stock-driving factors, I defaulted to a plan of including every possible risk factor, competitor, and valuation metric. This strategy was designed primarily as a defense mechanism to hedge against a wide range of possible outcomes, whether those outcomes were probable or very unlikely. Often, stuffing irrelevant information into reports resulted in ineffectual, non-committal opinions, which could provide cosmetic wiggle room for me to rationalize any future upward or downward movement in the stock price.

Lynch understood as well as anyone that stock investing does not have to be complex rocket science:

“Everyone has the brainpower to follow the stock market. If you made it through fifth-grade math, you can do it.”

In fact, when Lynch worked with investment analysts, he ran a three-minute timer and forced the analysts to pitch stock ideas in basic terms before the timer expired.

If you went back further in time, legendary Value guru Benjamin Graham also understood brain surgery is not required to conduct successful equity analysis:

“People don’t need extraordinary insight or intelligence. What they need most is the character to adopt simple rules and stick to them.”

Similarly, Warren Buffett hammers home the idea that a gargantuan report or extravagant explanation isn’t required in equity research:

“You should be able to explain why you bought a stock in a paragraph.”

Hedge fund veteran manager Michael Steinhardt held the belief that a stock recommendation should be elegant in its simplicity as well. In his book No Bull – My Life In and Out of Markets he states that an analyst “should be able to tell me in two minutes, four things: 1) the idea; 2) the consensus view; 3) his variant perception; and 4) a trigger event.

All these previously mentioned exceptional investors highlight the basic truth of equity investing. A long, type-written report inundated with confusing charts and irrelevant data is counterproductive to the investment and portfolio management process. Outlining a stock investment thesis is much more powerful when succinctly written with a crayon.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own a range of positions in certain exchange traded fund positions, but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Got Growth?

Investing in the stock market can be quite stressful, especially during periods of volatility…but investing doesn’t have to be nerve-racking. Investing legend T. Rowe price captured the beneficial sentiments of growth investing beautifully when he stated the following:

“The growth stock theory of investing requires patience, but is less stressful than trading, generally has less risk, and reduces brokerage commissions and income taxes.”

What I’ve learned over my investing career is that fretting over such things as downgrades, management changes, macroeconomic data, earnings misses, geopolitical headlines, and other irrelevant transitory factors leads to more heartache than gains. If you listen to a dozen so-called pundits, talking heads, journalists, or bloggers, what you quickly realize is that all you are often left with are a dozen different opinions. Opinions don’t matter…the facts do.

Finding Multi-Baggers: The Power of Compounding

Rather than succumbing to knee-jerk reactions from the worries of the day, great long-term investors realize the benefits of compounding. We know T. Rowe Price appreciated this principle because he agreed with Nobel Prize winning physicist Albert Einstein’s view that “compounding interest” should be considered the “8th wonder of the world” – see also how Christopher Columbus can turn a penny into $121 billion (Compounding: A Penny Saved is Billions Earned).

People generally refer to Warren Buffett as a “Value” investor, but in fact, despite the Ben Graham moniker, Buffett has owned some of the greatest growth stocks of all-time. For example, Coca Cola Co (KO) achieved roughly a 20x return from 1988 – 1998, as shown below:

If you look at other charts of Buffett’s long-term holdings, such as Wells Fargo & Company (WFC), American Express Co (AXP), and Procter & Gamble – Gillette (PG), the incredible compounded gains are just as astounding.

In recent decades, there is no question that stocks have benefited from P/E expansion. P/E ratios, or the average price paid for stocks, has increased from the early 1980s as long-term interest rates have declined from the high-teens to the low single-digits, but the real lifeblood for any stock is earnings growth (see also It’s the Earnings, Stupid). As growth investor extraordinaire Peter Lynch once said:

“People may bet on hourly wiggles of the market but it’s the earnings that waggle the wiggle long term.”

As Lynch also pointed out, it only takes the identification of a few great multi-bagger stocks every decade to compile a tremendous track record, while simultaneously hiding many sins:

“Fortunately the long-range profits earned from really good common stocks should more than balance the losses from a normal percentage of such mistakes.”

The Scarcity of Growth

Ever since the technology bubble burst in 2000, Growth stocks have felt the pain. Since that period, the Russell 1000 Value index – R1KV (Ticker: IWD) has almost doubled in value and outperformed the Russell 1000 Growth index – R1KG (Ticker: IWF) by more than +60% (see chart below):

Although the R1KG index has yet to breach its previous year 2000 highs, ever since the onset of the Great Financial Crisis (end of 2007), the R1KG index has been on the comeback trail. Now, the Russell 1000 Growth index has outperformed its Value sister index by an impressive +25% (see chart below):

Why such a disparity? Well, in a PIMCO “New Normal & New Neutral” world where global growth forecasts are being cut by the IMF and a paltry advance of 1.7% in U.S. GDP is expected, investors are on a feverish hunt for growth. U.S. investors are myopically focused on our 2.34% 10-Year Treasury yield, but if you look around the rest of the globe, many yields are at multi-hundred year lows. Consider 10-year yields in Germany sit at 0.96%; Japan at 0.50%; Ireland at 1.98%; and Hong Kong at 1.94% as a few examples. This scarcity of growth has led to outperformance in Growth stocks and this trend should continue until we see a clear sustainable acceleration in global growth.

If we dig a little deeper, you can see the 25% premium in the R1KG P/E ratio of 20.8x vs. 16.7x for the R1KV is well deserved. Historical 5-year earnings growth for the R1KG has been +52% higher than R1KV (17.8% vs. 11.7%, respectively). Going forward, the superior earnings performance is expected to continue. Long-term growth for the R1KG index is expected to be around 55% higher than the R1KV index (14% vs 9%).

In this 24/7, Facebook, Twitter society we live in, investing has never been more challenging with the avalanche of daily news. The ultra-low interest rates and lethargic global recovery hasn’t made my life at Sidoxia any easier. But one thing that is clear is that the investment tide is not lifting all Growth and Value stocks at the same pace. The benefits of long-term Growth investing are clear, and in an environment plagued by a scarcity of growth, it is becoming more important than ever when reviewing your investment portfolios to ask yourself, “Got Growth?”

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold long positions in KO/PG (non-discretionary accounts) and certain exchange traded fund positions, but at the time of publishing SCM had no direct position in TWTR, FB, WFC, AXP, IWF, IWD or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Stock Market: Shrewd Bet or Stupid Gamble?

Trillions of dollars have been lost and gained over the last five years. The extreme volatility strangled investment portfolios, and as a result millions of investors capitulated by throwing in the towel and locking in losses. Melted 401ks, shrunken IRAs, and beat-up retirement accounts bruised the overarching psyche of Americans to the point they questioned whether the stock market is a shrewd bet or stupid gamble?

The warmth and safety of bonds provided some temporary relief in subsequent years, but the explosive rebound in stock prices to new record highs in 2013 coupled with the worst year in a decade for bonds still have many on the sidelines asking whether they should get back in?

As I’ve written many times in the past (see Timing Treadmill), timing the market is a fruitless effort. Elementary statistics, including the “Law of Large Numbers” will demonstrate that blind squirrels can and will beat the market on occasion, but very few can consistently beat the stock market indices for sustained periods (see Dart-Throwing Chimps).

However, there have been some gun-slinging hedge fund managers who have accumulated some impressive track records. Because of insanely high management fees, many overpaid hedge fund managers will swing for the fences by using a combination of excessive leverage and/or concentration. If the hedge funds connect with lucky returns, the managers can take the money and run. If they swing and miss…no problem. Close shop, hang out a shingle across the street, change the hedge fund’s name, and try again. Of course there are those successful hedge fund managers who have learned how to manipulate the system and exploit information to their advantage, but many of those managers like Raj Rajaratnam and Steven Cohen are either behind bars or dealing with the Feds (see fantastic Frontline piece on Cohen).

But not everyone cheats. There actually are a minority of managers who consistently beat the market by taking a long-term approach like Warren Buffett. Long-term outperforming managers are like lifetime .300 hitters in Major League Baseball – the outperformers exist, but they are rare. In 2007, AssociatedContent.com did a study that showed there were only 12 active career .300 hitters in Major League Baseball.

Another legend in the investment industry is John Bogle, the founder of the Vanguard Group, a firm primarily focused on passive, index-based investment strategies. Although it is counter-intuitive to most, just matching the market (or index) will put you in the top-quartile over the long-run (see Darts, Monkeys & Pros). There’s a reason Vanguard manages more than $2,000,000,000,000+ (yes…trillion) of investors’ money. Even at this gargantuan size, Vanguard remains a fraction of the overall industry. Regardless, the gospel of low-cost, tax-efficient, long-term horizons is slowly leaking out to the masses (Disclosure: Sidoxia is a devoted user of Vanguard and other providers’ low-cost Exchange Traded Funds [ETFs]).

Rolling the Dice?

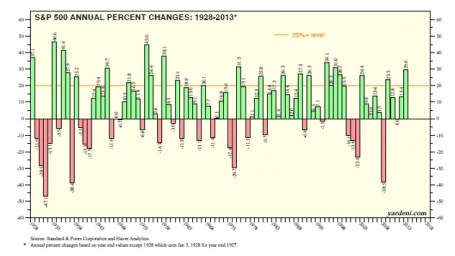

Unlike Las Vegas, where the odds are stacked against you, in the stock market the odds are stacked in your favor if you stay in the game long enough and don’t chase performance. Dr. Ed Yardeni has a great chart (below) summarizing stock market returns over the last 85 years, and what the data highlights is that the market is up (or flat) 69% of the time (59/86 years). The probabilities are so favorable that if I got comparable odds in Vegas, I’d probably live there!

Unfortunately, rather than using this time arbitrage in conjunction with the incredible power of compounding (see A Penny Saved is Billions Earned), many individuals look at the stock market like a casino – similarly to betting on black or red at a roulette wheel. Speculating about the direction of the market can be fun, and I’ve been known to guess on occasion, but it’s a complete waste of time. Creating a long-term plan of reaching or maintaining your retirement goals through a diversified portfolio is the way to go – not bobbing in out of the market with cash and bonds.

At Sidoxia, we don’t actively trade and time individual stocks either. For the majority of our client portfolios, we follow a growth philosophy similar to the late T. Rowe Price:

“The growth stock theory of investing requires patience, but is less stressful than trading, generally has less risk, and reduces brokerage commissions and income taxes.”

Nobody knows the direction of the stocks with certainty, and irrespective of whether the market goes down this year or not, history has proven the stock market has been a shrewd, long-term bet.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Bernanke: Santa Claus or Grinch?

I’ve written plenty about my thoughts on the Fed (see Fed Fatigue) and all the blathering from the media talking heads. Debates about the timing and probability of a Fed “taper” decision came to a crescendo in the recent week. As is often the case, the exact opposite of what the pundits expected actually happened. It was not a huge surprise the Federal Reserve initiated a $10 billion tapering of its $85 billion monthly bond buying program, but going into this week’s announcement, the betting money was putting their dollars on the status quo.

With the holiday season upon us, investors must determine whether the tapered QE1/QE2/QE3 gifts delivered by Bernanke are a cause for concern. So the key question is, will this Santa Claus rally prance into 2014, or will the Grinch use the taper as an excuse to steal this multi-year bull market gift away?

Regardless of your viewpoint, what we did learn from this week’s Fed announcement is that this initial move by the Fed will be a baby step, reducing mortgage-backed and Treasury security purchases by a measly $5 billion each. I say that tongue in cheek because the total global bond market has been estimated at about $80,000,000,000,000 (that’s $80 trillion).

As I’ve pointed out in the past, the Fed gets way too much credit (blame) for their impact on interest rates (see Interest Rates: Perception vs Reality). Interest rates even before this announcement were as high/higher than when QE1 was instituted. What’s more, if the Fed has such artificial influence over interest rates, then why do Austria, Belgium, Canada, Denmark, Finland, France, Germany, Japan, Netherlands, Sweden, and Switzerland all have lower 10-year yields than the U.S.? Maybe their central banks are just more powerful than our Fed? Unlikely.

Dow 128,000 in 2053

Readers of Investing Caffeine know I have followed the lead of investing greats like Warren Buffett and Peter Lynch, who believe trying to time the markets is a waste of your time. In a recent Lynch interview, earlier this month, Charlie Rose asked for Lynch’s opinion regarding the stock market, given the current record high levels. Here’s what he had to say:

“I think the market is fairly priced on what is happening right now. You have to say to yourself, is five years from now, 10 years from now, corporate profits are growing about 7 or 8% a year. That means they double, including dividends, about every 10 years, quadruple every 20, go up 8-fold every 40. That’s the kind of numbers you are interested in. The 10-year bond today is a little over 2%. So I think the stock market is the best place to be for the next 10, 20, 30 years. The next two years? No idea. I’ve never known what the next two years are going to bring.”

READ MORE ABOUT PETER LYNCH HERE

Guessing is Fun but Fruitless

I freely admit it. I’m a stock-a-holic and member of S.A. (Stock-a-holic’s Anonymous). I enjoy debating the future direction of the economy and financial markets, not only because it is fun, but also because without these topics my blog would likely go extinct. The reality of the situation is that my hobby of thinking and writing about the financial markets has no direct impact on my investment decisions for me or my clients.

There is no question that stocks go down during recessions, and an average investor will likely live through at least another half-dozen recessions in their lifetime. Unfortunately, speculators have learned firsthand about the dangers of trading based on economic and/or political headlines during volatile cycles. That doesn’t mean everyone should buy and do nothing. If done properly, it can be quite advantageous to periodically rebalance your portfolio through the use of various valuation and macro metrics as a means to objectively protect/enhance your portfolio’s performance. For example, cutting exposure to cyclical and debt-laden companies going into an economic downturn is probably wise. Reducing long-term Treasury positions during a period of near-record low interest rates (see Confessions of a Bond Hater) as the economy strengthens is also likely a shrewd move.

As we have seen over the last five years, the net result of investor portfolio shuffling has been a lot of pain. The acts of panic-selling caused damaging losses for numerous reasons, including a combination of agonizing transactions costs; increased inflation-decaying cash positions; burdensome taxes; and a mass migration into low-yielding bonds. After major indexes have virtually tripled from the 2009 lows, many investors are now left with the gut-wrenching decision of whether to get back into stocks as the markets reach new highs.

As the bulls continue to point to the scores of gifts still lying under the Christmas tree, the bears are left hoping that new Fed Grinch Yellen will come and steal all the presents, trees, and food from the planned 2014 economic feast. There are still six trading days left in the year, so Santa Bernanke cannot finish wrapping up his +30% S&P 500 total return gift quite yet. Nevertheless, ever since the initial taper announcement, stocks have moved higher and Bernanke has equity investors singing “Joy to the World!”

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Can Good News be Good News?

There has been a lot of hyper-taper sensitivity of late, ever since Fed Chairman Ben Bernanke broached the subject of reducing the monthly $85 billion bond buying stimulus program during the spring. With a better than expected ADP jobs report on Wednesday and a weekly jobless claims figure on Thursday, everyone (myself) included was nervously bracing for hot November jobs number on Friday. Why fret about potentially good economic numbers? Firstly, as a money manager my primary job is to fret, and secondarily, stronger than forecasted job additions in November would likely feed the fear monster with inflation and taper alarm, thus resulting in a triple digit Dow decline and a 20 basis point spike in 10-year Treasury rates. Right?

Well, the triple digit Dow move indeed came to fruition…but in the wrong direction. Rather than cratering, the Dow exploded higher by +200 points above 16,000 once again. Any worry of a potential bond market thrashing fizzled out to a flattish whimper in the 10-year Treasury yield (to approximately 2.86%). You certainly should not extrapolate one data point or one day of trading as a guaranteed indicator of future price directions. But, in the coming weeks and months, if the economic recovery gains steam I will be paying attention to how the market reacts to an inevitable Fed tapering and likely rise in interest rates.

The Expectations Game

Interpreting the correlation between the tone of news and stock direction is a challenging endeavor for most (see Circular Conversations & Tweet), but stock prices going up on bad news has not a been a new phenomenon. Many will argue the economy has been limp and the news flow extremely weak since stock prices bottomed in early 2009 (i.e., Europe, Iran, Syria, deficits, debt downgrade, unemployment, government shutdown, sequestration, taxes, etc.), yet actual stock prices have chugged higher, nearly tripling in value. There is one word that reconciles the counterintuitive link between ugly news and handsome gains…EXPECTATIONS. When expectations in 2009 were rapidly shifting towards a Great Depression and/or Armageddon scenario, it didn’t take much to move stock prices higher. In fact, sluggish growth coupled with historically low interest rates were enough to catapult equity indices upwards – even after factoring in a dysfunctional, ineffectual political backdrop.

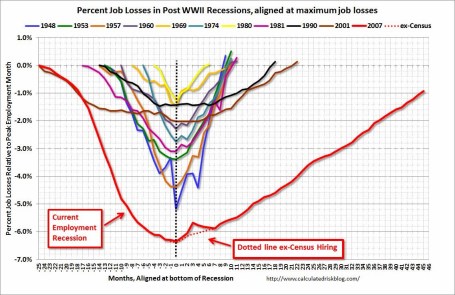

From a longer term economic cycle perspective, this recovery, as measured by job creation, has been the slowest since World War II (see Calculated Risk chart below). However, if you consider other major garden variety historical global banking crises, our crisis is not much different (see Oregon economic study).

While it’s true that stock prices can go up on bad news (and go down on good news), it is also possible for prices to go up on good news. Friday’s trading action after the jobs report is the proof of concept. As I’ve stated before, with the meteoric rise in stock prices, it’s my view the low hanging profitable fruit has been plucked, but there is still plenty of fruit on the trees (see Missing the Pre-Party). I am not the only person who shares this view.

Recently, legendary investor Warren Buffett had this to say about stocks (Source: Louis Navellier):

“I don’t have concerns about this market.” Buffet said stocks are “in a zone of reasonableness. Five years ago,” Buffett said, “I wrote an article for The New York Times that said they were very cheap. And every now and then, you can see that that they’re very overpriced or very underpriced.” Today, “they’re definitely not way overpriced. They’re definitely not underpriced.” “If you live long enough,” Buffett said, “you’ll see a lot higher prices. I don’t know what stocks will do next week or next month or next year, but five or 10 years from now, they are very likely to be higher.”

However, up cycles eventually run their course. As stocks continue to go up on good news, ultimately they begin to go down on good news. Expectations in time tend to get too lofty, and the market begins to anticipate a downturn. Stock prices are continually incorporating information that reflects the direction of future earnings and cash flow prospects. Looking into the rearview mirror at historical results may have some value, but gazing through the windshield and anticipating what’s around the corner is more important.

Rather than getting caught up with the daily mental somersault exercises of interpreting what the tone of news headlines means to the stock market (see Sentiment Pendulum), it’s better to take a longer-term cyclical sentiment gauge. As you can see from the chart below, waiting for the bad news to end can mean missing half of the upward cycle. And the same principle applies to good news.

Bad news can be good news for stock prices, and good news can be bad for stock prices. With the spate of recent positive results (i.e., accelerating purchasing manager data, robust auto sales, improving GDP, better job growth, and more new-home sales), perhaps good news will be good news for stock prices?

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

The Most Hated Bull Market Ever

Life has been challenging for the bears over the last four years. For the first few years of the recovery (2009-2010) when stocks vaulted +50%, supposedly we were still in a secular bear market. Back then the rally was merely dismissed as a dead-cat bounce or a short-term cyclical rally, within a longer-term secular bear market. Then, after an additional +50% move the commentary switched to, “Well, we’re just in a long-term trading range. The stock market hasn’t done a thing in a decade.” With major indexes now hitting all-time record highs, the pessimists are backpedaling in full gear. Watching the gargantuan returns has made it more difficult for the bears to rationalize a tripling +225% move in the S&P 600 index (Small-Cap); a +214% move in the S&P 400 index (Mid-Cap); and a +154% in the S&P 500 index (Large-Cap) from the 2009 lows.

For the unfortunate souls who bunkered themselves into cash for an extended period, the return-destroying carnage has been crippling. Making matters worse, some of these same individuals chased a frothy over-priced gold market, which has recently plunged -30% from the peak.

Bonds have generally been an OK place to be as Europe imploded and domestic political gridlock both helped push interest rates to record-lows (e.g., tough to go lower than 0% on the Fed-Funds rate). But now, those fears have subsided, and the recent rate spike from Ben Bernanke’s “taper tantrum” has caused bond bulls to reassess their portfolios (see Fed Fatigue). Staring at the greater than -90% underperformance of bonds, relative to stocks over the last four years, has been a bitter pill to swallow for fervent bond believers. The record -$9.9 billion outflow from Mr. New Normal’s (Bill Gross) Pimco Total Return Fund in June (a 26-year record) is proof of this anxiety. But rather than chase an unrelenting stock market rally, stock haters and skeptics remain stubborn, choosing to place their bond sale proceeds into their favorite inflation-depreciating asset…cash.

Crash Diet at the Buffet

I’ve seen and studied many markets in my career, but the behavioral reactions to this most-hated bull market in my lifetime have been fascinating to watch. In many respects this reminds me of an investing buffet, where those participating in the nourishing market are enjoying the spoils of healthy returns, while the skeptical observers on the sidelines are on a crash diet, selecting from a stingy menu of bread and water. Sure, there is some over-eating, heartburn, and food coma experienced by those at the stock market table, but one can only live on bread and water for so long. The fear of losses has caused many to lose their investing appetite, especially with news of sequestration, slowing China, Middle East turmoil, rising interest rates, etc. Nevertheless, investors must realize a successful financial future is much more like an eating marathon than an eating sprint. Too many retirees, or those approaching retirement, are not responsibly handling their savings. As legendary basketball player and coach John Wooden stated, “Failing to prepare is preparing to fail.”

20 Years…NOT 20 Days

I will be the first to admit the market is ripe for a correction. You don’t have to believe me, just take a look at the S&P 500 index over the last four years. Despite the explosion to record-high stock prices, investors have had to endure two corrections averaging -20% and two other drops approximating -10%. Hindsight is 20-20, but at each of those fall-off periods, there were plenty of credible arguments being made on why we should go much lower. That didn’t happen – it actually was the opposite outcome.

For the vast majority of investing Americans, your investing time horizon should be closer to 20 years…not 20 days. People that understand this reality realize they are not smart enough to consistently outwit the market (see Market Timing Treadmill). If you were that successful at this endeavor, you would be sitting on your private, personal island with a coconut, umbrella drink.

Successful long-term investors like Warren Buffett recognize investors should “buy fear, and sell greed.” So while this most hated bull market remains fully in place, I will follow Buffett’s advice comfortably sit at the stock market buffet, enjoying the superior long-term returns put on my plate. Crash dieters are welcome to join the buffet, but by the time they finally sit down at the stock market table, I will probably have left to the restroom.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), including IJR, and IJH, but at the time of publishing, SCM had no direct position in BRKA/B, Pimco Total Return Fund, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

The Challenge of Defining Growth vs. Value

“A challenge only becomes an obstacle when you bow to it.”

― Ray Davis (Famous General in the Marines)

In the investing world, one major challenge is defining the differences between “growth” vs. “value”. Warren Buffett said it best when he described growth and value as two separate sides of the same coin. In general, low or declining growth will be valued less than a comparable company with faster growth. Often, most companies go through a life cycle just like a human would (see Equity Life Cycle). In other words, companies frequently start small, grow larger, mature, and then die. Of course, some companies never grow, or because of lack of funding or outsized losses, end up suffering an early death. It’s tough to generalize with companies, because some businesses are more cat-like than human. For example, Apple Inc. (AAPL) may not have had nine lives, but the stock has been left for dead several times during its lifespan, before managing to resurrect itself from value status to growth darling (with a little assistance from Steve Jobs). Whether Tim Cook can lead Apple back to the Promised Land of growth remains to be seen, but many investors still see value.

Fluctuating price and earnings trends over a company’s life cycle frequently create confusion surrounding the proper categorization of a stock as growth or value. The other frustrating aspect to this debate is the absence of a universally accepted definition of growth and value. A few specialty companies have chosen to address this challenge. Russell Investments in Seattle, Washington is a leader in the benchmark/index creation field. Russell tackles the definitional issue by creating quantitatively based definitions, tediously explained in a thrilling 44-page paper titled, “Construction and Methodology.” Here is an exhilarating excerpt:

“Russell Investments uses a ‘non-linear probability’ method to assign stocks to the growth and value style valuation indexes. Russell uses three variables in the determination of growth and value. On the value side, book-to-price is used, while on the growth side, the I/B/E/S long-term growth variable was replaced by two variables- I/B/E/S forecast medium-term growth (2 yr) and sales per share historical growth (5 yr).”

As I bite my tongue in sarcasm, I like to point out that these methodologies constantly change – Russell most recently changed their methodology in 2011. What’s more, there are numerous other indexing companies that define growth and value quite differently (e.g., Standard & Poor’s, Lipper, MSCI, etc.).

Like religious beliefs that are viewed quite differently and are prone to passionate arguments, so too can be the debates over growth vs. value categorization. I’ve been brainwashed by numerous great investors (see Investor Hall Fame), and underpinning my philosophy is the belief that price follows earnings (see It’s the Earnings Stupid). As a result, I am constantly on the lookout for attractively priced stocks that have strong growth prospects. If Russell or S&P looked under the hood of my client portfolios, I’m certain they would find a healthy mix of growth and value stocks, as they define it. If they looked in Warren Buffett’s portfolio, arguably similar conclusions could be made. Most observers call Buffett a value investor, but over Buffett’s career, he has owned some of the greatest growth stocks of all-time (e.g., Coca Cola (KO), American Express Co (AXP), and Procter & Gamble (PG)).

At the end of the day, expectations embedded in the value of share prices determine future appreciation or depreciation, depending on how actual results register relative to those expectations. If stock prices are too high (as measured by the P/E, Price/Free-Cash-Flow, or other valuation metrics), slowing growth can lead to sharp and painful price declines. On the flip side, cheap or reasonably priced stocks can experience significant price appreciation if earnings and cash flows sustainably improve or accelerate.

In my view, the greatest stock pickers think about investing like sports handicapping (see What Happens in Vegas, Stays in Las Vegas). The key isn’t buying fast growth (high P/E) or slow growth (low P/E) companies, but rather discovering which stocks are mispriced. Finding heavily shorted stocks that are poised for growth, or discovering unloved stocks with underappreciated potential are both ways to make money.

While defining growth vs. value is certainly difficult, the more important challenge is calibrating a company’s future growth expectations and determining the fair price to pay for a stock based on those prospects. Investing entails many difficulties, but categorizing investors or stocks as growth or value is a less important challenge than honing forecasting and valuation skills. Investing is challenging enough without worrying about superfluous growth vs. value definitions.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), and AAPL, but at the time of publishing SCM had no direct position in KO, AXP, PG, MHP, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

M&A Bankers Away as Elephant Hunters Play

With trillions in cash sitting in CEO and private equity wallets, investment bankers have been chasing mergers & acquisitions with a vengeance. Unfortunately for the bankers, investor skittishness has slowed merger activity in the boardroom. Rather than aggressively stalk corporate prey, bidders look more like deer in headlights. However, animal spirits are not completely dead. Some board members have seen the light and realize the value-destroying characteristics of idle cash in a near-zero interest rate environment, so they have decided to go elephant hunting. During a nine day period alone in the first quarter of 2013, a total of $87.7 billion in elephant deals were announced:

- HJ Heinz Company (HNZ – $27.4 billion) – February 14, 2013 – Bidder: Berkshire Hathaway (BRKA)/ 3G Capital Partners.

- Virgin Media Inc. (VMED – $21.9 billion) – February 6, 2013 – Bidder: Liberty Global Inc. (LBTYA).

- Dell Inc. (DELL – $21.8 billion) – February 5, 2013 – Bidder: Silver Lake Partners LP, Michael Dell, Carl Icahn.

- NBCUniversal Media LLC 49% Stake (GE- $17.6 billion) – February 12, 2013 – Bidder: Comcast Corp. (CMCSA).

These elephant deals helped the overall M&A deal values in the United States increase by +34% in Q1 from a year ago to $167 billion (see Mergermarket report). Unfortunately, the picture doesn’t look so good on a global basis. The overall value for global M&A deals in Q1 registered $418 billion, down -7% from the first quarter of 2012. On a transaction basis, there were a total of 2,621 deals during the first three months of the year, down -20% from 3,262 deals in the comparable period last year.

With central banks across the globe pumping liquidity into the financial system and the U.S. stock market near record highs, one would think buyers would be writing big M&A checks as they wrote poems about rainbows, puppy dogs, and flowers. This is obviously not the case, so why such the sour mood?

The biggest scapegoat right now is Europe. While the U.S. economy appears to be slowly-but-surely plodding along on its economic recovery, Europe continues to dig a deeper recessionary hole. Austerity-driven fiscal policies are hindering growth, and concerns surrounding a Cypriot contagion continue to grab headlines. Although the U.S. dollar value of deals was up substantially in Q1, the number of transactions was down significantly to 703 deals from 925 in Q1-2012 (-24%). Besides buyer nervousness, unfriendly tax policy could have accelerated deals into 2012, and stole business from 2013.

Besides lackluster global M&A volume, the record low EBITDA multiples on private equity exit prices is proof that skepticism on the sustainability of the economic recovery remains uninspired. With exit multiples at a meager level of 8.2x globally, many investors are holding onto their companies longer than they would like.

While merger activity has been a mixed bag, a bright spot in the M&A world has been the action in emerging markets. In 2012, the value of global transactions was essentially flat, yet emerging market deal values were up approximately +9% to $524 billion. This value exceeded the pre-crisis M&A activity level in 2007 by $73 billion, a feat not achieved in the other regions around the globe. Although emerging markets also pulled back in Q1, this region now account for 23% of total global M&A deal values.

Elephant buyout deals in the private equity space (skewed heavily by the Heinz & Dell deals) caused results to surge in this segment during the first quarter. Private equity related buyouts accounted for the highest share of global M&A activity (~21%) since 2007. However, like the overall U.S. M&A market, the number of Q1 transactions in the buyout space (372 transactions) declined to the lowest count in about four years.

Until skepticism turns into confidence, elephant deals will continue to distort results in the M&A sector (Echostar’s [DISH] play for Sprint [S] is further evidence). However, the existence of these giant transactions could be a leading indicator for more activity in the coming quarters. If bankers want to generate more fees, they may consider giving Warren Buffett a call. Here’s what he had to say after the announcement of the Heinz deal:

“I’m ready for another elephant. Please, if you see any walking by, just call me.”

Despite the weak overall M&A activity, the hunters are out there and they have plenty of ammunition (cash).

See also: Mergermarket Monthly M&A Insider Report (April 2013)

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs) and CMCSA, but at the time of publishing SCM had no direct position in HNZ, BRKA, VMED, LBTYA, DELL, GE, DISH, S or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.