Posts tagged ‘VIX’

Sweating Your Way to Investment Success

There are many ways to make money in the financial markets, but if this was such an easy endeavor, then everybody would be trading while drinking umbrella drinks on their private islands. I mean with all the bright blinking lights, talking baby day traders, and software bells and whistles, how difficult could it actually be?

Unfortunately, financial markets have a way of driving grown men (and women) to tears, usually when confidence is at or near a peak. The best investors leave their emotions at the door and follow a systematic disciplined process. Investing can be a meat grinder, but the good news is one does not need to have a 90% success rate to make it lucrative. Take it from Peter Lynch, who averaged a +29% return per year while managing the Magellan Fund at Fidelity Investments from 1977-1990. “If you’re terrific in this business you’re right six times out of 10,” says Lynch.

Sweating Way to Success

If investing is so tough, then what is the recipe for investment success? As the saying goes, money management requires 10% inspiration and 90% perspiration. Or as strategist and long-time investor Don Hays notes, “You are only right on your stock purchases and sales when you are sweating.” Buying what’s working and selling what’s not, doesn’t require a lot of thinking or sweating (see Riding the Wave), just basic pattern recognition. Universally loved stocks may enjoy the inertia of upward momentum, but when the music stops for the Wall Street darlings, investors rarely can hit the escape button fast enough. Cutting corners and taking short-cuts may work in the short-run, but usually ends badly.

Real profits are made through unique insights that have not been fully discovered by market participants, or in other words, distancing oneself from the herd. Typically this means investing in reasonably priced companies with significant growth prospects, or cheap out-of-favor investments. Like dieting, this is easy to understand, but difficult to execute. Pulling the trigger on unanimously hated investments or purchasing seemingly expensive growth stocks requires a lot of blood, sweat, and tears. Eating doughnuts won’t generate the conviction necessary to justify the valuation and excess expected return for analyzed securities.

Times Have Changed

Investing in stocks is difficult enough with equity fund flows hemorrhaging out of investor accounts like the asset class is going out of style (See ICI data via The Reformed Broker). Stocks’ popularity haven’t been helped by the heightened volatility, as evidenced by the multi-year trend in the schizophrenic volatility index (VIX) – escalated by the “Flash Crash,” U.S. debt ceiling debate, and European financial crisis. Globalization, which has been accelerated by technology, has only increased correlations between domestic market and international markets. As we have recently experienced, the European tail can wag the U.S. dog for long periods of time. In decades past, concerns over economic activity in Iceland, Dubai, and Greece may not even make the back pages of The Wall Street Journal. Today, news travels at the speed of a “Tweet” for every Angela Merkel – Nicolas Sarkozy breakfast meeting or Chinese currency adjustment, and eventually results in a sprawling front page headline.

The equity investing game may be more difficult today, but investing for retirement has never been more important. Stuffing money under the mattress in Treasuries, money market accounts, CDs, or other conservative investments may feel good in the short run, but will likely not cover inflation associated with rising fuel, food, healthcare, and leisure costs. Regardless of your investment strategy, if your goal is to earn excess returns, you may want to check the moistness of your armpits – successful long-term investing requires a lot of sweat.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in ETFC, VXX, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

U.S. – Best House in Bad Global Neighborhood

Article below represents a portion of free December 1, 2011 Sidoxia monthly newsletter (Subscribe on right-side of page)

There is no shortage of issues to worry about in our troubled global neighborhood, but then again, anybody older than 25 years old knows the world is always an uncertain place. Whether we are talking about wars (Vietnam, Cold War, Iraq); presidential calamities (Kennedy assassination, Nixon resignation/impeachment proceedings); international turmoil (dissolution of Soviet Union, 9/11 attacks, Arab Spring); investment bubbles (technology, real estate); or financial crises (S&L crisis, Long Term Capital, Lehman Brothers bankruptcy), investors always have a large menu of concerns from which they can order.

Despite the doom and gloom dominating the media airwaves, and the lackluster performance of equities experienced over the last decade, the Dow Jones Industrial Average and the S&P 500 index are both up more than 20-fold since the 1970s (those gains also exclude the positive impact of dividends).

Times Have Changed

Just a few decades ago, nobody would have talked or cared about small economies like Iceland, Dubai, and Greece. Today, technology has accelerated the forces of globalization, resulting in information travelling thousands of miles at the click of a mouse, often creating scary financial mountains out of meaningless molehills. As a result of these trends, news of Italian bond auctions, which normally would be glossed over on the evening news, instantaneously clogs our smart phones, computers, radios, and televisions. The implications of all these developments mean investing has become much more difficult, just as its importance has never been more crucial.

How has investing become more critical? For starters, interest rates are near 60-year lows and Treasury bond prices are at record highs, while inflation (food, energy, healthcare, leisure, etc.) is shrinking the value of people’s savings. Next, entitlement and pension reliability are decreasing by the minute – fiscal imbalances and unrealistic promises have contributed to a less certain retirement outlook. Layer on hyper-manic volatility of daily, multi-hundred point swings in the Dow Jones Industrial index and a less experienced investor quickly realizes investing can become an overwhelming game. Case in point is the VIX volatility index (a.k.a., the “Fear Gauge”), which has registered a whopping +57% increase in 2011.

December to Remember?

After an explosive +23% return in the S&P 500 index for 2009 (excluding dividends) and another +13% return in 2010, equity investors have taken a breather thus far in 2011 – the Dow Jones Industrial Average is up modestly (+4%) and the S&P 500 index is down fractionally (-1%). We still have the month of December to log, but in the short-run the European tail has definitely been wagging the rest of the global dog.

Although the United States knows a thing or two about lack of political leadership and coordination, herding the 17 eurozone countries to resolve the European debt financial crisis has proved even more challenging. As you can see below in the performance figures of the major global equity markets, the U.S. remains the best house in a bad neighborhood:

Our fiscal house undeniably needs some work (i.e., unsustainable deficits and bloated debt), but record corporate profits, record levels of cash, voracious consumer spending, improving employment data, and attractive valuations are all contributing to a domestic house that makes opportunities in our backyard look a lot more appealing to investors than prospects elsewhere in the global neighborhood.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds and VGK, but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Sleeping like a Baby with Your Investment Dollars

Amidst the recent, historically high volatility in the financial markets, there have been a large percentage of investors who have been sleeping like a baby – a baby that stays up all night crying! For some, the dream-like doubling of equity returns achieved from the first half of 2009 through the first half of 2011 quickly turned into a nightmare over the last few weeks. We live in an inter-connected, globalized world where news travels instantaneously and fear spreads like a damn-bursting flood. Despite the positive returns earned in recent years, the wounds of 2008-2009 (and 2000 to a lesser extent) remain fresh in investors’ minds. Now, the hundred year flood is expected every minute. Every European debt negotiation, S&P downgrade, or word floating from Federal Reserve Chairman Ben Bernanke’s lips, is expected to trigger the next Lehman Brothers-esque event that will topple the global economy like a chain of dominoes.

Volatility Victims

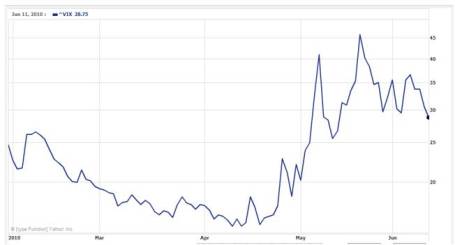

The few hours of trading that followed the release of the Federal Reserve’s August policy statement is living proof of investors’ edginess. After initially falling approximately -400 points in a 30 minute period late in the day, the Dow Jones Industrial Average then climbed over +600 points in the final hour of trading, before experiencing another -400 point drop in the first hour of trading the next day. Many of the day traders and speculators playing with the explosively leveraged exchange traded funds (e.g., TNA, TZA, FAS, FAZ), suffered the consequences related to the panic selling and buying that comes with a VIX (Volatility Index) that climbed about +175% in 17 days. A VIX reading of 44 or higher has only been reached nine times in the last 25 years (source: Don Hays), and is normally associated with significant bounce-backs from these extreme levels of pessimism. Worth noting is the fact that the 2008-2009 period significantly deteriorated more before improving to a more normalized level.

Keys to a Good Night’s Sleep

The nature of the latest debt ceiling negotiations and associated Standard & Poor’s downgrade of the United States hurt investor psyches and did little to boost confidence in an already tepid economic recovery. Investors may have had some difficulty catching some shut-eye during the recent market turmoil, but here are some tips on how to sleep comfortably.

• Panic is Not a Strategy: Panic selling (and buying) is not a sustainable strategy, yet we saw both strategies in full force last week. Emotional decisions are never the right ones, because if they were, investing would be quite easy and everyone would live on their own personal island. Rather than panic-sell, investments should be looked at like goods in a grocery store – successful long-term investors train themselves to understand it is better to buy goods when they are on sale. As famed growth investor Peter Lynch said, “I’m always more depressed by an overpriced market in which many stocks are hitting new highs every day than by a beaten-down market in a recession.”

• Long-Term is Right-Term: Everybody would like to retire at a young age, and once retired, live like royalty. Admirable goals, but both require bookoo bucks. Unless you plan on inheriting a bunch of money, or working until you reach the grave, it behooves investors to pull that money out from under the mattress and invest it wisely. Let’s face it, entitlements are going to be reduced in the future, just as inflation for food, energy, medical, leisure and other critical expenses continue eroding the value of your savings. One reason active traders justify their knee-jerk actions and derogatory description of long-term investors is based on the stagnant performance of U.S. equity markets over the last decade. Nonetheless, the vast number of these speculators fail to recognize a more than tripling in average values in markets like Brazil, India, China, and Russia over similar timeframes. Investing is a global game. If you do not have a disciplined, systematic long-term investment strategy in place, you better pray you don’t lose your job before age 70 and be prepared to eat Mac & Cheese while working as a Wal-Mart (WMT) greeter in your 80s.

• Diversification: Speaking of sleep, the boring topic of diversification often puts investors to sleep, but in periods like these, the power of diversification becomes more evident than ever. Cash, metals, and certain fixed income instruments were among the investments that cushioned the investment blow during the 2008-2009 time period. Maintaining a balanced diversified portfolio across asset classes, styles, size, and geographies is crucial for investment survival. Rebalancing your portfolio periodically will ensure this goal is achieved without taking disproportionate sized risks.

• Tailored Plan Matching Risk Tolerance: An 85 year-old wouldn’t go mountain biking on a tricycle, and a 10 year-old shouldn’t drive a bus to his fifth grade class. Sadly, in volatile times like these, many investors figure out they have an investment portfolio mismatched with their goals and risk tolerance. The average investor loves to take risk in up-markets and shed risk in down-markets (risk in this case defined as equity exposure). Regrettably, this strategy is designed exactly backwards for long-term investors. Historically, actual risk, the probability of permanent losses, is much lower during downturns; however, the perceived risk by average investors is viewed much worse. Indeed, recessions have been the absolute best times to purchase risky assets, given our 11-for-11 successful track record of escaping post World War II downturns. Could this slowdown or downturn last longer than expected and lead to more losses? Absolutely, but if you are planning for 10, 20, or 30 years, in many cases that issue is completely irrelevant – especially if you are still adding funds to your investment portfolio (i.e., dollar-cost averaging). On the flip side, if an investor is retired and entirely dependent upon an investment portfolio for income, then much less attention should be placed on risky assets like equities.

If you are having trouble sleeping, then one of two things is wrong: 1.) You are taking on too much risk and should cut your equity exposure; and/or 2.) You do not understand the risk you are taking. Volatile times like these are great for reevaluating your situation to make sure you are properly positioned to meet your financial goals. Talking heads on TV will tell you this time is different, but the truth is we have been through worse times (see History Never Repeats, but Rhymes), and lived to tell the tale. All this volatility and gloom may create anxiety and cause insomnia, but if you want to quietly sleep through the noise like a content baby, make yourself a long-term financial bed that you can comfortably sleep in during good times and bad. Focusing on the despondent headline of the day, and building a portfolio lacking diversification will only lead to panic selling/buying and results that would keep a baby up all night crying.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds (including emerging market ETFs) and WMT, but at the time of publishing SCM had no direct position in TNA, TZA, FAS, FAZ, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Ray Allen, the VIX, and the Rule of 16

Ray Allen gets paid a lot of money for running into people and bouncing an orange ball around a wooden floor, but even his game can appreciate the importance volatility can play in a high stakes game. First, Allen set an NBA Final’s basketball record of eight three-pointers made (including seven in a row) in Game 2, and then followed up in the next game with an astonishingly dismal “O” for thirteen performance – the second worst shooting performance during a Final’s game in 32 years. The emotional rollercoaster ride for the Celtics fans resembles a volatility chart of the VIX (Volatility Index) in recent weeks.

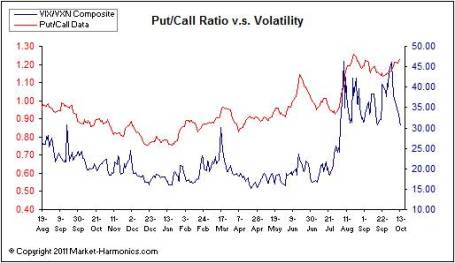

In the last 40 trading days the VIX has moved more than +/- 5% on 30 different trading sessions (75% of the time), including seventeen +/- 10% trading days. The +32% spike in the VIX on the day of the “Flash Crash” (May 6, 2010) would have even generated a smirk on the face of Ray Allen, not to mention the face changing impact of the other three +/- 30% move days that occurred within a month of the Flash Crash trading debacle. Even though the VIX has settled down from a short-term peak last month (48.20 on May 21st) to a lower level (28.79), the fear gauge still stands at almost double the rate of the multi-year low just a few months ago (15.23 on April 12th).

The VIX and the Rule of 16

No, this VIX is not the same as the Vicks vapor rub medication placed on your chest to relieve cough symptoms, rather this VIX indicator calculates inputs from various call and put options to create an approximation of the S&P 500 index implied volatility for the next 30 days. Put simply, when fear is high, the price of insurance catapults upwards as measured by the VIX – just like we saw when the VIX spiked above 80 during the 2008 financial crisis and above 40 during the more fresh Greek debt disaster. I’m not in the position to bust out some differential calculus to explain the nuances of a complex VIX formula, but what I can do is regurgitate a helpful formula relating to the VIX, called the Rule of 16. What the Rule of 16 allows laymans to do is understand the relationship between the VIX and daily volatility.

This is how Jeff Luby of Green Faucet describes the Rule of 16:

• VIX of 16 – 1/3 of the time the SPX will have a daily change of at least 1%

• VIX of 32 – 1/3 of the time the SPX will have a daily change of at least 2%

• VIX of 48 – 1/3 of the time the SPX will have a daily change of at least 3%

To put these VIX numbers in perspective, industry citations put the long-term VIX average around a level of 20. With a VIX hovering around 30 now, we are approaching the 2nd bucket of expectations (2%+ moves in the market 1/3 of the time). The price moves don’t correlate directly with the Dow Jones Industrial Average index, but I think about the current VIX levels equating to about a +/- 200 point move in the Dow one or two times per week…uggh.

Generally, I would prefer lower volatility, but I continually remind myself volatility is not necessarily a bad thing – volatility creates opportunities. I’m not sure if I can apply the Rule of 16 to Ray Allen’s scoring output, however based on last night’s 5-10 shooting performance, perhaps volatility in the market and Ray Allen’s shooting game will begin to normalize toward historical ranges.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

*DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds (including S&P 500-like positions), but at the time of publishing SCM had no direct positions in SPX, VIX-related securities, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Gravity Takes Hold in May

Wile E. Coyote, the bumbling, roadrunner-loving carnivore from Warner Bros.’ Looney Tunes series spends a lot of time in the air chasing his fine feathered prey. Unfortunately for Mr. Coyote his genetic make-up and Acme purchases could not cure the ills caused by gravity (although user error was the downfall of Wile E’s effective Bat-Man flying outfit purchase). Just as gravity hampered the coyote’s short-term objectives, so too has gravity hampered the equity markets’ performance this May.

So far the adage of “Sell in May and walk away” has been the correct course of action. Just one day prior to the end of the month, the Dow Jones Industrial and S&P 500 indexes were on pace of recording the worst May decline in almost 50 years. If the -6.8% monthly decline in the S&P and the -7.8% drop in the S&P remains in place through the end of the month, these declines would mark the worst performance in a May month since 1962.

Should we be surprised by the pace and degree of the recent correction? Flash crash and Greece worries aside, any time a market increases +70-80% within a year, investors should not be caught off guard by a subsequent 10%+ correction. In fact corrections are a healthy byproduct of rapid advances. Repeated boom-bust cycles are not market characteristics most investors crave.

It was a volatile, choppy month of trading for the month as measured by the Volatility Index (VIX). The fear gauge more than doubled to a short-run peak of around 46, up from a monthly low close of about a reading of 20, before settling into the high 20s at last close. Digesting Greek sovereign debt issues, an impending Chinese real estate bubble bursting, budget deficits, government debt, and financial regulatory reform will determine if elevated volatility will persist. Improving macroeconomic indicators coupled with reasonable valuations appear to be factoring in a great deal of these concerns, however I would not be surprised if this schizophrenic trading will persist until we gain certainty on the midterm elections. As Wile E. Coyote has learned from his roadrunner chasing days, gravity can be painful – just as investors realized gravity in the equity markets can hurt too. All the more reason to cushion the blow to your portfolio through the use of diversification in your portfolio (read Seesawing Through Chaos article).

Happy long weekend!

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

*DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct positions in TWX, VXX, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Seesawing Through Organized Chaos

Still fresh in the minds of investors are the open wounds created by the incredible volatility that peaked just a little over a year ago, when the price of insurance sky-rocketed as measured by the Volatility Index (VIX). Even though equity markets troughed in March of 2009, earlier the VIX reached a climax over 80 in November 2008. With financial institutions falling like flies and toxic assets clogging up the lending pipelines, virtually all asset classes moved downwards in unison during the frefall of 2008 and early 2009. The traditional teeter-totter phenomenon of some asset classes rising simultaneously while others were falling did not hold. With the recent turmoil in Greece coupled with the “Flash Crash” (read making $$$ trading article) and spooky headline du jour, the markets have temporarily reverted back to organized chaos. What I mean by that is even though the market recently dove about +8% in 8 days, we saw the teeter-totter benefits of diversification kick in over the last month.

Seesaw Success

While the S&P fell about -4.5% over the studied period below, the alternate highlighted asset classes managed to grind out positive returns.

While traditional volatility has returned after a meteoric bounce in 2009, there should be more investment opportunities to invest around. With the VIX hovering in the mid-30s after a brief stay above 40 a few weeks ago, I would not be surprised to see a reversion to a more normalized fear gauge in the 20s – although my game plan is not dependent on this occurring.

Regardless of the direction of volatility, I’m encouraged that even during periods of mini-panics, there are hopeful signs that investors are able to seesaw through periods of organized chaos with the assistance of good old diversification.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

*DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds (including AGG, BND, VNQ, IJR and TIP), but at the time of publishing SCM had no direct positions in VXX, GLD, or any security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

“Bye Bye Roubini, Hello Abby”

Bye-bye” Dr. Doom” and hello “Happy Abby.” Abby Joseph Cohen is back in the spotlight with the recent market resurgence and is calling for a sustained bull market rally. The death-like sentiment spread by NYU professor Nouriel Roubini has now swung – it’s time for CNBC to call in the bulls, much like a baseball coach calls in a fresh reliever after a starter has exhausted his strength.

Over the last year, we’ve gone from full-fledged panic, into a healthy level of fear – the decline in the CBOE Volatility Index (VIX) supports this claim. But with cash still piled to the ceiling and broad indices still are about -35% below 2007 peaks, I wouldn’t say sentiment is wildly ebullient quite yet. The low-hanging fruit has been picked and now we need to tread lightly and delay the victory lap for a little longer. Market timing has never been my gig, so gag me any time I attempt a market prediction. Having said that, sentiment comprises the softer art aspects of investing, and therefore it can swing the markets wildly in the short-run. Ultimately in the long-run, profits and cash flows are what drive stock prices higher, and that’s what I pay attention to. Profits and cash flows are currently depressed and unemployment remains high by historical standards, but there are signs of recovery. Cohen highlights easy profit comparisons in the second half of 2009 (versus 2008), coupled with inventory replenishment, as significant factors that can lead to larger than anticipated surges in early economic cycle recoveries. Whether the pending economic advance is sustainable is a question that Cohen would not address.

Investors are emotional creatures, and CNBC realizes this fact. Before investing in that 30-1 leveraged, long-only hedge fund, prudence should reign supreme as we start to see some of the previously bullish strategists begin crawling out of their caves – including perma-bull Abby Joseph Cohen.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.