Posts tagged ‘unemployment’

“Patient” Prick Proves More Pleasure than Pain

I will be the first one to admit I hate needles. In fact, I’ve been known to skip my annual flu shots out of cowardice simply to avoid the harmless prick of the syringe. The mere thought of a long needle jabbing into my arm, or other fleshy part of my body, has had the chilling effect of generating irrational decisions (i.e., I forgo flu shot benefits for no logical reason).

For months the talking heads and so-called pundits have speculated and fretted over the potential removal of the term “patient” from the periodically issued Federal Open Market Committee (FOMC) statement. Since the end of 2014, the statement read that the Fed “can be patient in beginning to normalize” monetary policy.

For investors, the linguistic fear of the removal of “patient” is as groundless as my needle fears. In the financial markets, the consensus view is often wrong. The stronger the euphoric consensus, the higher the probability the consensus will soon be wrong. You can think of technology in the late 1990s, real estate in the mid-2000s; or gold trading at $1,800/oz in 2011. The reverse holds true for the pessimistic consensus. Value guru, extraordinaire, Bill Miller stated it well,

“Stocks do not get undervalued unless somebody is worried about something. The question is not whether there are problems. There are always problems. The question is whether those problems are already fully discounted or not.”

Which brings us back to the Fed’s removal of the word “patient”. Upon release of the statement, the Dow Jones Industrial index skyrocketed about 400 points in 30 minutes. Considering the overwhelming consensus was for the Fed to remove the word “patient”, and given the following favorable factors, should anyone really be surprised that the market is trading near record highs?

FAVORABLE FACTORS:

- Queen Dove Yellen as Fed Chairwoman

- Declining interest rates near generational low

- Stimulative, low oil prices that are declining

- Corporate profits at/near record highs

- Unemployment figures approaching cyclical lows

- Core inflation in check below 2% threshold

While the short-term relief rally may feel good for the bulls, there are still some flies in the ointment, including a strong U.S. dollar hurting trade, an inconsistent housing recovery, and a slowing Chinese economy, among other factors.

Outside the scandalous “patient” semantics was the heated debate over the Fed’s “Dot Plot,” which is just a 3rd grader’s version of showing the Fed members’ Federal Funds rate forecasts. While to a layman the chart below may look like an elementary school dot-to-dot worksheet, in reality it is a good synopsis of interest rate expectations. Part of the reason stocks reacted so positively to the Fed’s statement is because the “Dot Plot” median interest rate expectations of 0.625% came down 0.50% for 2015, and by more than 0.60% for 2016 to 1.875%. This just hammers home the idea that there are currently no dark clouds looming on the horizon that would indicate aggressive rate hikes are coming.

These sub-2% interest rate expectations over the next few years hardly qualify as a “hawkish” stance. As I’ve written before, the stock market handled a 2.5% hike in stride when the Fed Funds rate increased in 1994 (see also 1994 Bond Repeat or Stock Defeat?). What’s more, the Fed Funds rate cycle peaked at 5.0% in 2007 before the market crashed in the Great Recession of 2008-2009.

Although volatility is bound to increase as the Federal Reserve transitions out of a six-year 0% interest rate policy, don’t let the irrational fear of a modest Fed hike prick scare you away from potential investment benefits.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing, SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Draghi Provides Markets QE Beer Goggles

While the financial market party has been gaining momentum in the U.S., Europe has been busy attending an economic funeral. Mario Draghi, the European Central Bank President is trying to reverse the somber deflationary mood, and therefore has sent out $1.1 trillion euros worth of quantitative easing (QE) invitations to investors with the hope of getting the eurozone party started.

Draghi and the stubborn party-poopers sitting on the sidelines have continually been skeptical of the creative monetary punch-spiking policies initially implemented by U.S. Federal Reserve Chairman Ben Bernanke (and continued by his fellow dovish successor Janet Yellen). With the sluggish deflationary European pity party (see FT chart below) persisting for the last six years, investors are in dire need for a new tool to lighten up the dead party and Draghi has obliged with the solution…“QE beer goggles.” For those not familiar with the term “beer goggles,” these are the vision devices that people put on to make a party more enjoyable with the help of excessive consumption of beer, alcohol, or in this case, QE.

Although here in the U.S. “QE beer goggles” have been removed via QE expiration last year, nevertheless the party has endured for six consecutive years. Even an economy posting such figures as an 11-year high in GDP growth (+5.0%); declining unemployment (5.6% from a cycle peak of 10.0%); and stimulative effects from declining oil/commodity prices have not resulted in the cops coming to break up the party. It’s difficult for a U.S. investor to admit an accelerating economy; improving job additions; recovering housing market; with stronger consumer balance sheet would cause U.S. 10-Year Treasury Note yields to plummet from 3.04% at the beginning of 2014 to 1.82% today. But in reality, this is exactly what happened.

To confound views on traditional modern economics, we are seeing negative 10-year rates on Swiss Treasury Bonds (see chart below). In other words, investors are paying -1% to the Swiss government to park their money. A similar strategy could be replicated with $100 by simply burning a $1 bill and putting the remaining $99 under a mattress. Better yet, why not just pay me to hold your money, I will place your money under my guarded mattress and only charge you half price!

Does QE Work?

Debate will likely persist forever as it relates to the effectiveness of QE in the U.S. On the half glass empty side of the ledger, GDP growth has only averaged 2-3% during the recovery; the improvement in the jobs upturn is arguably the slowest since World War II; and real wages have declined significantly. On the half glass full side, however, the economy has improved substantially (e.g., GDP, unemployment, consumer balance sheets, housing, etc.), and stocks have more than doubled in value since the start of QE1 at the end of 2008. Is it possible that the series of QE policies added no value, or we could have had a stronger recovery without QE? Sure, anyone can make that case, but the fact remains, the QE training wheels have officially come off the economy and Armageddon has still yet to materialize.

I expect the same results from the implementation of QE in Europe. QE is by no means an elixir or panacea. I anticipate minimal direct and tangible economic benefits from Draghi’s $1+ trillion euro QE bazooka, however the psychological confidence building impacts and currency depreciating effects are likely to have a modest indirect value to the eurozone and global financial markets overall. The downside for these unsustainable ultra-low rates is potential excessive leverage from easy credit, asset bubbles, and long-term inflation. Certainly, there may be small pockets of these excesses, however the scars and regulations associated with the 2008-2009 financial crisis have delayed the “hangover” arrival of these risk possibilities on a broader basis. Therefore, until the party ends or the cops come to break up the fun, you may want to enjoy the gift provided by Mario Draghi to global investors…and strap on the “QE beer goggles.”

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own a range of positions, including positions in certain exchange traded funds positions , but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Buy in May and Tap Dance Away

This article is an excerpt from a previously released Sidoxia Capital Management complementary newsletter (May 1, 2014). Subscribe on the right side of the page for the complete text.

The proverbial Wall Street adage that urges investors to “Sell in May, and go away” in order to avoid a seasonally volatile period from May to October has driven speculative trading strategies for generations. The basic premise behind the plan revolves around the idea that people have better things to do during the spring and summer months, so they sell stocks. Once the weather cools off, the thought process reverses as investors renew their interest in stocks during November. If investing was as easy as selling stocks on May 1 st and then buying them back on November 1st, then we could all caravan in yachts to our private islands while drinking from umbrella-filled coconut drinks. Regrettably, successful investing is not that simple and following naïve strategies like these generally don’t work over the long-run.

Even if you believe in market timing and seasonal investing (see Getting Off the Market Timing Treadmill ), the prohibitive transaction costs and tax implications often strip away any potential statistical advantage.

Unfortunately for the bears, who often react to this type of voodoo investing, betting against the stock market from May – October during the last two years has been a money-losing strategy. Rather than going away, investors have been better served to “Buy in May, and tap dance away.” More specifically, the S&P 500 index has increased in each of the last two years, including a +10% surge during the May-October period last year.

Nervous? Why Invest Now?

With the weak recent economic GDP figures and stock prices off by less than 1% from their all-time record highs, why in the world would investors consider investing now? Well, for starters, one must ask themselves, “What options do I have for my savings…cash?” Cash has been and will continue to be a poor place to hoard funds, especially when interest rates are near historic lows and inflation is eating away the value of your nest-egg like a hungry sumo wrestler. Anyone who has completed their income taxes last month knows how pathetic bank rates have been, and if you have pumped gas recently, you can appreciate the gnawing impact of escalating gasoline prices.

While there are selective opportunities to garner attractive yields in the bond market, as exploited in Sidoxia Fusion strategies, strategist and economist Dr. Ed Yardeni points out that equities have approximately +50% higher yields than corporate bonds. As you can see from the chart below, stocks (blue line) are yielding profits of about +6.6% vs +4.2% for corporate bonds (red line). In other words, for every $100 invested in stocks, companies are earning $6.60 in profits on average, which are then either paid out to investors as growing dividends and/or reinvested back into their companies for future growth.

Source: Dr. Ed’s Blog

Hefty profit streams have resulted in healthy corporate balance sheets, which have served as ammunition for the improving jobs picture. At best, the economic recovery has moved from a snail’s pace to a tortoise’s pace, but nevertheless, the unemployment rate has returned to a more respectable 6.7% rate. The mended economy has virtually recovered all of the approximately 9 million private jobs lost during the financial crisis (see chart below) and expectations for Friday’s jobs report is for another +220,000 jobs added during the month of April.

Source: Bespoke

Wondrous Wing Woman

Investing can be scary for some individuals, but having an accommodative Fed Chair like Janet Yellen on your side makes the challenge more manageable. As I’ve pointed out in the past (with the help of Scott Grannis), the Fed’s stimulative ‘Quantitative Easing’ program counter intuitively raised interest rates during its implementation. What’s more, Yellen’s spearheading of the unprecedented $40 billion bond buying reduction program (a.k.a., ‘Taper’) has unexpectedly led to declining interest rates in recent months. If all goes well, Yellen will have completed the $85 billion monthly tapering by the end of this year, assuming the economy continues to expand.

In the meantime, investors and the broader financial markets have begun to digest the unwinding of the largest, most unprecedented monetary intervention in financial history. How can we tell this is the case? CEO confidence has improved to the point that $1 trillion of deals have been announced this year, including offers by Pfizer Inc. – PFE ($100 billion), Facebook Inc. – FB ($19 billion), and Comcast Corp. – CMCSA ($45 billion).

Source: Entrepreneur

Banks are feeling more confident too, and this is evident by the acceleration seen in bank loans. After the financial crisis, gun-shy bank CEOs fortified their balance sheets, but with five years of economic expansion under their belts, the banks are beginning to loosen their loan purse strings further (see chart below).

The coast is never completely clear. As always, there are plenty of things to worry about. If it’s not Ukraine, it can be slowing growth in China, mid-term elections in the fall, and/or rising tensions in the Middle East. However, for the vast majority of investors, relying on calendar adages (i.e., selling in May) is a complete waste of time. You will be much better off investing in attractively priced, long-term opportunities, and then tap dance your way to financial prosperity.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in PFE, CMCSA, and certain exchange traded funds (ETFs), but at the time of publishing SCM had no direct position in FB or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Can Good News be Good News?

There has been a lot of hyper-taper sensitivity of late, ever since Fed Chairman Ben Bernanke broached the subject of reducing the monthly $85 billion bond buying stimulus program during the spring. With a better than expected ADP jobs report on Wednesday and a weekly jobless claims figure on Thursday, everyone (myself) included was nervously bracing for hot November jobs number on Friday. Why fret about potentially good economic numbers? Firstly, as a money manager my primary job is to fret, and secondarily, stronger than forecasted job additions in November would likely feed the fear monster with inflation and taper alarm, thus resulting in a triple digit Dow decline and a 20 basis point spike in 10-year Treasury rates. Right?

Well, the triple digit Dow move indeed came to fruition…but in the wrong direction. Rather than cratering, the Dow exploded higher by +200 points above 16,000 once again. Any worry of a potential bond market thrashing fizzled out to a flattish whimper in the 10-year Treasury yield (to approximately 2.86%). You certainly should not extrapolate one data point or one day of trading as a guaranteed indicator of future price directions. But, in the coming weeks and months, if the economic recovery gains steam I will be paying attention to how the market reacts to an inevitable Fed tapering and likely rise in interest rates.

The Expectations Game

Interpreting the correlation between the tone of news and stock direction is a challenging endeavor for most (see Circular Conversations & Tweet), but stock prices going up on bad news has not a been a new phenomenon. Many will argue the economy has been limp and the news flow extremely weak since stock prices bottomed in early 2009 (i.e., Europe, Iran, Syria, deficits, debt downgrade, unemployment, government shutdown, sequestration, taxes, etc.), yet actual stock prices have chugged higher, nearly tripling in value. There is one word that reconciles the counterintuitive link between ugly news and handsome gains…EXPECTATIONS. When expectations in 2009 were rapidly shifting towards a Great Depression and/or Armageddon scenario, it didn’t take much to move stock prices higher. In fact, sluggish growth coupled with historically low interest rates were enough to catapult equity indices upwards – even after factoring in a dysfunctional, ineffectual political backdrop.

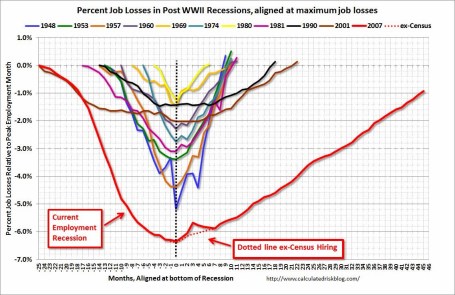

From a longer term economic cycle perspective, this recovery, as measured by job creation, has been the slowest since World War II (see Calculated Risk chart below). However, if you consider other major garden variety historical global banking crises, our crisis is not much different (see Oregon economic study).

While it’s true that stock prices can go up on bad news (and go down on good news), it is also possible for prices to go up on good news. Friday’s trading action after the jobs report is the proof of concept. As I’ve stated before, with the meteoric rise in stock prices, it’s my view the low hanging profitable fruit has been plucked, but there is still plenty of fruit on the trees (see Missing the Pre-Party). I am not the only person who shares this view.

Recently, legendary investor Warren Buffett had this to say about stocks (Source: Louis Navellier):

“I don’t have concerns about this market.” Buffet said stocks are “in a zone of reasonableness. Five years ago,” Buffett said, “I wrote an article for The New York Times that said they were very cheap. And every now and then, you can see that that they’re very overpriced or very underpriced.” Today, “they’re definitely not way overpriced. They’re definitely not underpriced.” “If you live long enough,” Buffett said, “you’ll see a lot higher prices. I don’t know what stocks will do next week or next month or next year, but five or 10 years from now, they are very likely to be higher.”

However, up cycles eventually run their course. As stocks continue to go up on good news, ultimately they begin to go down on good news. Expectations in time tend to get too lofty, and the market begins to anticipate a downturn. Stock prices are continually incorporating information that reflects the direction of future earnings and cash flow prospects. Looking into the rearview mirror at historical results may have some value, but gazing through the windshield and anticipating what’s around the corner is more important.

Rather than getting caught up with the daily mental somersault exercises of interpreting what the tone of news headlines means to the stock market (see Sentiment Pendulum), it’s better to take a longer-term cyclical sentiment gauge. As you can see from the chart below, waiting for the bad news to end can mean missing half of the upward cycle. And the same principle applies to good news.

Bad news can be good news for stock prices, and good news can be bad for stock prices. With the spate of recent positive results (i.e., accelerating purchasing manager data, robust auto sales, improving GDP, better job growth, and more new-home sales), perhaps good news will be good news for stock prices?

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Take Me Out to the Stock Game

This article is an excerpt from a previously released Sidoxia Capital Management complementary newsletter (October 1, 2013). Subscribe on the right side of the page for the complete text.

The Major League Baseball playoffs are just about to start, and the struggling U.S. economy is also trying to score some more wins to make the postseason as well. In 2008 and early 2009, the stock market looked more like The Bad News Bears with the S&P 500 index losing -58% of its value from the peak to the trough. The overleveraged (debt-laden) financial system, banged by a speculative housing bubble, swung the global economy into recession and put a large part of the economic team onto the disabled list.

Since the lows of 2009, S&P 500 stocks have skyrocketed +152%, including an +18% gain in 2013, and a +3% jump in September alone. With that incredible track record, one might expect a euphoric wave of investors pouring into the stock market stadium, ready to open their wallets at the financial market concession stand. Au contraire. Despite the dramatic winning streak, investors remain complacent skeptics, analyzing and critiquing every political, economic, and financial market movement and gyration.

Unfortunately, as stock prices have scored massive gains, many market followers have been too busy eating peanuts and drinking beer, rather than focusing on the positive economic statistics in the scorebook, such as these:

15/16 Quarters of Positive GDP Growth:

|

| Source: Crossing Wall Street |

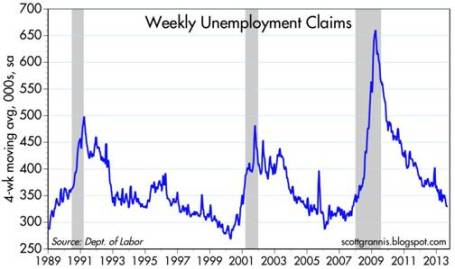

Precipitous Drop in Unemployment Claims: The lowest level since 2007 (7.5 million private sector jobs added since employment trough).

|

| Source: Bespoke |

All-Time Record Corporate Profits:

|

| Source: Ed Yardeni |

Financially Healthier Consumer – Lower Debt & Higher Net Worth:

|

| Source: Scott Grannis |

Improving Housing Market:

|

| Source: Scott Grannis |

While you can see a lot of financial momentum is propelling Team USA, there are plenty of observers concerned more about potential slumps and injuries emanating from a lineup of uncertainties. Currently, the fair-weather fans who are sitting in the bleachers are more interested in the uncertainty surrounding a government shutdown, debt ceiling negotiations, Syrian unrest, Iranian nuclear discussions, Obamacare defunding, and an imminent tapering of the Federal Reserve’s QE bond purchasing program (see Perception vs. Reality). The fearful skepticism of the fans has manifested itself in the form of a mountain of cash ($7 trillion), which is rapidly eroding to inflation and damaging millions of retirees’ long-term goals (see chart below). The fans sitting in the bleachers are less likely to buy long-term season tickets until some of these issues are settled.

|

| Source: Scott Grannis – $3 trillion added since crisis. |

The aforementioned list of worries are but a few of the concerns that have investors biting their nails. While there certainly is a possibility the market could be thrown a curve ball by one of these issues, veteran all-star investors understand there are ALWAYS uncertainties, and when the current list of concerns eventually gets resolved or forgotten, you can bet there will be plenty of new knuckle-balls and screw-balls (i.e., new list of worries) to fret over in the coming weeks, months, and years (see Back to the Future I, II,& III). Ultimately, the vast majority of concerns fade away.

Yoooouuuuuu’rrrreee Out!

The politicians in Washington are a lot like umpires, but what our country really needs are umpires who can change and improve the rules, especially the silly, antiquated ones (see also Strangest Baseball Rules). The problem is that bad rules (not good ones) often get put in place so the umpires/politicians can keep their jobs at the expense of the country’s best interest.

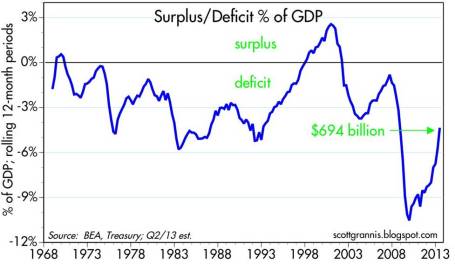

When umpires (politicians) cannot agree on how to improve the rules, gridlock actually is the next best outcome (see Who Said Gridlock is Bad?). The fact of the matter is that deficits and debt/GDP ratios have declined dramatically in recent years due in part to bitter political feuds (see chart below). When responsible spending is put into action, good things happen and a stronger economic foundation can be established to cushion future crises.

|

| Source: Scott Grannis |

There is plenty of room for improvement, but the statistics speak for themselves, which help explain why patient fans/investors have been handsomely rewarded with a homerun over the last four years. October historically has been a volatile month for the stock market, and the looming government shutdown and $16.7 trillion debt ceiling negotiations may contribute to some short-term strike-outs. However, if history proves to be a guide, stocks on average rise +4.26% during the last three months of the year (source: Bespoke), meaning the game may just not be over yet. With plenty of innings remaining for stocks to continue their upward trajectory, I still have ample time to grab my hot dog and malt during the 7th inning stretch.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing, SCM had no direct position in TSLA, PBI, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is the information to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Perception vs. Reality: Interest Rates & the Economy

There is a difference between perception and reality, especially as it relates to the Federal Reserve, the economy, and interest rates.

Perception: The common perception reflects a belief that Quantitative Easing (QE) – the Federal Reserve’s bond buying program – has artificially stimulated the economy and financial markets through lower interest rates. The widespread thinking follows that an end to tapering of QE will lead to a crash in the economy and financial markets.

Reality: As the chart below indicates, interest rates have risen during each round of QE (i.e., QE1/QE2/QE3) and fallen after the completion of each series of bond buying (currently at a pace of $85 billion per month in purchases). That’s right, the Federal Reserve has actually failed on its intent to lower interest rates. In fact, the yield on the 10-year Treasury Note stands at 2.94% today, while at the time QE1 started five years ago, on December 16, 2008, the 10-year rate was dramatically lower (~2.13%). Sure, the argument can be made that rates declined in anticipation of the program’s initiation, but if that is indeed the case, the recent rate spike of the 10-year Treasury Note to the 3.0% level should reverse itself once tapering begins (i.e., interest rates should decline). Wow, I can hardly wait for the stimulative effects of tapering to start!

Fact or Fiction? QE Helps Economy

Taken from a slightly different angle, if you consider the impact of the Federal Reserve’s actions on the actual economy, arguably there are only loose connections. More specifically, if you look at the jobs picture, there is virtually NO correlation between QE activity and job creation (see unemployment claims chart below). There have been small upward blips along the QE1/QE2/QE3 path, but since the beginning of 2009, the declining trend in unemployment claims looks like a black diamond ski slope.

Moreover, if you look at a broad spectrum of economic charts since QE1 began, including data on capital spending, bank loans, corporate profits, vehicle sales, and other key figures related to the economy, the conclusion is the same – there is no discernible connection between the economic recovery and the Federal Reserve’s quantitative easing initiatives.

I know many investors are highly skeptical of the stock market’s rebound, but is it possible that fundamental economic laws of supply and demand, in concert with efficient capital markets, could have something to do with the economic recovery? Booms and busts throughout history have come as a result of excesses and scarcities – in many cases assisted by undue amounts of fear and greed. We experienced these phenomena most recently with the tech and housing bubbles in the early and middle parts of last decade. Given the natural adjustments of supply and demand, coupled with the psychological scars and wounds from the last financial crisis, there is no clear evidence of a new bubble about to burst.

While it’s my personal view that many government initiatives, including QE, have had little impact on the economy, the Federal Reserve does have the ability to indirectly increase business and consumer confidence. Ben Bernanke clearly made this positive impact during the financial crisis through his creative implementation of unprecedented programs (TARP, TALF, QE, Twist, etc.). The imminent tapering and eventual conclusion of QE may result in a short-term hit to confidence, but the economy is standing on a much stronger economic foundation today. Making Ben Bernanke a scapegoat for rising interest rates is easy to do, but in actuality, an improving economy on stronger footing will likely have a larger bearing on the future direction of interest rates relative to any upcoming Fed actions.

Doubters remain plentiful, but the show still goes on. Not only are banks and individuals sitting on much sturdier and healthier balance sheets, but corporations are running lean operations that are reporting record profit margins while sitting on trillions of dollars in cash. In addition, with jobs on a slow but steady path to recovery, confidence at the CEO and consumer levels is also on the rise.

Despite all the negative perceptions surrounding the Fed’s pending tapering, reality dictates the impact from QE’s wind-down will likely to be more muted than anticipated. The mitigation of monetary easing is more a sign of sustainable economic strength than a sign of looming economic collapse. If this reality becomes the common perception, markets are likely to move higher.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing, SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is the information to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Who Said Gridlock is Bad?

Living in Southern California is extraordinary, but just like anything else, there are always tradeoffs, including traffic. Living in the United States is extraordinary too, but one of the detrimental tradeoffs is political gridlock…or is it? I am just as frustrated as anybody else that the knucklehead politicians in Washington can’t get their act together (especially on bipartisan issues such as taxes/immigration/deficits, etc.), but as it turns out, gridlock has created a significant financial silver lining.

Let’s take a look at some of the positive impacts of gridlock:

1) Federal Spending as % of GDP Declines

The demands of both Tax-and-Spend Democrats and Tea-Partier Republicans fell on deaf ears thanks to gridlock. The U.S. didn’t institute the depth of austerity that the far-right wanted, and Congress didn’t implement the additional fiscal stimulus the far-left desired. The result has been a slow but steady recovery, which has brought spending closer to historical averages.

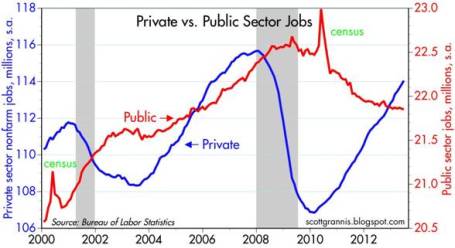

2) Private vs. Public Sector

The implementation of more responsible (or less irresponsible) government spending has freed up resources and allowed the private sector to slowly add jobs. The next wave of sequestration spending cuts may unleash some more pain on the public sector and delay overall economic recovery further, but just like dieting, we will feel much better once we have shed more debt and spending – at least as a percentage of GDP.

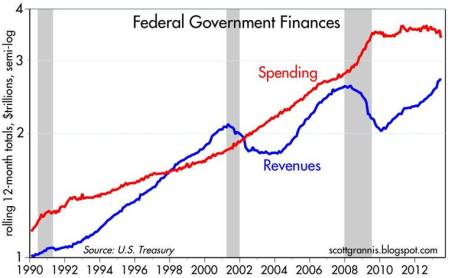

3) Deficit Reduced Significantly

The chart above is closely tied to point #1 (government spending), but as you can see, revenues have climbed significantly since 2010. I would argue plain economic cyclicality has more impact on the volatility of revenues. Blaming the current administration on the collapse or crediting them for the rebound is probably overstated. Comprehensive tax reform would likely have a lot more impact on the slope of revenues relative to the recent tax policy changes.

The same picture can be seen from a different angle, as shown above (Deficit as % of GDP). While the absolute dollar amounts are staggeringly high, as a percentage of GDP, the percentage has been chopped by more than half since the peak of the crisis.

Everyone would like to see politicians solve all of our problems, but as we have experienced, deep philosophical differences can lead to political gridlock. When it comes to our nation’s finances, gridlock may not be optimal, but you can also see that a stalemate is not always the worst outcome either. As politicians continue to scream at each other with purple faces, I will monitor the developments from my car radio while in California gridlocked traffic…sunroof open of course.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing, SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Jobs and the DMV Economy

If you have ever gone to get your driver’s license at the Department of Motor Vehicles (DMV)…you may still be waiting in line? It’s a painful but often a mandatory process, and in many ways the experience feels a lot like the economic recovery we currently have been living through over the last four years. Steady progress is being made, but in general, people hardly notice the economy moving forward.

My geographic neighbor and blogger here in Orange County, California (Bill McBride – Calculated Risk) has some excellent visuals that compare our sluggish DMV economy with previous economic cycles dating back to 1948:

As you can see from the chart above, the current economic recovery (red-line), as measured by job losses, is the slowest comeback in more than a half-century. Basically, over a two year period, the U.S. lost about nine million jobs, and during the following three years the economy regained approximately seven million of those jobs – still digging out of the hole. Last Friday’s June jobs report was welcomed, as it showed net jobs of +195,000 were added during the month, and importantly the previous two months were revised higher by another +70,000 jobs. These data points combined with last month’s Fed’s QE3 tapering comments by Ben Bernanke help explain why the continued rout in 10 year Treasury rates has continued in recent weeks, propelling the benchmark rate to 2.71% – almost double the 1.39% rate hit last year amidst continued European financial market concerns.

As with most recessions or crashes, the bursting of the bubble (i.e., damage) occurs much faster than the inflation (i.e., recovery), and McBride’s time series clearly shows this fact:

While pessimists point to the anemic pace of the current recovery, the glass half-full people (myself included) appreciate that the sluggish rebound is likely to last longer than prior recoveries. There are two other key dynamics underlying the reported employment figures:

- Continued Contraction in Government Workers: Excessive government debt and deficits have led to continued job losses – state and local job losses appear to be stabilizing but federal cuts are ongoing.

- Decline in the Labor Force Participation Rate: Discouraged workers and aging Baby Boomer demographics have artificially lowered the short-term unemployment figures because fewer people are looking for work. If economic expansion accelerates, the participation contraction trend is likely to reverse.

Skepticism Reigns Supreme

Regardless of the jobs picture and multi-year expansion, investors and business managers alike remain skeptical about the sustainability of the economic recovery. Anecdotally I encounter this sentiment every day, but there are other data points that bolster my assertion. Despite the stock market more than doubling in value from the lows of 2009, CNBC viewer ratings are the weakest in about 20 years (see Value Walk) and investments in the stock market are the lowest in 15 years (see Gallup poll chart below):

Why such skepticism? Academic research in behavioral finance highlights innate flaws in human decision-making processes. For example, humans on average weigh losses twice as much as gains as economist and Nobel prizewinner Daniel Kahneman explains in his book Thinking Fast and Slow (see Investing Caffeine article: Decision Making on Freeways and in Parking Lots). Stated differently, the losses from 2008-2009 are still too fresh in the minds of Americans. Until the losses are forgotten, and/or the regret of missing gains becomes too strong, many investors and managers will fearfully remain on the sideline.

The speed of our economic recovery is as excruciatingly agonizing, and so is waiting in line at the DMV. The act of waiting can be horrific, but obtaining a driver’s license is required for driving and investing is necessary for retirement. If you don’t want to go to investing jail, then you better get in the investing line now before job growth accelerates, because you don’t want to be sent to the back of the line where you will have to wait longer.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing, SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

The Central Bank Dog Ate My Homework

It’s been a painful four years for the bears, including Peter Schiff, Nouriel Roubini, John Mauldin, Jimmy Rogers, and let’s not forget David Rosenberg, among others. Rosenberg was recently on CNBC attempting to clarify his evolving bearish view by explaining how central banks around the globe have eaten his forecasting homework. In other words, Ben Bernanke is getting blamed for launching the stock market into the stratosphere thanks to his quantitative easing magic. According to Rosenberg, and the other world-enders, death and destruction would have prevailed without all the money printing.

In reality, the S&P 500 has climbed over +140% and is setting all-time record highs since the market bottomed in early 2009. Despite the large volume of erroneous predictions by Rosenberg and his bear buddies, that development has not slowed the pace of false forecasts. When you’re wrong, one could simply admit defeat, or one could get creative like Rosenberg and bend the truth. As you can tell from my David Rosenberg article from 2010 (Rams Butting Heads), he has been bearish for years calling for outcomes like a double-dip recession; a return to 11% unemployment; and a collapse in the market. So far, none of those predictions have come to fruition (in fact the S&P is up about +40% from that period, if you include dividends). After being incorrect for so long, Rosenberg has switched his mantra to be bullish on pullbacks on selective dividend-paying stocks. When pushed whether he has turned bullish, here’s what Rosenberg had to say,

“So it’s not about is somebody bearish or is somebody bullish or whether you’re agnostic, it’s really about understanding what the principle driver of this market is…it’s the mother of all liquidity-driven rallies that I’ve seen in my lifetime, and it’s continuing.”

Rosenberg isn’t the only bear blaming central banks for the unexpected rise in equity markets. As mentioned previously, fear and panic have virtually disappeared, but these emotions have matured into skepticism. Record profits, cash balances, and attractive valuations are dismissed as artificial byproducts of a Fed’s monetary Ponzi Scheme. The fact that Japan and other central banks are following Ben Bernanke’s money printing lead only serves to add more fuel to the bears’ proverbial fire.

Speculative bubbles are not easy to identify before-the-fact, however they typically involve a combination of excessive valuations and/or massive amounts of leverage. In hindsight we experienced these dynamics in the technology collapse of the late-1990s (tech companies traded at over 100x’s earnings) and the leverage-induced housing crisis of the mid-2000s ($100s of billions used to speculate on subprime mortgages and real estate).

I’m OK with the argument that there are trillions of dollars being used for speculative buying, but if I understand correctly, the trillions of dollars in global liquidity being injected by central banks across the world is not being used to buy securities in the stock market? Rather, all the artificial, pending-bubble discussions should migrate to the bond market…not the stock market. All credit markets, to some degree, are tied to the trillions of Treasuries and mortgage-backed securities purchased by central banks, yet many pundits (i.e., see El-Erian & Bill Gross) choose to focus on claims of speculative buying in stocks, and not bonds.

While bears point to the Shiller 10 Price-Earnings ratio as evidence of a richly priced stock market, more objective measurements through FactSet (below 10-year average) and Wall Street Journal indicate a forward P/E of around 14. A reasonable figure if you consider the multiples were twice as high in 2000, and interest rates are at a generational low (see also Shiller P/E critique).

The news hasn’t been great, volatility measurements (i.e., VIX) have been signaling complacency, and every man, woman, and child has been waiting for a “pullback” – myself included. The pace of the upward advance we have experienced over the last six months is not sustainable, but when we finally get a price retreat, do not listen to the bears like Rosenberg. Their credibility has been shot, ever since the central bank dog ate their homework.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs) , but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.