Posts tagged ‘unemployment’

Heartburn Pains After Digesting Market Gains

After gorging on +9% gains in the stock market (S&P 500 index) during July, investors suffered some heartburn pain in August (-4%). The indigestion really kicked in after Federal Reserve Chairman, Jerome Powell, gave a frank and candid outlook during his annual monetary policy speech at Jackson Hole, Wyoming. His key takeaways were that further interest rate increases are necessary to control and bring down inflation. And these economically-slowing measures, coupled with the Fed’s $95 billion in quantitative tightening policies (QT), will according to the Fed Chairman, “bring some pain to households and businesses. These are the unfortunate costs of reducing inflation. But a failure to restore price stability would mean far greater pain.”

But not everything is causing stomach pains. Yes, inflation is elevated (the rate declined to 8.5% in July from 9.1%), but there are multiple signs that overall prices are peaking. For example, gasoline prices have declined for 11 consecutive weeks to pre Russia-Ukraine invasion levels around $3.81/gallon nationally. There are also signs that housing prices, rent, used car prices, and other commodities like wheat, beef, and copper are all declining in price, as well. Even Bitcoin and other cryptocurrencies are joining in the deflation parade.

And while the Fed is doing its darnedest to bring a halt to gut-wrenching inflation, the job market remains on fire (see chart below). The unemployment rate registered in at a near a generational-low of 3.5% last month, but we will receive a fresh, new figure this week to see if this trend continues.

The economy’s ravenous appetite for workers can also be found in the just-released JOLTS job opening data (see chart below), which shows there are 11.2 million job openings, a total that is almost double the number of available workers (5.7 million).

Stimulus – Trillion Style

The subject of politics is not my strong suit, so perhaps only time will tell whether the net result of two large pieces of government legislation totaling more than $1 trillion (Inflation Reduction Act and Student Loan Forgiveness) will accelerate growth in the economy (Real GDP) or hasten the pace of inflation.

More specifically, the $565 billion Inflation Reduction Act is designed with the intent of investing in clean energy and healthcare initiatives, while negotiating lower pharmaceutical prices with drug companies, and raising tax revenues. The key measures planned in the legislation to fund the spending and forecasted deficit reduction are a minimum corporate tax, the termination of the carried interest tax loophole, and a doubling of the IRS (Internal Revenue Service) budget to hunt down tax dodgers.

With respect to the Student Loan Forgiveness Plan, the cost of the bill is estimated to be between $469 billion to $519 billion over a 10-year budget window, according to the University of Pennsylvania. The debt cancellation will apply to lower income individuals (earning less than $125,000 annually) with the potential of erasing debt of $10,000 – $20,000 per eligible person.

While the government passes various investing, spending, and tax-raising initiatives, corporations continue to crank out record results (see profit charts below), despite talks of an impending recession (see last month’s article, Recession or Mental Depression?).

Pessimists point to the economic strength as only temporary, as they brace for the Fed’s interest rate hiking medicine to take larger effect on the patient. Optimists point to the durability of corporate profits, relatively low interest rates (3.13% yield on the 10-Year Treasury Note), positive Q3 – GDP growth estimates of +1.6%, and reasonable valuations (17x Forward Price/Earnings ratio), given the evidence of peaking and declining inflation.

In view of all the current countervailing factors, the near-term volatility will likely create a lot of stomach-churning uneasiness. However, in the coming months, if it becomes clearer the Fed is closer to the end of its rate-hiking cycle and inflation subsides, you might be gleefully enjoying your tasty gains rather than complaining of financial heartburn and headache pains.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in BRKA/B or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact Page.

Bad Weather Coming: Hurricane or Drizzle?

It was a stormy month in the stock market, but the sun eventually came out and the Dow Jones Industrial Average rallied more than 2,300+ points before eking out a small gain (up +0.04%) and the S&P 500 index also posted an incremental increase (+0.005%). But there are clouds on the horizon. Although the economy is currently very strong (i.e., record corporate profits and a generationally low unemployment rate of 3.6% – see chart below), some forecasters are predicting a recession during 2023 as a result of the Federal Reserve pumping the brakes on the economy by increasing interest rates, in addition to elevated inflation, supply chain disruptions, COVID lockdowns in China, and a war between Russia and Ukraine.

UNEMPLOYMENT RATE (1997 – 2022)

But like weather forecasters, economists are perpetually unreliable. While some doomsday-er economists are expecting a deeply destructive hurricane (deep recession), others are only seeing a mild drizzle (soft landing) developing. The truth is, nobody knows for certain at this point, but what we do know is that the correction in stock prices this year (-13% now and -20% two weeks ago) has already significantly discounted (factored in) a mild recession. In other words, even if a mild recession were to occur in the coming months or quarters, there may be very little reaction or negative consequences for investors. Similarly, if inflation begins to be peaking as it appears to be doing (see chart below), and the Fed can orchestrate a soft landing (i.e., raise interest rates and reduce balance sheet debt without crippling the economy), then substantial rewards could accrue to stock market investors. On the flip side, if the economy were to go into a deep recession, history would suggest this stormy forecast might result in another -10% to -15% of chilliness.

INFLATION RATE (%)

Due to trillions of dollars in increased stimulus spending and Federal Reserve Quantitative Easing (bond buying), we experienced an explosion in the government deficit and surge in money supply growth (i.e., the root cause for swelling inflation). Arguably, some or all of these accommodations were useful in surviving through the worst parts of the COVID pandemic, however, we are paying the price now in sky-high food costs, explosive gasoline prices, and expanding credit card bills. The good news is the deficit is plummeting (see chart below) due to a reduction in spending (due in part to no Build Back Better infrastructure spending legislation) and soaring income tax receipts from a strengthening economy and capital gains in the stock market.

MONEY SUPPLY GROWTH% (M2) VS. GOVERNMENT DEFICIT

For many investors, getting used to large multi-year gains has been very comfortable, but interpreting downward gyrations in the stock market can be very confusing and counterintuitive. In short, attempting to decipher the reasons behind the short-term zigs and zags of the market is a fool’s errand. Not many people predicted a +48% gain in the stock market during a global pandemic (2020-2021), just like not many people predicted a short-lived -20% reduction in the stock market during 2022 as we witnessed record-high corporate profits and unemployment rates hovering near generational lows (3.6%).

Stock market veterans understand that stock prices can go down when current economic news is sunny but future expectations are too high. Experienced investors also understand stock prices can go up when the current economic news may be getting too cloudy but future expectations are too low.

Apparently, the world’s greatest investor of all-time thinks that all this gloomy recession talk is creating lots of stock market bargains, which explains why Buffett has invested $51 billion of his cash at Berkshire Hathaway as the stock market has gotten a lot more inexpensive this year. So, while the economy will likely face a number of headwinds going into 2023, it doesn’t mean a hurricane is coming and you need to hide in a bunker. If you pull out your umbrella and rain gear, just like smart investors do during all previous challenging economic cycles, the drizzle from the storm clouds will eventually pass and blue skies shall reappear.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (June 1, 2022). Subscribe on the right side of the page for the complete text.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in BRK.B/A or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

New Year’s Resolutions and Vaccine Distributions

Many people were ready to flush 2020 down the toilet after the novel coronavirus (COVID-19) global pandemic dominated the daily headlines, but panic eventually turned into optimism. With last year and a new year celebration now behind us, the annual tradition of creating a New Year’s resolution to better one’s life will be a challenge for many in 2021. Why? Well, from a financial perspective, the stock market, as measured by the S&P 500 index, finished the year at another mind-boggling, all-time record high (+16% for the year), making 2020 a tough act to follow.

One area of the stock market performed exceptionally well. With millions of employees, students, and bored Americans locked down for much of the year, demand for computers, mobile phones, and internet-connected televisions swelled. Due to a flood of sales into devices, gadgets, equipment, and software, technology stocks became huge beneficiaries in 2020. The performance of this sector can be gauged by the results of the tech-heavy NASDAQ index, which skyrocketed an astounding +44%.

Countering the Confusion

Given this unexpected surge in stock prices, many casual observers are asking how is it possible the Dow Jones Industrial Average capped off a year above the 30,000 level (best ever) after a year when 80 million people contracted COVID-19 and almost 2 million humans died from the virus?

This month, we will try to answer this confusing question. We shall explore the factors behind the unprecedented collapse early in the year and the subsequent recovery in stock prices surrounding this perplexing virus.

We’ve experienced a lot over the last year: death, destruction, an emotionally divisive presidential election, social distancing, face-coverings, Amazon deliveries, Netflix binging, DoorDash food deliveries, hand-sanitizer stocking, toilet-paper runs, and endless pants-less Zoom video sessions. After all this insanity, here are some reasons for why your and my investment accounts and 401(k) balances still managed to appreciate significantly last year:

- A COVID Cure: Although roughly only 4 million doses of the COVID-19 vaccine have been administered to date (after a 20 million goal), the government has contracted for the delivery of 400 million vaccine doses from Pfizer Inc. (PFE) and Moderna Inc. (MRNA) by summertime. With these two FDA (Food and Drug Administration) approvals alone, these doses should be enough to vaccinate all but about 60 million of the roughly 260 million adult Americans who are eligible to be inoculated. Even better, each of these cures appear to be over 90% effective. What’s more, in the not-too-distant future, additional relief is on its way in the form of further vaccine approvals by the likes of Johnson & Johnson (JNJ), Novavax Inc. (NVAX), AstraZeneca (AZN), and the Sanofi (SNY) / GlaxoSmithKline (GSK).

- Fed Firemen to the Rescue: As the COVID flames are blazing with record numbers of cases, hospitalizations, and deaths, the Federal Reserve firemen have come to an economic rescue by providing accommodative monetary policies. By effectively setting the benchmark Fed Funds Rate to 0% (see chart below), our central bank is not only stimulating loan activity for businesses, but also lowering the cost of mortgages and credit cards for consumers. In addition, the Fed has been providing support to financial markets and invigorating the economy through its asset purchases. More specifically, the Fed outlined its activities in its most recent December statement:

“The Federal Reserve will continue to increase its holdings of Treasury securities by at least $80 billion per month and of agency mortgage-backed securities by at least $40 billion per month until substantial further progress has been made toward the Committee’s maximum employment and price stability goals.“

- Economic Recovery is Well on its Way: In addition to the unmatched monetary policy stimulus from the Federal Reserve, we have also experienced an unparalleled $4 trillion in fiscal stimulus to trigger a sharp rebound in economic activity (see red line in chart below). There have been multiple rounds of PPP (Paycheck Protection Program) loans given to small businesses, millions of direct checks distributed to unemployed individuals, along with a host of other programs covering the healthcare, education, and infrastructure industries. As a result of these measures, coupled with the vaccines unleashing massive amounts of pent-up demand, pundits are forecasting above-trendline economic GDP growth in 2021 approximately 4% – 5% (e.g., Merrill Lynch +4.6%, Goldman Sachs +5.9%, and the Federal Reserve +3.7% to +5.0%).

As part of the recovery, the banner year in stocks has also helped catapult consumer household balance sheets to over $120 trillion dollars, while simultaneously reducing debt (leverage) ratios (see chart below).

Flies in the Ointment

It’s worth noting that not all is well in COVID-land. Unemployment rates remain at elevated recessionary levels and industries such as travel, leisure, and restaurants persist in devastation by the pandemic. Politically, the hotly contested 2020 presidential election has largely been resolved, but a Georgia runoff vote this week for two Senate seats could swing full control of Congress to the Democrats. With the stock market at fresh new highs, a Democrat sweep in Georgia would likely be interpreted as a mandate for President-elect Biden to increase taxes for many people and businesses. Under this scenario, a temporary downdraft in the market should come as no surprise to any investor. However, any potential tax hikes on corporations and the wealthy should be accompanied with more infrastructure spending and fiscal spending, which could offset the drag of taxes to varying degrees.

Although Sidoxia Capital Management is still finding plenty of opportunities in the stock market while considering these record low interest rates (yield on 10-year Treasury Note of only 0.92%), areas of vulnerability still exist in recent high-flying, money-losing IPOs (Initial Public Offerings) such as Snowflake Inc. (SNOW), Airbnb Inc (ABNB), and DoorDash Inc (DASH).

Other cautionary areas of excess speculation include the hundreds of SPAC (Special Purpose Acquisition Company) deals totaling more than $70 billion in 2020, and the reemergence of Bitcoin froth (up greater than +300% this year). The recent rush into Bitcoin has been fierce, but industry veterans with memory greater than a gnat recall that Bitcoin plummeted more than -80% from its peak to trough in 2018. Suffice it to say, Bitcoin is not for the faint of heart and buyers should beware.While there was a lot of pain and suffering experienced by millions due to the COVID-19 global pandemic, there was a lot to be thankful for as well, including vaccines to cure the global pandemic. Even though we had another record year at Sidoxia Capital Management, there is always room for improvement. At Sidoxia our New Year’s resolution is always the same: Provide superior investment management and financial planning services, as we build sustaining, long-term relationships with our clients.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (January 4, 2021). Subscribe on the right side of the page for the complete text.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in AMZN, NFLX, MRNA, ZM, PFE, NVAX, and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in DASH, JNJ, AZN, SNY, GSK, SNOW, ABNB, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

GDP Figures & Election Jitters

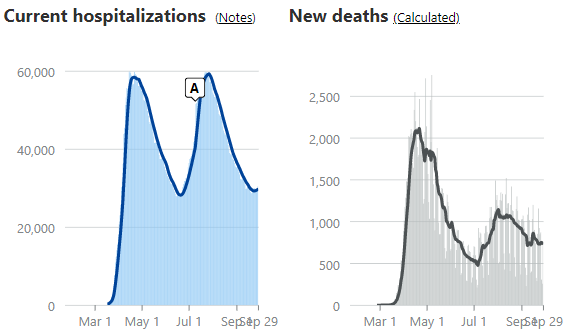

Ever since the beginning of 2020, it’s been a tale of two cities. As renowned author Charles Dickens famously stated, “It was the best of times and worst of times.” The year started with unemployment at a “best of times” low level of 3.5% (see chart below) before coronavirus shutdown the economy during March when we transitioned to the “worst of times.”

|

With the recent release of record-high Gross Domestic Product (GDP) figures of +33.1% growth in Q3 (vs. -31.4% in Q2), and a +49% stock market rebound from the COVID-19 lows of March, a debate has been raging. Is the re-opening economic rebound that has occurred a V-shaped recovery that will continue expanding, or is the recovery that has occurred since March a temporary dead-cat bounce?

|

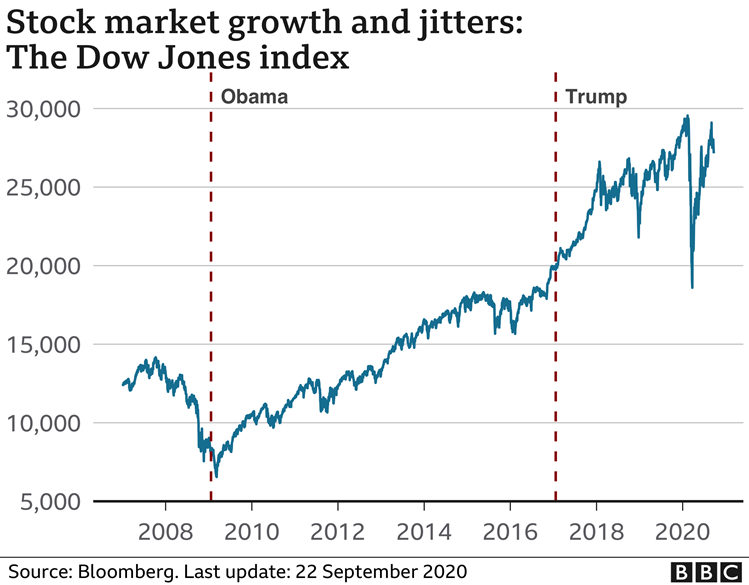

For many people, the ultimate answer depends on the outcome of the impending presidential election. Making matters worse are the polarized politics that are being warped, distorted, and amplified by social media (see Social Dilemma). Although the election jitters have many stock market participants on pins and needles, history reminds us that politics have little to do with the long-term direction of the stock market and financial markets. As the chart below shows, over the last century, stock prices have consistently gone up through both Democratic (BLUE) and Republican (RED) administrations.

|

Even if you have trouble digesting the chart above, I repeatedly remind investors that political influence and control are always temporary and constantly changing. There are various scenarios predicted for the outcome of the current 2020 elections, including a potential “Blue Wave” sweep of the Executive Branch (the president) and the Legislative Branch (the House of Representatives and Senate). Regardless of whether there is a Blue Wave, Red Wave, or gridlocked Congress, it’s worth noting that the previous two waves were fleeting. Unified control of government by President Obama (2008-2010) and President Trump (2016-2018) only lasted two years before the Democrats and Republicans each lost 100% control of Congress (the House of Representatives flipped to Republican in 2010 and Democrat in 2018).

Even though Halloween is behind us, many people are still spooked by the potential outcome of the elections (or lack thereof), depending on how narrow or wide the results turn out. Despite the +49% appreciation in stock prices, stock investors still experienced the heebie-jeebies last month. The S&P 500 index declined -2.8% for the month, while the Dow Jones Industrial Average and Nasdaq Composite index fell -4.6% and -2.3%, respectively. It is most likely true that a close election could delay an official concession, but with centuries of elections under our belt, I’m confident we’ll eventually obtain a peaceful continuation or transition of leadership.

Regardless of whomever wins the presidential election, roughly half the voters are going to be unhappy with the results. For example, even when President Ronald Reagan won in a landslide victory in 1980 (Reagan won 489 electoral votes vs. 49 for incumbent challenger President Jimmy Carter), Reagan only won 50.8% of the popular vote. In other words, even in a landslide victory, roughly 49% of voters were unhappy with the outcome. No matter the end result of the approaching 2020 election, suffice it to say, about half of the voting population will be displeased.

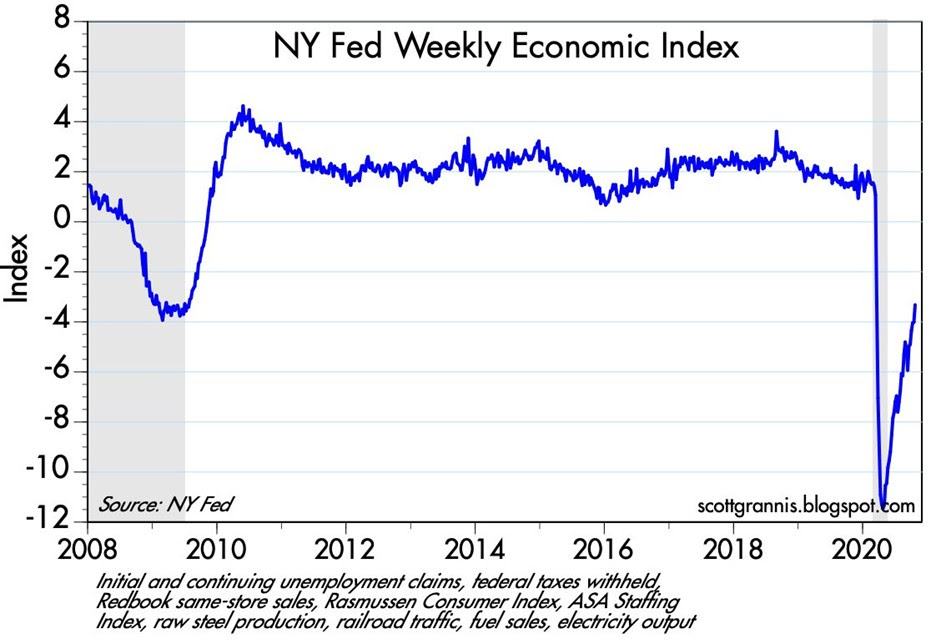

Despite the likely discontent, the upcoming winner will be working with (or inheriting) an economy firmly in recovery mode, whether you are referencing, jobs, automobile sales, home sales, travel, transportation traffic, consumer spending, or other statistics. The Weekly Economic Index from the New York Federal Reserve epitomizes the strength of the V-shaped recovery underway (see chart below).

It will come as no surprise to me if we continue to experience some volatility in financial markets shortly before and after the elections. However, history shows us that these election jitters will eventually fade, and the tale of two cities will become a tale of one city focused on the fundamentals of the current economic recovery.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (November 2, 2020). Subscribe on the right side of the page for the complete text.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFS), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Politics & COVID Tricks

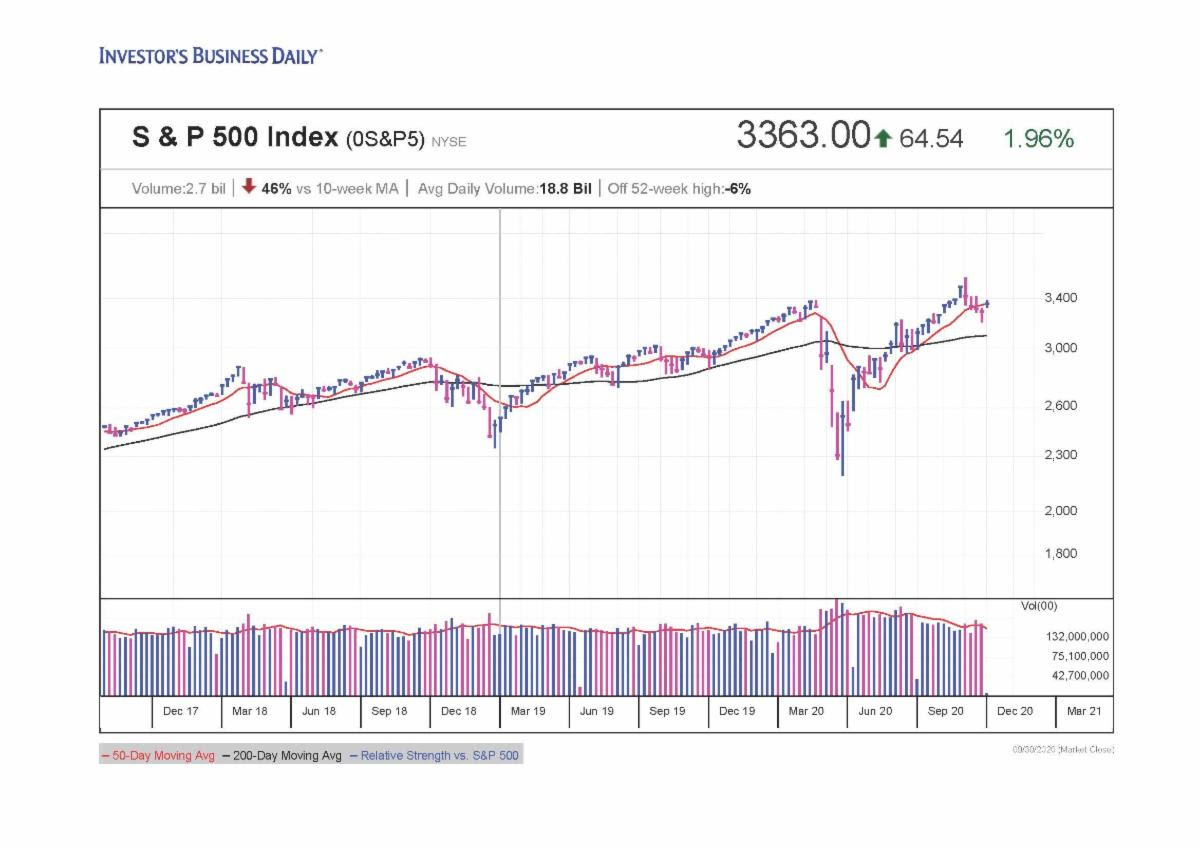

Thanks to a global epidemic, trillions of dollars instantly disappeared during the first quarter of this year, and then, abracadabra…the losses turned into gains and magically reappeared in the subsequent two quarters. After a stabilization in the spread of the COVID-19 virus earlier this year, the stock market rebounded for five consecutive months, at one point rebounding +64% (from late March to early September) – see chart below. However, things became a little bit trickier for the recent full month as concerns heightened over the outcome of upcoming elections; uncertainty over a potential coronavirus-related stimulus package agreement; and fears over a fall resurgence in COVID-19 cases. Although the S&P 500 stock index fell -3.9% and the Dow Jones Industrial Average slipped -2.3% during September, the same indexes levitated +8.5% and +7.6% for the third quarter, respectively.

Source: Investors.com

Washington Worries

Anxiety over politics is nothing new, and as I’ve written extensively in my Investing Caffeine blog, history teaches us that politics have little to do with the long-term performance of the overall stock market (e.g., see Politics & Your Money). Nobody knows with certainty how the elections will impact the financial markets and economy (myself included). But what I do know is that many so-called experts said the stock market would decline if Barack Obama won the presidential election…in reality the stock market soared. I also know the so-called experts said the stock market would decline if Donald Trump won the presidential election… in reality the stock market soared. So, suffice it to say, I don’t place a lot of faith into what any of the so-called political experts say about the outcome of upcoming elections (see the chart below).

COVID Coming Back?

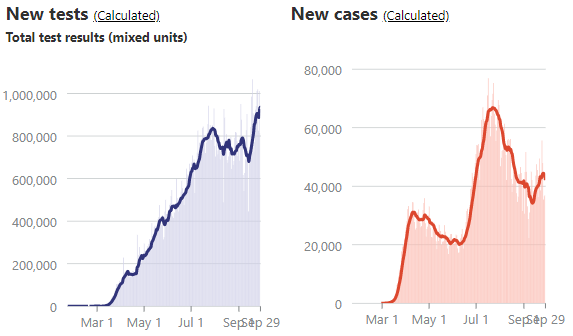

One of the reasons stock prices have risen more than 50%+ is due to a stabilization in COVID-19 virus trends. As you can see from the charts below, new tests, hospitalizations, and death rates are generally on good trajectories, according to the COVID Tracking Project. However, new COVID cases have bumped higher in recent weeks. This recent, troubling trend has raised the question of whether another wave of cases is building in front of a dangerous, seasonally-cooler fall flu season. Traditionally, it’s during this fall period in which contagious viruses normally spread faster.

Source: The COVID Tracking Project

Regardless of the trendline in new cases, there is plenty of other promising COVID developments to help fight this pandemic, such as the pending approvals of numerous vaccines, along with improved therapies and treatments, such as therapeutics, steroids, blood thinners, ventilators, and monoclonal antibodies.

Business Bounce

From the 10,000-foot level, despite worries over various political outcomes, the economy is recovering relatively vigorously. As you can see from the chart below, the rebound in employment has been fairly swift. After peaking in April at 14.7%, the most recent unemployment rate has declined to 8.4%, and a closely tracked ADP National Employment Report was released yesterday showing a higher than expected increase in new private-sector monthly jobs (749,000 vs. 649,000 median estimate).

Source: U.S. Bureau of Labor Statistics

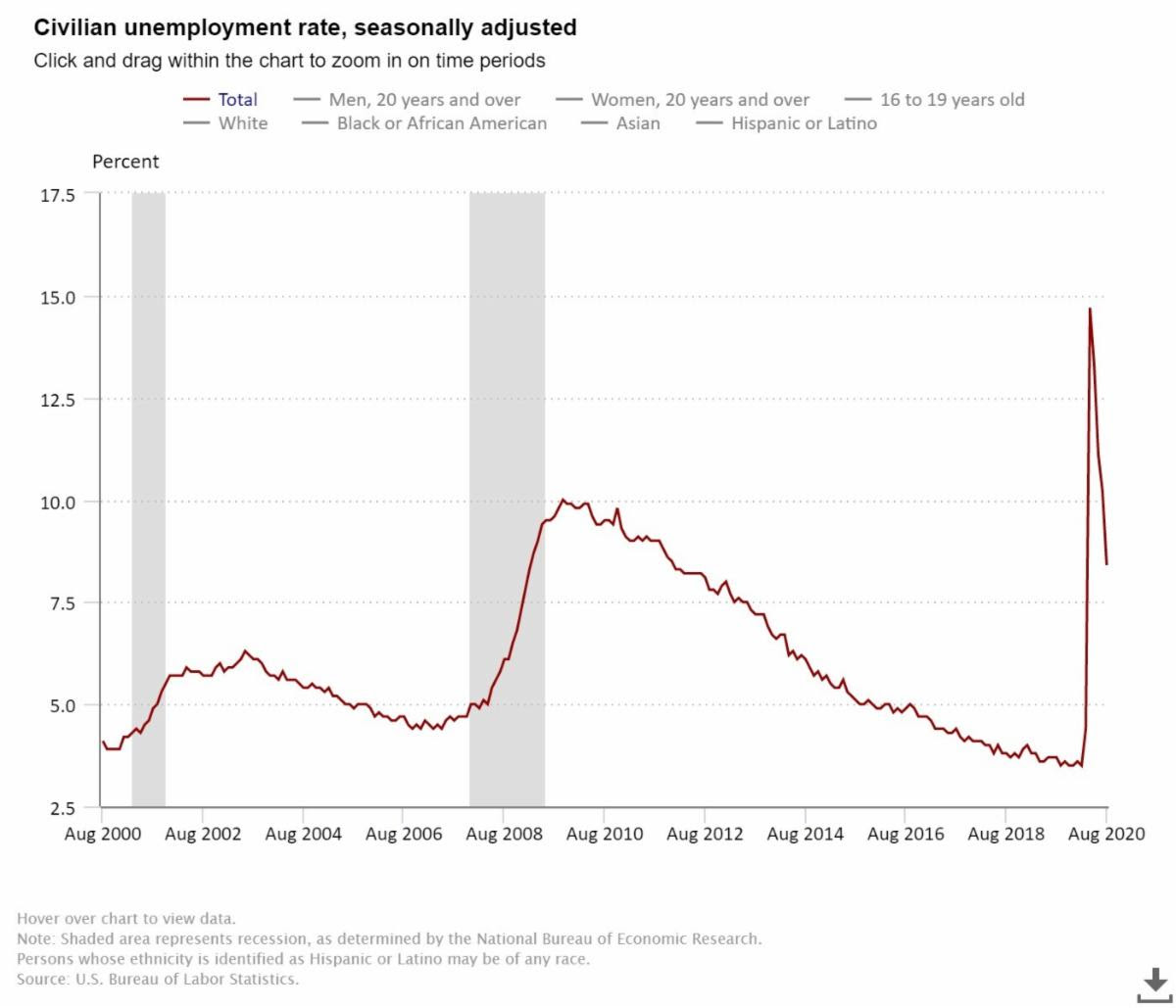

From a housing perspective, house sales have been on fire. Record-low interest rates, mortgage rates, and refinancing rates have been driving higher home purchases and rising prices. Urban flight to the suburbs has also been a big housing tailwind due to the desire for more socially distanced room, additional home office space, and expansive backyards. Adding fuel to the housing fire has been record low supply (i.e., home inventories). The robust demand is evident by the record Case-Shiller home prices (see chart below).

Source: Calculated Risk

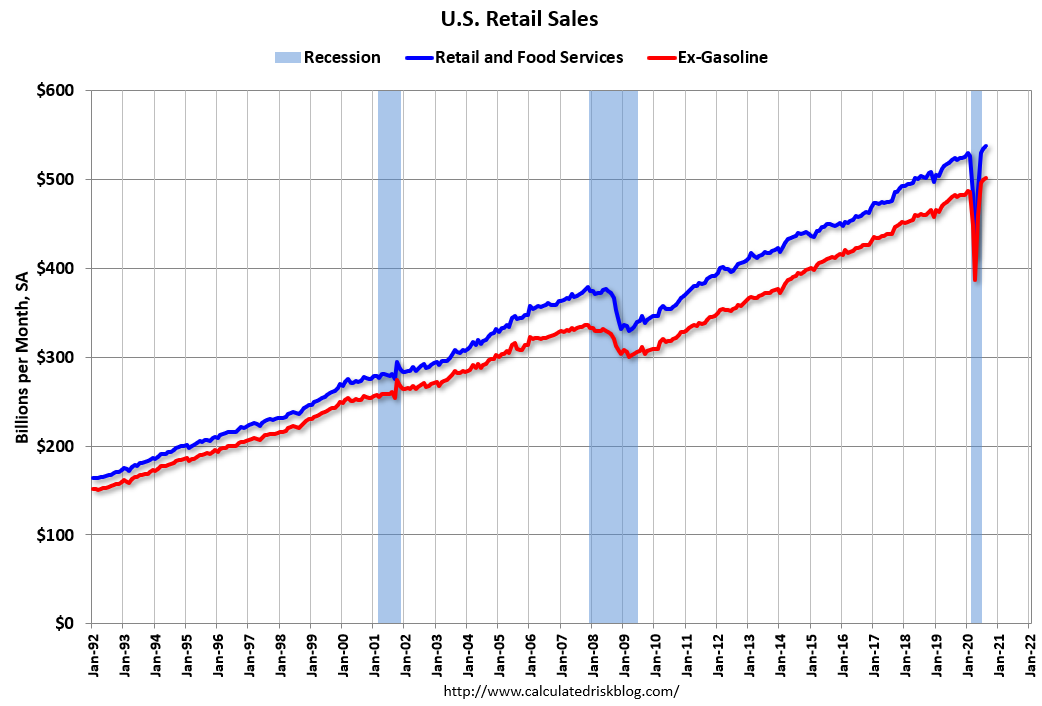

There are plenty of industries hurting, including airlines, cruise lines, hotels, retailers, and restaurants but the economic rebound along with government stimulus (i.e., direct government checks and unemployment relief payments) have led to record retail sales (see chart below). Spending could cool if an additional coronavirus-related stimulus package agreement is not reached, but until the government checks stop flowing, consumers will keep spending.

Source: Calculated Risk

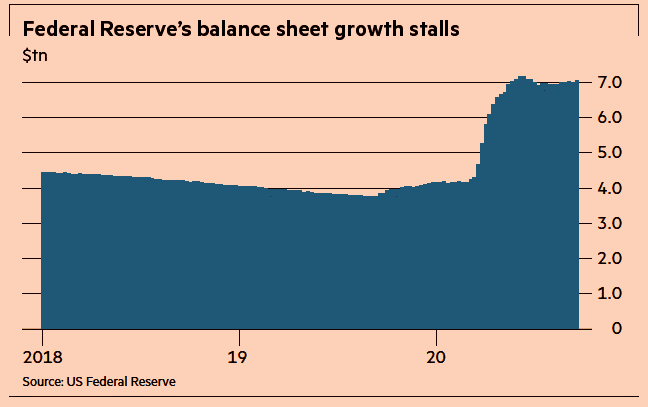

Besides trillions of dollars in fiscal relief injected into the economy, the Federal Reserve has also provided trillions in unprecedented relief (see chart below) through its government and corporate bond buying programs, in addition to its Main Street Lending Program.

Source:The Financial Times

There has been a lot of political hocus pocus and COVID smoke & mirrors that have much of the population worried about their investments. In every presidential election, you have about half the population satisfied with the winner, and half the population disappointed in the winner…this election will be no different. The illusion of fear and chaos is bound to create some short-term financial market volatility over the next month, but behind the curtains there are numerous positive, contributing factors that are powering the economy and stock market forward. Do yourself a favor by focusing on your long-term financial future and don’t succumb to politics and COVID tricks.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (October 1, 2020). Subscribe on the right side of the page for the complete text.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFS), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

The COVID Comeback

Rocky Balboa (“The Italian Stallion”) the underdog boxer from the movie, Rocky, was down and out until he was given the opportunity to fight World Heavyweight Champion, Apollo Creed. Like the stock market during early 2020, Rocky was up against the ropes and got knocked down, but eventually he picked himself up and rebounded to victory in his rematch with Creed.

The stock market comeback also persisted last month as the COVID-19 pandemic health situation continued to stabilize and the broader economy accelerated business re-openings. For the month, the Dow Jones Industrial Average increased +4.3% (+1,037 points to 25,383), while the S&P 500 index bounced+5.3%, and the NASDAQ catapulted the most by +6.8%.

How can the stock market (i.e., the Dow) rebound +39%, or more than 7,100 points, from the March 2020 lows? The large move is even more surprising once you consider 41 million people have lost their jobs since the epidemic hit American soil (see chart below), and COVID-19 related deaths have climbed to over 100,000 people.

Getting Back to Fighting Shape

By the time we reached Rocky VI, Rocky Balboa was retired and recovered from brain damage. But Rocky is no quitter, and he trained himself into championship fighting condition and got back into the boxing ring. With unemployment rates approaching Great Depression levels, the U.S. economy has been experiencing challenging circumstances as well – a self-induced coma (shutdown). Fortunately, our country has been slowly recovering day-by-day, and week-by-week. The economy may not be back to peak fighting shape, but activity is slowly and consistently getting better.

There are many different perspectives in looking at this extremely complex, unprecedented coronavirus pandemic. The speed and pace of selling stocks during February and March reached radically-high panic levels, as measured by objective indicators like the Volatility Index (i.e., the VIX – or Fear Gauge). However, like a coiled spring, the stock market sprung back up during April and May as stay-at-home orders and quarantine measures around the world significantly bent the curve of COVID-19 infections and deaths (see chart below). As you can see, with the exception of a few countries globally (e.g., Brazil and Russia), the number of daily confirmed deaths has been broadly declining for many weeks.

Estimated infections have been coming down as well, according to the Institute for Health Metrics and Evaluation (IMHE). IMHE estimates also show the number of daily infections has consistently been coming down over the last couple months.

In addition to the stay-at-home orders and social distancing protocols, what has also contributed to the declines in COVID-19 deaths and infections? Two words…”increased testing.” Although, arguably COVID-19 testing got off to a rough start, as seen in the chart below, nevertheless daily tests have risen dramatically over the last couple months from about 100,000 per day to roughly 500,000 per day (see chart below). Increased testing capacity has and will continue to help better control the spread (or lack thereof) of the virus.

Not only has the spread of the coronavirus been substantially mitigated, but the fighting economy has also received an adrenaline shot in the form of trillions of dollars of fiscal and monetary support as I described in my previous article ( see also Recovering from the Coma).

Investors Need to Keep Guard Up

Like Rocky Balboa, the U.S. is a strong, respected fighter but even though strength is being regained, the economy and stock market is susceptible to a surprise upper-cut punch or hook. What could potentially hurt the financial comeback?

- Flare Ups & Second Wave: As cities, counties, and states carry on with expanded business openings, we could experience “flare ups” of COVID-19 infections or a “second wave.” But the good news is, we should be in much better shape to handle these scenarios thanks to expanded stockpiles of ventilators; larger supplies of PPE (Personal Protective Equipment) for frontline workers; increased production of therapeutic drugs like remdesivir from Gilead Sciences Inc. (GILD); and improved contact tracing from the magnified number of tests. And this analysis doesn’t even contemplate the more than 100 vaccines being developed (i.e., a potential cure) for COVID-19, which could be available in limited quantities as early as the end of this year.

- Social Unrest: The death of George Floyd, an African-American man who died after a Minneapolis police officer forcefully restrained George by keeping his knee on his neck, which triggered lethal complications to the victim. As a result, nationwide racial injustice protests and disruptive violence have erupted, thereby forcing government intervention with the hope of limiting violence and damage caused by non-peaceful protesters.

- Strained Relations with China Due to Actions in Hong Kong: Recent political actions mandated by the Chinese government to strip autonomy from Hong Kong has strained relations with the United States, and progress made with the previous U.S. – China trade deal could erode.

- Inflation: Despite no near-term evidence of rising prices, the unparalleled increase of trillions of dollars in fiscal debt and deficits has the credible long-term potential of creating incendiary inflation that could burn through consumers’ buying power.

Rocky Balboa faced many formidable foes in the boxing ring, including Clubber Lang (Mr. T) and Russian Ivan Drago, but Rocky survived and persevered. The stock market is bound to face future punches from unforeseen challengers in the form of impending known and unknown threats, but the alarmist calls for a COVID knockout appear to be overstated.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (June 1, 2020). Subscribe on the right side of the page for the complete text.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in GILD and certain exchange traded funds (ETFS), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

What the Heck & What Now?

The Covid-19 viral pandemic that hit our shores in early 2020 shut down the economy to a virtual halt, and unemployment has skyrocketed to an estimated 19%, as 30 million people have now filed for unemployment benefits over the last six weeks (see chart below). Shockingly, we have not seen joblessness levels this high since the Great Depression. All this destruction has investors asking themselves, “What the heck, and what now?

Forecasts for 2nd quarter economic activity (Gross Domestic Product) are estimating an unprecedented decline of -12% (see chart below) with some projections plummeting as low as -34%. Despite the dreadful freefall in the stock market during March, along with the pessimistic economic outlook, the major stock indexes came back with a vengeance during April. More specifically, the Dow Jones Industrial Average soared +2,428 points, or +11% for the month. The other major indexes, S&P 500 and NASDAQ, catapulted higher over the same period by +13% and +15%, respectively.

Certainly, there have been some industries hurt by Covid-19 more than others. At the top of the misery list are travel related industries such as airlines, cruise lines, and hotels. Retailers like Neiman Marcus, Pier 1, and JCPenney are filing for bankruptcy or on the verge of closing. Restaurants have also been pummeled (partially offset by the ability to offer pickup and delivery services), and entertainment industries such as sporting arenas, concert venues, movie theaters, and theme parks have all painfully come to a screeching halt as well. Let’s not forget energy and oil companies, which are battling for their survival life in an environment that has witnessed oil prices plunge from $61 per barrel at the beginning of the year to $19 per barrel today (with a brief period at negative -$37…yes negative!) – click here for an explanation and see the chart below.

What the Heck?!

With all this horrifying economic data financially crippling millions of businesses and families coupled with an epidemic that has resulted in a U.S. death count surpassing 60,000, how in the heck can the stock market be up approximately +34% from the epidemic lows experienced just five short weeks ago?

I was optimistic in my Investing Caffeine post last month, but here are some more specific explanations that have contributed to the recent significant rebound in the stock market.

- Virus Curve Flattening: The wave of Covid-19 started in China and crashed all over Europe before landing in the U.S. Fortunately, as you can see from the chart below (U.S. = red line), social distancing and stay-at-home orders have slowed the growth in coronavirus deaths.

- Fiscal Stimulus: The government fire trucks are coming to the rescue and looking to extinguish the Covid fire by spraying trillions of stimulus and aid dollars to individuals, businesses, and governments. Most recently, Congress passed a $484 billion bill in stimulus funding, including $320 billion in additional funding for the wildly popular Payroll Protection Program (PPP), which is designed to quickly get money in the hands of small businesses, so employers can retain employees rather than fire them. This half trillion program adds to the $2 trillion package Congress approved last month (see also Recovering from the Coma).

- Monetary Stimulus: The Federal Reserve has pulled out another monetary bazooka with the announcement of $2.3 trillion dollars in additional lending to small businesses . This action, coupled with the long menu of actions announced last month brings the total amount of stimulus dollars to well above $6 trillion (see also Recovering from the Coma for a list of Fed actions). You can see in the chart below how the Fed’s balance sheet has ballooned by approximately $3 trillion in recent months. The central bank is attempting to stimulate commerce by injecting dollars into the economy through financial asset purchases.

- Improving Healthcare System: Treatments for sick Covid patients has only gotten better, including new therapeutics like the drug remdesivir from Gilead Sciences Inc. (GILD). Dr. Anthony Fauci, the NIAID Director (National Institute of Allergy and Infectious Diseases) stated remdesivir “will be the standard of care.” With 76 vaccine candidates under development, there is also a strong probability researchers could discover a cure for Covid by 2021. With the help of the Defense Production Act (DPA), the government is also slowly relieving critical manufacturing bottlenecks in areas such as ventilators, PPE (Personal Protective Equipment) and Covid test kits. Making testing progress is crucial because this process is a vital component to reopening the economy (see chart below).

- Economy Reopening: After I have completed all of Netflix, participated in dozens of Zoom Happy Hours, and stocked up on a year’s supply of toilet paper, I have become a little stir crazy like many Americans who are itching to return to normalcy. The government is doing its part by attempting a three-phase reopening of the economy as you can see from the table below. You can’t fall off the floor, so a rebound is almost guaranteed as states slowly reopen in phases.

What Now?!

In the short run, it appears the worst is behind us. Why do I say that? Covid deaths are declining; Congress is spending trillions of dollars to support the economy; the Federal Reserve has effectively cut interest rates to 0% and provided trillions of dollars to provide the economy a backstop; our healthcare preparedness has improved; and global economies (including ours) are in the process of reopening. What’s not to like?!

However, it’s not all rainbows, flowers, and unicorns. We are in the middle of a severe recession with tens of millions unemployed. The Covid-19 epidemic has created a generation of germaphobes who will be hesitant to dive back into old routines. And until a vaccine is found, fears of a resurgence of the virus during the fall is a possibility, even if the masses and our healthcare system are much more prepared for that possibility.

As the world adjusts to a post-Covid 2.0 reality, I’m confident consumer spending will rebound, and pent-up demand will trigger a steady rise of economic demand. However, I am not whistling past the graveyard. I fully understand behavior and protocols will significantly change in a post-Covid 2.0 world, if not permanently, at least for a long period of time. Before the 9/11 terrorist attacks, nobody suspected air travelers would be required to remove shoes, take off belts, place laptops in bins, and carry tiny bottles of mouthwash and shampoo. Nevertheless, a much broader list of social distancing and safety codes of behaviors will be established, which could slow down the pace of the economic recovery.

Regardless of the recovery pace, over just a few short months, we have already placed our hands around the throat of the virus. There are bound to be future setbacks related to the pandemic. Physical and economic wounds will take time to heal. Turbulence will remain commonplace during these uncertain times, but volatility will create opportunities as the recovery continues to gain stronger footing. Although Covid-19 has produced significant damage, don’t let fear and panic infect your long-term investment future.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (May 1, 2020). Subscribe on the right side of the page for the complete text.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in GILD, Zoom, Netflix , and certain exchange traded funds (ETFS), but at the time of publishing had no direct position in Neiman Marcus, Pier 1, and JCPenney or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Recovering from the Coma

The patient, the U.S. economy, is sick and remains in a coma. Although the patient was never healthier six weeks ago, now the economy has fallen victim to a worldwide pandemic that has knocked the global economy on its back. On the surface, the physical impact of coronavirus on the health of the 330 million Americans seems relatively modest statistically (4,394 deaths vs. 45,000 estimated common flu deaths this season). However, in order to kill this insidious novel coronavirus, which has spread like wildfire across 200 countries, governments have been forced to induce the economy into a coma, by closing schools, halting sporting events, creating social distancing guidelines, instituting quarantines/lockdowns, and by shutting down large non-essential swaths of the economy (e.g., restaurants, retail, airlines, cruises, hotels, etc.). We have faced and survived other epidemics like SARS (2003-04), H1N1 (2009-10), MERS (2012), and Ebola (2014-16), but the pace of COVID-19 spreading has been extraordinarily rapid and has created dramatic resource drains on healthcare systems around the world (including New York with approximately 75,000 cases alone). The need for test kits, personal protective equipment, and ventilators, among other demands has hit the U.S. caregiving system especially hard.

Given the unique characteristics of this sweeping virus, U.S. investors were not immune from the economic impact. The swift unprecedented downdraft from all-time record highs has not been seen since the October 1987 crash. And although the major indexes experienced an illness this month (Dow Jones Industrial Average -13.7%; S&P 500 -12.5%; NASDAQ -10.1%), the nausea was limited in large part thanks to trillions of dollars in unparalleled government intervention announced in the form of monetary and fiscal stimulus.

Healing the Patient

While the proliferation of the viral outbreak has been painful in many ways from a human and financial perspective, the beneficial impact of the medicine provided to the economic patient by the Federal Reserve and federal government through the Coronavirus Aid, Relief, and Economic Security (CARES) act cannot be overstated. The measures taken will provide a temporary safety net for not only millions of businesses, but also millions of workers and investors. Although last month many investors felt like vomiting when they looked at their investment account balances, gratefully the period ended on an upbeat note with the Dow bouncing +20% from last week’s lows.

Fed Financial Fixes

Here is a partial summary of the extensive multi-trillion dollar emergency measures taken by the Federal Reserve to keep the financial markets and economy afloat:

- Cut interest rates on the benchmark Federal Funds target to 0% – 0.25% from 1% – 1.25%.

- Make $1 trillion available in 14-day loans it is offering every week.

- Make $1 trillion of overnight loans a day available.

- Purchase an unlimited amount of Treasury securities after initially committing to $500 billion.

- Purchase an unlimited amount of mortgage-backed securities after initially committing to at least $200 billion.

- Provide $300 billion of financing to employers, consumers, and businesses. The Department of the Treasury will provide $30 billion in equity to this financing via the Exchange Stabilization Fund (ESF).

- Establish two lending facilities to support credit to large employers – the Primary Market Corporate Credit Facility (PMCCF) for new bond and loan issuance and the Secondary Market Corporate Credit Facility (SMCCF) to provide liquidity for outstanding corporate bonds.

- Create the Term Asset-Backed Securities Loan Facility (TALF), to support the flow of credit to consumers and businesses, including student loans, auto loans, credit card loans, loans guaranteed by the Small Business Administration (SBA).

- Expand the Money Market Mutual Fund Liquidity Facility (MMLF) and the Commercial Paper Funding Facility (CPFF) to include a wider range of securities.

Corona CARE to Country

Here is a limited summary of the sprawling $2.1 trillion bipartisan stimulus legislation that was recently passed by Congress (see summary and table below):

- Direct Payments: Americans who pay taxes will receive a one-time direct deposit of up to $1,200, and married couples will receive $2,400, plus an additional $500 per child. The payments will be available for incomes up to $75,000 for individuals and $150,000 for married couples, and phase out completely at $99,000 and $198,000, respectively.

- Unemployment: The program provides $250 billion for an extended unemployment insurance program and expands eligibility and offers workers an additional $600 per week for four months, on top of what state programs pay. It also extends UI benefits through Dec. 31 for eligible workers. The deal also applies to the self-employed, independent contractors and gig economy workers.

- Payroll Taxes: The measure allows employers to delay the payment of their portion of 2020 payroll taxes until 2021 and 2022.

- Use of Retirement Funds: The bill waives the 10% early withdrawal penalty for distributions up to $100,000 for coronavirus-related purposes, retroactive to Jan. 1. Withdrawals are still taxed, but taxes are spread over three years, or the taxpayer has the three-year period to roll it back in.

- Small Business Relief: $350 billion is being earmarked to preventing layoffs and business closures while workers need to stay home during the outbreak. Companies with 500 employees or fewer that maintain their payroll during coronavirus can receive up to 8 weeks of financial assistance. If employers maintain payroll, the portion of the loans used for covered payroll costs, interest on mortgage obligations, rent, and utilities would be forgiven.

- Large Corporations: $500 billion will be allotted to provide loans, loan guarantees, and other investments, these will be overseen by a Treasury Department inspector general. These loans will not exceed five years and cannot be forgiven. Airlines will receive $50 billion (of the $500 billion) for passenger air carriers, and $8 billion for cargo air carriers.

- Hospitals and Health Care: The deal provides over $140 billion in appropriations to support the U.S. health system, $100 billion of which will be injected directly into hospitals. The rest will be dedicated to providing personal and protective equipment for health care workers, testing supplies, increased workforce and training, accelerated Medicare payments, and supporting the CDC, among other health investments.

- Coronavirus Testing: All testing and potential vaccines for COVID-19 will be covered at no cost to patients.

- States and Local Governments: State, local and tribal governments will receive $150 billion. $30 billion is set aside for states, and educational institutions. $45 billion is for disaster relief, and $25 billion for transit programs.

- Agriculture: The deal would increase the amount the Agriculture Department can spend on its bailout program from $30 billion to $50 billion.

Source: The Wall Street Journal

Patient Requires Patience

As we enter the new 30-day extension of social distancing guidelines until April 30th, there is good news and bad news for the patient as the economy recovers from its self-induced coma. On the good news front, their appears to be a light at the end of the tunnel with respect to the spread of the virus. Enough data has been collected from countries like China, S. Korea, Italy, and our own, such that statisticians appear to have a better handle on the trajectory of the virus.

More specifically, here are some positive developments:

- Peak Seen on April 14th: According to the IMHE model that the White House is closely following, the number of COVID-19 deaths is projected to peak in two weeks.

Source: IHME

- Testing Ramping: The United States definitely got off to a slow start in the virus testing department, but as you can see from the chart below, COVID-19 tests are ramping significantly. Nevertheless, the number of tests still needs to increase dramatically until the percent of “positive” test results declines to a level of 5% or lower, based on data collected from South Korea. In another promising development, Abbott Laboratories (ABT) received emergency approval from the FDA for a rapid point-of-care test that produces results in just five minutes.

Source: Calculated Risk

- Closer to a COVID Cure: There are no Food and Drug Administration (FDA)-approved therapies or vaccines yet, but the FDA has granted emergency use authorization to anti-malarial drugs chloroquine phosphate and hydroxychloroquine sulfate to treat coronavirus patients. Patients are currently using these drugs in conjunction with the antibiotic azithromycin in hopes of achieving even better results. Remdesivir is a promising anti-viral treatment (also used in treating the Ebola virus) manufactured by Gilead Sciences Inc. (GILD), which is in Phase 3 clinical trial testing of the drug. If proven effective, broad distribution of remdesivir could be administered to COVID-19 patients in the not-too-distant future. Another company, Regeneron Pharmaceuticals (REGN), is working on clinical trials of its rheumatoid arthritis antibody drug Kevzara as a hopeful treatment. In addition, there are multiple companies, including Moderna Inc. (MRNA) and Johnson & Johnson (JNJ) that are making progress on coronavirus vaccines, that could have limited availability as soon as early-2021.

Darkest Before the Dawn

It is always darkest before the dawn, and the same principle applies to this coronavirus epidemic. Despite providing the patient’s medicine in the form of monetary and fiscal stimulus, time and patience is necessary for the prescription to take effect. As you can see from the chart below, the median total deaths projected is expected to rise to over 80,000 deaths by June 1st from roughly 4,000 today.

Source: IHME

The physical toll will exceedingly become difficult over the next month, and the same can be said economically, especially for the hardest hit industries such as leisure, hospitality, and transportation. Just take a look at the -93% decline in airport travel versus a year ago (see chart below).

Source: Calculated Risk

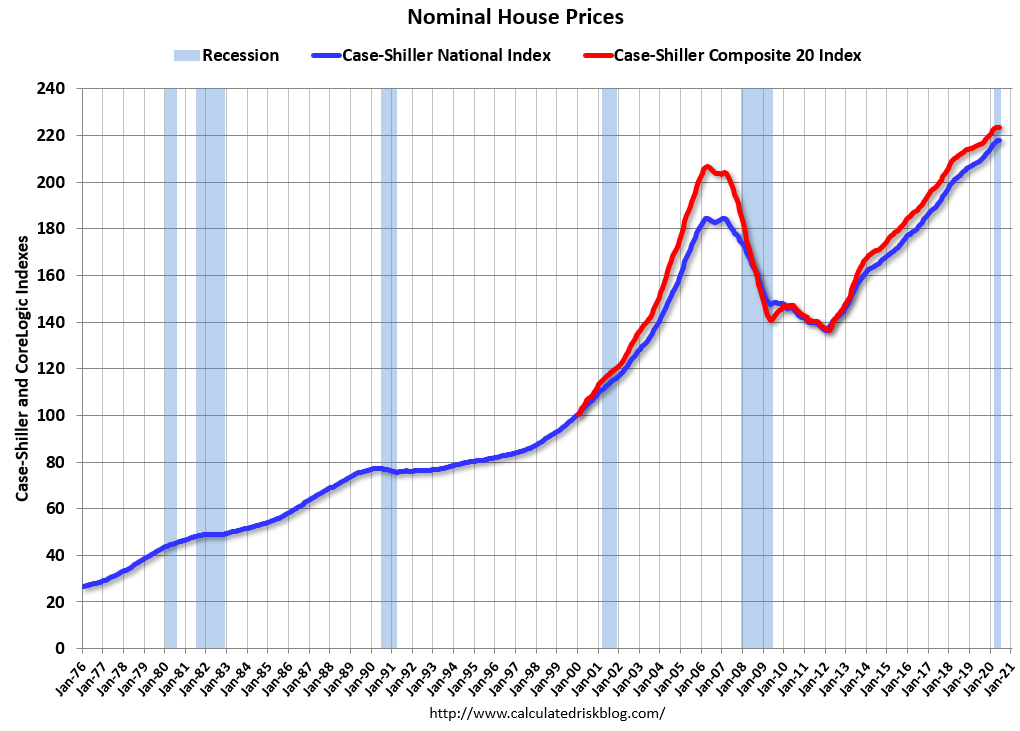

The closure of restaurants, retail stores, and hotels, coupled with a cratering of travel has resulted in a more than a 1,000% increase in Americans filing for unemployment payments (see chart below – gray shaded regions correspond to recessions), and the unemployment rate is expected to increase from a near record-low 3.5% unemployment to a staggering 10% – 30% unemployment rate.

Source: Macrotrends

The spread of the incredibly debilitating COVID-19 virus has placed the economic patient into a self-induced coma. The financial and physical pain felt by the epidemic will worsen in the coming weeks, but fortunately the monetary stimulus, fiscal emergency relief, and social distancing guidelines are pointing to a predictable recovery in the not-too-distant future. Financial markets have survived wars, assassinations, recessions, impeachments, banking crises, currency crises, housing collapses, and yes, even pandemics. Each and every time, we have emerged stronger than ever…and I’m confident we will achieve the same result once COVID-19 is defeated.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (April 1, 2020). Subscribe on the right side of the page for the complete text.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in GILD, MRNA, JNJ, and certain exchange traded funds (ETFS), but at the time of publishing had no direct position in ABT, REGN or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Missing the Financial Forest for the Political Trees

In the never-ending, 24/7, polarizing political news cycle, headlines of Ukraine phone calls, China trade negotiations, impeachment hearings, presidential elections, Federal Reserve monetary policy, and other Washington based stories have traders and news junkies glued to their phones, Twitter feeds, news accounts, blog subscriptions, and Facebook stories. However, through the incessant, deafening noise, many investors are missing the overall financial forest as they get lost in the irrelevant D.C. details.

Meanwhile, as many investors fall prey to the mesmerizing, but inconsequential headlines, financial markets have not fallen asleep or gotten distracted. The S&P 500 stock market index rose another +1.7% last month, and for the year, the index has registered a +18.7% return. As we enter the volatile fourth quarter, many stock market participants remain shell-shocked from last year’s roughly -20% temporary collapse, even though the S&P 500 subsequently rallied +29% from the 2018 trough to the 2019 peak.

Why are many people missing the financial forest? A big key to the significant rally in 2019 stock prices can be attributed to two words…interest rates. Unlike last year’s fourth quarter, when the Federal Reserve was increasing interest rates (i.e., tapping the economic brakes), this year the Fed is cutting rates (i.e., hitting the economic accelerator). Interest rates are a key leg to Sidoxia’s financial four-legged stool (see Don’t Be a Fool, Follow the Stool). Interest rates are at or near generational lows, depending where on the geographic map you reside. For example, interest rates on 10-year German government bonds are -0.55%. Yes, it’s true. If you were to invest $10,000 in a negative yielding -0.55% German bond for 10-years starting in 2019, if you held the bond until maturity (2029), the investor would get back less than the original $10,000 invested. In other words, many bond investors are choosing to pay bond issuers for the privilege of giving the issuers money for the unpalatable right of receiving less money in the future.

The unprecedented negative-yielding bond market is reaching epic proportions, having eclipsed $17 trillion globally (see chart below). This gargantuan and growing dollar figure of negative-yielding bonds defies common sense and feels very reminiscent of the panic buying of technology stocks in the late 1990s.

Source: Bloomberg

At Sidoxia Capital Management, we are implementing proprietary fixed income strategies to navigate this negative interest rate environment. However, the plummeting interest rates and skyrocketing bond prices only make our bond investing job tougher. On the other hand, declining rates, all else equal, also make my stock-picking job easier. Nevertheless, many market participants have gotten lost in the financial trees. More specifically, investors are losing sight of the key tenet that money goes where it is treated best (go where yields are highest and valuations lowest). With many bonds yielding low or negative interest rates, bond investors are being treated like criminals forced to serve jail time and pay large fines because future returns will become much tougher to accrue. In my Investing Caffeine blog, I have been writing about how the stock market’s earnings yield (current approximating +5.5%) and the S&P dividend yield of about +1.9% are handily outstripping the +1.7% yield on the 10-Year Treasury Note (see Going Shopping: Chicken vs. Beef ).

Unless our economy falls into a prolonged recession, interest rates spike substantially higher, or stock prices catapult appreciably, then any decline in stock prices will likely be temporary. Fortunately, the economy appears to be chugging along, albeit at a slower rate. For instance, 3rd quarter GDP (Gross Domestic Product) estimates are hovering around +2.0%.

Low Rates Aid Housing Market

Thanks to low interest rates, the housing markets remain strong. As you can see from the chart below, new home sales continue to ratchet higher over the last eight years, and lower mortgage rates are only helping this cause.

Source: Calafia Beach Pundit

The same tailwind of lower interest rates can be seen below with rising home prices.

Source: Calculated Risk

Consumer Flexes Muscles

At 3.7%, the unemployment rate remains low and the number of workers collecting unemployment is near multi-decade lows (see chart below).

Source: Calafia Beach Pundit

It should come as no surprise that the more employed workers there are collecting paychecks, the more consumer confidence will rise (see chart below). As you can see, consumer confidence is near multi-decade record highs.

Source: Calafia Beach Pundit

Although politics continue to dominate headlines and grab attention, many investors are missing the financial forest because the political noise is distracting the irrefutable, positive effect that low interest rates is contributing to the positive direction of the stock market and the economy. Do your best to not miss the forest – you don’t want your portfolio to suffer by you getting lost in the trees.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (October 1, 2019). Subscribe on the right side of the page for the complete text.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.