Posts tagged ‘S&P 500’

Another Month, Another Record

The S&P 500 eclipsed the 2,900 level and the NASDAQ jumped over 8,000 this month – both all-new record highs. The Dow Jones Industrial average also temporarily catapulted above 26,000 in August, but remains 2% shy of the January 2018 record highs. For the year, here are what the gains look like thus far:

- S&P 500: +5.3% (2,902)

- NASDAQ: +17.5% (8,110)

- Dow Jones Industrial: +5.0% (25,965)

For months, and even years, I have written how investors have underestimated the strength of this bull market, which has been driven by an incredible earnings growth, low interest rates, reasonable valuations, and a skeptical mass market of investors. As I pointed out in the article, Why the Masses Missed the 10-Year Bull Market, stock ownership has gone down during this massive quadrupling in the bull market. And many investors have missed the fruits of the bull market due to an over-focus on uncertain politics and scary headlines.

Nothing lasts forever, however, so another correction will likely be in the cards, just as we experienced this February when the S&P 500 index temporarily fell -18% from the January peak. But as I have highlighted previously, attempting to forecast or predict a correction is a Fool’s Errand. At Sidoxia we implement a disciplined, systematic process to identify attractive investments through our proprietary S.H.G.R. model (see also Holy Grail) and the four legs of our macroeconomic framework (earnings, interest rates, valuation, and investor sentiment – see Follow the Stool). With stock prices bouncing around near record highs, it is surprising to some that anxiety still remains elevated, primarily due to polarizing politics and an unfounded fear of an imminent recession.

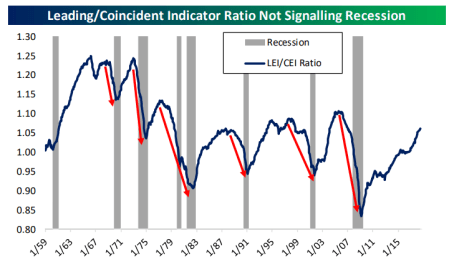

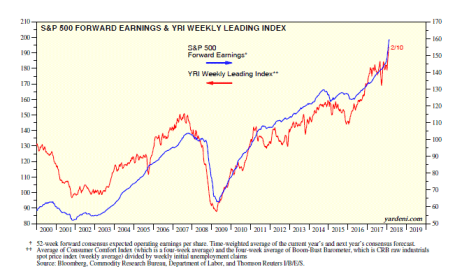

Despite all the hand wringing going on over political headlines, the fact remains the economic tailwinds have “trumped” any political concerns. After a strong Q2 GDP reading of +4.2%, according to numerous economists, Q3 is tracking for another healthy +3% gain. As the Leading & Coincident Indicator chart shows below, there currently is no sign of an imminent recession.

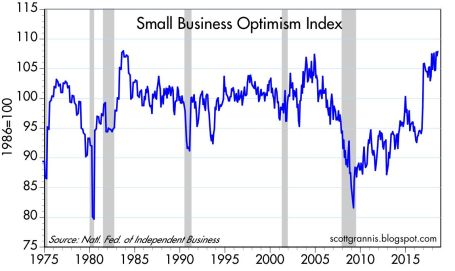

And jobs remain plentiful in part because of Small Business Optimism (see chart below). It’s common knowledge that small businesses generate the vast majority of new jobs, so these optimism levels hovering near 35-year highs augur well for future hiring, job growth, and investment.

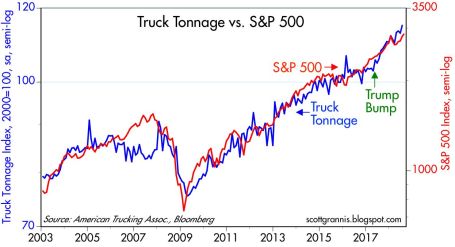

The real economy, as measured by the shipment of goods, is trucking along as well (see the truck tonnage chart below).

Source: Scott Grannis

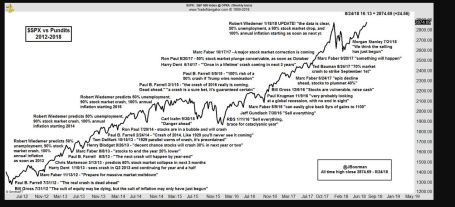

While all the positives above have been highlighted already, in the forefront has been an endless string of doomsday forecasts. Scott Grannis captured this sentiment in a six-year chart created by TradeNavigator.com (click here).

As we enter the tenth year of this bull stock market, politics remain polarizing and skepticism reigns supreme. However, until the storm clouds come rolling in, the economy keeps expanding and prices keep moving higher. If the trend continues, as has been the case in recent years, next month’s title could be the same, “Another Month, Another Record.”

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (September 4, 2018). Subscribe on the right side of the page for the complete text.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Tariff, Fed, & Facebook Fears but No Easter Bunny Tears

After an explosive 2017 (+19.4%) and first month of 2018 (+5.6%), the Easter Bunny came out and laid an egg last month (-2.7%). It is normal for financial markets to take a breather, especially after an Energizer Bunny bull market, which is now expanding into its 10th year of cumulative gains (up +296% since the lows of March 2009). Investors, like rabbits, can be skittish when frightened by uncertainty or unexpected events, and over the last two months, that’s exactly what we have seen.

Fears of Tariffs/Trade War: On March 8th, President Trump officially announced his 25% tariffs on steel and 10% on aluminum. The backlash was swift, not only in Washington, but also from international trading partners. In response, Trump and his economic team attempted to diffuse the situation by providing temporary tariff exemptions to allied trading partners, including Canada, Mexico, the European Union, and Australia. Adding fuel to the fire, Trump subsequently announced another $50-$60 billion in tariffs placed on Chinese imports. To place these numbers in context, let’s first understand that the trade value of steel (roughly $300 billion – see chart below), aluminum, and $60 billion in Chinese products represent a small fraction of our country’s $19 trillion economy (Gross Domestic Product). Nevertheless, financial markets sold off swiftly this month in unison with these announcements. The selloff did not necessarily occur because of the narrow scope of these specific announcements, but rather out of fear that this trade skirmish may result in large retaliatory tariffs on American exports, and ultimately these actions could blow up into a full-out trade war and trigger a spate of inflation.

Source: Bloomberg

These trade concerns are valid, but at this point, I am not buying the conspiracy theories quite yet. President Trump has been known to use fiery rhetoric in the past, whether talking about building “The Wall” or threats to defense contractors regarding the pricing of a legacy Air Force One contract. Often, the heated language is solely used as a first foray into more favorable negotiations. President Trump’s tough tariff talk is likely another example of this strategy.

Interest Rate/Inflation Phobia: Beginning in early February, anxiety in the equity markets intensified as interest rates on the benchmark 10-year Treasury note have now risen from a September-low yield of 2.40% to a 2018-high of 2.94%. Since that short-term high this year, rates have moderated to +2.74%. Adding to this month’s worries, Fed Chairman Jerome Powell hiked interest rates on the Federal Funds interest rate target by +0.25% to a range of 1.50% to 1.75%. While the direction of rate increases may be unnerving to some, both the absolute level of interest rates and the level of inflation remain relatively low, historically speaking (see 2008-2018 inflation chart below). Inflation of 1.5% is nowhere near the double digit inflation experienced in the late-1970s and early 1980s .

Source: Dr. Ed’s Blog

It is true that rates on mortgages, car loans, and credit cards might have crept up a little, but from a longer-term perspective rates still remain significantly below historical averages. Even if the Federal Reserve increases their interest rate target range another two to three times in 2018 as currently forecasted, we will still be at below-average levels, which should still invigorate economic growth (all else equal). In car terms, if the current strategy continues, the Fed will be moving from a strategy in which they are flooring the economic pedal to the medal, to a point where they will only be going 10 miles per hour over the speed limit. The strategy is still stimulative, but just not as stimulative as before. At some point, rising interest rates will slow down (or choke off) growth in the economy, but I believe we are still a long way from that happening.

Why am I not worried about runaway interest rates or inflation? For starters, I believe it is very important for investors to remove the myopic blinders, so they can open their eyes to what’s occurring with global interest rate trends. Although, U.S. rates have more than doubled from July 2016 to 2.74%, as long as interest rates in developed markets like Japan, the European Union, and Canada, remain near historically low levels (see chart below), the probabilities of runaway higher interest rates and inflation are unlikely to transpire.

Source: Ed Yardeni

With the Japanese 10-year government bond yielding 0.04% (near-zero percent), the German 10-year bond yielding 0.50%, and the U.K. 10-year bond yielding 1.35%, one of two scenarios is likely to occur: 1) global interest rates rise while U.S. rates decline or remain stable; or 2) U.S. interest rates decline while global rates decline or remain stable. While either scenario is possible, given the lack of rising inflation and the slack in our employment market, I believe scenario #2 is more likely to occur than scenario #1.

Privacy, Politics, and Facebook: A lot has recently been made of the 50 million user profiles that became exposed and potentially exploited for political uses in the 2016 presidential elections. How did this happen, and what was the involvement of Facebook Inc. (FB)? If you have ever logged into an internet website and been given the option to sign in with your Facebook password, then you have been exposed to third-party applications that are likely mining both your personal and Facebook “friend” data. The genesis of this particular situation began when Aleksandr Kogan, a Russian American who worked at the University of Cambridge created a Facebook quiz app that not only collected personal information from approximately 270,000 quiz-takers, but also extracted information from about 50 million Facebook friends of the quiz takers (data scandal explained here).

Mr. Kogan (believed to be in his early 30s) allegedly sold the Facebook data to a company called Cambridge Analytica, which employed Steve Bannon as a vice president. This is the same Steve Bannon who eventually became a senior adviser for the Trump Administration. Facebook has defended itself by blaming Aleksandr Kogan and Cambridge Analytica for violating Facebook’s commercial data sharing policies. Objectively, regardless of the culpability of Kogan, Cambridge Analytica, and/or Facebook, most observers, including Congress, believe that Facebook should have more closely monitored the data collected from third party app providers, and also done more to prevent such large amounts of data to be sold commercially. Now, the CEO (Chief Executive Officer) of Facebook, Mark Zuckerberg, faces an appointment in Washington DC, where he will receive tongue lashings and be raked over the coals, so politicians can better understand the breakdown of this data breach.

It is certainly possible that a large amount of data was compromised for political purposes relating to the 2016 presidential election. There has been some backlash as evidenced by a few high profile users threatening to leave the Facebook platform like actor/comedian Will Ferrell, Tesla CEO Elon Musk, and singer Cher, but since the data scandal was unearthed, there has been little evidence of mass defections. Even considering all the Facebook criticism, the stickiness and growth of Facebook’s 1.4 billion (with a “b”) monthly active users, coupled with the vast targeting capabilities available for a wide swath of advertisers, likely means any negative impact will be short-lived. Even if there are defectors, where will all these renegades go, Instagram? Well, if that were the case, Instagram is owned by Facebook. Snapchat, is another Facebook alternative, however this platform is skewed toward younger demographics, and few people who have invested years of sharing/saving memories on the Facebook cloud, are unlikely to delete these memories and migrate that data to a lesser-known platform.

Financial markets move up and financial markets down. The first quarter of 2018 reminded us that no matter how long a bull market may last, nothing money-related moves in a straight line forever. The fear du jour constantly changes, and last month, investors were fretting over tariffs, the Federal Reserve’s monetary policy, and a Facebook data scandal. Suffice it to say, next month will likely introduce new concerns, but one thing I do not need to worry about is an empty Easter basket. It will take me much longer than a month to work through all the jelly beans, chocolate bunnies, and marshmallow Peeps.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (April 2, 2018). Subscribe on the right side of the page for the complete text.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in FB, AMZN, TSLA, and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

The Scary Blip

I hated it when my mom reminded me when I was a younger, but now that I’ve survived into middle-aged adulthood, I will give you the same medicine she gave me:

“I told you so.”

As I cautioned in last month’s newsletter, “It’s important for investors to remember this pace of gains cannot be sustainable forever.” I added that there were a whole bunch of scenarios for stock prices to go down or “stock prices could simply go down due to profit-taking.”

And that is exactly what we saw. From the peak achieved in late January, stock prices quickly dropped by -12% at the low in early February, with little-to-no explanation other than a vague blame-game on rising interest rates – the 2018 yield on the 10-Year Treasury Note rose from 2.4% to 2.9%. This explanation holds little water if you take into account interest rates on the 10-Year increased from roughly 1.5% to 3.0% in 2013 (“Taper Tantrum”), yet stock prices still rose +20%. The good news, at least for now, is the stock correction has been contained or mitigated. A significant chunk of the latest double-digit loss has been recovered, resulting in stock prices declining by a more manageable -3.9% for the month. Despite the monthly loss, the subsequent rebound in late February has still left investors with a gain of 1.5% for 2018. Not too shabby, especially considering this modest return comes on the heels of a heroic +19.4% gain in 2017.

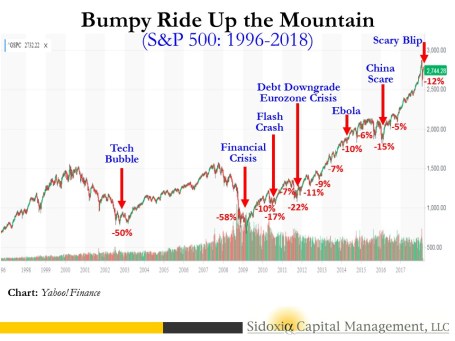

As you can see at from the 22-year stock market chart below for the S&P 500, the brief but painful drop was merely a scary blip in the long-term scheme of things.

Whenever the market drops significantly over a short period of time, as it did this month, conspiracy theories usually come out of the woodwork in an attempt to explain the unexplainable. When human behavior is involved, rationalizing a true root cause can be very challenging, to say the least. It is certainly possible that technical factors contributed to the pace and scale of the recent decline, as has been the case in the past. Currently no smoking gun or fat finger has been discovered, however some pundits are arguing the popular usage of leveraged ETFs (Exchange Traded Funds) has contributed to the accelerated downdraft last month. Leveraged ETFs are special, extra-volatile trading funds that will move at amplified degrees – you can think of them as speculative trading vehicles on steroids. The low-cost nature, diversification benefits, and ability for traders to speculate on market swings and sector movements have led to an explosion in ETF assets to an estimated $4.6 trillion.

Regardless of the cause for the market drop, long-term investors have experienced these types of crashes in the past. Do you remember the 2010 Flash Crash (down -17%) or the October 1987 Crash (-23% one-day drop in the Dow Jones Industrial Average index)? Technology, or the lack thereof (circuit breakers), helped contribute to these past crashes. Since 1987, the networking and trading technologies have definitely become much more sophisticated, but so have the traders and their strategies.

Another risk I highlighted last month, which remains true today, is the potential for the new Federal Reserve chief, Jerome Powell, to institute a too aggressive monetary policy. During his recent testimony and answers to Congress, Powell dismissed the risks of an imminent recession. He blamed past recessions on previous Fed Chairmen who over enthusiastically increased interest rate targets too quickly. Powell’s comments should provide comfort to nervous investors. Regardless of short-term inflation fears, common sense dictates Powell will not want to crater the economy and his legacy by slamming the economic brakes via excessive rate hikes early during his Fed chief tenure.

Tax Cuts = Profit Gains

Despite the heightened volatility experienced in February, I remain fairly constructive on the equity investment outlook overall. The recently passed tax legislation (Tax Cuts and Job Act of 2017) has had an undeniably positive impact on corporate profits (see chart below of record profit forecasts – blue line). More specifically, approximately 75% of corporations (S&P 500 companies) have reported better-than-expected results for the past quarter ending December 31st. On an aggregate basis, quarterly profits have also risen an impressive +15% compared to last year. When you marry these stellar earnings results with the latest correction in stock prices, historically this combination of factors has proven to be a positive omen for investors.

Source: Dr. Ed’s Blog

Despite the rosy profit projections and recent economic strength, there is always an endless debate regarding the future direction of the economy and interest rates. This economic cycle is no different. When fundamentals are strong, stories of spiking inflation and overly aggressive interest rate hikes by the Fed rule the media airwaves. On the other hand, when fundamentals deteriorate or slow down, fears of a 2008-2009 financial crisis enter the zeitgeist. The same tug-of-war fundamental debate exists today. The stimulative impacts of tax cuts on corporate profits are undeniable, but investors remain anxious that the negative inflationary side-effects from a potential overheating economy could outweigh the positive economic momentum of a near full-employment economy gaining steam.

Rather than playing Goldilocks with your investment portfolio by trying to figure out whether the short-term stock market is too hot or too cold, you would be better served by focusing on your long-term asset allocation, and low-cost, tax-efficient investment strategy. If you don’t believe me, you should listen to the wealthiest, most successful investor of all-time, Warren Buffett (The Oracle of Omaha), who just published his annual shareholder letter. In his widely followed letter, Buffett stated, “Performance comes, performance goes. Fees never falter.” To emphasize his point, Buffett made a 10-year, $1 million bet for charity with a high-fee hedge fund manager (Protégé Partners). As part of the bet, Buffett claimed an investment in a low-fee S&P 500 index fund would outperform a selection of high-fee, hot-shot hedge fund managers. Unsurprisingly, the low-cost index fund trounced the hedge fund managers. From 2008-2017, Buffett’s index fund averaged +8.5% per year vs. +3.0% for the hedge fund managers.

During scary blips like the one experienced recently, lessons can be learned from successful, long-term billionaire investors like Warren Buffett, but lessons can also be learned from my mother. Do yourself a favor by getting your investment portfolio in order, so my mother won’t have to say, “I told you so.”

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (March 1, 2018). Subscribe on the right side of the page for the complete text.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Glass Moving from Half-Empty to Half-Full

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (February 1, 2018). Subscribe on the right side of the page for the complete text.

Economic growth accelerated in 2017, the unemployment rate is sitting at a 17-year low, housing prices are up significantly, Consumer Confidence is near the highs of 2000, corporations are doing cartwheels thanks to tax cut legislation, and the stock market has recently set new records. Not a bad start to the year, eh?

Fat Wallets & Stuffed Purses

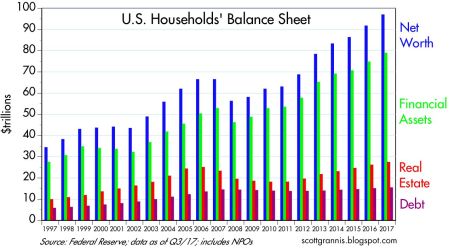

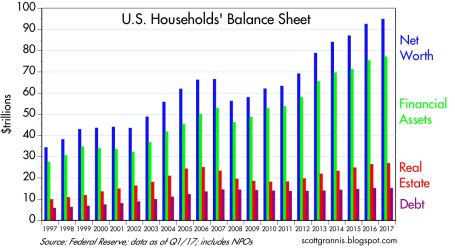

The strength of the economy, coupled with the optimism of business and consumers, has resulted in a financial boon for Americans, as shown in the chart below. Not only have financial assets and real estate gone up significantly since the 2008-2009 Financial Crisis, but household debt has also remained relatively stable. The combination of these factors have American households sitting on almost $1 trillion in household value, a new record.

Source: Calafia Beach Pundit

As we move ahead through the first month of 2018, the +5.8% gain in the Dow Jones Industrial Average, and the +5.6% advance in the S&P 500 index have further fattened wallets and stuffed the purses of equity investors. On an annual basis, the results only look even better, with the Dow up +32% and the S&P +24%. Given the sharp appreciation in value, casual observers might expect a flood of new investors to pile into stocks and equity mutual funds…not true. Actually, this buying phenomenon has yet to occur. However, it is true investor sentiment has begun shifting to a “glass half-full” perspective due to the vast number of positive economic headlines. Nevertheless, it’s important for investors to remember this pace of gains cannot be sustainable forever.

There is no theoretical limit on the number of potential market moving events. The stock market could temporarily get rattled by another North Korean nuclear test, a terrorist attack, a geopolitical standoff, an inflammatory tweet, an infinite number of other unforeseen events, or stock prices could simply go down due to profit-taking (i.e., investors sell to lock-in gains). Regardless, the economic momentum is palpable and the president did not waste any time at the recent State of the Union address to remind Americans.

Currently, there are limited signs of euphoric stock buying, but there will be a point in time, as in all economic cycles, when investment excesses will overwhelm demand and will therefore lead to a recession. Let’s not forget, an overzealous monetary policy (i.e., too many rate increases), led by a new Federal Reserve chief (Jerome Powell), is another scenario which could slam the breaks on an overheated economy.

Follow the Money

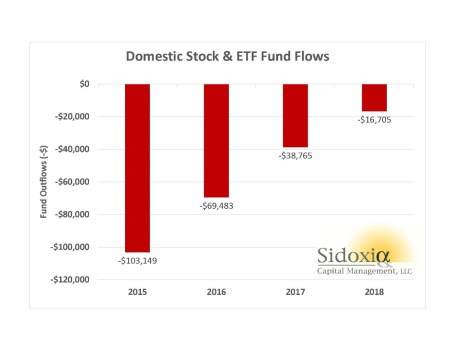

In attempting to read the tea leaves about the future direction of the stock market, we are inspired by the famous quote from the 1976 film All the President’s Men, “Follow the money.” Actions speak louder than words in our book, which is why at Sidoxia Capital Management (www.Sidoxia.com), we track the money buying and selling actions of investors. There is never a shortage of information, and the professionals at the ICI (Investment Company Institute) are kind enough to publish the Weekly Fund Flows data (see chart below), which details the amount of dollars funneling in and out of stock and bond funds. Despite the stock market more than tripling in value, and contrary to common belief, more than -$200 billion has poured out of domestic stock funds and ETFs (Exchange Traded Funds) from 2015 through early 2018.

Source: ICI through 1-17-18

How can this counterintuitive money exodus transpire during a bull market? Quite simply, corporations have been using record piles of cash to buy trillions of dollars in stock through “stock buybacks” and “mergers & acquisitions” activity. All this corporate stock purchase activity has offset the money flowing out of funds, which has helped catapult stock prices higher. History tells us, that before this long-term bull market that started in 2009 ends, flows into U.S. stock mutual funds and ETFs will turn significantly positive after years of hemorrhaging.

Many speculators and traders waste time on a plethora of unreliable sentiment surveys and indicators (e.g., CBOE Volatility Index, AAII Sentiment Survey, Put-Call Ratio, etc), but my 25+ years of investment experience tells me the fund flows data works much better as a longer-term contrarian indicator. To put “contrarian” investing in English, famed billionaire investor, Warren Buffett, summed it up best when he said, “Be fearful when others are greedy and greedy when others are fearful.”

Sharing the Wealth

Speaking of greed, corporations have been greedy capitalists as they have watched profits surge to record levels. Yet many of these greedy corporations have decided to share some of the spoils garnered from the recent tax legislation with rank and file employees. For instance, consider the small sampling of the following large corporations that have decided to pay their employees bonuses:

Overall, even though trillions of savings remain in cash and money is still flowing out of US stock funds, the investment glass is shifting from a glass half-empty perception to a glass half-full impression. A time will come when the masses will believe the glass half-full will turn to a glass over-flowing. I don’t think anyone can predict with any certainty when that time will arrive, but I will continue doing my best to drink as much water as possible before it spills.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in T, CMCSA, DIS, and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in AAL, BAC, JBLU, LUV, USB, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Celebrating Another Year, Another Decade for Sidoxia

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (January 2, 2018). Subscribe on the right side of the page for the complete text.

Not only is New Year’s the time to celebrate the year that has just passed, but it is also the time to set new resolutions for the year to come. For financial markets, especially the stock market, 2017 was a special year of celebration. In addition to the S&P 500 index rejoicing a +19% gain, the more narrowly focused Dow Jones Industrial Average (consisting solely of 30 stocks) partied to an even more impressive +25% advance. Out of the three major stock indexes, the icing on the cake can be savored by the technology-heavy NASDAQ index, which soared +28% in 2017.

Can the mojo of this festive bull market continue into its 10th year after the financial crisis? The short answer is “yes”, but there are numerous variables that can cause the performance gusts to swirl into a headwind or a tailwind. While many Americans are glued to the topic of politics and get caught up in the continual mudslinging, followers of Sidoxia Capital Management’s writings (see also Politics & Your Money) understand there are much more important factors impacting the long-term performance of your investments. More specifically, the following four factors I track on Sidoxia’s financial dashboard (Don’t Be a Fool) have continued to act as significant tailwinds for positive stock performance:

- Corporate profits

- Interest rates

- Valuations

- Sentiment

Sidoxia’s 10-Year Anniversary

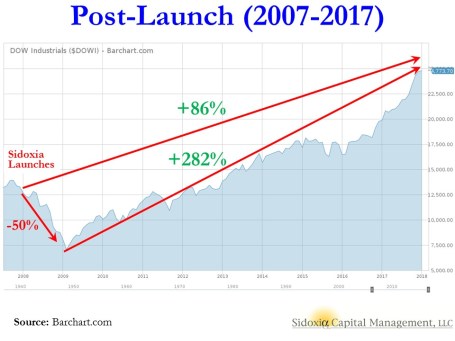

The year 2018 also happens to be a special year that marks a significant milestone in my professional career. A decade ago in late 2007, I ventured off from managing one of the largest multi-billion growth funds in the country (see How I Managed $20,000,000,000.00 by Age 32) and launched my own company, Sidoxia Capital Management in Newport Beach, California. At the time of the launch (December 2007), and subsequent to the bursting of the 2000 technology bubble, stock prices had about doubled over a five year period, starting in early 2003 (see chart).

On top of having the leading investment credentials (CFA, MBA, and CFP) and the experience of successfully managing a multi-billion fund, I also held the youthful confidence and optimism of a 30-something year-old (Trivia fact: the name Sidoxia is derived from the Greek word for “optimism”). What could possibly go wrong? How about the worst financial collapse in a generation (79 years)!

Suffice it to say, the global panic and recession that resulted in stock prices crumbling -50% (see chart below) temporarily bruised my youthful confidence and briefly punched my optimistic enthusiasm in the gut. In hindsight, what felt like a disaster at that point turned out to be a perfect time to start Sidoxia. The advantage of starting with virtually no clients meant that most of my early clients have enjoyed participating in a near quadrupling in stock prices to the near-record highs of today.

However, it wasn’t all rainbows and unicorns over Sidoxia’s first ten years (2007 – 2017). Despite the Dow advancing to 24,719 today from the 2009-low of 6,470, there were at least 11 substantial corrections (price drops) ranging from -5% to -22%. The extraordinary climb up the financial mountain included a “Flash Crash”, U.S. debt downgrade, eurozone economic crisis, Ebola scare, Brexit vote, multiple presidential elections, and China recession scares, among numerous other fear-grabbing headlines.

What Now?

As I have described on numerous occasions (see also Fool’s Errand), predicting short-term directions in the stock market is a fruitless effort. With that said, our correctly positioned positive stance over the years can be clearly documented on my blog (see InvestingCaffeine.com).

For example, 2017 was one of Sidoxia’s best years thanks in large part to our positive outlook (see Wiping Slate Clean), even though headlines were dominated by mass shootings, natural disasters, terrorist attacks, White House politics, Bitcoin/cryptocurrencies, and let’s not forget the sexual harassment revelations. But in going back to my previous comments, the key follow-up question becomes, “Do these headlines negatively impact the four key pillars of corporate profits, interest rates, valuations, and sentiment?” And the short answer is “No”.

On the positive side of the ledger, we have a newly minted tax legislation that dramatically loweres corporate tax rates from 35% to 21%. This move should significantly stimulate corporate profits, thereby creating extra cash for shareholder friendly actions like increased dividends and stock buybacks, not to mention more cash in corporate coffers for further acquisitions. Worth also noting, the global synchronized economic recovery continues to buoy the stellar U.S. performance. Evidence of the rising international tide lifting all global boats can be seen in the 2017 performance of various international equity markets*:

- Vietnam: +48%

- Hong Kong: +36%

- Asia (Overall): +30%

- India: +27%

- Brazil: +26%

- Europe (VGK): +23%

- Japan: +17%

Source: CNBC 12/29 & Sidoxia

What could negatively impact investment results in 2018? For starters, overly aggressive (“hawkish”) monetary policy by the Federal Reserve could potentially slam the brakes on the economy. In my view this scenario is unlikely given the rhetoric and new composition of the Federal Open Market Committee, including new chief Jerome Powell. Regardless of the historically low Federal Funds rate, interest rate policy is definitely worth following in the coming months.

Another wildcard that could slow down the 10-year bull market is a spike in the value of the U.S. dollar. As we saw in 2015-2016, a higher valued dollar makes American goods more expensive abroad, which will crimp corporate profits. Beyond these known unknowns, there are always what Donald Rumsfeld likes to call “unknown unknowns“. These unknowns can include things like terrorist attacks, currency crises, foreign bank defaults, natural disasters, etc. Short-term volatility typically ensues after these uncontrollable events, but history has proven our country’s resilience.

With the new tax legislation voted into law and shift of IRS calendar, a cohort of investors may now choose to temporarily sell stocks during January, which could briefly lower stock prices. I fully understand stock prices cannot go up forever, but as long as the previously discussed four key pillars remain positive on balance, the New Year’s celebration can continue.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Hot Dogs, Political Fireworks, and Our Nation’s Birthday

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (July 3, 2017). Subscribe on the right side of the page for the complete text.

The 4th of July has arrived once again as we celebrate our country’s 241st birthday of independence. Besides being a time to binge on hot dogs, apple pie, fireworks, and baseball, this national holiday allows Americans to also reflect on the greatness created by our nation’s separation from the British Empire.

As our Founding Fathers fought for freedom and believed in a more prosperous future, I’m not sure if the signers of our Declaration of Independence (Below [left to right]: Roger Sherman, Benjamin Franklin, Thomas Jefferson, John Adams, and Robert Livingston) envisioned a world with tweeting Presidents, driverless Uber taxis, internet dating, biotechnology medical breakthroughs, cloud storage, and countless other innovations that have raised the standard of living for billions of people around the world.

(These Founding Fathers may use different pictures for their Facebook profile, if they were alive today.)

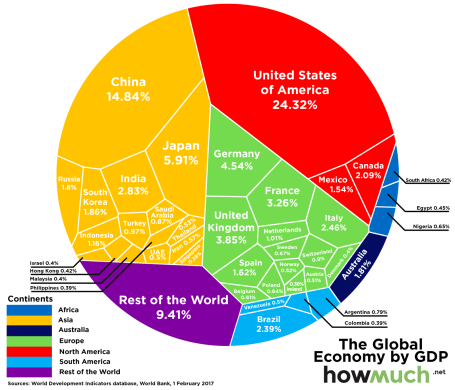

I tend to agree with the wealthiest billionaire investor on the planet, Warren Buffett, that being born in the United States is the equivalent of winning the “Ovarian Lottery.” The opportunities for finding success are exponentially higher, if you were born in America vs. Bangladesh, for example. Surprisingly, the U.S. only accounts for about 4% of the global population (325 million out of 7.5 billion world total). However, even though we Americans make up such a small portion of the of the people on the planet, we still manage to generate over $18 trillion in goods and services, which makes us the world’s largest economy. As the #1 economy, we account for almost 25% of the world’s total economic output (see table & graphic below).

| Rank | Country | GDP (Nominal, 2015) | Share of Global Economy (%) |

| #1 | United States | $18.0 trillion | 24.3% |

| #2 | China | $11.0 trillion | 14.8% |

| #3 | Japan | $4.4 trillion | 5.9% |

| #4 | Germany | $3.4 trillion | 4.5% |

| #5 | United Kingdom | $2.9 trillion | 3.9% |

Source: Visual Capitalist

How do we create six times the output of our population (i.e., 4% of world’s population producing 25% of the world’s output)? Despite the nasty, imperfect, mudslinging politics we live through daily, the U.S. has perfected the art of capitalism, which has landed us on top of the economic Mt. Everest. Although, there is always room for improvement, culturally, the winning “entrepreneurial” strain is born into our American DNA. The recent merger announcement between Amazon.com Inc. (AMZN) and Whole Foods (WFM), the leading natural and organic foods supermarket, is evidence of this entrepreneurial strain. Amazon has come a long way and gained significant steam since its founding in July 1994 by CEO Jeff Bezos. Consequently, the momentum of this internet giant has it steamrolling the entire retail industry, which has led to a flood of store closings, including department store chains, Macy’s, J.C. Penney, Sears and Kmart. The Amazon-Whole Foods merger announcement was not a huge surprise to my family because we actually order more than half of our groceries from AmazonFresh (Amazon’s food delivery program). What’s more, since I despise shopping, I continually find myself taking advantage of Amazon’s “Prime Now” 2-hour delivery option to my office, which is free to all Prime subscribers. It won’t be long before Amazon’s multi-channel strategy will allow me to make same-day orders for groceries, electronics, and general merchandise from my office, then pick up those items on my way home from work at the local Whole Foods store.

Leading the Pack

Replicating this competitive advantage around the world is a challenge for competing countries, and our nation remains leap years ahead of others, regardless of their efforts. However, the United States does not have a monopoly on capitalism. We are slowly exporting our entrepreneurial secret sauce abroad with the help of technology and globalization. Just consider these three Chinese companies alone are valued at almost $1 trillion (Alibaba Group $360B [BABA]; Tencent Holdings $340B [TCEHY]; and China Mobile $220B [CHL]), and the largest expected IPO (Initial Public Offering) in the world could be a Saudi Arabian company valued at $2 trillion (Saudi Aramco). When 96% of the world’s population lies outside of the U.S., this reality helps explain why exporting our advancements should not be considered a bad thing. In fact, a growing international pie means more American jobs and more dollars will flow back to the U.S., as we export more value-added products and services abroad.

Even if other countries are narrowing the entrepreneurial competitive gap with the United States, we still remain a beacon of light for others to follow. Despite what you may read in the newspaper or hear on the TV, Americans are dramatically better off financially over the last 20 years. Not only has net worth increased spectacularly, but consumers have also responsibly reduced debt leverage ratios (see chart below).

Source: Calafia Beach Pundit

If you were a bright CEO working for an innovative new start-up company, would you choose to launch your company in a closed, censored society like China? How about a fractured Britain that is pushing to break away from the European Union? Better yet, how about Japan with its exploding debt levels, a declining population, and a stock market that is about half the level it peaked at 28 years ago? Do emerging markets like Brazil with widespread corruption scandals blanketing a new president (after a recently impeached president) seem like the best location for a hot new venture? The answer to all these questions is a resounding “no”, even when compared to the warts and flaws that come with our durable democracy.

Political Pyrotechnics

Besides the bombs bursting in air during the 4th of July celebration, there were plenty of political fireworks blasting in our nation’s capital last month. No matter what side of the political fence you stand on, last month was explosive. Consider ousted FBI Director Jim Comey’s impassioned testimony relating to his firing by President Donald Trump; the contentious Attorney General Jeff Sessions Senate Intelligence Committee interview; the politically driven Republican baseball shooting; and the Special Counsel leader Robert Mueller’s investigation into Russian interference and potential Trump administration collusion into the 2016 elections.

Despite the combative atmosphere in Washington D.C., the stock market managed to notch another record high last month, with the Dow Jones Industrial Average index advancing another 340.98 points (+1.6%) for the month, and +8.0% for the first half of 2017. As I have written numerous times, the scary headlines accumulating since 2009 have prevented investors, strategists, economists, and even professionals from adequately participating in the almost quadrupling in stock prices since early 2009. Unfortunately, to the detriment of many, large swaths of investors who were burned by the 2008-2009 Financial Crisis have been scarred to almost permanent risk aversion. The fact of the matter is stock prices care more about economic factors than political / news headlines (see Moving on Beyond Politics).

The bitter, vitriolic political discourse is unlikely to disappear anytime soon, so do yourself a favor, and focus on the more important factors driving financial markets to new record highs – mainly corporate profits, interest rates, valuations, and sentiment (see Don’t Be a Fool). During this year’s 4th of July, partaking in hot dogs, apple pie, fireworks, and baseball are wholly encouraged, but please also take the time to celebrate and acknowledge the magnitude of our country’s greatness. That’s a birthday wish, I think we can all agree upon.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in AMZN and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in WFM, BABA, TCEHY, CHL, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

No April Fool’s Joke – Another Record

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (April 3, 2017). Subscribe on the right side of the page for the complete text.

Having children is great, but a disadvantage to having younger kids are the April Fool’s jokes they like to play on parents. Fortunately, this year was fairly benign as I only suffered a nail-polish covered bar of soap in the shower. However, what has not been a joke has been the serious series of new record highs achieved in the stock market. While it is true the S&P 500 index finished roughly flat for the month (-0.0%) after hitting new highs earlier in March, the technology-laden NASDAQ index continued its dominating run, advancing +1.5% in March contributing to the impressive +10% jump in the first quarter. For 2017, the NASDAQ supremacy has been aided by the stalwart gains realized by leaders like Apple Inc. (up +24%), Facebook Inc. (up +23%), and Amazon.com Inc. (up +18%). The surprising fact to many is that these records have come in the face of immense political turmoil – most recently President Trump’s failure to deliver on a campaign promise to repeal and replace the Obamacare healthcare system.

Like a broken record, I’ve repeated there are much more important factors impacting investment portfolios and the stock market other than politics (see also Politics Schmolitics). In fact, many casual observers of the stock market don’t realize we have been in the midst of a synchronized, global economic expansion, helped in part by the stabilization in the value of the U.S. dollar over the last couple of years.

Source: Investing.com

As you can see above, there was an approximate +25% appreciation in the value of the dollar in late-2014, early-2015. This spike in the value of the dollar suddenly made U.S. goods sold abroad +25% more expensive, resulting in U.S. multinational companies experiencing a dramatic profitability squeeze over a short period of time. The good news is that over the last two years the dollar has stabilized around an index value of 100. What does this mean? In short, this has provided U.S. multinational companies time to adjust operations, thereby neutralizing the currency headwinds and allowing the companies to return to profitability growth.

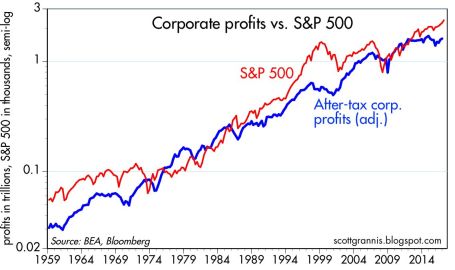

Source: Calafia Beach Pundit

And profits are back on the rise indeed. The six decade long chart above shows there is a significant correlation between the stock market (red line – S&P 500) and corporate profits (blue line). The skeptics and naysayers have been out in full force ever since the 2008-2009 financial crisis – I profiled these so-called “sideliners” in Get out of Stocks!.

As the stock market continues to hit new record highs, the doubters continue to scream danger. There will always be volatility, but when the richest investor of all-time, Warren Buffett, continues to say that stocks are still attractively priced, given the current interest rate environment, that goes a long way to assuage investor concerns.

Politically, a lot could still go wrong as it relates to healthcare, tax reform, and infrastructure spending, to name a few issues. However, it’s still early, and it’s possible positive surprises could also occur. More importantly, as I’ve noted before, corporate profits, interest rates, valuations, and investor sentiment are much more important factors than politics, and on balance these factors are on the favorable side of the ledger. These factors will have a larger impact on the long-term direction of stock prices.

With approval ratings of Congress and the President at low levels, investors have had trouble finding humor in politics, even on April Fool’s Day. Another significant factor more important than politics is the issue of retirement savings by Americans, which is no joke. As you finalize your tax returns in the coming weeks, it behooves you to revisit your retirement plan and investment portfolio. Inefficiently investing your money or outliving your savings is no laughing matter. I’ll continue with my disciplined financial plan and leave the laughing to my kids, as they enjoy planning their next April Fool’s Day prank.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in AAPL, FB, AMZN, and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

March Madness or Retirement Sadness?

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (March 1, 2017). Subscribe on the right side of the page for the complete text.

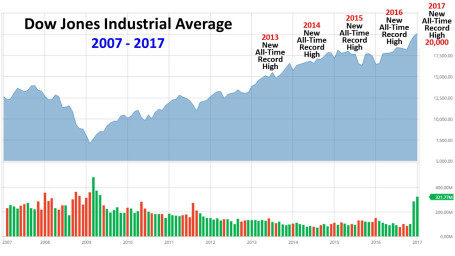

“March Madness” begins in a few weeks with a start of the 68-team NCAA college basketball tournament, but there has also been plenty of other economic and political madness going on in the background. As it relates to the stock market, the Dow Jones Industrial Average index reached a new, all-time record high last month, exceeding the psychologically prominent level of 20,000 (closing the month at 20,812). For the month, the Dow rose an impressive +4.8%, and since November’s presidential election it catapulted an even more remarkable +13.5%.

Despite our 45th president just completing his first State of the Union address to the nation, American voters remain sharply divided across political lines, and that bias is not likely to change any time soon. Fortunately, as I’ve written on numerous occasions (see Politics & Your Money), politics have no long-term impact on your finances and retirement. Sure, in the short-run, legislative policies can create winners and losers across particular companies and industries, but history is firmly on your side if you consider the positive track record of stocks over the last couple of centuries. As the chart below demonstrates, over the last 150 years or so, stock performance is roughly the same across parties (up +11% annually), whether you identify with a red elephant or a blue donkey.

Nevertheless, political rants flooding our Facebook news feeds can confuse investors and scare people into inaction. Pervasive fake news stories regarding the supposed policy benefits and shortcomings of immigration, tax reform, terrorism, entitlements, foreign policy, and economic issues often result in heightened misperception and anxiety.

More important than reading Facebook political rants, watching March Madness basketball, or drinking green beer on St. Patrick’s Day, is saving money for retirement. While some of these diversions can be temporarily satisfying and entertaining, lost in the daily shuffle is the retirement epidemic quietly lurking in the background. Managing money makes people nervous even though it is an essential part of life. Retirement planning is critical because a mountain of the 76 million Baby Boomers born between 1946 – 1964 have already reached retirement age and are not ready (see chart below).

The critical problem is most Americans are ill-prepared financially for retirement, and many of them run the risk of outliving their savings. A recent study conducted by the Economic Policy Institute (EPI) shows that nearly half of families have no retirement account savings at all. The findings go on to highlight that the median U.S. family only has $5,000 in savings (see also Getting to Your Number). Even after considering my tight-fisted habits, that kind of money wouldn’t be enough cash for me to survive on.

Saving and investing have never been more important. It doesn’t take a genius to understand that government entitlements like Social Security and Medicare are at risk for millions of Americans. While I am definitely not sounding the alarm for current retirees who have secure benefits, there are millions of others whose retirement benefits are in jeopardy.

Missing the 20,000 Point Boat? Dow 100,000

Making matters worse, saving and investing has never been more challenging. If you thought handling all of life’s responsibilities was tough enough already, try the impossible task of interpreting the avalanche of instantaneous political and economic headlines pouring over our electronic devices at lighting speed.

Knee-jerk reactions to headlines might give investors a false sense of security, but the near-impossibility of consistently timing the stock market has not stopped people from attempting to do so. For example, recently I have been bombarded with the same question, “Wade, don’t you think the stock market is overpriced now that we have eclipsed 20,000?” The short answer is “no,” given the current factors (see Don’t Be a Fool). Thankfully, I’m not alone in this response. Warren Buffett, the wealthiest billionaire investor on the planet, answered the same question this week after investing $20,000,000,000 more in stocks post the election:

“People talk about 20,000 being high. Well, I remember when it hit 200 and that was supposedly high….You know, you’re going to see a Dow [in your lifetime] that certainly approaches 100,000 and that doesn’t require any miracles, that just requires the American system continuing to function pretty much as it has.”

Like a deer in headlights, many Americans have been scared into complacency. To their detriment, many savers have sat silently on the sidelines earning near-0% returns on their savings, while the stock market has reached new all-time record highs. While Dow 20,000 might be new news for some, the reality is new all-time record highs have repeatedly been achieved in 2013, 2014, 2015, 2016, and now 2017 (see chart below).

While I am not advocating for all people to throw their entire savings into stocks, it is vitally important for individuals to construct diversified portfolios across a wide range of asset classes, subject to each person’s unique objectives, constraints, risk tolerance, and time horizon. The risk of outliving your savings is real, so if you need assistance, seek out an experienced professional. March Madness may be here, but don’t get distracted. Make investing a priority, so your daily madness doesn’t turn into retirement sadness.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in FB and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Super Bowl Blitz – Dow 20,000

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (February 3, 2017). Subscribe on the right side of the page for the complete text.

If you have been following the sports headlines, then you know the Super Bowl 51 NFL football championship game between the four-time champion New England Patriots and the zero-time champion Atlanta Falcons is upon us. It’s that time of the year when more than 100 million people will congregate in front of big screen TVs across our nation and stare at ludicrous commercials (costing $5 million each); watch a semi-entertaining halftime show; and gorge on thousands of calories until stomachs bloat painfully.

The other headlines blasting across the media airwaves relate to the new all-time record milestone of 20,000 achieved by the Dow Jones Industrials Average (a.k.a., “The Dow”). For those people who are not glued to CNBC business television all day, the Dow is a basket of 30 large company stocks subjectively selected by the editors of the Wall Street Journal with the intent of creating an index that can mimic the overall economy. A lot of dynamics in our economy have transformed over the Dow’s 132 year history (1885), so it should come as no surprise that the index’s stock components have changed 51 times since 1896 – the most recent change occurred in March 2015 when Apple Inc. (AAPL) was added to the Dow and AT&T Inc. (T) was dropped.

20,000 Big Deal?

The last time the Dow closed above 10,000 was on March 29, 1999, so it has taken almost 18 years to double to 20,000. Is the Dow reaching the 20,000 landmark level a big deal in the whole scheme of things? The short answer is “No”. It is true the Dow can act as a fairly good barometer of the economy over longer periods of time. Over the 1998 – 2017 timeframe, economic activity has almost doubled to about $18 trillion (as measured by Gross Domestic Product – GDP) with the added help of a declining interest rate tailwind.

In the short-run, stock indexes like the Dow have a spottier record in correlating with economic variables. At the root of short-term stock price distortions are human behavioral biases and emotions, such as fear and greed. Investor panic and euphoria ultimately have a way of causing wild stock price overreactions, which in turn leads to poor decisions and results. We saw this firsthand during the inflation and subsequent bursting of the 2000 technology bubble. If that volatility wasn’t painful enough, last decade’s housing collapse, which resulted in the 2008-2009 financial crisis, is a constant reminder of how extreme emotions can lead to poor decision-making. For professionals, short-term volatility and overreactions provide lucrative opportunities, but casual investors and novices left to their own devices generally destroy wealth.

As I have discussed on my Investing Caffeine blog on numerous occasions, the march towards 20,000 occurred in the middle of arguably the most hated bull market in a generation or two (see The Most Hated Bull Market). It wasn’t until recently that the media began fixating on this arbitrary new all-time record high of 20,000. My frustration with the coverage is that the impressive phenomenon of this multi-year bull market advance has been largely ignored, in favor of gloom and doom, which sells more advertising – Madison Avenue execs enthusiastically say, “Thank you.” While the media hypes these stock records as new, this phenomenon is actually old news. In fact, stocks have been hitting new highs over the last five years (see chart below).

More specifically, the Dow has hit consecutive, new all-time record highs in each year since 2013. This ignored bull market (see Gallup survey) may not be good for the investment industry, but it can be good for shrewd long-term investors, who react patiently and opportunistically.

Political Football

In Washington, there’s a different game currently going on, and it’s a game of political football. With a hotly contentious 2016 election still fresh in the minds of many voters, a subset of unsatisfied Americans are closely scrutinizing every move of the new administration. Love him or hate him, it is difficult for observers to accuse President Trump of sitting on his hands. In the first 11 days of his presidential term alone, Trump has been very active in enacting almost 20 Executive Orders and Memoranda (see the definitional difference here), as he tries to make supporters whole with his many previous campaign trail promises. The persistently increasing number of policies is rising by the day (…and tweet), and here’s a summarizing list of Trump’s executive actions so far:

- Refugee Travel Ban

- Keystone & Dakota Pipelines

- Border Wall

- Deportations/Sanctuary Cities

- Manufacturing Regulation Relief

- American Steel

- Environmental Reviews

- Affordable Care Act Requirements

- Border Wall

- Exit TPP Trade Deal

- Federal Hiring Freeze

- Federal Abortion Freeze

- Regulation Freeze

- Military Review

- ISIS Fight Plan

- Reorganization of Security Councils

- Lobbyist Bans

- Deregulation for Small Businesses

President Trump has thrown another political football bomb with his recent nomination of Judge Neil Gorsuch (age 49) to the Supreme Court in the hopes that no penalty flags will be thrown by the opposition. Gorsuch, the youngest nominee in 25 years, is a conservative federal appeals judge from Colorado who is looking to fill the seat left open by last year’s death of Justice Antonin Scalia at the age 79.

Politics – Schmolitics

When it comes to the stock market and the economy, many people like to make the president the hero or the scapegoat. Like a quarterback on the football field, the president certainly has influence in shaping the political and economic game plan, but he is not the only player. There is an infinite number of other factors that can (and do) contribute to our country’s success (or lack thereof).

Those economic game-changing factors include, but are not limited to: Congress, the Federal Reserve, Supreme Court, consumer sentiment, trade policy, demographics, regulations, tax policy, business confidence, interest rates, technology proliferation, inflation, capital investment, geopolitics, terrorism, environmental disruptions, immigration, rate of productivity, fiscal policy, foreign relations, sanctions, entitlements, debt levels, bank lending, mergers and acquisitions, labor rules, IPOs (Initial Public Offerings), stock buybacks, foreign exchange rates, local/state/national elections, and many, many, many other factors.

Regardless to which political team you affiliate, if you periodically flip through your social media stream (e.g., Facebook), or turn on the nightly news, you too have likely suffered some sort of political fatigue injury. As Winston Churchill famously stated, “Democracy is the worst form of government except for all the other forms that have been tried from time to time.”

When it comes to your finances, getting excited over Dow 20,000 or despondent over politics is not a useful or efficient strategy. Rather than becoming emotionally volatile, you will be better off by focusing on building (or executing) your long-term investment plan. Not much can be accomplished by yelling at a political charged Facebook rant or screaming at your TV during a football game, so why not calmly concentrate on ways to control your future (financial or otherwise). Actions, not fear, get results. Therefore, if this Super Bowl Sunday you’re not ready to review your asset allocation, budget your annual expenses, or contemplate your investment time horizon, then at least take control of your future by managing some nacho cheese dip and handling plenty of fried chicken.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in AAPL, T, FB and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Wiping Your Financial Slate Clean

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (January 3, 2017). Subscribe on the right side of the page for the complete text.

The page on the calendar has turned, and we now have a new year, and will shortly have a new president, and new economic policies. Although there is nothing magical about starting a fresh, new year, the annual rites of passage also allow investors to start with a clean slate again and reflect on their personal financial situation. Before you reach a desired destination (i.e., retirement), it is always helpful to know where you have been and where are you currently. Achieving this goal requires filtering through a never-ending avalanche of real-time data flooding through our cell phones, computers, TVs, radios, and Facebook accounts. This may seem like a daunting challenge, but that’s where I come in!

Distinguishing the signals from the noise is tough and there was plenty of noise in 2016 – just like there is every year. Before the S&P 500 stock index registered a +9.5% return in 2016, fears of a China slowdown blanketed headlines last January (the S&P 500 fell -15% from its highs and small cap stocks dropped -26%), and the Brexit (British exit) referendum caused a brief 48-hour -6% hiccup in June. Oil was also in the news as prices hit a low of $26 a barrel early in the year, before more than doubling by year-end to $54 per barrel (still well below the high exceeding $100 in 2014). On the interest rate front, 10-Year Treasury rates bottomed at 1.34% in July, while trillions of dollars in global bonds were incomprehensibly paying negative interest rates. However, fears of inflation rocked bond prices lower (prices move inversely to yields) and pushed bond yields up to 2.45% today. Along these lines, the Federal Reserve has turned the tide on its near-0% interest rate policy as evidenced by its second rate hike in December.

Despite the abbreviated volatility caused by the aforementioned factors, it was the U.S. elections and surprise victory of President-elect Donald Trump that dominated the media airwaves for most of 2016, and is likely to continue as we enter 2017. In hindsight, the amazing Twitter-led, Trump triumph was confirmation of the sweeping global populism trend that has also replaced establishment leaders in the U.K., France, and Italy. There are many explanations for the pervasive rise in populism, but meager global economic growth, globalization, and automation via technology are all contributing factors.

The Trump Bump

Even though Trump has yet to accept the oath of Commander-in-Chief, recent investor optimism has been fueled by expectations of a Republican president passing numerous pro-growth policies and legislation through a Republican majority-controlled Congress. Here are some of the expected changes:

- Corporate/individual tax cuts and reform

- Healthcare reform (i.e., Obamacare)

- Proposed $1 trillion in infrastructure spending

- Repatriation tax holiday for multinational corporate profits

- Regulatory relief (e.g., Dodd-Frank banking and EPA environmental reform)

The chart below summarizes the major events of 2016, including the year-end “Trump Bump”:

While I too remain optimistic, I understand there is no free lunch as it relates to financial markets (see also Half Trump Full). While tax cuts, infrastructure spending, and regulatory relief should positively contribute to economic growth, these benefits will have to be weighed against the likely costs of higher inflation, debt, and deficits.

Over the 25+ years I have been investing, the nature of the stock market and economy hasn’t changed. The emotions of fear and greed rule the day just as much today as they did a century ago. What has changed today is the pace, quality, and sheer volume of news. In the end, my experience has taught me that 99% of what you read, see or hear at the office is irrelevant as it relates to your retirement and investments. What ultimately drives asset prices higher or lower are the four key factors of corporate profits, interest rates, valuations, and sentiment (contrarian indicator) . As you can see from the chart below, corporate profits are at record levels and forecast to accelerate in 2017 (up +11.9%). In addition, valuations remain very reasonable, given how low interest rates are (albeit less low), and skeptical investor sentiment augurs well in the short-run.

Source: FactSet

Regardless of your economic or political views, this year is bound to have plenty of ups and downs, as is always the case. With a clean slate and fresh turn to the calendar, now is a perfect time to organize your finances and position yourself for a better retirement and 2017.

Wade W. Slome, CFA, CFP®

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in FB and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in TWTR or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.