Posts tagged ‘SEC’

April Flowers Have Investors Cheering Wow-sers!

Normally April showers bring May flowers, but last month the spring weather was dominated by sunshine that caused stock prices to blossom to new, all-time record highs across all major indexes. More specifically, the S&P 500 jumped +5.2% last month, the NASDAQ catapulted +5.4%, and the Dow Jones Industrial Average rose +2.7%. For the year, the Dow and S&P 500 index both up double-digit percentages (11%), while the NASDAQ is up a few percentage points less than that (8%).

What has led to such a bright and beaming outlook by investors? For starters, economic optimism has gained momentum as the global coronavirus pandemic appears to be improving after approximately 16 months. Not only are COVID-19 cases and hospitalizations rates declining, but COVID-19 related deaths are dropping as well. A large portion of the progress can be attributed to the 246 million vaccine doses administered so far in the United States.

Blossoming Economy

As a result of the improving COVID-19 health climate, economic activity, as measured by Gross Domestic Product (GDP), expanded by a healthy +6.4% rate during the first quarter. Economists are forecasting second quarter growth to accelerate to an even more brilliant rate of +10%.

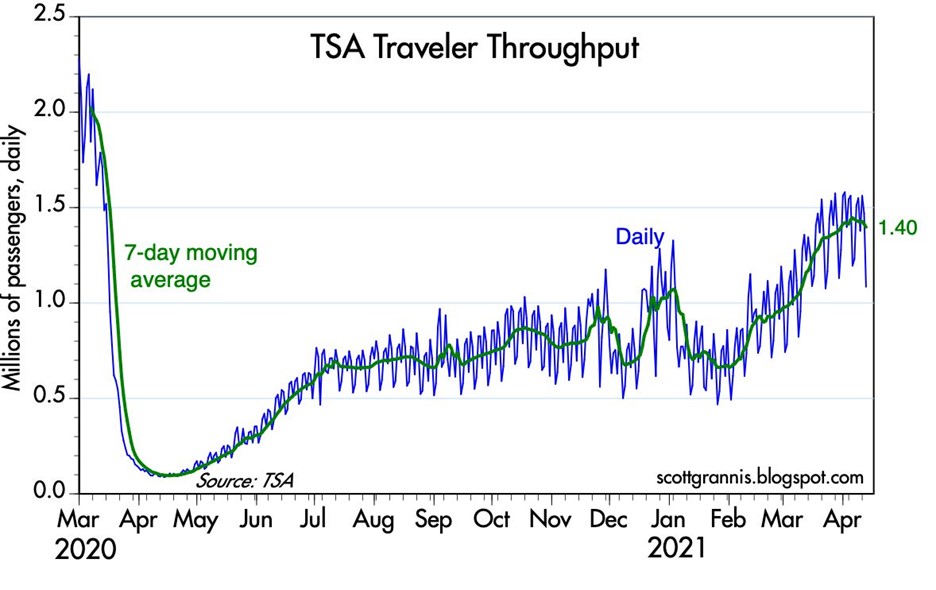

As the economy further re-opens and pent-up consumer demand is unleashed, activity is sprouting up in areas like airlines, hotels, restaurants, bars, movie theaters and gyms. An example of consumer demand climbing can be seen in the volume of passenger traffic in U.S. airports, which has increased substantially from the lows a year ago, as shown below in the TSA (Transportation Security Administration) data.

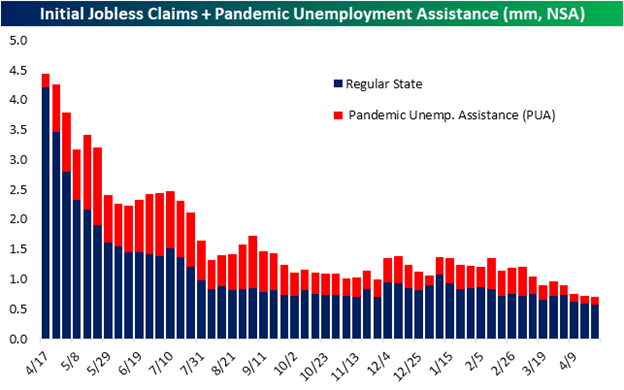

A germinating economy also means a healthier employment market and more jobs. The chart below shows the dramatic decline in the number of jobless receiving benefits and pandemic unemployment assistance.

Fed Fertilizer & Congressional Candy

Monetary and fiscal stimulus are creating fertile ground for the surge in growth as well. The Federal Reserve has been clear in their support for the economy by effectively maintaining its key interest rate target at 0%, while also maintaining its monthly bond buying program at $120 billion – designed to sustain low interest rates for the benefit of consumers and businesses.

From a fiscal perspective, Congress is serving up some sweet candy by doling out free money to Americans. So far, roughly $4 trillion of COVID-19 related stimulus and relief have passed Congress (see also Consumer Confidence Flies), and now President Biden is proposing roughly an additional $4 trillion of stimulus in the form of a $2 trillion jobs and infrastructure plan and a $1.8 trillion American Families Plan.

Candy and Spinach

While Congress is serving up trillions in candy, eventually, Americans are going to have to eat some less appetizing spinach in the form of higher taxes. Generally speaking, nobody likes higher taxes, so the question becomes, how does the government raise the most revenue (taxes) without upsetting a large number of voters? As 17th century French statesman Jean-Baptiste Colbert proclaimed, “The art of taxation consists in so plucking the goose as to get the most feathers with the least hissing.”

President Biden has stated he will only increase income taxes on people earning more than $400,000 annually and increase capital gains taxes for those earning more than $1,000,000 per year. According to CNBC, those earning more than $400,000 only represents 1.8% of total taxpayers.

Bitter tasting spinach for Americans may also come in the form of higher inflation (i.e., a general rise in a basket of goods and services), which silently eats away at everyone’s purchasing power, especially those retirees surviving on a fixed income. Federal Reserve Chairman Jerome Powell sees any increase in inflation as transitory, but if prices keep rising, the Federal Reserve will be forced to increase interest rates. Such a reversal in rates could choke off economic growth and potentially force the economy into a recession.

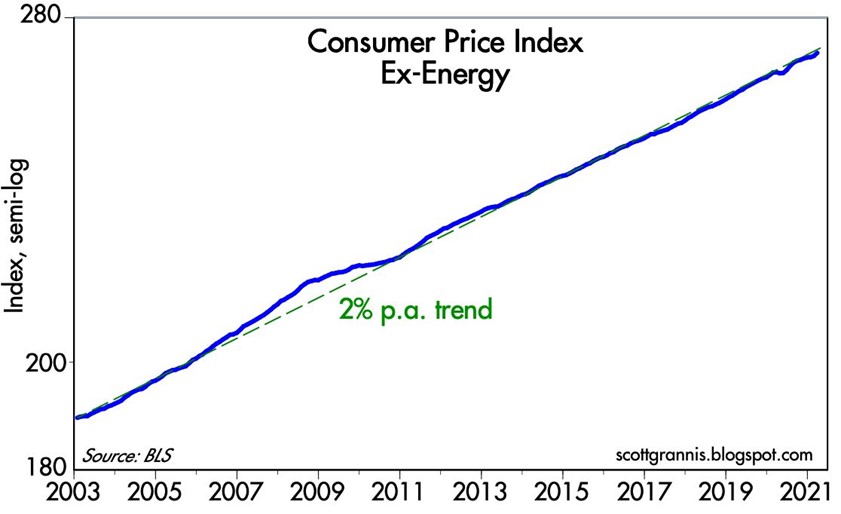

If you strip out volatile energy prices, the good news is that underlying inflation has not spiraled higher out of control, as you can see from the chart below.

In addition to the concerns of potential higher taxes, inflation, and rising interest rate policies from the Federal Reserve, for many months I have written about my apprehension about the speculation in SPACs (Special Purpose Acquisition Companies) and cryptocurrencies like Bitcoin. There are logical explanations to invest selectively into SPACs and purchase Bitcoin as a non-correlated asset for diversification purposes and a hedge against the dollar. But unfortunately, if history repeats itself, speculators will eventually end up in a pool of tears.

While there are certainly some storm clouds on the horizon (e.g., taxes, inflation, rising interest rates, speculative trading), April bloomed a lot of flowers, and the near-term forecast remains very sunny as the economy emerges from a global pandemic. As long as the government continues to provide candy to millions of Americans; the Federal Reserve remains accommodative in its policies; and the surge in pent-up demand persists to drive economic growth, we likely have some more time before we are forced to eat our spinach.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (May 3, 2021). Subscribe on the right side of the page for the complete text.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing had no direct position in GME or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Day Trading Your House

By several measures, this economic recovery has been the slowest, most-challenging expansion since World War II. Offsetting the painfully slow recovery has been a massive bull market in stocks, now hovering near all-time record highs, after about tripling in value since early 2009. Unfortunately, many investors have missed the boat (see Markets Soar – Investors Snore and Gallup Survey) with stock ownership near a 15-year low.

But it’s not too late for the “sideliners” to get in…is it? (see Get out of Stocks!*). Milfred and Buford are asking themselves that same question (see Investor Wake-Up Call). Milfred and Buford are like many other individuals searching for the American Dream and are looking for ways to pad their retirement nest egg. The seasoned couple has been around the block a few times and are somewhat familiar with one get-rich-quick strategy…day trading stocks. Thankfully, they learned that day trading stocks didn’t work out too well once the technology boom music ended in the late 1990s. Here’s what the SEC has to say about day trading on their government site:

Be prepared to suffer severe financial losses. Day traders typically suffer severe financial losses in their first months of trading, and many never graduate to profit-making status. Given these outcomes, it’s clear: day traders should only risk money they can afford to lose. They should never use money they will need for daily living expenses, retirement, take out a second mortgage, or use their student loan money for day trading.

Milfred & Buford Day Trade House

Milfred: “Now, Buford, I know we lost of our IRA retirement money day trading tech stocks, but if technical analysis works and all the financial news shows and talking babies on TV say it will make us a lot of cabbage, maybe we should try day trading our house?”

Buford: “Now I know why I married you 60 years ago – it’s that brilliant mind of yours that complements that sexy figure!”

Veteran readers of Investing Caffeine know I’ve been a skeptic of technical analysis (see Technical Analysis: Astrology or Lob Wedge), but a successful investor has to be open to new ideas, correct? So, if technical analysis works for stocks, then why not for houses? The recovery in housing prices hasn’t been nearly as robust as we’ve seen in stocks, so perhaps there’s more upside in housing. If I can get free stock charting technicals from my brokerage firm or online, there’s no reason I couldn’t access free charting technicals from Zillow (or Trulia) to make my fortunes. Case in point, I think I see a double-bottom and reverse head-and-shoulders pattern on the home price chart of Kim Kardashian’s house:

Of course, day trading isn’t solely dependent on random chart part patterns. Pundits, bloggers, and brokerage firms would also have you believe instant profits are attainable by trading based on the flow of news headlines. This is how Milfred and Buford would make their millions:

Milfred: “Snookums, it’s time for you to pack up all our stuff.”

Buford: “Huh? What are you talking about honey buns?”

Milfred: “Didn’t you see?! The University of Michigan consumer confidence index fell to a level of 81.3 vs. Wall street estimates of 83.0, bringing this measure to a new 4-month low.”

Buford: “I can’t believe I missed that. Nice catch ‘hun’. I’ll start packing, but where will we stay after we sell the house?”

Milfred: “We can hang out at the Motel 6, but it shouldn’t be long. I’m expecting the Philly Fed Manufacturing index to come in above 23 and I also expect a cease fire in Ukraine and Gaza. We can buy a new house then.”

I obviously frame this example very tongue-in-cheek, but buying and selling a house based on squiggly lines and ever-changing news headlines is as ridiculous as it sounds for trading stocks. The basis for any asset purchase or sale should be primarily based on the cash flow dynamics (e.g., rent, dividends, interest, etc., if there are any) of the asset, coupled with the appreciation/depreciation expectations based on a rigorous long-term analysis.

When Day Trading Works

Obviously there are some differences between real estate and stocks (see Stocks & Real Estate), including the practical utility of real estate and other subjective factors (i.e., proximity to family, schools, restaurants, beach, crime rates, etc.). Real estate is also a relatively illiquid and expensive asset to buy or sell compared to stocks. – However, that dynamic is rapidly changing. Like we witness in stocks, technology and the internet is making real estate cheaper and easier to match buyers and sellers.

Does day trading a stock ever work? Sure, even after excluding the factor of luck, having a fundamental information advantage can lead to immediate profits, but one must be careful how they capture the information. Raj Rajaratnam used this strategy but suffered the consequences of his insider trading conviction. Furthermore, the information advantage game can be expensive, as proven by Steven Cohen’s agreement to pay $1.2 billion to settle criminal charges. While I remain a day trading and technical analysis skeptic, I have noted a few instances when I use it.

Whatever your views are on the topics of day trading and technical analysis, do Milfred and Buford a favor by leading by example…invest for the long-term.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold long positions in certain exchange traded funds, but at the time of publishing SCM had no direct position in Z, TRLA, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Lewis Sells Flash Boys Snake Oil

I know what you’re saying, “Please, not another article on Michael Lewis’s Flash Boys book and high frequency trading (HFT),” but I can’t resist putting in my two cents after the well-known author emphatically proclaimed the stock market as “rigged.” Lewis is not alone with his outrageous claims… Clark Stanley (“The Rattlesnake King”) made equally outlandish claims in the early 1900s when he sold lucrative Snake Oil Liniment to heal the ailments of the masses. Ultimately Stanley’s assets were seized by the government and the healing assertions of his snake oil were proven fraudulent. Like Stanley, Lewis’s over-the-top comments about HFT traders are now being scrutinized under a microscope by more thoughtful critics than Steve Kroft from 60 Minutes (see television profile). For a more detailed counterpoint, see the Reuters interview with Manoj Narang (Tradeworx) and Haim Bodek (Decimus Capital Markets).

While Lewis may not be selling snake oil, the cash register is still ringing with book sales until the real truth is disseminated. In the meantime, Lewis continues to laugh to the bank as he makes misleading and deceptive claims, just like his snake oil selling predecessors.

The Inside Perspective

Regardless of what side of the fence you fall on, the debate created by Lewis’s book has created deafening controversy. Joining the jihad against HFT is industry veteran Charles Schwab, who distributed a press release calling HFT a “growing cancer” and stating the following:

“High-frequency trading has run amok and is corrupting our capital market system by creating an unleveled playing field for individual investors and driving the wrong incentives for our commodity and equities exchanges.”

What Charles Schwab doesn’t admit is that their firm is receiving about $100 million in annual revenues to direct Schwab client orders to the same HFT traders at exchanges in so called “payment-for-order-flow” contracts. Another term to describe this practice would be “kick-backs”.

While Michael Lewis screams bloody murder over investors getting fraudulently skimmed, some other industry legends, including the godfather of index funds, Vanguard founder Jack Bogle, argue that Lewis’s views are too extreme. Bogle reasons, “Main Street is the great beneficiary…We are better off with high-frequency trading than we are without it.”

Like Jack Bogle, other investors who should be pointing the finger at HFT traders are instead patting them on the back. Cliff Asness, managing and founding principal of AQR Capital Management, an institutional investment firm managing about $100 billion in assets, had this to say about HFT in his Wall Street Journal Op-Ed:

“How do we feel about high-frequency trading? We think it helps us. It seems to have reduced our costs and may enable us to manage more investment dollars… on the whole high-frequency traders have lowered costs.”

Is HFT Good for Main Street?

Many investors today have already forgotten, or were too young to remember, that stocks used to be priced in fractions before technology narrowed spreads to decimal points in the 1990s. Who has benefited from all this technology? You guessed it…everyone.

Lewis makes the case that the case that all investors are negatively impacted by HFT, including Main Street (individual) investors. Asness maintains costs have been significantly lowered for individual investors:

“For the first time in history, Main Street might have it rigged against Wall Street.”

In Flash Boys, Lewis claims HFT traders unscrupulously scalp pennies per share from retail investor pockets by using privileged information to jump in front of ordinary investors (“front-run”). The reality, even if you believe Lewis’s contentions are true, is that technology has turned any perceived detrimental penny-sized skimming scheme into beneficial bucks for ordinary investors. For example, trades that used to cost $40, $50, $100, or more per transaction at the large wirehouse brokerage firms can today be purchased at discount brokerage firms for $7 or less. What’s more, the spread (i.e., the profits available for middlemen) used to be measured in increments of 1/8, 1/4, and 1/2 , when today the spreads are measured in pennies or fractions of pennies. Without any rational explanation, Lewis also dismisses the fact that HFT traders add valuable liquidity to the market. His argument of adding “volume and not liquidity” would make sense if HFT traders only transacted solely with other HFT traders, but that is obviously not the case.

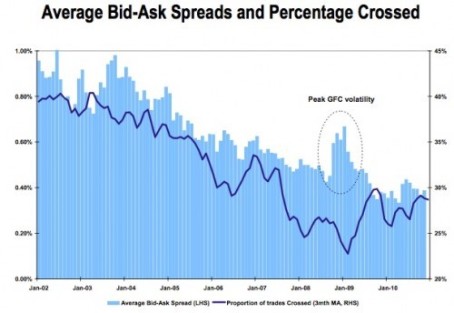

Regardless, as you can see from the chart below, the trend in spreads over the last decade or so has been on a steady, downward, investor-friendly slope.

Source: Business Insider

How Did We Get Here? And What’s Wrong with HFT?

Similarly to our country’s 73,954 page I.R.S. tax code, the complexity of our financial market trading structure rivals that of our government’s money collection system. The painting of all HFT traders as villains by Lewis is no truer than painting all taxpayers as crooks. Just as there are plenty of crooked and deceitful individuals that push the boundaries of our income tax system, so too are there traders that try to take advantage of an inefficient, Byzantine exchange system. The mere presence of some tax dodgers doesn’t mean that all taxpayers should go to jail, nor should all HFT traders be crucified by the SEC (Securities and Exchange Commission) police.

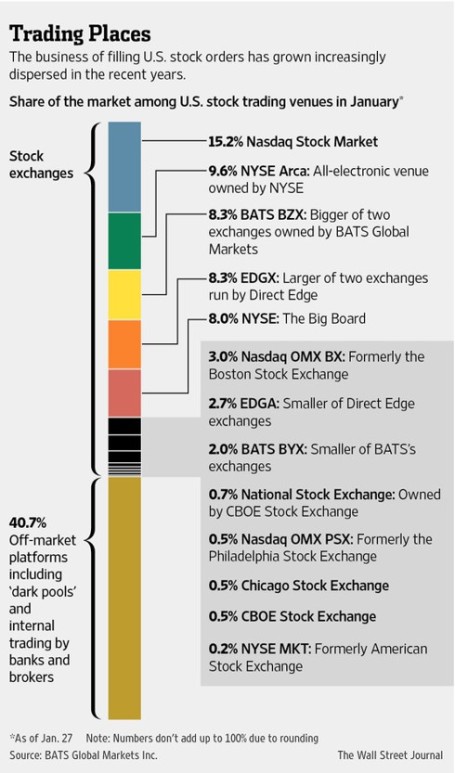

The heightened convoluted nature to our country’s exchange-based financial system can be traced back to the establishment of Regulation NMS, which was passed by the SEC in 2005 and implemented in 2007. The aim of this regulatory structure was designed to level the playing field through fairer trade execution and the creation of equal access to transparent price quotations. However, rather than leveling the playing field, the government destroyed the playing field and fragmented it into many convoluted pieces (i.e., exchanges) – see Wall Street Journal article and chart below.

Source: Wall Street Journal

The new Reg NMS competition came in the form of exchanges like BATS and Direct Edge (now merging), but the new multi-faceted structures introduced fresh loopholes for HFT traders to exploit – for both themselves and investors. More specifically, HFT traders used expensive, lightning-fast fiber optic cables; privileged access to data centers physically located adjacent to trading exchanges; and then they integrated algorithmic software code to efficiently route orders for best execution.

Are many of these HFT traders and software programs attempting to anticipate market direction? Certainly. As the WSJ excerpt below explains, these traders are shrewdly putting their capitalist genes to the profit-making test:

Computerized firms called high-frequency traders try to pick up clues about what the big players are doing through techniques such as repeatedly placing and instantly canceling thousands of stock orders to detect demand. If such a firm’s algorithm detects that a mutual fund is loading up on a certain stock, the firm’s computers may decide the stock is worth more and can rush to buy it first. That process can make the purchase costlier for the mutual fund.

Like any highly profitable business, success eventually attracts competition, and that is exactly what has happened with high frequency trading. To appreciate this fact, all one need to do is look at Goldman Sachs’s actions, which is to leave the NYSE (New York Stock Exchange), shutter its HFT dark pool trading platform (Sigma X), and join IEX, the dark pool created by Brad Katsuyama, the hero placed on a pedestal by Lewis in Flash Boys. Goldman is putting on their “we’re doing what’s best for investors” face on, but more experienced veterans understand that Goldman and all the other HFT traders are mostly just greedy S.O.B.s looking out for their best interests. The calculus is straightforward: As costs of implementing HFT have plummeted, the profit potential has dried up, and the remaining competitors have been left to fend for their Darwinian survival. The TABB Group, a financial markets’ research and consulting firm, estimates that US equity HFT revenues have declined from approximately $7.2 billion in 2009 to about $1.3 billion in 2014. As costs for co-locating HFT hardware next to an exchange have plummeted from millions of dollars to as low as $1,000 per month, the HFT market has opened their doors to anyone with a checkbook, programmer, and a pulse. That wasn’t the case a handful of years ago.

The Fixes

Admittedly, not everything is hearts and flowers in HFT land. The Flash Crash of 2010 highlighted how fragmented, convoluted, and opaque our market system has become since Reg NMS was implemented. And although “circuit breaker” remedies have helped prevent a replicated occurrence, there is still room for improvement.

What are some of the solutions? Here are a few ideas:

- Reform complicated Reg NMS rules – competition is good, complexity is not.

- Overhaul disclosure around “payment-for-order-flow” contracts (rebates), so potential conflicts of interest can be exposed.

- Stop inefficient wasteful “quote stuffing” practices by HFT traders.

- Speed up and improve the quality of the SIP (Security Information Processor), so the gaps between SIP and the direct feed data from exchanges are minimized.

- Improve tracking and transparency, which can weed out shady players and lower probabilities of another Flash Crash-like event.

These shortcomings of HFT trading do not mean the market is “rigged”, but like our overwhelmingly complex tax system, there is plenty of room for improvement. Another pet peeve of mine is Lewis’s infatuation with stocks. If he really thinks the stock market is rigged, then he should write his next book on the less efficient markets of bonds, futures, and other over-the-counter derivatives. This is much more fertile ground for corruption.

As a former manager of a $20 billion fund, I understand the complications firsthand faced by large institutional investors. In an ever-changing game of cat and mouse, investors of all sizes will continue looking to execute trades at the best prices (lowest possible purchase and highest possible sales price), while middlemen traders will persist with their ambition to exploit the spread (generate profits between the bid and ask prices). Improvements in technology will always afford a temporary advantage for a few, but in the long-run the benefits for all investors have been undeniable. The same undeniable benefits can’t be said for reading Michael Lewis’s Flash Boys. Like Clark Stanley and other snake oil salesmen before him, it will only take time for the real truth to come out about Lewis’s “rigged” stock market claims.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold long positions in certain exchange traded funds (ETFs), but at the time of publishing SCM had no direct position in GS, SCHW, ICE, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Wall Street Meets Greed Street

For investors, the emotional pendulum swings back and forth between fear and greed. Wall Street and large financial institutions, however, are driven by one single mode…and that is greed. This is nothing new and has been going on for generations. Over the last few decades, cheap money, loose regulation, and a relatively healthy economy have given Wall Street and financial institutions free rein to take advantage of the system.

Not only did the financial industry explode, but the large got much larger. The FCIC (Financial Crisis Inquiry Commission), a government appointed commission, highlighted the following:

“By 2005, the 10 largest U.S. commercial banks held 55% of the industry’s assets, more than double the level held in 1990. On the eve of the crisis in 2006, financial sector profits constituted 27% of all corporate profits in the United States, up from 15% in 1980.”

What’s more, the obscene profits were achieved with obscene amounts of debt:

“From 1978 to 2007, the amount of debt held by the financial sector soared from $3 trillion to $36 trillion, more than doubling as a share of gross domestic product.”

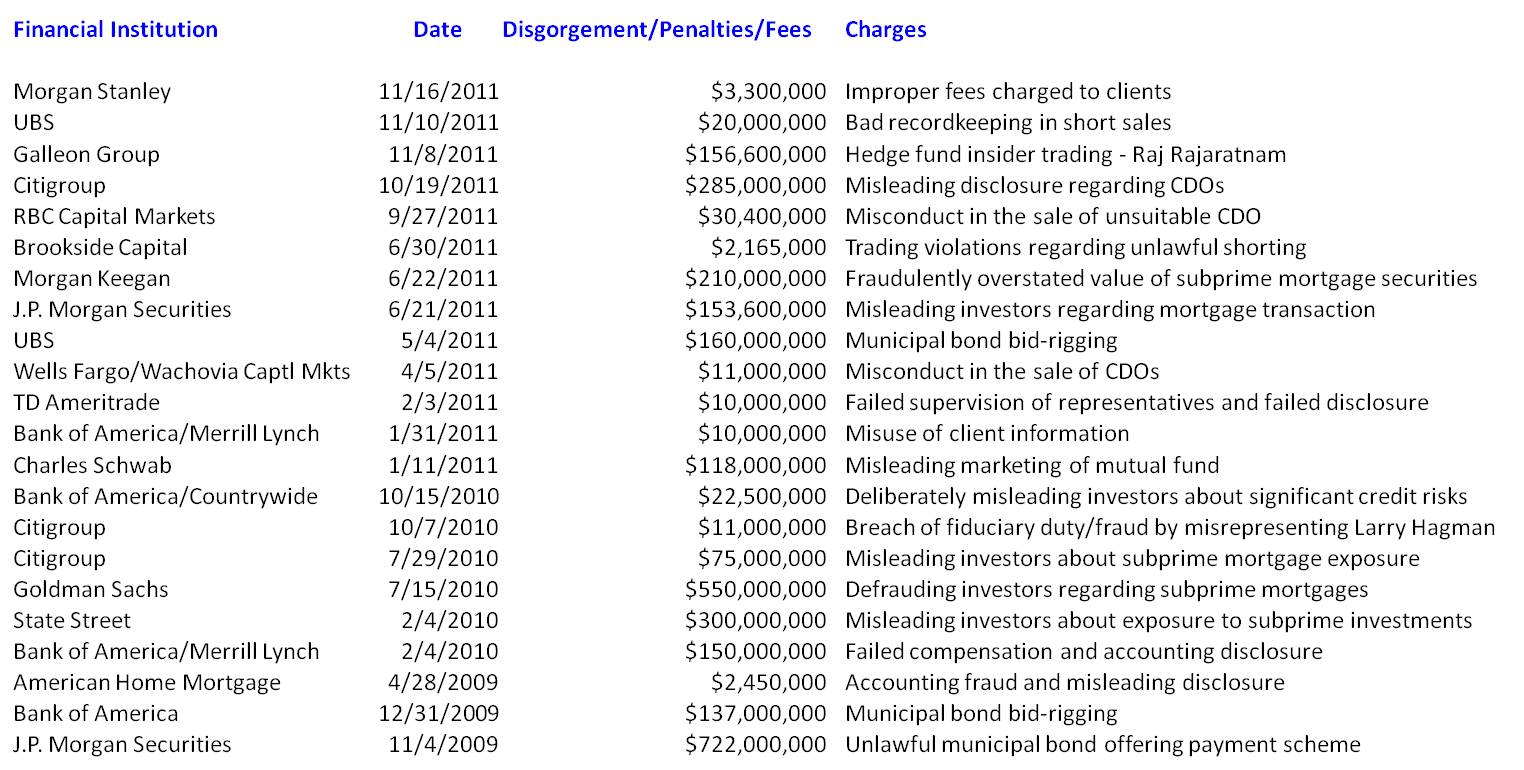

Times have changed, and financial institutions have gone from victors to villains. Sluggish economic growth in developed countries and choking levels of debt have transitioned political policies from stimulus to austerity. This in turn has created social unrest. Who’s to blame for all of this? Well if you watch the evening news and Occupy Wall Street movement, it becomes very easy to blame Wall Street. Certainly, fat cat bankers deserve a portion of the blame. As one can see from the following list, over the last few years, the financial industry has paid for its sins with the help of a checkbook:

The disgusting amount of inequitable excess is smeared across the whole industry in this tiny, partial list. Billions of dollars in penalties and disgorged assets isn’t insignificant, but besides Bernie Madoff and Raj Rajaratnam, very little time has been scheduled behind bars for the perpetrators.

Whom Else to Blame?

Are the greedy bankers and financial institution operators the only ones to blame? Without doubt, lack of government enforcement and adequate regulation, coupled with a complacent, debt-loving public, contributed to the creation of this financial crisis monster. When the economy was rolling along, there was no problem in turning a blind-eye to subversive activity. Now, the greed cannot be ignored.

At the end of the day, voters have to correct this ugly situation. The general public and Occupy Wall Street-ers need to boycott corrupt institutions and vote in politicians who will institute fair and productive regulations (NOT more regulations). Sure corporate financial lobbyists will try to tip the scales to their advantage, but a vote from a lobbyist attending a $10,000 black-tie dinner carries the same weight as a vote coming from a Occupy Wall Street-er paying $5 for a foot-long sandwich at Subway. As Thomas Jefferson stated, “A democracy is nothing more than mob rule, where fifty-one percent of the people may take away the rights of the other forty-nine.”

Investor Protocol

Besides boycotting greedy institutions and using the voting booth, what else should individuals do with their investments in this structurally flawed system? First of all, find independent firms with a fiduciary duty to act in your best interest, like an RIA firm (Registered Investment Advisor). Brokers, financial consultants, financial advisors, or whatever euphemism-of-the-day is being used for an investment product pusher, may not be evil, but their incentives typically are not aligned to protect and grow your financial future (see Fees, Exploitation, and Confusion and Letter Shell Game).

There is a lot of blame to be spread around for the financial crisis, and the intersection of Wall Street and Greed Street is a major contributing factor. However, investors and voters need to wake up to the brutal realities of our structurally flawed system and take matters into their own hands. Only then can Main Street and Wall Street peacefully coexist.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in MS, UBS, C, JPM, WFC, SCHW, AMTD, BAC, GS, STT, Galleon, RBC, Subway, Amer Home, Brookside Captl, Morgan Keegan, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Shrewd Research or Bilking the System?

Information is power and some hedge funds, mutual funds, and investment managers will go to great lengths to obtain the lowdown.

Integrity of the financial markets is key and recently several hedge funds (Level Global Investors LP, Diamondback Capital Management LLC and Loch Capital Management LLC) have been raided by the Federal Bureau of Investigation (FBI). Other large investment players, including SAC Capital Advisors, Janus Capital Group Inc. (JNS) and Wellington Management Co. have also received inquiries as part of what some journalists are calling rampant industry insider trading activity. Even investment bank Goldman Sachs (GS) is allegedly being examined for potential unlawful leakage of merger information. Little is known about the allegations, so it is difficult to decipher whether this is the tip of the iceberg or standard investigative work?

Regardless of the scope of the investigation, there is a fine line between what scoop is considered fair versus illegal. The distinction becomes even more difficult to pinpoint with the evolution of faster and more voluminous trading (i.e., high frequency trading). The internet has accelerated the speed of information transfer faster than a politician’s promise to cut spending. Data is chewed up and spit out so quickly, meaning tradable information has a very short shelf life before it is profitably exploited by someone. In the old days of snail mail and private back-office meetings, security prices would require time for information to be completely reflected.

Expert Networks Questioned

Another ingredient introduced over the last decade is the advent of the “expert network,” which are firms that connect fund managers to industry specialists, in many cases as part of a “channel check” to gauge the health of a particular industry. About 10 years ago Regulation FD (Fair Disclosure) was introduced to prevent selective disclosure of “material non-public” information (tips that will likely cause security prices to go significantly up or down) by senior company officials and investor relation professionals to investor types. Greedy (and/or ingenious) institutional investors are Darwinian and as a result figured out a loophole around the system. Hedge funds and other investment managers figured out if the senior executives won’t cough up the good info, then why not target the junior executives and squeeze the inside story from them like informants? Expert networks (read thorough description here) serve as an informational channel to service this demand. Although I’m sure there have been a minority of cases where mid-level managers or junior executives have leaked material information (intentionally or unintentionally), I’m very confident that it is the exception more than the rule. In many instances when the beans were spilled, Regulation FD protects both the person disseminating the information and the investor receiving the information.

Rigged Game for Individuals?

OK sure…hedge funds and institutional managers may occasionally have privileged access to executive teams and can afford access to industry experts. I should know, since I managed a multi-billion fund and consistently had access to the upper rank of corporate executives. Hearing directly from the horse’s mouth and trying to interpret body language can provide insights and instill confidence in a trade, but these executives are not stupid enough to risk prison time by selectively disclosing material non-public information. This dynamic of privileged access will never change as long as CEOs and CFOs are allowed to communicate with investors. Corporate executives will naturally prioritize their limited investor communications towards the larger players.

So with the big-wig managers gaining access to the big-wig executives, has the game become rigged for the individual investors? The short answer is “no.” Over the last decade individual investors have experienced a tremendous leveling of the playing field versus institutional investors. While institutions have privileged access and have pushed to exploit HFT and expert networks, individual investors have gained access to institutional quality research (e.g., SEC filings, real-time conference calls, Wall Street reports, etc.) for free or affordable prices. With the ubiquity of technology and the internet, I only see that gap narrowing more over time.

There will always be cheaters who stretch themselves beyond legal boundaries and should be prosecuted to the full extent of the law. However, for the vast majority of institutional investors, they are using technology and other tools (i.e., expert networks) as shrewd resources to compete in a difficult game. I will reserve full judgment on the names pasted all over the press until the FBI and SEC reveal all their cards. So far there appears to be more noise than smoke coming from the barrel tip of the insider trading gun.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in GS, SAC Capital Advisors, Janus Capital Group Inc. (JNS), Wellington Management Co., or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Making +457,425,000% – 13 Minutes at a Time

I love investing, but sometimes the shear boredom can get a little tiresome. I mean, a puny little -500 point collapse in the Dow Jones Industrial Average every five minutes can be so 1987. Thank goodness for yesterday’s largest, intra-day point-drop in history (almost 1,000 points) because without out such a meltdown, I might fall asleep at the trading desk and there would be no way to make an annualized +457,425,000% (~457 million percent) trade in a single day. Earning a well-deserved return like that will not only exceed the rates achieved on T-Bills, but will also likely outpace inflation as well. Making that kind of money is not bad work, if you can get it.

Executing the Tricky Trade

Sound difficult to do? Well, not really. All you need to do is find a stock or security that has fallen more than 99% in a single day, then buy the security for 10 cents per share and then sell it immediately, minutes later at $61.09. Repeat this process another 390 times per day for 52 weeks, and you’re well on your way of turning $1 into $4.5 million over a year.

Take for example, the iShares Russell 1000 Value Exchange Traded Fund (ETF), IWD, which yesterday traded for pennies at 3:47 p.m. Eastern Standard Time (EST) and skyrocketed over +600x fold in the subsequent 13 minutes. Fortunately (or unfortunately), depending on how you perceive the situation, the irregular trading activity was not limited to IWD. Other securities showing severe abnormal trading patterns include, Accenture (ACN), Boston Beer (SAM), Exelon (EXC), CenterPoint Energy (CNP), Eagle Material (EXP), Genpact Ltd (G), ITC Holdings (ITC), Brown & Brown (BRO), and Casey’s General (CASY). In full disclosure, I did not take advantage of any 99% pullbacks yesterday, but now that I know how the game works, I will be on full alert.

What the F*%$# Happened?

Initially reports pointed to a Citigroup (C) trader who entered into an inadvertent $16 billion (with a “b”) E-Mini futures trade order, when the trader meant to enter a trade for $16 million (with an “m”)…ooops! This alleged transaction purportedly triggered a wave of selling, culminating in a select group of stocks temporarily trading down to pennies in value. There is a related, yet more plausible, potential explanation. Quite possibly, as a function of excessive trading volume overwhelming the New York Stock Exchange, the overflow of trades migrated to less liquid ECNs (Electronic Communication Networks) and over-the-counter markets. Chances are the high frequency traders were not blindly jumping in front of the train. Whom really got screwed were the retail investors that had stop loss orders at “market” prices, which likely were triggered at unattractive prices.

I’m not sure if we will ever find out what truly happened, but whatever explanations are provided, rest assured there will be multiple more conspiracy theories on top of the legitimate guesses. The top 5 conspiracies I’m pushing are the following:

1) Frustrated by the fraud charges filed by the SEC (Securities and Exchange Commission), Goldman Sachs intentionally tripped over a power cord at the New York Stock Exchange (NYSE), which triggered a wave of bogus trades.

2) High Frequency Traders (see HFT Article) were upgrading their computers from Windows Vista to Windows 7 and experienced an outage causing global disruption.

3) In order to pay for the potential upcoming lawsuit liabilities and SEC fines, Goldman shorted the Dow Jones Industrial index at 10,800 and then went long once the index broke 10,000.

4) Warren Buffett was rumored to suffer a heart attack, but after realizing belching relieved his chest pain, the markets recovered dramatically.

5) Worried that regulatory reform may not pass, a secret group of Congressmen shorted stocks (see Do As I Say, Not As I Do article) to push stocks lower, then distributed TARP (Troubled Asset Relief Program) assets to voters minutes later in order to buy November votes and push stock prices higher.

Political Aftermath

Politicians will be frothing at the mouth or be pressured into approving financial reform. Even if markets manage to stabilize in the coming days and weeks, the pressure to ram regulatory reform through Capitol Hill will be mind-numbing. Mary Shapiro, Chairman of the SEC, and politicians will also be pushing to produce a clear scapegoat to throw under the bus, whether it is a trader at Citi, a high frequency traders at Goldman Sachs, the CEO at the NYSE (Duncan Niederauer), or a talking baby from the E-TRADE commercials. Regardless, depending on how quickly a credible explanation is unearthed, we will know how much, if any, reform is needed. If the markets are genuinely transparent, following the paper trail of responsibility to the stocks that dropped to $.00 or $.01 a share should be a piece of cake. If the systems are too complex to explain why handfuls of stocks are trading to $0, then even I am willing to look up to the skies and say heaven help us with some tighter oversight.

Over the last few years, there have been very few dull, financial moments and the markets did very little to disappoint yesterday. Irrespective of the political mudslinging, scapegoating, or irresponsible behavior, the SEC needs to get to the bottom of these issues rapidly in order to protect the integrity and trust of global players in our markets. What we don’t need is a political knee-jerk reaction that merely creates unintended, negative consequences. No matter what happens, I will at least be equipped to test a new strategy designed to make +457,425,000%.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

*DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct positions in GS, IWD, C, BRKA/B, CNP, EXP, G, ITC, BRO, and CASY, or any security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

SEC Awake at the Switch…Sort Of

The SEC is accusing Goldman Sachs (GS) of screwing its own clients through lack of disclosure (see also Goldman Cheat? article), but the SEC apparently enjoys passively watching a little action itself. Throughout the financial crisis, as investors watched the collapse of major financial institutions like Bear Stearns (JPM), Lehman Brothers, and AIG, the SEC was accused of falling asleep at the switch. As it turns out, the SEC was not asleep, but rather they were quite awake switching on the porn.

Efficiency may not be the core strength of all governmental agencies (several of my horrific trips to the department of motor vehicles (DMV) can attest to that fact), but little did I know that my tax dollars were supporting six-figure salaries (some over $200,000), so SEC employees could watch skin flick classics like Pulp Friction, Spankenstein, or Buttman and Throbbin’.

I guess from a certain standpoint, one might appreciate SEC employee ingenuity and determination. For example the Associated Press reported the following:

“An accountant was blocked more than 16,000 times in a month from visiting websites classified as “Sex” or “Pornography.” Yet he still managed to amass a collection of “very graphic” material on his hard drive by using Google images to bypass the SEC’s internal filter, according to an earlier report from the inspector general.”

“A senior attorney at the SEC’s Washington headquarters spent up to eight hours a day looking at and downloading pornography. When he ran out of hard drive space, he burned the files to CDs or DVDs, which he kept in boxes around his office.”

Perhaps the SEC is just like Goldman Sachs? They both just happened to get caught, even though many others have participated in the sinful behavior. How widespread is pornography viewing in the workplace? A study conducted by Websense in 2006 reported that 16% of men with internet access admitted to watching porn during office hours.

Watching nudey movies is less damaging than allegedly misrepresenting and hiding information from investors, but Dick Fuld, Bernie Madoff, and Allen Stanford are certainly thankful to the distracted SEC staffers for the extra time the crooked Wall Streeters were given to run their schemes. Wall Street has become a lightning rod, and given the fact that 2010 is an election year, there is extreme pressure on politicians to limit the power, size, and activities of the major banks. Maybe the new regulatory reform legislation being crafted in Congress will even include a ban on workplace pornography viewing. With additional free time, the SEC may successfully find more law-breakers. Who knows, possibly Goldman could even help the government recover some lost tax revenue by auctioning off excess dirty movies left over at the SEC?

Read the Rest of the AP Article

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

*DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds and in a security derived from an AIG subsidiary, but at the time of publishing SCM had no direct positions in GS, Bear Stearns (JPM), and Lehman Brothers, or any security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Goldman Cheat? Really?

Really? Am I supposed to be surprised that the SEC (Securities and Exchange Commission) has dug up a CDO (Collateralized Debt Obligation) deal with $1 billion in associated Goldman Sachs (GS) losses? The headline number may sound large, but the billion dollars is not much if you consider banks are expected to lose about $3 trillion dollars (according to an International Monetary Fund report) from toxic assets and bad loans related to the financial crisis. Specifically, Goldman is being charged for defrauding investors for not disclosing the fact that John Paulson (see Gutsiest Trade), a now-famous hedge fund manager who made billions by betting against the subprime mortgage market, personally selected underlying securities to be included in a synthetic CDO (a pool of mortgage derivatives rather than a pool of mortgage securities).

Hurray for the SEC, but surely we can come up with more than this after multiple years? More surprising to me is that it took the SEC this long to come up with any dirt in the middle of a massive financial pigpen. What’s more, the estimated $1 billion in investor losses associated with the Goldman deal represents about 0.036% of the global industry loss estimates. These losses are a drop in the bucket. If there is blood on Goldman’s hand, my guess is there’s enough blood on the hands of Wall Street bankers to paint the White House red (two coats). The Financial Times highlighted a study showing Goldman was a relative small-fry among the other banks doing these type of CDO deals. For 2005-2008, Goldman did a little more than 5% of the total $100+ billion in similar deals, earning them an unimpressive ninth place finish among its peers. As a matter of fact, Paulson also hocked CDO garbage selections to other banks like Deutsche Bank, Bear Stearns, and Credit Suisse. The disclosure made in those deals will no doubt play a role in determining Goldman’s ultimate culpability.

Context, with regard to the fees earned by Goldman, is important too. Goldman earned less than 8/100th of 1% of their $20 billion in pretax profits from the Abacus deal. Not to mention, unless other charges pile up, Goldman’s roughly $850 billion in assets, $170 billion in cash and liquid securities, and $71 billion in equity should buttress them in any future litigation. These particular SEC charges feel more like the government trying to convict Goldman on a technicality – like the government did with Al Capone on tax evasion charges. At the end of the day, the evidence will be presented and the courts will determine if fraud indeed occurred. If so, there will be consequences.

Demonize Goldman?

How bad can Goldman really be, especially considering their deep philanthropic roots (the firm donated $500 million for small business assistance), and CEO Lloyd Blankfein was kind enough to let us know he is doing “God’s work,” by providing Goldman’s rich menu of banking services to its clients.

Certainly, if Goldman broke securities laws, then there should be hell to pay and heads should roll. But if Goldman was really trying to defraud investors in this particular structured deal (called Abacus 2007-ACI), then why would they invest alongside the investors (Goldman claims to have lost $90 milllion in this particular deal)? I suppose the case could be made that Goldman only invested for superficial reasons because the fees garnered from structuring the deals perhaps outweighed any potential losses incurred by investing the firm’s own capital in these deals. Seems like a stretch if you contemplate the $90 million in losses overwhelmed the $15 million in fees earned by Goldman to structure the deal.

Maybe this will be the beginning of the debauchery flood gates opening in the banking industry, but let’s not fully jump on the Goldman Scarlet Letter bandwagon just quite yet. Politics may be playing a role too. The Volcker rule was conveniently introduced right after Senator Scott Brown’s Senate victory in Massachusetts, and political coincidence has reared its head again in light of the financial regulatory reform fury swelling up in Washington.

Waiting for More teeth

There is a difference between intelligent opportunism and blatant cheating. There is also a difference between immorally playing a game within the rules versus immorally breaking laws. Those participants breaking the law should be adequately punished, but before jumping to conclusions, let’s make sure we first gather all the facts. While the relatively minute Abacus deal may be very surprising to some, given the trillions in global losses caused by toxic assets, I am not. Surely the SEC can dig up something with more teeth, but until then I will be more surprised by Jesse Jame’s cheating on Sandra Bullock (with Michelle “Bombshell” McGee) than by Goldman Sachs’s alleged cheating in CDO disclosure.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

*DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct positions in GS, DB, Bear Stearns (JPM), and CSGN.VX/CS.N or any security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.