Posts tagged ‘PE’

Creating Your Investment Dashboard

Navigating the financial markets can be difficult in this volatile environment we’ve experienced over the last few years, which is why it is more important than ever to have a financial dashboard to ensure you do not drive off a cliff. If investors do not have the time or focus to drive their financial future, then perhaps for the safety of themselves and others, they may consider taking the bus or hiring a chauffeur. For those committed to handling their finances on their own, the road may become rocky, so here are some important factors to monitor on your financial dashboard:

1) Fundamental Direction: Before you decide on an investment destination, it is important to know whether trends are accelerating (speeding up) or deteriorating (slowing down) – see also Forecasting – Trend Analysis.

2) Are You Going the Speed limit? Nobody wants to get a costly speeding ticket, therefore assessing valuation metrics on your dashboard is a beneficiary tool. If you are speeding along the highway at a 100 miles per hour in an expensive stock (e.g., trading at a 50x+ Price/Earnings multiple), then there is little room for error. When traveling that fast you can forget about the price of a speeding ticket, because hitting a pothole at those speeds (valuation) can be much more costly to your portfolio, if you are not careful.

3) Temperature Outside: There’s a huge difference between driving in the icy-cold snow and in 100 degree heat. Each environment has its own challenges. The same principle applies to the financial markets. On occasion, sentiment can become red hot, forcing heightened caution, whereas during other periods, chilling fear can scare everyone else off the roads, leaving clear sailing ahead.

4) Optimal Tire Pressure: Low pressure or bald tires can lead to treacherous driving conditions. A company with healthy cash flow generation relative to its market capitalization can make your investment ride a lot more stable (see also Cash Flow Register). Dividends and share buybacks are generated from healthy and stable cash flows…not earnings.

5) Driver Skill Level: People generally believe they are better than average drivers, however statistics tell a different story. By definition, half of all drivers must be below average. If you are going to put your life’s retirement assets into stocks, you might as well select those companies led by seasoned management teams with proven track records.

Many investors drive blindly without relying on a dashboard. In the investment world, visibility is not very clear. Often, weather conditions in the financial markets become rainy, dark, and/or foggy. If you don’t want your portfolio to crash, it makes sense to build a reliable dashboard to navigate through the hazardous investment road conditions.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Private Equity Sitting on Stuffed Wallet

The clock is ticking and private equity (PE) firms need to put some $445 billion in their wallets to work. Otherwise, the dreams of outsized returns and hefty fees will have to wait for another Golden Era of deal making. Why such a hurry to use the cash? According to Andrea Auerbach, a Managing Director at Cambridge Associates, “Most funds legally have five or six years to invest that capital…it’s use it or lose it.”

Shop ‘til Wallet Drops

As easy as it sounds, spending half a trillion dollars can be difficult. Here’s how IBD’s Norm Alster characterizes the challenge:

“To realize the outsize profits investors expect, private equity firms would have to borrow two or three times that amount. But for the most part, credit spigots for such deals are still dry. At the same time, pinning down buyout targets is not that easy. Many potential sellers are balking at parting with corporate assets in the midst of a serious downturn.”

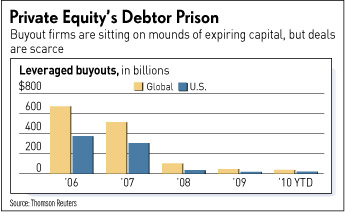

The 2010 private equity environment is quite a bit different than the LBO boom era from a handful of years ago, as you can see from the chart below. Thanks to cheap, free-flowing funding from the banks, $1.4 trillion worth of deals were consummated in 2006 and 2007, including large deals like First Data Corp. ($27 billion deal – KKR); Alltel ($28 billion – Goldman Sachs/ Texas Pacific Group); and Harrah’s ($30 billion – Apollo Management/Texas Pacific Group). Unfortunately, deals done during this period were done when valuations and leverage were at extremely high historical levels.

Deal Timeout

What’s causing the current dearth of deals? In many instances, business owners have not calibrated valuation expectations downward enough to account for the bruising financial crisis. Given the 77 leveraged buyout defaults in 2009, investors have become more reticent in committing capital as well. Refinancing the mountains of debt associated with the troubled 2006-07 vintage of deals will require patience and creative financing skills from the banks.

Because of the logjam of deals created by the financial crisis, PE firms are actively looking for exit strategies relating to their portfolio companies. Since private equity inherently involves illiquid investments, typically the industry creates liquidity through initial public offerings (IPOs), merger & acquisitions, and/or recapitalization structures that partially or fully return investor capital.

If the economic malaise lingers and valuations remain depressed, I have no doubt owners will eventually return to the negotiating table while waving a white towel in hand. Until then, private equity firms will continue begging for capital from the banks (i.e., using “other peoples’ money”) and beating down sellers into submission with regards to price expectations. If PE firms are not successful in using that wad of cash by the end of the fund’s term, then investors will be free to walk away with their money without paying lucrative fees to the PE firms.

Don’t Forget Benefits

The PE field is facing its fair share of trials and tribulations, but PE’s diversification benefits should not be forgotten. The success of the “Yale Model,” implemented by David Swensen, has come under attack with the recent bursting of the credit bubble, but with the ever-swinging performance pendulum of various asset classes/styles moving in and out of favor, I am confident a consistent strategy integrating PE as a portion of a diversified portfolio will yield respectable risk-adjusted returns over the long-run. Like other areas in the financial services industry, fees are being scrutinized and transparency requests by investors (limited partners) have been on the rise. But first things first – before attractive PE profits can be made as part of a diversified portfolio, the wad of cash in the wallets of PE firms must find a home in portfolio companies.

Read Norm Alster’s full IBD article originally referenced on TRB

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

*DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds (including S&P 500-like positions), but at the time of publishing SCM had no direct positions in GS, Harrah’s or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.