Posts tagged ‘Janet Yellen’

Oxymoron: Shrewd Government Refis Credit Card

With the upcoming Federal Reserve policy meetings coming up this Wednesday and Thursday, investors’ eyes remain keenly focused on the actions and words of Federal Reserve Chairwoman Janet Yellen.

If you have painstakingly filled out an IRS tax return or frustratingly waited in long lines at the DMV or post office, you may not be a huge fan of government services. Investors and liquidity addicted borrowers are also irritated with the idea of the Federal Reserve pulling away the interest rate punch bowl too soon. We will find out early enough whether Yellen will hike the Fed Funds interest rate target to 0.25%, or alternatively, delay a rate increase when there are clearer signs of inflation risks.

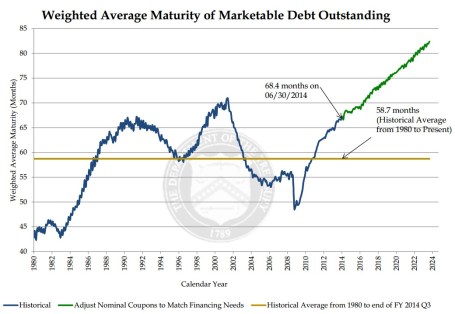

Regardless of the Fed decision this week, with interest rates still hovering near generational lows, it is refreshing to see some facets of government making shrewd financial market decisions – for example in the area of debt maturity management. Rather than squeezing out diminishing benefits by borrowing at the shorter end of the yield curve, the U.S. Treasury has been taking advantage of these shockingly low rates by locking in longer debt maturities. As you can see from the chart below, the Treasury has increased the average maturity of its debt by more than 20% from 2010 to 2015. And they’re not done yet. The Treasury’s current plan based on the existing bond issuance trajectory will extend the average bond maturity from 70 months in 2015 to 80 months by the year 2022.

If you were racking up large sums of credit card debt at an 18% interest rate with payments due one month from now, wouldn’t you be relieved if you were given the offer to pay back that same debt a year from now at a more palatable 2% rate? Effectively, that is exactly what the government is opportunistically taking advantage of by extending the maturity of its borrowings.

Most bears fail to acknowledge this positive trend. The typical economic bear argument goes as follows, “Once the Fed pushes interest rates higher, interest payments on government debt will balloon, and government deficits will explode.” That argument definitely holds up some validity as newly issued debt will require higher coupon payments to investors. But at a minimum, the Treasury is mitigating the blow of the sizable government debt currently outstanding by extending the average Treasury maturity (i.e., locking in low interest rates).

It is worth noting that while extending the average maturity of debt by the Treasury is great news for U.S. tax payers (i.e., smaller budget deficits because of lower interest payments), maturity extension is not so great news for bond investors worried about potentially rising interest rates. Effectively, by the Treasury extending bond maturities on the debt owed, the government is creating a larger proportion of “high octane” bonds. By referring to “high octane” bonds, I am highlighting the “duration” dynamic of bonds. All else equal, a lengthening of bond maturities, will increase a bond’s duration. Stated differently, long duration, “high octane” bonds will collapse in price if in interest rates spike higher. The government will be somewhat insulated to that scenario, but not the bond investors buying these longer maturity bonds issued by the Treasury.

All in all, you may not have the greatest opinion about the effectiveness of the IRS, DMV, and/or post office, but regardless of your government views, you should be heartened by the U.S. Treasury’s shrewd and prudent extension of the average debt maturity. Now, all you need to do is extend the maturity and lower the interest rate on your personal credit card debt.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs) , but at the time of publishing, SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Will Rising Rates Murder Market?

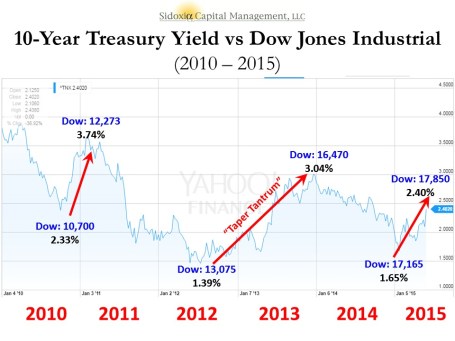

After an obituary of Mark Twain had been mistakenly published in the United States, Twain sent a cable from London stating, “The reports of my death have been greatly exaggerated.” Similar reports about the death of the stock market have been prematurely published as well. If you were to listen to the talking heads on TV or other self-proclaimed media pundits, the prevailing opinion is that rising interest rates will murder the stock market. In reality, the benchmark 10-Year Treasury Note has risen a whopping 0.23% so far this year. Could this be a start of a more prolonged increase in interest rates? It is certainly possible. Most investors have a very short memory because we have seen this movie before. It was just two short years ago that we witnessed a near doubling of 10-Year Treasury yields exploding from 1.76% to 3.03% in 2013. Did the stock market crater? In fact, quite the contrary. The S&P 500 index catapulted higher by a whopping +30%.

Even if we go back a litter further in recent history, interest rates were quite a bit higher. For example in early 2010, 10-Year Treasury yields breached 4.0%. Where was the Dow Jones Industrial index then? A mere 11,000 vs 17,850 today. Or in other words, when interest rates were significantly higher than today’s 2.40% yield, the stock market managed to climb +62% higher. Not too shabby, eh? As I have talked about in the past (see Don’t Be a Fool, Follow the Stool), there are other factors besides interest rates that are contributing to positive stock returns – primarily profits, valuations, and sentiment are the other key factors in determining stock prices. Suffice it to say, over the last five years, stocks have survived quite well in the face of multiple interest rate spikes; the 2013 “Taper Tantrum”; and the subsequent completion of quantitative easing – QE (see chart below).

Yield Curve on the Side of Bulls

Despite the trepidation over a series of potential Fed rate hikes, stocks continue to grind higher. If the fears are based on the expectation of a slowing economy on the horizon, then we would generally see two things happening. First, rising short-term interest rates would cause the yield curve to flatten, and then secondly, the yield curve would invert (typically a leading indicator for a recession). Currently, there are no signs of flattening or inverting. Actually, the recent better than expected jobs report for May (280,000 jobs added vs. estimate of 226,000) created a steeper yield curve – long-term interest rates increased more than short-term interest rates. Just as I wrote in 2009 about the recovery (see Steepening Yield Curve Recovery), right now the bond market is flashing recovery…not slowdown.

In the face of the mini-interest rate spike, bank stocks are also signaling economic recovery – evidenced by the 2.75% surge in the KBW Bank Index (KBX) last week. If there were signs of dark clouds on the horizon, a flattening yield curve would squeeze bank net interest margins and profits, which ultimately would send bank investors to the exit. That phenomenon will eventually happen later in the economic cycle, but right now investors are voting in the opposite direction with their dollars.

The media, economists, strategists, and other nervous onlookers will continue fretting over the Federal Reserve’s eventual rate increases. As long as dovish Janet Yellen is at the helm of the Fed, future rate increases will be measured, and rather than murdering the stock market, the policies will merely reflect a removal of the economy from artificial life support.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing, SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on ICContact page.

Yellen is “Yell-ing” About High Stock Prices!

Earlier this week, Janet Yellen, chair of the U.S. Federal Reserve, spoke at the Institute for New Economic Thinking conference at the IMF headquarters in Washington, D.C. In addition to pontificating about the state of the global economy and the direction of interest rates, she also decided to chime in with her two cents regarding the stock market by warning stock values are “quite high.” She went on to emphasize “there are potential dangers” in the equity markets.

Unfortunately, those investors who have hinged their investment careers on the forecasts of economists, strategists, and Fed Chairmen have suffered mightily. Already, Yellen’s soapbox rant about elevated stock prices is being compared to former Fed Chairman Alan Greenspan’s “Irrational Exuberance” speech, which I have previously discussed on numerous occasions (see Irrational Exuberance Déjà Vu).

Greenspan’s bubble warning talk was given on December 5, 1996 when the NASDAQ closed around 1,300 (it closed at 5,003 this week). Greenspan specifically said the following:

“But how do we know when irrational exuberance has unduly escalated asset values, which then become subject to unexpected and prolonged contractions as they have in Japan over the past decade?”

After his infamous speech, the NASDAQ index almost quadrupled in value to 5,132 in the ensuing three years before cratering by approximately -78%,

Greenspan’s successor, economics professor Ben Bernanke, didn’t fare much better than the previous Fed Chairmen. Unlike many, I give full credit where credit is due. Bernanke deserves extra credit for his nimble but aggressive actions that helped prevent a painful recession from expanding into a protracted and lethal depression.

With that said, as late as May 2007, Bernanke noted Fed officials “do not expect significant spillovers from the subprime market to the rest of the economy.” Moreover, in 2005, near the peak in housing prices, Bernanke said the probability of a housing bubble was “a pretty unlikely possibility.” Bernanke went on to add housing price increases, “largely reflect strong economic fundamentals.” Greenspan concurred with Bernanke. Just a year prior, Greenspan noted that the increase in home values was “not enough in our judgment to raise major concerns.” History has proven how Bernanke and Greenspan could not have been more wrong.

If you still believe Yellen is the bee’s knees when it comes to the investing prowess of economists, perhaps you should review Long Term Capital Management (LTCM) debacle. In the midst of the 1998 Asian financial crisis, Robert Merton and Myron Scholes, two world renowned Nobel Prize winners almost single handedly brought the global financial market to its knees. Merton and Scholes used their lifetime knowledge of economics to create complex computerized investment algorithms. Everything worked just fine until LTCM lost $500 million in one day, which required a $3.6 billion bailout from a consortium of banks.

NASDAQ 5,000…Bubble Repeat?

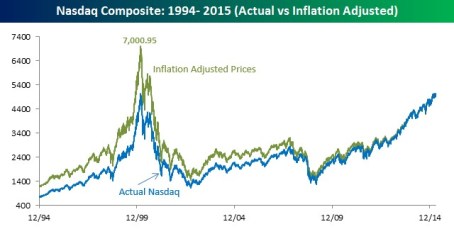

Janet Yellen’s recent prognostication about the valuation of the U.S. stock market happens to coincide with the NASDAQ index breaking through the 5,000 threshold, a feat not achieved since the piercing of the technology bubble in the year 2000. Investing Caffeine readers and investors of mine understand today’s NASDAQ index is much different than the NASDAQ index of 15 years ago (see also NASDAQ Redux), especially when it comes to valuation. The folks at Bespoke put NASDAQ 5,000 into an interesting context by adding the important factor of inflation to the mix. Even though the NASDAQ index is within spitting distance of its all-time high of 5,132 (reached in 2000), the index would actually need to rally another +40% to reach an all-time “inflation adjusted” closing high (see chart below).

Economists and strategists are usually articulate, and their arguments sound logical, but they are notorious for being horribly bad at predicting the future, Janet Yellen included. I agree valuation is an all-important factor in determining future stock market returns. Howeer, by Robert Shiller, Janet Yellen, and a host of other economists relying on one flawed metric (CAPE PE), they have not only been wildly wrong year after year, but they are recklessly neglecting many other key factors (see also Shiller CAPE Smells Like BS).

I freely admit stocks will eventually go down, most likely a garden variety -20% recessionary decline in prices. While from a historical standpoint we are overdue for another recession (about two recessions per decade), this recovery has been the slowest since World War II, and the yield curve is currently not flashing any warning signals. When the eventual stock market decline happens, it likely will not be driven by high valuations. The main culprit for a bear market will be a decline in earnings – high valuations just act as gasoline on the fire. Janet Yellen will continue to offer her opinions on many aspects of the economy, but if she steps on her soapbox again and yells about stock market valuations, you will be best served by purchasing a pair of earplugs.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing, SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Chicken or Beef? Time for a Stock Diet?

The stock market has been gorging on gains over the last six years and the big question is are we ready for a crash diet? In other words, have we consumed too much, too fast? Since the lows of 2009 the S&P 500 index has more than tripled (or +209% without dividends).

In our daily food diets our proteins of choice are primarily chicken and beef. When it comes to finances, our investment choices are primarily stocks and bonds. There are many factors that can play into a meat-eaters purchase decision, including the all-important factor of price. When the price of beef spikes, guess what? Consumers rationally vote with their wallets and start substituting beef for relatively lower priced chicken options.

The same principle applies to stocks and bonds. And right now, the price of bonds in general have gone through the roof. In fact bond prices are so high, in Europe we are seeing more than $2 trillion in negative yielding sovereign bonds getting sucked up by investors.

Another area where we see evidence of pricey bonds can be found in the value of current equity risk premiums. Scott Grannis of Calafia Beach Pundit posted a great 50-year history of this metric (chart below), which shows the premium paid to stockholders over bondholders is near the highest levels last seen during the Great Recession and the early 1980s. To clarify, the equity risk premium is defined as the roughly 5.5% yield currently earned on stocks (i.e., inverse of the approx. 18x P/E ratio) minus the 2.0% yield earned on 10-Year Treasury Notes.

The equity risk premium even looks more favorable if you consider the negative interest rate European environment mentioned earlier. The 60 billion euros of monthly debt in ECB (European Central Bank) quantitative easing purchases has accelerated the percentage of negative yield bond issuance, as you can see from the chart below.

Hibernating Bond Vigilantes

Dr. Ed Yardeni coined the famous phrase “bond vigilantes” to describe the group of hedge funds and institutional investors who act as the bond market sheriffs, ready to discipline any over leveraged debt-issuing entity by deliberately cratering prices via bond sales. For now, the bond vigilantes have in large part been hibernating. As long as the vigilantes remain asleep at the switch, stock investors will likely continue earning these outsized premiums.

How long will these fat equity premiums and gains stick around? A simple diet of sharp interest rate increases or P/E expansion would do the trick. An increase in the P/E ratio could come in one of two ways: 1) sustained stock price appreciation at a rate faster than earnings growth; or 2) a sharp earnings decline caused by a recessionary environment. On the bright side for the bulls, there are no imminent signs of interest rate spikes or recessions. If anything, dovish commentary coming from Fed Chairwoman Janet Yellen and the FOMC would indicate the economy remains in solid recovery mode. What’s more, a return to normalized monetary policy will likely involve a very gradual increase in interest rates – not a piercing rise as feared by many.

Regardless of whether it’s beef prices or bond prices spiking, rather than going on a crash diet, prudently allocating your money to the best relative value will serve your portfolio and stomach best over the long run.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing, SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

“Patient” Prick Proves More Pleasure than Pain

I will be the first one to admit I hate needles. In fact, I’ve been known to skip my annual flu shots out of cowardice simply to avoid the harmless prick of the syringe. The mere thought of a long needle jabbing into my arm, or other fleshy part of my body, has had the chilling effect of generating irrational decisions (i.e., I forgo flu shot benefits for no logical reason).

For months the talking heads and so-called pundits have speculated and fretted over the potential removal of the term “patient” from the periodically issued Federal Open Market Committee (FOMC) statement. Since the end of 2014, the statement read that the Fed “can be patient in beginning to normalize” monetary policy.

For investors, the linguistic fear of the removal of “patient” is as groundless as my needle fears. In the financial markets, the consensus view is often wrong. The stronger the euphoric consensus, the higher the probability the consensus will soon be wrong. You can think of technology in the late 1990s, real estate in the mid-2000s; or gold trading at $1,800/oz in 2011. The reverse holds true for the pessimistic consensus. Value guru, extraordinaire, Bill Miller stated it well,

“Stocks do not get undervalued unless somebody is worried about something. The question is not whether there are problems. There are always problems. The question is whether those problems are already fully discounted or not.”

Which brings us back to the Fed’s removal of the word “patient”. Upon release of the statement, the Dow Jones Industrial index skyrocketed about 400 points in 30 minutes. Considering the overwhelming consensus was for the Fed to remove the word “patient”, and given the following favorable factors, should anyone really be surprised that the market is trading near record highs?

FAVORABLE FACTORS:

- Queen Dove Yellen as Fed Chairwoman

- Declining interest rates near generational low

- Stimulative, low oil prices that are declining

- Corporate profits at/near record highs

- Unemployment figures approaching cyclical lows

- Core inflation in check below 2% threshold

While the short-term relief rally may feel good for the bulls, there are still some flies in the ointment, including a strong U.S. dollar hurting trade, an inconsistent housing recovery, and a slowing Chinese economy, among other factors.

Outside the scandalous “patient” semantics was the heated debate over the Fed’s “Dot Plot,” which is just a 3rd grader’s version of showing the Fed members’ Federal Funds rate forecasts. While to a layman the chart below may look like an elementary school dot-to-dot worksheet, in reality it is a good synopsis of interest rate expectations. Part of the reason stocks reacted so positively to the Fed’s statement is because the “Dot Plot” median interest rate expectations of 0.625% came down 0.50% for 2015, and by more than 0.60% for 2016 to 1.875%. This just hammers home the idea that there are currently no dark clouds looming on the horizon that would indicate aggressive rate hikes are coming.

These sub-2% interest rate expectations over the next few years hardly qualify as a “hawkish” stance. As I’ve written before, the stock market handled a 2.5% hike in stride when the Fed Funds rate increased in 1994 (see also 1994 Bond Repeat or Stock Defeat?). What’s more, the Fed Funds rate cycle peaked at 5.0% in 2007 before the market crashed in the Great Recession of 2008-2009.

Although volatility is bound to increase as the Federal Reserve transitions out of a six-year 0% interest rate policy, don’t let the irrational fear of a modest Fed hike prick scare you away from potential investment benefits.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing, SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Draghi Provides Markets QE Beer Goggles

While the financial market party has been gaining momentum in the U.S., Europe has been busy attending an economic funeral. Mario Draghi, the European Central Bank President is trying to reverse the somber deflationary mood, and therefore has sent out $1.1 trillion euros worth of quantitative easing (QE) invitations to investors with the hope of getting the eurozone party started.

Draghi and the stubborn party-poopers sitting on the sidelines have continually been skeptical of the creative monetary punch-spiking policies initially implemented by U.S. Federal Reserve Chairman Ben Bernanke (and continued by his fellow dovish successor Janet Yellen). With the sluggish deflationary European pity party (see FT chart below) persisting for the last six years, investors are in dire need for a new tool to lighten up the dead party and Draghi has obliged with the solution…“QE beer goggles.” For those not familiar with the term “beer goggles,” these are the vision devices that people put on to make a party more enjoyable with the help of excessive consumption of beer, alcohol, or in this case, QE.

Although here in the U.S. “QE beer goggles” have been removed via QE expiration last year, nevertheless the party has endured for six consecutive years. Even an economy posting such figures as an 11-year high in GDP growth (+5.0%); declining unemployment (5.6% from a cycle peak of 10.0%); and stimulative effects from declining oil/commodity prices have not resulted in the cops coming to break up the party. It’s difficult for a U.S. investor to admit an accelerating economy; improving job additions; recovering housing market; with stronger consumer balance sheet would cause U.S. 10-Year Treasury Note yields to plummet from 3.04% at the beginning of 2014 to 1.82% today. But in reality, this is exactly what happened.

To confound views on traditional modern economics, we are seeing negative 10-year rates on Swiss Treasury Bonds (see chart below). In other words, investors are paying -1% to the Swiss government to park their money. A similar strategy could be replicated with $100 by simply burning a $1 bill and putting the remaining $99 under a mattress. Better yet, why not just pay me to hold your money, I will place your money under my guarded mattress and only charge you half price!

Does QE Work?

Debate will likely persist forever as it relates to the effectiveness of QE in the U.S. On the half glass empty side of the ledger, GDP growth has only averaged 2-3% during the recovery; the improvement in the jobs upturn is arguably the slowest since World War II; and real wages have declined significantly. On the half glass full side, however, the economy has improved substantially (e.g., GDP, unemployment, consumer balance sheets, housing, etc.), and stocks have more than doubled in value since the start of QE1 at the end of 2008. Is it possible that the series of QE policies added no value, or we could have had a stronger recovery without QE? Sure, anyone can make that case, but the fact remains, the QE training wheels have officially come off the economy and Armageddon has still yet to materialize.

I expect the same results from the implementation of QE in Europe. QE is by no means an elixir or panacea. I anticipate minimal direct and tangible economic benefits from Draghi’s $1+ trillion euro QE bazooka, however the psychological confidence building impacts and currency depreciating effects are likely to have a modest indirect value to the eurozone and global financial markets overall. The downside for these unsustainable ultra-low rates is potential excessive leverage from easy credit, asset bubbles, and long-term inflation. Certainly, there may be small pockets of these excesses, however the scars and regulations associated with the 2008-2009 financial crisis have delayed the “hangover” arrival of these risk possibilities on a broader basis. Therefore, until the party ends or the cops come to break up the fun, you may want to enjoy the gift provided by Mario Draghi to global investors…and strap on the “QE beer goggles.”

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own a range of positions, including positions in certain exchange traded funds positions , but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

After 2014 Stock Party, Will Investors Have a 2015 Hangover?

This article is an excerpt from a previously released Sidoxia Capital Management complementary newsletter (January 2, 2015). Subscribe on the right side of the page for the complete text.

Investors in the U.S. stock market partied their way to a sixth consecutive year of gains during 2014 (S&P 500 +11.4%; Dow Jones Industrial Average +7.5%; and NASDAQ +13.4%). From early 2009, at the worst levels of the crisis, the S&P 500 has more than tripled – not too shabby. But similar to recent years, this year’s stock bubbly did not flow uninterrupted. Several times during the party, neighbors and other non-participants at the stock party complained about numerous concerns, including the Fed Tapering of bond purchases; the spread of the deadly Ebola virus; tensions in Ukraine; the rise of ISIS; continued economic weakness across the eurozone; the decline of “The Fragile Five” emerging markets (Brazil, India, Indonesia, Turkey and South Africa), and other headline grabbing stories to name just a few. In fact, the S&P 500 briefly fell -10% from its mid-September level to mid-October before a Santa Claus rally pushed the index higher by +4% in the last quarter of the year.

Even though the U.S. was partying hardy in 2014, it was not all hats and horns across all segments of the market. Given all the geopolitical trepidation and sluggish economic growth abroad, international markets as measured by the Total World Stock ETF (VT) gained a paltry +1.2% for the year. This dramatic underperformance was also seen in small capitalization stocks (Russell 2000 Index ETF – IWM), which only rose +3.7% last year, and the Total Bond Market (BND), which increased +2.9%.

Despite these anxieties and the new Federal Reserve Chairwoman Janet Yellen removing the Quantitative Easing (QE) punchbowl in 2014, there were still plenty of festive factors that contributed to gains last year, which should prevent any hangover for stocks going into 2015. As I wrote in Don’t Be a Fool, corporate profits are the lifeblood for stock prices. Fortunately for investors, the news on this front remains positive (see chart below). As strategist Dr. Ed Yardeni pointed out a few weeks ago, profit growth is still expected to accelerate to +9.3% in 2015, despite the recent drag from plummeting oil prices on the energy sector.

While a -50% decline in oil prices may depress profits for some energy companies, the extra discretionary spending earned by consumers from $2.24 per gallon gasoline at the pump has been a cheery surprise. This consumer spending tailwind, coupled with the flow-through effect to businesses, should provide added stimulative benefit to the economy in 2015 too. Let’s not forget, this economic energy boost comes on the heels of the best economic growth experienced in the U.S. in over a decade. More specifically, the recently reported third quarter U.S. GDP (Gross Domestic Product) statistics showed growth accelerating to +5%, the highest rate seen since 2003.

Another point to remember about lower energy prices is how this phenomenon positively circulates into lower inflation and lower interest rate expectations. If energy prices remain low, this only provides additional flexibility to the Federal Reserve’s monetary policy decisions. With the absence of any substantive inflation data, Chairwoman Yellen can remain “patient” in hitting the interest rate brakes (i.e., raising the Federal Funds rate) in 2015.

Geographically, our financial markets continue to highlight our country’s standing as one of the best houses in a sluggish global growth neighborhood. Not only do we see this trend in our outperforming stock indexes, relative to other countries, but we also see this in the rising value of the U.S. dollar. It is true that American exports become less competitive internationally in a strong dollar environment, but from an investment standpoint, a rising dollar makes U.S. stock markets that much more attractive to foreign investors. To place this dynamic into better perspective, I would note the U.S. Dollar index rose by approximately +13% in 2014 against a broad basket of currencies (including the basket case Russian Rouble). With the increasing likelihood of eurozone Quantitative Easing to take place, in conjunction with loose monetary policies in large developed markets like Japan, there is a good chance the dollar will continue its appreciation in the upcoming year.

On the political front, despite the Republicans winning a clean sweep in the midterm elections, we should still continue to expect Washington gridlock, considering a Democrat president still holds the all-important veto power. But as I have written in the past (see Who Said Gridlock is Bad?), gridlock has resulted in our country sitting on a sounder financial footing (i.e., we have significantly lower deficits now), which in turn has contributed to the U.S. dollar’s strength. At the margin however, one can expect any legislation that does happen to get passed by the Republican majority led Congress will likely be advantageous for businesses and the stock market.

When Will the Party End?

What could cause the party to come to a screeching halt? While I can certainly point out some obvious potential negative scenarios (e.g., European financial mayhem, China economic speed bump, interest rate spike), history shows us it is usually unforeseen events (surprises) that cause significant downdrafts in stock market prices. The declines rarely come from factors you read in current newspaper headlines or hear on television.

Just like any party, this year is likely to include high points and low points in the financial markets – and of course some lull periods mixed in as well. However, with the economy improving and risk appetites increasing, we are bound to see more party poopers on the sidelines come join the celebration in 2015. It will be a while before the cops arrive and stop the party, so there should be plenty of time to prepare for any hypothetical hangover.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own a range of positions, including positions in certain exchange traded funds positions (including BND), but at the time of publishing SCM had no direct position in VT, IWM or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Santa and the Rate-Hike Boogeyman

Boo! … Rates are about to go up. Or are they? We’re in the fourth decade of a declining interest rate environment (see Don’t be a Fool), but every time the Federal Reserve Chairman speaks or monetary policies are discussed, investors nervously look over their shoulder or under their bed for the “Rate Hike Boogeyman.” While this nail-biting mentality has resulted in lost sleep for many, this mindset has also unfortunately led to a horrible forecasting batting average for economists. Santa and many equity investors have ignored the rate noise and have been singing Ho Ho Ho as stock prices hover near record highs.

A recent Deutsche Bank report describes the prognostication challenges here:

i.) For the last 10 years, professional forecasters have consistently been wrong on their predictions of rising interest rates.

ii.) For the last five years, investors haven’t fared any better. As you can see, they too have been continually wrong about their expectations for rising interest rates.

I’m the first to admit that rates have remained “lower for longer” than I guessed, but unlike many, I do not pretend to predict the exact timing of future rate increases. I strongly believe inevitable interest rate rises are not a matter of “if” but rather “when”. However, trying to forecast the timing of a rate increase can be a fool’s errand. Japan is a great case in point. If you take a look at the country’s interest rates on their long-term 10-year government bonds (see chart below), the yields have also been declining over the last quarter century. While the yield on the 10-Year U.S. Treasury Note is near all-time historic lows at 2.18%, that rate pales in comparison to the current 10-Year Japanese Bond which is yielding a minuscule 0.36%. While here in the states our long-term rates only briefly pierced below the 2% threshold, as you can see, Japanese rates have remained below 2% for a jaw-dropping duration of about 15 years.

There are plenty of reasons to explain the differences in the economic situation of the U.S. and Japan (see Japan Lost Decades), but despite the loose monetary policies of global central banks, history has proven that interest rates and inflation can remain stubbornly low for longer than expected.

The current pundit thinking has Federal Reserve Chairwoman Yellen leading the brigade towards a rate hike during mid-calendar 2015. Even if the forecasters finally get the interest rate right for once, the end-outcome is not going to be catastrophic for equity markets. One need look no further than 1994 when Federal Reserve Chairman Greenspan increased the benchmark federal funds rate by a hefty +2.5%. (see 1994 Bond Repeat?). Rather than widespread financial carnage in the equity markets, the S&P 500 finished roughly flat in 1994 and resumed the decade-long bull market run in the following year.

Currently 15 of the 17 Fed policy makers see 2015 median short-term rates settling at 1.125% from the current level of 0-0.25%. This hardly qualifies as interest rate Armageddon. With a highly transparent and dovish Janet Yellen at the helm, I feel perfectly comfortable the markets can digest the inevitable Fed rate hikes. Will (could) there be volatility around changes in Fed monetary policy during 2015? Certainly – no different than we experienced during the “taper tantrum” response to Chairman Ben Bernanke’s rate rise threats in 2013 (see Fed Fatigue).

As 2014 comes to an end, Santa has wrapped investor portfolios with a generous bow of returns in the fifth year of this historic bull market. Not everyone, however, has been on Santa’s “nice” list. Regrettably, many sideliners have received no presents because they incorrectly assessed the elimination impact of Quantitative Easing (QE). If you prefer presents over a lump of coal in your stocking, it will be in your best interest to ignore the Rate Hike Boogeyman and jump on Santa’s sleigh.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own a range of positions, including certain exchange traded fund positions, but at the time of publishing SCM had no direct position in DB or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

The Treadmill Market – Jogging in Place

This article is an excerpt from a previously released Sidoxia Capital Management complementary newsletter (April 1, 2014). Subscribe on the right side of the page for the complete text.

After the stock market raced ahead to about a +30% gain last year, it became clear this meteoric trend was not sustainable into perpetuity. Correct investing should be treated more like a marathon than a sprint. After dashing ahead by more than +100% over the last handful of years, 2014 stock prices took a breather by spending the first quarter jogging in place. Like a runner on the treadmill, year-to-date returns equated to a -0.7% for the Dow Jones Industrial Average index, and +1.3% for the S&P index. Digesting the large gains from previous years, despite making no discernable forward progress this quarter, is a healthy exercise that builds long-term portfolio endurance. As far as I’m concerned, nothing in life worthwhile comes easy, and the first three months of the year have demonstrated this principle.

As I’ve written in the past (see Series of Unfortunate Events), there is never a shortage of issues to worry about. The first few months of 2014 have been no exception. Vladimir Putin’s strong armed military backed takeover of Crimea, coupled with the Federal Reserve’s unwinding $30 billion of the $85 billion of its “Quantitative Easing” bond buying program (i.e. tapering) have contributed to investors’ nervousness. When the “Fairy Godmother of the Bull Market,” Federal Reserve Chair Janet Yellen, hinted at potentially raising interest rates in about 12 months, the mood soured further.

The unseasonably cold winter back east (a.k.a., Polar Vortex) has caused some additional jitters due to the dampening effects on economic conditions. More specifically, economic growth as measured by GDP (Gross Domestic Product) is expected to come in around a meager +2.0% rate during the first quarter of 2014, before picking up later in the year.

And if that isn’t enough, best-selling author Michael Lewis, whose books include Money Ball, The Blind Side, and Liar’s Poker, just came out on national television and sparked a debate with his controversial statement that the “stock market is rigged.” (read and listen more here)

Runners High

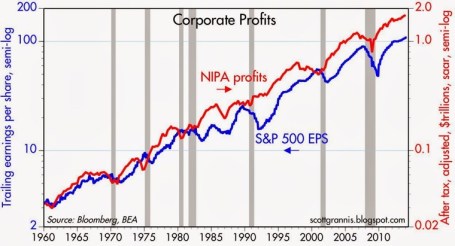

But as always, not everything is gloom and doom. Offsetting the temporary price fatigue, resilient record corporate profits have supported the surprising market stamina. Like a runner’s high, corporations are feeling elated about historically elevated profit margins. As you can see from the chart below, the reason it’s prudent for most to have some U.S. equity exposure is due to the clear, upward multi-decade trend of U.S. corporate earnings.

While the skeptics wait for these game-ending dynamics to take root, core economic fundamentals in areas like these remain strong:I didn’t invent the idea of profits impacting the stock market, but the concept is simple: stock prices generally follow earnings over long periods of time (see It’s the Earnings, Stupid). In other words, as profits accelerate, so do stock prices – and the opposite holds true (decelerating earnings leads to price declines). This direct relationship normally holds over the long-run as long as the following conditions are not in place: 1) valuations are stretched; 2) a recession is imminent; and/or 3) interest rates are spiking. Fortunately for long-term investors, there is no compelling evidence of these factors currently in place.

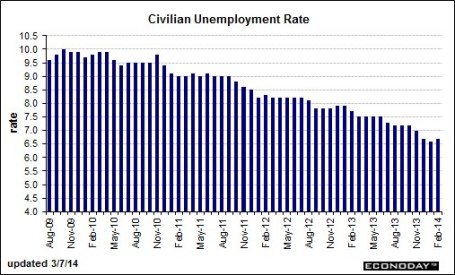

Employment Adrenaline

The employment outlook received a boost of adrenaline last month. Despite the slight upward nudge in the unemployment rate to 6.7%, total nonfarm payroll jobs increased by +175,000 in February versus a +129,000 gain in January and an +84,000 gain in December. Not only was last month’s increase better than expectations, but the net figures calculated over the previous two months were also revised higher by +25,000 jobs. As you can see below, the improvement since 2009 has been fairly steady, but as the current rate flirts with the Fed’s 6.5% target, Chair Yellen has decided to remove the quantitative objective. The rising number of discouraged workers (i.e., voluntarily opt-out of job searching) and part-timers has distorted the numbers, rendering arbitrary numeric targets less useful.

Source: Barron’s Online

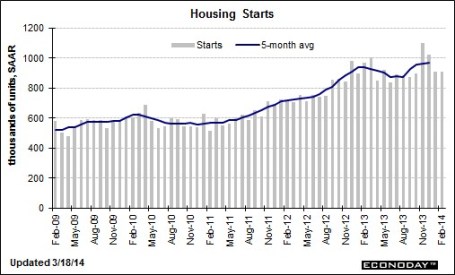

Housing Holding Strong

In the face of the severe winter weather, the feisty housing market remains near multi-year highs as shown in the 5-month moving average housing start figure below. With the spring selling season upon us, we should be able to better gauge the impact of cold weather and higher mortgage rates on the housing market.

Source: Barron’s Online

Even though stock market investors found themselves jogging in place during the first quarter of the year, long-term investors are building up endurance as corporate profits and the economy continue to consistently grow in the background. Successful investors must realize stock prices cannot sustainably sprint for long periods of time without eventually hitting a wall and collapsing. Those who recognize investing as a marathon sport, rather than a mad dash, will be able to jump off the treadmill and ultimately reach their financial finish line.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold long positions in certain exchange traded funds (ETFs), but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Bernanke: Santa Claus or Grinch?

I’ve written plenty about my thoughts on the Fed (see Fed Fatigue) and all the blathering from the media talking heads. Debates about the timing and probability of a Fed “taper” decision came to a crescendo in the recent week. As is often the case, the exact opposite of what the pundits expected actually happened. It was not a huge surprise the Federal Reserve initiated a $10 billion tapering of its $85 billion monthly bond buying program, but going into this week’s announcement, the betting money was putting their dollars on the status quo.

With the holiday season upon us, investors must determine whether the tapered QE1/QE2/QE3 gifts delivered by Bernanke are a cause for concern. So the key question is, will this Santa Claus rally prance into 2014, or will the Grinch use the taper as an excuse to steal this multi-year bull market gift away?

Regardless of your viewpoint, what we did learn from this week’s Fed announcement is that this initial move by the Fed will be a baby step, reducing mortgage-backed and Treasury security purchases by a measly $5 billion each. I say that tongue in cheek because the total global bond market has been estimated at about $80,000,000,000,000 (that’s $80 trillion).

As I’ve pointed out in the past, the Fed gets way too much credit (blame) for their impact on interest rates (see Interest Rates: Perception vs Reality). Interest rates even before this announcement were as high/higher than when QE1 was instituted. What’s more, if the Fed has such artificial influence over interest rates, then why do Austria, Belgium, Canada, Denmark, Finland, France, Germany, Japan, Netherlands, Sweden, and Switzerland all have lower 10-year yields than the U.S.? Maybe their central banks are just more powerful than our Fed? Unlikely.

Dow 128,000 in 2053

Readers of Investing Caffeine know I have followed the lead of investing greats like Warren Buffett and Peter Lynch, who believe trying to time the markets is a waste of your time. In a recent Lynch interview, earlier this month, Charlie Rose asked for Lynch’s opinion regarding the stock market, given the current record high levels. Here’s what he had to say:

“I think the market is fairly priced on what is happening right now. You have to say to yourself, is five years from now, 10 years from now, corporate profits are growing about 7 or 8% a year. That means they double, including dividends, about every 10 years, quadruple every 20, go up 8-fold every 40. That’s the kind of numbers you are interested in. The 10-year bond today is a little over 2%. So I think the stock market is the best place to be for the next 10, 20, 30 years. The next two years? No idea. I’ve never known what the next two years are going to bring.”

READ MORE ABOUT PETER LYNCH HERE

Guessing is Fun but Fruitless

I freely admit it. I’m a stock-a-holic and member of S.A. (Stock-a-holic’s Anonymous). I enjoy debating the future direction of the economy and financial markets, not only because it is fun, but also because without these topics my blog would likely go extinct. The reality of the situation is that my hobby of thinking and writing about the financial markets has no direct impact on my investment decisions for me or my clients.

There is no question that stocks go down during recessions, and an average investor will likely live through at least another half-dozen recessions in their lifetime. Unfortunately, speculators have learned firsthand about the dangers of trading based on economic and/or political headlines during volatile cycles. That doesn’t mean everyone should buy and do nothing. If done properly, it can be quite advantageous to periodically rebalance your portfolio through the use of various valuation and macro metrics as a means to objectively protect/enhance your portfolio’s performance. For example, cutting exposure to cyclical and debt-laden companies going into an economic downturn is probably wise. Reducing long-term Treasury positions during a period of near-record low interest rates (see Confessions of a Bond Hater) as the economy strengthens is also likely a shrewd move.

As we have seen over the last five years, the net result of investor portfolio shuffling has been a lot of pain. The acts of panic-selling caused damaging losses for numerous reasons, including a combination of agonizing transactions costs; increased inflation-decaying cash positions; burdensome taxes; and a mass migration into low-yielding bonds. After major indexes have virtually tripled from the 2009 lows, many investors are now left with the gut-wrenching decision of whether to get back into stocks as the markets reach new highs.

As the bulls continue to point to the scores of gifts still lying under the Christmas tree, the bears are left hoping that new Fed Grinch Yellen will come and steal all the presents, trees, and food from the planned 2014 economic feast. There are still six trading days left in the year, so Santa Bernanke cannot finish wrapping up his +30% S&P 500 total return gift quite yet. Nevertheless, ever since the initial taper announcement, stocks have moved higher and Bernanke has equity investors singing “Joy to the World!”

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.