Posts tagged ‘investments’

Stocks Winning vs. Weak Competitors

This article is an excerpt from a previously released Sidoxia Capital Management complementary newsletter (June 2, 2014). Subscribe on the right side of the page for the complete text.

Winning at any sport is lot easier if you can compete without an opponent. Imagine an NBA basketball MVP LeBron James driving to the basket against no defender, or versus a weakling opponent like a 44-year-old investment manager. Under these circumstances, it would be pretty easy for James and his team, the Miami Heat, to victoriously dominate without even a trace of sweat.

Effectively, stocks have enjoyed similar domination in recent years, while steamrolling over the bond competition. To put the stock market’s winning streak into perspective, the S&P 500 index set a new all-time record high in May, with the S&P 500 advancing +2.1% to 1924 for the month, bringing the 2013-2014 total return to about +38%. Not too shabby results over 17 months, if you consider bank deposits and CDs are paying a paltry 0.0-1.0% annually, and investors are gobbling up bonds yielding a measly 2.5% (see chart below).

The point, once again, is that even if you are a skeptic or bear on the outlook for stocks, the stock market still offers the most attractive opportunities relative to other asset classes and investment options, including bonds. It’s true, the low hanging fruit in stocks has been picked, and portfolios can become too equity-heavy, but even retirees should have some exposure to equities.

As I wrote last month in Buy in May and Dance Away, why would investors voluntarily lock in inadequate yields at generational lows when the earnings yield on stocks are so much more appealing. The approximate P/E (Price-Earnings) ratio for the S&P 500 currently averages approximately +6.2% with a rising dividend yield of about +1.8% – not much lower than many bonds. Over the last five years, those investors willing to part ways with yield-less cash have voted aggressively with their wallets. Those with confidence in the equity markets have benefited massively from the approximate +200% gains garnered from the March 2009 S&P 500 index lows.

For the many who have painfully missed the mother of all stock rallies, the fallback response has been, “Well, sure the market has tripled, but it’s only because of unprecedented printing of money at the QE (Quantitative Easing) printing presses!” This argument has become increasingly difficult to defend ever since the Federal Reserve announced the initiation of the reduction in bond buying (a.k.a., “tapering”) six months ago (December 18th). Over that time period, the Dow Jones Industrial Average has increased over 800 points and the S&P 500 index has risen a healthy 8.0%.

As much as everyone would like to blame (give credit to) the Fed for the bull market, the fact is the Federal Reserve doesn’t control the world’s interest rates. Sure, the Fed has an influence on global interest rates, but countries like Japan may have something to do with their own 0.57% 10-year government bond yield. For example, the economic/political policies and demographics in play might be impacting Japan’s stock market (Nikkei), which has plummeted about -62% over the last 25 years (about 39,000 to 15,000). Almost as shocking as the lowly rates in Japan and the U.S. and Japan, are the astonishingly low interest rates in Europe. As the chart below shows, France and Germany have sub-2% 10-year government bond yields (1.76% and 1.36%, respectively) and even economic basket case countries like Italy and Spain have seen their yields pierce below the 3% level.

Suffice it to say, yield is not only difficult to find on our shores, but it is also challenging to find winning bond returns globally.

Well if low interest rates and the Federal Reserve aren’t the only reasons for a skyrocketing stock market, then how come this juggernaut performance has such long legs? The largest reason in my mind boils down to two words…record profits. Readers of mine know I follow the basic tenet that stock prices follow earnings over the long-term. Interest rates and Fed Policy will provide headwinds and tailwinds over different timeframes, but ultimately the almighty direction of profits determines long-run stock performance. You don’t have to be a brain surgeon or rocket scientist to appreciate this correlation. Scott Grannis (Calafia Beach Pundit) has beautifully documented this relationship in the chart below.

Supporting this concept, profits help support numerous value-enhancing shareholder activities we have seen on the rise over the last five years, which include rising dividends, share buybacks, and M&A (Mergers & Acquisitions) activity. Eventually the business cycle will run its course, and during the next recession, profits and stock prices will be expected to decline. A final contributing factor to the duration of this bull market is the abysmally slow pace of this economic recovery, which if measured in job creation terms has been the slowest since World War II. Said differently, the slower a recovery develops, the longer the recovery will last. Bill McBride at Calculated Risk captured this theme in the following chart:

Despite the massive gains and new records set, skeptics abound as evidenced by the nearly -$10 billion of withdrawn money out of U.S. stock funds over the last month (most recent data).

I’ve been labeled a perma-bull by some, but over my 20+ years of investing experience I understand the importance of defensive positioning along with the benefits of shorting expensive, leveraged stocks during bear markets, like the ones in 2000-2001 and 2008-2009. When will I reverse my views and become bearish (negative) on stocks? Here are a few factors I’m tracking:

- Inverted Yield Curve: This was a good precursor to the 2008-2009 crash, but there are no signs of this occurring yet.

- Overheated Fund Inflows: When everyone piles into stocks, I get nervous. In the last four weeks of domestic ICI fund flow data, we have seen the opposite…about -$9.5 billion outflows from stock funds.

- Peak Employment: When things can’t get much better is the time to become more worried. There is still plenty of room for improvement, especially if you consider the stunningly low employment participation rate.

- Fed Tightening / Rising Bond Yields: The Fed has made it clear, it will be a while before this will occur.

- When Housing Approaches Record Levels: Although Case-Shiller data has shown housing prices bouncing from the bottom, it’s clear that new home sales have stalled and have plenty of head room to go higher.

- Financial Crisis: Chances of experiencing another financial crisis of a generation is slim, but many people have fresh nightmares from the 2008-2009 financial crisis. It’s not every day that a 158 year-old institution (Lehman Brothers) or 85 year-old investment bank (Bear Stearns) disappear, but if the dominoes start falling again, then I guess it’s OK to become anxious again.

- Better Opportunities: The beauty about my practice at Sidoxia is that we can invest anywhere. So if we find more attractive opportunities in emerging market debt, convertible bonds, floating rate notes, private equity, or other asset classes, we have no allegiances and will sell stocks.

Every recession and bear market is different, and although the skies may be blue in the stock market now, clouds and gray skies are never too far away. Even with record prices, many fears remain, including the following:

- Ukraine: There is always geopolitical instability somewhere on the globe. In the past investors were worried about Egypt, Iran, and Syria, but for now, some uncertainty has been created around Ukraine.

- Weak GDP: Gross Domestic Product was revised lower to -1% during the first quarter, in large part due to an abnormally cold winter in many parts of the country. However, many economists are already talking about the possibility of a 3%+ rebound in the second quarter as weather improves.

- Low Volatility: The so-called “Fear Gauge” is near record low levels (VIX index), implying a reckless complacency among investors. While this is a measure I track, it is more confined to speculative traders compared to retail investors. In other words, my grandma isn’t buying put option insurance on the Nasdaq 100 index to protect her portfolio against the ramifications of the Thailand government military coup.

- Inflation/Deflation: Regardless of whether stocks are near a record top or bottom, financial media outlets in need of a topic can always fall back on the fear of inflation or deflation. Currently inflation remains in check. The Fed’s primary measure of inflation, the Core PCE, recently inched up +0.2% month-to-month, in line with forecasts.

- Fed Policy: When are investors not worried about the Federal Reserve’s next step? Like inflation, we’ll be hearing about this concern until we permanently enter our grave.

In the sport of stocks and investing, winning is never easy. However, with the global trend of declining interest rates and the scarcity of yields from bonds and other safe investments (cash/money market/CDs), it should come as no surprise to anyone that the winning streak in stocks is tied to the lack of competing investment alternatives. Based on the current dynamics in the market, if LeBron James is a stock, and I’m forced to guard him as a 10-year Treasury bond, I think I’ll just throw in the towel and go to Wall Street. At least that way my long-term portfolio has a chance of winning by placing a portion of my bets on stocks over bonds.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

What’s Going on with This Crazy Market?!

The massive rally of the stock market since March 2009 has been perplexing for many, but the state of confusion has reached new heights as the stock market has surged another +2.0% in May, surpassing the Dow 15,000 index milestone and hovering near all-time record highs. Over the last few weeks, the volume of questions and tone of disbelief emanating from my social circles has become deafening. Here are some of the questions and comments I’ve received lately:

“Wade, why in the heck is the market up so much?”; “This market makes absolutely no sense!”; “Why should I buy at the peak when I can buy at the bottom?”; “With all this bad news, when is the stock market going to go down?”; “You must be shorting (betting against) this market, right?”

If all the concerns about the Benghazi tragedy, IRS conservative targeting, and Federal Reserve bond “tapering” are warranted, then it begs the question, “How can the Dow Jones and other indexes be setting new all-time highs?” In short, here are a few reasons:

You hear a lot of noise on TV and read a lot of blathering in newspapers/blogs, but what you don’t hear much about is how corporate profits have about tripled since the year 2000 (see red line in chart above), and how the profit recovery from the recent recession has been the strongest in 55 years (Scott Grannis). The profit collapse during the Great Recession was closely chronicled in nail-biting detail, but a boring profit recovery story sells a lot less media advertising, and therefore gets swept under the rug.

II.) Reasonable Prices (Comparing Apples & Oranges):

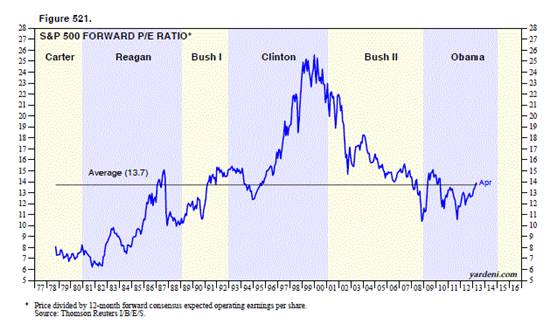

Source: Dr. Ed’s Blog

The Price-Earnings ratio (P/E) is a general barometer of stock price levels, and as you can see from the chart above (Ed Yardeni), current stock price levels are near the historical average of 13.7x – not at frothy levels experienced during the late-1990s and early 2000s.

Comparing Apples & Oranges:

At the most basic level of analysis, investors are like farmers who choose between apples (stocks) and oranges (bonds). On the investment farm, growers are generally going to pick the fruit that generates the largest harvest and provide the best return. Stocks (apples) have historically offered the best prices and yielded the best harvests over longer periods of time, but unfortunately stocks (apples) also have wild swings in annual production compared to the historically steady crop of bonds (oranges). The disastrous apple crop of 2008-2009 led a massive group of farmers to flood into buying a stable supply of oranges (bonds). Unfortunately the price of growing oranges (i.e., buying bonds) has grown to the highest levels in a generation, with crop yields (interest rates) also at a generational low. Even though I strongly believe apples (stocks) currently offer a better long-term profit potential, I continue to remind every farmer (investor) that their own personal situation is unique, and therefore they should not be overly concentrated in either apples (stocks) or oranges (bonds).

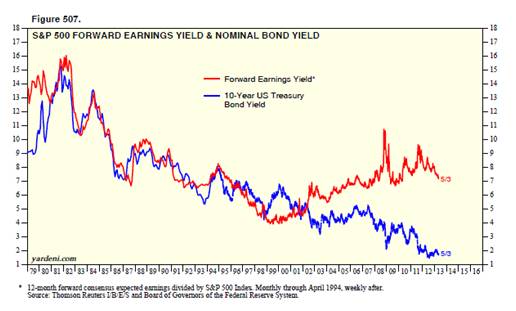

Source: Dr. Ed’s Blog

Regardless, you can see from the chart above (Dr. Ed’s Blog), the red line (stocks) is yielding substantially more than the blue line (bonds) – around 7% vs. 2%. The key for every investor is to discover an optimal balance of apples (stocks) and oranges (bonds) that meets personal objectives and constraints.

III.) Skepticism (Market Climbs a Wall of Worry):

Source: Calafia Beach Pundit

Although corporate profits are strong, and equity prices are reasonably priced, investors have been withdrawing hundreds of billions of dollars from equity funds (negative blue lines in chart above – Calafia Beach Pundit). While the panic of 2008-2009 has been extinguished from average investors’ psyches, the Recession in Europe, slowing growth in China, Washington gridlock, and the fresh memories of the U.S. financial crisis have created a palpable, nervous skepticism. Most recently, investors were bombarded with the mantra of “Selling in May, and Going Away” – so far that advice hasn’t worked so well. To buttress my point about this underlying skepticism, one need not look any further than a recent CNBC segment titled, “The Most Confusing Market Ever” (see video below):

It’s clear that investors remain skittish, but as legendary investor Sir John Templeton so aptly stated, “Bull markets are born on pessimism, grow on skepticism, mature on optimism and die on euphoria.” The sentiment pendulum has been swinging in the right direction (see previous Investing Caffeine article), but when money flows sustainably into equities and optimism/euphoria rules the day, then I will become much more fearful.

Being a successful investor or a farmer is a tough job. I’ll stop growing apples when my overly optimistic customers beg for more apples, and yields on oranges also improve. In the meantime, investors need to remember that no matter how confusing the market is, don’t put all your oranges (bonds) or apples (stocks) in one basket (portfolio) because the financial markets do not need to get any crazier than they are already.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Cutting Losses with Fisher’s 3 Golden Sell Rules

Returning readers to Investing Caffeine understand this is a location to cover a wide assortment of investing topics, ranging from electric cars and professional poker to taxes and globalization. Investing Caffeine is also a location that profiles great investors and their associated investment lessons.

Today we are going to revisit investing giant Phil Fisher, but rather than rehashing his accomplishments and overall philosophy, we will dig deeper into his selling discipline. For most investors, selling securities is much more difficult than buying them. The average investor often lacks emotional self-control and is unable to be honest with himself. Since most investors hate being wrong, their egos prevent taking losses on positions, even if it is the proper, rational decision. Often the end result is an inability to sell deteriorating stocks until capitulating near price bottoms.

Selling may be more difficult for most, but Fisher actually has a simpler and crisper number of sell rules as compared to his buy rules (3 vs. 15). Here are Fisher’s three sell rules:

1) Wrong Facts: There are times after a security is purchased that the investor realizes the facts do not support the supposed rosy reasons of the original purchase. If the purchase thesis was initially built on a shaky foundation, then the shares should be sold.

2) Changing Facts: The facts of the original purchase may have been deemed correct, but facts can change negatively over the passage of time. Management deterioration and/or the exhaustion of growth opportunities are a few reasons why a security should be sold according to Fisher.

3) Scarcity of Cash: If there is a shortage of cash available, and if a unique opportunity presents itself, then Fisher advises the sale of other securities to fund the purchase.

Reasons Not to Sell

Prognostications or gut feelings about a potential market decline are not reasons to sell in Fisher’s eyes. Selling out of fear generally is a poor and costly idea. Fisher explains:

“When a bear market has come, I have not seen one time in ten when the investor actually got back into the same shares before they had gone up above his selling price.”

In Fisher’s mind, another reason not to sell stocks is solely based on valuation. Longer-term earnings power and comparable company ratios should be considered before spontaneous sales. What appears expensive today may look cheap tomorrow.

There are many reasons to buy and sell a stock, but like most good long –term investors, Fisher has managed to explain his three-point sale plan in simplistic terms the masses can understand. If you are committed to cutting investment losses, I advise you to follow investment legend Phil Fisher – cutting losses will actually help prevent your portfolio from splitting apart.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Reasoning with Investment Confusion

Some things never change, and in the world of investing many of the same principles instituted a century ago are just as important today. So while we are dealing with wars, military conflicts, civil unrest, and natural disasters, today’s process of filtering and discounting all these events into stock prices is very similar to the process that George Selden describes in his 1912 book, “Psychology of the Stock Market.”

Snub the Public

Investing in stocks is nowhere close to a risk-free endeavor, and 2008-2009 was a harsh reminder of that fact. Since a large part of the stock market is based on emotions and public opinion, stock prices can swing wildly. Public opinion may explain why the market is peaking or troughing, but Selden highlights the importance of the silent millionaires (today’s billionaires and institutional investors), and that the true measurement of the stock market is dollars (not opinions of the masses):

“Public opinion in a speculative market is measured in dollars, not in population. One man controlling one million dollars has double the weight of five hundred men with one thousand dollars each. Dollars are the horsepower of the markets–the mere number of men does not signify.”

When the overwhelming consensus of participants is bullish, by definition, the small inexperienced investors and speculators are supplied stock from someone else – the silent, wealthy millionaires.

The newspaper headlines that we get bombarded with on a daily basis are a mirror reflection of the general public’s attitudes and when the euphoria or despondency reaches extreme levels, these points in time have been shown to correlate with market tops and bottoms (see Back to the Future Magazine Covers).

In the short-run, professional traders understand this dynamic and will often take a contrarian approach to news flow. Or as Seldon explains:

“A market which repeatedly refuses to respond to good news after a considerable advance is likelely to be ‘full of stocks.’ Likewise a market which will not go down on bad news is usually ‘bare of stock.’”

This contrarian dynamic in the market makes it virtually impossible for the average investor to trade the market based on the news flow of headlines and commentator. Before the advent of the internet, 98 years ago, Selden prophetically noted that the increasing difficulty of responding to sentiment and tracking market information:

“Public opinion is becoming more volatile and changeable by the year, owing to the quicker spread of information and the rapid multiplication of the reading public.”

Following what the so-called pundits are saying is fruitless, or as Gary Helms says, “If anybody really knew, they wouldn’t tell you.”

Selden’s Sage Advice

If trading was difficult in 1912, it must be more challenging today. Selden’s advice is fairly straightforward:

“Stick to common sense. Maintain a balanced, receptive mind and avoid abstruse deductions…After a prolonged advance, do not call inverted reasoning to your aid in order to prove that prices are going still higher; likewise after a big break do not let your bearish deductions become too complicated.”

The brain is a complex organ, but we humans are limited in the amount and difficulty of information we can assimilate.

“When it comes to so complicated a matter as the price of stocks, our haziness increases in proportion to the difficulty of the subject and our ignorance of it.”

The mental somersault that investors continually manage is due to the practice of “discounting.” Discounting is a process that adjusts today’s price based on future expected news. Handicapping sports “spreads” involves a very similar methodology as discounting stock prices (read What Happens in Vegas). But not all events can be discounted, for instance the recent earthquake and tsunami in Japan. When certain factors are over-discounted or under-discounted, these are the situations to profit from on a purchase or shorting basis.

The Dow Jones Industrial Average traded below a value of 100 versus more than 12,000 today, but over that period some things never change, like the emotional and mental aspects of investing. George Selden makes this point clear in his century old writings – it’s better to focus on the future rather than fall prey to the game of mental somersault we call the stock market.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Shoring Up Your Investment Stool from Collapse

With March Madness just kicking into full gear, there’s a chance that your gluteal assets may be parked on a stool in the next two weeks. When leaning on a bar countertop, while seated on a stool, we often take for granted the vital support this device provides, so we can shovel our favorite beverage and pile of nachos into our pie holes. OK, maybe I speak for myself when it comes to my personal, gluttonous habits. But the fact remains, whether you are talking about your rump, or your investment portfolio, you require a firm foundation.

The main problem, when it comes to investments, is the lack of a tangible, visible stool to analyze. Sure, you are able to see the results of a portfolio collapse when there is no foundation to support it, or you may even be able to ignore the results when they remain above water. But many investors do not evenperform the basic due diligence to determine the quality of their investment stool. Before you place your life savings in the hands of some brokerage salesman, or in your personal investment account, you may want to make sure your stool has more than one or two legs.

In the money management world, investors typically choose to buy the stool, rather than build it, which makes perfect common sense. Many people do not have the time or emotional make-up to manage their finances. If left to do it themselves, more often than not, investors usually do a less than stellar job. Unfortunately, when many investors do outsource the management of their investments, they neglect to adequately research the investment stool they buy. Usually the wobbly industry stool operates on the two legs of performance chasing and commission generation (see Fees, Exploitation, and Confusion). For most average investors, it doesn’t take long before that investment strategy teeters and collapses.

If the average investor does not have time to critically evaluate managers that take a long-term, low-cost, tax-efficient strategy to investing, those individuals would be best served by following Warren Buffet’s advice about passive investments, “A very low-cost index is going to beat a majority of the amateur-managed money or professionally-managed money.”

The Four Legs of the Investment Stool

For DIY-ers (Do-It-Yourself-ers), you do not need to buy a stool – you can build it. There are many ways to build a stool, but these are the four crucial legs of investing that have saved my hide over my career, and can be added as support for your investment stool:

1.) Valuation: I love sustainable growth as much as anything, just as much as I would like a shiny new Ferrari. But there needs to be a reasonable price paid for growth, and paying an attractive or fair price for a marquis asset will improve your odds for long-term success.

“Valuations do matter in the stock market, just as good pitching matters in baseball.”

-Fred Hickey (High Tech Strategist)

2.) Cash Flows: Cash flows, and more importantly free cash flows (cash left over after money is spent on capital expenditures), should be investors’ metric of choice. Companies do not pay for dividends, share buybacks, and capital expenditures with pro forma earnings, or non-GAAP earnings. Companies pay for these important outlays with cash.

“In looking for stocks to buy, why do you put so much emphasis on free cash flow? Because it makes the most sense to me. My first job was at a little corner grocery store, and it seemed pretty simple. Cash goes into the register; cash comes out.”

-Bruce Berkowitz (The Fairholme Fund)

3.) Interest Rates: Money goes where it is treated best, so capital will look at the competing yields paid on bonds. Intuitively, interest factors also come into play when calculating the net present value of a stock. Just look at the low Price-Earnings ratios of stocks in the early 1980s when the Fed Funds reached about 20% (versus effectively 0% today). In the long run, higher interest rates (and higher inflation) are bad for stocks, but worse for bonds.

“I don’t know any company that has rewarded any bondholder by raising interest rates [payments] – unlike companies raising dividends.”

-Peter Lynch (Former manager of the Fidelity Magellan Fund)

4.) Quality: This is a subjective factor, but this artistic assessment is as important, if not more important than any of the previous listed factors. In searching for quality, it is best to focus on companies with market share leading positions, strong management teams, and durable competitive advantages.

“If you sleep with dogs, you’re bound to get fleas.”

-Old Proverb

These four legs of the investment stool are essential factors in building a strong investment portfolio, so during the next March Madness party you attend at the local sports bar, make sure to check the sturdiness of your bar stool – you want to make sure your assets are supported with a sturdy foundation.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in Fairholme, Ferrari, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Paper Cut to Death with 12b-1 Fees

Paying all these 12b-1 fees and other expenses found in the small-print can be a lot like getting paper-cut to death. The Securities and Exchange Commission (SEC) is looking to put a Band-Aid on the problem by capping these nonsensical fees and proposing more disclosure, albeit three decades after these fees initially got introduced. According to InvestmentNews, the SEC has proposed a .25 percent cap on 12b-1 fees, which may save investors upwards of $857 million per year if the proposal is enacted. That’s all good and great, but aren’t investors already getting pillaged and plundered with load expenses and other investment management fees?

The Original Rationale

The original thought process behind the 12b-1 fee movement was designed to allow the little guys (small fund management companies) to compete on an even playing field against the big guys (think of Fidelity, Vanguard, and the American Funds) when it came to product distribution. The SEC says about 2/3 of the 8,000 mutual funds in the industry charge 12b-1 fees, which reached over $13 billion in 2008. These 12b-1 fees generally account for 18% of the total annual fund expenses (ICI – Investment Company Institute).

So are small fund management companies truly benefitting from the customer kickbacks after 12b1-fees were unveiled in 1980? It appears the small fry fund companies have indeed scraped up some extra fees as ammo to market products against the big guys, but the big guys are receiving the same 12b-1 fees. It’s like giving both me and Alex Rodriguez (New York Yankees) an aluminum bat in the game of baseball. There’s a good chance I may be able to clear the infield now, but A-Rod will instantly have the power to hit one out of the stadium – I have effectively gained no advantage with my new metal bat.

The Investor Perspective

If I’m an investor, what do I care if my mutual fund company has one investor or one million investors? I just want the best products at the lowest price. Yeah, there are these special items used in other industries that help pay for marketing and distribution expenses…they’re called sales and profits. What a novel idea.

Deciphering all the mutual fund class flavors is tough enough. Like trading in a used car when buying a new car, the juggling of prices, fees, and taxes can become a head-spinning exercise in discovering the true component costs. The cards become even more stacked against investors, if you consider alternative products like the shady world of annuities (see Annuity Trap article). If translating 12b-1 and load fees is not challenging enough for you, try digesting a slice of legalese heaven by examining this 259 page annuity prospectus gem.

The Flawed Structure

Unfortunately, the financial industry is rife with conflicts and opacity, with the investor getting the short end of the stick. The industry’s main incentive is all about generating commissions for the broker (salesman) and financial institution – not about generating the best return for the client. Here is how I see a typical conversation playing out between a broker and prospect:

Broker A: “This is a slam dunk investment with guaranteed returns.”

Prospect XYZ: “Wow, that sounds great – guaranteed returns in a world that everyone is talking double-dip. How do I learn more?”

Broker A: “You can sign here on the dotted line, or borrow this forklift and take two months to review this gargantuan 259 page prospectus that I don’t even understand.”

Prospect XYZ: “If I have questions about 12b-1 fees, administrative fees, up-front commissions, management fees, mortality charges, trail expenses, or other costs, can I give you call?”

Broker A: “Oh sure, but I’ll probably be in the Bahamas drinking umbrella-coconut drinks with all the commission dollars I’ve earned, so if I don’t answer, just leave a message.”

Why do 12b-1 Fees Exist at All?

OK, now that I’ve returned from my annuity rant, let’s get back to the pointless value of 12b-1 fees. I mean honestly, what privileged status does the financial industry have in charging customers for a business’s operating expenses? Why stop at charging customers for marketing and distribution costs…maybe customers can start paying for new fund development expenses or for employee health benefits? What’s more, if the financial industry is going to nickel and dime clients with all kinds of fees, then why not have customers subsidize the marketing and advertising campaigns in other industries, like in the pharmaceutical, tobacco, beer, and junk food industries?

Not all 12b-1 fees are created equally. Many funds do not even carry 12b-1 fees, or many that do carry a much more modest punch. While I respect Mary Shapiro’s courage in addressing the useless 30-year 12b-1 fee structure institutionalized by industry lobbyists, putting a Band-Aid on this paper-cut is only hiding the wound, not healing it.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds and mutual funds, including Vanguard and Fidelity, but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

The Cindy Crawford Economy

Photo source: http://www.joyyoga.blogspot.com

I remember intently examining a few magazine covers that former supermodel Cindy Crawford adorned in my prime high school and collegiate years. Like our economy, the resultant recovery in 2009-2010 feels a little like a more mature version of Cindy Crawford (now 43 years old). Things look pretty good on the surface, but somehow people are more focused on pointing out the prominent mole, rather than appreciating the more attractive features. Many market commentators feel to be making similar judgments about the economy – we’re seeing nice-looking growth (albeit at a slowing pace) and corporations are registering exceptional results (but are not hiring). Even Ben Bernanke, our money-man superhero at the Federal Reserve, has underscored the “unusually uncertain” environment we are currently experiencing.

Certainly, the economy (and Cindy) may not be as sexy as we remember in the 1990s, but nonetheless constant improvement should be our main goal, regardless of the age or stage of recovery. Sure, Cindy chose cosmetic surgery while our government chose a stimulus (along with healthcare and financial regulatory reform) for its economic facelift. But the government must walk a fine line because if it continues to make poor decisions, our country could walk away looking like a scary, cosmetically altered version of Heidi Montag.

Our government in many ways is like Cindy Crawford’s former husband Richard Gere – if the Obama administration doesn’t play its cards right, the Democrats risk a swift divorce from their Congressional majority come this November – the same fate Richard suffered after a four year marriage with Cindy. Like a married couple, we need the federal government like a partner or spouse. Fortunately, our government has a system of checks and balances – if voters think Congress is ugly, they can always decide to break-up the relationship. Voters will make that decision in three months, just like Cindy and Richard voted to separate.

The Superpower Not Completely Washed Up

We may not have the hottest economy, but a few factors still make the equity markets look desirable:

- Corporate profit, margins, and cash levels at or near record levels. S&P profits are estimated to rise +46% in 2010.

- Interest rates are at or near record lows (Fed Funds effectively at 0% and the 10-Year Treasury Note at 2.74%).

- The stock market (as measured by the S&P 500 index) is priced at a reasonably alluring level of 13x’s 2010 profit forecasts and 12x’s 2011 earnings estimates.

Multiple Assets & Swapping

I don’t have anything against the institution of marriage (I’ve been happily married for thirteen years), but one advantage to the financial markets is that it affords you the ability to trade and own multiple assets. If a more mature Cindy Crawford doesn’t fit your needs, you can always swap or add to your current holding(s). For example, you could take more risk with a less established name (asset), for example Karolina Kurkova, or in the case of global emerging markets, Brazil. Foreign markets can be less stable and unpredictable (like Kate Moss), but can pay off handsomely, both from an absolute return basis and from a diversification perspective.

Money ultimately goes to where it is treated best in the long-term, so if Cindy doesn’t fit your style, feel free to expand your portfolio into other asset classes (e.g., stocks, bonds, real estate, commodities, etc.). Just be wary of stuffing all your money under the mattress, earning virtually nothing on your money – certainly Cindy Crawford is a much more appealing option than that.

Wade W. Slome, CFA, CFP®

P.S. For all women followers of Investing Caffeine, I will do my best to even the score, by writing next about the Marcus Schenkenberg economy.

Plan. Invest. Prosper.

*DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds (including those with exposure to Brazil and other emerging markets), but at the time of publishing SCM had no direct position in any other security directly referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Securing Your Bacon and Oreo Future

Stuffing money under the mattress earning next to nothing (e.g., 1.3% on a on a 1-year CD or a whopping 1.59% on a 5-year Treasury Note) may feel secure and safe, but how protected is that mattress money, when you consider the inflation eating away at its purchasing power?

We’ve all been confronted by older friends and family members proudly claiming, “When I was your age, (“fill in XYZ product here”) cost me a nickel and today it costs $5,000!” Well guess what…you’re going to become that same curmudgeon, except 20 or 30 years from now, you’re going to replace the product that cost a “nickel” with a “$15 3-D movie,” “$200 pair of jeans” and “$15,000 family health plan.” Chances are these seemingly lofty priced products and services will look like screaming bargains in the years to come.

The inflation boogeyman has been relatively tame over the last three decades. Kudos goes to former Federal Reserve Chairman Paul Volcker, who tamed out-of-control double-digit inflation by increasing short-term interest rates to 20% and choking off the money supply. Despite, the Bernanke printing presses smoking from excess activity, money has been clogged up on the banks’ balance sheets. This phenomenon, coupled with the debt-induced excess capacity of our economy, has led to core inflation lingering around the low single-digit range. Some even believe we will follow in the foot-steps of Japanese deflation (see why we will not follow Japan’s Lost Decades).

The Essentials: Oreos and Bacon

Even if you believe movie, jeans, and healthcare won’t continue inflating at a rapid clip, I’m even more concerned about the critical essentials – for example, indispensable items like Oreos and bacon. Little did you probably know, but according to ProQuest’s Historic newspaper database, a package of Oreos has more than quadrupled in price over the last 30 years to over $4.00 per package – let’s just say I’m not looking forward to spending $16.00 a pop for these heavenly, synthetic, hockey-puck-like, creamy delights.

Beyond Oreos, another essential staple of my diet came under intense scrutiny during my analysis. I’ve perused many an uninspiring chart in my day, but I must admit I experienced a rush of adrenaline when I stumbled across a chart highlighting my favorite pork product. Unfortunately the chart delivered a disheartening message. For my fellow pork lovers, I was saddened to learn those greasy, charred slices of salty protein paradise (a.k.a. bacon strips), have about tripled in price over a similar timeframe as the Oreos. Let us pray we will not suffer the same outcome again.

It’s Not Getting Any Easier

Volatility aside, investing has become more challenging than ever. However, efficiently investing your nest egg has never been more critical. Why has efficiently managing your investments become so vital? First off, let’s take a look at the entitlement picture. Not so rosy. I suppose there are some retirees that will skate by enjoying their fully allocated Social Security check and Medicare services, but for the rest of us chumps, those luxurious future entitlements are quickly turning to a mirage.

What the financial crisis, rating agency conflicts, Madoff scandal, Lehman Brothers bankruptcy, AIG collapse, Goldman Sachs hearings, FinReg legislation, etc. taught us is the structural financial system is flawed. The system favors institutions and penalizes the investor with fees, commissions, transactions costs, fine print, and layers of conflicts of interests. All is not lost however. For most investors, the money stuffed under the mattress earning nothing needs to be resourcefully put to work at higher returns in order to offset rising prices. Putting together a diversified, low-cost, tax-efficient portfolio with an investment management firm that invests on a fee-only basis (thereby limiting conflicts) will put you on a path of financial success to cover the imperative but escalating living expenses, including of course, Oreos and bacon.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

*DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in KFT, GS, Lehman Brothers, AIG (however own derivative tied to insurance subsidary), or any security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

WEBINAR: 10 Ways to Protect & Grow Your Nest Egg

If analyzing quarterly reports, managing a hedge fund/client accounts, teaching a course, writing a second book, and squeezing in a vacation is not enough, then why not try to squeeze in a webinar too? That’s exactly what I decided to do, so please join us on Friday (7/23 @ 12:30 p.m. PST) to learn about the critical 10 Ways to Protect and Grow Your Nest Egg in Uncertain Times.

Webinar Details:

—July 23, 2010 (Friday) at 12:30 p.m. – 1:30 p.m. (Pacific Standard Time)

CLICK HERE TO CONNECT TO WEBINAR

Toll Free # (if not using PC): 1-877-669-3239

Access Code: 800 505 230

Managing your investments has never been more difficult in this volatile and uncertain world we live in. With life expectancies increasing, and ambiguity surrounding the reliability of future financial safety nets (Social Security & Medicare), prudently investing your hard earned money to protect and grow your nest egg has never been this critical.

Invest in yourself and block off some time at 12:30 p.m. PST on July 23rd to educate yourself on the “10 Ways to Protect and Grow Your Nest Egg” in a relaxed webinar setting in front of your own computer.

CLICK HERE TO CONNECT TO WEBINAR

Toll Free # (if not using PC): 1-877-669-3239

Access Code 800 505 230

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

*DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct positions in any security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Kass: Triple Lindy Redux

About a year ago, I wrote about Doug Kass (founder and president of Seabreeze Partners) and his attempt at pulling off the famous “Triple Lindy” dive, which was made famous in the classic movie Back to School starring Rodney Dangerfield. If I were a judge, I would say Kass’s landing wasn’t a perfect 10, but rather closer to a 6.5. After successfully nailing the bear market in 2008, and subsequently declaring the “generational low” of March 2009, Kass became cautious in June 2009. At the time, Kass pulled in his horns by pronouncing a consumer-led double dip in late 2009 or in the first half 2010 from a consumption binge hangover, while declaring his previous 1050 S&P 500 index target as overly ambitious. What actually transpired is the S&P 500 went from around 942 to 1220 over the next ten months, or up about +30%.

Today, Kass is trying to make another large splash, but now he is reversing course and once more calling for a rally…at least a mini one. Rather than speaking in terms of his previous generational low (S&P 666), Kass sees the recent lows around 1,010 being the “bottom for the year” and his new 2010 target is based on climbing to positive territory for the year, implying a +10% to +12% move from the beginning of July.

View Doug Kass Interview and Prediction

View Doug Kass Interview and Prediction

Kass is not your traditional investor, and he admits as much:

“I’m not a perma-bear, I’m not a perma-bull. I try to be flexible and eclectic in my view, and this is especially necessary in a market, which is so volatile as it’s been for the last several years.”

In explaining his upbeat rationale, Kass highlights nuanced aspects to employment data, payroll growth, moderate economic expansion, and an attractive valuation for the overall market:

“I’m not technically based, therefore I’m not sentiment based, I’m fundamental based….The markets are traveling on a path of fear and share prices have significantly disconnected from fundamentals.”

Even if Kass didn’t nail the “Triple Lindy,” he still deserves special attention as a practitioner, in addition to his side job as a market prognosticator. Additional recognition is warranted solely based on the potshots he aimed at rent-a-strategists like Nouriel Roubini, CNBC celebrity, (see Roubini articles #1 or #2) and Robert Prechter, long-running technician who is currently predicting Dow destruction to unfathomable level of 1,000. I’m not in the business of predicting short-term market gyrations, but I’ll enjoy watching Kass’s next dive to see whether he’ll make a splash or not.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

*DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct positions in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.