Posts tagged ‘investing’

Passive vs. Active Investing: Darts, Monkeys & Pros

Bob Turner is founder of Turner Investments and a manager of several funds at the investment company. In a recent article he reintroduces the all-important, longstanding debate of active management (“hands-on”) versus passive management (“hands off”) approaches to investing. Mr. Turner makes some good arguments for the active management camp, however some feel differently – take for example Burton Malkiel. The Princeton professor theorizes in his book A Random Walk Down Wall Street that “a blindfolded monkey throwing darts at a newspaper’s stock page could select a portfolio that would do just as well as one carefully selected by experts.” In fact, The Wall Street Journal manages an Investment Dartboard contest that stacks up amateur investors’ picks against the pros’ and random stock picks selected by randomly thrown darts. In many instances, the dartboard picks outperform the professionals. Given the controversy, who’s right…the darts, monkeys, or pros? Distinguishing between the different categorizations can be difficult, but we will take a stab nevertheless.

Arguments for Active Management

Turner contends, active management outperforms in periods of high volatility and he believes the industry will be entering such a phase:

“Active managers historically have tended to perform best in a market in which the performance of individual stocks varies widely.”

He also acknowledges that not all active managers outperform and admits there are periods where passive management will do better:

“The reason why most active investors fail to outperform is because they in fact constitute most of the market. Even in the best of times, not all active managers can hope to outperform…The business of picking stocks is to some degree a zero-sum game; the results achieved by the best managers will be offset at least somewhat by the subpar performance of other managers.”

Buttressing his argument for active management, Turner references data from Advisor Perspectives showing an inconclusive percentage (40.5%-67.8%) of the actively managed funds trailing the passively managed indexes from 2000 to 2008.

The Case for Passive Management

Turner cites one specific study to support his active management cause. However, my experience gleaned from the vast amounts of academic and industry data point to approximately 75% of active managers underperforming their passively managed indexes, over longer periods of time. Notably, a recent study conducted by Standard & Poor’s SPIVA division (S&P Indices Versus Active Funds) discovered the following conclusions over the five year market cycle from 2004 to 2008:

- S&P 500 outperformed 71.9% of actively managed large cap funds;

- S&P MidCap 400 outperformed 79.1% of mid cap funds;

- S&P SmallCap 600 outperformed 85.5% of small cap funds.

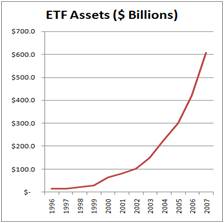

Read more about the dirty secrets shrinking your portfolio. According to the Vanguard Group and the Investment Company Institute, about 25% of institutional assets and about 12% of individual investors’ assets are currently indexed (passive strategies). If you doubt the popularity of passive investment strategies, then look no further than the growth of Exchange Traded Funds (ETFs – see chart), index funds, or Vanguard Groups more than $1 trillion dollars in assets under management.

Although I am a firm believer in passive investing, one of its shortcomings is mean reversion. This is the idea that upward or downward moving trends tend to revert back to an average or normal level over time. Active investing can take advantage of mean reversion, conversely passive investing cannot. Indexes can get very top-heavy in weightings of outperforming sectors or industries, meaning theoretically you could be buying larger and larger shares of an index in overpriced glamour stocks on the verge of collapse. We experienced these lopsided index weightings through the technology bubbles in the late 1990s and financials in 2008. Some strategies may be better than other over the long run, but every strategy, even passive investing, has its own unique set of deficiencies and risks.

Professional Sports and Investing

As I discuss in my book, there are similarities that can be drawn between professional sports and investing with respect to active vs. passive management. Like the scarce number of .300 hitters in baseball, I believe there are a select few investment managers who can consistently outperform the market. In 2007, AssociatedContent.com did a study that showed there were only 22 active career .300 hitters in Major League Baseball. I recognize in the investing world there can be a larger role for “luck,” which is difficult, if not impossible, to measure (luck won’t help me much in hitting a 100 mile per hour fastball thrown by Nolan Ryan). Nonetheless, in the professional sports arena, there are some Hall of Famers (prospects) that have proved they could (can) consistently outperform their peers for extended durations of time. Experience is another distinction I would highlight in comparing sports and investing. Unlike sports, in the investment world I believe there is a positive correlation between age and ability. The more experience an investor gains, generally the better long-term return achieved. Like many professions, the more experience you gain, the more valuable you become. Unfortunately, in many sports, ability deteriorates and muscles atrophy over time.

Size Matters

Experience alone will not make you a better investor. Some investors are born with an innate gift or intellect that propels them ahead of the pack. However, most great investors eventually get cursed by their own success thanks to accumulating assets. Warren Buffet knows the consequences of managing large amounts of dollars, “gravity always wins.” Having managed a $20 billion fund, I fully appreciate the challenges of investing larger sums of money. Managing a smaller fund is similar to navigating a speed boat – not too difficult to maneuver and fairly easy to dodge obstacles. Managing heftier pools of money can be like captaining a supertanker, but unfortunately the same rapid u-turn expectations of the speedboat remain. Managing large amounts of capital can be crippling, and that’s why captaining a supertanker requires the proper foresight and experience.

Room for All

As I’ve stated before, I believe the market is efficient in the long run, but can be terribly inefficient in the short-run, especially when the behavioral aspects of emotion (fear and greed) take over. The “wait for me, I want to play too” greed from the late 1990s technology craze and the credit-based economic collapse of 2008-2009 are further examples of inefficient situations that can be exploited by active managers. However, due to multiple fees, transaction costs, taxes, not to mention the short-term performance/compensation pressures to perform, I believe the odds are stacked against the active managers. For those experienced managers that have played the game for a long period and have a track record of success, I feel active management can play a role. At Sidoxia Capital Management, I choose to create investment portfolios that blend a mixture of passive and active investment strategies. Although my hedge fund has outperformed the S&P 500 in 4 of the last 5 years, that fact does not necessarily mean it’s the appropriate sole approach for all clients. As Warren Buffet states, investors should stick to their “circle of competence” so they can confidently invest in what they know. That’s why I generally stick to the areas of my expertise when I’m actively investing in stocks, and fill in the remainder of client portfolios with transparent, low-cost, tax-efficient equity and fixed income products (i.e., Exchange Traded Funds). Even though the actively managed Turner Funds appear to have a mixed-bag of performance numbers relative to passively managed strategies, I appreciate Bob Turner’s article for addressing this important issue. I’m sure the debate will never fully be resolved. In the meantime, my client portfolios will aim to mix the best of both worlds within active and passive management strategies in the eternal quest of outwitting the darts, monkeys, and other pros.

Read the full Bob Turner article on Morningstar.com

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds but had no direct position in stocks mentioned in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Investing, Housing, and Speculating

We all know there was a lot of speculation going on in the housing market during 2005-2007 as risk-loving adventurists loaded up on NINJA loans (No Income, No Job, and No Assets) and subprime CDS (Credit Default Swap) securities. But there is a different kind of speculation going on now, and it isn’t tied directly to housing. Instead of buying a house with no down payment and a no interest loan, speculators are leaping into other hazardous areas of danger. Like a frog jumping from lily pad to lily pad, speculators are now hopping around onto money-chasing industries, including biotech, social media, Bitcoin, and alternative energy.

As French novelist Jean-Baptise Alphonse Karr noted, “The more things change, the more they stay the same.” Irrespective of the painful consequences of the bubble-bursting aftermaths, human behavior and psychology addictively succumb to the ever-seductive emotion of greed. Over the last 15 years, massive fortunes have been gained and lost while chasing frothy financial dreams in areas like technology, housing, and gold.

Most get-rich-quick dream chasers have no idea of how to invest in or value a stock, but they sure know a good story when they hear one. Chasing top performing stocks is lot like jumping off a bridge – anyone can do it, and it feels exhilarating until you hit the ground. However, there is a better way to create wealth. Despite rampant speculation, most individuals understand the principles behind buying a house, which if applied to stocks, can make you a superior investor, and assist you in avoiding dangerous, speculative investments.

Here are some valuable housing insights to improve your stock buying:

#1.) Price is the Almighty Variable: Successful real estate investors don’t make their fortunes by chasing properties that double or triple in value. Buying a rusty tool shed for $1 million makes about as much sense as Facebook paying $19 billion (1,000 x’s the estimated 2013 annual revenues) for a money-losing company, WhatsApp. Better to buy real estate when there is blood in the street. Like the stock market, housing is cyclical. Many traders believe that price patterns are more important than the actual price. If squiggly, technical price moving averages (see Technical Analysis article) make so much money for stock-renting speculators, then how come day traders haven’t used their same crossing-lines and Point & Figure software in the housing market? Yes, it’s true that the real estate transactions costs and illiquidity can be costly for real estate buyers, but 6% load fees, lockup periods, 20% hedge fund fees, and 9% margin rates haven’t stopped stock speculators either.

#2). Cash is King: It doesn’t take a genius to purchase a rental property – I know because practically half the people I know in Southern California own rental properties. For example, if I buy a rental property for $1 million cash, is it a good purchase? Well, it depends on how much after-tax cash I can collect by renting it out? If I can only net $3,000 per month (3.6% annualized return), and be responsible for replacing roofs, fixing toilets, and evicting tenants, then perhaps I would be better off by collecting 6.5% from a low-cost, tax-efficient exchange traded real estate fund, without having to suffer from all the headaches that physical real estate investing brings. Forecasting future asset price appreciation is tougher, but the point is, understanding the underlying cash flow dynamics of a company is just as important as it is for housing purchases.

#3). Debt/Leverage Cuts in Both Directions: Adding debt (or leverage) to a housing or stock investment can be fantastic if prices go up, and disastrous if prices go down. Putting a 20% down payment on a $1 million house works out wonderfully, if the price of the house increases to $1.2 million. My $200,000 down payment is now worth $400,000, or up +100%. The same math works in reverse. If the price of the home drops to $800,000, then my $200,000 down payment is now worth $0, or down -100% (ouch). Margin debt on an equity brokerage account works in a similar fashion, but usually a 50% down payment is needed (less risky than real estate). That’s why I always chuckle when many real estate investors tell me they steer clear of stocks because they are “too risky”.

#4). Growth Matters: If you buy a home for $1 million, is it likely to be worth more if you add a kitchen, tennis court, swimming pull, third floor, and putting green? In short, the answer is yes. The same principle applies to stocks. All else equal, if a company based in Los Angeles, establishes new offices in New York, London, Beijing, and Rio de Janeiro, and then acquires a profitable competitor at a discounted price, chances are the company will be much more valuable after the additions. The key concept here is that asset values are not static. Asset valuations are impacted in both directions, whether we are talking about positive growth opportunities or negative disruptions.

Overall, speculatively chasing performance is tempting, but if you don’t want your financial foundation to crumble, then build your successful investment future by sticking to the fundamentals and financial basics.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold long positions in certain exchange traded funds (ETFs), but at the time of publishing SCM had no direct discretionary position in FB, Bitcoin, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Retirement Epidemic: Poison Now or Later?

We live in an instant gratification society. The house, the car, and annual vacation take precedence over contributions to retirement and savings accounts. It therefore comes as no surprise to me that Americans spend more time on planning for vacation than they do on planning for retirement.

Given the choice of spending or saving, Americans in large part choose, “spend now, save later.” Or in other words, Americans choose to drink $10 margaritas now (spend) and swallow the more expensive poison (save) later. Spending now and saving later sounds good in theory until you reach your mid-60s and realize you’re going to have to work as a Wal-Mart Stores (WMT) greeter into your 80s while eating cat food in your tent.

To make matters worse, you don’t have to be a genius to see irresponsible government spending and globalization has compromised the health of our countries entitlements (Social Security and Medicare). Benefits are likely to be reduced over time and age eligibility requirements are likely to increase. If you fold in the dynamic of exploding healthcare costs and broad-based inflationary pressures, one can quickly realize savings habits need to change. The traditional model of working for 40 years and then relying on a pension and Social Security payments to cover a blissful multi-decade retirement just doesn’t apply to current reality. On top of the disappearance of plump pensions, life expectancy is rising (around 80 years in the U.S.), so the realistic risk of outliving your savings has a larger probability of occurring.

Surely I am overly dramatizing the situation by sounding the investing alarm bells out of self-interest…right? Wrong. As a geeky, financial numbers guy, I can objectively rely on numbers, and the statistics aren’t pretty.

Here’s a sampling:

- Empty Savings Cupboard: A 2013 study by the Employee Benefit Research Institute found that nearly half of workers had less than $10,000 saved, and according to Blackrock Inc (BLK), CEO, Larry Fink, the average American has saved only $25,000 for retirement

- Food Stamp Living: Almost half of middle-class workers, will be forced into a poor retirement lifestyle, living on a food budget of about $5 a day.

- 401(k) Will Not Save the Day: Compared to other forms of savings, the average 401(k) balance reached $89,300 at the end of 2013 – that’s the good news. The bad news is that only about half of all companies offer their employees 401(k) benefits, and for the approximately 60 million people that participate, about a fourth withdraw these 401(k) funds before retirement – out of necessity or for frivolous reasons. Even if you cheerily accept the size of the average balance, sadly this dollar amount is still massively deficient in meeting retirement needs. It’s believed that your savings should approximate 15-20 times your annual retirement expenses that aren’t covered by outside sources of income, such as social security or a pension.

If these figures aren’t scary enough to get you saving more, then just use common sense and understand the future is very uncertain. A 2012 New York Times article sarcastically captured how easy it is to plan for retirement:

First, figure out when you and your spouse will be laid off or be too sick to work. Second, figure out when you will die. Third, understand that you need to save 7 percent of every dollar you earn. (30 percent of every dollar [if you are 55 now].) Fourth, earn at least 3 percent above inflation on your investments, every year. (Easy. Just find the best funds for the lowest price and have them optimally allocated.) Fifth, do not withdraw any funds when you lose your job, have a health problem, get divorced, buy a house or send a kid to college. Sixth, time your retirement account withdrawals so the last cent is spent the day you die.

What to Do?

The short answer is save! Simplistically, this can be achieved in one of two ways: cut expenses or raise income. I won’t go into the infinite ways of doing this, but adjusting your mindset to live within your means is probably the first necessary step for most.

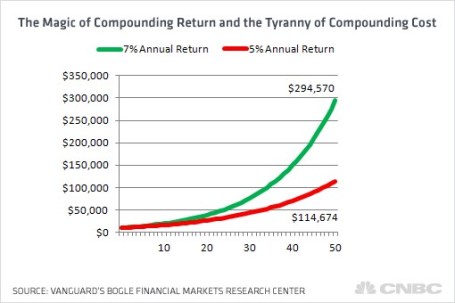

As it relates to your investments, fees should be your other major area of focus. The godfather of passive investing, Jack Bogle, highlighted the dramatic impact of fees on retirement savings. As you can see from the chart below, the difference between making 7% vs. 5% over an investing career by reducing fees can equate to hundreds of thousands of dollars, and prevent your nest egg from collapsing 2/3rd in value.

Lastly, if you are going to use an investment advisor, make sure to ask the advisor whether they are a “fiduciary” who legally is required to place your interests first. Sidoxia Capital Management is certainly not the only fiduciary firm in the industry, but less than 10% of advisors operate under this gold standard.

Investing and saving is a lot like dieting…easy to understand the concept but difficult to execute. The numbers speak for themselves. Rather than dealing with a crisis in your 70s and 80s, it’s better to take your poison now by investing, and reap the rewards of your hard work during your golden years.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold long positions in certain exchange traded funds (ETFs), and WMT, but at the time of publishing SCM had no direct discretionary position in BLK, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Controlling the Investment Lizard Brain

“Normal fear protects us; abnormal fear paralyses us.”

– Martin Luther King, Jr.

Investing is challenging enough without bringing emotions into the equation. Unfortunately, humans are emotional, and as a result investors often place too much reliance on their feelings, rather than using objective information to drive rational decision making.

What causes investors to make irrational decisions? The short answer: our “amygdala.” Author and marketer Seth Godin calls this almond-shaped tissue in the middle of our head, at the end of the brain stem, the “lizard brain” (video below). Evolution created the amygdala’s instinctual survival flight response for lizards to avoid hungry hawks and humans to flee ferocious lions.

Over time, the threat of lions eating people in our modern lives has dramatically declined, but the human’s “lizard brain” is still running in full gear, worrying about other fear-inducing warnings like Iran, Syria, Obamacare, government shutdowns, taxes, Cyprus, sequestration, etc. (see Series of Unfortunate Events)

When the brain in functioning properly, the prefrontal cortex (the front part of the brain in charge of reasoning) is actively communicating with the amygdala. Sadly, for many people, and investors, the emotional response from the amygdala dominates the rational reasoning portion of the prefrontal cortex. The best investors and traders have developed the ability of separating emotions from rational decision making, by keeping the amygdala in check.

With this genetically programmed tendency of constantly fearing the next lion or stock market crash, how does one control their lizard brain from making sub-optimal, rash investment decisions? Well, the first thing you should do is turn off the TV. And by turning off the TV, I mean stop listening to talking head commentators, economists, strategists, analysts, neighbors, co-workers, blogger hacks, newsletter writers, journalists, and other investing “wannabes”. Sure, you could throw my name into the list of people to ignore if you wanted to, but the difference is, at least I have actually invested real money for over 20 years (see How I Managed $20,000,000,000.00), whereas the vast majority of those I listed have not. But don’t take my word for it…listen or read the words of other experienced investors Warren Buffett, Peter Lynch, Ron Baron, John Bogle, Phil Fisher, and other investment titans (see also Sidoxia Hall of Fame). These investment legends have successful long-term investment track records and they lived through wars, recessions, financial crises, and other calamities…and still managed to generate incredible returns.

Another famed investor, William O’Neil, summed this idea nicely by adding the following:

“Since the market tends to go in the opposite direction of what the majority of people think, I would say 95% of all these people you hear on TV shows are giving you their personal opinion. And personal opinions are almost always worthless … facts and markets are far more reliable.”

The Harmful Consequence of Brain on Pain

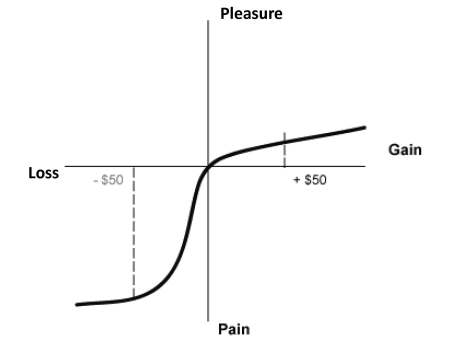

Besides forcing damaging decisions, another consequence of our lizard brain is its ability to distort reality. Behavioral economists Daniel Kahneman (Nobel Prize winner) and Amos Tversky through their research demonstrated the pain of $50 loss is more than twice as painful as the pleasure from $50 gain (see Pleasure/Pain Principle). Common sense would dictate our brains would treat equivalent scenarios in a proportional manner, but as the chart below shows, that is not the case:

Kahneman adds to the decision-making relationship of the amygdala and prefrontal cortex by describing the concepts of instinctual and deliberative choices in his most recent book, Thinking Fast and Slow (see Decision Making on Freeways).

Optimizing Risk

Taking excessive risks in technology stocks in the 1990s or in housing in the mid-2000s was very damaging to many investors, but as we have seen, our lizard brains can cause investors to become overly risk averse. Over the last five years, many people have personally experienced the ill effects of unwarranted conservatism. Investment great Sir John Templeton summed up this risk by stating, “The only way to avoid mistakes is not to invest – which is the biggest mistake of all.”

Every person has a different perception and appetite for risk. The optimal amount of risk taken by any one investor should be driven by their unique liquidity needs and time horizon…not a perceived risk appetite. Typically risk appetites go up as markets peak, and conservatism reaches a fearful apex near market bottoms – the opposite tendency of rational decision making. Besides liquidity and time horizon, a focus on valuation coupled with diversification across asset class (stocks/bonds), geography (domestic/international), size (small/large), style (value/growth) is critical in controlling risk. If you can’t determine your personal, optimal risk profile, then find an experienced and knowledgeable investment advisor to assist you.

With the advent of the internet and mobile communication, our brains and amygdala continually get bombarded with fearful stimuli, leading to disastrous decision-making and damaging portfolio outcomes. Turning off the TV and selectively choosing the proper investment advice is paramount in keeping your amygdala in check. Your lizard brain may protect you from getting eaten by a lion, but falling prey to this structural brain flaw may eat your investment portfolio alive.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Investors Feast While Bears Get Cooked

This article is an excerpt from a previously released Sidoxia Capital Management complementary newsletter (December 2, 2013). Subscribe on the right side of the page for the complete text.

As I ponder this year’s events with a notch-loosened belt after a belly-busting Thanksgiving gorging, I give thanks for my many blessings this year (see my last year’s Top 10). Investors in the stock market have had quite a feast in 2013 as well, while pessimistic bears have gotten cooked. Just this month, stock indexes reached all-time record highs (16,000 for the Dow Jones Industrial average and 1,800 for the S&P 500). Even the tech-heavy NASDAQ index surpassed 4,000 – a level not seen since 1999. How does this translate in percentage terms? Here’s what the stellar 2013 numbers looks like so far:

- Dow Jones: +22.8%

- S&P 500: +26.6%

- NASDAQ: +34.5%

These results demolish the near 0.0% returns earned on the sidelines, sitting on cash. And worth noting, these gains become even more impressive once you add dividends to the mix. To put these numbers into better perspective, it would take you more than a few decades of your lifetime to achieve this year’s stock gains, if your cash was invested at today’s CD and savings account rates.

For the bears, the indigestion has become even more unbearable if you consider the 2013 bloodbath in gold. The endless mantra of unsustainable QE (Quantitative Easing) hasn’t played out quite as the cynics planned this year (see also QE – Greatest Thing Since Sliced Bread):

- CBOE Gold Index (GOX): -51.5%

- SPDR Gold Shares (GLD): -25.5%

Bonds have been challenging too. Investors and Nervous Nellies have not been able to hide in longer-term Treasury bonds or broader bond indexes without some pain during 2013:

- iShares 20-Year Treasury Bond (TLT): -13.8%

- iShares Total U.S. Bond Market (AGG): -3.3%

As I’ve preached in the past, bonds have a place in most portfolios for income and diversification purposes, and many of my clients own them in their portfolios. But not all bonds are created equally. At Sidoxia (Sidoxia.com), we’ve smoothed out interest rate volatility and even recorded some gains by investing in specific classes of bonds such as short duration, floating rate, and convertible securities.

Why the Turkey High?

Since I invest professionally, inevitably the dinner table conversation switches from stuffing to stock market, or from pumpkin pie to politics. More often than not, the discussion reflects a tone such as, “This market is crazy! We’re due for a crash aren’t we?”

Without coming off as Pollyannaish, or offending anyone, I am quick to acknowledge I too am unhappy with Obamacare (my health insurance coverage was recently dropped due to the Affordable Care Act) and recognize that most politicians are bottom-feeders. Objectively, an argument can also be made by the doubters that a bubble is forming in a sub-segment of the market (see also Confusing Stock Bubbles). While the Yelps (YELP), Twitters (TWTR), and Teslas (TSLA) of the world may be dramatically inflated in price, there are plenty of attractively and reasonably priced areas of the market to opportunistically exploit.

Unfortunately, many people fail to recognize there are other factors besides politics and fad stocks that drive financial markets higher or lower. As the chart below shows (see also Conquering Politics & Hurricanes), the stock market has gone up and down regardless of party politics.

Source: Yardeni.com

Besides politics, there is an infinite number of other factors affecting financial markets. While Obamacare, Iran, Syria, 2014 elections, Federal Reserve QE tapering, etc. may account for many of the concerns du jour, there are other important factors driving stock prices higher.

Here are but a few:

- Record corporate profits

- Near record-low interest rates

- Improving fiscal deficit / debt situation relative to our economy

- Improving housing and jobs picture

- Reasonable stock valuations

- Low inflation / declining oil prices

The stock market feast has been exceptional, but even I acknowledge the pace of this year’s advance is not sustainable. Like an overloading of pie or an unnecessary, extra drumstick, we’re bound to experience another -10% correction, just like a common case of heartburn. For long-term investors however, fear of a temporary upset stomach is no reason to leave the investing dining table. Focusing only on the negatives and ignoring the positives may result in your investment portfolio getting cooked…just like the poor Thanksgiving turkey.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), Yelp (YELP), Twitter (TWTR), and Tesla (TSLA), but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Investing: Coin Flip or Skill?

The Sidoxia Monthly Newsletter will be released in a few days (subscribe on right side of the page), so here is an Investing Caffeine classic to tide you over until then:

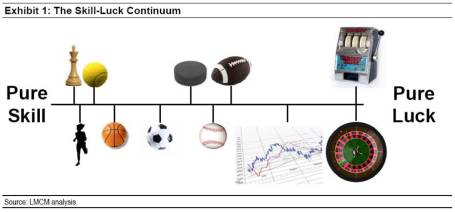

Everyone believes they are above-average drivers and most investors believe successful investing can be attributed to skill. Michael Mauboussin, author and Chief Investment Strategist at Legg Mason Capital Management, tackles the issue of how important a role luck plays in various professional activities, including investing (read previous IC article on Mauboussin) in his meaty 42-page thought piece, Untangling Skill and Luck.

Skill Litmus Test

Whenever someone becomes successful or a sports team wins, doubters often respond with the response, “Well, they are just lucky.” For some, the intangible factor of luck can be difficult to measure, but for Mauboussin, he has a simple litmus test to evaluate the level of skill and luck credited to a professional activity:

“There’s a simple and elegant test of whether there is skill in an activity: ask whether you can lose on purpose. If you can’t lose on purpose, or if it’s really hard, luck likely dominates that activity. If it’s easy to lose on purpose, skill is more important.”

Mauboussin uses various sports and games as tools to explain the relative importance that skill (or lack thereof) plays in determining an outcome. At one extreme end of the spectrum you have a brain game like chess, in which a skillful chess pro could beat an amateur 1,000 times in a 1,000 matches. In the field of professional sports, at the other end of the spectrum, Mauboussin hammers home the relative significance luck contributes in professional baseball:

“In major league baseball the worst team will beat the best team in a best-of-five series about 15 percent of the time.“

Here is a skill-luck continuum provided by Mauboussin:

Streaks vs. Mean Reversion

Mr. Mauboussin spends a great deal of time exploring the implications of skill and luck in relation to streaks and mean reversion. In the streak department, Mauboussin uses Joe DiMaggio’s record 56-consecutive game hitting stretch. He acknowledges the presence of luck, but skill is a prerequisite:

“Not all skillful performers have streaks, but all long streaks of success are held by skillful performers.”

When detailing streaks, Mauboussin may also be defending his fellow Legg Mason colleague Bill Miller (see Revenge of the Dunce), who had an incredible 15 consecutive year of besting the S&P 500 index before mean reverting back to lousy human-like returns.

This is a nice transition into his discussion about mean reversion because Mauboussin basically states this reversion concept dominates activities laden with luck (as shown in the Skill-Luck Continuum chart above). Time will tell whether Miller’s streak was due to skill, if he can put together another streak, or whether his streak was merely a lucky fluke. Unlike the judicial world, investment managers are often treated as guilty until proven innocent. For now, Miller’s 1991-2005 streak is being treated as luck by many in the investment community, rather than skill.

Nobel-prize winner Paul Samuelson may believe differently since he concedes the existence of skillful investing:

“It is not ordained in heaven, or by the second law of thermodynamics, that a small group of intelligent and informed investors cannot systematically achieve higher mean portfolio gains with lower average variabilities. People differ in their heights, pulchritude, and acidity. Why not their P.Q. or performance quotient?”

Peter Lynch’s +29% annual return from 1977-1990 is another streak on which historians can chew (read more on Lynch). I, like Samuelson, will give Lynch the benefit of the doubt.

Creating a Skillful Analytical Edge

Unlike the process of mowing lawns, in which more applied work time generally equates to more lawns cut (i.e., more profits), the investment world doesn’t quite work that way. Many people could work all day, stare at their screen for 23 hours, trade off of useless information, and still earn lousy returns. When it comes to investing, more work does not necessarily produce better results. Mauboussin’s prescription is to create an analytical edge. Here is how he describes it:

“At the core of an analytical edge is an ability to systematically distinguish between fundamentals and expectations.”

Thinking like a handicapper is imperative to win in this competitive game, and I specifically addressed this in my previous Vegas-Wall Street article. Steven Crist sums up this indispensable concept beautifully:

“There are no “good” or “bad” horses, just correctly or incorrectly priced ones.”

A disciplined, systematic approach will incorporate these ideas, however all good investors understand the good processes can lead to bad outcomes in the short-run. By continually learning from mistakes, and refining the process with a constant feedback loop, the investment process can only get better. On the other hand, schizophrenically reacting to an endless flood of ever-changing information, or fearfully chasing the leadership du jour will only lead to pain and sorrow. Fortunately for you, you have skillfully completed this article, meaning financial luck should now be on your side.

Read full Mauboussin article (Untangling Skill and Luck) here

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing, SCM had no direct position in any other security referenced in this article. Radio interviews included opinions of Wade Slome – not advice. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is the information to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

March Madness Brings Productivity Sadness

You feel that scratchy throat coming on? Taking a long lunch to discuss business? Has there been a death in the family? Don’t feel bad about calling in sick or being unproductive during March Madness, the multi-week annual NCAA college basketball tournament, because you are not alone. According to Challenger, Gray and Christmas, 3.0 million people plan to watch up to three hours of basketball games during work hours, costing companies and the economy at least $134 million in lost wages during the first two days of the tournament. What’s more, March Madness tends to attract other unproductive habits in the form of illegal gambling to the tune of $2.5 billion each year (source: FBI).

While I don’t have the time to spend hours filling out a 64-team bracket, I can’t do all the finger-pointing – I too participate in my fair share of unproductive lollygagging. I’ve been known to throw away hours of my time scrolling through my Twitter news feed (twitter.com/WadeSlome) or paging through my Flipboard timelines. Heck, if you really want to talk about unproductive, the President of the United States even filled out a bracket (click here) – so far, so good, but his Wisconsin pick didn’t help his cause.

If you need more proof of our country’s collective lack of productivity, then consider the following:

- Fantasy Fun: In 2008, there were 35 million people (mostly men) participating in fantasy football at a cost of $6.5 billion over a 17-week NFL season (source: Challenger, Gray and Christmas).

- The Juice: The 1995 O.J. Simpson verdict cost the country $480 million in lost output and the New York Stock Exchange trading volume plummeted by 41% during the half hour surrounding the reading of the verdict (source: Alan Dershowitz’s America on Trial).

- Shop until You Drop: “Cyber Monday” is one of the largest online shopping days of the year, which occurs shortly after Thanksgiving’s “Black Friday”. Workers wasted $488 million of their time in 2007, and that number has undoubtedly increased significantly since then (source: Challenger, Gray and Christmas).

- Summer Sport: In 2012, Captivate Network found out that workers watching the Summer Olympics at the office resulted in a productivity loss of $650 million.

- Hangover Hammer: Super Bowl Sunday is one of the largest alcohol consumption evenings of the year. The U.S. Center for Disease Control estimates that hangovers cost our nation about $160.5 billion annually.

- Social Media Profit Black Hole: Are you addicted to Facebook (FB), Twitter, LinkedIn (LNKD) or other social media network of choice? A report by LearnStuff shows that Americans spend as much time collectively on social media in one day as they do watching online movies in a year. The cost? A whopping 4.4% of GDP or $650 billion.

Investor Madness

One of the biggest black hole productivity drains for investors is the endless deluge of foreboding news items – each story potentially becoming the next domino to collapse the global economy. The most productive use of time is an offensive strategy focused on identifying the best investment opportunities that meet lasting financial objectives. Reading prospectuses, annual reports, and quarterly financial results may not be as sexy as scanning the latest Twitter-worthy headline, but detailed research and questioning goes a long way towards producing superior long-term returns.

On the other hand, news-driven fears that cause investment paralysis can cause irreparable damage. A counter greed-driven performance chasing strategy will lead to tears as well. It’s OK to read the newspaper in order to be informed about long term trends and economic shifts, but as Mark Twain says, “If you don’t read the newspaper, you are uninformed. If you do read the newspaper, you are misinformed.”

While March Madness may not be the most productive time of the year, when your sore throat clears or you get back from that late lunch, it behooves you to become more productive with your investment strategies. Picking the wrong investment players on your portfolio team may turn March Madness into investor sadness.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing SCM had no direct position in FB, LNKD, Twitter, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Damned if You Do, and More Damned if You Don’t

In the stock market you are damned if you do, and more damned if you don’t.

There are a million reasons why the market should or can go down, and the press, media, and bears come out with creative explanations every day. The “Flash Crash,” debt ceiling debate, credit downgrades, elections, and fiscal cliff were all credible events supposed to permanently crater the market. Now we have higher taxes (capital gains, income, and payroll), sequester spending cuts, and a nagging recession in Europe. What’s more, the pessimists point to the unsustainable nature of elevated corporate profit margins, and use the ludicrous Robert Shiller 10-year Price-Earnings ratio as evidence of an expensive market (see also Foggy Rearview Mirror). If an apple sold for $10 ten days ago and $0.50 today, would you say, I am not buying an apple today because the 10-day average price is too high? If you followed Robert Shiller’s thinking, this logic would make sense.

Despite the barrage of daily concerns and excuses, the market continues to set new record highs and the S&P 500 is up by more than +130% since the 2009 lows – just a tad higher than the returns earned on cash, gold, and bonds (please note sarcasm). Cash has trickled into equities for the first few months of 2013 after years of outflows, but average investors have only moved from fear to skepticism (see also Investing with the Sentiment Pendulum ). With cash and bonds earning next to nothing; gold underperforming for years; and inflationary pressures eroding long-term purchasing power, the vice is only squeezing tighter on the worrywarts.

Are there legitimate reasons to worry? Certainly, and the opportunities are not what they used to be a few years ago (see also Missing the Pre-Party). Although an endangered species, long-term investors understand backwards looking economic news is useless. Or as Peter Lynch wisely stated, “If you spend 13 minutes a year on economics, you’ve wasted 10 minutes.” The fact remains that the market is up 70% of the time, on an annual basis, and has been a great place to beat inflation over time. It’s a tempting endeavor to avoid the down markets that occur 30% of the time, but those who try to time the market fail miserably over the long-run (see also Market Timing Treadmill).

Equity investors would be better served by looking at their investment portfolios like real estate. Homeowners implicitly know the value of their home changes on a daily basis, but there are no accurate, real-time quotes to reference your home value on a minute by minute basis, as you can with stocks. Most property owners know that real estate is a cyclical asset class that is not impacted by daily headlines, and if purchased at a reasonable price, will generally go up in value over many years. Unfortunately, for many average investors, equity portfolios are treated more like gambling bets in Vegas, and get continually traded based on gut instincts.

Volatility is at six-year lows, and investors are getting less uncomfortable with owning stocks. Although everybody and their mother has been waiting for a pullback (myself included), don’t get too myopically focused. For the vast majority of investors, who should have more than a ten year time horizon, you should understand that volatility is normal and recessions will cause stocks to gown significantly, twice every ten years on average. If you are a long-term investor, like you should be, and you understand these dynamics, then you will also understand that you will be more damned if you don’t invest in equities as part of a diversified portfolio.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Sidoxia Debuts Video & Goes to the Movies

Article is an excerpt from previously released Sidoxia Capital Management’s complementary February 1, 2013 newsletter. Subscribe on right side of page.

The red carpet was rolled out for the stock market in January with the Dow Jones Industrial Average rising +5.8% and the S&P 500 index up an equally impressive +5.0% (a little higher rate than the 0.0001% being earned in bank accounts). Movie stars are also strutting their stuff down the red carpet this time of the year as they collect shiny statues at ritzy award shows like the Golden Globes and Oscars. Given the vast volumes of honors bestowed, we thought what better time to put on our tuxes and create our own 2013 nominations for the economy and financial markets. If you are unhappy with our selections, you are welcome to cast your own votes in the comments section below.

By award category, here are Sidoxia’s 2013 selections:

Best Drama (Government Shutdown & Debt Ceiling): Washington D.C. has provided no shortage of drama, and the upcoming blockbusters of Shutdown & Debt Ceiling are worthy of its Best Drama nomination. If Congressional Democrats and Republicans don’t vote in favor of a new “Continuing Resolution” by March 27th, then our United States government will come to a grinding halt. At issue is Republican’s desire for additional government spending cuts to lower our deficit, which is likely to exceed $1 trillion for the fifth consecutive year. If you like more heart pumping drama, the Senate has just passed a Debt Ceiling extension through May 18th…mark those calendars!

Best Horror Film (Sequestration): Most people have already seen the scary prequel, The Fiscal Cliff, but the sequel Sequestration deserves the horror film honors of 2013. This upcoming blood-filled movie about broad, automatic, across-the-board government cost cuts will make any casual movie-watcher scream in terror. The $1.2 trillion in spending cuts (over 10 years) are so gory, many viewers may voluntarily leave the theater early. If you are waiting for the release, Sequestration is coming to a theater near you on March 1st, unless Congress, in an unlikely scenario, cancels the launch.

Best Director (Ben Bernanke): Federal Reserve Chairman Ben Bernanke’s film, entitled, The U.S. Economy, had a massive budget of about $16 trillion dollars, based on estimates of last year’s GDP (Gross Domestic Product). Nevertheless, Bernanke managed to do whatever it took (including trillions of dollars in bond buying) to prevent the economic movie studio from collapsing into bankruptcy. While many movie-goers were critical of his directorial debut, inflation has remained subdued thus far, and he has promised to continue his stimulative monetary policies (i.e., keep interest rates low) until the national unemployment rate falls below 6.5% or inflation rises above 2.5%.

Best Foreign Film (China): Americans are not the only people who produce movies globally. A certain country with a population of nearly 1.4 billion people also makes movies too…China. In the most recently completed 4th quarter, China’s economy experienced blockbuster growth in the form of +7.9% GDP expansion. This was the fastest pace achieved by China in two whole years. To put this metric into perspective, compare China’s heroic growth to the bomb created by the U.S. economy, which registered a disappointing -0.1% contraction at the economic box office. China’s popularity should bring in business all around the globe.

Best Special Effects (Japan): After coming out with a series of continuous flops, Japan recently launched some fresh new special effects in the form of a $116 billion emergency stimulus package. The country also has plans to superficially enhance the visual portrayal of its economy by implementing its own faux money-printing program modeled after our country’s quantitative easing actions (i.e., the Federal Reserve stimulus). As a result of these initiatives, the Japanese Nikkei index – their equivalent of our Dow Jones Industrial index – has risen by +29% in less than 3 months to a level of 11,138.66 (click here for chart). But don’t get too excited. This same Nikkei index peaked at 38,957 in 1989, a far cry from its current level.

Best Action Film (Icahn vs. Ackman): This surprisingly entertaining action film features a senile 76-year-old corporate raider and a white-haired, 46-year-old Harvard grad. The investment foes I am referring to are the elder Carl Icahn, Chairman of Icahn Enterprises, and junior Bill Ackman, CEO of Pershing Square Capital Management. In addition to terms such as crybaby, loser, and liar, the 27-minute verbal spat (view more here) between Icahn (his net worth equal to about $15 billion) and Ackman (net worth approaching $1 billion) includes some NC-17 profanity. The clash of these investment titans stems from a decade-old lawsuit, in addition to a recent disagreement over a controversial short position in Herbalife Ltd. (HLF), a nutritional multi-level marketing firm.

Best Documentary (Europe): As with a lot of reality-based films, many don’t receive a lot of attention. So too has been the commentary regarding the eurozone, which has been relatively peaceful compared to last spring. Despite the comparative media silence, European unemployment reached a new high of 11.8% late last year. This European documentary is not one you should ignore. European Central Bank (ECB) President Mario Draghi just stated, “The risks surrounding the outlook for the euro area remain on the downside.”

Best Original Song (National Anthem): We won’t read anything politically into Beyonce’s lip-synced rendition of The Star-Spangled Banner at the presidential inauguration, but she is still worthy of the Sidoxia nomination because music we hear in the movies is also recorded. I’m certain her rapping husband Jay-Z agrees whole-heartedly with this viewpoint.

Best Motion Picture (Sidoxia Video): It may only be three minutes long, but as my grandmother told me, “Great things come in small packages.” I may be a little biased, but judge for yourself by watching Sidoxia’s Oscar-worthy motion picture debut:

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing SCM had no direct position in HLF, Japanese ETFs, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Fiscal Cliff: Will a 1937 Repeat = 2013 Dead Meat?

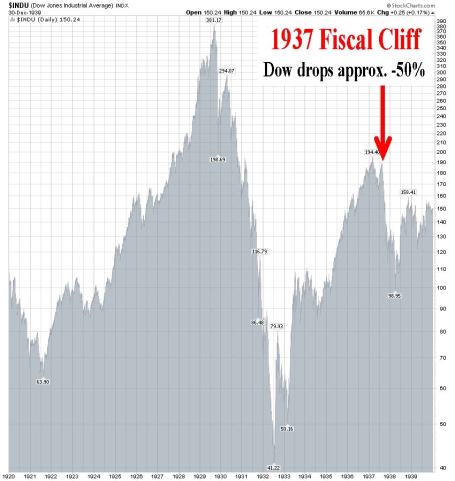

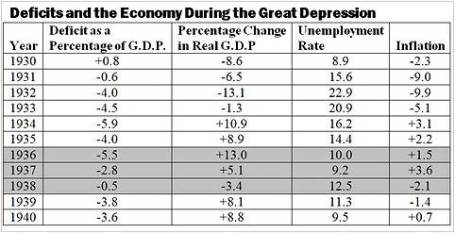

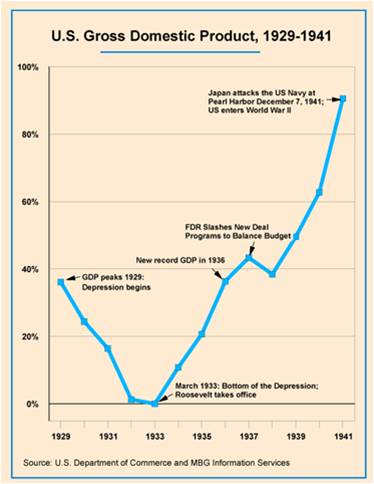

The presidential election is upon us and markets around the globe are beginning to factor in the results. More importantly, in my view, will be the post-election results of the “fiscal cliff” discussions, which will determine whether $600 billion in automated spending cuts and tax increases will be triggered. Similar dynamics in 1937 existed when President FDR (Franklin Delano Roosevelt) felt pressure to balance the budget after his 1933 New Deal stimulus package began to rack up deficits and lose steam.

What’s Similar Today

Just as there is pressure to cut spending today by Republicans and “Tea-Party” Congressmen, so too there was pressure for FDR and the Federal Reserve in 1937 to unwind fiscal and monetary stimulus. At the time, FDR thought self-sustaining growth had been restored and there was a belief that the deficits would become a drag on expansion and a source of future inflation. What’s more, FDR’s Treasury Secretary, Henry Morgenthau, believed that continued economic growth was dependent on business confidence, which in turn was dependent on creating a balanced budget. History has a way of repeating itself, which explains why the issues faced in 1937 are eerily similar to today’s discussions.

The Results

FDR was successful in dramatically reducing spending and significantly increasing taxes. Specifically, federal spending was reduced by -17% over two years and FDR’s introduction of a Social Security payroll tax contributed to federal revenues increasing by a whopping +72% over a similar timeframe. The good news was the federal deficit fell from -5.5% of GDP to -0.5%. The bad news was the economy went into a tail-spinning recession; the Dow crashed approximately -50%; and the unemployment rate burst higher by about +3.3% to +12.5%.

What’s Different This Time?

For starters, one difference between 1937 and 2012 is the level of unemployment. In 1937, unemployment was +14.3%, and today it is +8.1%. Objectively, today there could be higher percentage of the population “under-employed,” but nonetheless the job market was in worse shape back then and labor unions had much more power.

Another major difference is the stance carried by the Fed. Today, Ben Bernanke and the Fed have made it crystal clear they are in no hurry to take away any of the monetary stimulus (see Hekicopter Ben QE3 article), until we have experienced a long-lasting, sustainable recovery. Back in early 1937, the Fed increased banks’ reserve requirements twice, doubling the requirement in less than a year, thereby contracting monetary supply drastically.

Furthermore, we live in a much more globalized world. Today, central banks and governments around the world are doing their part to keep growth alive. Emerging markets are large enough now to move the needle and impact the growth of developed markets. For example, China, the #2 global superpower, continues to cut interest rates and has recently implemented a $158 billion infrastructure spending program.

Net-Net

Whether you’re a Republican or Democrat, everyone generally agrees that job creation is an important common objective, which is consistent with growing our economy. The disagreement between parties stems from the differing opinions on what are the best ways of creating jobs. From my perch, the frame of the debate should be premised on what policies and incentives should be structured to increase competitiveness. Without competitiveness there are no jobs. At the end of the day, money and capital are agnostic. Cold hard cash migrates to the countries in which it is treated best. And where the money goes is where the jobs go.

There is no single silver bullet to solve the competiveness concerns of the United States. Like baseball (since playoffs are quickly approaching), winning is not based solely on hitting, pitching, defense, or base-running. All of these facets and others are required to win. The same principles apply to our country’s competitiveness.

In order to be a competitive leader in the 21st century, here are few necessary areas in which we must excel:

Education: Chicago school unions have been in the news, and I have no problems with unions, if accountability can be structured in. Unfortunately, however, it is clear to me that for now our system is broken (a must see: Waiting for Superman). We cannot compete in the 21st century with an illiterate, uneducated workforce. Our colleges and universities are still top-notch, but as Bill Gates has stated, our elementary schools and high schools are “obsolete”.

Entitlements: Social safety nets like Social Security and Medicare are critical, but unsustainable promises that explode our debt and deficits will not make us more competitive. Politicians may gain votes by making promises in the short-run, but when those promises can’t be delivered in the medium-run or long-run, then those votes will disappear quickly. The sworn guarantees made to the 76 million Baby Boomers now entering retirement are a disaster waiting to happen. Benefits need to be reduced and or criteria need to be adjusted (i.e., means-testing, increase age requirements). The problems are clear as day, so Americans cannot walk away from this sobering reality.

Strategic Government Investment: – Government played a role in building our country’s railways, highways, and our military – a few strategic areas of our economy that have made our nation great. Thoughtful investments into areas like energy infrastructure (e.g., smart grid), internet infrastructure (e.g., higher speed super highway), and healthcare (e.g., human genome research) are a few examples of how jobs can be created while simultaneously increasing our global competitiveness. The great thing about strategic government investments is that government does NOT have to do all the heavy lifting. Rather than write all the checks and do all the job creation from Washington, government can implement these investments and create these jobs by providing incentives for the private sector. Strategic public-private partnerships can generate win-win results for government, businesses, and job seekers. If, however, you’re convinced that our government is more efficient than the private sector, then I highly encourage you to go visit your local DMV, post office, or VA to better appreciate the growth-sucking bureaucracy and inefficiency.

Taxes / Regulations / Laws: Taxes come from profits, and businesses create profits. In order to have a strong and competitive government, we need strong and competitive businesses. Higher taxes, excessive regulations, and burdensome laws will not create stronger and more competitive businesses. I acknowledge that reckless neglect and consumer exploitation will not work either, but reasonable protections for consumers and businesses can be instituted without multi-thousand page regulations. Reducing ridiculous subsidies and loopholes, while tightening tax collection processes and punishing tax dodgers makes perfect sense…so why not do it?

Politics are sharply polarized at both ends of the spectrum, but no matter who wins, our problems are not going away. We may or may not have a new president of the United States this November, but perhaps more important than the elections themselves will be the outcome of the “fiscal cliff” legislation (or lack thereof). If we want to maintain our economic power as the strongest in the world, solving this “fiscal cliff” is the key to improving our competiveness. Avoiding a messy 1937 (and 2011) political repeat will prevent us from becoming dead meat.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing SCM had no direct positions in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.