Posts tagged ‘housing’

Markets Soar and Investors Snore

This article is an excerpt from a previously released Sidoxia Capital Management complementary newsletter (August 1, 2013). Subscribe on the right side of the page for the complete text.

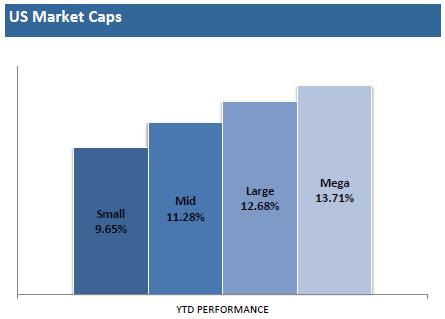

If you haven’t been paying close attention, or perhaps if you were taking a long nap, you may not have noticed that the stock market was up an astounding +5% in July (+78% if compounded annualized), pushing the S&P 500 index up +18% for the year to near all-time record highs. Wait a second…how can that be when that bald and grey-bearded man at the Federal Reserve has hinted at bond purchase “tapering” (see also Fed Fatigue)? What’s more, I thought the moronic politicians were clueless about our debt and deficit-laden economy, jobless recovery, imploding eurozone, Chinese real estate bubble, and impending explosion of inflation – all of which are expected to sink our grandchildren’s grandchildren into a standard of living not seen since the Great Depression. Okay, well a dash of hyperbole and sarcasm never hurt anybody.

This incessant stream of doom-and-gloom pouring over our TVs, newspapers, and internet devices has numbed Americans’ psyches. To prove my point, the next time you are talking to somebody at the water cooler, church, soccer game, or happy hour, gauge how excited your co-worker, friend, or acquaintance gets when you bring up the subject of the stock market. If my suspicions are correct, they are more likely to yawn or pass out from boredom than to scream in excitement or do cartwheels.

You don’t believe me? Reality dictates the wounds from the 2008-2009 financial crisis are still healing. Panic and fear may have disappeared, but skepticism remains in full gear, even though stocks have more than doubled in price in recent years. Here is some data to support my case there are more stock detractors than defenders:

Record Savings Deposits

|

| Source: Calafia Beach Pundit |

Although there are no signs of an impending recession, defensive cash hoarded in savings deposits has almost increased by $3 trillion since the end of the financial crisis.

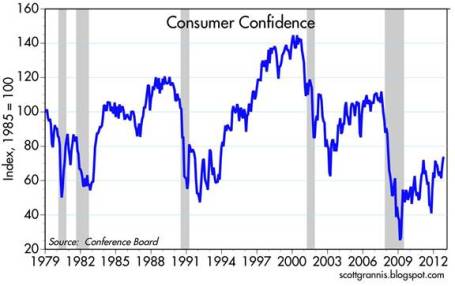

Blah Consumer Confidence

|

| Source: Calafia Beach Pundit |

As you can see from the chart above, Consumer Confidence has bounced around quite a bit over the last 30+ years, but there is no sign that consumer sentiment has turned euphoric.

15-Year Low Stock Market Participation

|

|

Source: Gallup Poll

|

There has been a trickling of funds into stocks in 2013, yet participation in the stock market is at a 15-year low. Investors remain nervous.

Lack of Equity Fund Buying

|

| Source: ICI & Calafia Beach Pundit |

After a short lived tax-driven purchase spike in January, the buying trend quickly turned negative in the ensuing months. Modest inflows resumed into equity funds during the first few weeks of July (source: ICI), but the meager stock fund investments represent < 95% of 2012 positive bond flows ($15 billion < $304 billion, respectively). Moreover, these modest stock inflows pale in comparison to the hundreds of billions in investor withdrawals since 2008. See also Fund Flows Paradox – Investing Caffeine.

Decline in CNBC Viewership

In spite of the stock market more than doubling in value from the lows of 2009, CNBC viewer ratings are the weakest in about 20 years (source: Value Walk). Stock investing apparently isn’t very exciting when prices go up.

The Hater’s Index:

And if that is not enough, you can take a field trip to the hater’s comment section of my most recent written Seeking Alpha article, The Most Hated Bull Market Ever. Apparently the stock market more than doubling creates some hostile feelings.

JOLLY & JOVIAL MEMO

Keeping the previous objective and subjective data points in mind, it’s clear to me the doom-and-gloom memo has been adequately distributed to the masses. Less clear, however, is the dissemination success of the jolly-and-jovial memo. I think Ron Bailey, an author and science journalist at Reason.com (VIDEO), said it best, “News is always bad news. Good news is simply not news…that is our [human] bias.” If you turn on your local TV news, I think you may agree with Ron. Nevertheless, there are actually plenty of happier news items to report, so here are some positive bullet points to my economic and stock market memo:

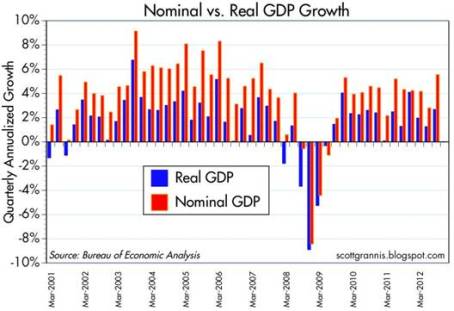

16th Consecutive Positive GDP Quarter*

|

| Source: Quartz.com |

The broadest measure of economic activity, GDP (Gross Domestic Product), was reported yesterday and came in better than expected in Q2 (+1.7%) for the 16th straight positive reported quarter (*Q1-2011 was just revised to fractionally negative). Obviously, the economists and dooms-dayers who repeatedly called for a double-dip recession were wrong.

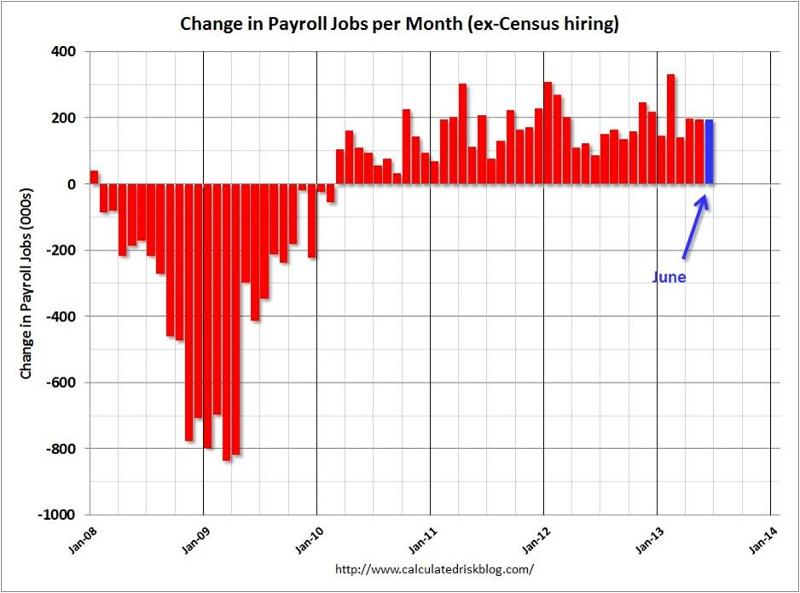

40 Consecutive Months & 7 Million Jobs

Source: Calculated Risk

The economic recovery has been painfully slow, but nevertheless, the U.S. has experienced 40 consecutive months of private sector job additions, representing +7.2 million jobs created. With about -9 million jobs lost during the most recent recession, there is still plenty of room for improvement. We will find out if the positive job creation streak will continue this Friday when the July total non-farm payroll report is released.

Housing on the Mend

|

| Source: Calafia Beach Pundit |

New home sales are up significantly from the lows; housing starts have risen about 40% over the last two years; and Case Shiller home prices rose by +12.2% in the latest reported numbers. The housing market foundation is firming.

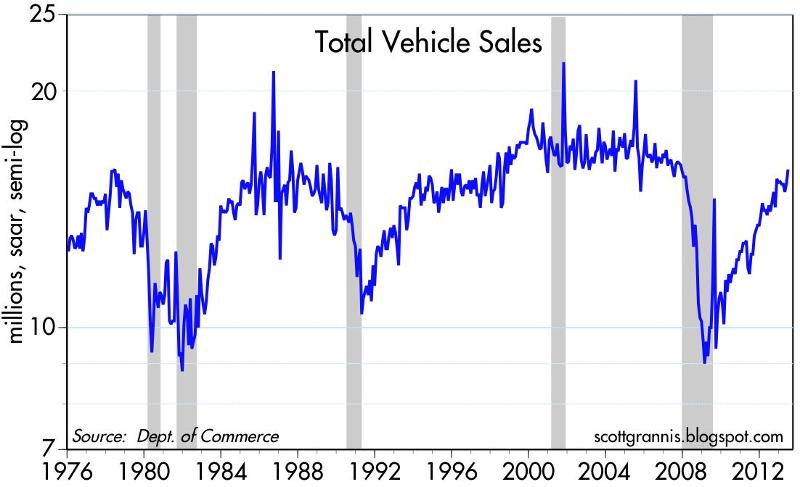

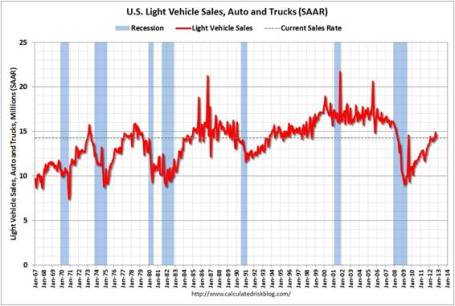

Auto Sales Rebound

|

| Source: Calafia Beach Pundit |

Auto sales remain on a tear, reaching an annualized level of 15.9 million vehicles, the highest since November 2007, and up +12% from June 2012. Car sales have almost reached pre-recessionary levels.

Record Corporate Profits

|

| Source: Dr. Ed’s Blog |

Optimistic forecasts have been ratcheted down, nonetheless corporate profits continue to grind to all-time record highs. As you can see, operating earnings have more than doubled since 2003. Given reasonable historical valuations in stocks, as measured by the P/E (Price Earnings) ratio, persistent profit growth should augur well for stock prices.

Bad Banks Bounce Back

Europe on the Comeback Trail

|

| Source: Calafia Beach Pundit |

There are signs of improvement in the Eurozone after years of recession. Talks of a European Armageddon have recently abated, in part because of Markit manufacturing manager purchasing statistics that are signaling expansion for the first time in two years.

Overall, corporations are achieving record profits and sitting on mountains of cash. The economy is continuing on a broad, steady recovery, however investors remain skeptical. Domestic stocks are at historic levels, but buying stocks solely because they are going up is never the right reason to invest. Alternatively, bunkering away excessive cash in useless, inflation depreciating assets is not the best strategy either. If nervousness and/or anxiety are driving your investment strategy, then perhaps now is the time to create a long-term plan to secure your financial future. However, if your goal is to soak up the endless doom-and-gloom and watch your money melt away to inflation, then perhaps you are better off just taking another nap.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing, SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Lily Pad Jumping & Term Paper Cramming

Article is an excerpt from previously released Sidoxia Capital Management’s complementary December 3, 2012 newsletter. Subscribe on right side of page.

Over the last year, investors’ concerns have jumped around like a frog moving from one lily pad to the next. From the debt ceiling debate to the European financial crisis, and then from the presidential election to now the “fiscal cliff.” With the election behind us (Obama winning 332 electoral votes vs 206 for Romney; and Obama 50.8% of the popular vote vs 47.5% for Romney), the frog’s bulging eyes are squarely focused on the fiscal cliff. For the uninformed frogs that have been swimming underwater, the fiscal cliff is the roughly $600 billion in automatic tax hikes and spending cuts that are scheduled to be triggered by the end of this year, if Congress cannot come to some type of agreement (for more fiscal cliff information see videos here). The mathematical consequences are clear: Congress + No Deal = Recession.

While political brinksmanship and theater are nothing new, the explosive amount of data is something new. In our mobile world of 6 billion cell phones (more than the number of toothbrushes on our planet) and trillions of text messages sent annually, nobody can escape the avalanche of global data. Google (GOOG), Facebook (FB), Twitter, and millions of blogs (including this one) didn’t exist 15 years ago, therefore fiscal boogeymen like obscure Greek debt negotiations and Chinese PMI figures wouldn’t have scared pre-internet generations underneath their beds like today’s investors. The fact of the matter is our country has triumphed over plenty of significant issues (many of them scarier than today’s headlines), including wars, assassinations, currency crises, banking crises, double digit inflation, SARS, mad cow disease, flash crashes, Ponzi schemes, and a whole lot more.

Although today’s jumpy investors may worry about the lily pads of a double-dip recession in the US, a financial meltdown in Europe, and/or a hard landing in China, fiscal frogs will undoubtedly be worried about different lily pads (concerns) twelve months from now. This may not be an insightful observation for day traders, but for the other 99% of investors, taking a longer term view of the daily news cycle may prove beneficial.

Fiscal Cliff Term Paper Due on Friday December 21st

As a college student, chugging Jolt Cola, in combination with a couple dosages of NoDoz, was part of the routine procrastination process the day before a term paper was due. Apparently Congress has also earned a PhD in procrastination, judging by the last minute conclusion of the debt ceiling negotiations last summer. There are only a few more weeks until politicians break for the Christmas holiday break, therefore I am setting an Investing Caffeine mandated fiscal cliff due date of December 21st. Could Congress turn in its term paper early? Anything is possible, but unfortunately turning in the assignment early is highly unlikely, especially when politically bashing your opponent is perceived as a better re-election tactic compared to bipartisan negotiation.

A higher probability scenario involves Americans stuck listening to Nancy Pelosi, Harry Reid, John Boehner, and Mitch McConnell on a daily basis as these politicians finger-point and call the other side obstructionists. While I’m not alone in believing a deal will ultimately get done before Christmas, how credible and substantive the announcement will be depends on whether the politicians seriously face entitlement and tax reforms. Regardless, any deal announced by Investing Caffeine’s December 21st due date will likely be received well by the market, as long as a framework for entitlement and tax reform is laid out for 2013.

Frog News Bites

Source: Photobucket

GDP Revised Higher: Despite all the gloom and uncertainties, the barometer of the economy’s health (i.e., Real Gross Domestic Product), was revised higher to 2.7% growth for the third quarter (from 2.0%). Nominal growth, a related measurement that includes inflation, reached a five-year high of 5.55%. In the wake of Superstorm Sandy, which caused upwards of $50 billion in damage, fourth quarter GDP numbers are likely to be artificially depressed. The silver lining, however, is first quarter 2013 figures may get an economic boost from reconstruction efforts.

Source: Calafia Beach Pundit

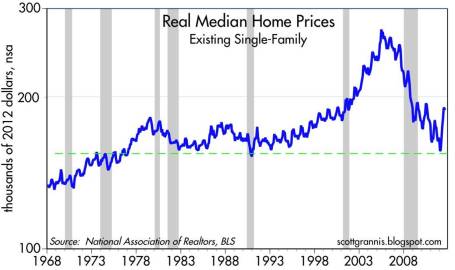

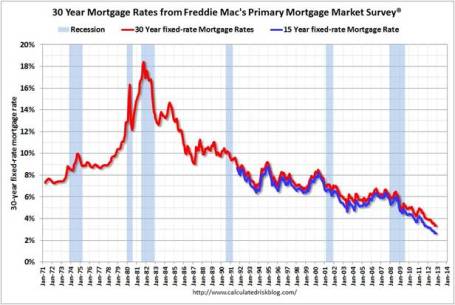

Housing Recovery Continues: Buoyed by record low interest rates (30-yr fixed mortgages < 3.5%), housing sales and prices continue on an upward trajectory. New home sales came in at 368,000 in October, below expectations, but sales are still up around +20% from 2011 (Calculated Risk).

Source: Calculated Risk

Confidence Still Low but Climbing: The recently reported consumer confidence figures reached the highest level in more than four years, but as Scott Grannis highlights, this is nothing to write home about. These current confidence levels match where we were during the 1990-91 and 1980-82 recessions.

Source: Calafia Beach Pundit

Car Sales Picking Up: Fiscal cliff discussions haven’t discouraged consumers from buying cars. As you can see from the chart below, car and truck sales reached 14.3 million annualized units in October. November sales are expected to rise about +13% on a year-over-year basis, reaching approximately 15.3 million units.

Source: Calculated Risk

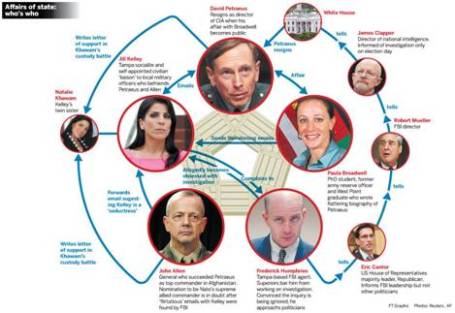

CIA Chief Fired in Sex Scandal: If you didn’t get enough of the Lindsay Lohan bar brawl dirt in New York, never fear, there was plenty of salacious details emanating from Washington DC this month. A complicated web of Florida socialites, a biographer, email chains, and a bare-chested FBI agent led to the firing of CIA director David Petraeus.

Source: The Financial Times

Death to Twinkies: After lining stomachs with golden cream-filled cakes for more than 80+ years, Hostess Brands was forced to halt production of Twinkies, Ding Dongs, and Ho Hos. Negotiations with union bakers crumbled, which led to Hostess Brands’ Chapter 7 bankruptcy and liquidation proceedings. My financial brain understands, but my sweet tooth is still grieving (see also Twinkie Investing).

Source: Photobucket

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing SCM had no direct positions in FB, Twitter or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Autumn, Elections and Replacement Refs

Article is an excerpt from previously released Sidoxia Capital Management’s complementary October 1, 2012 newsletter. Subscribe on right side of page.

As September has come to a close, the grand finale of our annual seasons has commenced… autumn. How do we know autumn is here? Well, for starters, the leaves are changing colors; the weather is about to cool; and the NFL replacement referees are watching Sunday football games from their couches.

While 2012 is split into quarters, football games and investment seasons are also divided into four quarters. Right now, the economic fourth quarter has just started and the home team is winning. As we can see from the stock market scoreboard, the S&P 500 index is up +15% this year (+6% in Q3) and the NASDAQ index has catapulted +20% through September (+6% also in Q3). The U.S. home team is winning, but a fumble, blocked kick, or interception could mean the difference between an exciting win and a devastating loss.

Another game divided into four parts is the game of presidential politics. However, presidential elections are divided into four years – not four quarters. Five weeks from now, we’ll find out if our Commander in Chief Obama will get to lead our team for another game lasting four years, or whether backup quarterback Mit Romney will be called into the game. The fans are getting restless due to anemic growth and lingering joblessness, but for now, the coach is keeping the president in the starting lineup. Both President Obama and Governor Romney will take some head-to-head practice snaps against each other in the first of three scheduled presidential debates beginning this week.

Bernanke Changes Rules

The New York Jets have Tim Tebow for their secret weapon (1 for 1 yesterday!), and the United States economy has Ben Bernanke. Although our home team may be winning, it has required some monetary rule-changing policies to be instituted by Federal Reserve Chairman Ben Bernanke to keep our team in the lead. Just a few weeks ago, Mr. Bernake instituted QE3 (3rd round of quantitative easing), which is an open-ended mortgage buying program designed to lower home buying interest rates and stimulate the economy (see Helicopter Ben to QE3 Rescue). The short-term benefits of the $40 billion monthly bond buying binge are relatively clear (lower borrowing costs for homebuyers), but the longer-term costs of inflation are stewing patiently on the backburner.

As you can see from the chart above, August median home prices are up +10% for existing single-family homes over the last year. Housing affordability is at extremely attractive levels, and although the bank loan purse strings are tight, a modest loosening is beginning to unfold.

Economy Playing Injured

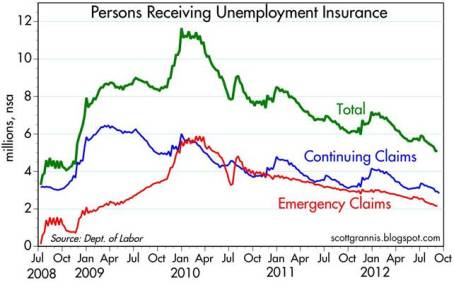

Our starters may still be playing, but many are injured, just like the jobless are limping through the employment market. Encouragingly, although unemployment remains stubbornly high, the number of people collecting unemployment checks is a lot lower (-1.25 million fewer than a year ago). Not great news, but at least we are hobbling in the right direction (see chart below).

Time for Fiscal Cliff Hail Mary?

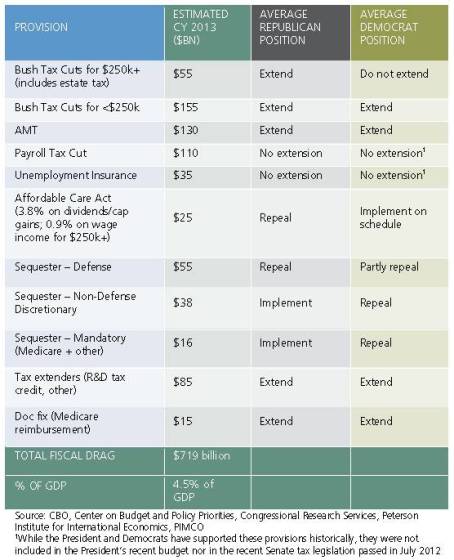

If a team is losing at the end of a game, a “Hail Mary” pass might be necessary. We are quickly nearing this fiscal Armageddon situation as the approximately $700 billion “fiscal cliff” (a painful combo of spending cuts and tax hikes) kicks in at the end of the year (see PIMCO chart below via The Reformed Broker).

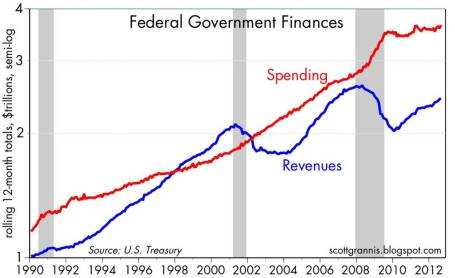

Running trillion dollar deficits in perpetuity is not a sustainable strategy, so for most people, a combination of spending cuts and/or tax hikes makes sense to narrow the gap (see chart below). Last year’s recommendations from the bipartisan Simpson-Bowles commission, which were ignored, are not a bad place to start. What happens in the lame-duck session of Congress (after the elections) will dramatically impact the score of the current economic game, and decide who wins and who loses.

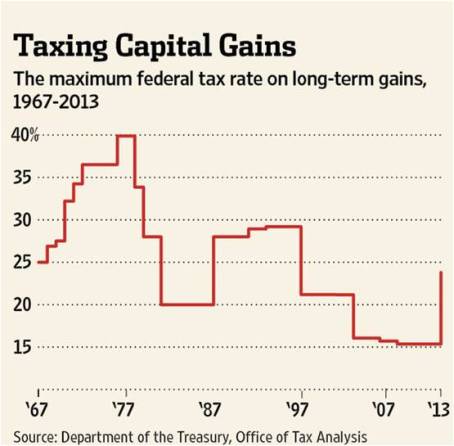

Heated debates continue on how the gap between expenses and revenues will be narrowed, but regardless, Democrats will continue to push for capital gains tax hikes on the rich (see tax chart below); and the Republicans will push to cut spending on entitlements, including untenable programs like Medicare and Social Security.

The game is not quite over, but the fourth quarter promises to be a bloody battle. So while the replacement refs may be back at home, the experienced returning refs have been known to blow calls too. Let’s just hope that autumn, the season of bounteous fecundity, ends up being a continued trend of sweet market success, rather than a political period of botched opportunities.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing SCM had no direct positions in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

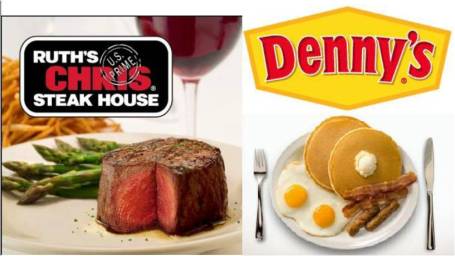

Paulson Funds: From Ruth’s Chris’s to Denny’s

Investing in hedge funds is similar to eating at a high-priced establishment like Ruth’s Chris’s (RUTH) – not everyone can eat there and the prices are high. In dining terms, John Paulson, President of Paulson & Co. (approximately $34 billion in assets under management), may be considered the managing chef of the upper-crust restaurant. But rather than opening the doors of his funds to an elite few, Paulson is now making his select strategies available to the masses through a much more affordable structure. Or in other words, Paulson is opening an investing version of Denny’s (DENN), in addition to his Ruth’s Chris, so a broader set of investors can buy into his funds at a reasonable price.

Hedge funds typically are reserved for pension funds, endowments, wealthy individuals, or so-called “accredited investors” – individuals earning $200,000 annually, couples earning $300,000, or people with a net worth greater than $1,000,000. By using alternate structures, Paulson will be able to bypass the accredited investor regulatory requirements and reach a more expansive audience.

UCITS Added as a New Item on the Menu

How exactly is Paulson opening his hedge fund strategies to the broader public on a Denny’s menu? He is assembling what is called a “Ucits” structure (Undertakings for Collective Investments in Transferable Securities). These investment vehicles, adopted in 1985, resemble mutual funds and are domiciled in Europe. Although Ucits have been used by relatively few hedge fund managers, Paulson is not the first to institute them (York Capital, Highbridge Capital Management, BlueCrest Capital, and AHL are among the others who have already taken the plunge). According to the Financial Times, Paulson’s Ucits funds will launch later this year. Part of the reason this structure was chosen over others is because the regulations associated with these structures are expected to be less stringent than other onerous regulations currently being discussed by the European Union.

Will the Investing Mouths be Fed?

Should this move by Paulson be surprising? Perhaps Andy Warhol’s quote about everyone being famous for 15 minutes is apropos. Paulson’s $15 billion subprime housing profits in 2007 (read The Greatest Trade Ever) were a handsome reward and now he is attempting to further his wealth position based on this notoriety. Do I blame him? No, not at all, but time will tell if he will be viewed as a one-hit wonder, or whether his subprime bet was only an opening act. More recently, Paulson has been vocal about his seemingly peculiar combination of bullish wagers on gold and California real estate, which he sees rising in price by +20% in 2010 (see Paulson on California home rally). With his optimistic outlook on the U.S. markets and economy, his gold play apparently is riding on the expectation of a future inflation flare up, not another financial meltdown, which was the catalyst that catapulted gold prices higher in late 2008 and throughout 2009.

I’m not sure how many domestic investors will participate in these Ucits investments, however I am eager to see the prospectuses associated with the funds. Like most hedge funds, caution should be used when investing in these types of vehicles, and should only be used as a part of a broadly diversified investment portfolio. For most investors, my guess is the Paulson funds will have an attractive price of entry (i.e., availability), much like a Denny’s restaurant, but the quality and fee structure may be as desirable as a $5.99 greasy steak and pile of gravy-covered mash potatoes.

Read the Entire Financial Times Article on Paulson’s Ucits Launch

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

*DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct positions in RUTH, DENN, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Decade in Review

We laughed, we cried, we kissed another ten years goodbye. It is virtually impossible to cram ten years into one article, nonetheless I will attempt to chronicle some of the central and silly events that bubble up in my memory bank.

2000

- Technology-heavy NASDAQ index peaks at 5,132 before completing its -78% decline by late 2002.

- Y2K (Year 2000) fears do not materialize and technology orders begin downward slide.

- AOL buys Time Warner for $164 Billion in hopes of converging media and internet worlds.

- Al Gore Democratic nominee for the Presidency wins popular vote but loses election to George Bush after effort for Florida recount fails.

- Elian Gonzalez, six-year old boy returned to Cuba.

- Reality TV show Survivor finishes first season with Richard Hatch winning prize.

2001

- Apple introduces iPod digital music player.

- Enron files Chapter 11 bankruptcy.

- Wikipedia online community encyclopedia launches.

- 9/11 attacks occur pushing economy further down.

- Alan Greenspan starts 1st of 11 rate cuts in 2001.

- China joins WTO (World Trade Organization).

2002

- Severe Acute Respiratory Syndrome (SARS), an atypical form of pneumonia, rears its ugly head in the Guangdong Province of China.

- SEC files charges against WorldCom and Tyco international in connection with accounting irregularities

- United Airlines files for bankruptcy.

- American Idol television singing contest begins first season.

- Guantanomo Bay detention camp is opened.

2003

- Federal Funds rate reaches a 45 year low at 1.00% – fuel for future credit bubble.

- $350 billion in tax cuts approved, spanning a ten year period.

- Iraqi Gulf War II commences with “shock and awe” military campaign.

- Space Shuttle Columbia disintegrates upon attempted reentry into the Earth’s atmosphere.

- Broad stock market recovery (>90% of stocks in S&P500 climb), including a +50% rise in the NASDAQ index.

- Martha Stewart indicted for using privileged investment information and then obstructing a federal investigation.

- Arnold Schwarzenegger, movie star, becomes governor of California.

2004

- Google (GOOG) goes public with IPO at $85 per share.

- Mark Zuckerberg unveils Facebook and people begin “friending” each other.

- Comcast makes failing unsolicited bid for Disney. K-Mart buys Sears with aid of Eddie Lampert

- Ronald Reagan, 40th President, dies at 93.

- Janet Jackson and Justin Timberlake experience “wardrobe malfunction” on Super Bowl halftime show.

- Boston Red Sox win their first World series since 1918.

2005

- P&G announces $57 billion acquisition of Gillette. Conoco Philips buys Burlington Resources for over $30 billion. Bank of America buys credit card company MBNA.

- Ben Bernanke is nominated as new Federal Reserve Chairman.

- Hurricane Katrina overwhelms New Orleans as 80% of city becomes covered with water.

- North Korea announces its nuclear weapons arsenal.

- YouTube starts sharing online videos before Google Inc. eventually buys company.

- Lance Armstrong wins 7th consecutive Tour de France.

2006

- Inverted yield curve turns out to be an accurate leading indicator for 2008 recession despite markets advance.

- Internet activity accelerates: Google buys YouTube after News Corp buys MySpace. Twitter is introduced.

- Playstation 3 (PS3) and Nintendo Wii unveiled.

- Merger & acquisition activity reaches $3.79 trillion worldwide, surpassing previous 2000 peak (Thomson).

- Options backdating takes center stage. United Health and technology companies were among those dragged into controversy.

- Housing market peaks.

2007

- Markets continue multi-year rally with three major indexes holding single-digit gains. Emerging markets build on previous year gains – Shanghai composite +97%.

- Monoline insurers MBIA and rival Ambac become early canaries in the coal mine given the greater than $1 trillion in exposure on insuring securities.

- Apple presents the iPhone – part phone, part music, part computer.

- KKR (Kohlberg Kravis Roberts & Co.) and TPG complete $44.4 billion buyout of Texas power company TXU Corp.

- Microsoft Vista operating system introduced after five years of development.

- Housing decline accelerates as Countrywide Financial announces 12,000 job cuts (20% of its workforce), New Century Financial (#2 subprime lender at one point) files Chapter 11 bankruptcy, and two Bear Stearns mortgage based hedge funds go under.

- Chuck Prince, Citigroup CEO, steps down.

2008

- Bank of America agrees to buy Countrywide mortgage company for about $4 billion.

- JPMorgan Chase agrees to buy Bear Stearns for $2 per share in a sale brokered by the Fed and the U.S. Treasury – eventually bid revised upwards to $10 per share (~$1.1 billion) to appease angry shareholders.

- Lehman Brothers goes bankrupt.

- Bank of America agrees to acquire Merrill Lynch for about $50 billion.

- Government takes over AIG after providing insurance company $85 billion loan.

- Goldman Sachs and Morgan Stanley become bank holding companies to improve access to capital.

- Washington Mutual Inc. is seized by FDIC and sold to JPMorgan Chase in the biggest U.S. bank failure in history.

- Wells Fargo & Co., agrees to purchase Wachovia for about $15.1 billion, trumping Citigroup’s bid.

- $700 billion TARP (Troubled Asset Relief Program) eventually approved by Congress to stabilize financial system.

- Eliot Spitzer resigns after prostitution scandal.

- Michael Phelps wins eight gold medals at the 2008 Beijing Summer Olympics.

2009

- Barack Obama inaugurated in as 44th President of the United States. Healthcare reform bills pass in both the House and Senate.

- GM and Chrysler declare bankruptcy.

- Recession ends as stimulus kicks in and inventories rebuild. Government announces new PPIP and TALF programs.

- Warren Buffett pays $26 billion to buy Burlington Northern Santa Fe. Other announcements include: Oracle /Sun Microsystems; Pfizer/Wyeth; Merck/Schering Plough; and Pulte Homes/Centex.

- Commodities and emerging markets rebound. Gold tops $1,000 per ounce.

- Signs of housing bottoming as low mortgage rates, tax credits, and declining inventories create a more constructive environment.

- Madoff goes to prison after he was convicted for a $65 billion Ponzi Scheme.

- Chesley B. “Sully” Sullenberger successfully carries out the treacherous crash-landing of US Airways Flight 1549 into the Hudson River.

- Dubai debt debacle forces Abu Dhabi to lend support to calm global markets.

- Tiger Woods admits transgressions after car crash pushes him into spotlight.

2010 ???

Time will tell what the new year will bring. Stay tuned for some iron clad 2010 predictions coming to an Investing Caffeine blog near you in the not too distant future!

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds and BAC, AAPL, and GOOG, but did not have any direct positions in the following stocks mentioned in this article at time of publication (including AOL/TWX, VIA/CBS, NWS, TYC, UAUA, MSO, CMCSA, DIS, SHLD, PG, COP, Nintendo, MBI, ABK, MSFT, C, JPM, AIG, MS, WFC, GM, Chrysler, BRKA, ORCL, JAVA, PFE, MRK, PHM, BNI, LCC, GLD, and NKE). No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Housing: Green Shoots Turning to Golden Trunks?

The doom and gloomers say the “green shoots” are actually “yellow weeds” and turn a blind eye to the positive (or less negative) economic data. The unemployment rate declined marginally last month to 9.4%, and GDP rates are expected to turn positive in the current quarter. Even so, the nay-sayers like Nouriel Roubini, Marc Faber, and Nassim Taleb still believe worse days lie ahead. Recent comments from a steely industry veteran may point to maturing “golden trunks” rather than younger, greener varieties.

Normally I do not expend too much energy on a single quarter of data relating to a stock I do not own, however comments coming from Bob Toll, founding CEO of Toll Brothers Inc. (dating back to 1967) caught my fancy. Besides the invaluable perspective he provides on the industry, he is in the unique position to explain the spending dynamics covering the higher-end demographic area. Toll Brothers is the largest luxury home builder in the U.S., operating in 21 states spanning the North, South, Mid-Atlantic, and West regions.

Although counterintuitive to many of the current news headlines, here is what Mr. Toll had to regarding Tolls’ recent quarterly earnings data and the state of the U.S. housing market:

• “Although our industry continues to face significant challenges, we are encouraged by the increase in number of net contracts signed this quarter. This marks the first time in sixteen quarters (4 years) dating back to fiscal year ’05’s fourth quarter that our net contracts exceeded the prior year same quarter. (The Results) also marked the first quarterly sequential unit increase in our backlog in more than three years.”• “Price is no longer the overwhelmingly dominant factor. It appears that those taking this step today have more confidence than one year ago.”

• “As the supply of unsold housing inventory shrinks nationwide, and if consumer confidence continues to improve, we should see stronger demands. It has already positively impacted our pricing power as we are reducing incentives in many markets.”

• “Fiscal year ’09’s third quarter cancellation rate, current quarter cancellations divided by current quarter’s signed contracts, was 8.5% versus 19.4% in fiscal year ’08’s third quarter. This was our lowest cancellation rate since the second quarter of fiscal year ’06 and is approaching our historic average of approximately 7% since going public.”

• “There’s a better feeling about jobs, a better feeling about the economy. Six months ago …we were all scared that the end was near…So I think we’ve just got a better market now and if things continue to improve, I think the market will continue to improve.”

• “(Traffic data) is certainly more than anecdotal information. You’re getting these averages from 235 approximately communities, 250 communities, so that’s a pretty good indicator of where the market is right now.”

• “The number of weeks of improvement that we have had as I said in the monologue, are certainly more than anecdotal. You’re talking about a whole lot of communities in 40, 50 markets and 20, 22 states. So we’re getting pretty deep information.”

Certainly Mr. Toll’s responses should be taken with a grain of salt. CEOs comments are generally overoptimistic and the economy is clearly not out of the woods yet. Having said that, for those that have followed Mr. Toll’s comments over the last few years, know that he did not always sugar-coat the weak results on the way down. Just six months ago, Mr. Toll said this: “We have not yet seen a pickup in activity at our communities,” and to combat pricing pressures the company offered a multitude of promotions, including a 3.99% mortgage rate to buyers.

The sustainability of the positive housing trends is unclear, but the signs are encouraging – especially since government stimulus cannot be directly responsible (i.e., no $8,000 new home-buyer credits for homes in the $700,000 price range) for awaking the housing bear from a four-year hibernation. The passage of time will determine whether Toll’s improving assessment of housing fundamentals will deteriorate into “yellow weeds” or flourish into a “golden trunk.”

Watch Extended Interview of CEO Bob Toll (Post Q3 2009 Conference Call)

Sidoxia Capital Management and its clients did not have any position in TOL at the time the article was published. No information accessed through the “Investing Caffeine” website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision.