Posts tagged ‘fixed income’

Winning Coaches Telling Players to Quit

How would you feel if your coach told you not only are you going to lose, but you should quit and join the other team? Effectively, that is what Loomis Sayles bond legend Dan Fuss (read Fuss Making a Fuss), and fellow colleagues Margie Patel (Wells Fargo Advantage Funds), and Anthony Crescenzi (PIMCO) had to say about the chances of bonds winning at the recent Advisors’ Money Show.

This is what Fuss said regarding “statistically cheap” equities:

“I’ve never seen it this good in half a century.”

Patel went on to add:

“By any measure you want to look at, free cash flow, dividend yield, P/E ratio – stocks look relatively cheap for the level of interest rates.” Stock offer a “once-in-a-decade opportunity to buy and make some real capital appreciation.”

Crescenzi included the following comments about stocks:

“Valuations are not risky…P/E ratios have been fine for a decade, in part because of the two shocks that drove investors away from equities and compressed P/E ratios.”

Bonds Dynasty Coming to End

The bond team has been winning for three decades (see Bubblicious Bonds), but its players are getting tired and old. Crescenzi concedes the “30-year journey on rates is near its ending point” and that “we are at the end of the duration tailwind.” Even though it is fairly apparent to some that the golden bond era is coming to a close, there are ways for the bond team to draft new players to manage duration (interest rate/price sensitivity) and protect oneself against inflation (read Drowning TIPS).

Equities on the other hand have had a massive losing streak relative to bonds, especially over the last decade. The equity team had over-priced player positions that exceeded their salary cap and the old market leaders became tired and old. Nothing energizes a new team better than new blood and new talent at a much more attractive price, which leaves room in the salary cap to get the quality players to win. There is always a possibility that bonds will outperform in the short-run despite sky-high prices, and the introduction of any material, detrimental exogenous variable (large country bailout, terrorist attack, etc.) could extend bonds’ outperformance. Regardless, investors will find it difficult to dispute the relative attractiveness of equities relative to prices a decade ago (read Marathon Investing: Genesis of Cheap Stocks).

As I have repeated in the past, bonds and cash are essential in any portfolio, but excessively gorging on a buffet of bonds for breakfast, lunch, and dinner can be hazardous for your long-term financial health. Maximizing the bang for your investment buck means not neglecting volatile equity opportunities due to disproportionate conservatism and scary economic media headlines.

There are bond coaches and teams that believe the winning streak will continue despite the 30-year duration of victories. Fear, especially in this environment, is often used as a tactic to sell bonds. Conflicts of interest may cloud the advice of these bond coaches, but the successful experienced coaches like Dan Fuss, Margie Patel, Anthony Crescenzi are the ones to listen to – even if they tell you to quit their team and join a different one.

Read Full Advisor Perspectives Article

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds (including TIP), but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

PIMCO – The Downhill Marathon Machine

How would you like to run a marathon? How about a marathon that is prearranged all downhill? How about a downhill marathon with the wind at your back? How about a downhill marathon with the wind at your back in a wheelchair? Effectively, that is what a 30-year bull market has meant for PIMCO (Pacific Investment Management Co.) and the “New Normal” brothers (Co-Chairman Bill Gross and Mohamed El-Erian) who are commanding the bond behemoth (read also New Normal is Old Normal). Bill Gross can appreciate a thing or two about running marathons since he once ran six marathons in six consecutive days.

This perseverance also assisted Gross in co-founding PIMCO in 1971 with $12 million in assets under management. Since then, the company has managed to add five more zeroes to that figure (today assets exceed $1.2 trillion). In the first 10 years of the company’s existence, as interest rates were climbing, PIMCO managed to layer on a relatively thin amount of assets (approximately $1 billion). But with the tailwind of declining rates throughout the 1980s, PIMCO’s growth began to accelerate, thereby facilitating the addition of more than $25 billion in assets during the decade.

The PIMCO Machine

For the time-being, PIMCO can do no wrong. As the endless list of media commentators and journalists bow to kiss the feet of the immortal bond kings, the blinded reporters seem to forget the old time-tested Wall Street maxim:

“Never confuse genius with a bull market.”

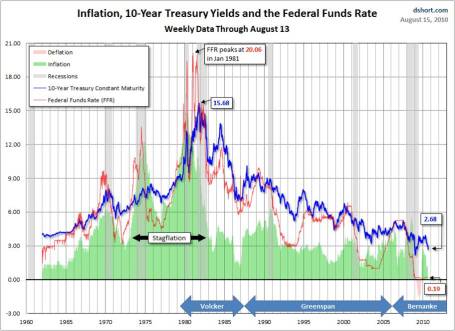

The gargantuan multi-decade move in interest rates, the fuel used to drive bond prices to the moon, might have something to do with the company’s success too? PIMCO is not exactly selling ice to the Eskimos – many investors are scooping up PIMCO’s bond products as they wait in their bunkers for Armageddon to arrive. Thanks to former Federal Reserve Chairman Paul Volcker (appointed in 1979), the runaway inflation of the early 1980s was tamed by hikes he made in the key benchmark Federal Funds Rate (the targeted rate that banks lend to each other). From a peak of around 20% in 1980-1981 the Fed Funds rate has plummeted to effectively 0% today with the most recent assistance coming from current Fed Chairman Ben Bernanke.

Although these west-coast beach loving bond gurus are not the sole beneficiary in this “bond bubble” (see Bubblicious Bonds story), PIMCO has separated itself from the competition with its shrewd world-class marketing capabilities. A day can hardly go by without seeing one of the bond brothers on CNBC or Bloomberg, spouting on about interest rates, inflation, and global bond markets. As PIMCO has been stepping on fruit in the process of collecting the low-hanging fruit, the firm has not been shy about talking its own book. Subtlety is not a strength of El-Erian – here’s what he had to pimp to the USA Today a few months ago as bond prices were continuing to inflate: “Simply put, investors should own less equities, more bonds, more global investments, more cash and more dry ammunition.”

If selling a tide of fear resulted in a continual funnel of new customers into your net, wouldn’t you do the same thing? Fearing people into bonds is something El-Erian is good at: “In the New Normal you are more worried about the return of your capital, not return on your capital.” Beyond alarm, accuracy is a trivial matter, as long as you can scare people into your doomsday way of thinking. The fact Bill Gross’s infamous Dow 5,000 call never came close to fruition is not a concern – even if the forecast overlapped with the worst crisis in seven decades.

Mohamed Speak

Mohamed El-Erian is a fresher face to the PIMCO scene and will be tougher to pin down on his forecasts. He arrived at the company in early 2008 after shuffling over from Harvard’s endowment fund. El-Erian has a gift for cryptically speaking in an enigmatic language that could only make former Federal Reserve Chairman Alan Greenspan proud. Like many economists, El-Erian laces his commentary with many caveats, hedges, and generalities – concrete predictions are not a strength of his. Here are a few of my favorite El-Erian obscurities:

- “ongoing paradigm shift”

- “endogenous liquidity”

- “tail hedging”

- “deglobalization”

- “post-realignment”

- “socialization losses”

Excuse me while I grab my shovel – stuff is starting to pile up here.

Don’t get me wrong…plenty of my client portfolios hold bonds, with some senior retiree portfolios carrying upwards of 80% in fixed income securities. This positioning is more a function of necessity rather than preference, and requires much more creative hand-holding in managing interest-rate risk (duration), yield, and credit risk. At the margin, unloved equities, including high dividend paying Blue Chip stocks, provide a much better risk-adjusted return for those investors that have the risk tolerance and time-horizon threshold to absorb higher volatility.

PIMCO has traveled along a long prosperous road over the last 30 years with the benefit of a historic decline in interest rates. While PIMCO may have coasted downhill in a wheelchair for the last few decades, this behemoth may be forced to crawl uphill on its hands and knees for the next few decades, as interest rates inevitably rise. Now that is a “New Normal” scenario Bill Gross and Mohamed El-Erian have not forecasted.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in PIMCO/Allianz, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Siegel & Co. See “Bubblicious” Bonds

Siegel compares 1999 stock prices with 2010 bonds

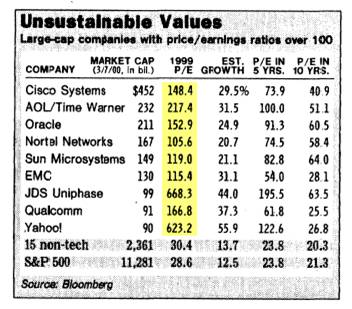

Unlike a lot of economists, Jeremy Siegel, Professor at the Wharton School of Business, is not bashful about making contrarian calls (see other Siegel article). Just days after the Nasdaq index peaked 10 years ago at a level above 5,000 (below 2,200 today), Siegel called the large capitalization technology market a “Sucker’s Bet” in a Wall Street Journal article dated March 14, 2000. Investors were smitten with large-cap technology stocks at the time, paying balloon-like P/E (Price-Earnings) ratios in excess of 100 times trailing earnings (see table above).

Bubblicious Boom

Today, Siegel has now switched his focus from overpriced tech-stock bubbles to “Bubblicious” bonds, which may burst at any moment. Bolstering his view of the current “Great American Bond Bubble” is the fact that average investors are wheelbarrowing money into bond funds. Siegel highlights recent Investment Company Institute data to make his point:

“From January 2008 through June 2010, outflows from equity funds totaled $232 billion while bond funds have seen a massive $559 billion of inflows.”

The professor goes on to make the stretch that some government bonds (i.e., 10-year Treasury Inflation-Protected Securities or TIPS) are priced so egregiously that the 1% TIPS yield (or 100 times the payout ratio) equates to the crazy tech stock valuations 10 years earlier. Conceptually the comparison of old stock and new bond bubbles may make some sense, but let’s not lose sight of the fact that tech stocks virtually had a 0% payout (no dividends). The risk of permanent investment loss is much lower with a bond as compared to a 100-plus multiple tech stock.

Making Rate History No Mystery

What makes Siegel so nervous about bonds? Well for one thing, take a look at what interest rates have done over the last 30 years, with the Federal Funds rate cresting over 20%+ in 1981 (View RED LINE & BLUE LINE or click to enlarge):

As I have commented before, there is only one real direction for interest rates to go, since we currently sit watching rates at a generational low. Rates have a minute amount of wiggle room, but Siegel rightfully understands there is very little wiggle room for rates to go lower. How bad could the pain be? Siegel outlines the following scenario:

“If over the next year, 10-year interest rates, which are now 2.8%, rise to 3.15%, bondholders will suffer a capital loss equal to the current yield. If rates rise to 4% as they did last spring, the capital loss will be more than three times the current yield.”

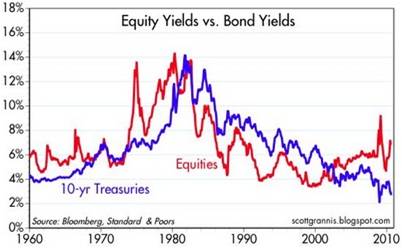

Siegel is not the only observer who sees relatively less value in bonds (especially government bonds) versus stocks. Scott Grannis, author of the Calafia Report artfully shows the comparisons of the 10-Year Treasury Note yield relative to the earnings yield on the S&P 500 index:

As you can see, rarely have there been periods over the last five decades where bonds were so poorly attractive relative to equities.

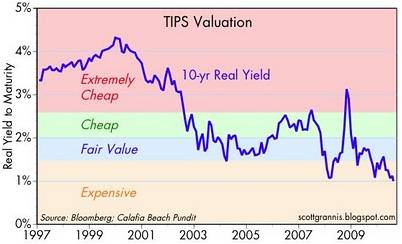

Grannis mirrors Siegel’s view on government bond prices through his chart on TIPS pricing:

Pricey Treasuries is not a new unearthed theme, however, Siegel and Grannis make compelling points to highlight bond risks. Certainly, the economy could soften further, and trying to time the bottom to a multi-decade bond bubble can be hazardous to your investing health. Having said that, effectively everyone should desire some exposure to fixed income securities, depending on their objectives and constraints (retirees obviously more). The key is managing duration and the risk of inflation in a prudent fashion. If you believe Siegel is correct about an impending bond bubble bursting, you may consider lightening your Treasury bond load. Otherwise, don’t be surprised if you do not collect on another “sucker’s bet.”

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

*DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds (including TIP and other fixed income ETFs), but at the time of publishing SCM had no direct position in any security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Baseball, Hot Dogs, and Fixed Income Securities

Having just celebrated another 4th of July holiday, I reflected on the historical importance of our country’s independence finalized 234 years ago, the defining birthday of our great country that permanently marked the separation of our nation from Great Britain. In honor of this revolutionary milestone, our culture has added a few American traditions over the centuries, including watching baseball, and gorging ourselves on hot dogs, and apple pie.There is no better symbol of the importance our culture places on overindulgence than Nathan’s International Hot Dog Eating Contest, held each year on July 4th in Coney Island, Brooklyn, New York. The 95th annual contest winner was Joey Chestnut with a total of 54 HDBs (Hot Dogs & Buns) consumed, but not without some controversy thanks to the arrest of former Nathan’s champ Takeru Kobayashi, who watched from the sidelines this year due to a contract dispute with event organizers. Chestnut holds the world record set in 2009 with 68 HDBs, equivalent to about 20,000 calories. In setting the unmatched record, the winner of wiener eating contest inhaled in 10 minutes what an average human should consume in 10 days.

Bond Binge

In the financial markets, Americans have been pigging out on something else over the last few decades, and that is bonds. The craving for bonds has not changed since the end of the financial crisis either. According to Morningstar, since the end of 2008, investors have placed a net $390 billion into taxable bond funds and withdrawn -$45 billion out of U.S. stock funds. A continuation of these trends can be seen in the latest ICI (Investment Company Institute) fund flow data, in which we saw a +$6.3 billion inflow into bonds and a -$1.3 billion abandonment of stocks from the hands of jittery stock investors.

Beyond the endless checklist of worries (Europe default, China slowing, twin deficits, elections, etc.), there has been a consistent exodus of capital from money market funds due to the ridiculously low yields – the seven-day yield on taxable money-market funds, as measured by IMoneyNet, has recently held steady around 0.04%. For yield-hungry investors, bondholders are not getting a lot of bang for their buck if you consider the 10-Year Treasury Note is trading at 2.98%. Nothing in life comes for free, so in the case of Treasuries, bond investors are predominantly swapping market risk for interest rate risk. As I have repeatedly stated in the past, bonds are not evil, however fixed income exposure in a portfolio should be customized for an individual in the context of a diversified portfolio that meets investors’ objectives and risk tolerance.

Although the inflation skies are sunny now, there are clouds on the horizon and the stimulative monetary policies conducted over the last few years do not augur well for a likely climb in future interest rates.

Reversal of Fortune

In the competitive eating world, there is a so-called “reversal of fortune” that disqualifies eaters. At some point, you can only consume so much before the forces of nature take over.

I don’t know when the day of regurgitation will come for many fixed income securities, but managing your consumption of bonds, and the associated duration, becomes crucial as bond bellies continue to bulge. Takeru Kobayashi discovered this first hand at the Nathan’s 2007 championship event.

Baseball, hot dogs, and apple pie have been essential components to the unique aspects of the great American culture. In the world of investing, we have witnessed an acceleration in investors’ appetite for bonds – I just hope for the sake of overzealous bond investors, they will not suffer a reversal of fortune.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

*DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds (including fixed income ETFs), but at the time of publishing SCM had no direct positions in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Stocks…Bonds on Steroids

With all the spooky headlines in the news today, it’s no wonder everyone is piling into bonds. The Investment Company Institute (ICI), which tracks mutual fund data, showed -88% of the $14 billion in weekly outflows came from equity funds relative to bonds and hybrid securities. With the masses flocking to bonds, it’s no wonder yields are hovering near multi-decade historical lows. Stocks on the other hand are the Rodney Dangerfield (see Doug Kass’s Triple Lindy attempt) of the investment world – they get “no respect.” By flipping stock metrics upside down, we will explore how hated stocks can become the beloved on steroids, if viewed in the proper context.

Davis on Debt Discomfort

Chris Davis, head of the $65 billion in assets at the Davis Funds, believes like I do that navigating the “bubblicious” bond market will be a treacherous task in the coming years. Davis directly states, “The only real bubble in the world is bonds. When you look out over a 10-year period, people are going to get killed.” In the short-run, inflation is not a real worry, but it if you consider the exploding deficits coupled with the exceedingly low interest rates, bond investors are faced with a potential recipe for disaster. Propping up the value of the dollar due to sovereign debt concerns in Greece (and greater Europe) has contributed to lower Treasury rates too. There’s only one direction for interest rates to go, and that’s up. Since the direction of bond prices moves the opposite way of interest rates, mean reversion does not bode well for long-term bond holders.

Earnings Yield: The Winning Formula

Average investors are freaked out about the equity markets and are unknowingly underestimating the risk of bonds. Investors would be in a better frame of mind if they listened to Chris Davis. In comparing stocks and bonds, Davis says, “If people got their statement and looked at the dividend yield and earnings yield, they might do things differently right now. But you have to be able to numb yourself to changes in stock prices, and most people can’t do that.” Humans are emotional creatures and can find this a difficult chore.

What us finance nerds learn through instruction is that a price of a bond can be derived by discounting future interest payments and principle back to today. The same concept applies for dividend paying stocks – the value of a stock can be determined by discounting future dividends back to today.

A favorite metric for stock jocks is the P/E (Price-Earnings) ratio, but what many investors fail to realize is that if this common ratio is flipped over (E/P) then one can arrive at an earnings yield, which is directly comparable to dividend yields (annual dividend per share/price per share) and bond yields (annual interest/bond price).

Earnings are the fuel for future dividends, and dividend yields are a way of comparing stocks with the fixed income yields of bonds. Unlike virtually all bonds, stocks have the ability to increase dividends (the payout) over time – an extremely attractive aspect of stocks. For example, Procter & Gamble (PG) has increased its dividend for 54 consecutive years and Wal-Mart (WMT) 37 years – that assertion cannot be made for bonds.

As stock prices drop, the dividend yields rise – the bond dynamics have been developing in reverse (prices up, yields down). With S&P 500 earnings catapulting upwards +84% in Q1 and the index trading at a very reasonable 13x’s 2010 operating earnings estimates, stocks should be able to outmuscle bonds in the medium to long-term (with or without steroids). There certainly is a spot for bonds in a portfolio, and there are ways to manage interest rate sensitivity (duration), but bonds will have difficulty flexing their biceps in the coming quarters.

Read the full article on Chris Davis’s bond and earnings yield comments

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

*DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds and WMT, but at the time of publishing SCM had no direct positions in PG, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Sidoxia Introduces “Fusion”

With the quote machines taking a temporary breather, what better time than now to talk about a new product creation from Sidoxia Capital Management – Fusion. For those readers following Investing Caffeine for some time, you likely have an informed understanding of Sidoxia Capital Management’s investment philosophy (www.Sidoxia.com). Well, now Sidoxia has formalized its investment product through the introduction of Fusion, a hybrid product integrating low-cost, tax-efficient investment vehicles and strategies, including individual stocks, individual bonds, equity ETFs (Exchange Traded Funds), and fixed income ETFs. Rather than being boxed into a simplistic life cycle fund, Fusion offers a customized investment vehicle that can meet investors’ wide ranging objectives and constraints. A key differentiating component of Fusion is its inclusion of some of the same stocks and securities employed in the Slome Sidoxia Fund (a hedge fund also managed by Sidoxia Capital Management for accredited investors). The aim of Fusion is to maximize the risk-adjusted returns in the context of a broadly diversified balanced portfolio (including international exposure).

Client Product Process

For those qualified investors, a one-on-one interview is conducted with each separate account investor to determine the objectives and constraints associated with the account. Subsequently, a customized Investment Policy Statement (IPS) is created for each client, effectively creating a blueprint for how the account will be managed. Depending on the risk-tolerance, time horizon, and objectives of the client, an equity allocation will be customized to meet the client’s needs. The balance of the portfolio will be invested in fixed-income, cash/liquid assets, and hybrid securities – including convertible bonds and alternative investments on a more limited basis. Individual security selection is derived from implementing fundamental and quantitative screening tools, leveraging the investment experience of the investment manager (Wade Slome), and the ranking of securities on a risk-adjusted valuation basis. Lower ranked securities are generally used as funding sources for purchases of higher ranked investment candidates.

Buy Discipline

A systematic, disciplined process is performed before the inclusion of any security is finalized into a portfolio. With respect to the selected equity securities, particular emphasis is placed on valuation metrics, including cash flows, earnings growth, dividend yields, price-earnings ratios, and other important fundamental statistics. In regards to equity related exchange traded funds (ETFs), some of the previously mentioned factors will be considered in addition to a top-down view of a funds underlying long-term growth potential. The buy discipline, established for the fixed income allocation of the portfolio, carefully considers dynamics such as yield, duration, maturity, income, inflation-protection, currency risk, and other factors. Compared to other competing domestic-centric products, Fusion has the ability and willingness to invest globally to explore attractive risk-reward investment opportunities abroad.

Portfolio Construction

Within the parameters of the various Fusion product versions (aggressive, conservative, and moderate), each portfolio is constructed with flexibility in meeting the unique objectives and constraints of each account – including any liquidity or income requirements indicated by the client. Every portfolio is constructed from the same menu of underlying investment options, thereby assuring relative consistency across accounts. Allocations across investment selections will vary based upon the Fusion product version selected.

Trading Strategies

Under normal economic circumstances, Fusion invests with a long-term time horizon of three to five years for its equity positions. As a result, factors such as transaction costs, impact costs, opportunity costs, bid-ask spreads, tax consequences, are considered before conducting trades. Regarding fixed income portfolios, the previously mentioned factors along with the underlying yield, duration, and fundamental factors will determine the holding period. Trading frequency may fluctuate, depending on financial market and client-specific circumstances, but generally speaking heightened volatility will lead to additional opportunistic portfolio activity.

Sell Discipline

The Fusion sell discipline is fairly straight forward. If a security reaches a designated price target, provides an inferior risk-adjusted return profile relative to other opportunities, or if the original investment rationale negatively changes, then the investment becomes a sell candidate. If Fusion discovers opportunities with superior investment characteristics, the sell candidates, in addition to cash, will be utilized to fund new purchases.

Product Fee Structure

The annual fee charged for portfolio management services is rendered on a percentage of assets under management basis. As a fee-only investment advisor, inherent incentives are built-in to preserve and grow client account values – a principle not practiced by many commissioned based brokers/advisors. Contact a Sidoxia Capital Management representative by phone (949-258-4322) or e-mail (info@Sidoxia.com) to learn more about Fusion’s fee structure and account minimum threshold.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

*DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct positions in any security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

New Normal is the Old Normal

By Bruce Wimberly (Contributing Writer to Investing Caffeine)

Pimco bond gurus love to talk about the “new normal” as if there is such a thing in financial markets. The problem with promoting such a view is that it assumes markets are static. Ask John Meriwether and his pack of Nobel Prize winning colleagues at LTCM how static the markets are? The point is nothing is normal about the markets or the economy for that matter. No one has a magic crystal ball that can predict the future and if you did you would certainly not promote it on CNBC. Mohamed El-Erian and his bond fund mavens (see also article on Bill Gross) are the poster children for the “new normal.” I will give them credit it is a great marketing gimmick. Not only does it sound cool but it covers just about everything while packaging it into a nice neat sound bite. Talk about media hounds –does El-Erian actually have time to run Pimco after spending hours getting his make-up ready for the countless interviews he gives each day? And what is up with the 1970ʼs mustache?

In the world according to Pimco the new normal, “reflects a growing realization that some of the recent abrupt changes to markets, households, institutions, and government policies are unlikely to be reversed in the next few years. Global growth will be subdued for a while and unemployment high; a heavy hand of government will be evident in several sectors…. But, hold on, I am getting ahead of myself here. I still have a few more preambles”! Iʼll bet he does.

El-Erian is never short on opinions. As an investor all I really care about is what does this mean for asset prices? Ok, so global GDP is going to slow as consumers and institutions repair balance sheets, government policies are becoming more burdensome, and unemployment stays high. Check. Got it. While I am not El-Erain I think what he really meant to say is, “We have already established our bond positions and if you want to help our shareholders you should follow our example and invest on the short end of the curve and be wary of inflation. The Fed is printing money and history suggests this will end badly.”

El-Erian is never short on opinions. As an investor all I really care about is what does this mean for asset prices? Ok, so global GDP is going to slow as consumers and institutions repair balance sheets, government policies are becoming more burdensome, and unemployment stays high. Check. Got it. While I am not El-Erain I think what he really meant to say is, “We have already established our bond positions and if you want to help our shareholders you should follow our example and invest on the short end of the curve and be wary of inflation. The Fed is printing money and history suggests this will end badly.”

As a formal multi-billion dollar fund manager, I happen to agree with the guy. While I think he could have been more direct with his message, there is no way the fed can inflate us out of this mess without their being some pain down the road. The United States cannot print its way to a recovery. Todayʼs long bond auction is just the first shot against the bow. The 4 3/8% coupon went off at a price of $97.6276 for a 4.52% yield versus a 4.49% prior. In other words, the so-called “new normal” really is the old normal and rates are heading higher my friends.

In this so- called “new normal” of higher rates what should an investor do? First, avoid the treasury bubble like the plague. This is where irrational exuberance is occurring the most. Wake-up people. What Pimco bond managers should be telling you is, “Donʼt buy our funds” (except Reits, Tips and Commodities). Bonds are going to get killed. That is the “new normal”. The “new normal” is inflation is your worst nightmare for bonds and bond buyers. Yes, bonds had a great run the last decade and that is the point! History will not repeat itself. The “new normal” is stocks will outperform bonds over the next ten years handily. Yes, stocks might get hit in the short run as rates rise but in the long run they are a far better asset class to weather inflation. The simple truth is businesses can raise prices. That is all you need to know. Donʼt anchor to the last ten years, as Pimco would like you to do. Donʼt worry about slick slogans – like the “new normal”. Just think about all the assets that have poured into Pimcoʼs funds over the last 10-15 and ask yourself “is this likely to continue?”

To paraphrase Wayne Gretzky great investors “skate to where the puck will be”. In my opinion, that leads you away from the mutual fund behemoth that is Pimco and the safe haven of bonds and back into equities. Yes, the S&P 500 has gone nowhere the last 11 years and that is my point…. the “new normal” is the old normal and equities regain their long term return advantage over other asset classes.

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds and equity securities in client and personal portfolios at the time of publishing. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Equities Up, But Investors Queasy

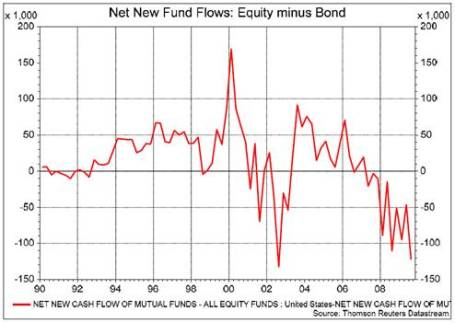

The market may have recovered partially from its illness over the last two years, but investors are still queasy when it comes to equities. The market is up by more than +60% since the March 2009 lows despite the unemployment rate continuing to tick higher, reaching 10.2% in October. Even though equity markets have rebounded, recovering investors have flocked to the drug store with their prescriptions for bonds. Mark Dodson, CFA, from Hays Advisory published a telling chart that highlights the extreme aversion savers have shown towards stocks.

Dodson adds:

“Net new fund mutual fund flows favor bonds over stocks dramatically, so much so that flows are on the cusp of breaking into record territory, with the previous record occurring back in the doldrums of the 2002 bear market. Given nothing but the chart (above), we would never in a million years guess that the stock market has rallied 50-60% off the March lows. It looks more like what you would see right in the throes of a nasty stock market decline.”

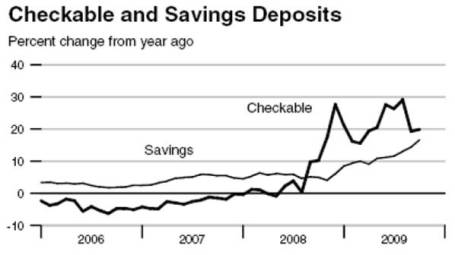

Checking and savings data from the Federal Reserve Bank of Saint Louis further corroborates the mood of the general public as the nausea of the last two years has yet to wear off. The mountains of cash on the sidelines have the potential of fueling further gains under the right conditions (see also Dry Powder Piled High story).

As Dodson notes in the Hays Advisory note, not everything is doom and gloom when it comes to stocks. For one, insider purchases according to the Emergent Financial Gambill Ratio is the highest since the recent bear market came to a halt. This trend is important, because as Peter Lynch emphasizes, “There are many reasons insiders sell shares but only one reason they buy, they feel the price is going up.”

What’s more, the yield curve is the steepest it has been in the last 25 years. This opposing signal should provide comfort to those blue investors that cried through inverted yield curves (T-Bill yields higher than 10-Year Notes) that preceded the recessions of 2000 and 2008.

Equity investors are still feeling ill, but time will tell if a dose of bond selling and a prescription for “cash-into-stocks” will make the queasy patient feel better?

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Treasury Bubble Hasn’t Burst….Yet

Clusterstlock’s Joe Weisenthal’s takes a historical look on 10-year Treasury yields going back to 1962. As you can see, the yield is still below 1962 levels, despite the massive inflationary steps the Federal Reserve and Treasury have taken over the last 18 months (6-26-09 yield was 3.51%). These trends can also be put into perspective by reading Vincent Fernando’s post at http://www.researchreloaded.com. Take a peek.

Ways to take advantage of this trend include purchases of TBT (UltraShort 20+ Year Treasury ProShares) or short TLT (iShares Barclays 20+ Year Treasury Bond)*.

*Disclosure: Sidoxia Capital Management clients and/or Slome Sidoxia Fund may have a short position in TLT.

“Bill, Say It Ain’t So…”

Bond guru and Newport Beach neighbor, Bill Gross, is out with his entertaining monthly PIMCO piece (Click Here). Try to keep a box of tissues close by in case you cry during the read. His views support my stance on short duration bonds and TIPs (Treasury Inflation Protected Securities), but big Bill would NEVER stand to root for equities – especially after his call for Dow 5000 a while back.

In this CNBC piece, he points out the obvious troubles we face from all the debt we’re choking on. As a country, we need the “Heimlich Maneuver!”