Posts tagged ‘fed’

No Market Misgiving on This Thanksgiving

We’ll see if there is any gravy left for investors during the last month of the year, but so far 2024 has been a satiating feast that has stuffed investors. There has been a cornucopia of items to be thankful for, including the Federal Reserve, which is expected to provide some dessert this month in the form of its third interest rate cut this year.

Investors certainly can also be grateful for the performance of the stock market, which has had a phenomenal year thus far (see chart below):

• S&P 500: +26.5%

• Dow Jones Industrial Average:+19.2%

• NASDAQ: +28.0%

On a two-year basis, the S&P 500 results look even tastier: +57.1%

Why is there such a large appetite for stocks? For starters, we are coming off a fresh election last month, and the majority of Americans decided to vote for the new administration that has promised additional stimulative tax cuts, and deregulation. If these promises come to fruition, these changes could augur well for corporate profits and a rising stock market. Regardless of whether your candidate won or lost the election, investors can agree there is less uncertainty with an uncontested election, which is welcomed by all. In addition, the two Fed rate cuts that started in September have also buoyed enthusiasm.

What is less clear are the effects of President-elect Donald Trump’s tariff policy threats, which if enacted run the risk of increasing inflation, stifling global trade, and jeopardizing future Fed rate cuts. Combined, these negative side effects have the potential of significantly dampening economic growth. On the other hand, if the tariffs are only used as a negotiating tool with our larger trading partners (including China, Mexico, Canada, and Europe), the tariff discussion will likely have more bark than bite. Time will tell.

Dissecting Stock Performance & Valuations

A lot of pundits are pointing to an overheated market, but on a 3-year basis, returns are looking more normalized (+8.2% per year) because of the -20% hit on stocks during 2022. As you may recall, much of the 2022 decline was caused by the Fed slamming on the economic breaks with its fastest rate-hiking cycle in four decades (raising rates from 0.0% to 5.5%).

Objectively, stock values, as measured by the Price-Earnings (P/E) ratio of the S&P 500, are at elevated levels – registering in at approximately 22-times next year’s forecasted profits. As you can see from the chart below, the stock market is priced at levels not seen since 2001 and valuations are roughly double what they were at the lows of the 2008 Financial Crisis.

Source: Yardeni.com

A major reason for escalated valuations has been the concentration of performance in the largest seven companies, or the so-called Magnificent 7 stocks, which include, Apple, Microsoft, Alphabet, Amazon.com, Nvidia, Meta Platforms and Tesla. In fact, the index concentration is the highest it has been in more than a half century – even higher than at the peak of the 2000 Tech Bubble when Cisco Systems, Microsoft, GE, Intel, and Exxon Mobil were the five largest companies by market capitalization (see chart below).

The good news is the other 493 companies in the S&P 500 (I call them the “Absentee 493”) are priced much more reasonably. This bifurcated dynamic between the largest seven companies versus everything else, highlights the plethora of opportunities available to be harvested in Value stocks, Small-cap stocks, and Mid-cap stocks.

As is evident in the chart below, the S&P 500 index (red-line), which is skewed by the Magnificent 7, is about 30% more expensive than Small-cap and Mid-cap stocks, which are hovering near historically attractive valuation levels.

Source: Yardeni.com

Value stocks (blue-line) in the market look equally attractive (about 30% cheaper than the S&P 500), as can be seen in the chart below.

Source: Yardeni.com

As always, the future is uncertain, and risks abound for next year. But 2024 has been a blockbuster year and there has been plenty to be thankful for, especially the performance of the U.S. stock market.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (December 2, 2024). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in AAPL, AMZN, MSFT, GOOGL, META, TSLA, NVDA, and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in CSCO, GE, XOM, INTC or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

From Hard Landing to Soft Landing to No Landing?

I haven’t received my pilot’s license yet, but in trying to figure out whether the economy is heading for a hard landing, soft landing, or no landing, I’m planning to enroll in flight school soon! With the Federal Reserve approaching the tail end of an aggressive interest rate hiking cycle, investors have been bracing for a hard landing. However, with near record-low unemployment (3.4%) and multi-trillion dollars in government stimulus still working its way through the system, others see an economic soft landing. More recently, economic data has been flying in at an accelerating pace, which could mean the economy will stay in the air and have no landing.

For those waiting for an imminent recession, it looks like there could be a delay. In other words, bearish pessimists may be waiting at the gate longer than expected. As you can see in the chart below, economists at the Atlanta Federal Reserve are currently forecasting economic growth (GDP – Gross Domestic Product) to increase to a respectable +2.8% rate for the first quarter.

How have investors been interpreting this confusing array of landing scenarios? The stock market has stabilized and risen since last October (S&P +13.7%) but has also hit a temporary air pocket last month (-2.6%). Similarly, the Dow Jones Industrial Average has rebounded +13.9% since October, but pulled back further in February (-4.2%). As mentioned earlier, investors are having difficulty reading all the economic dials, instruments, and controls in the cockpit because there is no consensus on interest rates, inflation, economic growth, corporate earnings growth, and employment.

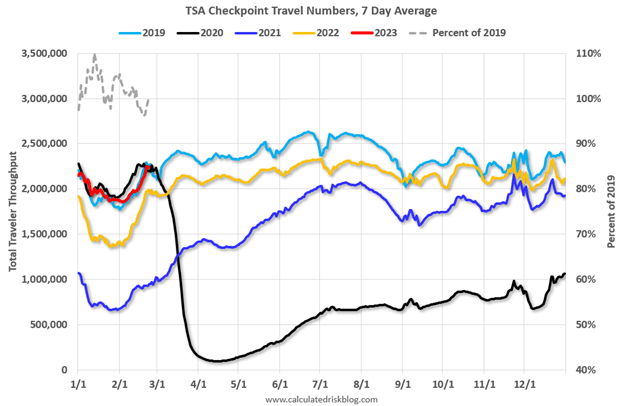

At the one end of the spectrum, you have a consumer who remains employed and willing to spend his/her savings accumulated during the pandemic. Case in point, air travel has hit pre-pandemic levels of 2019, despite business travelers staying at home conducting business on Zoom (see red line on chart below).

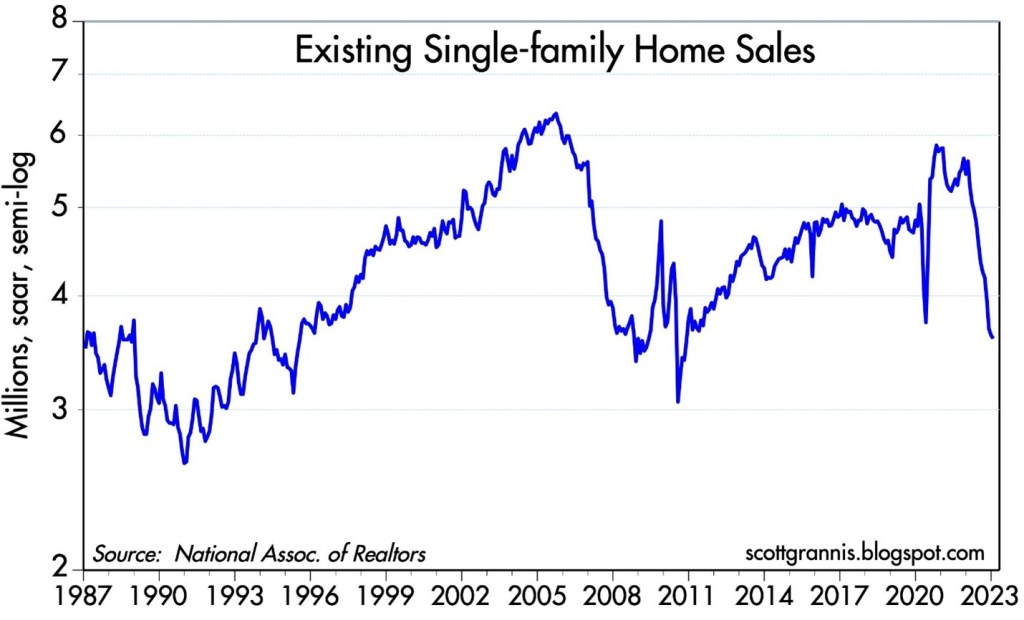

At the other end of the spectrum, we are witnessing the crippling effects that 7% mortgage rates can have on the $4 trillion real estate industry. As you can see from the chart below, sales of existing homes have plummeted at the fastest rate since the beginning of the 2008 Financial Crisis.

With all of that said, there is a consensus building that inflation is steadily coming down. Even the very skeptical and hawkish Federal Reserve Chairman, Jerome Powell, acknowledged that the “disinflationary process has begun.” We can see that in this inflation expectation chart below (green line), which measures the average anticipated inflation over the next five years by comparing the difference in yields between the five-year Treasury Notes and the five-year TIPS (Treasury Inflation Protection Securities).

Although, currently, there are many financial crosswinds swirling, the good news is that in the near-term, the economy has been maintaining its elevation and there is no imminent sign of a hard landing. We certainly could face the potential of turbulence and changing weather conditions, but that is always the case when you invest in the financial markets. If, however, inflation continues to move in the same direction, and growth continues to surprise on the upside, there may be no landing at all. Under this scenario of maintaining a comfortable altitude, I guess I can put my pilot training on hold.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (Mar. 1, 2023). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Fed Ripping Off the Inflation Band-Aid

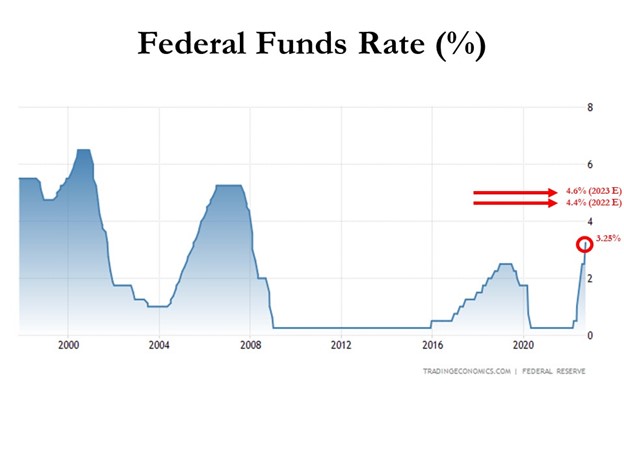

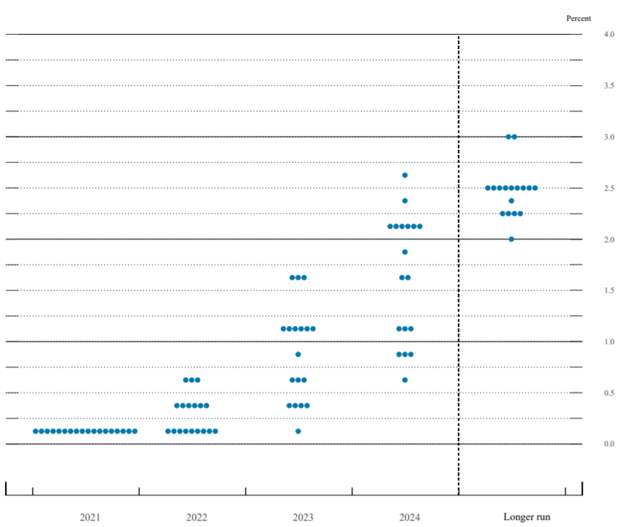

Inflation rates have been running near 40-year highs, and as a result, the Federal Reserve is doing everything in its power to rip off the Band-Aid of insidious high price levels in a swift manner. The Fed’s goal is to inflict quick, near-term pain on the economy in exchange for long-term price stability and future economic gains. How quickly has the Fed been hiking interest rates? The short answer is the rate of increases has been the fastest in decades (see chart below). Essentially, the Federal Reserve has pushed the targeted benchmark Federal Funds target rate from 0% at the beginning of this year to 3.25% today. Going forward, the goal is to lift rates to 4.4% by year-end, and then to 4.6% by next year (see Fed’s “dot plot” chart).

How should one interpret all of this? Well, if the Fed is right about their interest rate forecasts, the Band-Aid is being ripped off very quickly, and 95% of the pain should be felt by December. In other words, there should be a light at the end of the tunnel, soon.

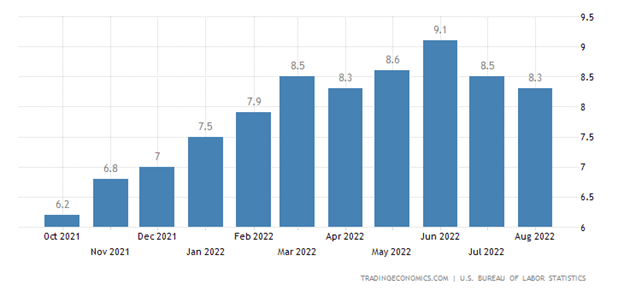

The Good News on Inflation

When it comes to inflation, the good news is that it appears to be peaking (see chart below), and many economists see the declining inflation trend continuing in the coming months. Why do pundits see inflation peaking? For starters, a broad list of commodity prices have declined significantly in recent months, including gasoline, crude oil, steel, copper, and gold, among many others.

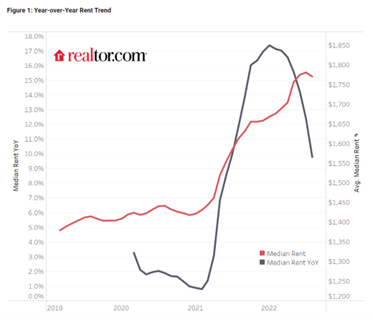

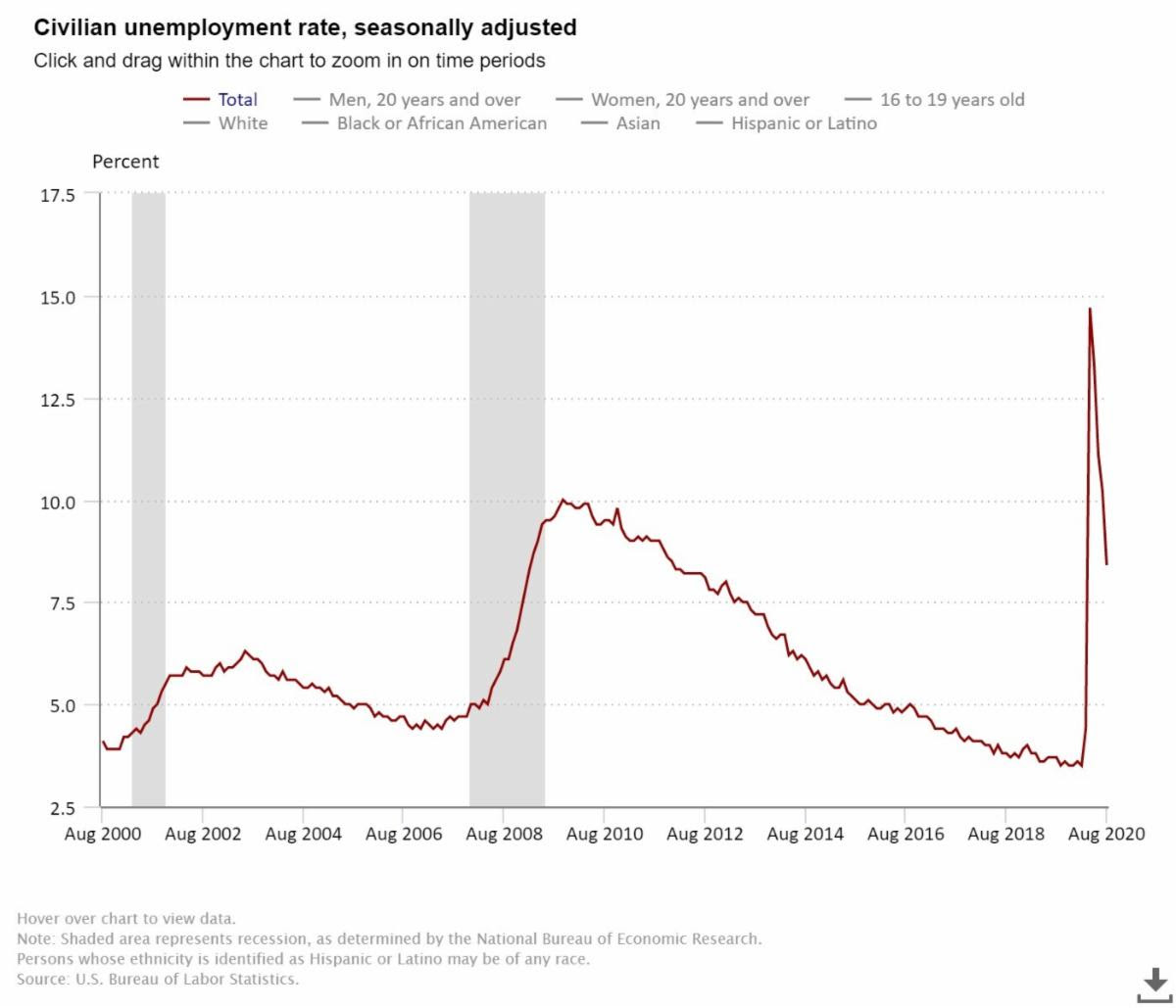

Outside of commodities, investors have seen prices drop in other areas of the economy as well, including housing prices, which recently experienced the fastest monthly price drop in 11 years, and rent prices as well (see chart below).

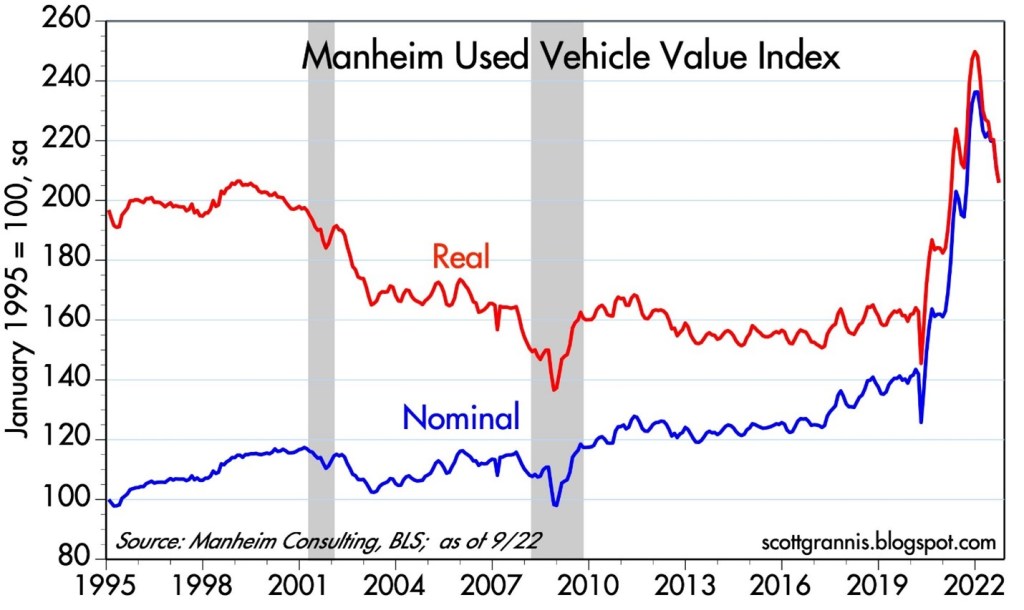

Anybody who was shopping for a car during the pandemic knows what happened to pricing – it exploded higher. But even in this area, we are seeing prices coming down (see chart below), and CarMax Inc. (KMX), the national used car retail chain confirmed the softening price trend last week.

Pain Spread Broadly

When interest rates increase at the fastest pace in 40 years, pain is felt across almost all asset classes. It’s not just U.S. stocks, which declined -9.3% last month (S&P 500), but it’s also housing -8.5% (XHB), real estate investment trusts -13.8% (VNQ), bonds -4.4% (BND), Bitcoin -3.1%, European stocks -10.1% (VGK), Chinese stocks -14.4% (FXI), and Agriculture -3.0% (DBA). The +17% increase in the value of the U.S. dollar this year against a basket of foreign currencies is substantially pressuring cross-border business for larger multi-national companies too – Microsoft Corp. (MSFT), for example, blamed U.S. dollar strength as the primary reason to cut earnings several months ago. Like Hurricane Ian, large interest rate increases have caused significant damage across a wide swath of areas.

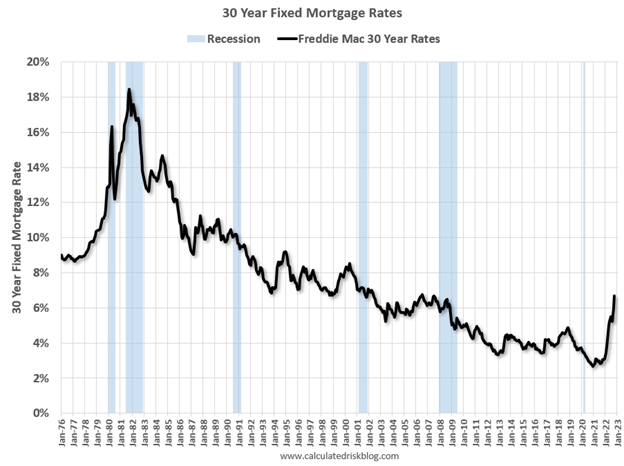

But for those following the communication of Federal Reserve Chairman, Jerome Powell, in recent months, they should not be surprised. Chairman Powell has signaled on numerous occasions, including last month at a key economic conference in Jackson Hole, Wyoming, that the Fed’s war path to curb inflation by increasing interest rates will inflict wide-ranging “pain” on Americans. Some of that pain can be seen in mortgage rates, which have more than doubled in 2022 and last week eclipsed 7.0% (see chart below), the highest level in 20 years.

Now is Not the Time to Panic

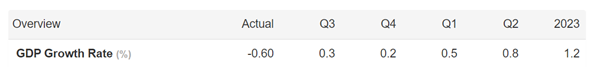

There is a lot of uncertainty out in the world currently (i.e., inflation, the Fed, Russia-Ukraine, strong dollar, elections, recession fears, etc.), but that is always the case. There is never a period when there is nothing to be concerned about. With the S&P 500 down more than -25% from its peak (and the NASDAQ down approximately -35%), now is not the right time to panic. Knee-jerk emotional decisions during stressful times are very rarely the right response. With these kind of drops, a mild-to-moderate recession is already baked into the cake, even though the economy is expected to grow for the next four quarters and for all of 2023 (see GDP forecasts below). Stated differently, it’s quite possible that even if the economy deteriorates into a recession, stock prices could rebound smartly higher because any potential future bad news has already been anticipated in the current price drops.

Worth noting, as I have pointed out previously, numerous data points are indicating inflation is peaking, if not already coming down. Inflation expectations have already dropped to about 2%, if you consider the spread between the yield on the 5-Year Note (4%) and the yield on the 5-Year TIP-Treasury Inflation Protected Note (2%). If the economy continues to slow down, and inflation has stabilized or declined, the Federal Reserve will likely pivot to decreasing interest rates, which should act like a tailwind for financial markets, unlike the headwind of rising rates this year.

Ripping off the Band-Aid can be painful in the short-run, but the long-term gains achieved during the healing process can be much more pleasurable.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in MSFT, BND and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in KMX, XHB, VNQ, VGK, FXI, DBA or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

From Rocket Ship to Roller Coaster

The stock market has been like a rocket ship over the last three years 2019/2020/2021, advancing +90% as measured by the S&P 500 index, and +136% for the NASDAQ. After this meteoric multi-year rise, stock values started to come back to earth in 2022, and the rocket ship turned into a roller coaster during January. More specifically, the S&P 500 fell -5% for the month and the NASDAQ -9%. Yes, it’s true volatility has increased, and your blood pressure may have risen with all the ups and downs. However, the fact remains the economy remains strong, corporate profits are at record levels, unemployment is low, and interest rates remain at attractive levels despite nagging inflation (see chart below) and the removal of accommodative monetary policies by the Federal Reserve.

Math Matters

I did okay in school and was educated on many different topics, including the basic principle that math matters. This notion rings especially true when it comes to finance and investing. As I have discussed numerous times in the past, money goes where it is treated best, which is why interest rates, cash flows, and valuations play such a key role in ultimately determining long-term values across all asset classes. This concept of money seeking the best home applies equally to stocks, bonds, real estate, commodities, crypto-currencies, and any other asset class you can imagine because interest rates help determine the cost of holding and using money.

Normally, mathematics teaches us the lesson that more is better when discussing financial matters. And currently the stock market is compensating investors significantly more for investing in stocks relative to investing in bonds – I have reviewed this concept repeatedly on my Investing Caffeine blog (see Going Shopping: Chicken vs. Beef ). Currently, investors are getting paid about +5% to hold stocks based on the forward earnings yield (i.e., the inverse of the stock market’s Price-Earnings ratio of 20x) vs. the +2% yield on the 10-Year Treasury Note (1.78% more precisely on 1/31/22). What’s more, historically speaking, stock investors typically get rewarded with an earnings yield that doubles about every 10 years, whereas bond yields usually remain stagnantly flat, if bonds are held until maturity.

With that said, I am always quick to point out that diversification in a portfolio is important (i.e., most people should at least own some bonds), even if bonds are currently very expensive relative to other asset classes (see Sleeping on Expensive Financial Pillows). If bond yields climb significantly to the point where returns are more competitive with stocks, I will likely be buying significantly more bonds for me and my Sidoxia (www.sidoxia.com) clients.

Fed Jitters

The recent stock market volatility is reinforcing the idea that the Federal Reserve’s more aggressive stance regarding hiking interest rates is making many investors very anxious – just not me. I have lived through many tightening cycles in my lifetime and lived to tell the tale. It is true that all else equal, higher interest rates generally depress asset values, but it is also important to place the current interest rate environment in historical context. Although the Federal Funds interest rate target is expected to increase to 2.5% over the next few years (currently at 0%), this forecast is nothing new and there is no guarantee the Fed can successfully pull off this feat. Many people have short memories and forget the Fed hiked interest rates 10 times from the end of 2015 through 2018. In the face of this scary period, the stock market (S&P 500) still managed to approximately climb a respectable +22% (albeit with some volatility). Furthermore, if you give the Fed the benefit of the doubt of achieving this uncertain target, this 2.5% level is very appealing and still extremely low, historically speaking (see chart below).

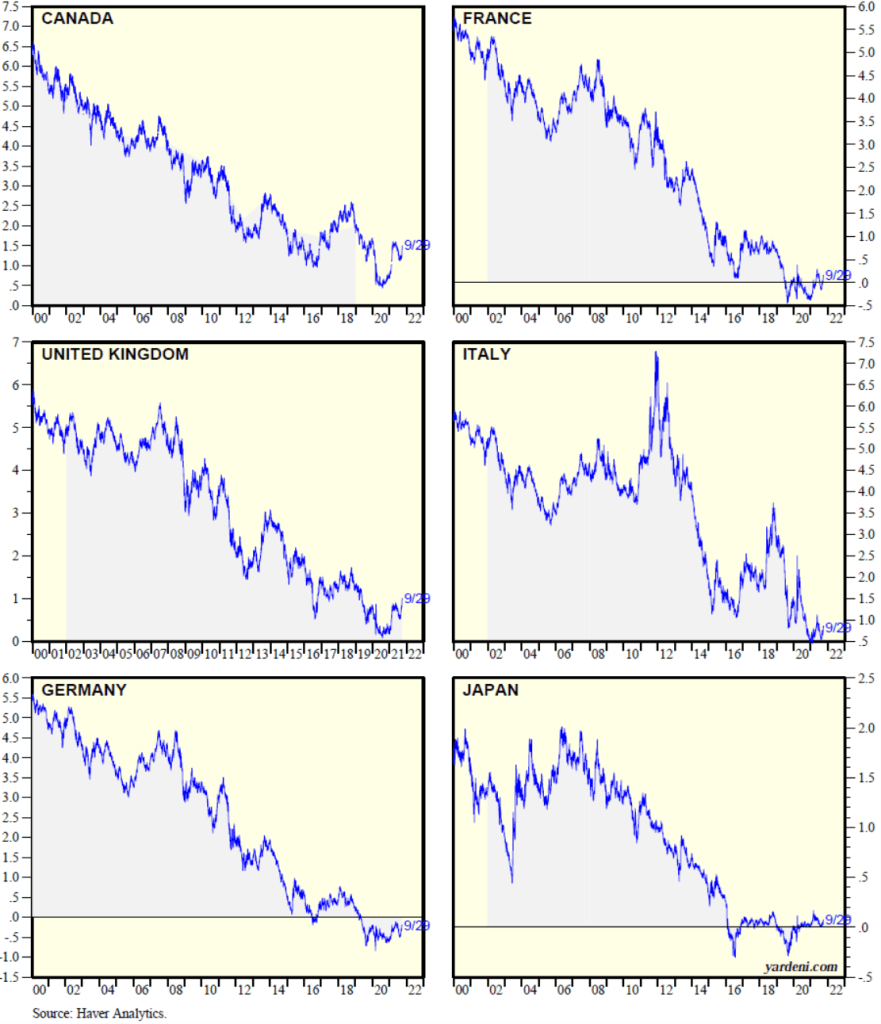

When discussing interest rates and inflation, investors should also expand their views globally to the other 95% of the world’s population. Many investors are very myopic in their focus on U.S. interest rates. It is important to understand that rates are not just low here in the United States, but also low almost everywhere else as well. While international interest rates have bounced marginally higher in recent months, those countries’ long-term international rates, by and large, remain tremendously low too – in most cases even lower than rates in the U.S. (see chart below). Yes, the Fed has some control over short-term interest rates in the U.S., but considering other crucial forces that are depressing long-term global rates is worth pondering. Factors such as globalization and the pervading expansion of deflationary technology into our personal and work lives are contributing to disinflation. Valuable conclusions can be synthesized beyond digesting the pessimistic and nauseating analysis of Jerome Powell’s Congressional testimony, along with the needless wordsmithing of recent Fed minutes.

In order to earn above-average, financial returns in your portfolio over the long-run, experiencing unsettling volatility and corrections is the price of doing business. Flying on rocket ships might be fun, but sometimes the rocket can run out of gas, and you are forced to jump on a roller coaster. The ups-and-downs can be frustrating at times, but if you stay on for the full ride, you will almost always end with a smile on your face when it’s over.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (February 1, 2022). Subscribe on the right side of the page for the complete text.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in PFE and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Cash Is Trash

The S&P 500 stock market index took a breather and ended its six-month winning streak, declining -4.8% for the month. Even after this brief pause, the S&P has registered a very respectable +14.7% gain for 2021, excluding dividends. Nevertheless, even though the major stock market indexes are roaming near all-time record highs, FUD remains rampant (Fear, Uncertainty, Doubt).

As the 10-Year Treasury Note yield has moved up to a still-paltry 1.5% level this month, the talking heads and peanut gallery bloggers are still fretting over the feared Federal Reserve looming “tapering”. More specifically, Jerome Powell, the Fed Chairman and the remainder of those on the FOMC (Federal Open Market Committee) are quickly approaching the decision to reduce monthly bond purchases (i.e., “tapering”). The so-called, quantitative easing (QE) program is currently running at about $120 billion per month, which was established with the aim to lower interest rates and stimulate the economy. Now that the COVID recovery is well on its way, the Fed is effectively trying to decrease the size of the current, unruly punch-keg down to the volume of a more manageable punch bowl.

Stated differently, even when the arguably overly-stimulative current bond buying slows or stops, the Federal Funds Rate is still effectively set at 0% today, a level that still offers plenty of accommodative fuel to our economy. Although interest rates will not stay at 0% forever, many people forget that between 2008 and 2015, the Fed Funds Rate stubbornly stayed sticky at 0% (i.e., a full punch bowl) for seven years, even without any spike in inflation.

Because the economy continues to improve, current consensus projections by economists show the first interest rate increase of this cycle (i.e., “liftoff”) to occur sometime in 2022 and subsequently climb to a still extraordinarily low level of 2.0% by 2024 (see “Dot Plot” below). For reference, the projected 2.0% figure would still be significantly below the 6.5% Fed Funds Rate we saw in the year 2000, the 5.3% in 2007, or the 2.4% in 2019. If history is any guide, under almost any scenario, Chairman Powell is very much a dove and is likely to tap the interest rate hike brakes very gently.

Low But Not the Lowest

In a world of generationally low interest rates, what I describe as our low bond yields here in the United States are actually relatively high, if you consider rates in other major industrialized economies and the trillions of negative-interest-rate bonds littered all over the rest of the world (see August’s article, $16.5 Trillion in Negative-Yielding Debt). Although our benchmark government rates are hovering around 1.5%, as you can see from the chart below, Germany is sitting considerably lower at -0.2%, Japan at 0.1%, France at 0.2%, and the United Kingdom at 1.0%.

Taper Schmaper

As with many government related policies, the Federal Reserve often gets too much credit for successes and too much blame for failures, as it relates to our economy. I have illustrated the extent of how globally interconnected our world of interest rates is, and one taper announcement is unlikely to reverse a four-decade disinflationary declining trend in interest rates.

Back in 2013, after of five years of quantitative easing (QE) that began in 2008, investors were terrified that interest rates were artificially being depressed by a money-printing Fed that had gone hog-wild in bond buying. At that time, pundits feared an imminent explosion higher in interest rates once the Fed began tapering. So, what happened after Federal Reserve Chairman Ben Bernanke broached the subject of tapering on June 19, 2013? The opposite occurred. Although 10-Year yields jumped 0.1% to 2.3% on the day of the announcement, interest rates spent the majority of the next six years declining to 1.6% in 2019, pre-COVID. As COVID began to spread globally, rates declined further to 0.95% in March of 2020, the day before Jerome Powell announced a fresh new round of quantitative easing (see chart below).

Obviously, every economic period is different from previous ones, and fearing to fall off the floor to lower interest rate levels is likely misplaced at such minimal current rates (1.5%). However, panicking over potential exploding interest rates, as in 2013 (which did not happen), again may not be the most rational behavior either.

What to Do?

If interest rates are low, and inflation is high (see chart below), then what should you do with your money? Currently, if your money is sitting in cash, it is losing 4-5% in purchasing power due to inflation. If your money is sitting in the bank earning minimal interest, you are not going to be doing much better than that. Everybody’s time horizon and risk tolerance is different, but regardless of your age or anxiety level, you need to efficiently invest your money in a diversified portfolio to counter the insidious, degrading effects of inflation and generationally low interest rates. The “do-nothing” strategy will only turn your cash into trash, while eroding the value of your savings and retirement assets.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (October 1, 2021). Subscribe on the right side of the page for the complete text.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Investors Ponder Stimulus Size as Rates Rise

Stock prices rose again last month in part based on passage optimism of a government stimulus package (currently proposed at $1.9 trillion). But the rise happened before stock prices took a breather during the last couple of weeks, especially in hot growth sectors like the technology-heavy QQQ exchange traded fund, which fell modestly by -0.1% in February. As some blistering areas cooled off, investors decided to shift more dollars into the value segment of the stock market (e.g., the Russell 1000 Value index soared +6% last month). Over the same period, the S&P 500 and Dow Jones Industrial Average indexes climbed +2.6% and +3.2%, respectively.

What was the trigger for the late-month sell-off? Many so-called pundits point to a short-term rise in interest rates. While investor anxiety heightened significantly at the end of the month, the S&P 500 dropped a mere -3.5% from all-time record highs after a slingshot jump of +73.9% from the March 2020 lows.

Do Rising Interest Rates = Stock Price Declines?

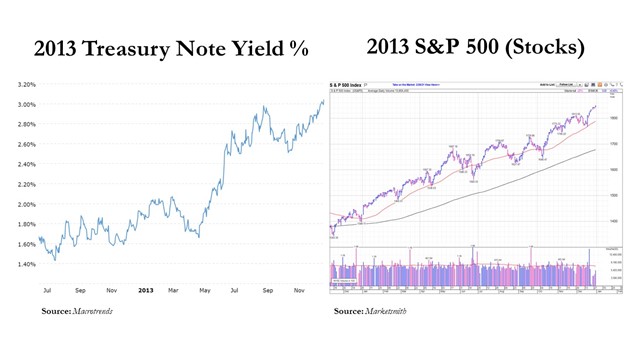

Conventional wisdom dictates that as interest rates rise, stock prices must fall because higher rates are expected to pump the breaks on economic activity and higher yielding fixed income investments will serve as better alternatives to investing in stocks. Untrue. There are periods of time when stock prices move higher even though interest rates also move higher

Take 2013 for example – the yield on the benchmark 10-Year Treasury Note climbed from +1.8% to 3.0%, while the S&P 500 index catapulted +29.6% higher (see charts below).

Similarly to now, during 1994 we were still in a multi-decade, down-trending interest rate environment. However, from the beginning of 1994 to the middle of 1995 the Federal Reserve hiked the Federal Funds interest rate target from 3% to 6% (and the 10-Year Treasury yield temporarily climbed from about 6% to 8%), yet stock prices still managed to ascend +17% over that 18-month period. The point being, although rising interest rates are generally bad for asset price appreciation, there are periods of time when stock prices can move higher in synchronization with interest rates.

What’s the Fuss about Stimulus?

One of the factors keeping the stock market afloat near record highs is the prospect of the federal government passing a COVID stimulus package to keep the economic recovery continuing. Even though there is a new administration in the White House, Democrats hold a very narrow majority of seats in Congress, leaving a razor thin margin to pass legislation. This means President Biden needs to keep moderate Democrats like Joe Manchin in check, and/or recruit some Republicans to jump on board to pass his $1.9 trillion COVID stimulus plan. If the bill is passed as proposed, “The relief plan would enhance and extend jobless benefits, provide $350 billion to state and local governments, send $1,400 to many Americans and fund vaccine distribution, among other measures,” according to the Wall Street Journal.

Valuable Vaccines

Fresh off the press, we just received additional good news on the COVID vaccine front. The U.S. Food and Drug Administration (FDA) approved the third vaccine for COVID-19 by Johnson & Johnson (JNJ). This J&J treatment is also the first single-dose vaccine to be distributed, unlike the other two vaccines manufactured by Pfizer Inc. (PFE) and Moderna Inc. (MRNA), which both require two shots. Johnson & Johnson expects to ship four million doses immediately and 20 million doses by the end of March.

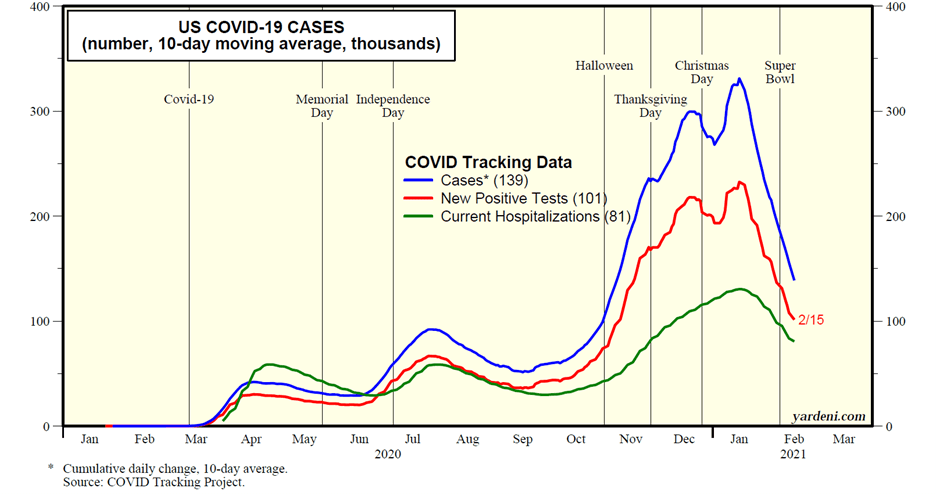

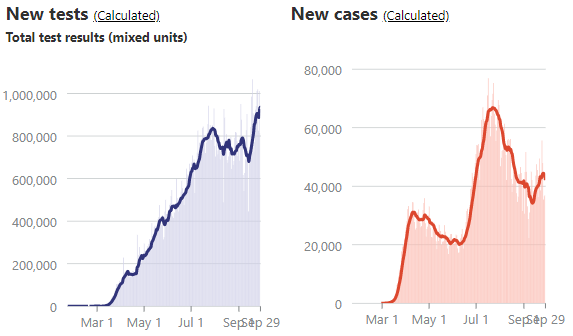

So far, over 50 million doses of the COVID vaccines have been administered, and the White House believes they can go from currently about 1.5 million injections per day to approximately 4 million people per day by the end of March. The combination of the vaccines, mitigation behavior, and a slow march towards herd immunity have resulted in encouraging COVID trends, as you can see from the chart below. However, the bad news is new COVID cases, hospitalizations, and deaths still remain above peak levels experienced last spring and summer.

Revived Recovery

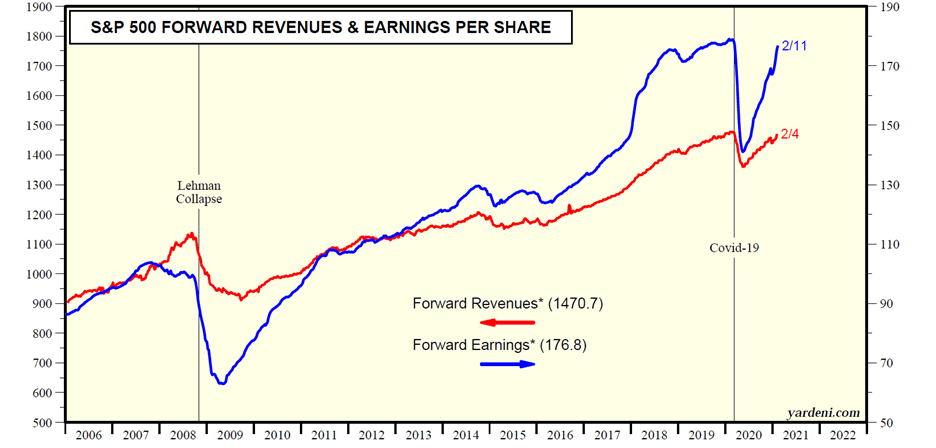

Thanks to the improving COVID trends, a continued economic recovery driven by reopenings, along with fiscal and monetary stimulus, business profits and revenues have effectively recovered all of the 2020 pandemic losses within a year (see chart below).

But with elevated stock prices have come elevated speculation, which we have seen bubble up in various forms. With the rising tide of new investors flooding onto new trading platforms like Robinhood, millions of individuals are placing speculative bets in areas like Bitcoin; new SPACs (Special Purpose Acquisition Companies); overpriced, money-losing cloud software companies; and social media recommended stocks found on Reddit’s WallStreetBets like GameStop (GME), which was up +150% alone last week. At Sidoxia Capital Management, we don’t spend a lot of time chasing the latest fad or stock market darling. Nevertheless, as long-term investors, we continue to find attractively valued investment opportunities that align with our clients’ objectives and constraints.

Overall, the outlook for the end of this pandemic looks promising as multiple COVID vaccines get administered, and the economic recovery gains steam with the help of reopenings and stimulus. If rising interest rates and potential inflation accelerate, these factors could slow the pace of the recovery and limit future stock market returns. However, if you follow a systematic, disciplined, long-term investment plan, like we implement at Sidoxia, you will be in a great position to prosper financially over the long-run.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (March 1, 2021). Subscribe on the right side of the page for the complete text.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in MRNA, PFE, and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in GME, JNJ, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

GDP Figures & Election Jitters

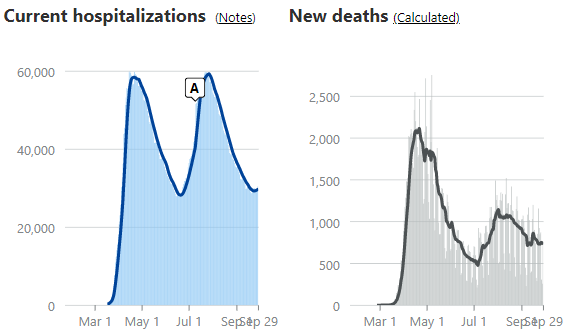

Ever since the beginning of 2020, it’s been a tale of two cities. As renowned author Charles Dickens famously stated, “It was the best of times and worst of times.” The year started with unemployment at a “best of times” low level of 3.5% (see chart below) before coronavirus shutdown the economy during March when we transitioned to the “worst of times.”

|

With the recent release of record-high Gross Domestic Product (GDP) figures of +33.1% growth in Q3 (vs. -31.4% in Q2), and a +49% stock market rebound from the COVID-19 lows of March, a debate has been raging. Is the re-opening economic rebound that has occurred a V-shaped recovery that will continue expanding, or is the recovery that has occurred since March a temporary dead-cat bounce?

|

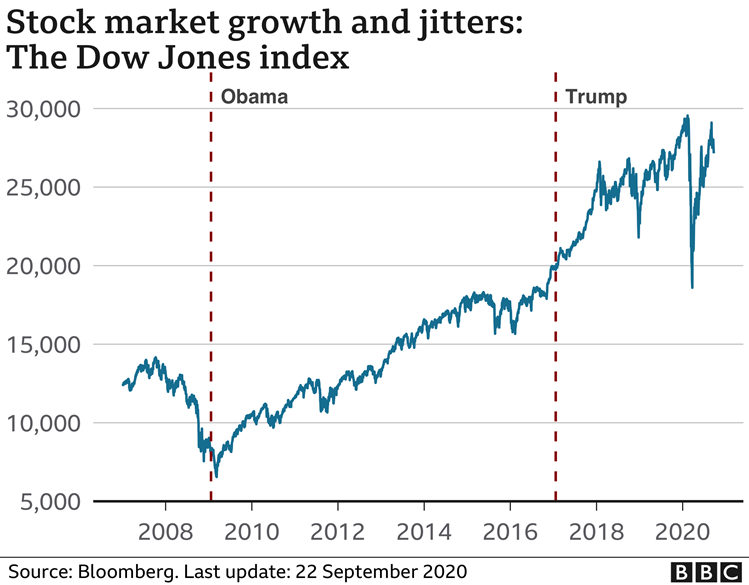

For many people, the ultimate answer depends on the outcome of the impending presidential election. Making matters worse are the polarized politics that are being warped, distorted, and amplified by social media (see Social Dilemma). Although the election jitters have many stock market participants on pins and needles, history reminds us that politics have little to do with the long-term direction of the stock market and financial markets. As the chart below shows, over the last century, stock prices have consistently gone up through both Democratic (BLUE) and Republican (RED) administrations.

|

Even if you have trouble digesting the chart above, I repeatedly remind investors that political influence and control are always temporary and constantly changing. There are various scenarios predicted for the outcome of the current 2020 elections, including a potential “Blue Wave” sweep of the Executive Branch (the president) and the Legislative Branch (the House of Representatives and Senate). Regardless of whether there is a Blue Wave, Red Wave, or gridlocked Congress, it’s worth noting that the previous two waves were fleeting. Unified control of government by President Obama (2008-2010) and President Trump (2016-2018) only lasted two years before the Democrats and Republicans each lost 100% control of Congress (the House of Representatives flipped to Republican in 2010 and Democrat in 2018).

Even though Halloween is behind us, many people are still spooked by the potential outcome of the elections (or lack thereof), depending on how narrow or wide the results turn out. Despite the +49% appreciation in stock prices, stock investors still experienced the heebie-jeebies last month. The S&P 500 index declined -2.8% for the month, while the Dow Jones Industrial Average and Nasdaq Composite index fell -4.6% and -2.3%, respectively. It is most likely true that a close election could delay an official concession, but with centuries of elections under our belt, I’m confident we’ll eventually obtain a peaceful continuation or transition of leadership.

Regardless of whomever wins the presidential election, roughly half the voters are going to be unhappy with the results. For example, even when President Ronald Reagan won in a landslide victory in 1980 (Reagan won 489 electoral votes vs. 49 for incumbent challenger President Jimmy Carter), Reagan only won 50.8% of the popular vote. In other words, even in a landslide victory, roughly 49% of voters were unhappy with the outcome. No matter the end result of the approaching 2020 election, suffice it to say, about half of the voting population will be displeased.

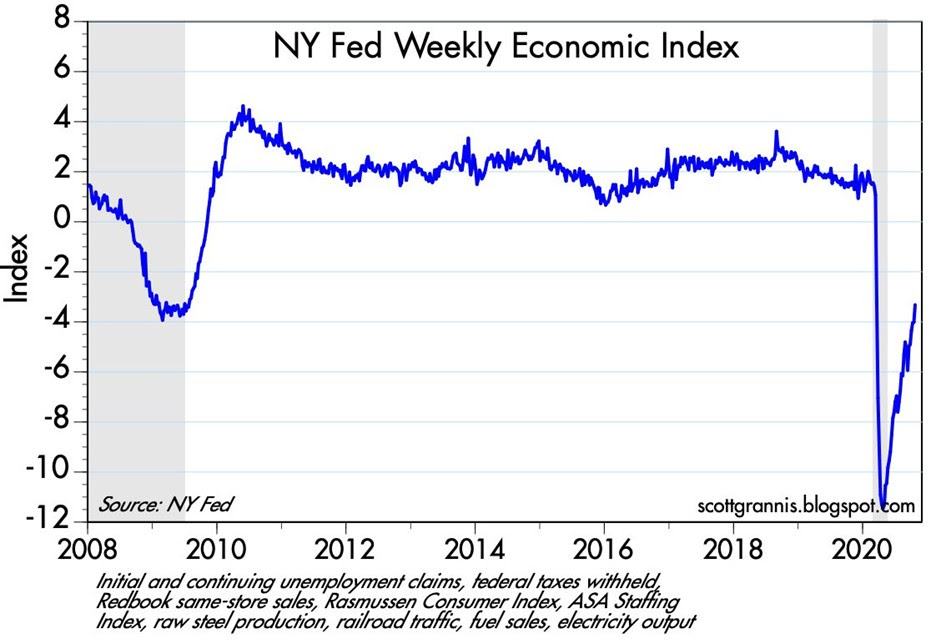

Despite the likely discontent, the upcoming winner will be working with (or inheriting) an economy firmly in recovery mode, whether you are referencing, jobs, automobile sales, home sales, travel, transportation traffic, consumer spending, or other statistics. The Weekly Economic Index from the New York Federal Reserve epitomizes the strength of the V-shaped recovery underway (see chart below).

It will come as no surprise to me if we continue to experience some volatility in financial markets shortly before and after the elections. However, history shows us that these election jitters will eventually fade, and the tale of two cities will become a tale of one city focused on the fundamentals of the current economic recovery.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (November 2, 2020). Subscribe on the right side of the page for the complete text.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFS), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Politics & COVID Tricks

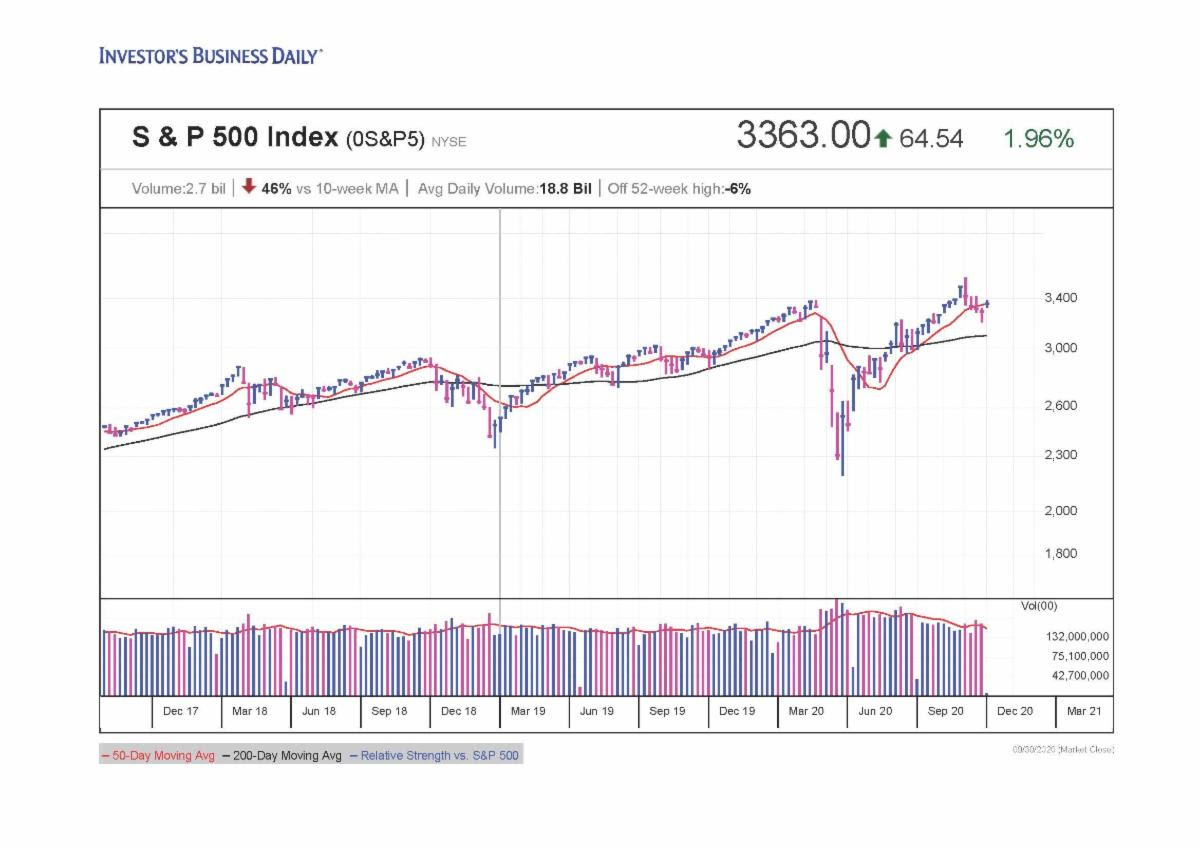

Thanks to a global epidemic, trillions of dollars instantly disappeared during the first quarter of this year, and then, abracadabra…the losses turned into gains and magically reappeared in the subsequent two quarters. After a stabilization in the spread of the COVID-19 virus earlier this year, the stock market rebounded for five consecutive months, at one point rebounding +64% (from late March to early September) – see chart below. However, things became a little bit trickier for the recent full month as concerns heightened over the outcome of upcoming elections; uncertainty over a potential coronavirus-related stimulus package agreement; and fears over a fall resurgence in COVID-19 cases. Although the S&P 500 stock index fell -3.9% and the Dow Jones Industrial Average slipped -2.3% during September, the same indexes levitated +8.5% and +7.6% for the third quarter, respectively.

Source: Investors.com

Washington Worries

Anxiety over politics is nothing new, and as I’ve written extensively in my Investing Caffeine blog, history teaches us that politics have little to do with the long-term performance of the overall stock market (e.g., see Politics & Your Money). Nobody knows with certainty how the elections will impact the financial markets and economy (myself included). But what I do know is that many so-called experts said the stock market would decline if Barack Obama won the presidential election…in reality the stock market soared. I also know the so-called experts said the stock market would decline if Donald Trump won the presidential election… in reality the stock market soared. So, suffice it to say, I don’t place a lot of faith into what any of the so-called political experts say about the outcome of upcoming elections (see the chart below).

COVID Coming Back?

One of the reasons stock prices have risen more than 50%+ is due to a stabilization in COVID-19 virus trends. As you can see from the charts below, new tests, hospitalizations, and death rates are generally on good trajectories, according to the COVID Tracking Project. However, new COVID cases have bumped higher in recent weeks. This recent, troubling trend has raised the question of whether another wave of cases is building in front of a dangerous, seasonally-cooler fall flu season. Traditionally, it’s during this fall period in which contagious viruses normally spread faster.

Source: The COVID Tracking Project

Regardless of the trendline in new cases, there is plenty of other promising COVID developments to help fight this pandemic, such as the pending approvals of numerous vaccines, along with improved therapies and treatments, such as therapeutics, steroids, blood thinners, ventilators, and monoclonal antibodies.

Business Bounce

From the 10,000-foot level, despite worries over various political outcomes, the economy is recovering relatively vigorously. As you can see from the chart below, the rebound in employment has been fairly swift. After peaking in April at 14.7%, the most recent unemployment rate has declined to 8.4%, and a closely tracked ADP National Employment Report was released yesterday showing a higher than expected increase in new private-sector monthly jobs (749,000 vs. 649,000 median estimate).

Source: U.S. Bureau of Labor Statistics

From a housing perspective, house sales have been on fire. Record-low interest rates, mortgage rates, and refinancing rates have been driving higher home purchases and rising prices. Urban flight to the suburbs has also been a big housing tailwind due to the desire for more socially distanced room, additional home office space, and expansive backyards. Adding fuel to the housing fire has been record low supply (i.e., home inventories). The robust demand is evident by the record Case-Shiller home prices (see chart below).

Source: Calculated Risk

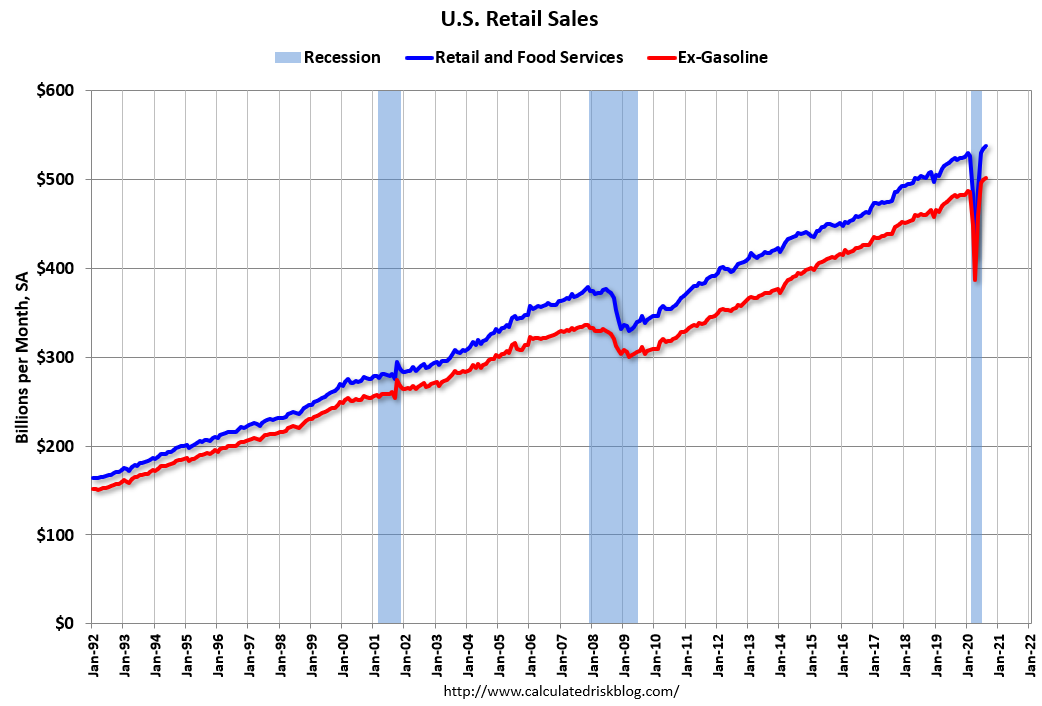

There are plenty of industries hurting, including airlines, cruise lines, hotels, retailers, and restaurants but the economic rebound along with government stimulus (i.e., direct government checks and unemployment relief payments) have led to record retail sales (see chart below). Spending could cool if an additional coronavirus-related stimulus package agreement is not reached, but until the government checks stop flowing, consumers will keep spending.

Source: Calculated Risk

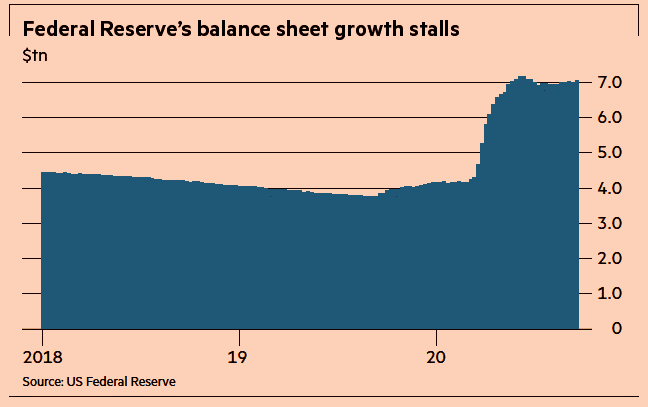

Besides trillions of dollars in fiscal relief injected into the economy, the Federal Reserve has also provided trillions in unprecedented relief (see chart below) through its government and corporate bond buying programs, in addition to its Main Street Lending Program.

Source:The Financial Times

There has been a lot of political hocus pocus and COVID smoke & mirrors that have much of the population worried about their investments. In every presidential election, you have about half the population satisfied with the winner, and half the population disappointed in the winner…this election will be no different. The illusion of fear and chaos is bound to create some short-term financial market volatility over the next month, but behind the curtains there are numerous positive, contributing factors that are powering the economy and stock market forward. Do yourself a favor by focusing on your long-term financial future and don’t succumb to politics and COVID tricks.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (October 1, 2020). Subscribe on the right side of the page for the complete text.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFS), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

The Fed: Myths vs. Reality

Traders, bloggers, media talking heads, and pundits of all stripes went into a feverish sweat as they anticipated the comments of Federal Reserve Chairman Janet Yellen at the annual economic summit held in Jackson Hole, Wyoming. When Yellen, arguably the most dovish Fed Chairman in history, uttered, “I believe the case for an increase in the federal funds rate has strengthened in recent months,” an endless stream of commentators used this opportunity to spout out a never-ending stream of predictions describing the looming consequences of such a potential rate increase.

As I’ve stated before, the Fed receives both too much blame and too much credit for basically doing nothing except moving short-term interest rates up or down (and most of the time they do nothing). However, until the next Fed meeting in September (or later), we all will be placed in purgatory with non-stop speculation regarding the timing of the next rate increase.

The ludicrous and myopic analysis can be encapsulated by the recent article written by Pulitzer Prize-winning Fed writer Jon Hilsenrath, in his piece titled, The Great Unraveling: Fed Missteps Fueled 2016 Populist Revolt. Somehow, Hilsenrath is making the case that a group of 12 older, white people that meet eight times per year in Washington to discuss interest rate policy based on inflation and employment trends has singlehandedly created income inequality, and a populist movement leading to the rise of Donald Trump and Bernie Sanders.

While this Fed scapegoat explanation is quite convenient for the doom-and-gloomers (see The Fed Ate My Homework), it is way off base. I hate to break it to Mr. Hilsenrath, or other conspiracy theorists and perma-bears, but blaming a small group of boring bankers is an overly-simplistic “straw man” argument that does not address the infinite number of other factors contributing to our nation’s social and economic problems.

Ever since the bull market began in 2009, a pervasive skepticism and mistrust have kept the bull market climbing a wall of worry to all-time record levels. In the process, Hilsenrath et. al. have proliferated an inexhaustible list of myths about the Fed and its powers. Here are some of them:

Myth #1: The printing of money by the Fed has led to an artificially inflated stock market bubble and Ponzi Scheme.

- As stock prices have more than tripled over the last eight years to record levels, I’ve reveled in the hypocrisy of the “money printers” contention. First of all, the money printing derived from Quantitative Easing (QE) was originally cited as the sole reason for low, declining interest rates and the rising stock market. The money printing community vociferously predicted once QE ended, as it eventually did in 2014, interest rates would explode higher and stock market prices would collapse. What happened? The exact opposite occurred. Interest rates have gone to record low levels, and stock prices have advanced to all-time record highs.

Myth #2: The Fed controls all interest rates.

- Yes, the Fed can influence short-term interest rates through bond purchases and the targeting of the Federal Funds rate. However, the Fed has little-to-no influence on longer-term interest rates. The massive global bond market dwarfs the size of the Fed and U.S. stock market, and as such, large global financial institutions, pensions, hedge funds, and millions of other investors around the world have more influence on longer-term interest rates. The relationship between the 10-Year Treasury Note yield and the Fed’s monetary policy is loose at best.

Myth #3: The stock market will crash when the Fed raises interest rates.

- Well, we can see that logic is already wrong because the stock market is up significantly since the Fed raised interest rates in mid-December 2015. It is true that additional interest rate hikes are likely to occur in our future, but that does not necessarily mean stock prices are going to plummet. Commentators and bloggers are already panicking about a potential rate hike in September. Before you go jump out a window, let’s put this potential rate hike into context. For starters, let’s not forget the “dove of all doves,” Janet Yellen, is in charge and there has only been one rate increase 0f 0.25% over the last decade. As I point out in one of my previous articles (see Fed Fatigue), stock prices increased during the last rate hike cycle (2004 – 2006) when the Fed raised interest rates from 1.0% to 5.25% (the equivalent of another 16 rate hikes of 0.25%). The world didn’t end in 1994 either, when the Fed Funds rate increased from 3% to 6% over a short time frame, and stocks finished roughly flat for the period. Inflation levels remain at relatively low levels, and the Fed has moved less than 10% of recent hike cycles, so now is not the time to panic. Regardless of what the fear mongers say, the Fed and the bull market fairy godmother (Janet Yellen) will be measured and deliberate in its policies and will verify that any policy action is made into a healthy, strengthening economy.

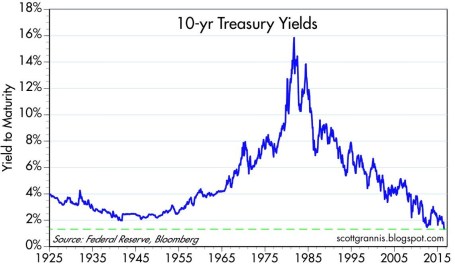

Myth #4: Stimulative monetary policies instituted by the Fed and other central banks will lead to hyperinflation.

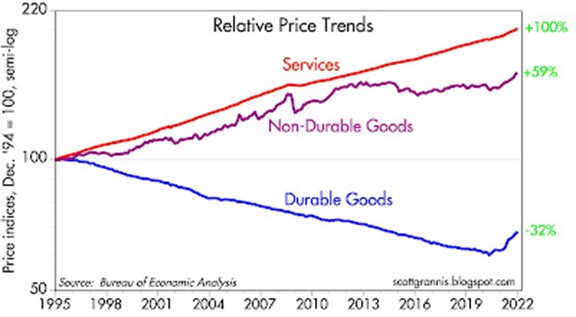

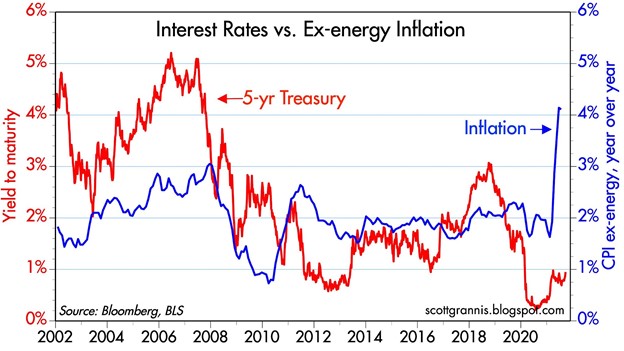

- Japan has done QE for decades, and QE efforts in the U.S. and Europe have also disproved the hyperinflation myth. While commentators, pundits, and journalists like to all point and blame Janet Yellen and the Fed for today’s so-called artificially low interest rates, one does not need to be a genius to realize there are other factors contributing to low rates and inflation. Declining interest rates and inflation are nothing new…this has been going on for over 35 years! (see chart below) As I have discussed previously the larger contributors to declining interest rates and disinflation are technology, globalization, and emerging markets (see Why 0% Interest Rates?). By next year, over one-third of the world’s population is expected to own a smartphone (2.6 billion people), the equivalent of a supercomputer in the palm of their hands. Mobile communication, robotics, self-driving cars, virtual & augmented reality, drones, artificial intelligence, drones, biotechnology, and other technologies are dramatically impacting productivity (i.e., downward pressure on prices and interest rates). These advancements, combined with the billions of low-priced workers in emerging markets, who are lifting themselves out of poverty, are contributing to the declining rate/inflation trend.

Source: Calafia Beach Pundit

As the next Fed meeting approaches, there is no doubt the airwaves and internet will be filled with alarmist calls from the likes of Jon Hilsenrath and other Fed-haters. Fortunately, more informed financial market observers will be able to filter out this noise and be able to separate out the many Fed and interest rate myths from the reality.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.