Posts tagged ‘equities’

Turn Off TV – Emperor Media Has No Clothes!

Famous Danish author Hans Christian Andersen told a renowned fairy tale of an emperor who was conned into believing he is wearing an invisible suit. The crowd was too embarrassed to acknowledge his nakedness, so they pretend to not notice – until a young boy shouted, “The emperor has no clothes!”

Much like the fairy tale, when it comes to pointing out the many shortcomings of the financial media, I have no problem yelling, “The Emperor Media has no clothes!”

Media Spreads Fear and Misinformation

Mark Twain famously stated, “If you don’t read the newspaper, you’re uninformed. If you read the newspaper, you’re misinformed.” That sentiment rings especially true amid today’s swirl of alarming headlines. Here’s a sampling of recent media-induced worries:

- Global trade war caused by tariffs

- Declining value of the U.S. dollar

- Rising interest rates due to foreign debt sales

- Doubts over the U.S. dollar’s global reserve currency status

- Recession anxiety

- Stagflation fears

- Concerns about Executive Branch overreach

- Threats to remove the Federal Reserve Chairman

Is the sky falling? Is now the time to sell stocks, as the media often implies? Or are these risks being overstated and distorted by media outlets that chase monetary gains?

Issues are More Gray Than Black or White

Journalists – most of whom have little investing experience – like to authoritatively paint economic issues in black-or-white terms. But most reasonable people understand that these matters are complex, and the truth lies somewhere in the gray. To claim the media offers a balanced view of both the positives and negatives of complicated financial topics would be disingenuous.

I have been investing for over 30 years, and while I’ve never faced a global rebalancing of trade impacting trillions in economic activity, I’ve lived through far more uncertain times. Not only have my investments survived those volatile periods, but they have also thrived – repeatedly hitting new record highs.

F.U.D. Sells!

Does the media want you to believe the accurate, long-term stock market prosperity story? Hardly. As the saying goes, “If it bleeds, it leads.” Fear, uncertainty, and doubt (F.U.D.) sell more ads, subscriptions, newspapers, and magazines. The more blood, sweat, and anxiety in the headlines, the more money the media makes from distressed readers.

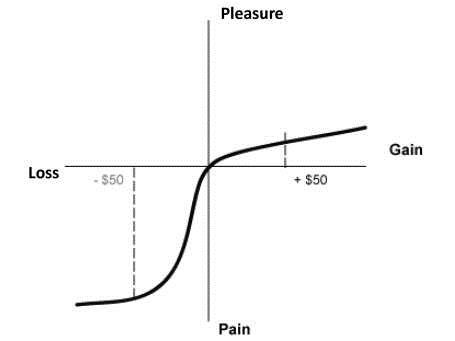

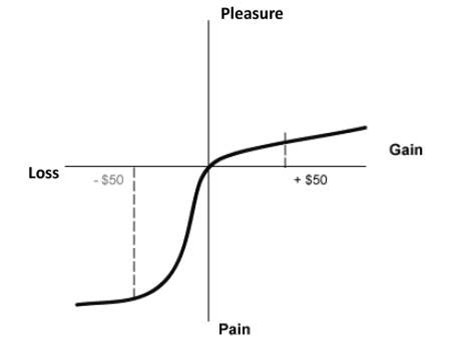

Behavioral finance pioneers, Nobel Prize winner Daniel Kahneman and Amos Tversky, showed that losses feel twice as painful as the pleasure of gains (see the Pleasure/Pain diagram below). Their Prospect Theory remains just as relevant today as when it was introduced in the late 1970s.

The greatest investor of all-time, Warren Buffett, once said, “Be fearful when others are greedy, and greedy when others are fearful.” Unfortunately, the media pushes the opposite mantra: “sell fear and buy greed.” When markets fall, they sell Armageddon. When markets soar, they sell nirvana. During periods of over-optimism, they also exploit FOMO (Fear of Missing Out) by feasting on investors’ emotional cycle of excitement.

Reassuring long-term investors that everything will be okay—or that dips are buying opportunities—doesn’t generate as much media profits and ad sales. Fear does.

History Doesn’t Repeat Itself, But It Often Rhymes

Too many investors suffer from short-term thinking and goldfish-like memory. But as Mark Twain wisely stated, “History doesn’t repeat itself, but It often rhymes.” And history has shown that listening to the media during times of extreme market volatility often leads to poor decisions.

Let’s take a look at some key examples where media-driven fear was more misleading than helpful over the decades:

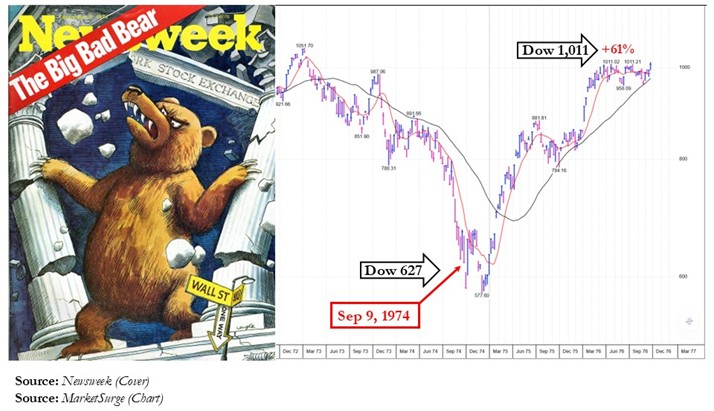

The Nifty Fifty Collapse (1973-1974)

In the early 1970s, long before the “Magnificent 7” stocks came to the fore, we had the “Nifty Fifty” stocks. These large-cap blue chip stocks traded at lofty P/E (Price-Earnings) ratios and were seen as invincible before they came crashing down in 1973-1974. Suffice it to say, the media headlines were horrific during this period.

Here is some context for this period:

- The U.S. was exiting the Vietnam War

- Economy was undergoing a major recession

- Watergate scandal and presidential resignation

- 9% unemployment

- The Arab Oil Embargo

- Surging inflation

The media’s response? Doom and gloom. Here’s an example of this sentiment from the Newsweek cover, “The Big Bad Bear,” published on September 9, 1974.

For those who sold in fear, the results were disastrous. The Dow bottomed shortly after the magazine was released and the market rebounded +61% in less than two years. Panic was the wrong move.

“The Death of Equities” (1979)

Inflation plagued the 1970s, and just before one of the longest bull markets in history, BusinessWeek declared “The Death of Equities” on its now-infamous September 1979 cover. Once again, the media acted as a perfect contrarian indicator with the Dow quadrupling over the next decade.

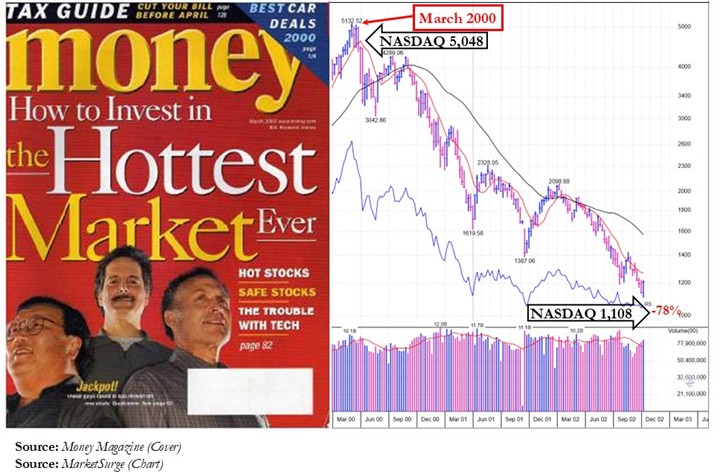

Dot-Com Bubble: “The Hottest Market Ever” (2000)

In March 2000, at the peak of the tech bubble, Money magazine ran a cover story: “How to Invest in the Hottest Market Ever.” Weeks later, the bubble burst. Suboptimal timing once again.

In that same timeframe, Newsweek captured the essence of FOMO with its July 5, 1999 cover: “Everyone Is Getting Rich but Me.” Right when risk was at its peak, most investors were blind to it and got sucked into the downdraft.

Source: NewsWeek

Financial Crisis – Depression 2.0 (2008)

In October 2008, the Time magazine cover encapsulated the zeitgeist of the period with a 1929 photo that included a line of desperate people waiting for food donations at a soup kitchen. Many feared a second Great Depression. Yet it was one of the best times in history to buy stocks with the Dow tripling over the next decade.

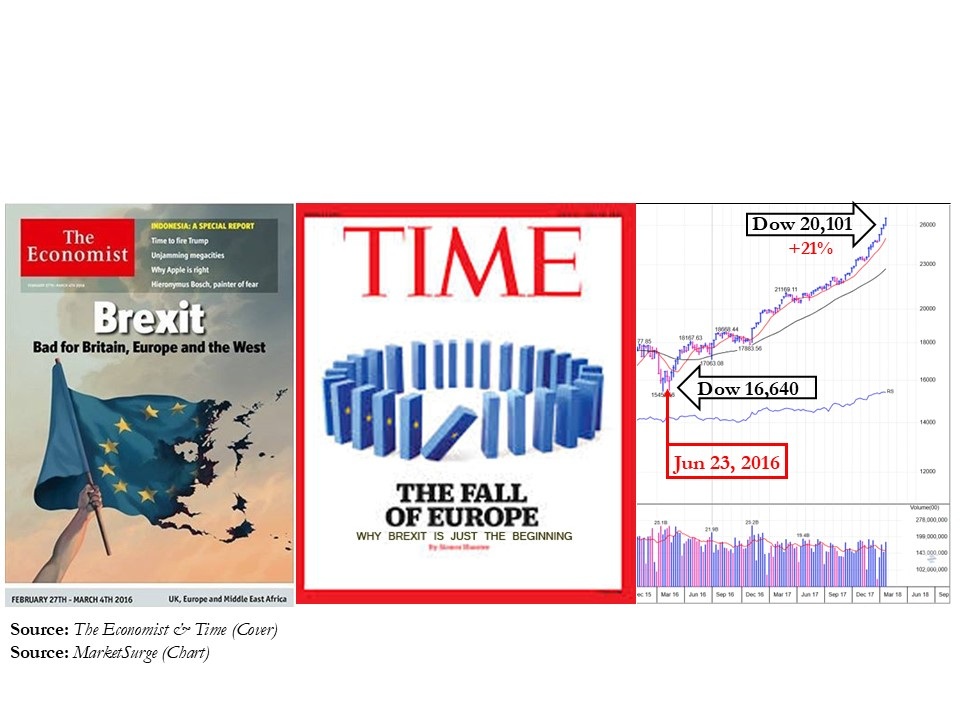

Brexit Panic (2016)

Media coverage around the U.K.’s Brexit vote to leave the EU (European Union) painted a picture of imminent recession and contagion. Instead, the media blitz surrounding Brexit turned out to be more molehill than mountain. Markets rebounded strongly and reached new highs in the subsequent months.

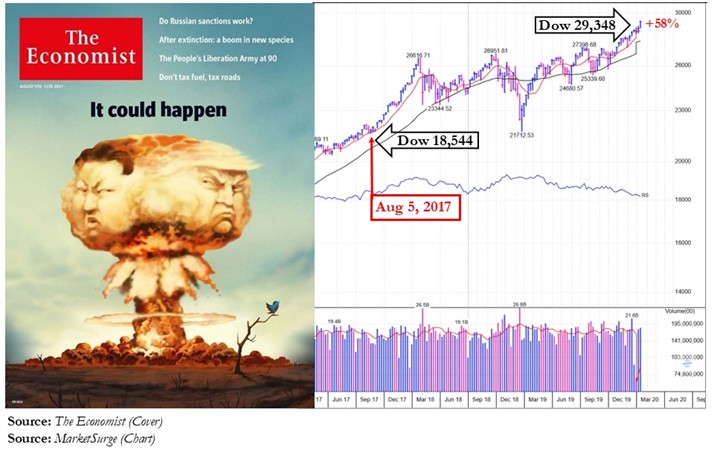

“Rocketman” and North Korea Missiles (2017)

Tensions flared in 2017 as North Korea tested missiles and President Trump threatened retaliation against dictator Kim Jong Un by bombing Pyongyang and “Rocket Man”. The media went into overdrive regarding the nuclear unease, but the market brushed it off and continued climbing +58% over the next few years.

COVID-19 Pandemic (2020)

With over 3 million deaths worldwide and a grinding halt to the global economy, markets initially fell roughly -35%. But as consumers stockpiled toilet paper, fast vaccine development and stimulus sparked a powerful rebound, with stocks finishing the year up +16%. Over the next two years, the Dow almost doubled.

Hostage to Our Lizard Brain

Why are we so susceptible to the sensationalist tendencies of the media? Evolution holds the answer. Humans’ DNA and brains are hard-wired to flee prey. The small almond-shaped tissue in our brain called the amygdala—or what author Seth Godin calls the “lizard brain”—evolved to respond instantly to danger. When headlines scream “crash” or “war,” our emotional brain overrides our logical one, which leads to poor long-term results. As Seth Godin explains, we’re wired to react, not reflect (Watch here). And the media knows it.

Headlines Change but the Long-Term Market Trend Doesn’t

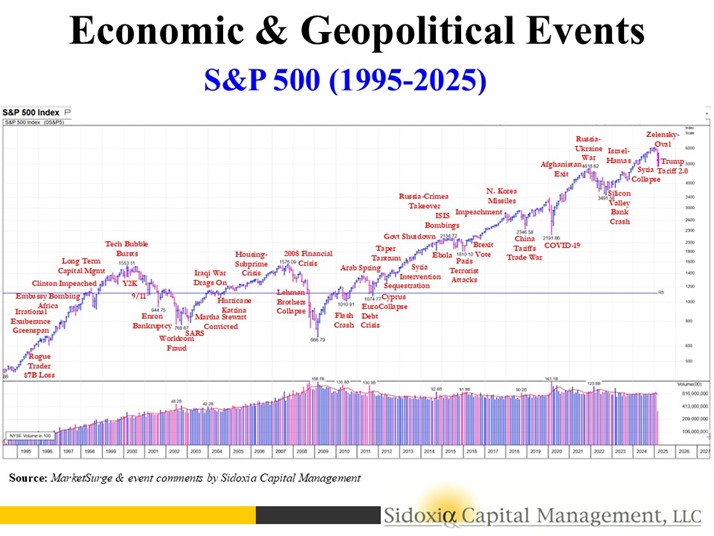

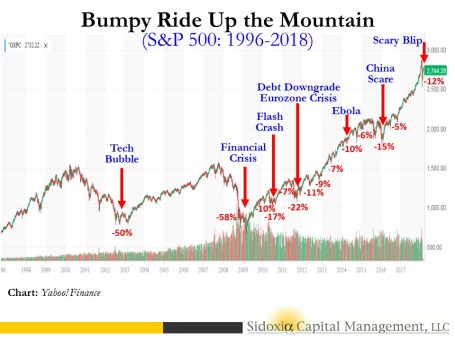

Despite a barrage of negative headlines, stocks have remained resilient over the long run. The market has overcome wars, assassinations, currency crises, banking failures, terrorist attacks, pandemics, natural disasters, impeachments, tax hikes, recessions, restrictive Fed policies, debt downgrades, inflation, and yes, even tariffs (see chart below). Since WWII, we’ve had 12 recessions—each followed by a full recovery to new record highs. In baseball terms, the economy has batted a perfect 1.000 (12-for-12) with recession recoveries.

How to Survive the Avalanche of Media Headlines

Here are five key strategies:

- Turn off the TV: Don’t obsess over headlines. Emotional reactions result in poor decisions.

Buying high (greed) and selling low (fear) is not a recipe for long-term investment success.

- Diversify Your Investments: A well-balanced portfolio across asset classes helps reduce panic.

- Invest According to Time Horizon: Are you young? Assuming more risk and higher exposure to the stock market is generally fine. Are you near retirement? Don’t jeopardize your retirement goals – de-risk accordingly.

- Ignore Talking Heads: Most pundits don’t invest and their credibility is compromised by monetary conflicts of interest. It’s much more beneficial to follow seasoned professionals with real track records through multiple bull and bear markets.

- Avoid the Herd: Continually following the herd into the most popular investments often leads to underperformance. The grass is greener, and the food sources are more plentiful, off the beaten path trampled by the herd. Contrarian thinking works even though it can feel scary.

In the age of constant connectivity, headlines and the 24/7 news cycle are addictive. But if you’re tired of being a pawn in the media’s game, I invite you to join my fight by acknowledging that the Emperor Media has no clothes.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (May 1, 2025). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on the IC Contact page.

No Market Misgiving on This Thanksgiving

We’ll see if there is any gravy left for investors during the last month of the year, but so far 2024 has been a satiating feast that has stuffed investors. There has been a cornucopia of items to be thankful for, including the Federal Reserve, which is expected to provide some dessert this month in the form of its third interest rate cut this year.

Investors certainly can also be grateful for the performance of the stock market, which has had a phenomenal year thus far (see chart below):

• S&P 500: +26.5%

• Dow Jones Industrial Average:+19.2%

• NASDAQ: +28.0%

On a two-year basis, the S&P 500 results look even tastier: +57.1%

Why is there such a large appetite for stocks? For starters, we are coming off a fresh election last month, and the majority of Americans decided to vote for the new administration that has promised additional stimulative tax cuts, and deregulation. If these promises come to fruition, these changes could augur well for corporate profits and a rising stock market. Regardless of whether your candidate won or lost the election, investors can agree there is less uncertainty with an uncontested election, which is welcomed by all. In addition, the two Fed rate cuts that started in September have also buoyed enthusiasm.

What is less clear are the effects of President-elect Donald Trump’s tariff policy threats, which if enacted run the risk of increasing inflation, stifling global trade, and jeopardizing future Fed rate cuts. Combined, these negative side effects have the potential of significantly dampening economic growth. On the other hand, if the tariffs are only used as a negotiating tool with our larger trading partners (including China, Mexico, Canada, and Europe), the tariff discussion will likely have more bark than bite. Time will tell.

Dissecting Stock Performance & Valuations

A lot of pundits are pointing to an overheated market, but on a 3-year basis, returns are looking more normalized (+8.2% per year) because of the -20% hit on stocks during 2022. As you may recall, much of the 2022 decline was caused by the Fed slamming on the economic breaks with its fastest rate-hiking cycle in four decades (raising rates from 0.0% to 5.5%).

Objectively, stock values, as measured by the Price-Earnings (P/E) ratio of the S&P 500, are at elevated levels – registering in at approximately 22-times next year’s forecasted profits. As you can see from the chart below, the stock market is priced at levels not seen since 2001 and valuations are roughly double what they were at the lows of the 2008 Financial Crisis.

Source: Yardeni.com

A major reason for escalated valuations has been the concentration of performance in the largest seven companies, or the so-called Magnificent 7 stocks, which include, Apple, Microsoft, Alphabet, Amazon.com, Nvidia, Meta Platforms and Tesla. In fact, the index concentration is the highest it has been in more than a half century – even higher than at the peak of the 2000 Tech Bubble when Cisco Systems, Microsoft, GE, Intel, and Exxon Mobil were the five largest companies by market capitalization (see chart below).

The good news is the other 493 companies in the S&P 500 (I call them the “Absentee 493”) are priced much more reasonably. This bifurcated dynamic between the largest seven companies versus everything else, highlights the plethora of opportunities available to be harvested in Value stocks, Small-cap stocks, and Mid-cap stocks.

As is evident in the chart below, the S&P 500 index (red-line), which is skewed by the Magnificent 7, is about 30% more expensive than Small-cap and Mid-cap stocks, which are hovering near historically attractive valuation levels.

Source: Yardeni.com

Value stocks (blue-line) in the market look equally attractive (about 30% cheaper than the S&P 500), as can be seen in the chart below.

Source: Yardeni.com

As always, the future is uncertain, and risks abound for next year. But 2024 has been a blockbuster year and there has been plenty to be thankful for, especially the performance of the U.S. stock market.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (December 2, 2024). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in AAPL, AMZN, MSFT, GOOGL, META, TSLA, NVDA, and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in CSCO, GE, XOM, INTC or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

March Madness Leads to Gladness

As usual, there was plenty of “madness” in March, and this year did not disappoint. Just as is the case with the annual NCAA basketball tournament, certain investors suffered the agony of defeat in the financial markets, but overall, the thrill of victory triumphed in March. So much so that the S&P 500 index posted its largest first-quarter gain in more than 20 years. Not only did the major indexes post gains for the month, but the winning record looks even better for the year-to-date results. For 2019, the S&P 500 index is up +13.1%; the Dow Jones Industrial Average +11.2%; and the tech-heavy NASDAQ index +16.5% for the year. The monthly gains in the major indexes were more muted, ranging from 0% for the Dow to +2.6% for the NASDAQ.

Busy? Listen to Wade discuss this article and other topics each week on the Weekly Grind podcast:

While 2018 ended with a painful injury (S&P 500 -6.2% in Q4), on fears of a deteriorating China trade deal and a potentially overly aggressive Federal Reserve hiking interest rates, the stock market ultimately recovered in 2019 on changing perceptions. Jerome Powell, the Federal Reserve Chairman, indicated the Fed would be more “patient” going forward in increasing interest rates, and President Trump’s tweet-storm on balance has been optimistic regarding the chances of hammering out a successful trade deal with China.

With the new cautious Fed perspective on interest rates, the yield on the 10-Year Treasury Note fell by -0.28% for the quarter from 2.69% to 2.41%. In fact, investors are currently betting there is a greater than 50% probability the Fed will cut interest rates before year-end. Moreover, in testimony before Congress, Powell signaled the economic dampening policy of reducing the Fed’s balance sheet was almost complete. All else equal, the shift from a perceived rate-hiking Fed to a potentially rate-cutting Fed has effectively turned an apparent headwind into tailwind. Consumers are benefiting from this trend in the housing market, as evidenced by lower 30-year fixed mortgage rates, which in some cases have dropped below 4%.

Economy: No Slam Dunk

However, not everything is a slam dunk in the financial markets. Much of the change in stance by the Fed can be attributed to slowing economic growth seen both here domestically and abroad, internationally.

Here in the U.S., the widely followed monthly jobs number last month only showed a gain of 20,000 jobs, well below estimates of 180,000 jobs. This negative jobs surprise was the biggest miss in more than 10 years. Furthermore, the overall measure for our nation’s economic activity, growth in Gross Domestic Product (GDP), was revised downward to +2.2% in Q4, below a previous estimate of +2.6%. The so-called “inverted yield curve” (i.e., short-term interest rates are higher than long-term interest rates), historically a precursor to a recession, is consistent with slowing growth expectations. This inversion temporarily caused investors some heartburn last month.

If you combine slowing domestic economic growth figures with decelerating manufacturing growth in Europe and China (e.g. contracting Purchasing Managers’ Index), then suddenly you end up with a slowing global growth picture. In recent months, the U.S. economy’s strength was perceived as decoupling from the rest of the world, however recent data could be changing that view.

Fortunately, the ECB (European Central Bank) and China have not been sitting on their hands. ECB President Mario Draghi announced three measures last month that could cumulatively add up to some modest economic stimulus. First, it “expects the key ECB interest rates to remain at their present levels at least through the end of 2019.” Second, it committed to reinvesting all maturing bond principal payments in new debt “for an extended period of time.” And third, the ECB announced a new batch of “Targeted Long-Term Refinancing Operations” starting in September. Also, Chinese Premier Li Keqiang announced the government will reduce taxes, primarily Value Added Taxes (VAT) and social security taxes (SST). Based on the rally in equities, it appears investors are optimistic these stimulus efforts will eventually succeed in reigniting growth.

Volume of Political Noise Ratcheted Higher

While I continually try to remind investors to ignore politics when it comes to their investment portfolios, the deafening noise was especially difficult to overlook considering the following:

- Mueller Report Completed: Robert Mueller’s Special Counsel investigation into potential collusion as it relates Russian election interference and alleged obstruction of justice concluded.

- Michael Cohen Testifies: Former President Trump lawyer, Michael Cohen, testified in closed sessions before the House and Senate intelligence committees, and in public to the House Oversight Committee. In the open session, Cohen, admitted to paying hush money to two women during the election. Cohen called President Trump a racist, a conman, and a cheat but Cohen is the one heading to jail after being sentenced for lying to Congress among other charges.

- Manafort Sentenced: Former Trump Campaign Chairman Paul Manafort was sentenced to prison on bank and tax fraud charges.

- North Korea No Nuke Deal: In geopolitics,President Trump flew 21 hours to Vietnam to meet for a second time with North Korean leader Kim Jong Un on denuclearization of the Korean peninsula. The U.S. president ended up leaving early, empty handed, without signing an agreement, after talks broke down over sanction differences.

- Brexit Drama Continues: The House of Commons in the lower house of the U.K. Parliament continued to stifle Prime Minister Theresa May’s plan to exit the European Union with repeated votes rejecting her proposals. Brexit outcomes remain in flux, however the European Union did approve an extension to May 22 to work out kinks, if the House can approve May’s plan.

Positive Signals Remain

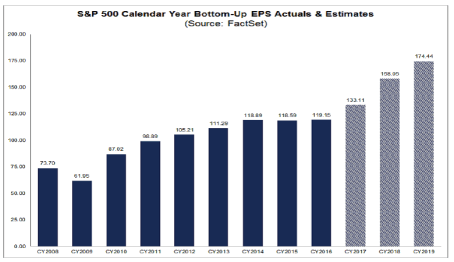

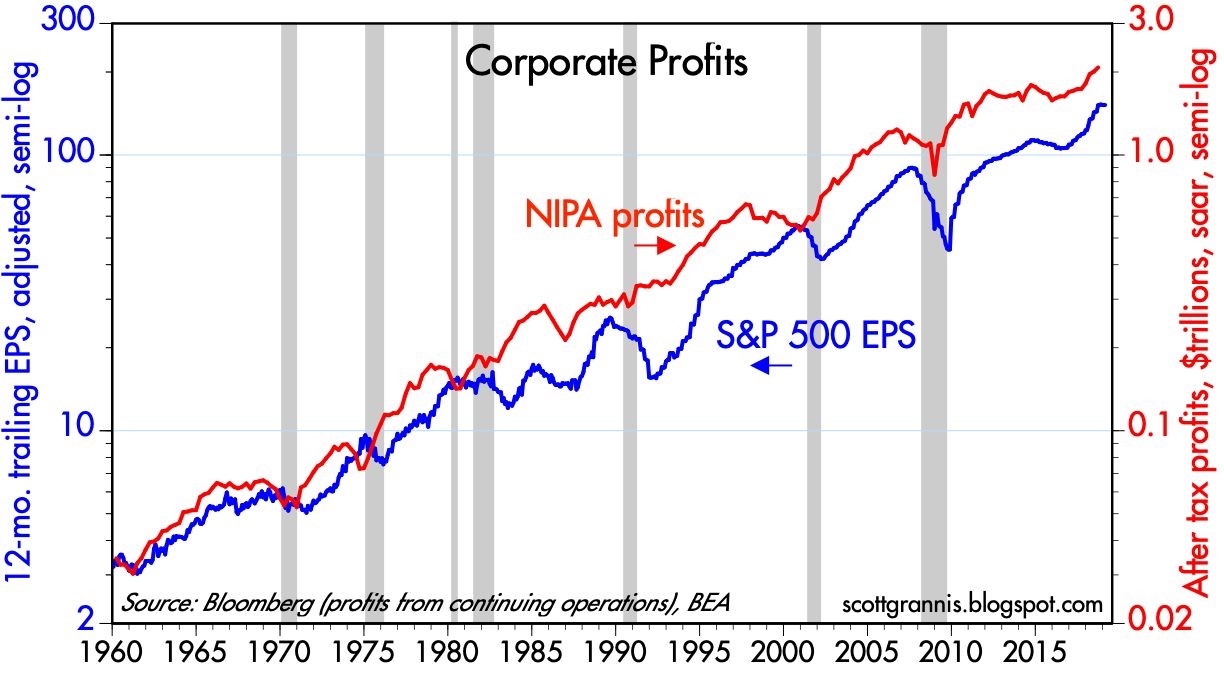

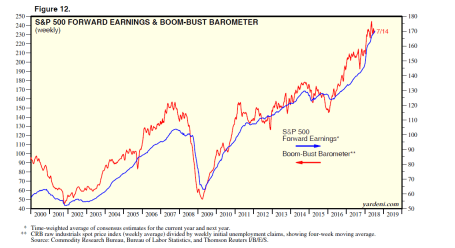

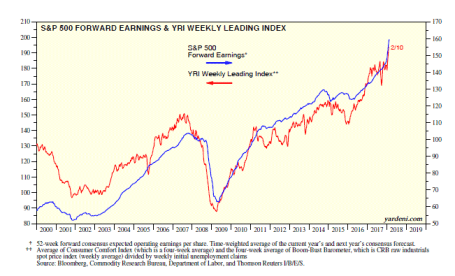

March Madness reminds us that a big lead can be lost quickly, however a few good adjustments can also swiftly shift momentum in the positive direction. Although growth appears to be slowing both here and internationally, corporate profits are not falling off a cliff, and earnings remain near record highs (see chart below).

Source: Calafia Beach Pundit

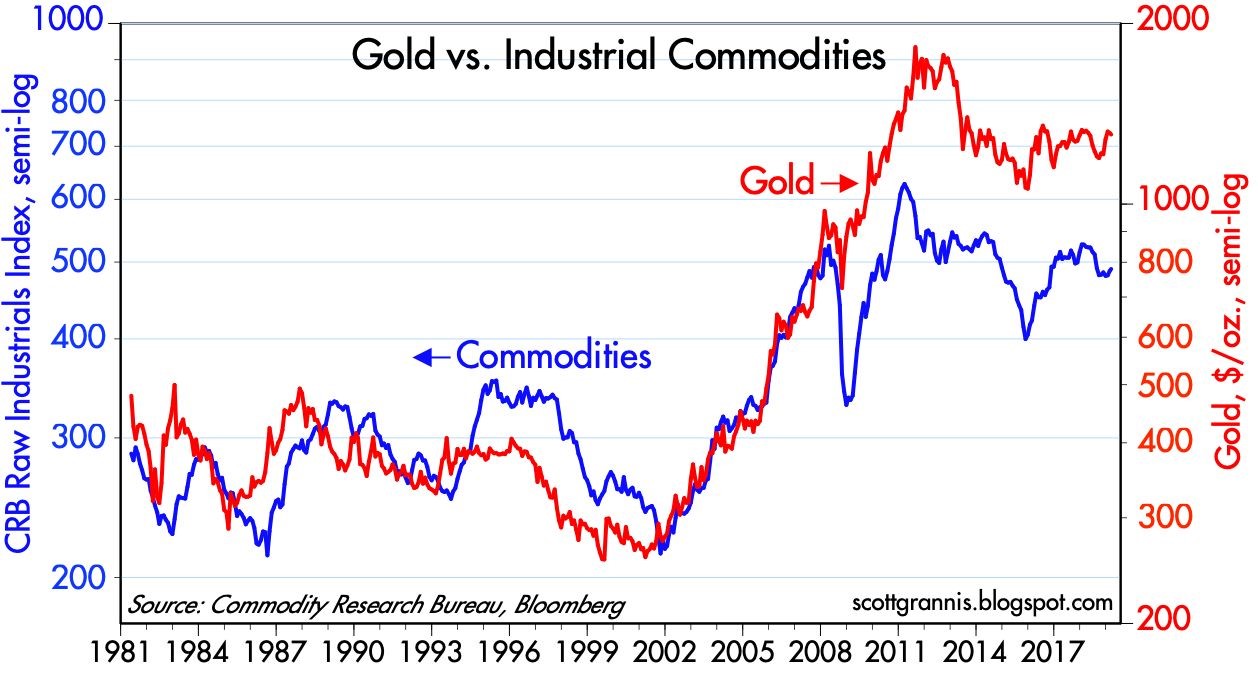

Similar to the stock market, commodities can be a good general barometer of current and future economic activity. As you can see from the chart below, not only have commodity prices remained stable in the face of slowing economic data, but gold prices have not spiked as they did during the last financial crisis.

Source: Calafia Beach Pundit

After 2018 brought record growth in corporate profits and negative returns, 2019 is producing a reverse mirror image – slow profit growth and record returns. The volatile ending to 2018 and triumphant beginning to 2019 is a reminder that “March Madness” does not need to bring sadness…it can bring gladness.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (April 1, 2019). Subscribe on the right side of the page for the complete text.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

The Dirty Little Stock Market Secret

Shhhh…don’t tell anyone, I have a dirty little secret. Are you ready? Are you sure? The world is not going to end…really.

Despite lingering trade concerns (see Trump Hits China with Tariffs on $200 Billion in Goods), Elon Musk being sued by the Securities and Exchange Commission (SEC) for tweeting his controversial intentions to take Tesla Inc. (TSLA) private, and Supreme Court nominee, Brett Kavanaugh, facing scandalous sexual assault allegations when he was in high school, life goes on. In the face of these heated headlines, stocks still managed to rise to another record in September (see Another Month, Another Record). For the month, the Dow Jones Industrial Average climbed +1.9% (+7.0% for 2018), the S&P 500 notched a +0.4% gain (+9.0% for 2018), while the hot, tech-laden NASDAQ index cooled modestly by -0.8% after a scorching +17.5% gain for the year.

If the world were indeed in the process of ending and we were looking down into the abyss of another severe recession, we most likely would not see the following tangible and objective facts occurring in our economy.

- New Revamped NAFTA (North American Free Trade Agreement) 2.0 trade deal between the U.S., Mexico, and Canada was finalized (new deal is called United States-Mexico-Canada Agreement).

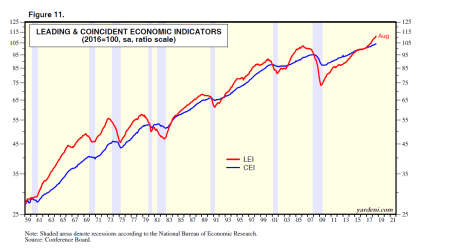

- Leading Economic Indicators are at a record high (a predictive statistic that historically falls before recessionary periods – in gray)

Source: Yardeni.com

- Unemployment Rate of 3.9% is near a record low

- Small Business Optimism is near record highs

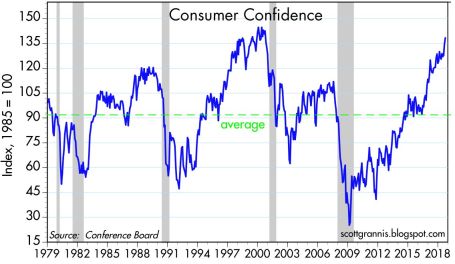

- Consumer Confidence is near record highs

Source: Scott Grannis

- Corporate Profits are at record highs

- Interest Rates remain at historically low levels despite the Federal Reserve’s actions to slowly migrate their interest rate target higher

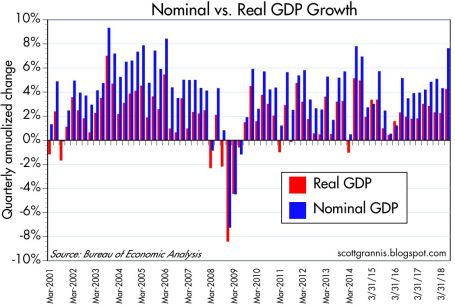

- Economic Growth (GDP) accelerating to +4.2% growth rate in the recent quarter

Source: Scott Grannis

Are we closer to a recession with the stock market potentially falling 20-30% in value? As I have written on numerous occasions, so-called pundits have been falsely forecasting recessions over the last decade, for as long as this bull market has been alive (see Professional Double-Dip Guesses are “Probably” Wrong).

Why so much investor angst as stock prices continue to chug along to record levels? One reason is investors are used to historically experiencing a recession approximately twice a decade on average, and we have yet to suffer one since the Great Recession around 10 years ago. While the mantra “we are due” for a recession might be a true statement, the fact also remains that this economic recovery has been the slowest since World War II, which logically could argue for a longer expansionary period.

What also holds true is that corporate profits already experienced a significant “profit recession” during this economic cycle, post the 2008-2009 financial crisis. More specifically, S&P 500 operating profits declined for seven consecutive quarters from December 2014 through June 2016. The largest contributors to the 2014-2016 profit recession were collapsing oil and commodity prices, coupled with a rapid appreciation in the value of the U.S. dollar, which made our exports more expensive and squeezed multinational corporation profits. The stock market eventually digested these profit-crimping headwinds and resumed its ascent to record levels, but not before the S&P 500 remained flat to down for about a year and a half (2014-2016).

Doom-and-gloom, in conjunction with toxic politics, continue to reign supreme over the airwaves. If you want in on a beneficial dirty little secret, you and your investments would be best served by ignoring all of the media noise and realizing the world is not going to end any time soon.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (October 1, 2018). Subscribe on the right side of the page for the complete text.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing had no direct position in TSLA or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Arm Wrestling the Economy & Tariffs

Financial markets have been battling back and forth like a championship arm-wrestling match as economic and political forces continue to collide. Despite these clashing dynamics, capitalism won the arm wrestling match this month as investors saw the winning results of the Dow Jones Industrial Average adding +4.7% and the S&P 500 index advancing +3.6%.

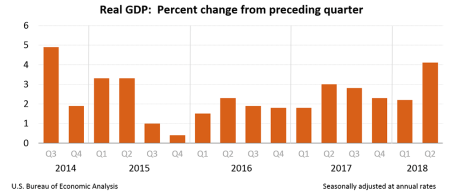

Fueling the strength this month was U.S. economic activity, which registered robust 2nd quarter growth of +4.1% – the highest rate of growth achieved in four years (see below).

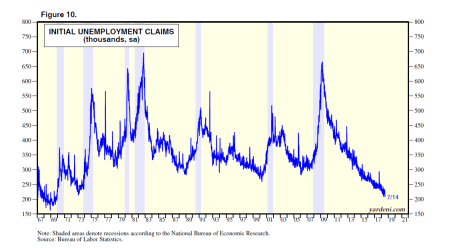

The job market is on fire too with U.S. jobless claims hitting their lowest level in 48 years (see chart below). This chart shows the lowest number of people in a generation are waiting in line to collect unemployment checks.

Source: Dr. Ed’s Blog

If that isn’t enough, so far, the record corporate profits being reported for Q2 are up a jaw-dropping +23.5% from a year ago. What can possibly be wrong?

Excess Supply of Concern

While the economic backdrop is largely positive, there is never a shortage of things to worry about – even during decade-long bull market of appreciation. More specifically, investors have witnessed the S&P 500 index more than quadruple from a March 2009 low of 666 to 2,816 today (+322%). Despite the massive gains achieved over the last decade, there have been plenty of volatility and geopolitics to worry about. Have you already forgotten about the Flash Crash, Arab Spring, Occupy Wall Street, Government Shutdowns, Sequestration, Taper Tantrum, Ebola, Iranian nuclear threat, plunging oil prices, skyrocketing oil prices, Brexit, China scares, Elections, and now tariffs, trade, and the Federal Reserve monetary policy?

Today, tariffs, trade, Federal Reserve monetary policy, and inflation are top-of-mind investor concerns, but history insures there will be new issues to worry about tomorrow. Ever since the bull market began a decade ago, there have been numerous perma-bears incorrectly calling for a deathly market collapse, and I have written a substantial amount about these prognosticators’ foggy crystal balls (see Emperor Schiff Has No Clothes [2009] & Clashing Views with Dr. Roubin [2009]. While these doomsdayers get a lot less attention today, similar bears like John Hussman, who like a broken record, has erroneously called for a market crash every year for the last seven years (click chart link).

Although many investment accounts are up over the last 10 years, many people quickly forget it has not been all rainbows and unicorns. While the stock market has more than quadrupled in value since 2009, we have lived through about a dozen alarming corrections, including the worrisome -12% pullback we experienced in February. If we encounter another -5 -10% correction this year, this is perfectly healthy, normal, and should not be surprising. More often than not, these temporary drops provide opportunistic openings to scoop up valued bargains.

Longtime readers and followers of Sidoxia’s investment philosophy and Investing Caffeine understand the majority of these economic predictions and political headlines are useless noise. Social media, addiction to smart phones, and the 24/7 news cycle create imaginary, scary mountains out of harmless molehills. As I have preached for years, the stock market does not care about politics and opinions – the stock market cares about 1) corporate profits (at record levels) – see chart below; 2) interest rates (rising, but still near historically low levels); 3) the price of the stock market/valuation (which is getting cheaper as profits soar from tax cuts); and 4) sentiment (a favorable contrarian indicator until euphoria kicks in).

Source: Dr. Ed’s Blog

Famed investor manager, Peter Lynch, who earned +29% annually from 1977-1990 also urged investors to ignore attempts of predicting the direction of the economy. Lynch stated, “I’ve always said if you spend 13 minutes a year on economics, you’ve wasted 10 minutes.”

I pay more attention to successful long-term investors, like Warren Buffett (the greatest investor of all-time), who remains optimistic about the stock market. As I’ve noted before, although we remain constructive on the markets over the intermediate to long-term periods, nobody has been able to consistently prophesize about the short-term direction of financial markets.

At Sidoxia, rather than hopelessly try to predict every twist and turn in the market, or react to every meaningless molehill, we objectively analyze the available data without getting emotional, and then take advantage of the opportunities presented to us in the marketplace. Certain asset classes, stocks, and bonds, will constantly move in and out of favor, which allows us to continually find new opportunities. A contentious arm wrestling struggle between uncertain tariffs/rising interest rates and stimulative tax cuts/strong economy is presently transpiring. As always, we will continually monitor the evolving data, but for the time being, the economy is flexing its muscle and winning the battle.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (August 1, 2018). Subscribe on the right side of the page for the complete text.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

S.T.I.N.K. – Deja Vu All Over Again

Yogi Berra is a Baseball Hall of Fame catcher and manager who played 18 out of 19 seasons with the New York Yankees. Besides his incredible baseball skills, Berra was also known for his humorous and witty quotes, which were called “Yogi-isms.” Reportedly, one of Berra’s most famous Yogi-isms occurred after he observed fellow teammates, Mickey Mantle and Roger Maris, continually hitting back-to-back home runs:

“It’s déjà vu all over again.”

The Merriam-Webster dictionary defines déjà vu as “a feeling that one has seen or heard something before.” I experienced the same sense last month as I was bombarded with ominous news headlines. Some of you may recall the panic attack over the PIIGS regions during the 2010 – 2012 timeframe (Solving Europe & Deadbeat Cousin). I’m obviously not referring to the pork product, but rather Portugal, Italy, Ireland, Greece, and Spain, which rocked financial markets due to investor fears that Greece’s fiscal irresponsibility may force the country to leave the eurozone and drag the rest of Europe into financial ruin.

Suffice it to say, the imploding Greece/Europe disaster scenario did not happen. If you fast forward to today, the fear has returned again, however with a different acronym spin. Rather than speak about PIIGS, today the talking heads are fretting over S.T.I.N.K. – Spain, Tariffs, Italy, and North Korea.

*Worth noting, the letter “I” in S.T.I.N.K. could also be sustained or replaced by the word Iran, given the Trump administration’s desire to exit the Iran Nuclear Deal. The move comes despite support by our country’s tight NATO (North Atlantic Treaty Organization) allies who want the U.S. to remain in the agreement.

An overview of S.T.I.N.K. unease is summarized here:

Spain: After a reign of six years, Spain’s Prime Minister Mariano Rajoy is on the verge of being ousted to socialist opposition leader, Pedro Sanchez. Corruption convictions involving former members in Rajoy’s conservative Popular Party only increases the probability that the imminent no-confidence vote in the Spanish parliament will lead to Rajoy’s exit.

Tariffs: President Trump is lifting the temporary steel and aluminum tariff exemptions provided to many of our allies, including Canada, Mexico, and the European Union. Recent breakdowns in trade discussions with allies like Mexico and Canada are likely to make the renegotiation of NAFTA (North American Free Trade Agreement) even more challenging. Handicapping President Trump’s global trade rhetoric can be difficult, especially given the periodic inconsistency in Trump’s actions relative to his words. Time will tell whether Trump’s tough trade talk is merely a negotiating tool designed to gain better trade terms for the U.S., or whether this strategy backfires, and trading partner allies choose to retaliate with tariffs of their own. For example, the EU has threatened to impose import taxes on bourbon; Mexico has warned about levying taxes on American farm products; and Canada is focused on the same steel and aluminum tariffs that Trump has been referencing.

Italy: Pandemonium temporarily set in when Italy’s President Sergio Mattarella essentially vetoed the finance minister selection by Italian Prime Minister Giuseppe Conte. Initially, Italian bond prices plummeted and interest rates spiked as fears of an Italian exit from the euro currency, but after the rejection of the original finance chief, the populist Five Star and League coalition parties agreed to institute a more moderate finance minister and bond prices/rates stabilized.

North Korea: The on-again-off-again denuclearization summit between the U.S. and North Korea may actually take place in Singapore on June 12th. In recent days, Secretary of State Mike Pompeo has held face-to-face meetings with North Korean General Kim Yong Chol in New York. The senior North Korean leader is also planning to hand deliver a letter from Korean leader Kim Jong Un to President Trump in preparation for the nuclear summit. The U.S. is attempting to incentivize North Korea with economic relief in return for North Korea giving up their nuclear capabilities.

Thanks to S.T.I.N.K., volatility has risen, but the downdrafts have been relatively muted as evidenced by the moves in the stock averages this month. More specifically, the S&P 500 index rose +2.2% last month, while the technology-heavy Nasdaq index catapulted +5.3%. Nevertheless, not all indexes are created equally as witnessed by the Dow Jones Industrial Index, which climbed a more muted +1.1% for the month. For the year, the Dow is down -1.2%, while the S&P and Nasdaq indexes are higher by +1.2% and +7.8%, respectively.

Ever since the 2008-2009 financial crisis, observers have incessantly and anxiously waited for the return of a “stinky” economic and/or geopolitical catastrophe that will wreck the American economy. Unfortunately for the pessimists, stock prices have more than quadrupled in value since early-2009. Yogi Berra may have been correct when he said, “It’s déjà vu all over again,” but just like PIIGS concerns failed to cause global economic contagion, STINK concerns are unlikely to cause significant economic damage either. Over the last year, the only “stink” occurring has been the stink of cool, hard cash.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (June 1, 2018). Subscribe on the right side of the page for the complete text.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Tariff, Fed, & Facebook Fears but No Easter Bunny Tears

After an explosive 2017 (+19.4%) and first month of 2018 (+5.6%), the Easter Bunny came out and laid an egg last month (-2.7%). It is normal for financial markets to take a breather, especially after an Energizer Bunny bull market, which is now expanding into its 10th year of cumulative gains (up +296% since the lows of March 2009). Investors, like rabbits, can be skittish when frightened by uncertainty or unexpected events, and over the last two months, that’s exactly what we have seen.

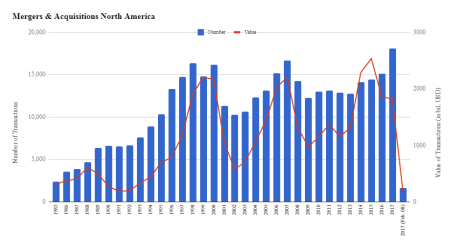

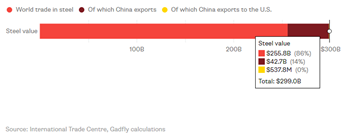

Fears of Tariffs/Trade War: On March 8th, President Trump officially announced his 25% tariffs on steel and 10% on aluminum. The backlash was swift, not only in Washington, but also from international trading partners. In response, Trump and his economic team attempted to diffuse the situation by providing temporary tariff exemptions to allied trading partners, including Canada, Mexico, the European Union, and Australia. Adding fuel to the fire, Trump subsequently announced another $50-$60 billion in tariffs placed on Chinese imports. To place these numbers in context, let’s first understand that the trade value of steel (roughly $300 billion – see chart below), aluminum, and $60 billion in Chinese products represent a small fraction of our country’s $19 trillion economy (Gross Domestic Product). Nevertheless, financial markets sold off swiftly this month in unison with these announcements. The selloff did not necessarily occur because of the narrow scope of these specific announcements, but rather out of fear that this trade skirmish may result in large retaliatory tariffs on American exports, and ultimately these actions could blow up into a full-out trade war and trigger a spate of inflation.

Source: Bloomberg

These trade concerns are valid, but at this point, I am not buying the conspiracy theories quite yet. President Trump has been known to use fiery rhetoric in the past, whether talking about building “The Wall” or threats to defense contractors regarding the pricing of a legacy Air Force One contract. Often, the heated language is solely used as a first foray into more favorable negotiations. President Trump’s tough tariff talk is likely another example of this strategy.

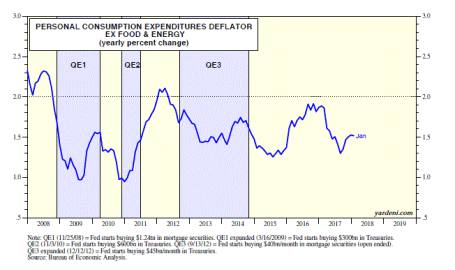

Interest Rate/Inflation Phobia: Beginning in early February, anxiety in the equity markets intensified as interest rates on the benchmark 10-year Treasury note have now risen from a September-low yield of 2.40% to a 2018-high of 2.94%. Since that short-term high this year, rates have moderated to +2.74%. Adding to this month’s worries, Fed Chairman Jerome Powell hiked interest rates on the Federal Funds interest rate target by +0.25% to a range of 1.50% to 1.75%. While the direction of rate increases may be unnerving to some, both the absolute level of interest rates and the level of inflation remain relatively low, historically speaking (see 2008-2018 inflation chart below). Inflation of 1.5% is nowhere near the double digit inflation experienced in the late-1970s and early 1980s .

Source: Dr. Ed’s Blog

It is true that rates on mortgages, car loans, and credit cards might have crept up a little, but from a longer-term perspective rates still remain significantly below historical averages. Even if the Federal Reserve increases their interest rate target range another two to three times in 2018 as currently forecasted, we will still be at below-average levels, which should still invigorate economic growth (all else equal). In car terms, if the current strategy continues, the Fed will be moving from a strategy in which they are flooring the economic pedal to the medal, to a point where they will only be going 10 miles per hour over the speed limit. The strategy is still stimulative, but just not as stimulative as before. At some point, rising interest rates will slow down (or choke off) growth in the economy, but I believe we are still a long way from that happening.

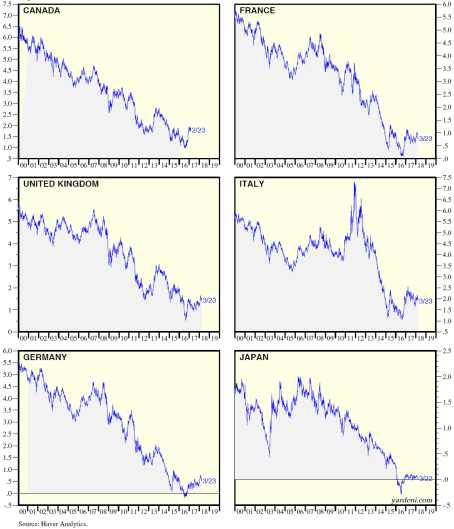

Why am I not worried about runaway interest rates or inflation? For starters, I believe it is very important for investors to remove the myopic blinders, so they can open their eyes to what’s occurring with global interest rate trends. Although, U.S. rates have more than doubled from July 2016 to 2.74%, as long as interest rates in developed markets like Japan, the European Union, and Canada, remain near historically low levels (see chart below), the probabilities of runaway higher interest rates and inflation are unlikely to transpire.

Source: Ed Yardeni

With the Japanese 10-year government bond yielding 0.04% (near-zero percent), the German 10-year bond yielding 0.50%, and the U.K. 10-year bond yielding 1.35%, one of two scenarios is likely to occur: 1) global interest rates rise while U.S. rates decline or remain stable; or 2) U.S. interest rates decline while global rates decline or remain stable. While either scenario is possible, given the lack of rising inflation and the slack in our employment market, I believe scenario #2 is more likely to occur than scenario #1.

Privacy, Politics, and Facebook: A lot has recently been made of the 50 million user profiles that became exposed and potentially exploited for political uses in the 2016 presidential elections. How did this happen, and what was the involvement of Facebook Inc. (FB)? If you have ever logged into an internet website and been given the option to sign in with your Facebook password, then you have been exposed to third-party applications that are likely mining both your personal and Facebook “friend” data. The genesis of this particular situation began when Aleksandr Kogan, a Russian American who worked at the University of Cambridge created a Facebook quiz app that not only collected personal information from approximately 270,000 quiz-takers, but also extracted information from about 50 million Facebook friends of the quiz takers (data scandal explained here).

Mr. Kogan (believed to be in his early 30s) allegedly sold the Facebook data to a company called Cambridge Analytica, which employed Steve Bannon as a vice president. This is the same Steve Bannon who eventually became a senior adviser for the Trump Administration. Facebook has defended itself by blaming Aleksandr Kogan and Cambridge Analytica for violating Facebook’s commercial data sharing policies. Objectively, regardless of the culpability of Kogan, Cambridge Analytica, and/or Facebook, most observers, including Congress, believe that Facebook should have more closely monitored the data collected from third party app providers, and also done more to prevent such large amounts of data to be sold commercially. Now, the CEO (Chief Executive Officer) of Facebook, Mark Zuckerberg, faces an appointment in Washington DC, where he will receive tongue lashings and be raked over the coals, so politicians can better understand the breakdown of this data breach.

It is certainly possible that a large amount of data was compromised for political purposes relating to the 2016 presidential election. There has been some backlash as evidenced by a few high profile users threatening to leave the Facebook platform like actor/comedian Will Ferrell, Tesla CEO Elon Musk, and singer Cher, but since the data scandal was unearthed, there has been little evidence of mass defections. Even considering all the Facebook criticism, the stickiness and growth of Facebook’s 1.4 billion (with a “b”) monthly active users, coupled with the vast targeting capabilities available for a wide swath of advertisers, likely means any negative impact will be short-lived. Even if there are defectors, where will all these renegades go, Instagram? Well, if that were the case, Instagram is owned by Facebook. Snapchat, is another Facebook alternative, however this platform is skewed toward younger demographics, and few people who have invested years of sharing/saving memories on the Facebook cloud, are unlikely to delete these memories and migrate that data to a lesser-known platform.

Financial markets move up and financial markets down. The first quarter of 2018 reminded us that no matter how long a bull market may last, nothing money-related moves in a straight line forever. The fear du jour constantly changes, and last month, investors were fretting over tariffs, the Federal Reserve’s monetary policy, and a Facebook data scandal. Suffice it to say, next month will likely introduce new concerns, but one thing I do not need to worry about is an empty Easter basket. It will take me much longer than a month to work through all the jelly beans, chocolate bunnies, and marshmallow Peeps.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (April 2, 2018). Subscribe on the right side of the page for the complete text.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in FB, AMZN, TSLA, and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

The Scary Blip

I hated it when my mom reminded me when I was a younger, but now that I’ve survived into middle-aged adulthood, I will give you the same medicine she gave me:

“I told you so.”

As I cautioned in last month’s newsletter, “It’s important for investors to remember this pace of gains cannot be sustainable forever.” I added that there were a whole bunch of scenarios for stock prices to go down or “stock prices could simply go down due to profit-taking.”

And that is exactly what we saw. From the peak achieved in late January, stock prices quickly dropped by -12% at the low in early February, with little-to-no explanation other than a vague blame-game on rising interest rates – the 2018 yield on the 10-Year Treasury Note rose from 2.4% to 2.9%. This explanation holds little water if you take into account interest rates on the 10-Year increased from roughly 1.5% to 3.0% in 2013 (“Taper Tantrum”), yet stock prices still rose +20%. The good news, at least for now, is the stock correction has been contained or mitigated. A significant chunk of the latest double-digit loss has been recovered, resulting in stock prices declining by a more manageable -3.9% for the month. Despite the monthly loss, the subsequent rebound in late February has still left investors with a gain of 1.5% for 2018. Not too shabby, especially considering this modest return comes on the heels of a heroic +19.4% gain in 2017.

As you can see at from the 22-year stock market chart below for the S&P 500, the brief but painful drop was merely a scary blip in the long-term scheme of things.

Whenever the market drops significantly over a short period of time, as it did this month, conspiracy theories usually come out of the woodwork in an attempt to explain the unexplainable. When human behavior is involved, rationalizing a true root cause can be very challenging, to say the least. It is certainly possible that technical factors contributed to the pace and scale of the recent decline, as has been the case in the past. Currently no smoking gun or fat finger has been discovered, however some pundits are arguing the popular usage of leveraged ETFs (Exchange Traded Funds) has contributed to the accelerated downdraft last month. Leveraged ETFs are special, extra-volatile trading funds that will move at amplified degrees – you can think of them as speculative trading vehicles on steroids. The low-cost nature, diversification benefits, and ability for traders to speculate on market swings and sector movements have led to an explosion in ETF assets to an estimated $4.6 trillion.

Regardless of the cause for the market drop, long-term investors have experienced these types of crashes in the past. Do you remember the 2010 Flash Crash (down -17%) or the October 1987 Crash (-23% one-day drop in the Dow Jones Industrial Average index)? Technology, or the lack thereof (circuit breakers), helped contribute to these past crashes. Since 1987, the networking and trading technologies have definitely become much more sophisticated, but so have the traders and their strategies.

Another risk I highlighted last month, which remains true today, is the potential for the new Federal Reserve chief, Jerome Powell, to institute a too aggressive monetary policy. During his recent testimony and answers to Congress, Powell dismissed the risks of an imminent recession. He blamed past recessions on previous Fed Chairmen who over enthusiastically increased interest rate targets too quickly. Powell’s comments should provide comfort to nervous investors. Regardless of short-term inflation fears, common sense dictates Powell will not want to crater the economy and his legacy by slamming the economic brakes via excessive rate hikes early during his Fed chief tenure.

Tax Cuts = Profit Gains

Despite the heightened volatility experienced in February, I remain fairly constructive on the equity investment outlook overall. The recently passed tax legislation (Tax Cuts and Job Act of 2017) has had an undeniably positive impact on corporate profits (see chart below of record profit forecasts – blue line). More specifically, approximately 75% of corporations (S&P 500 companies) have reported better-than-expected results for the past quarter ending December 31st. On an aggregate basis, quarterly profits have also risen an impressive +15% compared to last year. When you marry these stellar earnings results with the latest correction in stock prices, historically this combination of factors has proven to be a positive omen for investors.

Source: Dr. Ed’s Blog

Despite the rosy profit projections and recent economic strength, there is always an endless debate regarding the future direction of the economy and interest rates. This economic cycle is no different. When fundamentals are strong, stories of spiking inflation and overly aggressive interest rate hikes by the Fed rule the media airwaves. On the other hand, when fundamentals deteriorate or slow down, fears of a 2008-2009 financial crisis enter the zeitgeist. The same tug-of-war fundamental debate exists today. The stimulative impacts of tax cuts on corporate profits are undeniable, but investors remain anxious that the negative inflationary side-effects from a potential overheating economy could outweigh the positive economic momentum of a near full-employment economy gaining steam.

Rather than playing Goldilocks with your investment portfolio by trying to figure out whether the short-term stock market is too hot or too cold, you would be better served by focusing on your long-term asset allocation, and low-cost, tax-efficient investment strategy. If you don’t believe me, you should listen to the wealthiest, most successful investor of all-time, Warren Buffett (The Oracle of Omaha), who just published his annual shareholder letter. In his widely followed letter, Buffett stated, “Performance comes, performance goes. Fees never falter.” To emphasize his point, Buffett made a 10-year, $1 million bet for charity with a high-fee hedge fund manager (Protégé Partners). As part of the bet, Buffett claimed an investment in a low-fee S&P 500 index fund would outperform a selection of high-fee, hot-shot hedge fund managers. Unsurprisingly, the low-cost index fund trounced the hedge fund managers. From 2008-2017, Buffett’s index fund averaged +8.5% per year vs. +3.0% for the hedge fund managers.

During scary blips like the one experienced recently, lessons can be learned from successful, long-term billionaire investors like Warren Buffett, but lessons can also be learned from my mother. Do yourself a favor by getting your investment portfolio in order, so my mother won’t have to say, “I told you so.”

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (March 1, 2018). Subscribe on the right side of the page for the complete text.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.