Posts tagged ‘emerging markets’

Filet or Mac & Cheese? Investing for Retirement

The financial crisis of 2008-2009 placed a large swath of investors into paralysis based on a fear the United States and the rest of the world was on the verge of irreversible destruction. Regardless of what the newspaper headlines are reading and television pundits are spouting, individuals have to shrewdly plan for retirement no matter what the economy is doing. So then the question becomes, do you want to be eating macaroni & cheese in retirement, or does filet mignon or alternate five-star cuisine sound more appealing? I vote for the latter.

Despite what the government statistics are saying about the current state of benign inflation, you do not need to be a genius to see medical costs are exploding, energy charges have skyrocketed, and even more innocuous items such as movie ticket prices continue to rise. If that’s not a burden enough, depending on your age, there’s a legitimate concern the Social Security and Medicare safety nets may not be there for you in retirement. It is more important than ever to take control of your financial future by investing your money in a more efficient manner (see Fusion), focusing on long-term, low-cost, tax-efficient strategies. Whatever the direction of the financial markets (up, down, or sideways), if you don’t wisely invest your money, you will run the risk of working as a Wal-Mart (WMT) greeter into your 80s and relegated to eating mac & cheese (for lunch and dinner).

Broaden Your Horizons

The last decade has been tough for domestic equities. It’s true that not a lot of compounding of returns has occurred in the domestic equity markets over the last decade (see Lost Decade), but that weakness is not necessarily representative of the next decade’s performance or the past relative strength seen in areas like emerging markets, materials and certain fixed income markets. These alternatives, including cash, would have added significant diversification benefits to investor portfolios during previous years. Rather than focusing on what’s best for the investor, so much financial industry attention has been placed on high cost, high fee, high commission domestic stock funds or insurance-based products. Due to many inherent conflicts of interest, many individual investors have lost sight of other more attractive opportunities, like exchange traded funds, international strategies, and fixed-income investment vehicles.

Rule of 72

Depending on your risk profile, objectives and constraints, the “Rule of 72” implies your retirement portfolio should double from a $100,000 investment now to roughly $200,000 in seven years (to $400,000 in 14 years, $800,000 in 21 years, etc.), assuming your portfolio can earn a 10% annual return. Unfortunately, this snowballing effect of money growth does not work if you are paying out significant chunks of your returns to aggressive brokers and salespeople in the forms of high commissions, fees, and taxes (see a Penny Saved is Billions Earned). For example, if you are paying out total annual expenses of 2-3% to a broker, advisor, or investment manager, the doubling effect of the Rule of 72 will be stretched out to 9-10 years (rather than the above mentioned seven years). If you do not know what you are paying in fees and expenses (like the majority of people), then do yourself a favor and educate yourself about the fee structures and tax strategies utilized in your investments (see also Investor Confusion). If you haven’t started investing, or you are shoveling out a lot of money in fees, expenses, and taxes, then you should reconsider your current investment stretegy. Otherwise, you may just want to begin stockpiling a lot of macaroni & cheese in your retirement pantry.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

*DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds and shares in WMT, but at the time of publishing SCM had no direct positions in any security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on the IC “Contact” page for more information.

Mobius: The Kojak of Emerging Markets

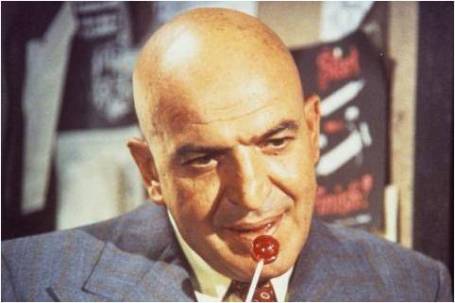

Lieutenant Theo Kojak, played by Telly Savalas in the 1970s television series Kojak, is a bald, hard-nosed New York City police detective who hunts down criminals. Mark Mobius, executive chairman of Templeton Asset Management, is a bald, hard-nosed investment manager devoted to hunting down winning stocks in emerging markets. Expanding on his numerous authored books, Mobius recently decided to write his own blog expanding on his global travels and reporting back his investment findings.

Recently Mobius fielded some questions from his readers, covering emerging markets from China and Brazil to “Frontier” markets like Sri Lanka and Serbia (see also Trade of the Century). Here are a few of the exchanges:

In which countries, regions or sectors are you finding the best values?

“We are finding opportunities in almost all emerging markets. Our ground-up research process locates opportunities in countries where the political or economic outlooks may not, at first appearance, look good. Nevertheless, we generally favor China and Brazil, but also have large positions in Russia, India and Turkey. In terms of sectors, we believe commodity stocks look good because we expect the global demand for commodities to continue its long-term growth. We also favor consumer stocks. With rising per-capita income and strong demand for consumer goods and services in many emerging markets, we believe the earnings growth outlook for these stocks is positive.”

It appears that the financial market has changed, in that one needs to be more skeptical and cautious when investing than in the past. Alan Greenspan said that last year’s crash was unforeseen, and given the uncertainty of the markets and global financing, the big crash could happen again. What say you?

“Actually some analysts did see the crash coming in view of Greenspan’s loose monetary policies. The nature of markets is that there will always be booms and crashes since people tend to get either too optimistic or too pessimistic. The good news is that on average, bull markets have lasted longer than bear markets, and bull markets have gone up in percentage terms more than bear markets have gone down. In terms of other risks, I believe there is still a danger of the unregulated derivatives market.

Do you think Sri Lanka will turn around?

“We believe that Sri Lanka is fundamentally a rich country and that the challenges revolve around how the true potential in tourism, agriculture and industry can be effectively met. We have been investing in Sri Lanka for many years. For us, the biggest challenge in the public market is liquidity. Trading turnover is rather low although we have found some investment bargains.”

Belgrade’s Stock Exchange suffered heavy losses in the 2008 meltdown, with the Belex index falling sharply. I am from Serbia, and so I was thrilled to find out that Franklin Templeton is investing in Serbia.

“Yes, we are interested in the Serbian market and we are now looking at opportunities there. Of course, when markets are down, it is the best time to start looking and Belgrade is definitely on our list. We have already invested in a company in Serbia and look forward to looking more closely at that market.”

While Telly Savalas discovered fame 30 years ago from his Kojak role, Mr. Mobius has spent more than 30 years in the emerging markets chasing successful investments. Franklin Templeton Investors should remain happy if Mobius’ picks continue to shine, like his bald, polished crown.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds (EEM, FXI, BKF). No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.