Posts tagged ‘double dip’

The Central Bank Dog Ate My Homework

It’s been a painful four years for the bears, including Peter Schiff, Nouriel Roubini, John Mauldin, Jimmy Rogers, and let’s not forget David Rosenberg, among others. Rosenberg was recently on CNBC attempting to clarify his evolving bearish view by explaining how central banks around the globe have eaten his forecasting homework. In other words, Ben Bernanke is getting blamed for launching the stock market into the stratosphere thanks to his quantitative easing magic. According to Rosenberg, and the other world-enders, death and destruction would have prevailed without all the money printing.

In reality, the S&P 500 has climbed over +140% and is setting all-time record highs since the market bottomed in early 2009. Despite the large volume of erroneous predictions by Rosenberg and his bear buddies, that development has not slowed the pace of false forecasts. When you’re wrong, one could simply admit defeat, or one could get creative like Rosenberg and bend the truth. As you can tell from my David Rosenberg article from 2010 (Rams Butting Heads), he has been bearish for years calling for outcomes like a double-dip recession; a return to 11% unemployment; and a collapse in the market. So far, none of those predictions have come to fruition (in fact the S&P is up about +40% from that period, if you include dividends). After being incorrect for so long, Rosenberg has switched his mantra to be bullish on pullbacks on selective dividend-paying stocks. When pushed whether he has turned bullish, here’s what Rosenberg had to say,

“So it’s not about is somebody bearish or is somebody bullish or whether you’re agnostic, it’s really about understanding what the principle driver of this market is…it’s the mother of all liquidity-driven rallies that I’ve seen in my lifetime, and it’s continuing.”

Rosenberg isn’t the only bear blaming central banks for the unexpected rise in equity markets. As mentioned previously, fear and panic have virtually disappeared, but these emotions have matured into skepticism. Record profits, cash balances, and attractive valuations are dismissed as artificial byproducts of a Fed’s monetary Ponzi Scheme. The fact that Japan and other central banks are following Ben Bernanke’s money printing lead only serves to add more fuel to the bears’ proverbial fire.

Speculative bubbles are not easy to identify before-the-fact, however they typically involve a combination of excessive valuations and/or massive amounts of leverage. In hindsight we experienced these dynamics in the technology collapse of the late-1990s (tech companies traded at over 100x’s earnings) and the leverage-induced housing crisis of the mid-2000s ($100s of billions used to speculate on subprime mortgages and real estate).

I’m OK with the argument that there are trillions of dollars being used for speculative buying, but if I understand correctly, the trillions of dollars in global liquidity being injected by central banks across the world is not being used to buy securities in the stock market? Rather, all the artificial, pending-bubble discussions should migrate to the bond market…not the stock market. All credit markets, to some degree, are tied to the trillions of Treasuries and mortgage-backed securities purchased by central banks, yet many pundits (i.e., see El-Erian & Bill Gross) choose to focus on claims of speculative buying in stocks, and not bonds.

While bears point to the Shiller 10 Price-Earnings ratio as evidence of a richly priced stock market, more objective measurements through FactSet (below 10-year average) and Wall Street Journal indicate a forward P/E of around 14. A reasonable figure if you consider the multiples were twice as high in 2000, and interest rates are at a generational low (see also Shiller P/E critique).

The news hasn’t been great, volatility measurements (i.e., VIX) have been signaling complacency, and every man, woman, and child has been waiting for a “pullback” – myself included. The pace of the upward advance we have experienced over the last six months is not sustainable, but when we finally get a price retreat, do not listen to the bears like Rosenberg. Their credibility has been shot, ever since the central bank dog ate their homework.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs) , but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Risk of “Double-Rip” on the Rise

Okay, you heard it here first. I’m officially anointing my first new 2013 economic term of the year: “Double-Rip!” No, the biggest risk of 2013 is not a “double-dip” (the risk of the economy falling back into recession), but instead, the larger risk is of a double-rip – a sustained expansion of GDP after multiple quarters of recovery. I know, this sounds like heresy, given we’ve had to listen to perma-bears like Nouriel Roubini, Peter Schiff, John Mauldin, Mohamed El-Erian, Bill Gross, et al shovel their consistently wrong pessimism for the last 14 quarters. However, those readers who have followed me for the last four years of this bull market know where I’ve stood relative to these unwavering doomsday-ers. Rather than endlessly rehash the erroneous gospel spewed by this cautious clan, you can decide for yourself how accurate they’ve been by reviewing the links below and named links above:

Roubini calling for double-dip in 2012

Roubini calling for double-dip in 2011

Roubini calling for double-dip in 2010

Roubini calling for double-dip in 2009

If we switch from past to present, Bill Gross has already dug himself into a deep hole just two weeks into the year by tweeting equity markets will return less than 5% in 2013. Hmmm, I wonder if he’d predict the same thing now that the market is up about +4.5% during the first 18 days of the year?

Why Double-Rip Over Double-Dip?

How can stocks rip if economic growth is so sluggish? If forced to equate our private sector to a car, opinions would vary widely. We could probably agree the U.S. economy is no Ferrari. Faster growing countries like China, which recently reported 4th quarter growth of +7.9% (up from +7.4% in 3rd quarter), have lapped us complacent, right-lane driving Americans in recent years. But speed alone should not be investors’ only key objective. If speed was the number one priority, the only places investors would be placing their money would be in countries like Rwanda, Turkmenistan, and Libya (see Business Insider article). However, freedom, rule of law, and entrepreneurial spirit are other important investment factors to be considered. The U.S. market is more like a Toyota Camry – not very flashy, but it will reliably get you from point A to point B in an efficient and safe manner.

Beyond lackluster economic growth, corporate profit growth has slowed remarkably. In fact, with about 10% of the S&P 500 index companies reporting 4th quarter earnings thus far, earnings growth is expected to rise a measly 2.5% from a year ago (from a previous estimate of 3.0% growth). With this being the case, how can stock prices go up? Shrewd investors understand the stock market is a discounting mechanism of future fundamentals, and therefore stocks will move in advance of future growth. It makes sense that before a turn in the economy, the brakes will often be activated before accelerating into another fast moving straight-away.

In addition, valuation acts like shock absorbers. With generational low interest rates and a below-average forward 12-month P/E (Price-Earnings) ratio of 13x’s, this stock market car can absorb a significant amount of fundamental challenges. The oft quoted message that “In the short run, the market is a voting machine but in the long run it is a weighing machine,” from value icon Benjamin Graham holds as true today as it did a century ago. The recent market advance may be attributed to the voters, but long-term movements are ultimately tied to the sustainable scales of sales, earnings, and cash flows.

If that’s the case, how can someone be optimistic in the face of the slowing growth challenges of this year? What 2013 will not have is the drag of election uncertainty, the fiscal cliff, Superstorm Sandy, and an end-of-the-world Mayan calendar concern. This is setting the stage for improved fundamentals as we progress deeper into the year. Certainly there will be other puts and takes, but the absence of these factors should provide some wind under the economy’s sails.

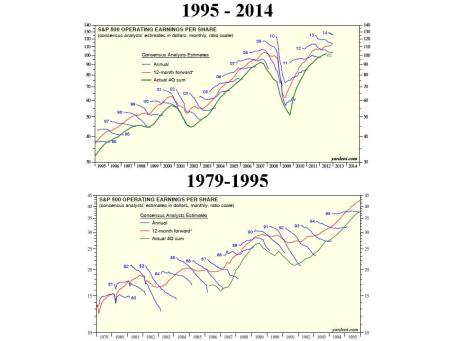

What’s more, history shows us that indeed stock prices can go up quite dramatically (more than +325% during the 1990s) when consensus earnings forecasts continually get trimmed. We have seen this same dynamic since mid-2012 – earnings forecasts have come down and stock prices have gone up. Strategist Ed Yardeni captures this point beautifully in a recent post on his Dr. Ed’s Blog (see charts below).

What Will Make Me Bearish?

Am I a perma-bull, incessantly wearing rose-colored glasses that I refuse to take off? I’ll let you come to your own conclusion. When I see a combination of the following, I will become bearish:

#1. I see the trillions of dollars parked in near-0% cash start coming outside to play.

#2. See Pimco’s Bill Gross and Mohammed El-Erian on CNBC fewer than 10 times per week.

#3. See money flow stop flooding into sub-3% bonds (Scott Grannis) and actually reverse.

#4. Observe a sustained reversal in hemorrhaging of equity investments (Scott Grannis).

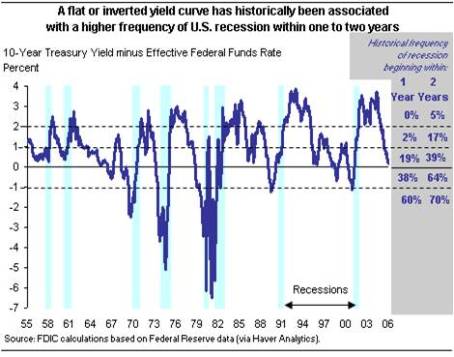

#5. Yield curve flattens dramatically or inverts.

#6. Nouriel and his bear buds become bullish and call for a “triple-rip” turn in the equity markets.

#7. Smarter, more-experienced investors than I, á la Warren Buffett, become more cautious. I arrogantly believe that will occur in conjunction with some of the previously listed items.

Despite my firm beliefs, it is evident the bears won’t go down without a fight. If you are getting tired of drinking the double-dip Kool-Aid, then perhaps it’s time to expand your bullish horizons. If not, just wait 12 months after a market rally, and buy yourself a fresh copy of the Merriam-Webster dictionary. There you can locate and learn about a new definition…double-rip!

Read Also: Double-Dip Guesses are “Probably Wrong”

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing SCM had no direct position in Fiat, Toyota, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Rams Butting Heads: Rosenberg vs. Paulsen

After a massive decline in financial markets during 2008, followed by a significant rebound in during 2009, should it be a surprise to anyone that economists hold directly opposing views? Financial markets are Darwinian in many respects, and Bloomberg was not bashful about stirring up a battle between David Rosenberg (Chief Economist & Strategist at Gluskin Sheff) and James Paulsen (Chief Investment Strategist at Wells Capital Management). The two economists, like the equivalent of two rams, lowered their horns and butted heads regarding their viewpoints on the economy. Rams butt heads (two words) together as a way to create a social order and hierarchy, so depending on your views, you can determine for yourself whom is the survival of the fittest. Regardless of your opinion, the exchange is an entertaining clash:

Paulsen’s Case (see also Unemployment Hypochondria): Paulsen makes the case that although the recovery has not been a gangbuster, nonetheless, the rebound has been the strongest in 25 years if you look at real GDP growth in the first year after a recession ends. He blames demographic atrophy in labor force growth (i.e., less job growth from Baby Boomers and fewer women joining the workforce relative to the mid-1980s) for the less than stellar absolute number.

Rosenberg’s Case: Rosenberg explains that the last two recoveries bear no resemblance to the recent recovery. The recent recession was one of the worst of all-time, therefore we should have experienced a sharper V-shaped recovery. All the major economic statistics are at dismal levels, and nowhere near the levels experienced in late 2007. He goes on to add that the stimulus, monetary policy, and bailouts have not produced the bang for our buck. Rosenberg says he will put on his bull hat once we enter a credit creation cycle that allows the economy to grow on an organic, sustained basis without artificial stimuli.

Like other pre-crisis bears who have floated to the top of the media mountain, Rosenberg has had difficulty adjusting his doom and gloom playbook as markets have rebounded approximately +80% from March 2009. Rosenberg maintained his pessimistic outlook as he transitioned from Merrill Lynch to Gluskin Sheff and has been wrong ever since. How wrong? Let’s take a look at Rosenberg’s first letter at his new employer, Gluskin Sheff (dated May 19th 2009):

Statement #1: “It stands to reason that this was just another counter-trend rally.” Reality: Dow Jones Industrial Average was at 8,475 then, and 11,114 today.

Statement #2: “It now looks as though the major averages are about to embark on the fabled retesting phase towards the March lows.” Reality: Dow never got close to 6,470 and stands at 11,114 today.

Statement #3: “It is unlikely that we have crossed the Rubicon into new bull market terrain and that the fundamental lows have been put in.” Reality: Dow just needs to fall -42% and Rosenberg will be right.

Statement #4: “[Unemployment] looks like we will likely get back to that old peak of 10.8% in coming quarters.” Reality: We peaked at 10.1% in October a year ago, and stand at 9.6% today.

Statement #5: “Deflation risks continue to trump inflation risks, at least over the near- and intermediate-term.” Reality: Commodity prices are dramatically escalating (CRB commodity index skyrocketing) across many categories, including the four-Cs (copper, corn, cotton, and crude oil).

I don’t pretend to be whistling past the graveyard, because we indeed have serious structural problems (deficits, debt, unsustainable entitlements, high unemployment, etc., etc., etc.), but when was there never something to worry about? See 1963 article? Like the endless “double dip” economists before him (see also Double-Dip Guesses). As the evidence shows, Rosenberg’s anything-but-rosy outlook is a tad extreme and has been dead wrong…at least for the last 1 and ½ years or almost 3,000 Dow Points. Just a few months ago, Rosenberg raised the odds of a double-dip recession from 45% to 67%.

Perhaps the sugar high stimulus will wear off, the steroid side-effects will kick in, and the Fed’s printing presses will break down and cause an economic fire? Until then, corporate profits continue to swell, cash is piling higher, valuations have been chopped in half from a decade ago (see Marathon Investing), and money stuffed under the mattress earning 0.5% will eventually leak back into the market.

I do however agree with Rosenberg in a few respects, and that revolves around his belief that banking industry will not be the leading group out of this cyclical recovery, and housing headwinds will remain in place for a extended period of time. Moreover, I agree with many of the bears when it comes to government involvement. Artificially propping up sectors like housing makes no sense. Why delay the inevitable by flushing taxpayer money down the toilet. Did you see the government running cash for clunker servers and storage in 2000 when the tech bubble burst? Does incentivizing capacity expansion with free money in an industry with boatloads of excess capacity already really make sense? Although media commentators and gloomy economists like Rosenberg paint everything as black and white, most reasonable people understand there are many shades of gray.

Gray that is…like the color of two rams butting heads.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Does Double-Dip Pass Duck Test?

If it looks like a duck, walks like a duck, and quacks like a duck, then chances are it is a duck. Regrettably, not everything passes the common “duck test” when it comes to judging the state of the economy. The prevailing opinion is the economy is on the brink of falling into another double-dip recession. Driving this sentiment has been the relentless focus on the softening short-term data (e.g., weekly jobless claims, monthly retail sales, daily dollar index, etc.). I’m no prophet or Nostradamus when it comes to picking the direction of the market, but if you consider the status of the steep Treasury yield curve, the perceived sitting duck economy may actually just be something completely different – perhaps one of those oily birds recovering from the BP oil spill.

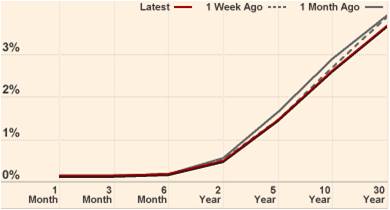

Pictures Worth Thousands of Words

Despite all the talk of “double-dip”, the curve’s extreme slope is still near record levels achieved over the last quarter century. Here’s what the Treasury snapshot looks like now:

Does this look like an inverted yield curve, which ordinarily precedes an economy falling into recession? Quite the opposite – this picture looks more like a ramp from which Evel Knievel is about to jump. Maybe Federal Reserve Chairman Ben Bernanke is actually the daredevil himself by setting artificially low interest rates for extended periods of time? If so, it’s possible the economy will suffer a fate like Mr. Knievel’s at Caesar’s Palace, but my guess is we are closer to the take-off than landing based on the yield curve.

I’ve recently harped on the wide range of “double-dip” guesses made by economists and strategists (see “Probably” Wrong article), but if that was not enough for you, here are a few more cheery views taken from this weekend’s Barron’s magazine and a few other publications of choice:

Kopin Tan (Barron’s): “The Treasuries camp is expecting another recession… In reality, with retailers and customers alike eyeing a second recession this year, it’s a season of anxiety.”

John Crudele (NY Post): “We’ll get a correction that’ll put the words ‘double-dip’ back into the headlines… When the final figures are produced years from now, historians might just decide that this was just one long downturn — not a series of dips.”

Jeremy Cook (Chief Economist-World First): “This will further heighten fears that the US economy is careening into the dreaded double-dip recession.”

How can the double-dippers be wrong? For starters, as I alluded to earlier, we are nowhere near an inverted yield curve. The 10-Year Treasury Note currently yields 2.62% while the T-Bill a measly 0.15%, creating a spread of about +2.47% (a long distance from negative).

As this chart implies, and others confirm, over the last 50 years or so, the yield curve has turned negative (or near 0% in the late 1950s and early 1960s) before every recession. Admittedly, before the soft-patch in economic data-points, the steepness was even greater than now (closer to 3.5%). Maybe the double-dippers are just more prescient than history has been as a guide, but until we start flirting with sub-1% spreads, I’ll hold off on sweating bullets. Less talked about now is the possibility of stagflation (stagnant inflation). I’m not in that camp, but down the road I see this as a larger risk than the imminent double-dip scenario.

I’m not in the business of forecasting the economy, and history books are littered with economists that come and go in glory and humiliation. And although it’s fun guessing on what will or will not happen with the economy, I rather choose to follow the philosophy of the great Peter Lynch (see my profile of Lynch):

“If you spend more than 13 minutes analyzing economic and market forecasts, you’ve wasted 10 minutes.”

Along those same lines, he adds:

“Assume the market [economy] is going nowhere and invest accordingly.”

I choose to spend my time hunting and investing in opportunities all over the map. With fear and anxiety high, fortunately for me and my clients, I am finding more attractive prospects. While some get in the stale debate of stocks versus bonds, there are appealing openings across the whole capital structure, geographies, and the broad spectrum of asset classes. So, as others look to test whether the economic animal is a bear, bull, or duck, I’ll continue sniffing away for opportunities like a bloodhound.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

*DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in BP or any security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Professional Double-Dip Guesses are “Probably” Wrong

As you may have noticed from previous articles, I take a significant grain (or pound) of salt when listening to economists and strategists like Peter Schiff, Nouriel Roubini, Meredith Whitney, John Mauldin, et.al. Typically, these financial astrologists weave together convincing, elaborate, grand guesses that extrapolate every short-term, fleeting economic data point into an imposing (or magnificent) long-term secular trend.

With all this talk of “double-dip” recession, I cannot help but notice the latest verbal tool implemented by every Tom, Dick, and Harry economist when discussing this topic… the word “probability”. Rather than honestly saying I have no clue on what the economy will do, many strategists place a squishy numerical “probability” around the possibility of a “double-dip” recession consistent with the news du jour. Over recent weeks, unstable U.S. economic data have been coming in softer than expectations. So, guess what? Economists have become more pessimistic about the economy and raised the “probability” of a double dip recession. Thanks Mr. Professor “Obvious!” I’m going to go out on a limb, and say the probability of a double-dip recession will likely go down if economic data improves. Geez…thanks.

Here is a partial list of double-dip “probabilities” spouted out by some well-known and relatively unknown economists:

- Robert Shiller (Professor at Yale University): “The probability of that kind of double-dip is more than 50 percent.”

- Bill Gross (Founder/Managing Director at PIMCO): The New York Times described Gross’s double-dip radar with the following, “He put the probability of a recession — and of an accompanying bout of deflation — at 25 to 35 percent.”

- Mohamed El-Erian (CEO of PIMCO): “If you wonder how meaningful 25 per cent is, ask yourself the following question: if I offered you that I drive you back to work, but there’s a one in four chance that I get into a big accident, would you come with me?”

- David Rosenberg (Chief Economist at Gluskin Chef): In a recent newsletter, Rosenberg has raised the odds of a double-dip recession from 45 per cent a month ago to 67 per cent currently.

- Nouriel Roubini (Professor at New York University): “As early as August 2009 I expressed concern in a Financial Times op-ed about the risk of a double-dip recession, even if my benchmark scenario characterizes the risk of a W as still a low probability event (20% probability) as opposed to a 60% probability for a U-shaped recovery.”

- Robert Reich (Former Secretary of Labor): According to Martin Fridson, Global Credit Strategist at BNP Paribas, Robert Reich has assigned a 50% probability of a double dip, even if Reich believes we are actually in one “Long Dipper.”

- Graeme Leach (Chief Economist at the Institute of Directors): “I would give a 40 per cent probability to what I call ‘one L of a recovery’, in other words a fairly weak flattish cycle over the next 12 months. A double-dip recession would get a 40 per cent probability as well.”

- Ed McKelvey (Sr. U.S. Economist at Goldman Sachs): “We think the probability is unusually high — between 25 percent and 30 percent — but we do not see double dip as the base case.”

- Avery Shenfeld (Chief Economist at CIBC): “The probability estimate is likely more consistent with a slowdown rather than a true double-dip recession but, given the uncertainties, fiscal tightening ahead and the potential for a slow economy to be vulnerable to shocks, we will keep an eye on our new indicator nevertheless.” This guy can’t even be pinned down for a number!

- National Institute for Economic and Social Research (NIESR) : “The probability of seeing a contraction of output in 2011 as compared to 2010 has risen from 14 per cent to 19 per cent.”

- New York Fed Treasury Spread Model (see chart below): Professor Mark J. Perry notes, “For July 2010, the recession probability is only 0.06% and by a year from now in June of next year the recession probability is only slightly higher, at only 0.3137% (less than 1/3 of 1%).”

Listening to these economic armchair quarterbacks predict the direction of the financial markets is as painful as watching Jim Gray’s agonizing hour-long interview of Lebron James’s NBA contract decision (see also Lebron: Buy, Sell, or Hold?). Just what I want to hear – a journalist that probably has never dribbled a ball in his life, inquiring about cutting edge questions like whether Lebron is still biting his nails? Most of these economists are no better than Jim Gray. In many instances these professionals don’t invest in accordance with their recommendations and their probability estimates are about as reliable as an estimate of the volatility index (see chart below) or a prediction about Lindsay Lohan’s legal system status.

I can virtually guarantee you at least one of the previously mentioned economists will be correct on their forecasts. That isn’t much of an achievement, if you consider all the strategists’ guesses effectively cover every and any economic scenario possible. If enough guesses are thrown out there, one is bound to stick. And if they’re wrong, no problem, the economists can simply blame randomness of the lower probability event as the cause of the miscue.

Unlike Wayne Gretzky, who said, “I skate to where the puck is going to be, not where it has been,” economists skate right next to the puck. Because the economic data is constantly changing, this strategy allows every forecaster to constantly change their outlook in lock-step with the current conditions. This phenomenon is like me looking at the dark clouds outside my morning window and predicting a higher probability of rain, or conversely, like me looking at the blue skies outside and predicting a higher chance of sunshine.

Using this “probability” framework is a convenient B.S. means of saving face if a directional guess is wrong. By continually adjusting probability scenarios with the always transforming economic data, the strategist can persistently waffle with the market sentiment vicissitudes.

What would be very refreshing to see is a strategist on CNBC who declares he was dead wrong on his prediction, but acknowledges the world is inherently uncertain and confesses that nobody can predict the market with certainty. Instead, the rent-o-strategists consistently change their predictions in such a manner that it is difficult to measure their accuracy – especially when there is rarely hard numbers to hold these professional guessers accountable for.

Economists and strategists may be well-intentioned people, just as is the schizophrenic trading advice of Jim Cramer of CNBC’s Mad Money, but the “probability” of them being right over relevant investing time horizons is best left to an experienced long-term investor that understands the pitfalls of professional guessing.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

*DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in GS, NYT or any security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Kass: Triple Lindy Redux

About a year ago, I wrote about Doug Kass (founder and president of Seabreeze Partners) and his attempt at pulling off the famous “Triple Lindy” dive, which was made famous in the classic movie Back to School starring Rodney Dangerfield. If I were a judge, I would say Kass’s landing wasn’t a perfect 10, but rather closer to a 6.5. After successfully nailing the bear market in 2008, and subsequently declaring the “generational low” of March 2009, Kass became cautious in June 2009. At the time, Kass pulled in his horns by pronouncing a consumer-led double dip in late 2009 or in the first half 2010 from a consumption binge hangover, while declaring his previous 1050 S&P 500 index target as overly ambitious. What actually transpired is the S&P 500 went from around 942 to 1220 over the next ten months, or up about +30%.

Today, Kass is trying to make another large splash, but now he is reversing course and once more calling for a rally…at least a mini one. Rather than speaking in terms of his previous generational low (S&P 666), Kass sees the recent lows around 1,010 being the “bottom for the year” and his new 2010 target is based on climbing to positive territory for the year, implying a +10% to +12% move from the beginning of July.

View Doug Kass Interview and Prediction

View Doug Kass Interview and Prediction

Kass is not your traditional investor, and he admits as much:

“I’m not a perma-bear, I’m not a perma-bull. I try to be flexible and eclectic in my view, and this is especially necessary in a market, which is so volatile as it’s been for the last several years.”

In explaining his upbeat rationale, Kass highlights nuanced aspects to employment data, payroll growth, moderate economic expansion, and an attractive valuation for the overall market:

“I’m not technically based, therefore I’m not sentiment based, I’m fundamental based….The markets are traveling on a path of fear and share prices have significantly disconnected from fundamentals.”

Even if Kass didn’t nail the “Triple Lindy,” he still deserves special attention as a practitioner, in addition to his side job as a market prognosticator. Additional recognition is warranted solely based on the potshots he aimed at rent-a-strategists like Nouriel Roubini, CNBC celebrity, (see Roubini articles #1 or #2) and Robert Prechter, long-running technician who is currently predicting Dow destruction to unfathomable level of 1,000. I’m not in the business of predicting short-term market gyrations, but I’ll enjoy watching Kass’s next dive to see whether he’ll make a splash or not.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

*DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct positions in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Clashing Views with Dr. Roubini

The say keep your friends close, and your enemies even closer. Nouriel Roubini, professor of economics and international business at the NYU Stern School of Business, is not an enemy, but I think his fluctuating views (see previous story) and Armageddon expectations are off base. Perma-bears like Roubini and Peter Schiff (view article) have gloated and danced in the media limelight due to their early but eventually right calls. Over the last seven months or so, their forecasts on the U.S. economy and markets have been off the mark. With that said, even those with competing views at times can find common ground. For Nouriel and I, we currently share similar beliefs on gold (see my article on gold).

Here’s what Professor Roubini has to say:

“ I don’t believe in gold. Gold can go up for only two reasons. [One is] inflation, and we are in a world where there are massive amounts of deflation because of a glut of capacity, and demand is weak, and there’s slack in the labor markets with unemployment peeking above 10 percent in all the advanced economies. So there’s no inflation, and there’s not going to be for the time being.The only other case in which gold can go higher with deflation is if you have Armageddon, if you have another depression. But we’ve avoided that tail risk as well. So all the gold bugs who say gold is going to go to $1,500, $2,000, they’re just speaking nonsense. Without inflation, or without a depression, there’s nowhere for gold to go. Yeah, it can go above $1,000, but it can’t move up 20-30 percent unless we end up in a world of inflation or another depression. I don’t see either of those being likely for the time being. Maybe three or four years from now, yes. But not anytime soon.”

My thoughts on oil are less bearish, but nonetheless more cautious given the massive price bounce to around $80 per barrel. Could I see prices coming down to $50 like Roubini feels is appropriate? Certainly. With the $100+ per barrel swing we saw last year, I cannot discount completely the possibility of that scenario. However, unlike gold, oil has a much stronger utility value, and based on the slow adoption of more expensive alternative energies, this commodity will be in strong demand for many years to come. The pace of global economic recovery, especially in countries like China, India, and Brazil provide an underlying demand for the petroleum product. In order to understand the underlying bid for this economic lubricant, all one has to do is look at the appetite of emerging economies like China when it comes to this black gold (see my article on China).

And where does Roubini think markets go from here?

“If the recovery of the economy is going to be anemic, sub-par, below-trend and U-shaped, there is going to be a correction. And therefore my view is to stay away from risky assets. Stay in liquid assets. I don’t know when the correction is going to occur, it could be a while longer, but eventually it will be a pretty ugly correction, across many different asset classes.”

Perhaps Roubini’s “double dip” fears will eventually come true – and he leaves himself plenty of room with vague loose language – however, I follow the philosophy of Peter Lynch: ‘‘If you spend more than 14 minutes a year worrying about the market, you’ve wasted 12 minutes.” Great companies don’t disappear in challenging markets – they become cheaper – and new innovative companies emerge to replace the old guard.

As much as I would like to be right all the time, that’s not the case. In order to learn from past mistakes and continually improve my process, it’s important to get the views of others…even from those with clashing perspectives.

Read IndexUniverse.com Interview with Nouriel Roubini Here

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management and client accounts do not have direct long or short positions in gold positions, however accounts do have long exposure to certain energy stocks and ETFs. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Kass Attempts the “Triple Lindy”

Although Doug Kass, founder and president of Seabreeze Partners, has historically been primarily a dedicated short-seller, he presciently called the market low in March 2009 (what he now calls a “generational low”). Like in the movie Back to School starring Rodney Dangerfield, Doug Kass is trying to successfully execute the impossible “Triple Lindy” dive of his own. Thus far, Kass has completed the first two legs of the dive by accurately being bearish in late 2007 and subsequently bullish at the recent market bottom in March 2009. Now he sees, “potholes on the road to higher prices,” and he thinks we will be stuck in neutral for quite a while.

Although Doug Kass, founder and president of Seabreeze Partners, has historically been primarily a dedicated short-seller, he presciently called the market low in March 2009 (what he now calls a “generational low”). Like in the movie Back to School starring Rodney Dangerfield, Doug Kass is trying to successfully execute the impossible “Triple Lindy” dive of his own. Thus far, Kass has completed the first two legs of the dive by accurately being bearish in late 2007 and subsequently bullish at the recent market bottom in March 2009. Now he sees, “potholes on the road to higher prices,” and he thinks we will be stuck in neutral for quite a while. Click Here for Kass’ Yahoo! Video Interview

Click Here for Kass’ Yahoo! Video Interview

Like other prognosticators, I feel like Mr. Kass is trying to have a little of his cake and eat it too, since he previously called a run to 1,050 (S&P was at 942 on 6/4/09) and now he has adjusted his posture to a neutral stance. Therefore if prices move upwards, his previous 1,050 call is firmly in place, and on the other hand if we move sideways or downwards, then his neutral prediction is still in play.

As one of the American judges, I give Kass a score of 9.0 regardless of whether his squishy call for a potential double-dip (consumer led recession) comes to fruition in late 2009, or early 2010. Congratulations Doug on completion of the first two sequences of the Triple Lindy!