Posts tagged ‘debt ceiling’

Sleeping like a Baby with Your Investment Dollars

Amidst the recent, historically high volatility in the financial markets, there have been a large percentage of investors who have been sleeping like a baby – a baby that stays up all night crying! For some, the dream-like doubling of equity returns achieved from the first half of 2009 through the first half of 2011 quickly turned into a nightmare over the last few weeks. We live in an inter-connected, globalized world where news travels instantaneously and fear spreads like a damn-bursting flood. Despite the positive returns earned in recent years, the wounds of 2008-2009 (and 2000 to a lesser extent) remain fresh in investors’ minds. Now, the hundred year flood is expected every minute. Every European debt negotiation, S&P downgrade, or word floating from Federal Reserve Chairman Ben Bernanke’s lips, is expected to trigger the next Lehman Brothers-esque event that will topple the global economy like a chain of dominoes.

Volatility Victims

The few hours of trading that followed the release of the Federal Reserve’s August policy statement is living proof of investors’ edginess. After initially falling approximately -400 points in a 30 minute period late in the day, the Dow Jones Industrial Average then climbed over +600 points in the final hour of trading, before experiencing another -400 point drop in the first hour of trading the next day. Many of the day traders and speculators playing with the explosively leveraged exchange traded funds (e.g., TNA, TZA, FAS, FAZ), suffered the consequences related to the panic selling and buying that comes with a VIX (Volatility Index) that climbed about +175% in 17 days. A VIX reading of 44 or higher has only been reached nine times in the last 25 years (source: Don Hays), and is normally associated with significant bounce-backs from these extreme levels of pessimism. Worth noting is the fact that the 2008-2009 period significantly deteriorated more before improving to a more normalized level.

Keys to a Good Night’s Sleep

The nature of the latest debt ceiling negotiations and associated Standard & Poor’s downgrade of the United States hurt investor psyches and did little to boost confidence in an already tepid economic recovery. Investors may have had some difficulty catching some shut-eye during the recent market turmoil, but here are some tips on how to sleep comfortably.

• Panic is Not a Strategy: Panic selling (and buying) is not a sustainable strategy, yet we saw both strategies in full force last week. Emotional decisions are never the right ones, because if they were, investing would be quite easy and everyone would live on their own personal island. Rather than panic-sell, investments should be looked at like goods in a grocery store – successful long-term investors train themselves to understand it is better to buy goods when they are on sale. As famed growth investor Peter Lynch said, “I’m always more depressed by an overpriced market in which many stocks are hitting new highs every day than by a beaten-down market in a recession.”

• Long-Term is Right-Term: Everybody would like to retire at a young age, and once retired, live like royalty. Admirable goals, but both require bookoo bucks. Unless you plan on inheriting a bunch of money, or working until you reach the grave, it behooves investors to pull that money out from under the mattress and invest it wisely. Let’s face it, entitlements are going to be reduced in the future, just as inflation for food, energy, medical, leisure and other critical expenses continue eroding the value of your savings. One reason active traders justify their knee-jerk actions and derogatory description of long-term investors is based on the stagnant performance of U.S. equity markets over the last decade. Nonetheless, the vast number of these speculators fail to recognize a more than tripling in average values in markets like Brazil, India, China, and Russia over similar timeframes. Investing is a global game. If you do not have a disciplined, systematic long-term investment strategy in place, you better pray you don’t lose your job before age 70 and be prepared to eat Mac & Cheese while working as a Wal-Mart (WMT) greeter in your 80s.

• Diversification: Speaking of sleep, the boring topic of diversification often puts investors to sleep, but in periods like these, the power of diversification becomes more evident than ever. Cash, metals, and certain fixed income instruments were among the investments that cushioned the investment blow during the 2008-2009 time period. Maintaining a balanced diversified portfolio across asset classes, styles, size, and geographies is crucial for investment survival. Rebalancing your portfolio periodically will ensure this goal is achieved without taking disproportionate sized risks.

• Tailored Plan Matching Risk Tolerance: An 85 year-old wouldn’t go mountain biking on a tricycle, and a 10 year-old shouldn’t drive a bus to his fifth grade class. Sadly, in volatile times like these, many investors figure out they have an investment portfolio mismatched with their goals and risk tolerance. The average investor loves to take risk in up-markets and shed risk in down-markets (risk in this case defined as equity exposure). Regrettably, this strategy is designed exactly backwards for long-term investors. Historically, actual risk, the probability of permanent losses, is much lower during downturns; however, the perceived risk by average investors is viewed much worse. Indeed, recessions have been the absolute best times to purchase risky assets, given our 11-for-11 successful track record of escaping post World War II downturns. Could this slowdown or downturn last longer than expected and lead to more losses? Absolutely, but if you are planning for 10, 20, or 30 years, in many cases that issue is completely irrelevant – especially if you are still adding funds to your investment portfolio (i.e., dollar-cost averaging). On the flip side, if an investor is retired and entirely dependent upon an investment portfolio for income, then much less attention should be placed on risky assets like equities.

If you are having trouble sleeping, then one of two things is wrong: 1.) You are taking on too much risk and should cut your equity exposure; and/or 2.) You do not understand the risk you are taking. Volatile times like these are great for reevaluating your situation to make sure you are properly positioned to meet your financial goals. Talking heads on TV will tell you this time is different, but the truth is we have been through worse times (see History Never Repeats, but Rhymes), and lived to tell the tale. All this volatility and gloom may create anxiety and cause insomnia, but if you want to quietly sleep through the noise like a content baby, make yourself a long-term financial bed that you can comfortably sleep in during good times and bad. Focusing on the despondent headline of the day, and building a portfolio lacking diversification will only lead to panic selling/buying and results that would keep a baby up all night crying.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds (including emerging market ETFs) and WMT, but at the time of publishing SCM had no direct position in TNA, TZA, FAS, FAZ, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Rating Agencies to Government: Go Back to College!

Remember those days as a young adult, when you were a starving student in college, doing everything you possible could in your power to not run out of money (OK, if you were born with a silver spoon in your mouth, just play along). You know what I’m talking about… Corn Flakes for breakfast, PB&J for lunch, and maybe splurge with a little Mac & Cheese or Top Ramen for dinner. Well, the rating agencies, especially Standard & Poor’s (S&P) with their long-term sovereign credit rating downgrade on the U.S. from AAA rated to AA+ rated, are signaling our U.S. government to cut back on the champagne and caviar spending and go back to living like a college student.

Rent-A-Cops Assert Power

The rating agencies may have been asleep at the switch during the tech bubble (Enron & WorldCom) and the financial crisis of 2008-2009 (i.e., ratings of toxic mortgage backed securities), but they are doing their best to reassert themselves as credible security rating entities. By the way, as long as S&P has some wise critical advice for the U.S. government regarding fiscal responsibility, I have a suggestion for S&P: When providing a fresh ratings downgrade, please limit error estimations to less than $2,000,000,000,000.00 – this is exactly what S&P did in its ratings downgrade. Time will tell whether S&P can maintain its role as credit market policeman or will be mocked like those unarmed, overweight rent-a-cops you see at the shopping mall.

In reality, S&P’s moves represent little fundamental change, especially since these moves have been signaled for months (S&P initially lowered its outlook on the U.S. to negative on 4/18/11). I know there will be some that panic at this announcement (won’t be the first or last time), but should anyone really be shocked by an independent entity telling the U.S. government they are spending too much money and hold too much debt? If my memory serves me correctly, Americans have been screaming S&P’s same message for years – I think the rise of the Tea-Party, the results of the mid-term elections, and the tone of the debt ceiling debate may indicate a few people have caught onto this unsustainable fiscal disaster.

Two Simple Choices

As I have said for some time, these horrendously difficult issues will get resolved. The only question is who will resolve this negligent fiscal behavior? There are only two simple answers: 1) Politicians can proactively chip away at the problem with solutions my first grader has already identified (spend less and/or increase revenue); or 2) Financial Market Vigilantes can rip apart financial markets and force borrowing costs to the stratosphere. Option number one is preferable for everyone, and for those that don’t understand option number two, I refer you to Greece, Iceland, Ireland, Portugal, Italy and Spain.

If you’re getting sick of listening to debt and spending issues now, I will gently remind you this is an election year, so the nauseating debates are only going to get worse from here. I encourage everyone to make a game of this fiscal discussion, and do enough homework to the point you have informed, convicted opinions about our country’s fiscal situation. Unlike in periods past, when Americans could take a nap and ride the U.S. gravy train to prosperity, the ultra-competitive globalized game no longer allows us to rest on our laurels of being the world’s strongest superpower. There are a lot more people playing in our game outside our borders, and many of them are stronger, faster, smarter, and more efficient. Decisions being made today, tomorrow, and over the next year will have profound effects on millions of Americans, myself included. So as the government prioritizes spending programs and debates methods of raising revenue, I advise you to go back to your college days and decide whether you prefer Corn Flakes, PB&J, and Mac & Cheese. If voters don’t pressure politicians into doing the right thing, then we’ll all be collecting food stamps from the Financial Market Vigilantes.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in MHP, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Plumbers & Cops: Can the Debt Ceiling be Fixed?

The ceiling is leaking, but it’s unclear whether it will be repaired? Rather than fix the seeping fiscal problem, Democrats and Republicans have stared at the leaky ceiling and periodically applied debt ceiling patches every year or two by raising the limit. Nanosecond debt ceiling coverage has reached a nauseating level, but this issue has been escalating for many months. Last fall, politicians feared their long-term disregard of fiscally responsible policies could lead to a massive collapse in the financial ceiling protecting us, so the President called in the bipartisan plumbers of Alan Simpson & Erskine Bowles to fix the leak. The commission swiftly identified the problems and came up with a deep, thoughtful plan of action. Unfortunately, their recommendations were abruptly dismissed and Washington fell back into neglect mode, choosing instead to bicker like immature teenagers. The result: poisonous name calling and finger pointing that has placed Washington politicians one notch above Cuba’s Fidel Castro, Venezuela’s Hugo Chavez, and Iran’s Mahmoud Ahmadinejad on the list of the world’s most hated leaders. Strategist Ed Yardeni captured the disappointment of American voters when he mockingly states, “The clowns in Washington are making people cry rather than laugh.”

Although despair is in the air and the outlook is dour, our government can redeem itself with the simple passage of a debt ceiling increase, coupled with credible spending reduction legislation (and possibly “revenue enhancers” – you gotta love the tax euphimism).

The Elephant in the Room

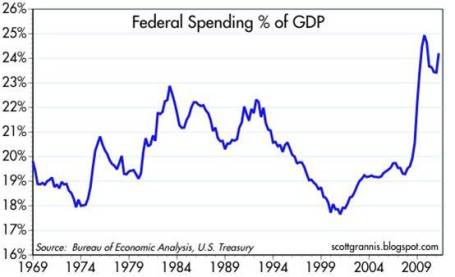

Our country’s spending problems is nothing new, but the 2008-2009 financial crisis merely amplified and highlighted the severity of the problem. The evidence is indisputable – we are spending beyond our means:

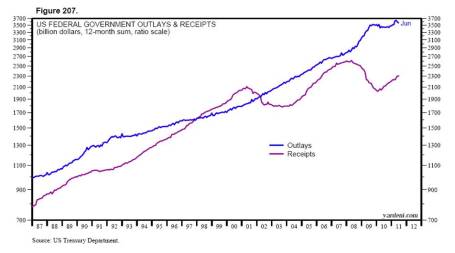

If the federal spending to GDP chart is not convincing enough, then review the following graph:

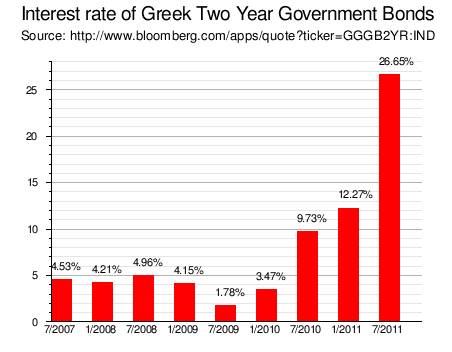

You don’t need to be a brain surgeon or rocket scientist to realize government expenditures are massively outpacing revenues (tax receipts). Expenditures need to be dramatically reduced, revenues increased, and/or a combination thereof. Applying for a new credit card with a limit to spend more isn’t going to work anymore – the lenders reviewing those upcoming credit applications will straightforwardly deny the applications or laugh at us as they gouge us with prohibitively high borrowing costs. The end result will be the evaporation of entitlement programs as we know them today (including Medicare and Social Security). For reference of exploding borrowing costs, please see Greek interest rate chart below. The mathematical equation for the Greek financial crisis (and potentially the U.S.) is amazingly straightforward…Loony Spending + Looney Politicians = Loony Interest Rates.

To illustrate my point further, imagine the government owning a home with a mortgage payment tied to a 2.5% interest rate (a tremendously low, average borrowing cost for the U.S. today). Now visualize the U.S. going bankrupt, which would then force foreign and domestic lenders to double or triple the rates charged on the mortgage payment (in order to compensate the lenders for heightened U.S. default risk). Global investors, including the Chinese, are pointing a gun at our head, and if a political blind eye on spending continues, our foreign brethren who have provided us with extremely generous low priced loans will not be bashful about pulling the high borrowing cost trigger. The ballooning mortgage payments resulting from a default would then break an already unsustainably crippling budget, and the government would therefore be placed in a position of painfully slashing spending. Too extreme a shift towards austerity could spin a presently wobbling economy into chaos. That’s precisely the situation we face under a no-action Congressional default (i.e., no fix by August 2nd or shortly thereafter). To date, the Chinese have collected their payments from us with a nervous smile, but if the U.S. can’t make some fiscally responsible choices, our Asian Pacific pals will be back soon with a baseball bat to collect.

The Cops to the Rescue

Any parent knows disciplining teenagers doesn’t always work out as planned. With fiscally irresponsible spending habits and debt load piling up to the ceiling, politicians are stealing the prospects of a brighter future from upcoming generations. The good news is that if the politicians do not listen to the parental voter cries for fiscal sanity, the capital market cops will enforce justice for the criminal negligence and financial thievery going on in Washington. Ed Yardeni calls these capital market enforcers the “bond vigilantes.” If you want proof of lackadaisical and stubborn politicians responding expeditiously to capital market cops, please hearken back to September 2008 when Congress caved into the $700 billion TARP legislation, right after the Dow Jones Industrial average plummeted 777 points in a single day.

Who exactly are these cops? These cops come in the shape of hedge funds, sovereign wealth funds, pension funds, endowments, mutual funds, and other institutional investors that shift their dollars to the geographies where their money is treated best. If there is a perceived, heightened risk of the United States defaulting on promised debt payments, then global investors will simply take their dollar-denominated investments, sell them, and then convert them into currencies/investments of more conscientious countries like Australia or Switzerland.

Assisting the capital market cops in disciplining the unruly teenagers are the credit rating agencies. S&P (Standard and Poor’s) and Moody’s (MCO) have been watching the slow-motion train wreck develop and they are threatening to downgrade the U.S.’ AAA credit rating. Republicans and Democrats may not speak the same language, but the common word in both of their vocabularies is “reelection,” which at some point will effect a reaction due to voter and investor anxiety.

Nobody wants to see our nation’s pipes burst from excessive debt and spending, and if the political plumbers can repair the very obvious and fixable fiscal problems, we can move on to more important challenges. It’s best we fix our problems by ourselves…before the cops arrive and arrest the culprits for gross negligence.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Performance data from Morningstar.com. Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in MCO, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

No Respect: The Rodney Dangerfield of the Investment World

Ask any average Joe off the street what investment category is at or near record all-time highs, and a good number of them will confidently answer “gold,” as prices recently eclipsed $1,600 per ounce. But of course this makes perfect sense, right? The Fed is printing money like it’s going out of style, the dollar is collapsing like a drunken sailor, inflation is about to sky-rocket to the moon, and China is on the verge of becoming the world’s new reserve currency. Never mind that Greece, Portugal and Ireland are in shambles with the Euro on its death bed. Or Japan has achieved a debt to GDP ratio that would even make U.S. vote grubbing politicians blush. A sub-3% 10-Year Treasury Note doesn’t appear to discourage fervent gold-bugs either.

No Respect

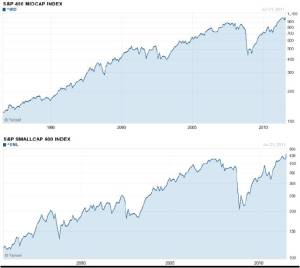

While gold has experienced an incredible sextupling in prices over the last decade and hit new-all time highs, believe it or not, there is an unlikely asset class that is reaching new historic highs and has outperformed gold for almost 2.5 years. Can you guess what asset class star I am talking about? If I said U.S. “stocks,” would you believe me? OK, well maybe I’m not referring to large capitalization stocks like Johnson & Johnson (JNJ), Microsoft Corp. (MSFT), Wal-Mart Stores (WMT), Intel Corp. (INTC), and AT&T Inc. (T), all of which have effectively gone nowhere in the 21st Century. However, the story is quite different if you look at small and mid capitalization stocks, which have received about as much respect as Rodney Dangerfield.

As a matter of fact, the S&P 400 (MidCap Index) and S&P 600 Index (SmallCap Index) have more than doubled gold’s performance since the lows of March 2009 (SmallCap +149.0%; MidCap +145.1%; Gold/GLD +71.0%). Given the spectacular performance of small and mid-sized companies, I’m still waiting with bated breath for a telemarketer call asking me if I have considered selling my small and mid cap stock certificates for cash – since everyone has melted their gold chains and fillings, a new hobby is needed.

What Next?

Has the fear trade ended? Perhaps not, if you consider European sovereign debt and U.S. debt ceiling concerns, but what happens if the half empty glass becomes half full. The early 1980s may be a historical benchmark period for comparison purposes. An interesting thing happened from 1980-1982 when Federal Reserve Chairman Paul Volcker began raising interest rates to fight inflation – gold prices dropped -65% (~$800/oz. to under $300/oz.) from 1980-1982 and the shiny metal lived through approximately a 25 year period with ZERO price appreciation. Since there is only one direction for the Fed’s zero interest rate policy (ZIRP) to go, conceivably history will repeat itself once again?

In hindsight gold was a beautiful safe haven vehicle during the panic-filled, nail-biting period during late-2007 throughout 2008. Since then, small and mid cap stocks have trounced gold. Like stocks, Rodney Dangerfield may have gotten no respect, but once fear has subsided and rates start increasing, maybe stocks will steal the show and get the respect they deserve.

See also Rodney Dangerfield’s perspective on Doug Kass and the Triple Lindy

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Performance data from Morningstar.com. Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds (including small cap and mid cap ETFs), and WMT, but at the time of publishing SCM had no direct position in JNJ, MSFT, INTC, T, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Bin Laden Killing Overshadows Royal Rally

Excerpt from No-Cost May Sidoxia Monthly Newsletter (Subscribe on right-side of page)

Before the announcement of the killing of the most wanted terrorist in the world, Osama bin Laden, the royal wedding of Prince William Arthur Philip Louis and Catherine Middleton (Duke and Duchess of Cambridge) grabbed the hearts, headlines, and minds of people around the world. As we exited the month, a less conspicuous royal rally in the U.S. stock market has continued into May, with the S&P 500 index climbing +2.8% last month as the economic recovery gained firmer footing from the recession of 2008 and early 2009. As always, there is no shortage of issues to worry about as traders and speculators (investors not included) have an itchy sell-trigger finger, anxiously fretting over the possibility of losing gains accumulated over the last two years.

Here are some of the attention-grabbing issues that occurred last month:

Powerful Profits: According to Thomson Reuters, first quarter profit growth as measured by S&P 500 companies is estimated at a very handsome +18% thus far. At this point, approximately 84% of companies are exceeding or meeting expectations by a margin of 7%, which is above the long-term average of a 2% surprise factor.

Powerful Profits: According to Thomson Reuters, first quarter profit growth as measured by S&P 500 companies is estimated at a very handsome +18% thus far. At this point, approximately 84% of companies are exceeding or meeting expectations by a margin of 7%, which is above the long-term average of a 2% surprise factor.

Debt Anchor Front & Center: Budget battles remain over record deficits and debt levels anchoring our economy, but clashes over the extension of our debt ceiling will occur first in the coming weeks. Skepticism and concern were so high on this issue of our fiscal situation that the Standard & Poor’s rating agency reduced its outlook on the sovereign debt rating of U.S. Treasury securities to “negative,” meaning there is a one-in-three chance our country’s debt rating could be reduced in the next two years. Democrats and Republicans have put forth various plans on the negotiating table that would cut the national debt by $4 – $6 trillion over the next 10-12 years, but a chasm still remains between both sides with regard to how these cuts will be best achieved.

Debt Anchor Front & Center: Budget battles remain over record deficits and debt levels anchoring our economy, but clashes over the extension of our debt ceiling will occur first in the coming weeks. Skepticism and concern were so high on this issue of our fiscal situation that the Standard & Poor’s rating agency reduced its outlook on the sovereign debt rating of U.S. Treasury securities to “negative,” meaning there is a one-in-three chance our country’s debt rating could be reduced in the next two years. Democrats and Republicans have put forth various plans on the negotiating table that would cut the national debt by $4 – $6 trillion over the next 10-12 years, but a chasm still remains between both sides with regard to how these cuts will be best achieved.

Inflation Heating Up: The global economic recovery, fueled by loose global central bank monetary policies, has resulted in fanning of the inflation flames. Crude oil prices have jumped to $113 per barrel and gasoline has spiked to over $4 per gallon. Commodity prices have jumped up across the board, as measured by the CRB (Commodity Research Bureau) BLS Index, which measures the price movements of a basket of 22 different commodities. The CRB Index has risen over +28% from a year ago. Although the topic of inflation is dominating the airwaves, this problem is not only a domestic phenomenon. Inflation in emerging markets, like China and Brazil, has also expanded into a dangerous range of 6-7%, and many of these governments are doing their best to slow-down or reverse loose monetary policies from a few years ago.

Inflation Heating Up: The global economic recovery, fueled by loose global central bank monetary policies, has resulted in fanning of the inflation flames. Crude oil prices have jumped to $113 per barrel and gasoline has spiked to over $4 per gallon. Commodity prices have jumped up across the board, as measured by the CRB (Commodity Research Bureau) BLS Index, which measures the price movements of a basket of 22 different commodities. The CRB Index has risen over +28% from a year ago. Although the topic of inflation is dominating the airwaves, this problem is not only a domestic phenomenon. Inflation in emerging markets, like China and Brazil, has also expanded into a dangerous range of 6-7%, and many of these governments are doing their best to slow-down or reverse loose monetary policies from a few years ago.

Expansion Continues but Slows: Economic expansion continued in the first quarter, but slowed to a snail’s pace. The initial GDP (Gross Domestic Product) reading for Q1 slowed down to +1.8% growth. Brakes on government stimulus and spending subtracted from growth, and high fuel costs are pinching consumer spending.

Expansion Continues but Slows: Economic expansion continued in the first quarter, but slowed to a snail’s pace. The initial GDP (Gross Domestic Product) reading for Q1 slowed down to +1.8% growth. Brakes on government stimulus and spending subtracted from growth, and high fuel costs are pinching consumer spending.

Ben Holds the Course: One person who is not overly eager to reverse loose monetary policies is Federal Reserve Chairman, Ben Bernanke. The Chairman vowed to keep interest rates low for an “extended period,” and he committed the Federal Reserve to complete his $600 billion QE2 (Quantitative Easing) bond buying program through the end of June. If that wasn’t enough news, Bernanke held a historic, first-ever news conference. He fielded a broad range of questions and felt the first quarter GDP slowdown and inflation uptick would be transitory.

Ben Holds the Course: One person who is not overly eager to reverse loose monetary policies is Federal Reserve Chairman, Ben Bernanke. The Chairman vowed to keep interest rates low for an “extended period,” and he committed the Federal Reserve to complete his $600 billion QE2 (Quantitative Easing) bond buying program through the end of June. If that wasn’t enough news, Bernanke held a historic, first-ever news conference. He fielded a broad range of questions and felt the first quarter GDP slowdown and inflation uptick would be transitory.

Skyrocketing Silver Prices: Silver surged ahead +28% in April, the largest monthly gain since April 1987, and reached a 30-year high in price before closing at around $49 per ounce at the end of the month. Speculators and investors have been piling into silver as evidenced by activity in the SLV (iShares Silver Trust) exchange traded fund, which on occasion has seen its daily April volume exceed that of the SPY (iShares SPDR S&P 500) exchange traded fund.

Obama-Trump Birth Certificate Faceoff: Real estate magnate and TV personality Donald Trump broached the birther issue again, questioning whether President Barack Obama was indeed born in the United States. President Obama produced his full Hawaiian birth certificate in hopes of putting the question behind him. If somehow Trump can be selected as the Republican presidential candidate for 2012, he will certainly try to get President Obama “fired!”

Obama-Trump Birth Certificate Faceoff: Real estate magnate and TV personality Donald Trump broached the birther issue again, questioning whether President Barack Obama was indeed born in the United States. President Obama produced his full Hawaiian birth certificate in hopes of putting the question behind him. If somehow Trump can be selected as the Republican presidential candidate for 2012, he will certainly try to get President Obama “fired!”

Charlie Sheen…Losing! The Charlie Sheen soap opera continues. Ever since Sheen has gotten kicked off the show Two and a Half Men, speculation has percolated as to whether someone would replace Sheen to act next to co-star John Cryer. Names traveling through the gossip circles include everyone from Woody Harrelson to Jeremy Piven to Rob Lowe. Time will tell whether the audience will laugh or cry, but regardless, Sheen will be laughing to the bank if he wins his $100 million lawsuit against Warner Brothers (TWX).

Charlie Sheen…Losing! The Charlie Sheen soap opera continues. Ever since Sheen has gotten kicked off the show Two and a Half Men, speculation has percolated as to whether someone would replace Sheen to act next to co-star John Cryer. Names traveling through the gossip circles include everyone from Woody Harrelson to Jeremy Piven to Rob Lowe. Time will tell whether the audience will laugh or cry, but regardless, Sheen will be laughing to the bank if he wins his $100 million lawsuit against Warner Brothers (TWX).

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain commodity and S&P 500 exchange traded funds, but at the time of publishing SCM had no direct position in SLV, SPY, TWX, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.