Posts tagged ‘consumer confidence’

Lily Pad Jumping & Term Paper Cramming

Article is an excerpt from previously released Sidoxia Capital Management’s complementary December 3, 2012 newsletter. Subscribe on right side of page.

Over the last year, investors’ concerns have jumped around like a frog moving from one lily pad to the next. From the debt ceiling debate to the European financial crisis, and then from the presidential election to now the “fiscal cliff.” With the election behind us (Obama winning 332 electoral votes vs 206 for Romney; and Obama 50.8% of the popular vote vs 47.5% for Romney), the frog’s bulging eyes are squarely focused on the fiscal cliff. For the uninformed frogs that have been swimming underwater, the fiscal cliff is the roughly $600 billion in automatic tax hikes and spending cuts that are scheduled to be triggered by the end of this year, if Congress cannot come to some type of agreement (for more fiscal cliff information see videos here). The mathematical consequences are clear: Congress + No Deal = Recession.

While political brinksmanship and theater are nothing new, the explosive amount of data is something new. In our mobile world of 6 billion cell phones (more than the number of toothbrushes on our planet) and trillions of text messages sent annually, nobody can escape the avalanche of global data. Google (GOOG), Facebook (FB), Twitter, and millions of blogs (including this one) didn’t exist 15 years ago, therefore fiscal boogeymen like obscure Greek debt negotiations and Chinese PMI figures wouldn’t have scared pre-internet generations underneath their beds like today’s investors. The fact of the matter is our country has triumphed over plenty of significant issues (many of them scarier than today’s headlines), including wars, assassinations, currency crises, banking crises, double digit inflation, SARS, mad cow disease, flash crashes, Ponzi schemes, and a whole lot more.

Although today’s jumpy investors may worry about the lily pads of a double-dip recession in the US, a financial meltdown in Europe, and/or a hard landing in China, fiscal frogs will undoubtedly be worried about different lily pads (concerns) twelve months from now. This may not be an insightful observation for day traders, but for the other 99% of investors, taking a longer term view of the daily news cycle may prove beneficial.

Fiscal Cliff Term Paper Due on Friday December 21st

As a college student, chugging Jolt Cola, in combination with a couple dosages of NoDoz, was part of the routine procrastination process the day before a term paper was due. Apparently Congress has also earned a PhD in procrastination, judging by the last minute conclusion of the debt ceiling negotiations last summer. There are only a few more weeks until politicians break for the Christmas holiday break, therefore I am setting an Investing Caffeine mandated fiscal cliff due date of December 21st. Could Congress turn in its term paper early? Anything is possible, but unfortunately turning in the assignment early is highly unlikely, especially when politically bashing your opponent is perceived as a better re-election tactic compared to bipartisan negotiation.

A higher probability scenario involves Americans stuck listening to Nancy Pelosi, Harry Reid, John Boehner, and Mitch McConnell on a daily basis as these politicians finger-point and call the other side obstructionists. While I’m not alone in believing a deal will ultimately get done before Christmas, how credible and substantive the announcement will be depends on whether the politicians seriously face entitlement and tax reforms. Regardless, any deal announced by Investing Caffeine’s December 21st due date will likely be received well by the market, as long as a framework for entitlement and tax reform is laid out for 2013.

Frog News Bites

Source: Photobucket

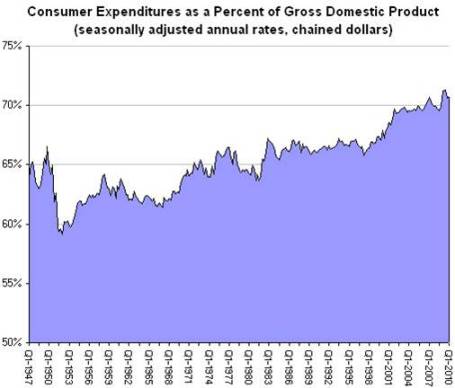

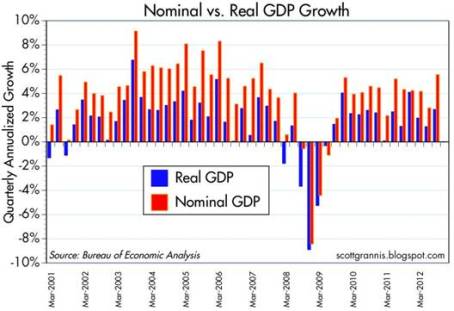

GDP Revised Higher: Despite all the gloom and uncertainties, the barometer of the economy’s health (i.e., Real Gross Domestic Product), was revised higher to 2.7% growth for the third quarter (from 2.0%). Nominal growth, a related measurement that includes inflation, reached a five-year high of 5.55%. In the wake of Superstorm Sandy, which caused upwards of $50 billion in damage, fourth quarter GDP numbers are likely to be artificially depressed. The silver lining, however, is first quarter 2013 figures may get an economic boost from reconstruction efforts.

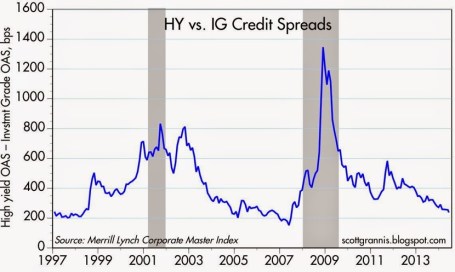

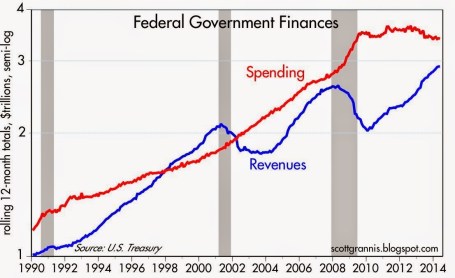

Source: Calafia Beach Pundit

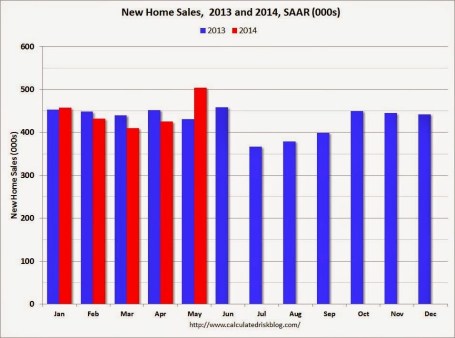

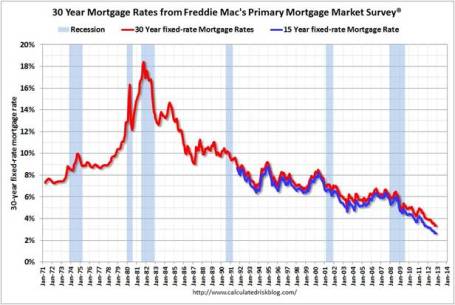

Housing Recovery Continues: Buoyed by record low interest rates (30-yr fixed mortgages < 3.5%), housing sales and prices continue on an upward trajectory. New home sales came in at 368,000 in October, below expectations, but sales are still up around +20% from 2011 (Calculated Risk).

Source: Calculated Risk

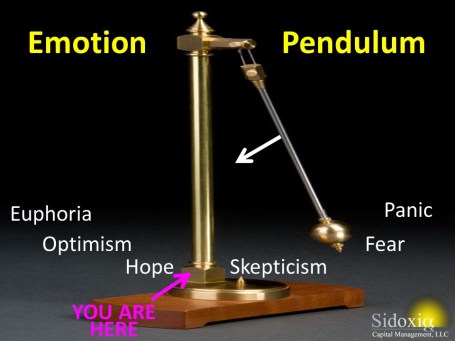

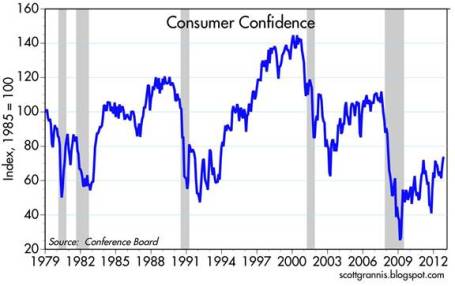

Confidence Still Low but Climbing: The recently reported consumer confidence figures reached the highest level in more than four years, but as Scott Grannis highlights, this is nothing to write home about. These current confidence levels match where we were during the 1990-91 and 1980-82 recessions.

Source: Calafia Beach Pundit

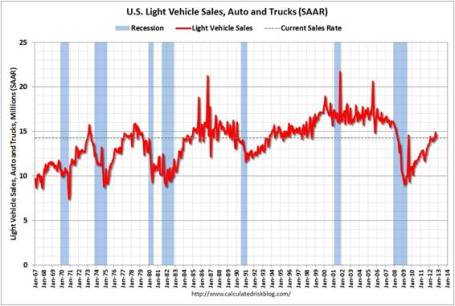

Car Sales Picking Up: Fiscal cliff discussions haven’t discouraged consumers from buying cars. As you can see from the chart below, car and truck sales reached 14.3 million annualized units in October. November sales are expected to rise about +13% on a year-over-year basis, reaching approximately 15.3 million units.

Source: Calculated Risk

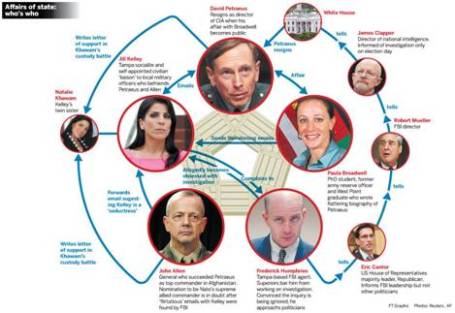

CIA Chief Fired in Sex Scandal: If you didn’t get enough of the Lindsay Lohan bar brawl dirt in New York, never fear, there was plenty of salacious details emanating from Washington DC this month. A complicated web of Florida socialites, a biographer, email chains, and a bare-chested FBI agent led to the firing of CIA director David Petraeus.

Source: The Financial Times

Death to Twinkies: After lining stomachs with golden cream-filled cakes for more than 80+ years, Hostess Brands was forced to halt production of Twinkies, Ding Dongs, and Ho Hos. Negotiations with union bakers crumbled, which led to Hostess Brands’ Chapter 7 bankruptcy and liquidation proceedings. My financial brain understands, but my sweet tooth is still grieving (see also Twinkie Investing).

Source: Photobucket

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing SCM had no direct positions in FB, Twitter or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Markets Race Out of 2012 Gate

Article includes excerpts from Sidoxia Capital Management’s 2/1/2012 newsletter. Subscribe on right side of page.

Equity markets largely remained caged in during 2011, but U.S. stocks came racing out of the gate at the beginning of 2012. The S&P 500 index rose +4.4% in January; the Dow Jones Industrials climbed +3.4%; and the NASDAQ index sprinted out to a +8.0% return. Broader concerns have not disappeared over a European financial meltdown, high U.S. unemployment, and large unsustainable debts and deficits, but several key factors are providing firmer footing for financial race horses in 2012:

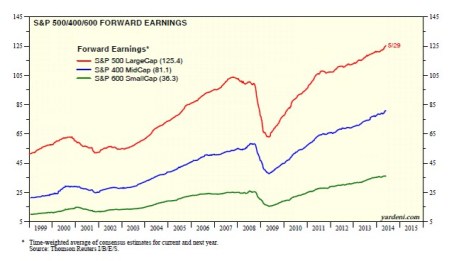

• Record Corporate Profits: 2012 S&P operating profits were recently forecasted to reach a record level of $106, or +9% versus a year ago. Accelerating GDP (Gross Domestic Product Growth) to +2.8% in the fourth quarter also provided a tailwind to corporations.

• Mountains of Cash: Companies are sitting on record levels of cash. In late 2011, U.S. non-financial corporations were sitting on $1.73 trillion in cash, which was +50% higher as a percentage of assets relative to 2007 when the credit crunch began in earnest.

• Employment Trends Improving: It’s difficult to fall off the floor, but since the unemployment rate peaked at 10.2% in October 2009, the rate has slowly improved to 8.5% today. Data junkies need not fret – we have fresh new employment numbers to look at this Friday.

• Consumer Optimism on Rise: The University of Michigan’s consumer sentiment index showed optimism improved in January to the highest level in almost a year, increasing to 75.0 from 69.9 in December.

• Federal Reserve to the Rescue: Federal Reserve Chairman, Ben Bernanke, and the Fed recently announced the extension of their 0% interest rate policy, designed to assist economic expansion, through the end of 2014. In addition, Bernanke did not rule out further stimulative asset purchases (a.k.a., QE3 or quantitative easing) if necessary. If executed as planned, this dovish stance will extend for an unprecedented six year period (2008 -2014).

Europe on the Comeback Trail?

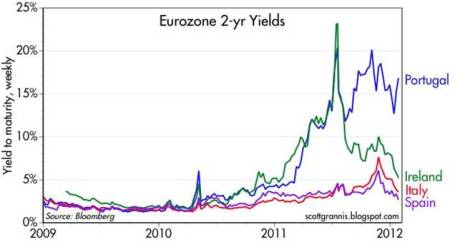

Europe is by no means out of the woods and tracking the day to day volatility of the happenings overseas can be a difficult chore. One fairly easy way to track the European progress (or lack thereof) is by following the interest rate trends in the PIIGS countries (Portugal, Ireland, Italy, Greece, and Spain). Quite simply, higher interest rates generally mean more uncertainty and risk, while lower interest rates mean more confidence and certainty. The bad news is that Greece is still in the midst of a very complex restructuring of its debt, which means Greek interest rates have been exploding upwards and investors are bracing for significant losses on their sovereign debt investments. Portugal is not in as bad shape as Greece, but the trends have been moving in a negative direction. The good news, as you can see from the chart above (Calafia Beach Pundit), is that interest rates in Ireland, Italy and Spain have been constructively moving lower thanks to austerity measures, European Central Bank (ECB) actions, and coordination of eurozone policies to create more unity and fiscal accountability.

Political Horse Race

The other horse race going on now is the battle for the Republican presidential nomination between former Massachusetts governor Mitt Romney and former House of Representatives Speaker Newt Gingrich. Some increased feistiness mixed with a little Super-Pac TV smear campaigns helped whip Romney’s horse to a decisive victory in Florida – Gingrich ended up losing by a whopping 14%. Unlike traditional horse races, we don’t know how long this Republican primary race will last, but chances are this thing should be wrapped up by “Super Tuesday” on March 6th when there will be 10 simultaneous primaries and caucuses. Romney may be the lead horse now, but we are likely to see a few more horses drop out before all is said and done.

Flies in the Ointment

As indicated previously, although 2012 has gotten off to a strong start, there are still some flies in the ointment:

• European Crisis Not Over: Many European countries are at or near recessionary levels. The U.S. may be insulated from some of the weakness, but is not completely immune from the European financial crisis. Weaker fourth quarter revenue growth was suffered by companies like Exxon Mobil Corp (XOM), Citigroup Inc. (C), JP Morgan Chase & Co (JPM), Microsoft Corp (MSFT), and IBM, in part because of European exposure.

• Slowing Profit Growth: Although at record levels, profit growth is slowing and peak profit margins are starting to feel the pressure. Only so much cost-cutting can be done before growth initiatives, such as hiring, must be implemented to boost profits.

• Election Uncertainty: As mentioned earlier, 2012 is a presidential election year, and policy uncertainty and political gridlock have the potential of further spooking investors. Much of these issues is not new news to the financial markets. Rather than reading stale, old headlines of the multi-year financial crisis, determining what happens next and ascertaining how much uncertainty is already factored into current asset prices is a much more constructive exercise.

Stocks on Sale for a Discount

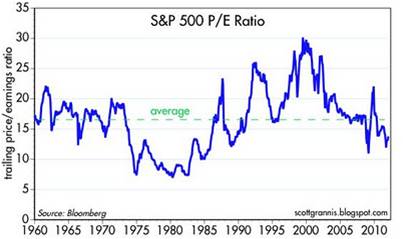

A lot of the previous concerns (flies) mentioned is not new news to investors and many of these worries are already factored into the cheap equity prices we are witnessing. If everything was all roses, stocks would not be selling for a significant discount to the long-term averages.

A key ratio measuring the priceyness of the stock market is the Price/Earnings (P/E) ratio. History has taught us the best long-term returns have been earned when purchases were made at lower P/E ratio levels. As you can see from the 60-year chart above (Calafia Beach Pundit), stocks can become cheaper (resulting in lower P/Es) for many years, similar to the challenging period experienced through the early 1980s and somewhat analogous to the lower P/E ratios we are presently witnessing (estimated 2012 P/E of approximately 12.4). However, the major difference between then and now is that the Federal Funds interest rate was about 20% back in the early-’80s, while the same rate is closer to 0% currently. Simple math and logic tell us that stocks and other asset-based earnings streams deserve higher prices in periods of low interest rates like today.

We are only one month through the 2012 financial market race, so it much too early to declare a Triple Crown victory, but we are off to a nice start. As I’ve said before, investing has arguably never been as difficult as it is today, but investing has also never been as important. Inflation, whether you are talking about food, energy, healthcare, leisure, or educational costs continue to grind higher. Burying your head in the sand or stuffing your money in low yielding assets may work for a wealthy few and feel good in the short-run, but for much of the masses the destructive inflation-eroding characteristics of purported “safe investments” will likely do more damage than good in the long-run. A low-cost diversified global portfolio of thoroughbred investments that balances income and growth with your risk tolerance and time horizon is a better way to maneuver yourself to the investment winner’s circle.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in XOM, MSFT, JPM, IBM, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Cockroach Consumer Cannot be Exterminated

We’re told that cockroaches would inherit the earth if a nuclear war were to occur, due to the pests’ impressive resiliency. Like a cockroach, the American consumer has managed to survive its own version of a financial nuclear war, as a result of the global debt binge and bursting of the real estate bubble. Although associating a consumer to a disease-carrying cockroach is not the most flattering comparison, I suppose it is okay since I too am a consumer (cockroach).

Confidence Cuisine

Cockroaches enjoy feasting on food, but they have been known to live close to a month without food, two weeks without water, and a half hour without air while submerged in water. On the other hand, consumers can’t live that long without food, water, and oxygen, but what really feeds buyer purchasing patterns is confidence. The April Consumer Confidence number from the Confidence Board showed the April reading reaching the highest level since September 2008. On a shorter term basis, the April figure measured in at 57.9, up from 52.3 in the previous month.

Where is all this buying appetite coming from? What we’re witnessing is merely a reversal of what we experienced in the previous years. In 2008 and 2009 more than 8 million jobs were shed and the fear-induced spiraling of confidence pushed consumers’ buying habits into a cave. With +290,000 new jobs added in April, the fourth consecutive month of additions, the tide has turned and consumers are coming out to see the sun and smell the roses. Recently the Bureau of Economic Analysis (BEA) revealed real personal consumption expenditures grew +3.6% in the first quarter – the largest quarterly increase in consumer spending since the first quarter of 2007.

Sure, there still are the “double-dippers” predicting an impending recession once the sugar-high stimulus wears off and tax increases kick-in. From my perch, it’s difficult for me to gauge the timing of any future slowing, other than to say I have not been surprised by the timing or magnitude of the rebound (I was writing about the steepening yield curve and the end of the recession last June and July, respectively). Sometimes, the farther you fall, the higher you will bounce. Rather than try to time or predict the direction of the market (see market timing article), I look, rather, to exploit the opportunities that present themselves in volatile times (e.g., your garden variety Dow Jones -1,000 point hourly plunge).

Will the Trend End?

Can this generational rise in consumer spending continue unabated? Probably not. To some extent we are victims of our own success. As about 25% of global GDP and only 5% of the world’s population, changing directions of the U.S.A. supertanker is becoming increasingly more difficult.

However, more nimble, resource-rich developing countries have fewer demographic and entitlement-driven debt issues like many developed countries. In order to build on an envious standard of living, our country needs to build on our foundation of entrepreneurial capitalism by driving innovation to create higher paying jobs. With those higher paying jobs will come higher spending. Of course, if uncompetitive industries cannot compete in the global marketplace, and a mirage of spending is re-created through drug-like credit cards and excess leveraged corporate lending, then heaven help us. Even the impressively resilient cockroach will not be able to survive that scenario.

Read full New York Times article here

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

*DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct positions in any security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Economic Indicators Like Kissing Your Sister

The economy is on the mend, but we are obviously not out of the woods. Leverage and asset inflation through the housing bubble were major causes of the financial crisis of 2008-09. Now some of the major indicators are turning upwards with GDP expected to rise around +3% in Q3 this year and we are seeing housing units up, housing prices up, and housing inventories down (charts below). Although some of these numbers may create some warm and fuzzy sensations, abnormally high unemployment rates, massive budget deficits, and stuttering consumer confidence make this rebound feel more like kissing your sister.

There are, however, other signs of economic strength. For example, credit appears to be healing as well. Moodys predicts global speculative debt default rates will peak in Q4 this year at 12.5% – lower than the 18% Moodys predicted earlier this year in January. The CEO Confidence Board index, which typically leads profit growth by two quarters, jumped to a five year high in the 3rd quarter. The recovery is not limited to our domestic economy either – the International Monetary Fund (IMF) recently raised its global growth forecasts in 2010 from +2.5% to +3.1%.

How sustainable is the recovery? Bears like Nouriel Roubini still think we are likely heading into a double-dip recession, perhaps by mid-2010, once the temporary home purchase credits expire and the stimulus funds run out. A collapse in the dollar due to exploding debt and rising deficits is feared to cause a spiraling in debt costs – another factor that could cause a relapse into recession. Unemployment remains at an abnormally 26 year high at 9.8% (September) and any self-maintaining recovery will require an improvement from this deteriorating trend. Before consumers freely open their wallets and purses, consumer confidence could use a boost in light of the recent -10% month-to-month drop in October.

Fewer people are debating the existence of “green shoots,” however now the discussion is turning to sustainability. Time will tell whether those feelings of harmless sibling cheek pecks will lead to the discovery of a new long-lasting romantic relationship with a non-family member.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.