Posts tagged ‘consumer confidence’

Animal Spirits to Animal Hibernation

Investor mood or sentiment can change rather quickly. Immediately after the 2024 presidential elections, positive animal spirits catapulted the stock market higher due to hopes of stimulating tax cuts and deregulation legislation. However, those warm and fuzzy feelings soured last month, as investor focus shifted to on-again, off-again tariff talks, and stagflation concerns, which have converted animal spirits into gloomy feelings of hibernation.

As a result, the advancing bull market took a breather and transformed into a weary bear during March. For the month, the S&P 500 (-5.8%), NASDAQ (-8.2%), and the Dow Jones Industrial Average (-4.2%) all fell significantly in the wake of tariffs, inflation, and recession worries.

Lovely Liberation Day or Tariff Trouble?

Since the President took office in January, he has announced, reversed, and implemented tariffs across a wide range of countries and sectors, including China, Canada, Mexico, the EU, Colombia, Venezuela, steel, aluminum, oil, automobiles, digital services taxes, and more.

The day of reckoning begins on April 2nd, designated Liberation Day by the president. This is when the president and the White House officially announce global reciprocal tariffs on foreign countries in an attempt to reverse the nation’s large trade deficit (see chart below) and bring manufacturing back to the United States. For example, if Germany subsidizes BMW cars sold in the U.S. while simultaneously placing tariffs (i.e., additional taxes) on American Ford Explorers sold in Germany, the president wants to impose equivalent reciprocal tariffs on those same BMWs sold in the U.S. in an effort to level the trading playing field. On the surface, a $131 billion trade deficit sounds very significant, but when compared to a $30 trillion economy (Gross Domestic Product – GDP), this negative trade balance represents less than 0.5% of GDP – effectively a rounding error. I have previously written how tariffs represent more of a molehill than a mountain (see Tariff Sheriff), in part because consumer spending and services make up the vast majority of our country’s economic activity, whereas trade and manufacturing are relatively smaller segments.

Source: Trading Economics

Driving home the point that tariffs are more bark than bite, Senior White House trade and manufacturing counselor Peter Navarro recently stated the 2025 tariffs could add $700 billion annually to U.S. revenues, including $100 billion from the recently announced 25% auto tariffs. Many economists believe this collection estimate is too optimistic. However, even if this target is achievable, $700 billion only represents a measly 2% of overall GDP.

Tariffs = Recession or Stagflation?

With the recent stock market downdraft and growing concerns related to tariffs, some economists and pundits are raising the probability of a recession and the possibility of inflation accompanying an economic downturn (i.e., stagflation).

Economic data should clear some of the fog. Fresh employment numbers will be released this Friday, which should shine some light on the health of the economy. Irrespective of this month’s results, the most recent 4.1% unemployment rate (see chart below), though slightly higher over the last two years, does not strongly indicate a recession.

Source: Trading Economics

Other “hard” data, such as GDP, also suggest a slowing economy rather than a recession. For instance, a recent survey of 14 economists estimates the economy is growing at a paltry +0.3% rate in Q1 – 2025 versus +2.3% in Q4 – 2024. Data is continually changing, but if a looming recession were imminent, corporate earnings would likely be trending downward, not upwards, as evident in the chart below.

Source: Yardeni Research

Tariff Inflation Has Yet to Arrive

There is no doubt tariffs function as a tax hike on consumers because U.S. companies that pay the tariffs on imported goods are eventually forced to raise prices to maintain profit margins or limit margin degradation.

Nonetheless, inflation did not spike under President Trump’s first term. Even if the president’s new policies result in more aggressive tariff actions this go-around, inflation will likely remain in check due to the point mentioned earlier – imported goods represent a small percentage of overall consumer and business purchases.

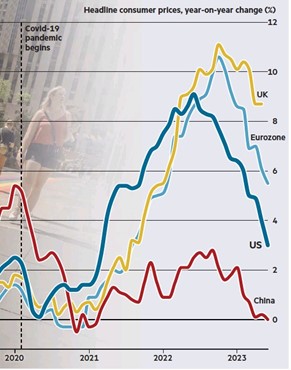

Tariff implementation is just beginning, so only time will tell how pervasive inflation will become. However, what we do know now is that inflation has declined dramatically over the last couple of years and has not yet spiked (see Consumer Price Index chart below).

Source: Calafia Beach Pundit

Where Could I Be Wrong?

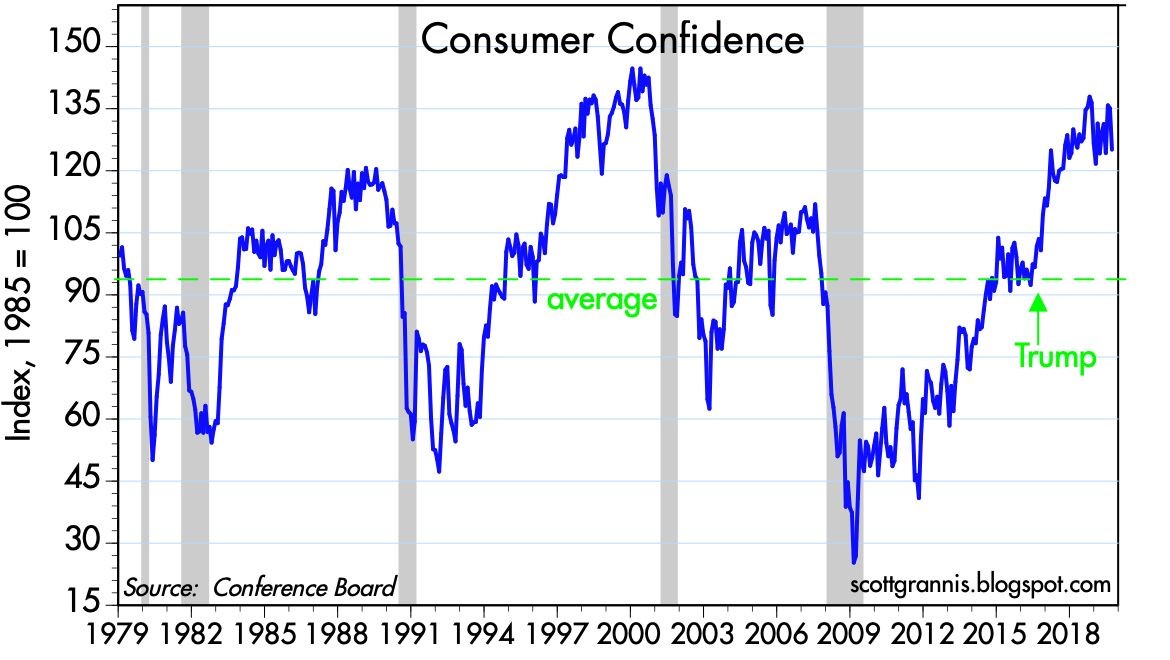

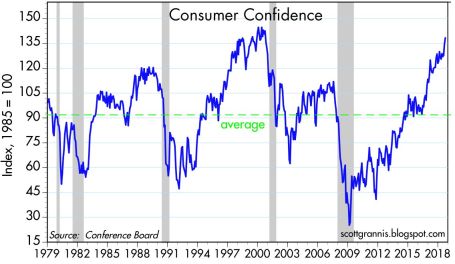

I have explained how some of the lagging “hard” data does not signal recession or stagflation, but what could I be missing? For starters, some of the leading “soft” data (e.g., surveys) indicate various cracks in the economic foundation are forming. Take the recent Consumer Confidence data (see chart below), which has weakened dramatically from pre-COVID and even post-COVID levels.

Source: Trading Economics

It’s not just consumers who are feeling uneasy about the economic environment; businesses are as well. Another soft data point flashing red is the NFIB Small Business Uncertainty index, which recently reported its second-highest reading in 48 years (see chart below). Even if my argument that tariffs are too small to materially impact the economy holds, if the psychological effects of tariff uncertainty paralyzes consumer and business economic activity to a standstill, then tariffs could indeed become a substantial factor.

Source: National Federation of Independent Business (NFIB)

What Comes Next After Liberation Day?

Liberation Day is unlikely to trigger an immediate and sustained V-shaped recovery in the stock market because international trading partners will be forced to announce retaliatory tariffs in response to President Trump’s reciprocal tariffs, potentially leading to additional reactionary tariffs by the U.S.

Additionally, the reciprocal tariffs announced on April 2nd will likely serve as a starting point for subsequent negotiations with trading partners. Without a comprehensive resolution, investor sentiment will likely remain somewhat unresolved and unsettled. Regardless of your views on the size and impact of tariffs, Liberation Day will at least bring some clarity and reduce the uncertainty surrounding the current murky and chaotic environment.

The multi-year bull market continued its charge after the presidential election, but investor sentiment has weakened the bull run due to tariff uncertainty. In response, the excited bull has temporarily turned into a sleepy bear. Depending on how these tariff events unfold, we will soon find out whether Liberation Day will awaken the bear to hunt for bulls or send it into deep hibernation.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (April 1, 2025). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing had no direct position in F or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on the IC Contact page.

Hollywood Shuts Down & Market Goes Uptown

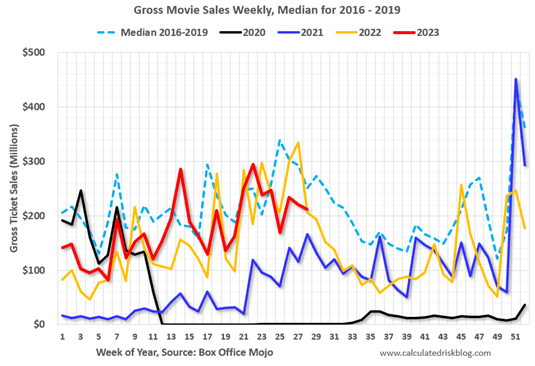

According to scientists, July set a record as the hottest month in 120,000 years. In order to beat the scorching heat, millions of Americans made the pilgrimage to their local air-conditioned movie theaters to watch the combo-blockbuster “Barbenheimer” (Barbie and Oppenheimer), which has raked in sales of more than $1 billion globally in the first two weeks of its release. Thankfully, in the short-run, Barbenheimer has given a shot in the arm to the beleaguered movie industry that suffered dramatically during the pandemic. The chart below (before Barbenheimer) shows industry sales have recovered (red line) somewhat, almost to pre-pandemic averages (dashed light blue line), but still has some ground to gain before industry sales consistently outpaces pre-pandemic levels.

Source: Calculated Risk

Movie Strike Explained

If movies are your gig, you better race to the theaters now because Hollywood has come to a grinding halt, thanks to a dual strike of Hollywood acting unions (SAG-AFTRA) and the Writers Guild of America (WGA) union. The feud between the unions and the movie/television studios centers around demands for higher pay, better working conditions, and protections from AI (Artificial Intelligence) technologies, which could theoretically replace actors and writers. Combined, the unions almost carry an estimated 200,000 members, which means a broad strike like equals no new movies, tv shows, or streaming content. The last time there was a “double strike” like this occurred in 1960 when former President Ronald Reagan was running SAG. Until the dispute is resolved, you better pace your media binging consumption habits because with no new content currently being created, the dispute may begin to eat into your show backlog on Netflix and disrupt your happy couch-streaming time.

Stocks on Fire

But scorching heat and red-hot popular movies were not the only things on fire last month. The stock market continued its fiery, blistering pace with the S&P 500 boiling higher by +3.1%, making the seven-month total gain of 2023 a spicy +20% (see chart below). The Dow Jones Industrial Average joined in on the fun too. Not only did the Dow increase by +3.4% for the month, the index rose for 13 consecutive days, the longest streak of daily advances since 1987. Bubbling up to the top of the performance table, however, is the technology-heavy NASDAQ index (home of the largest Magnificent 7 technology stocks – see also Fight the Fed) with a sizzling +4.1% return for the month, and a scalding +37% rise for the year, so far. The pace of gains is not sustainable forever, so it’s important to have a disciplined process in place to manage the risk of over-extended, over-valued investments, which is exactly what we do at Sidoxia Capital Management.

Source: TradingEconomics.com

Inflation Moving in the Right Direction

After such a lousy 2022 in the financial markets, why such a searing return for 2023? The biggest reason can be summed up with three words: inflation, inflation, and inflation. More specifically, it’s the pace of “disinflation” we are witnessing that is getting people so excited. As you can see from the chart below, annualized inflation as measured by the Consumer Price Index (CPI) has declined dramatically to 3.3% (blue line), while CPI less shelter (red line) has dropped to 1.4%, which is below the Federal Reserve’s 2% target (green line). These trends have gotten investors excited because they believe Jerome Powell, the Fed Chairman, is closer to ending this year-and-a-half long interest rate hiking cycle. In fact, investors are currently betting for multiple interest rate cuts in 2024.

Source: Calafia Beach Pundit

And the disinflation phenomenon is just not limited to U.S. borders – we are witnessing the same disinflationary trends across our borders (see chart below).

Source: The Financial Time (FT)

Confident Consumers

While many economists and traders have incorrectly been calling for a recession for some two years, a more resilient U.S. economy just reported better-than-expected growth for the 2nd quarter (+2.4% – Gross Domestic Product [GDP] growth). The stronger economy along with the improving inflation dynamics mentioned previously have buoyed Consumer Confidence too, as you can see from the chart below.

Source: Calafia Beach Pundit

Everything isn’t perfect (it never is). We continue to experience geopolitical risk as a result of the destabilized war between Russia and Ukraine; growth in China has stalled and not recovered from the pandemic; complacency is beginning to filter into investor attitudes; and we live with a dysfunctional Washington political process. But the economy remains strong, inflation appears to be cooling, and short-term interest rates could be close to peaking. Your air-conditioning bill may be going up this summer, but so will your stock market portfolio, if your investments are being properly managed.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (August 1, 2023). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

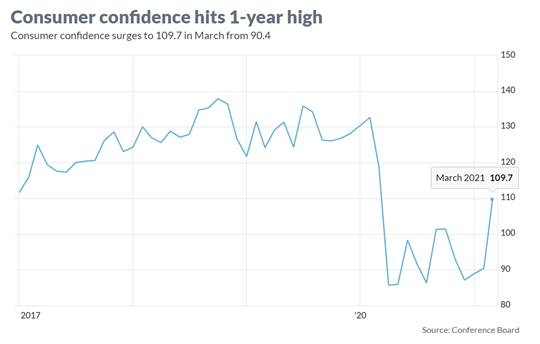

Consumer Confidence Flies as Stock Market Hits New Highs

As the economy starts reopening from a global pandemic that is improving, consumers and businesses are beginning to see a light at the end of the tunnel. The surge in the recently reported Consumer Confidence figures to a new one-year high (see chart below) is evidence the recovery is well on its way. A stock market reaching new record highs is further evidence of the reopening recovery. More specifically, the Dow Jones Industrial Average catapulted 2,094 points higher (+6.2%) for the month to 32,981 and the S&P 500 index soared +4.2%. A rise in interest rate yields on the 10-Year Treasury Note to 1.7% from 1.4% last month placed pressure on technology growth stocks, which led to a more modest gain of +0.4% in the tech-heavy NASDAQ index during March.

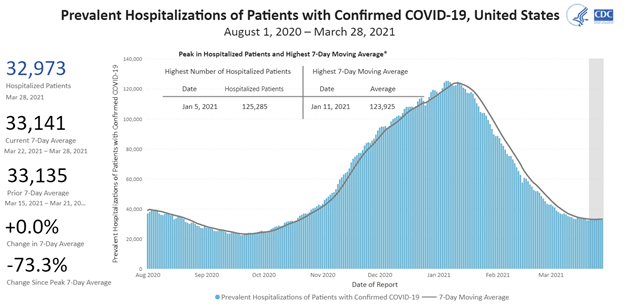

Comeback from COVID

With a combination of 150 million vaccine doses administered and 30 million cumulative COVID cases, the U.S. population has creeped closer toward herd immunity protection against the virus and pushed down hospitalizations dramatically (see chart below).

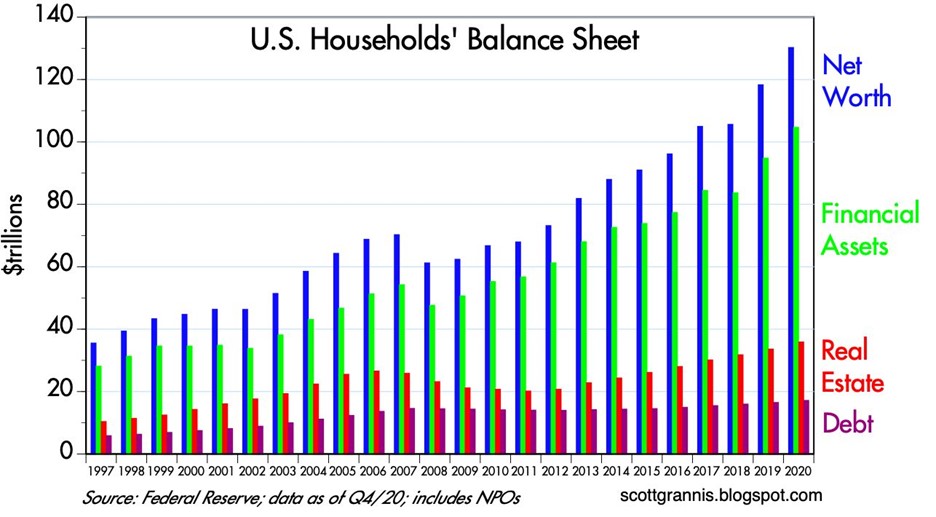

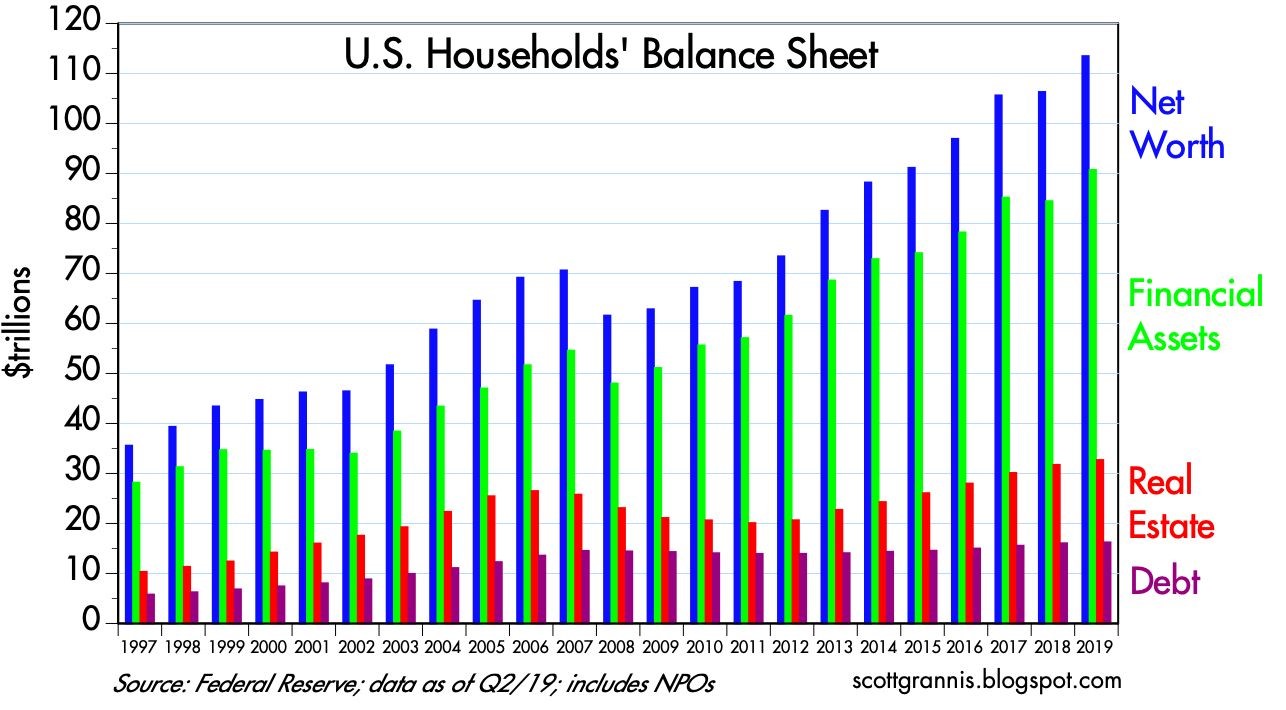

Also contributing to investor optimism have been the rising values of investments and real estate assets thanks to an improving economy and COVID case count. As you can see from the chart below, the net worth of American households has more than doubled from the 2008-2009 financial crisis to approximately $130 trillion dollars, which in turn has allowed consumers to responsibly control and manage their personal debt. Unfortunately, the U.S. government hasn’t been as successful in keeping debt levels in check.

Spending and Paying for Infrastructure Growth

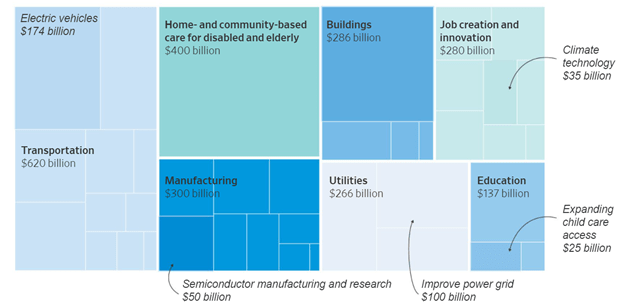

Besides focusing on positive COVID trends, investors have also centered their attention on the passage of a $1.9 trillion stimulus bill last month and a new proposed $2.3 trillion infrastructure bill that President Biden unveiled details on yesterday. At the heart of the multi-trillion dollar spending are the following components (see also graphic below):

- $621 billion modernize transportation infrastructure

- $400 billion to assist the aging and disabled

- $300 billion to boost the manufacturing industry

- $213 billion to build and retrofit affordable housing

- $100 billion to expand broadband access

With over $28 trillion in government debt, how will all this spending be funded? According to The Fiscal Times, there are four main tax categories to help in the funding:

Corporate Taxes: Raising the corporate tax rate to 28% from 21% is expected to raise $730 billion over 10 years

Foreign Corporate Subsidiary Tax: A new global minimum tax on foreign subsidiaries of American corporations is estimated to raise $550 billion

Capital Gains Tax on Wealthy: Increasing income tax rates on capital gains for wealthy individuals is forecasted to raise $370 billion

Income Tax on Wealthy: Lifting the top individual tax rate back to 39.6% for households earning more than $400,000 per year is seen to bring in $110 billion

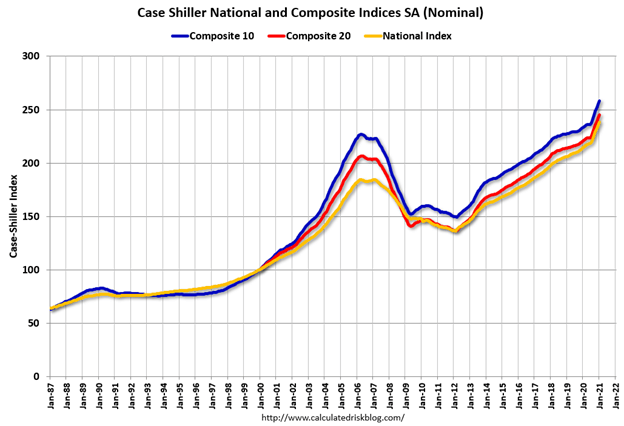

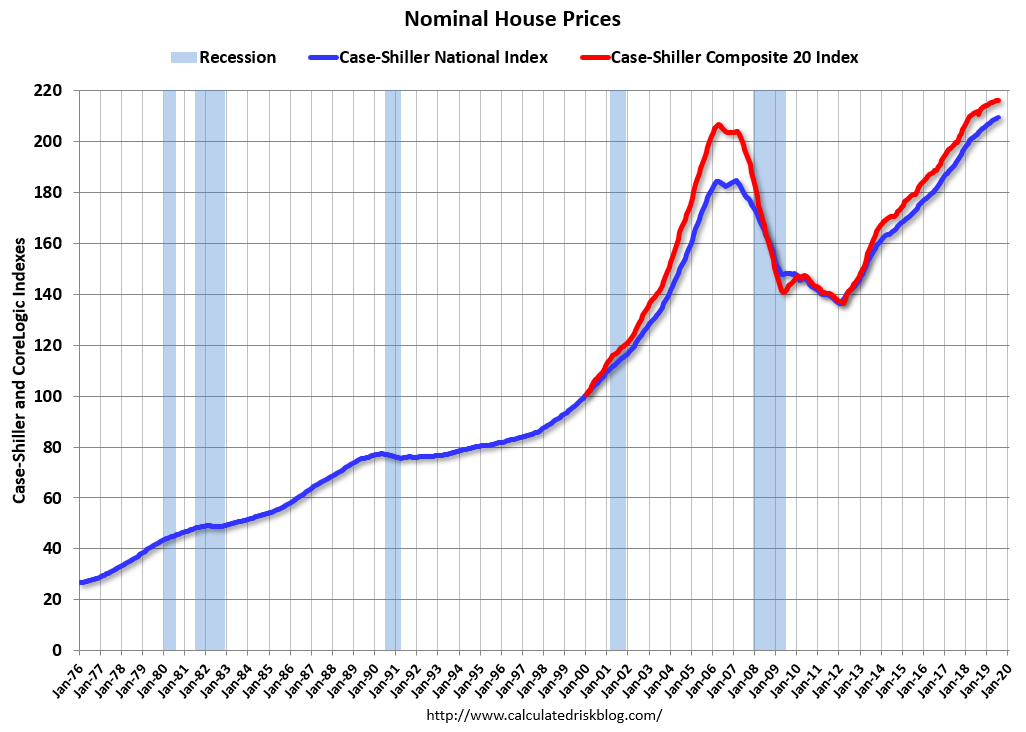

Besides the economy being supported by government spending, growth and appreciation in the housing market are contributing to GDP growth. The recently released housing data shows housing prices accelerating significantly above the peak levels last seen before the last financial crisis (see chart below).

Although the economy appears to be on solid footing and stock prices have marched higher to new record levels, there are still plenty of potential factors that could derail the current bull market advance. For starters, increased debt and deficit spending could lead to rising inflation and higher interest rates, which could potentially choke off economic growth. Bad things can always happen when large financial institutions take on too much leverage (i.e., debt) and speculate too much (see also Long-Term Capital Management: When Genius Failed). The lesson from the latest, crazy blow-up (Archegos Capital Management) reminds us of how individual financial companies can cause billions in losses and cause ripple-through effects to the whole financial system. And if that’s not enough to worry about, you have rampant speculation in SPACs (Special Purpose Acquisition Companies), Reddit meme stocks (e.g., GameStop Corp. – GME), cryptocurrencies, and NFTs (Non-Fungible Tokens).

Successful investing requires a mixture of art and science – not everything is clear and you can always find reasons to be concerned. At Sidoxia Capital Management, we continue to find attractive opportunities as we strive to navigate through areas of excess speculation. At the end of the day, we remain disciplined in following our fundamental strategy and process that integrates the four key legs of our financial stool: corporate profits, interest rates, valuations, and sentiment (see also Don’t Be a Fool, Follow the Stool). As long as the balance of these factors still signal strength, we will remain confident in our outlook just like consumers and investors are currently.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (April 1, 2021). Subscribe on the right side of the page for the complete text.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing had no direct position in GME or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Investors Scared Silly While Stocks Enjoy Sugar High

China trade war, impeachment hearings, Brexit negotiations, changing Federal Reserve monetary policy, Turkish-Kurd battles in Syria, global slowdown fears, and worries over an inverted yield curve. Do these headlines feel like a conducive environment for stock market values to break out to new all-time, record highs? If you answered “no”, then you are not alone – investors have been scared silly despite stocks experiencing a sugar high.

For the month, the S&P 500 index climbed another +2.0% and set a new monthly-high record. The same can be said for the Dow Jones Industrial Average, which also set a new monthly record at 27,046, up +0.5% from the previous month. For the S&P 500, these monthly gains contributed to what’s become an impressive 2019 total appreciation of +21%. Normally, such heady gains would invoke broad-based optimism, however, the aforementioned spooky headlines have scared investors into a coffin as evidenced by the hundreds of billions of dollars that have poured out of stocks into risk-averse bonds. More specifically, ICI (Investment Company Institute) releases weekly asset flow figures, which show -$215 billion fleeing stock funds in 2018-2019 through the end of October, while over +$452 billion have flocked into the perceived safe haven of bonds. I emphasize the word “perceived” safe haven because many long duration (extended maturity) bonds can be extremely risky, if (when) interest rates rise materially and prices fall significantly.

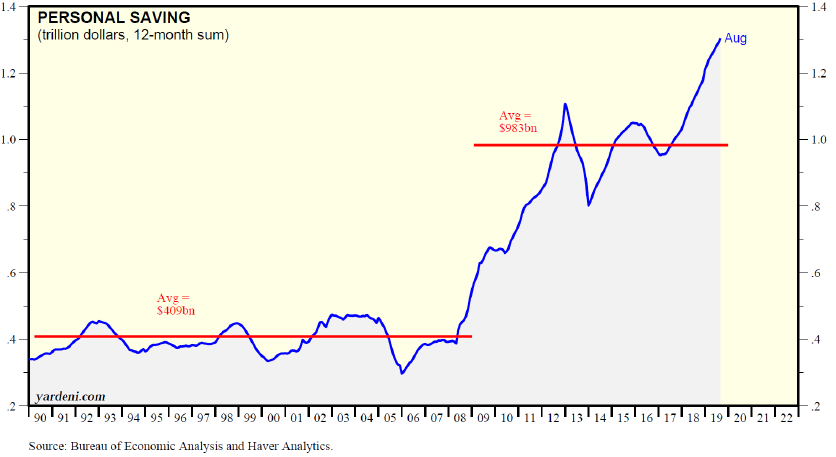

Besides the data showing investors fleeing stocks and flocking to bonds, we have also witnessed the risk-averse saving behavior of individuals. When uncertainty rose in 2008 during the financial crisis, you can see how savings spiked (see chart below), even as the economy picked up steam. With the recent spate of negative headlines, you can see that savings have once again climbed and reached a record $1.3 trillion! All those consumer savings translate into dry powder spending dollars that can be circulated through the economy to extend the duration of this decade-long financial expansion.

Source: Dr. Ed’s Blog

If you look at the same phenomenon through a slightly different lens, you can see that the net worth of consumer households has increased by 60% to $113 trillion from the 2007 peak of about $70 trillion (see chart below). This net worth explosion compares to only a 10% increase in household debt over the same timeframe. In other words, consumer balance sheets have gotten much stronger, which will likely extend the current expansion or minimize the blow from the next eventual recession.

Source: Calafia Beach Pundit

If hard numbers are not good enough to convince you of investor skepticism, try taking a poll of your friends, family and/or co-workers at the office watercooler, cocktail party, or family gathering. Chances are a majority of the respondents will validate the current actions of investors, which scream nervousness and anxiety.

How does one reconcile the Armageddon headlines and ebullient stock prices? Long-time clients and followers of my blog know I sound like a broken record, but the factors underpinning the decade-long bull market bears repeating. What the stock market ultimately does care about are the level and direction of 1) corporate profits; 2) interest rates; 3) valuations; and 4) investor sentiment (see the Fool-Stool article). Sure, on any one day, stock prices may move up or down on any one prominent headline, but over the long run, the market cares very little about headlines. Our country and financial markets have survived handsomely through wars (military and trade), recessions, banking crises, currency crises, housing crises, geopolitical tensions, impeachments, assassinations, and even elections.

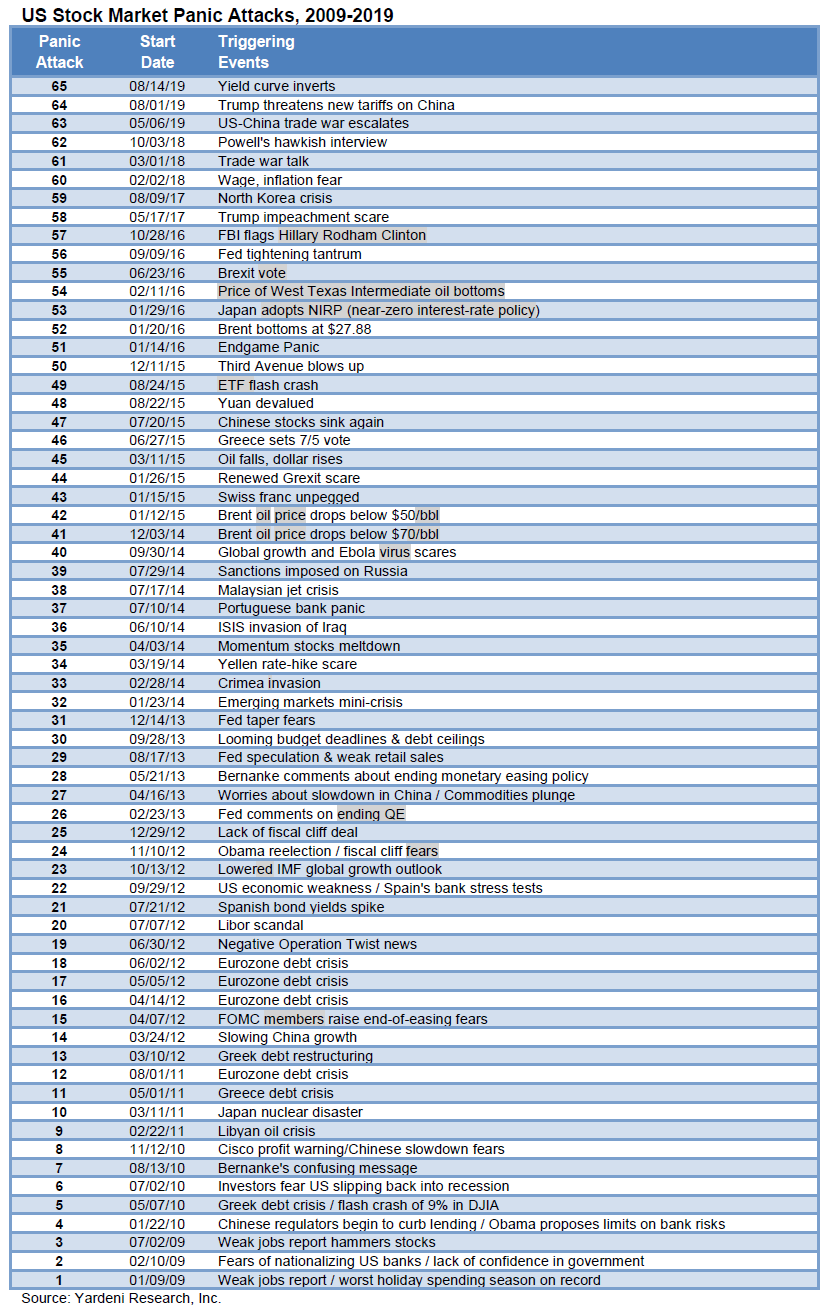

Case in point on a shorter period of time, Dr. Ed Yardeni, author of Dr. Ed’s Blog created list of 65 U.S. Stock Market Panic Attacks from 2009 – 2019 (see below). What have stock prices done over this period? From a low of 666 in 2009, the S&P 500 stock index has more than quadrupled to 3,030!

For the majority of this decade-long, rising bull market, the previously mentioned stool factors have created a tailwind for stock price appreciation (i.e., interest rates have moved lower, profits have moved higher, valuations have remained reasonable, and investors have stayed persistently nervous…a contrarian positive indicator). Investors may remain scared silly for a while, but as long as the four stock factors on balance remain largely constructive stock prices should continue experiencing a sugar high.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (November 1, 2019). Subscribe on the right side of the page for the complete text.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Missing the Financial Forest for the Political Trees

In the never-ending, 24/7, polarizing political news cycle, headlines of Ukraine phone calls, China trade negotiations, impeachment hearings, presidential elections, Federal Reserve monetary policy, and other Washington based stories have traders and news junkies glued to their phones, Twitter feeds, news accounts, blog subscriptions, and Facebook stories. However, through the incessant, deafening noise, many investors are missing the overall financial forest as they get lost in the irrelevant D.C. details.

Meanwhile, as many investors fall prey to the mesmerizing, but inconsequential headlines, financial markets have not fallen asleep or gotten distracted. The S&P 500 stock market index rose another +1.7% last month, and for the year, the index has registered a +18.7% return. As we enter the volatile fourth quarter, many stock market participants remain shell-shocked from last year’s roughly -20% temporary collapse, even though the S&P 500 subsequently rallied +29% from the 2018 trough to the 2019 peak.

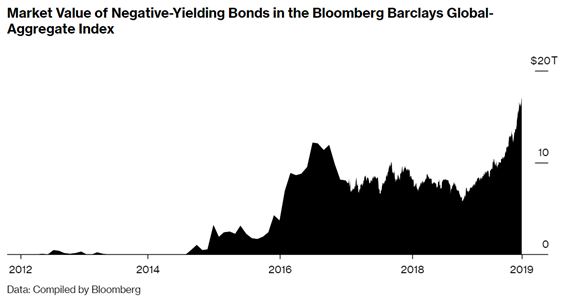

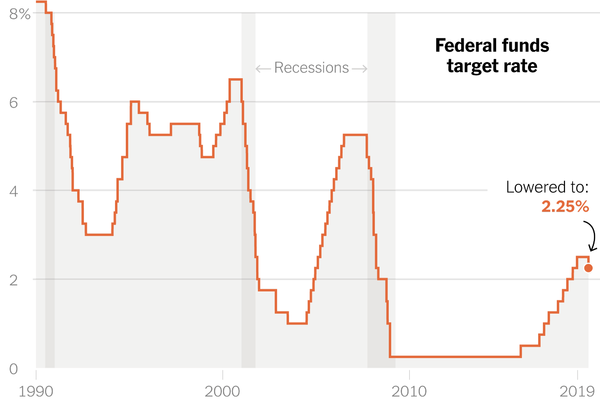

Why are many people missing the financial forest? A big key to the significant rally in 2019 stock prices can be attributed to two words…interest rates. Unlike last year’s fourth quarter, when the Federal Reserve was increasing interest rates (i.e., tapping the economic brakes), this year the Fed is cutting rates (i.e., hitting the economic accelerator). Interest rates are a key leg to Sidoxia’s financial four-legged stool (see Don’t Be a Fool, Follow the Stool). Interest rates are at or near generational lows, depending where on the geographic map you reside. For example, interest rates on 10-year German government bonds are -0.55%. Yes, it’s true. If you were to invest $10,000 in a negative yielding -0.55% German bond for 10-years starting in 2019, if you held the bond until maturity (2029), the investor would get back less than the original $10,000 invested. In other words, many bond investors are choosing to pay bond issuers for the privilege of giving the issuers money for the unpalatable right of receiving less money in the future.

The unprecedented negative-yielding bond market is reaching epic proportions, having eclipsed $17 trillion globally (see chart below). This gargantuan and growing dollar figure of negative-yielding bonds defies common sense and feels very reminiscent of the panic buying of technology stocks in the late 1990s.

Source: Bloomberg

At Sidoxia Capital Management, we are implementing proprietary fixed income strategies to navigate this negative interest rate environment. However, the plummeting interest rates and skyrocketing bond prices only make our bond investing job tougher. On the other hand, declining rates, all else equal, also make my stock-picking job easier. Nevertheless, many market participants have gotten lost in the financial trees. More specifically, investors are losing sight of the key tenet that money goes where it is treated best (go where yields are highest and valuations lowest). With many bonds yielding low or negative interest rates, bond investors are being treated like criminals forced to serve jail time and pay large fines because future returns will become much tougher to accrue. In my Investing Caffeine blog, I have been writing about how the stock market’s earnings yield (current approximating +5.5%) and the S&P dividend yield of about +1.9% are handily outstripping the +1.7% yield on the 10-Year Treasury Note (see Going Shopping: Chicken vs. Beef ).

Unless our economy falls into a prolonged recession, interest rates spike substantially higher, or stock prices catapult appreciably, then any decline in stock prices will likely be temporary. Fortunately, the economy appears to be chugging along, albeit at a slower rate. For instance, 3rd quarter GDP (Gross Domestic Product) estimates are hovering around +2.0%.

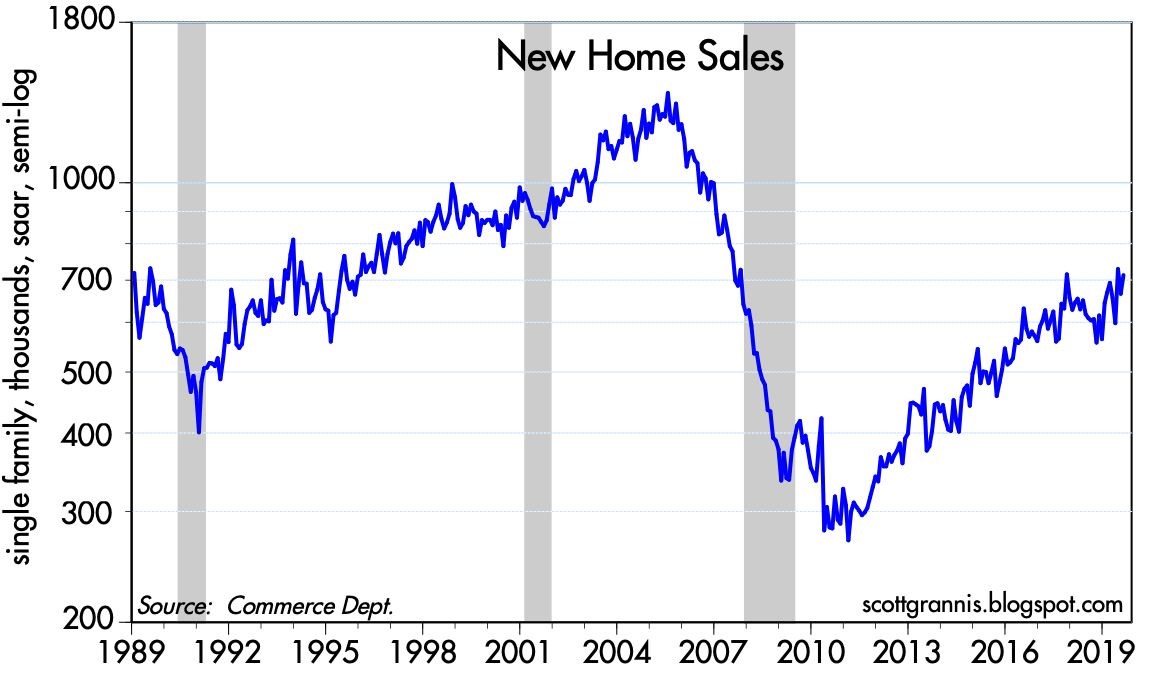

Low Rates Aid Housing Market

Thanks to low interest rates, the housing markets remain strong. As you can see from the chart below, new home sales continue to ratchet higher over the last eight years, and lower mortgage rates are only helping this cause.

Source: Calafia Beach Pundit

The same tailwind of lower interest rates can be seen below with rising home prices.

Source: Calculated Risk

Consumer Flexes Muscles

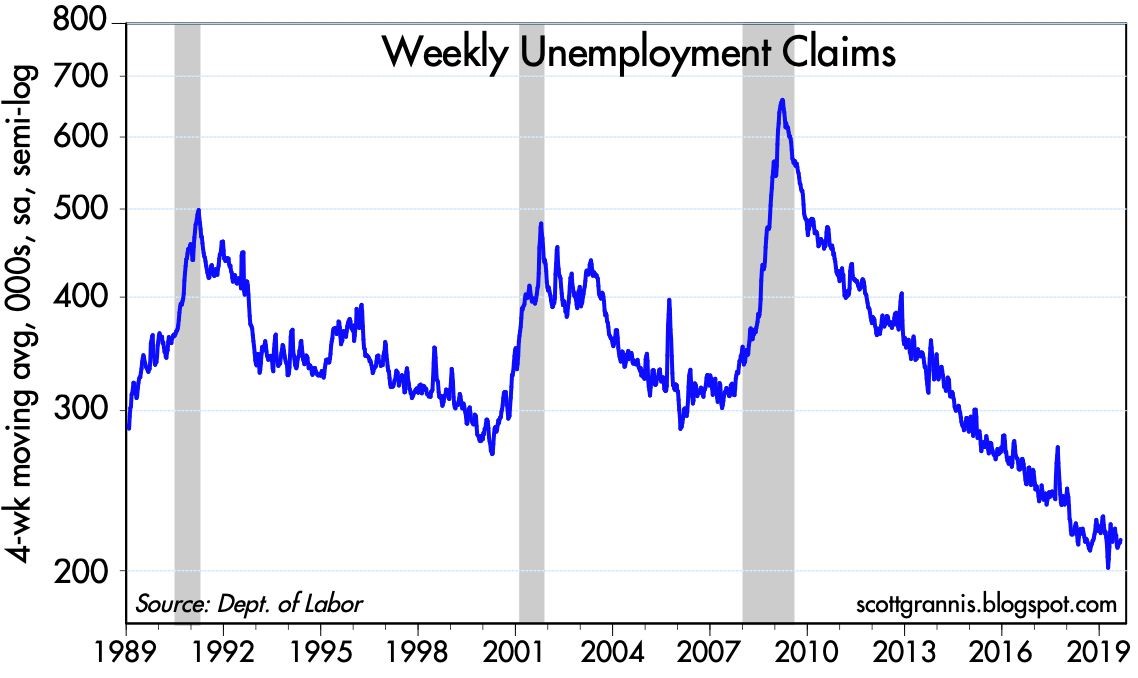

At 3.7%, the unemployment rate remains low and the number of workers collecting unemployment is near multi-decade lows (see chart below).

Source: Calafia Beach Pundit

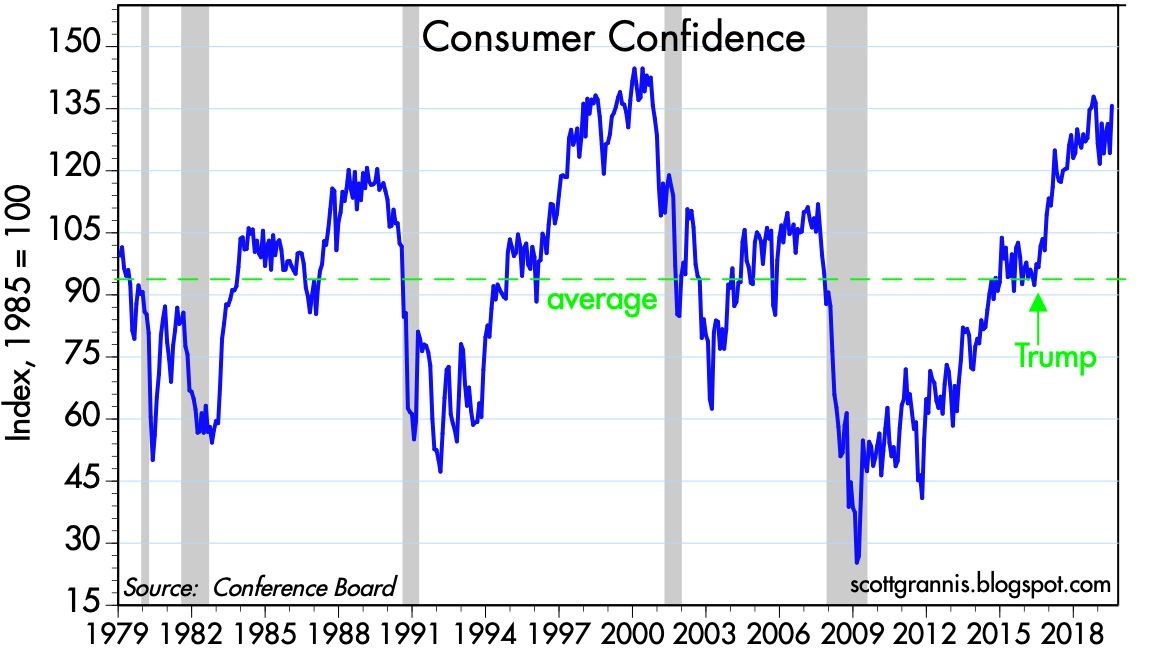

It should come as no surprise that the more employed workers there are collecting paychecks, the more consumer confidence will rise (see chart below). As you can see, consumer confidence is near multi-decade record highs.

Source: Calafia Beach Pundit

Although politics continue to dominate headlines and grab attention, many investors are missing the financial forest because the political noise is distracting the irrefutable, positive effect that low interest rates is contributing to the positive direction of the stock market and the economy. Do your best to not miss the forest – you don’t want your portfolio to suffer by you getting lost in the trees.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (October 1, 2019). Subscribe on the right side of the page for the complete text.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Central Bank Fires Insurance Bullet

Another month and another record high in the stock market. Why are stock prices climbing to new highs? One major contributing factor is the accommodative monetary policy implemented by our government’s central bank. For the first time in 12 years since the last financial crisis began (2007), the Federal Reserve recently cut interest rates by -0.25% to a new target range of 2.00% to 2.25% (see chart below).

Source: New York Times

At the end of this period, with economic activity having expanded and millions of new jobs created, the Federal Reserve realized they needed to begin creating some ammunition to protect the economy for the next, eventual recession (even if the timing of the next recession remained unknown). A gun needs bullets, therefore beginning in late 2015, former Federal Reserve Chair, Janet Yellen, began manufacturing economic bullets with the first of nine interest rate hikes in December 2015.

If you fast forward to today, the economy objectively remains fairly strong and there are no clear signs of an impending recession. Current Federal Reserve Chairman Jerome Powell made it clear that he has decided to fire one of those stimulative bullets yesterday as a precautionary insurance measure against a potential U.S. recessionary slowdown (click here to read the rationale behind the Fed’s rate cut). Fed officials also added to investor enthusiasm when they declared they would end the runoff of their $3.8 trillion asset portfolio (i.e., “halt quantitative tightening”) two months earlier than previously planned.

Thanks in part to Powell’s protective rate cut measure and halt to quantitative tightening, the Dow Jones Industrial Average closed at a new all-time monthly high of 26,864, up +1.0% for the month. Records were also set by the S&P 500 index, which increased by +1.3% and the technology-heavy Nasdaq market achieved a monthly advance of +2.1%.

Despite global slowdown fears and evidence of flattening corporate profits, the 2019 year-to-date stock returns realized thus far have been quite impressive:

- Dow Jones Industrial Average YTD%: +15.2%

- S&P 500 YTD%: +18.9%

- Nasdaq YTD%: +23.2%

In addition to the recent interest rate cut, investors have appreciated other positive fundamental factors enduring in the economy. For example, the job market remains incredibly strong and resilient with the current unemployment rate of 3.7% hovering near 50-year record lows. This week’s recently released data from payroll processor ADP payroll also showed a healthy addition of 156,000 new private-sector jobs.

Source: MarketWatch

Another confirming source of data highlighting the strength of our economy has been Consumer Confidence (see chart below). Consumer activity accounts for roughly 70% of our country’s economy, therefore with confidence approaching 20-year highs, most investors can confidently sleep at night knowing we are likely not at the edge of a steep recession.

Source: Calafia Beach Pundit

Rainbows and Unicorns

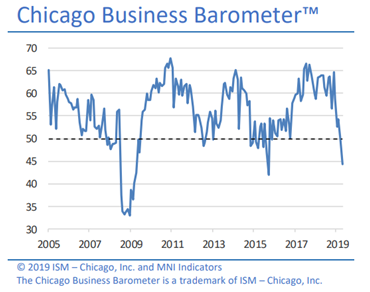

Although the economy appears to be on firm footing, and the Fed has been accommodative with its monetary policy, not everything is rainbows and unicorns. In fact, recently released data from a Chicago-based manufacturing purchasing manager’s survey showed a reading of 44.4, a level indicating a contraction in economic activity (the lowest level seen since December 2015).

Source: MNI Market News

The ongoing U.S. – China trade spat has also contributed to slowing global activity, even here in our country. U.S. trade representatives (Treasury Secretary Steven Mnuchin and top trade negotiator Robert E. Lighthizer) once again recently returned empty handed from China after another round of discussions. But there have been some positive developments. In return for tariff reductions, China has shown indications it’s willing to purchase large amounts of U.S. agricultural products (e.g., soybeans and other products) and seriously address concerns about the protection of U.S. intellectual property. Discussions are expected to resume on our soil in early September.

Despite all investors’ concerns and fears, the U.S. stock market has continued to climb to new record territories. Economic data may continue to unfold in a “mixed” fashion in coming weeks and months, but investors may gain some comfort knowing that Fed Chair Jerome Powell has a gun with protective interest rate cut bullets that can be fired at potential recessionary threats attacking our economy.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (August 1, 2019). Subscribe on the right side of the page for the complete text.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Will Santa Leave a Lump of Coal?

As we enter the last month of the year, the holiday season is kicking into full gear, decorations are popping up everywhere, and the burning question arises, “Will Santa Claus bring gifts for stock market investors, or will he leave a lump of coal in their stockings?”

It was a bumpy sleigh ride last month, but we ultimately entered December in a festive mood with joyful monthly gains of +1.7% in the Dow Jones Industrial Average, and +1.8% in the S&P 500. There have been some naughty and nice factors leading to some turbulent but modest gains in 2018. For the first 11 months of the year, the Dow has rejoiced with a +3.3% advance, and the S&P 500 has celebrated a rise of +3.2% – and these results exclude additional dividends of approximately 2%.

Despite the monthly gains, not everything has been sugar plums. President Trump has been repeatedly sparring with the Federal Reserve Chairman, Jerome Powell, treating him more like the Grinch due to his stingy interest rate increases than Santa. As stockholders have contemplated the future path of interest rates, the major stock indexes temporarily slipped into negative territory for the year, until Mr. Powell gave stock and bond investors an early Christmas present last week by signaling interest rates are “just below” the nebulous neutral target. The dovish comment implied we are closer to the end of the economy-slowing rate-hike cycle than we are to the beginning.

Trade has also contributed to the recent spike in stock market volatility, despite the fresh establishment of the trade agreement reached between the U.S., Mexico, and Canada (USMCA – U.S.-Mexico-Canada Agreement), a.k.a., NAFTA 2.0. Despite the positive progress with our Mexican and Canadian neighbors, uncertainty surrounding our country’s trade relations with China has been challenging due to multiple factors including, Chinese theft of American intellectual property, cyber-attacks, forced technology transfer, agricultural trade, and other crucial issues. Fortunately, optimism for a substantive agreement between the world’s two super-powers advanced this weekend at the summit of the Group of 20 nations in Argentina, when a truce was reached to delay an additional $200 billion in tariffs for 90 days, while the two countries further negotiate in an attempt to finalize a comprehensive trade pact.

Source: Financial Times

Economic Tailwinds

Besides positive developments on the interest rate and trade fronts, the economy has benefited from tailwinds in some other important areas, such as the following:

Low Unemployment: The economy keeps adding jobs at a healthy clip with the unemployment rate reaching a 48-year low of 3.7%.

Source: Calculated Risk

Rising Consumer Confidence: Although there was a slight downtick in the November Consumer Confidence reading, you can see the rising long-term, 10-year trend has been on a clear upward trajectory.

Source: Chad Moutray

Solid Economic Growth: As the chart below indicates, the last two quarters of economic growth, measured by GDP (Gross Domestic Product), have been running at multi-year highs. Forecasts for the 4th quarter currently stand at a respectable mid-2% range.

Source: BEA

Uncertain Weather Forecast

Although the majority of economic data may have observers presently singing “Joy to the World,” the uncertain political weather forecast could require Rudolph’s red-nose assistance to navigate the foggy climate. The mid-term elections have created a split Congress with the Republicans holding a majority in the Senate, and the Democrats gaining control of the House of Representatives. As we learned in the last presidential term, gridlock is not necessarily a bad thing (see also, Who Said Gridlock is Bad?). For instance, a lack of government control can place more power in the hands of the private sector. Political ambiguity also surrounds the timing and outcome of Robert Mueller’s Special Counsel investigation into potential Russian interference and collusion, however as I have continually reminded followers, there are more important factors than politics as it relates to the performance of the stock market (see also, Markets Fly as Media Noise Goes By).

From an economic standpoint, some speculative areas have been pricked – for example the decline in FAANG stocks or the burst of the Bitcoin bubble as the price has declined from roughly $19,000 from its peak to roughly $4000 today (see chart below).

Source: Coindesk

On the housing front, unit sales of new and existing homes have not been immune to the rising interest rate policies of the Federal Reserve. Nevertheless, as you can witness below, housing prices remain at all-time record high prices, according to the recent Case-Shiller data.

Source: Calculated Risk

I like to point out to my investors there is never a shortage of things to worry about. Even when the economy is Jingle Bell Rocking, the issues of inflation and Fed policy inevitably begin to creep into investor psyches. While prognosticators and talking heads will continue trying to forecast whether Santa Claus will place presents or coal into investors’ stockings this season, at Sidoxia we understand predictions are a fool’s errand. Regardless of Santa’s generosity (or lack thereof), we continue to find attractive opportunities for our investors, as we look to balance the risk and rewards presented to us during both stable and volatile periods.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (December 3, 2018). Subscribe on the right side of the page for the complete text.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

The Dirty Little Stock Market Secret

Shhhh…don’t tell anyone, I have a dirty little secret. Are you ready? Are you sure? The world is not going to end…really.

Despite lingering trade concerns (see Trump Hits China with Tariffs on $200 Billion in Goods), Elon Musk being sued by the Securities and Exchange Commission (SEC) for tweeting his controversial intentions to take Tesla Inc. (TSLA) private, and Supreme Court nominee, Brett Kavanaugh, facing scandalous sexual assault allegations when he was in high school, life goes on. In the face of these heated headlines, stocks still managed to rise to another record in September (see Another Month, Another Record). For the month, the Dow Jones Industrial Average climbed +1.9% (+7.0% for 2018), the S&P 500 notched a +0.4% gain (+9.0% for 2018), while the hot, tech-laden NASDAQ index cooled modestly by -0.8% after a scorching +17.5% gain for the year.

If the world were indeed in the process of ending and we were looking down into the abyss of another severe recession, we most likely would not see the following tangible and objective facts occurring in our economy.

- New Revamped NAFTA (North American Free Trade Agreement) 2.0 trade deal between the U.S., Mexico, and Canada was finalized (new deal is called United States-Mexico-Canada Agreement).

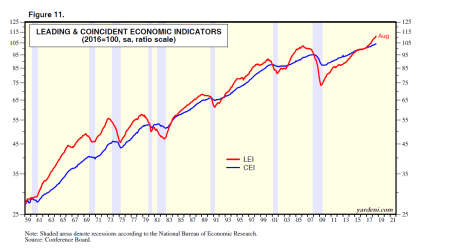

- Leading Economic Indicators are at a record high (a predictive statistic that historically falls before recessionary periods – in gray)

Source: Yardeni.com

- Unemployment Rate of 3.9% is near a record low

- Small Business Optimism is near record highs

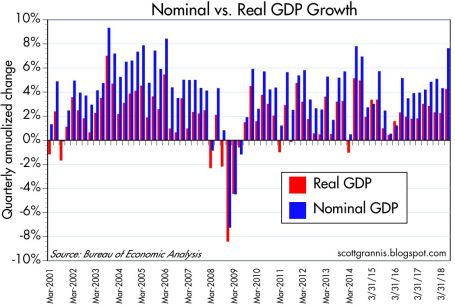

- Consumer Confidence is near record highs

Source: Scott Grannis

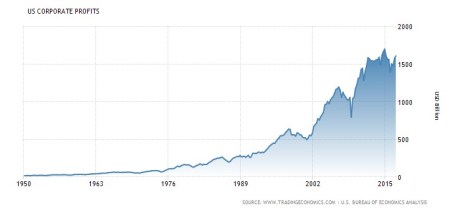

- Corporate Profits are at record highs

- Interest Rates remain at historically low levels despite the Federal Reserve’s actions to slowly migrate their interest rate target higher

- Economic Growth (GDP) accelerating to +4.2% growth rate in the recent quarter

Source: Scott Grannis

Are we closer to a recession with the stock market potentially falling 20-30% in value? As I have written on numerous occasions, so-called pundits have been falsely forecasting recessions over the last decade, for as long as this bull market has been alive (see Professional Double-Dip Guesses are “Probably” Wrong).

Why so much investor angst as stock prices continue to chug along to record levels? One reason is investors are used to historically experiencing a recession approximately twice a decade on average, and we have yet to suffer one since the Great Recession around 10 years ago. While the mantra “we are due” for a recession might be a true statement, the fact also remains that this economic recovery has been the slowest since World War II, which logically could argue for a longer expansionary period.

What also holds true is that corporate profits already experienced a significant “profit recession” during this economic cycle, post the 2008-2009 financial crisis. More specifically, S&P 500 operating profits declined for seven consecutive quarters from December 2014 through June 2016. The largest contributors to the 2014-2016 profit recession were collapsing oil and commodity prices, coupled with a rapid appreciation in the value of the U.S. dollar, which made our exports more expensive and squeezed multinational corporation profits. The stock market eventually digested these profit-crimping headwinds and resumed its ascent to record levels, but not before the S&P 500 remained flat to down for about a year and a half (2014-2016).

Doom-and-gloom, in conjunction with toxic politics, continue to reign supreme over the airwaves. If you want in on a beneficial dirty little secret, you and your investments would be best served by ignoring all of the media noise and realizing the world is not going to end any time soon.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (October 1, 2018). Subscribe on the right side of the page for the complete text.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing had no direct position in TSLA or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Markets Fly as Media Noise Goes By

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (November 1, 2017). Subscribe on the right side of the page for the complete text.

That loud pitched noise is not a frightening scream from Halloween, but rather what you are likely hearing is the deafening noise coming from Washington D.C or cries from concerned Americans watching senseless acts of terrorism. Thanks to the explosion of real-time social media and smart phones, coupled with the divisive politics and depressing headlines blasted across all media outlets, it is almost impossible to ignore the daily avalanche of informational irrelevance.

As I have been writing for some time, the good news for long-term investors is the financial markets continue to plug their ears and ignore poisonous politics and the spread of F.U.D. (Fear, Uncertainty & Doubt). There is a financial benefit to turning off the TV and disregarding political rants over your Facebook feed. Regardless of your political views, President Trump’s approval ratings have objectively been going down, but that really doesn’t matter…the stock market keeps going up (see chart below).

Source: Bespoke

While politicians on both sides scream at each other, investment portfolios have been screaming higher. Stock prices are more focused on the items that really matter, which include corporate profits, interest rates, valuations (price levels), and sentiment (i.e., determining whether investors are too optimistic or too pessimistic). The proof is in the pudding. Stock prices continue to set new records, as witnessed by the 7th consecutive monthly high registered by the Dow Jones Industrial Average to a level of 23,377. For the month, these results translate into an astonishing +4.3% gain. For the year, this outcome equates to an even more impressive +18.3% return. This definitely beats the near-0% rate earned on your checking account and cash stuffed under the mattress.

On the surface, 2017 has been quite remarkable, but over the last decade, stock market returns have proved to be even more extraordinary. Bolstering my contention that politics rarely matter to your long-term pocketbook, one can simply observe history. We are now approaching the 10-year anniversary of the 2008-2009 Financial Crisis – arguably the worst recession experienced in a generation. Over the last decade, despite political power in Washington bouncing around like a hot potato, stock performance has skyrocketed. From early 2009, when the Dow briefly touched a low of 6,470, the index has almost quadrupled above the 23,000 threshold (see chart below).

Source: Barchart.com

To place this spectacular period into better context, one should look at the political control dynamics across Congress and the White House over the same time frame (see the right side of the chart below). Whether you can decipher the chart or not, anyone can recognize that the colors consistently change from red (Republican) to blue (Democrat), and then from blue to red.

More specifically, since the end of 2007, the Democrats have controlled the Senate for approximately 80% of the time; the Republicans have controlled the House of Representatives for 60% of the time; and the Oval Office has switched between three different presidents (two Republicans and one Democrat). And if that is not enough diversity for you, we have also had two Federal Reserve Chairs (Ben Bernanke and Janet Yellen) who controlled the world’s most powerful monetary system, and a Congressional mid-term election taking place in twelve short months. There are two morals to this story: 1) No matter how sad or excited you are about your candidate/political party, you can bank on the control eventually changing; and 2) One person alone cannot save the economy, nor can that same person singlehandedly crater the economy.

Source: Wikipedia

Waterfall of Worries

If you simply read the newspapers and watched the news on TV all day, you would be shocked to learn about the magnificent magnitude of this equity bull market. Reaching these new highs has not been a walk in the park for most investors. There certainly has been no shortage of issues to worry about, including the following:

- Special Counsel Indictments: After the abrupt firing of former FBI Director James Comey by President Donald Trump, Deputy Attorney General Rod Rosenstein established a special counsel in May and appointed ex-FBI official and attorney Robert Mueller to investigate potential Russian meddling into the 2016 presidential elections. Just this week, Mueller indicted Paul Manafort, the former Trump campaign chairman, and Manafort’s business partner and Trump campaign volunteer, Rick Gates. The special counsel also announced the guilty plea of George Papadopoulos, a former foreign policy adviser for the Trump campaign who admitted lying to the FBI regarding interactions between Russian officials and the Trump campaign.

- Terrorist Attacks: Senseless murders of eight people in New York by a 29-year-old man from Uzbekistan, and 59 people shot dead by a 64-year-old shooter from a Las Vegas casino have created a chilling blanket of concern over American psyches.

- New Money Chief? The term of current Federal Reserve Chair, Janet Yellen, ends this February. President Trump has fueled speculation he will announce the appointment of a new Fed chief as early as this week. Although the president has recently praised Yellen, a registered Democrat, many pundits believe Trump wants to select Jerome Powell, a Republican, who currently sits on the Federal Board of Governors.

- North Korea Rocket Launches: So far in 2017, North Korea has launched 22 missiles and tested a hydrogen bomb, while simultaneously threatening to fire missiles over the US territory of Guam and conduct an atmospheric nuclear test. Saber rattling has diminished somewhat in recent weeks since the last North Korean missile launch took place on September 15th. Nevertheless, tensions could rise at any moment, if missile launches resume.

Although media headlines are often depressing, F.U.D. will never go away – it’s only the list of worries that change over time. As noted earlier, the entrepreneurial DNA of the financial markets is focused on more important economic factors like the economy, rather than politics or terrorism. One barometer of economic health can be gauged by the chart below – Consumer Confidence is at the highest level since 2000.

Source: Bespoke

This trend is important because consumers make up approximately 70% of our nation’s economic output. Therefore, it should come as no surprise that Americans are feeling considerably better due to the following factors:

- Strong Job Market: The 4.2% unemployment rate is at the lowest level in 16 years.

- Strong Economy: Despite the dampening effect of the hurricanes, the economy is poised to register its best six-month performance of at least 3% growth in three years.

- Strong Housing Market: Just-released data shows an acceleration in national home price appreciation by +6.1% compared to a year ago.

- Low Interest Rates: Inflation has been low, credit has been cheap, and the Federal Reserve has been cautious in raising interest rates. These low rates have improved the affordability of credit, which has been stimulative for the economy.

Tax Reform Could be the Norm

The icing on the stock market cake has been the optimism surrounding the potential passage of tax reform, likely in the shape of corporate & personal tax cuts, foreign profit repatriation, and tax simplification. The process has been slow, but by passing a budget, the Republican-led Congress was able to pave the way for substantive new tax reform, something not seen since the Ronald Reagan administration, some 30-years ago. Everybody loves paying lower taxes, but victory cannot be claimed yet. Democrats and some fiscally conservative Republicans are not interested in exploding our country’s already-large deficits and debt levels. In order to achieve responsible tax legislation, Congress is looking to remove certain tax loopholes and is negotiating precious tax breaks such as mortgage interest deductibility, state/local tax deductibility, 401(k) tax incentives, and corporate interest expense deductibility, among many other possible iterations. Although corporate tax discussions have been heated, the chart below demonstrates individual income tax legislation is much more important for tax reform legislation because the government collects a much larger share of taxes from individuals vs. corporations.

Source: Calafia Beach Pundit

In spite of all the deafening political noise heard over social media and traditional media, it’s important to block out all the F.U.D. and concentrate on how to achieve your long-term financial goals. If you don’t have the time, energy, or emotional fortitude to follow a disciplined financial plan, I urge you to find an experienced investment advisor who is also a fiduciary. If you need assistance finding one, I am confident Sidoxia Capital Management can help you with this endeavor.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs) and FB, but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Glass Half Full or Half Empty?

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (May 1, 2017). Subscribe on the right side of the page for the complete text.

We live in a time of confusing dichotomies, which makes deciphering the flood of daily data quite challenging. In that context, determining whether the current economic fundamentals should be viewed from a glass half empty of glass half full perspective can be daunting.

More specifically, stock markets have again recently hit new all-time record highs, yet if you read the newspaper headlines, you might think we’re in the midst of Armageddon. Last month, the Dow Jones Industrial Average stock index eclipsed 21,000 and the technology-heavy NASDAQ index surpassed the psychologically important 6,000 threshold. In spite of the records, here’s a sampling of the steady stream of gloomy feature stories jamming the airwaves:

- French Elections – Danger of European Union Breakup

- Heightened Saber Rattling by U.S. Towards North Korea

- Threat of U.S. Government Shutdown

- First 100 Days – Obamacare repeal failure, tax reform delays, no significant legislation

- NAFTA Trade Disputes

- Russian Faceoff Over Syrian Civil War & Terrorism

- Federal Reserve Interest Rate Hikes Could Derail Stock Market

- Slowing GDP / Economic Data

Given all this doom, how is it then that stock markets continue to defy gravity and continually set new record highs? Followers of my writings understand the crucial, driving dynamics of financial markets are not newspaper, television, magazine, and internet headlines. The most important factors are corporate profits, interest rates, valuations, and investor sentiment. All four of these elements will bounce around, month-to-month, and quarter-to-quarter, but for the time being, these elements remain constructive on balance, despite the barrage of negative, gut-wrenching headlines.

Countering the perpetual flow of gloomy, cringe-worthy headlines, we have seen a number of positive developments:

- Record Breaking Corporate Profits: Profits are the chief propellant for higher stock prices, and so far, for the 1st quarter, S&P 500 company profits are estimated to have risen +12.4% – the highest rate since 2011, according to Thomson Reuters I/B/E/S. As I like to remind my readers, stock prices follow profits over the long-run, which is evidenced by the chart below.

Source: Trading Economics

- Interest Rates Low: With interest rate levels still near generational lows (10-Year Treasury @ 2.28%), and inflation relatively stable around 2%, this augurs well for most asset prices. For U.S. consumers there are many stimulative effects to lower interest rates, whether you are buying a house, purchasing a car, paying off a school loan, and/or reducing credit card debt. Lower rates equal lower payments.

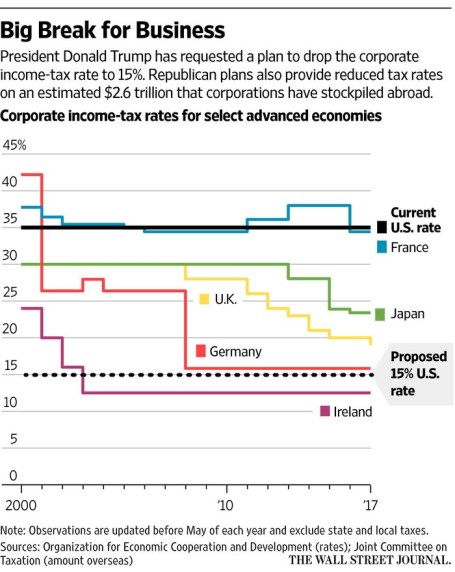

- Potential Tax Reform: There are numerous stimulative components to the largest planned tax-cut in history. First of all, cutting the tax rate from 35% to 15% for corporations and small businesses (i.e. pass-through entities like LLCs and S-Corps) would place a lot of dollars back in the pockets of taxpayers and should stimulate economic growth. Other components of the White House proposal include the termination of the estate tax, the elimination of the AMT (Alternative Minimum Tax) targeted at wealthier households, and the doubling of the standard deduction to help middle-income families. All of this sounds great on paper, but not a lot of details have been provided yet on how these benefits will be paid for – removing state tax deductions alone is unlikely to fully offset revenue declines. The chart below highlights how high U.S. corporate income tax rates are relative to other foreign counterparts.

Source: The Wall Street Journal

- Business Spending & Confidence on the Rise: Ever since the 2008-09 Great Recession, the U.S. has been a better house in a bad neighborhood relative to other global developed economies. However, the recovery has been gradual and muted due to tight-fisted companies being slow to hire and invest. Although recent Q1 GDP economic data came in at a sluggish +0.7% growth rate, the bright spot embedded in the data was a +12% annualized increase in private fixed investment. This is consistent with the spike we’ve seen in recent business and consumer confidence surveys (see chart below). Although this confidence has yet to translate into an acceleration in broader economic data, the ramp in capital spending and positive business sentiment could be a leading indicator for faster economic growth to come. Stimulative legislation enacted by Congress (i.e., tax reform, infrastructure spending, foreign repatriation, etc.) could add further fuel to the economic growth engine.

Source: Trading Economics

- Economy Keeps Chugging Along: As the wealthiest country on the planet, we Americans can become a little spoiled with success, which helps explain the media’s insatiable appetite for growth. Nevertheless, the broader economic data show a continuing trend of improvement. Simply consider the trend occurring in these major areas of the economy:

- Unemployment – The jobless rate has been chopped by more than half from a 10.0% cycle peak to 4.5% today.

- Housing – The number of annual existing home sales has increased by more than +60% from the cycle low to 5.7 million units, which still leaves plenty of headroom for growth before 2006 peak sales levels are reached.

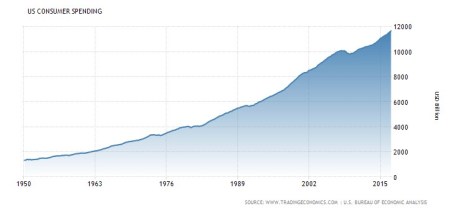

- Consumer Spending – This segment accounts for roughly 70% of our country’s economic activity. Although we experienced a soft patch in Q1 of 2017, as you can see from the chart below, we Americans have had no problem spending more to keep our economy functioning.

Source: Trading Economics

While key economic statistics remain broadly constructive, there will come a time when prudence will dictate the pursuit of a more defensive investment strategy. When will that be? In short, the time to become more cautious will be when we see a combination of the following occur:

- Sharp increase in interest rates

- Signs of a significant decline in corporate profits

- Indications of an economic recession (e.g., an inverted yield curve)

- Spike in stock prices to a point where valuation (prices) are at extreme levels and skeptical investor sentiment becomes euphoric

To date, there is no objective evidence indicating these dynamics are in place, so until then, I will remain thirsty and grab my half glass full of water.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.