Posts tagged ‘capital allocation’

Investing in Pigs and Kidneys: Building a $100 Billion Empire and Revolutionizing Organ Transplants

How does one create a $100 billion empire while pioneering an endless supply of transplantable organs that could save millions of lives? The first step is launching a multi-billion-dollar satellite company (SiriusXM – SIRI). The next step? Founding a biotechnology company with nothing more than a high school-level biology education — all in a desperate attempt to save the life of your seven-year-old daughter from a rare heart disease that claims lives within three to five years.

This is the extraordinary path of Martine Rothblatt, CEO and visionary of United Therapeutics Corp. (UTHR), who began this journey 35 years ago.

Transforming Industries: From SiriusXM to Organ Transplants

Few individuals have singlehandedly transformed entire industries. One name that comes to mind is Steve Jobs – who revolutionized consumer electronics and laid the foundation for Apple Inc.’s (AAPL) meteoric rise to a multi-trillion dollar company before he passed away. While Rothblatt and United Therapeutics may not yet be household names, she is undeniably reshaping the healthcare industry and steering it toward a future of unprecedented, life-extending medical advancements.

How can these ambitious, world-changing goals be achieved? A whole aisle of books could be written about Rothblatt’s impressive lifetime accomplishments, but the unique investment opportunity for investors cannot be fully understood without appreciating the person that created United Therapeutics 29 years ago in 1996.

Rothblatt has accomplished more than most humans could in multiple lifetimes – here is a partial sampling of her achievements:

- Earned a Bachelor of Arts, a Juris Doctor (JD), and Master of Business Administration (MBA) degrees from the University of California, Los Angeles (UCLA).

- Finished her PhD at The London School of Medicine (Barts)

- Practiced law at the Covington & Burling law firm representing the television broadcasting industry before the Federal Communications Commission (FCC).

- Hired by NASA to seek approval from the FCC for NASA systems used to track and relay satellite data.

- Created the multi-billion-dollar satellite radio company SiriusXM in 1990 with the inspiration of physicist Gerard O’Neill, the same Princeton professor who motivated Amazon CEO, Jeff Bezos to create Blue Origin.

- Invented the Terasem Movement, an organization with the mission of human life extension that uses cognitive and artificial intelligence software. Terasem’s technology has created a lifelike robot (BINA48), which is modeled after her spouse, Bina Rothblatt.

- Pioneered EV (electric) helicopter transportation through the company’s Unither Bioelectronics division with the purpose of cutting energy consumption and speeding up organ delivery times.

The United Therapeutics Story

In 1996, while leading SiriusXM, Rothblatt faced every parent’s worst nightmare. Doctors diagnosed her seven-year-old daughter, Jenesis, with Pulmonary Arterial Hypertension (PAH) — a rare, devastating disease with no known cure. Determined to save her daughter, Rothblatt initially funded research grants totaling over a million dollars to a narrow group of five doctors studying the disease. When the scientists failed to find a cure, she took matters into her own hands.

With no formal medical background, she quit SiriusXM, immersed herself in biology, and founded United Therapeutics. Against all odds, armed with her mantra that “persistence leads to omnipotence,” Rothblatt’s relentless pursuit paid off when she discovered a cure. Today, decades later, Jenesis is 42 years old and thriving as a high-profile manager at United Therapeutics.

Addressing the Organ Shortage Crisis

United Therapeutics’ advancements in PAH treatment have allowed patients like Jenesis to live long, productive lives. However, many eventually require organ transplants – the company is already assisting hundreds of patients with lifesaving human lung transplants. Despite some progress, the current organ shortage crisis is staggering:

- Over 100,000 people are on the national transplant waiting list.

- More than 92,000 of them need a kidney due to kidney failure or End-Stage Renal Disease (ESRD).

To address the organ shortage, United Therapeutics recently made history last month when the FDA approved the first-ever clinical trial for its UKidney xenotransplantation procedure for kidney failure patients.

The severity of the organ shortage problem is clear-cut if you examine the numbers. In addition to the 92,000 patients on the kidney transplant waitlist mentioned above, there are approximately 500,000 additional ESRD dialysis patients not on the national transplant list. Roughly 10% of these ESRD patients die each year due to dialysis-related complications.

If you combine the wait list population with the dialysis patient population you get to a total of around 600,000 people total. Regrettably, the vast majority of these patients do not receive an organ. In fact, only 27,759 kidney transplants were performed in the U.S. last year. In other words, despite the enormous demand for transplantable organs, less than 5% of the addressable market have actually benefited from a new kidney.

The Future of Organ Transplants: Profitable Pig Potential

How can this massive undersupply of transplants be fixed? One word…pigs. With a very scarce supply of human donors, pigs may hold the key to solving the organ shortage. United Therapeutics has pioneered genetically engineered pig organs (xenotransplantation) by modifying 10 key genes to prevent immune system rejection. As part of the xenotransplantation trial, United Therapeutics has built multiple DPF (designated pathogen free) facilities that house the pigs carrying the gene-modified kidneys.

All of this may sound like science fiction, but the dream of xenotransplantation has already become reality. Just last November, a genetically engineered pig kidney was transplanted into a patient (Towana Looney) under a compassionate use basis granted by the FDA. With its new clinical trial now underway, United Therapeutics is planning to transplant up to 50 patients with modified pig kidneys in the coming months.

And UKidney is just the beginning. United Therapeutics has a deep organ transplant pipeline that extends beyond kidneys into livers, hearts, and lungs (see graphic below). The company is also working on the “holy grail” of transplants – 3D printed organs using the cells of organ recipients to build the tissue structure, which dramatically reduces or eliminates the risk of organ rejection.

If UKidney is successful, United Therapeutics and Martine Rothblatt will be one step closer to realizing the company’s vision of manufacturing an endless supply of transplantable organs.

Source: United Therapeutics

Investment Opportunity of a Lifetime?

Nothing in life is certain, and there are risks to making any investment, but betting against Martine Rothblatt over the years has been a major losing proposition. From an investment standpoint, the core PAH drug business is trading at an immense discount, and investors are essentially valuing the organ transplant business at $0.

Despite its groundbreaking advancements and tremendous profit growth, United Therapeutics has huge stock price appreciation potential. Here’s why:

Stock is Dirt Cheap: At $317 per share, the stock currently trades at roughly a 50% discount to the trailing S&P 500 Price-Earnings ratio (PE) – 13x P/E vs. 26x index P/E. In other words, the shares should be trading north of $600 (double the price), if United Therapeutics was afforded an “average” company P/E multiple. But United Therapeutics clearly is not an average company.

Over the last two years, the company has grown revenues +48% from $1.9 billion to $2.9 billion and seen earnings explode +64% higher from $15.00 per share to $24.64. The stock becomes even cheaper on a forward P/E multiple (11x P/E) if the company can meet 2025 Wall Street expectations of 15% growth in its EPS to $28.23. Its superior products, execution, and competitive moats should afford the company a significant premium, not a drastic discount. Short-term investors are missing the boat by ignoring the gargantuan market potential for the company.

Is it possible for a $15 billion company to reach a $100 billion market value? This is not difficult to imagine if the company can bring its innovative and revolutionary pipeline products to market and take its current revenue base of almost $3 billion to $16 billion (see graphic below). The company certainly will not reach $16 billion in revenues tomorrow, but if you applied an average market multiple to those projections, and the company were able to maintain its current profit margin profile, a $3,000 per share stock price would be well within reason, equating to a market value well above $100 billion.

Source: United Therapeutics

Many Irons (Catalysts) in the Fire: United Therapeutics is no one-trick pony. Besides the company’s organ transplant plans, and their core commercial PAH and PH-ILD franchise, which includes, Remodulin, Orenitram, and Adcirca, United Therapeutics has many more irons in the fire that can be catalysts for stock price appreciation over the next 12 – 24 months (see graphic below).

Here is a more detailed description of the drivers:

- New Markets for Core Drugs: Any biotech or pharmaceutical company is in the business of searching for new markets to sell its products. United Therapeutics has found that in both the IPF (Idiopathic Pulmonary Fibrosis) and PPF (Progressive Pulmonary Fibrosis) markets, which are two different forms of chronic lung disease that are characterized by the gradual scarring and thickening of the lung tissue, which is called fibrosis. These patients can be administered with modified formulations of its existing Tyvaso molecule. The revenue potential is huge if the efficacy data comes in as planned because the pools of patients suffering from these horrible, progressive lung diseases could more than double the size of the present addressable market. Data from the company’s TETON 1 (IPF), TETON 2 (IPF), and TETON PPF studies will be released over the next few years, starting as early as next quarter.

- Improved Drug Formulation: United Therapeutics is also waiting for groundbreaking data from a drug called Ralinepag, the first once-per-day prostacyclin pill that is an improvement over its existing drugs of Remodulin, Tyvaso, and Orenitram. The company is releasing the Ralinepag data from its ADVANCE OUTCOMES study next year, and if the data proves to be positive, this could represent another multi-billion dollar opportunity for the company and investors.

- Other Near-Term Catalysts: Although perhaps representing a less meaningful potential from a long-term revenue standpoint, the company’s Centralized Lung Evaluation System (CLES) program is awaiting an FDA decision this year – CLES is designed to expand the supply of donor lungs. Last, but not least, data from United Therapeutics’ microliverELAP study represents another sizeable revenue opportunity for liver transplants.

Source: United Therapeutics

Fly in the Ointment: Failing Capital Allocation Grade

United Therapeutics deserves an A+ grade for developing the critical, world-class therapeutics that serve the PAH and PH-ILD market and the massive potential pipeline in xenotransplantation and alternative organ platforms. However, the company receives a failing grade for the implementation of its capital allocation strategy. United Therapeutics holds an excessively bloated cash surplus on its balance sheet, which has exploded higher from $1.0 billion in 2015 to $4.7 billion in 2024.

Sadly, the problem is only getting worse, as the company is on pace to add more than $1 billion more to the cash balance this year, and in subsequent years. This is woefully inefficient and becoming an alarmingly growing percentage (approximately 30% currently) of the company’s market value. To put this issue into perspective, investors should consider the company has enough cash on its balance sheet to effectively fund two decades of capital expenditure requirements. Profitable companies in United Therapeutics’ hand-selected proxy peer group hold a much more responsible amount of cash, representing about 4% of their market values.

If you had $100k of annual spending requirements, would you negligently place $2 million dollars in a low-single-digit yielding checking account or multi-year CD at your bank, when you could responsibly earn a 10% or higher return by paying down credit card debt? This is what United Therapeutics is doing. The company is essentially burning shareholder money by letting cash sit idly on its balance sheet earning a pittance when it could be earning significantly more. Why invest in government Treasuries when you could invest in your own company, compounding at rates greater than 10%?

The solution is clear. Implement a meaningful share repurchase program that is immediately EPS-accretive with the company’s bloated mountain of cash and bring down to responsible levels that are consistent with profitable growth peers. And rather than limiting your share repurchase to a one-time accelerated stock repurchase (ASR) program, expand the buyback to be more open ended on top of immediate purchases. This strategy provides the company with the flexibility to opportunistically purchase shares at a discount when the share price is depressed – like now, when shares are down -24% over the last five months.

Unfortunately, my message appears to be falling on deaf ears. I was hoping to gain clarity through communications with the company along with a letter sent to management and the board of directors. In my letter, I attempted to remind management of the importance of upholding its rigorous corporate governance standards and exercise its fiduciary duty when it comes to the company’s allocation strategy. However, regrettably, up to this point, there has been no indication to the market or me that there is any urgency to take advantage of the massively discounted United Therapeutics share price that exists today.

READ RECENT LETTER SENT TO MANAGEMENT & BOARD OF DIRECTORS BY CLICKING HERE

Investors Should Not Miss the Forest for the Trees

Although the company receives a failing capital allocation grade from my perspective, investors should not miss the forest from the trees. United Therapeutics’ share price is currently trading at a gigantic discount, yet it boasts unparalleled profitability and a groundbreaking organ transplant pipeline.

This lack of appreciation for the shares is surprising given how wildly profitable the company is and its tremendous long-term track record of success. But the company is not sitting on its hands – United Therapeutics has ambitious plans to expand its current annual revenue base by more than five-fold from $3 billion to $16 billion due to full cupboard of pipeline products.

With Martine Rothblatt at the helm—a visionary with a track record rivaling Steve Jobs—the company is poised to revolutionize healthcare. The world is a better place due to Martine Rothblatt, and your portfolio will be a better place with an investment in United Therapeutics.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in UTHR, AAPL, and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in SIRI or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on the IC Contact page.

Avoiding Cigarette Butts

Too many investors hang their hat on investments that seem “cheap”. Unfortunately, too often something that looks like a bargain turns out to be a cigarette butt from which investors are hoping to take a last puff. As the old adage states, “you get what you pay for,” and that certainly applies to the world of investments. There are endless examples of cheap stocks getting cheaper, or in other words, stocks with low price/earnings ratios going lower. Stocks that appear cheap today, in many cases turn out to be expensive tomorrow because of deteriorating or collapsing profitability.

For instance, take Haliburton Company (HAL), an energy services company. Wall Street analysts are forecasting the Houston, Texas based oil services company to achieve 2016 EPS (earnings per share) of $0.32, down -79%. The share price currently stands at $37, so this translates into an eye-popping valuation of 128x P/E ratio, based on 2016 earnings estimates. What has effectively occurred in the HAL example is earnings have declined faster than the share price, which has caused the P/E to go higher. If you were to look at the energy sector overall, the same phenomenon is occurring with the P/E ratio standing at a whopping 97x (at the end of Q1).

These inflated P/E ratios are obviously not sustainable, so two scenarios are likely to occur:

- The price of the P/E (numerator) will decline faster than earnings (denominator)

- AND/OR

- The earnings of the P/E (denominator) will rise faster than the price (numerator)

Under either scenario, the current nose-bleed P/E ratio should moderate. Energy companies are doing their best to preserve profitability by cutting expenses as fast as possible, but when the product you are selling plummets about -70% in 18 months (from $100 per barrel to $30), producing profits can be challenging.

The Importance of Price (or Lack Thereof)

Similarly to the variables an investor would consider in purchasing an apartment building, “price” is supreme. With that said, “price” is not the only important variable. As famed investor Warren Buffett shrewdly notes, the quality of a company can be even more important than the price paid, especially if you are a long-term investor.

“It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.”

The advantage of identifying and owning a “wonderful company” is the long-term stream of growing earnings. The trajectory of future earnings growth, more than current price, is the key driver of long-term stock performance.

Growth investor extraordinaire Peter Lynch summed it up well when he stated,

“People Concentrate too much on the P, but the E really makes the difference.”

Albert Einstein identified the power of “compounding” as the 8th Wonder of the World, which when applied to earnings growth of a stock can create phenomenal outperformance – if held long enough. Warren Buffett emphasized the point here:

“If you aren’t willing to own a stock for ten years, don’t even think about owning it for ten minutes. Put together a portfolio of companies whose aggregate earnings march upward over the years, and so also will the portfolio’s market value.”

Throw Away Cigarette Butts

I have acknowledged the importance of aforementioned price, but your investment portfolio will perform much better, if you throw away the cigarette butts and focus on identifying market leading franchise that can sustain earnings growth. The lower the growth potential, the more important price becomes in the investment question. (see also Magic Quadrant)

Here are the key factors in identifying wining stocks:

- Market Share Leaders: If you pay peanuts, you usually get monkeys. Paying a premium for the #1 or #2 player in an industry is usually the way to go. Certainly, there is plenty of money to be made by smaller innovative companies that disrupt an industry, so for these exceptions, focus should be placed on share gains – not absolute market share numbers.

- Proven Management Team: It’s nice to own a great horse (i.e., company), but you need a good jockey as well. There have been plenty of great companies that have been run into the ground by inept managers. Evaluating management’s financial track record along with a history of their strategic decisions will give you an idea what you’re working with. Performance doesn’t happen in a vacuum, so results should be judged relative to the industry and their competitors. There are plenty of incredible managers in the energy sector, even if the falling tide is sinking all ships.

- Large and/or Growing Markets: Spotting great companies in niche markets may be a fun hobby, but with limited potential for growth, playing in small market sandboxes can be hazardous for your investment health. On the other hand, priority #1, #2, and #3 should be finding market leaders in growth markets or locating disruptive share gainers in large markets. Finding fertile ground on long runways of growth is how investors benefit from the power of compound earnings.

- Capital Allocation Prowess: Learning the capital allocation skillset can be demanding for executives who climb the corporate ladder from areas like marketing, operations, or engineering. Regrettably, these experiences don’t prepare them for the ultimate responsibility of distributing millions/billions of dollars. In the current low/negative interest rate environment, allocating capital to the highest return areas is more imperative than ever. Cash sitting on the balance sheet earning 0% and losing value to inflation is pure financial destruction. Conservatism is prudent, however, excessive piles of cash and overpaying for acquisitions are big red flags. Managers with a track record of organically investing in their businesses by creating moats for long-term competitive advantage are the leaders we invest in.

Many so-called “value” investors solely use price as a crutch. Anyone can print out a list of cheap stocks based on Price-to-Earnings, Enterprise Value/EBITDA, or Price/Cash Flow, but much of the heavy lifting occurs in determining the future trajectory of earnings and cash flows. Taking that last puff from that cheap, value stock cigarette butt may seem temporarily satisfying, but investing into too many value traps may lead you gasping for air and force you to change your stock analysis habits.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing had no direct position in HAL or any security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Dividends: From Sapling to Abundant Fruit Tree

Dividends are like fruit and an investment in stock is much like purchasing a sapling. When purchasing a stock (sapling) the goal is two-fold: 1) Buy a sapling (tree) that is expected to bear a lot of fruit; and 2) Pay a cheap or fair price. If the right saplings are purchased at the right prices, then investors can enjoy a steady diet of fruit that has the potential of producing more fruit each year. Fruit can come in the form of future profits, but as we will see, the sweetness of a profitable company also paying dividends can prove much more fruitful over the long-term.

Investing in growth equities at reasonable prices seems like a pretty intelligent strategy, but of late the vast majority of fresh investor capital has been piling into bonds. This is not a flawed plan for retirees (and certain wealthy individuals) and should be a staple in all investment portfolios, to a degree (some of my client portfolios contain more than 80%+ in fixed income-like securities), but for many investors this overly narrow bond focus can lead to suboptimal outcomes. Right now, I like to think of bonds like a reliable bag of dried fruit, selling for a costly price. However, unlike stocks, bonds do not have the potential of raising periodic payments like a sapling with strong growth prospects. “Double-dippers” who are expecting the economy to spiral into a tailspin, along with nervous snakebit equity investors, prefer the reliability of the bagged dry fruit (bonds)… no matter how high the price.

How Sweet is the Fruit? How Does a +2,300% Yield Sound?

Not only do equities offer the potential of capital appreciation, but they also present the prospect of dividend hikes in the future – important characteristics, especially in inflationary environments. Bonds, on the other hand, offer static fixed payments (no hope of interest rate hikes) with declining purchasing power during periods of escalating general prices.

Given the possibility of a “double-dip” recession, one would expect corporate executives to be guarding their cash with extreme stinginess. On the contrary, so far in 2010, companies have shown their confidence in the recovery by increasing or initiating dividends at a +55% higher clip versus the same period last year. Underpinning these announcements, beyond a belief in an economic recovery, are large piles of cash growing on the balance sheets of nonfinancial companies. According to Standard & Poor’s (S&P), cash hit a record $837 billion at the end of March, up from $665 billion last year.

The S&P 500 dividend yield at 2.06% may not sound overwhelmingly high, but with CDs and money markets paying next to nothing, the Federal Funds rate at effectively 0%, and the 10-Year Treasury Note yielding an uninspiring 3.11%, the S&P yield looks a little more respectable in that light.

If the stock market yield doesn’t enthuse you, how does a +2,300% yield sound to you? That’s roughly what a $.05 (split adjusted) purchase of Wal-Mart (WMT) stock in 1972 would be earning you today based on the current $1.21 dividend per share paid today. That return alone is mind-blowing, but this analysis doesn’t even account for the near 1,000-fold increase in the stock price over the similar timeframe. That’s what happens if you can find a company that increases its dividend for 37 consecutive years.

Procter & Gamble (PG) is another example. After PG increased its dividend for 54 consecutive years, from a split-adjusted $.01 per share in 1970 to a $1.93 payout today, original shareholders are earning an approximate 245% yield on their initial investment (excluding again the massive capital appreciation over 40 years). There’s a reason investment greats like Warren Buffett have invested in great dividend franchises like WMT, PG, KO, BUD, WFC, and AXP.

Bad Apples do Exist

Dividend payment is not guaranteed by any means, as evidenced by the dividend cuts by financial institutions during the 2008-2009 crisis (e.g., BAC, WFC, C) or the discontinuation of BP PLC’s (BP) dividend after the Gulf of Mexico oil spill disaster. Bonds are not immune either. Although bonds are perceived as “safe” investments, the interest and principal payment streams are not fully insured – just ask bondholders of bankrupt companies like Lehman Brothers, Visteon, Tribune, or the countless other companies that have defaulted on their debt promises.

This is where doing your homework by analyzing a company’s competitive positioning, financial wherewithal, and corporate management team can lead you to those companies that have a durable competitive advantage with a corporate culture of returning excess capital to shareholders (see Investing Caffeine’s “Education” section). Certainly finding a WMT and/or PG that will increase dividends consistently for decades is no easy chore, but there are dozens of budding possibilities that S&P has identified as “Dividend Aristocrats” – companies with a multi-year track record of increasing dividends. And although there is uncertainty revolving around dividend taxation going into 2011, I believe it is fair to assume dividend payment treatment will be more favorable than bond income.

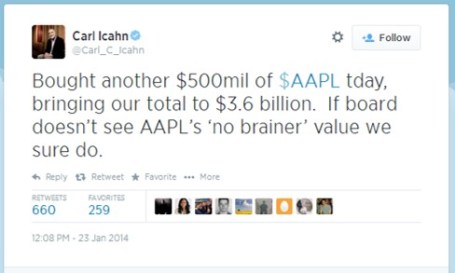

Apple Allocation

Growth companies that reinvest profits into new value-expanding projects and/or hoard cash on the balance sheet may make sense conceptually, but dividend paying cultures instill a self-disciplining credo that can better ensure proper capital stewardship by corporate boards. All too often excess capital is treated as funny money, only to be flushed away by overpaying for some high-profile acquisition, or meaningless share buybacks that merely offset generous equity grants to employees.

So, when looking at new and existing investments, consider the importance of dividend payments and dividend growth potential. Investing in an attractively priced sapling with appealing growth prospects can lead to incredibly fruitful returns.

Read the Whole WSJ Article on Dividends

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

*DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds and WMT, but at the time of publishing SCM had no direct positions in BAC, WFC, C, BP, PG, KO, BUD, WFC, AXP, Lehman Brothers, Visteon, Tribune, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.