Posts tagged ‘bonds’

Stocks Take a Breather after Long Sprint

Like a sprinter running a long sprint, the stock market eventually needs to take a breather too, and that’s exactly what investors experienced this week as they witnessed the Dow Jones Industrial Average face its largest drop of 2013 (down -2.2%) – and also the largest weekly slump since 2012. Runners, like financial markets, sooner or later suffer fatigue, and that’s exactly what we’re seeing after a relatively unabated +27% upsurge over the last nine months. Does a -2% hit in one week feel pleasant? Certainly not, but before the next race, the markets need to catch their breath.

By now, investors should not be surprised that pitfalls and injuries are part of the investment racing game – something Olympian Mary Decker Slaney can attest to as a runner (see 1984 Olympic 3000m final against Zola Budd). As I have pointed out in previous articles (Most Hated Bull Market), the almost tripling in stock prices from the 2009 lows has not been a smooth, uninterrupted path-line, but rather investors have endured two corrections averaging -20% and two other drops approximating -10%. Instead of panicking by locking in damaging transaction costs, taxes, and losses, it is better to focus on earnings, cash flows, valuations, and the relative return available in alternative asset classes. With generationally low interest rates occurring over recent periods, the available subset of attractive investment opportunities has narrowed (see Confessions of a Bond Hater), leaving many investing racers to default to stocks.

Recent talk of potential Federal Reserve bond purchase “tapering” has led to a two-year low in bond prices and caused a mini spike in interest rates (10-year Treasury note currently yielding +2.83%). At the margin, this trend makes bonds more attractive (lower prices), but as you can see from the chart below, interest rates are still relatively close to historically low yields. For the time being, this still makes domestic equities an attractive asset class.

Source: Yahoo! Finance

Price Follows Earnings

The simple but true axiom that stock prices follow earnings over the long-run is just as true today as it was a century ago. Interest rates and price-earnings ratios can also impact stock prices. To illustrate my argument, let’s talk baseball. Wind, rain, and muscle (interest rates, PE ratios, political risk, etc.) are factors impacting the direction of a thrown baseball (stock prices), but gravity is the key factor influencing the ultimate destination of the baseball. Long-term earnings growth is the equivalent factor to gravity when talking about stock prices.

To buttress my point that stock prices following long-term earnings, consider the fact that S&P 500 annualized operating earnings bottomed in 2009 at $39.61. Since that point, annualized earnings through the second quarter of 2013 (~94% of companies reported results) have reached $99.30, up +151%. S&P 500 stock prices bottomed at 666 in 2009, and today the index sits at 1655, +148%. OK, so earnings are up +151% and stock prices are up +148%. Coincidence? Perhaps not.

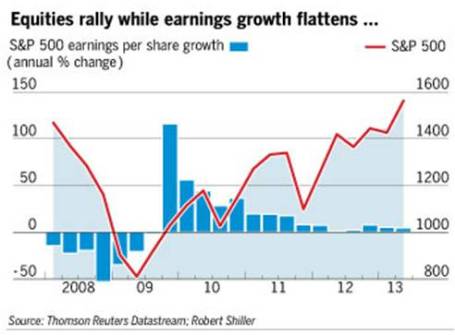

If we take a closer look at earnings, the deceleration of earnings growth is unmistakable (see Financial Times chart below), yet the S&P 500 index is still up +16% this year, excluding dividends. In reality, predicting multiple expansion or contraction is nearly impossible. For example, earnings in the S&P 500 grew an incredible +15% in 2011, yet stock prices were anemically flat for that year, showing no price appreciation (+0.0%). Since the end of 2011, earnings have risen a meager +3%, however stock prices have catapulted +32%. Is this multiple expansion sustainable? Given stock P/E ratios remain in a reasonable 15-16x range, according to forward and trailing earnings, there is some room for expansion, but the low hanging fruit has been picked and further double-digit price appreciation will require additional earnings growth.

Source: Financial Times

But stocks should not be solely looked through a domestic lens…there is another 95% of the world’s population slowly embracing capitalism and democracy to fuel future dynamic earnings growth. At Sidoxia (www.Sidoxia.com), we are finding plenty of opportunities outside our U.S. borders, including alternative asset classes.

The investment race continues, and taking breathers is part of the competition, especially after long sprints. Rather than panic, enjoy the respite.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing, SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Confessions of a Bond Hater

Hi my name is Wade, and I’m a bond hater. Generally, the first step in addressing any type of personal problem is admitting you actually have a problem. While I am not proud of being a bond hater, I have been called many worse things during my life. But as we have learned from the George Zimmerman / Trayvon Martin case, not every situation is clear-cut, whether we are talking about social issues or bond investing. For starters, let me be clear to everyone, including all my detractors, that I do not hate all bonds. In fact, my Sidoxia clients own many types of fixed income securities. What I do hate however are low yielding, long duration bonds.

Duration…huh? Most people understand what “low yielding” means, when it comes to bonds (i.e., low interest, low coupon, low return, etc.), but when the word duration is uttered, the conversation is usually accompanied by a blank stare. The word “duration” may sound like a fancy word, but in reality it is a fairly simple concept. Essentially, high-duration bonds are those fixed income securities with the highest sensitivity to changes in interest rates, meaning these bonds will go down most in price as interest rates rise.

When it comes to equity markets, many investors understand the concept of high beta stocks, which can be used to further explain duration. There are many complicated definitions for beta, but the basic principle explains why high-beta stock prices generally go up the most during bull markets, and go down the most during bear markets. In plain terms, high beta equals high octane.

If we switch the subject back to bonds, long duration equals high octane too. Or stated differently, long duration bond prices generally go down the most during bear markets and go up the most during bull markets. For years, grasping the risk of a bond bear market caused by rising rates has been difficult for many investors to comprehend, especially after witnessing a three-decade long Federal Funds tailwind taking the rates from about 20% to about 0% (see Fed Fatigue Setting In).

The recent interest rate spike that coincided with the Federal Reserve’s Ben Bernanke’s comments on QE3 bond purchase tapering has caught the attention of bond addicts. Nobody knows for certain whether this short-term bond price decline is the start of an extended bear market in bonds, but mathematics would dictate that there is only really one direction for interest rates to go…and that is up. It is true that rates could remain low for an indefinite period of time, but neither scenario of flat to down rates is a great outcome for bond holders.

Fixes to Fixed-Income Failings

Even though I may be a “bond hater” of low yield, high duration bonds, currently I still understand the critical importance and necessity of a fixed income portfolio for not only retirees, but also for the diversification benefits needed by a broader set of investors. So how does a bond hater reconcile investing in bonds? Easy. Rather than focusing on lower yielding, longer duration bonds, I invest more client assets in shorter duration and/or higher yielding bonds. If you harbor similar beliefs as I do, and believe there will be an upward bias to the trajectory of long-term interest rates, then there are two routes to go. Investors can either get compensated with a higher yield to counter the increased interest rate risk, and/or they can shorten duration of bond holdings to minimize capital losses.

Worth noting, there is an alternative strategy for low yielding, long duration bond lovers. In order to minimize interest rate risk, these bond lovers may accept sub-optimal yields and hold bonds to maturity. This strategy may be associated with short-term price volatility, but if the bond issuer does not default, at least the bond investor will get the full principal at maturity to help relieve the pain of meager yields.

Now that you’ve survived all this bond babbling, let me cut to the chase and explain a few ways Sidoxia is taking advantage of the recent interest rate volatility for our clients:

Floating Rate Bonds: Duration of these bonds is by definition low, or near zero, because as interest rates rise, coupons/interest payments are advantageously reset for investors at higher rates. So if interest rates jump from 2% to 3%, the investor will receive +50% higher periodic payments.

Inflation Protection Bonds: These bonds come in long and short duration flavors, but if interest rates/inflation rise higher than expected, investors will be compensated with higher periodic coupons and principal payments.

Shorter Duration: One definition of duration is the weighted average of time until a bond’s fixed cash flows are received. A way of shortening the duration of your bond portfolio is through the purchase of shorter maturity bonds (e.g., buying 3-year bonds rather than 30-year bonds).

High Yield Bonds: Investing in the high yield bond category is not limited to domestic junk bond purchases, but higher yields can also be earned by investing in international and/or emerging market bonds.

Investment Grade Corporate Bonds: Similar to high yield bonds, investment grade bonds offer the potential of capital appreciation via credit improvement. For instance, credit rating upgrades can provide gains to help offset price declines caused by rising interest rates.

Despite my bond hater status, the recent taper tantrum and interest rate spike, highlight some advantages bonds have over stocks. Even though prices declined, bonds by and large still have lower volatility than stocks; provide a steady stream of income; and provide diversification benefits.

To the extent investors have, or should have, a longer-term time horizon, I still am advocating a stock bias to client portfolios, subject to each investor’s risk tolerance. For example, an older retired couple with a conservative target allocation of 20%/80% (equity/fixed income) may consider a 25% – 30% allocation. A shift in this direction may still meet the retirees’ income needs (especially if dividend-paying stocks are incorporated), while simultaneously acknowledging the inflation and interest rate risks impacting bond positions. It’s important to realize one size doesn’t fit all.

Higher Volatility, Higher Reward

Frequent readers of Investing Caffeine have known about my bond hating tendencies for quite some time (see my 2009 article Treasury Bubble has not Burst…Yet), but the bond baby shouldn’t be thrown out with the bath water. For those investors who thought bonds were as safe as CDs, the recent -6% drop in the iShares Aggregate Bond Index (AGG) didn’t feel comfortable for most. Although I am still an enthusiastic stock cheerleader (less so as valuation multiples expand), there has been a cost for the gargantuan outperformance of stocks since March of ’09. While stocks have outperformed bonds (S&P vs. AGG) by more than +140%, equity investors have had to endure two -10% corrections and two -20% corrections (e.g.,Flash Crash, Debt Ceiling Debate, European Financial Crisis, and Sequestration/Elections). If investors want to earn higher long-term equity returns, this desire will translate into more volatility than bonds…and more Tums.

I may still be a bond hater, and the general public remains firm stock haters, but at some point in the multi-year future, I will not be surprised to hear myself say, “Hi my name is Wade, and I am addicted to bonds.” In the mean time, Sidoxia will continue to optimize its client bond portfolios for a rising interest rate environment, while also investing in attractive equity securities and ETFs. There’s nothing to hate about that.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), including floating rate bonds/loan funds, inflation-protection funds, corporate bond ETF, high-yield bond ETFs, and other bond ETFs, but at the time of publishing, SCM had no direct position in AGG or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

1994 Bond Repeat or 2013 Stock Defeat?

Interest rates are moving higher, bond prices are collapsing, and fear regarding a stock market plunge is palpable. Sound like a recent news headline or is this a description of a 1994 financial market story? For those with a foggy, double-decade-old memory, here is a summary of the 1994 economic environment:

- The economy registered its 34th month of expansion and the stock market was on a record 40-month advance

- The Federal Reserve embarked on its multi-hike, rate-tightening monetary policy

- The 10-year Treasury note exhibited an almost 2.5% jump in yields

- Inflation was low with a threat of rising inflation lurking in the background

- An upward sloping yield curve encouraged speculative bond carry-trade activity (borrow short, invest long)

- Globalization and technology sped up the pace of price volatility

Many of these listed items resemble factors experienced today, but bond losses in 1994 were much larger than the losses of 2013 – at least so far. At the time, Fortune magazine called the 1994 bond collapse the worst bond market loss in history, with losses estimated at upwards of $1.5 trillion. The rout started with what might have appeared as a harmless 0.25% increase in the Federal Funds rate (the rate that banks lend to each other) from 3% to 3.25% in February 1994. By the time 1994 came to a close, acting Federal Reserve Chairman Alan Greenspan had jacked up this main monetary tool by 2.5%.

Rising rates may have acted as the flame for bond losses, but extensive use of derivatives and leverage acted as the gasoline. For example, over-extended Eurobond positions bought on margin by famed hedge fund manager Michael Steinhardt of Steinhardt Partners lead to losses of about-30% (or approximately $1.5 billion). Renowned partner of Omega Partners, Leon Cooperman, took a similar beating. Cooperman’s $3 billion fund cratered -24% during the first half of 1994. Insurance company bond portfolios were hit hard too, as collective losses for the industry exceeded $20 billion, or more than the claims paid for Hurricane Andrew’s damage. Let’s not forget the largest casualty of this era – the public collapse of Orange County, California. Poor derivatives trades led to $1.7 billion in losses and ultimately forced the county into bankruptcy.

There are plenty of other examples, but suffice it to say, the pain felt by other bond investors was widespread as a massive number of margin calls caused a snowball of bond liquidations. The speed of the decline was intensified as bond holders began selling short and using derivatives to hedge their portfolios, accelerating price declines.

Just as the accommodative interest rate punch bowl was eventually removed by Greenspan, so too is Ben Bernanke (current Fed Chairman) threatening to do today. Even if Bernanke unleashes a cold-turkey tapering of the $85 billion per month in bond-purchases, massive losses in bond values won’t necessarily mean catastrophe for stock values. For evidence, one needs to look no further than this 1994-1995 chart of the stock market:

Volatility for stocks definitely increased in 1994 with the S&P 500 index correcting about -10% early in the year. But as you can see, by the end of the year the market was off to the races, tripling in value over the next five years. Volatility has been the norm for the current bull market rally as well. Despite the more than doubling in stock prices since early 2009, we have experienced two -20% corrections and one -10% pullback.

What’s more, the onset of potential tapering is completely consistent with core economic principles. Capitalism is built on free trading markets, not artificial intervention. Extraordinary times required extraordinary measures, but the probabilities of a massive financial Armageddon have been severely diminished. As a result, the unprecedented scale of quantitative easing (QE) will eventually become more harmful than beneficial. The moral of the story is that volatility is always a normal occurrence in the equity markets, therefore any significant stock pullback associated with potential bond tapering (or fed fund rate hikes) shouldn’t be viewed as the end of the world, nor should a temporary weakening in stock prices be viewed as the end to the bull market in stocks.

Why have stocks historically provided higher returns than bonds? The short answer is that stocks are riskier than bonds. The price for these higher long-term returns is volatility, and if investors can’t handle volatility, then they shouldn’t be investing in stocks.

If you are an investor that thinks they can time the market, you wouldn’t be wasting your time reading this article. Rather, you’d be spending time on your personal island while drinking coconut drinks with umbrellas (see Market Timing Treadmill).

Although there are some distinct similarities between the economic backdrop of 1994 and 2013, there are quite a few differences also. For starters, the economy was growing at a much healthier clip then (+4.1% GDP growth), which stoked inflationary fears in the mind of Greenspan. Moreover, unemployment was quite low (5.5% by year-end vs. 7.6% today) and the Fed did not communicate forward looking Fed policy back then.

It’s unclear if the recent 50 basis point ascent in 10-year Treasury rates was just an appetizer for what’s to come, but simple mathematics indicate there is really only one direction left for interest rates to go…higher. If history repeats itself, it will likely be bond investors choking on higher rates (not stock investors). For the sake of optimistic bond speculators, I hope Ben Bernanke knows the Heimlich maneuver. Studying history may help bond bulls avoid indigestion.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Time to Trade in the Investment Tricycle

This article is an excerpt from a previously released Sidoxia Capital Management’s complementary newsletter (May 1, 2013). Subscribe on the right side of the page for an entire monthly update.

As the stock market continues to set new, all-time record highs and the Dow Jones Industrial index nears another historic milestone (15,000 level), investors remain cautiously skeptical of the rebound – like a nervous toddler choosing to ride a tricycle instead of a bicycle. Investors have been moving slowly, but stock prices have not – the Dow has risen +13% in 2013 alone. What’s more, over the last four years the S&P 500 index (which represents large companies) has climbed +140%; the S&P 400 (mid-sized companies) +195%; and the S&P 600 (small-sized companies) +200%.

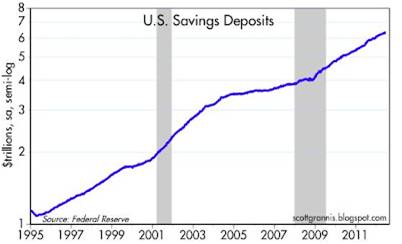

The gains have been staggering, but like the experience of riding a bicycle, the bumps, scrapes, and bruises suffered during the 2008-2009 financial crash have caused investors to abandon their investment bikes for a perceived safer vehicle…a tricycle. What do I mean by that? Well, over the last six years, investors have pulled out more than -$521,000,000,000 from stock funds and piled those proceeds into bonds (Calafia Beach Pundit chart below). For retirees and billionaires this strategy may make sense in certain instances. But for millions of others, interest rate risk, inflation risk, and the risk of outliving your money can be more hazardous to financial well-being, than the artificially perceived safety expected from bonds. The fact of the matter is investing inefficiently in cash, money markets, CDs, and low-yielding fixed income securities can be riskier in the long-run than a globally diversified portfolio invested across a broad set of asset classes (including equities). The latter should be the strategy of choice, unless of course you are someone who yearns to work at Wal-Mart (WMT) as a greeter in your 80s!

Investor Training Wheels

I don’t want to irresponsibly flog everyone, because investing attitudes have begun to change a little in 2013, as investors have added $66 billion to stock funds (data from ICI). Effectively, some investors have gone from riding their tricycle to hopping on a bike with training wheels. With this change in mindset, surely people have commenced selling bonds to buy stocks, right? Wrong! Investors have actually bought more bonds (+$69 billion) than stocks in the first three months of the year, which helps explain why interest rates on the 10-year Treasury are only yielding a paltry 1.67% (near last year’s record summer low) – remember, bond buying causes interest rates to go down. If you really want to do research, you could ask your parents when rates were ever this low, but some readers’ parents may not even had been born yet. The previous record low in interest rates, according to Bloomberg, at 1.95% was achieved in 1941.

I don’t want to irresponsibly flog everyone, because investing attitudes have begun to change a little in 2013, as investors have added $66 billion to stock funds (data from ICI). Effectively, some investors have gone from riding their tricycle to hopping on a bike with training wheels. With this change in mindset, surely people have commenced selling bonds to buy stocks, right? Wrong! Investors have actually bought more bonds (+$69 billion) than stocks in the first three months of the year, which helps explain why interest rates on the 10-year Treasury are only yielding a paltry 1.67% (near last year’s record summer low) – remember, bond buying causes interest rates to go down. If you really want to do research, you could ask your parents when rates were ever this low, but some readers’ parents may not even had been born yet. The previous record low in interest rates, according to Bloomberg, at 1.95% was achieved in 1941.

Over the last five years the news has been atrocious, and as we have proven, investing based off of current headlines is a horrible investment strategy. As we’ve seen firsthand, there can be very long, multi-year periods when stock performance has absolutely no correlation with the positive or negative nature of news reports. To better make my point, I ask you, what types of headlines have you been reading over the last four years? I can answer the question for you with a few examples. For starters, we’ve endured financial collapses in Iceland, Ireland, Dubai, Greece, and now Cyprus. At home domestically, we’ve experienced a “flash crash” that temporarily evaporated about $1 trillion dollars in value (and 1,000 Dow points) within a few minutes due to high frequency algorithmic traders. How about unemployment data? We’ve witnessed the slowest, jobless U.S. recovery in a generation (since World War II), and European countries have it much worse than we do (e.g., Spain just registered a 27% unemployment rate). What about political gridlock and brinksmanship? We’ve seen debt ceiling stand-offs lead to a historic loss of our country’s AAA debt status; a partisan presidential election; a deafening fiscal cliff debate; and now mindless sequestration. Nevertheless, large cap stocks and small cap stocks have more than doubled and tripled, respectively.

Fear sells advertising, and sounds smarter than “everything is rosy,” but the fact remains, things are not as bad as many bears claim. Corporations are earning record profits, and hold trillions in cash (e.g., Apple Inc.’s recent announcement of more than $50 billion in share repurchase and $11 billion in annual dividend payments are proof). Moreover, central banks around the globe are doing whatever it takes to stimulate growth – most recently the Bank of Japan promised to inject $1.4 trillion into its economy by the end of 2014, in order to kick-start expansion. Lastly, the U.S. employment picture continues to improve, albeit slowly (7.6% unemployment in March), allowing consumers to pay down debt, buy more homes, and spend money to spur economic growth.

Dangers of Being Informed

Hopefully this clarifies how useless and futile newspaper headlines are when it comes to effective investing. As Mark Twain astutely noted, “If you don’t read the newspaper, you are uninformed. If you do read the newspaper, you are misinformed.” It’s perfectly fine to remain in tune with current events, but shuffling around your life’s savings based on this information is a foolish plan.

Hopefully this clarifies how useless and futile newspaper headlines are when it comes to effective investing. As Mark Twain astutely noted, “If you don’t read the newspaper, you are uninformed. If you do read the newspaper, you are misinformed.” It’s perfectly fine to remain in tune with current events, but shuffling around your life’s savings based on this information is a foolish plan.

If the concerns and worries du jour have you nervously riding a tricycle, just realize that you may not reach your investment destination with this mode of transportation. I understand that it is not all hearts and flowers in the financial markets, and there are plenty of legitimate risks to consider. However, excessive exposure in low-rate asset classes may be riskier than many realize. If you’re still riding your investment tricycle, you’re probably better off by grabbing a helmet and pads (i.e., globally diversified portfolio) and jumping on a bike – you are more likely to reach your financial destination.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), WMT and AAPL, but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Beware: El-Erian & Gross Selling Buicks…Not Chevys

As my grandmother always told me, “Be careful where you get your advice!” Or as renowned Wall Street trader Gerald Loeb once said, “The Buick salesman is not going to tell you a Chevrolet will fit your needs.” In other words, when it comes to investment advice, it is important to realize that opinions and recommendations are often biased and steeped with inherent conflicts of interest. Having worked in the financial industry over several decades, I have effectively seen it all.

However, one unique aspect I have grown accustomed to is the nauseating and fatiguing over-exposure of PIMCO’s dynamic bond duo, CEO Mohamed El-Erian and founder Bill Gross. Over the last four years and 13 consecutive quarters of GDP growth (likely 14 after Q4 revisions), I and fellow CNBC viewers have been forced to endure the incessant talk of the “New Normal” of weak economic growth to infinity. Actual results have turned out quite differently than the duet’s cryptic and verbose predictions, which have piled up over their seemingly non-stop media interview schedule. Despite the doomsday rhetoric from the bond brothers, El-Erian and Gross have witnessed a more than doubling in equity prices, which has soundly trounced the performance of bonds over the last four years.

After being mistaken for such a long period, certainly the PIMCO marketing machine would revise their pessimistic outlook, right? Wrong. In true biased fashion, El-Erian cannot admit defeat. Just this week, El-Erian argues stocks are artificially high due to excessive liquidity pumped into the financial system by central banks (see video below). I’m the first one to admit Federal Reserve Chairman Ben Bernanke is explicitly doing his best to force investors into risky assets, but doesn’t generational low interest rates help bond prices too? Apparently that mathematical fact has escaped El-Erian’s bond script.

El-Erian’s buddy, Bill Gross, can’t help himself from jumping on the stock rain parade either. Just six weeks ago Gross followed the bond-pumping playbook by making another dour prediction that the market would rise less than 5% in 2013. Unfortunately for Gross, his crystal ball has also been a little cloudy of late, with the S&P 500 index already up more than +6.5% this year. Since doomsday outlooks are what keeps the $2 trillion PIMCO machined primed, it’s no surprise we hear about the never-ending gloom. For those keeping score at home, let’s please not forget Bill Gross’s infamously wrong Dow 5,000 prediction (see article).

PIMCO Smoke & Mirrors: Stock Funds with NO Stocks

Just when I thought I had seen it all, I came across PIMCO’s Equity-Related funds. Never in my career have I seen “equity” mutual funds that invest solely in “bonds.” Well, apparently PIMCO has somehow creatively figured out how to create stock funds without investing in stocks. I guess that is one strategy for a bond-centric company of getting into the equity fund market? This is either ingenious or bordering on the line of criminal. I fall into the latter camp. How the SEC allows the world’s largest bond company to deceivingly market billions in bond-filled stock funds to individual investors is beyond me. After innocent people got fleeced by unscrupulous mortgage brokers and greedy lenders, in this Dodd-Frank day and age, I can’t help but wonder how PIMCO is able to solicit a StockPlus Fund that has 0% invested in common stocks. You can judge for yourself by reviewing their equity-related funds on their website (see also chart below):

PIMCO Active Equity Funds Struggle

With more than 99% of PIMCO’s $2 trillion in assets under management locked into bonds, company executives have made a half-hearted effort of getting into the equity markets, even though they’ve enjoyed high-fiving each other during the three-decade-long bond bull market (see Downhill Marathon Machine). In hopes of diversifying their bond-heavy revenue stream, in 2009 they hired the head of the high-profile $700 billion, government TARP program (Neil Kashkari). Subsequently, PIMCO opened its first set of actively managed funds in 2010. Regrettably for PIMCO, the sledding has been quite tough. In 2012, all six actively managed equity funds lagged their benchmarks. Moreover, just a few weeks ago, Kashkari their rock star hire decided to quit and pursue a return to politics.

Mohamed El-Erian and Bill Gross have never been camera shy or bashful about bashing stocks. PIMCO has virtually all their bond eggs in one basket and their leaderless equity division is struggling. What’s more, like some car salesmen, they have had a creative way of describing the facts. If it’s a Chevy or unbiased advice you’re looking for, I recommend you steer clear from Buick salesmen and PIMCO headquarters.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing SCM had no direct position in PIMCO funds, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Uncertainty: Love It or Hate It?

Uncertainty is like a fin you see cutting through the water – many people are uncertain whether the fin sticking out of the water is a great white shark or a dolphin? Uncertainty generates fear, and fear often produces paralysis. This financially unproductive phenomenon has also reared its ugly fin in the investment world, which has led to low-yield apathy, and desensitization to both interest rate and inflation risks.

The mass exodus out of stocks into bonds worked well for the very few that timed an early 2008 exit out of equities, but since early 2009, the performance of stocks has handily trounced bonds (the S&P has outperformed the bond market (BND) by almost 100% since the beginning of March 2009, if you exclude dividends and interest). While the cozy comfort of bonds has suited investors over the last five years, a rude awakening awaits the bond-heavy masses when the uncertain economic clouds surrounding us eventually lift.

The Certainty of Uncertainty

What do we know about uncertainty? Well for starters, we know that uncertainty cannot be avoided. Or as former Secretary of the Treasury Robert Rubin stated so aptly, “Nothing is certain – except uncertainty.”

Why in the world would one of the world’s richest and most successful investors like Warren Buffett embrace uncertainty by imploring investors to “buy fear, and sell greed?” How can Buffett’s statement be valid when the mantra we continually hear spewed over the airwaves is that “investors hate uncertainty and love clarity?” The short answer is that clarity is costly (i.e., investors are forced to pay a cherry price for certainty). Dean Witter, the founder of his namesake brokerage firm in 1924, addressed the issue of certainty in these shrewd comments he made some 78 years ago, right before the end of worst bear market in history:

“Some people say they want to wait for a clearer view of the future. But when the future is again clear, the present bargains will have vanished.”

Undoubtedly, some investors hate uncertainty, but I think there needs to be a distinction between good investors and bad investors. Don Hays, the strategist at Hays Advisory, straightforwardly notes, “Good investors love uncertainty.”

When everything is clear to everyone, including the novice investing cab driver and hairdresser, like in the late 1990s technology bubble, the actual risk is in fact far greater than the perceived risk. Or as Morgan Housel from Motley Fool sarcastically points out, “Someone remind me when economic uncertainty didn’t exist. 2000? 2007?”

What’s There to Worry About?

I’ve heard financial bears argue a lot of things, but I haven’t heard any make the case there is little uncertainty currently. I’ll let you be the judge by listing these following issues I read and listen to on a daily basis:

- Fiscal cliff induced recession risks

- Syria’s potential use of chemical weapons

- Iran’s destabilizing nuclear program

- North Korean missile tests by questionable new regime

- Potential Greek debt default and exit from the eurozone

- QE3 (Quantitative Easing) and looming inflation and asset bubble(s)

- Higher taxes

- Lower entitlements

- Fear of the collapse in the U.S. dollar’s value

- Rigged Wall Street game

- Excessive Dodd-Frank financial regulation

- Obamacare

- High Frequency Trading / Flash Crash

- Unsustainably growing healthcare costs

- Exploding college tuition rates

- Global warming and superstorms

- Etc.

- Etc.

- Etc.

I could go on for another page or two, but I think you get the gist. While I freely admit there is much less uncertainty than we experienced in the 2008-2009 timeframe, investors’ still remain very cautious. The trillions of dollars hemorrhaging out of stocks into bonds helps make my case fairly clear.

As investors plan for a future entitlement-light world, nobody can confidently count on Social Security and Medicare to help fund our umbrella-drink-filled vacations and senior tour golf outings. Today, the risk of parking your life savings in low-rate wealth destroying investment vehicles should be a major concern for all long-term investors. As I continually remind Investing Caffeine readers, bonds have a place in all portfolios, especially for income dependent retirees. However, any truly diversified portfolio will have exposure to equities, as long as the allocation in the investment plan meshes with the individual’s risk tolerance and liquidity needs.

Given all the uncertain floating fins lurking in the economic background, what would I tell investors to do with their hard-earned money? I simply defer to my pal (figuratively speaking), Warren Buffett, who recently said in a Charlie Rose interview, “Overwhelmingly, for people that can invest over time, equities are the best place to put their money.” For the vast majority of investors who should have an investment time horizon of more than 10 years, that is a question I can answer with certainty.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs) including BND, but at the time of publishing SCM had no direct positions in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Sleeping Through Bubbles and Decade Long Naps

We have lived through many investment bubbles in our history, and unfortunately most investors sleep through the early wealth-creating inflation stages. Typically, the average investor wakes up later to a hot idea once every man, woman, and child has identified the clear trend…right as the bubble is about burst. Sadly, the masses do a great job of identifying financial bubbles at the end of a cycle, but have a tougher time realizing the catastrophic consequences of exiting a tired winner. Or as strategist Jim Stack states, “Bubbles, for the most part, are invisible to those trapped inside the bubble.” The challenge of recognizing bubbles explains why they are more easily classified as bubbles after a colossal collapse occurs. For those speculators chasing a precise exit point on a bubblicious investment, they may be better served by waiting for the prick of the bubble, then take a decade long nap before revisiting the fallen angel investment idea.

Even for the minority of pundits and investors who are able to accurately identify these financial bubbles in advance, a much smaller number of these professionals are actually able to pinpoint when the bubble will burst. Take for example Alan Greenspan, the ex-Federal Reserve Chairman from 1987 to 2006. He managed to correctly identify the technology bubble in late-1996 when he delivered his infamous “irrational exuberance” speech, which questioned the high valuation of the frothy, tech-driven stock market. The only problem with Greenspan’s speech was his timing was massively off. Stated differently, Greenspan was three years premature in calling out the pricking of the bubble, as the NASDAQ index subsequently proceeded to more than triple from early 1997 to early 2000 (the index exploded from about 1,300 to over 5,000).

One of the reasons bubbles are so difficult to time during their later stages is because the deflation period occurs so quickly. As renowned value investor Howard Marks fittingly notes, “The air always goes out a lot faster than it went in.”

Bubbles, Bubbles, Everywhere

Financial bubbles do not occur every day, but thanks to the psychological forces of investor greed and fear, bubbles do occur more often than one might think. As a matter of fact, famed investor Jeremy Grantham claims to have identified 28 bubbles in various global markets since 1920. Definitions vary, but Webster’s Dictionary defines a financial bubble as the following:

A state of booming economic activity (as in a stock market) that often ends in a sudden collapse.

Although there is no numerical definition of what defines a bubble or collapse, the financial crisis of 2008 – 2009, which was fueled by a housing and real estate bubble, is the freshest example in most people minds. However, bubbles go back much further in time – here are a few memorable ones:

Dutch Tulip-Mania: Fear and greed have been ubiquitous since the dawn of mankind, and those emotions even translate over to the buying and selling of tulips. Believe it or not, some 400 years ago in the 1630s, individual Dutch tulip bulbs were selling for the same prices as homes ($61,700 on an inflation adjusted basis). This bubble ended like all bubbles, as you can see from the chart below.

British Railroad Mania: In the mid-1840s, hundreds of companies applied to build railways in Britain. Like all bubbles, speculators entered the arena, and the majority of companies went under or got gobbled up by larger railway companies.

Roaring 20s: Here in the U.S., the Roaring 1920s eventually led to the great Wall Street Crash of 1929, which finally led to a nearly -90% plunge in the Dow Jones Industrial stock index over a relatively short timeframe. Leverage and speculation were contributors to this bust, which resulted in the Great Depression.

Nifty Fifty: The so-called Nifty Fifty stocks were a concentrated set of glamour stocks or “Blue Chips” that investors and traders piled into. The group of stocks included household names like Avon (AVP), McDonald’s (MCD), Polaroid, Xerox (XRX), IBM and Disney (DIS). At the time, the Nifty Fifty were considered “one-decision” stocks that investors could buy and hold forever. Regrettably, numerous of these hefty priced stocks (many above a 50 P/E) came crashing down about 90% during the1973-74 period.

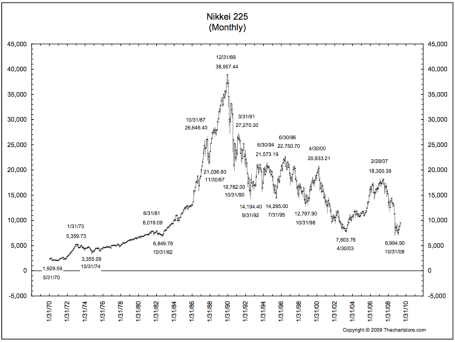

Japan’s Nikkei: The Japanese Nikkei 225 index traded at an eye popping Price-Earnings (P/E) ratio of about 60x right before the eventual collapse. The value of the Nikkei index increased over 450% in the eight years leading up to the peak in 1989 (from 6,850 in October 1982 to a peak of 38,957 in December 1989).

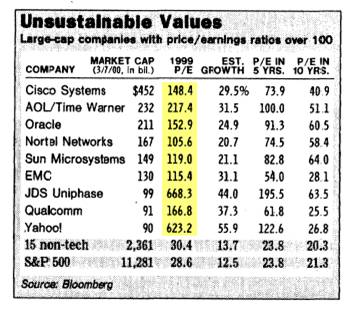

The Tech Bubble: We all know how the technology bubble of the late 1990s ended, and it wasn’t pretty. PE ratios above 100 for tech stocks was the norm (see table below), as compared to an overall PE of the S&P 500 index today of about 14x.

The Next Bubble

What is/are the next investment bubble(s)? Nobody knows for sure, but readers of Investing Caffeine know that long-term bonds are one fertile area. Given the generational low in yields and rates, and the near doubling of long-term Treasury prices over the last twelve years, it can be difficult to justify heavy allocations of inflation losing bonds for long time-horizon investors. Gold, another asset class that has increased massively in price (over 6-fold rise since about 2000) and attracted swaths of speculators, is another target area. However, as we discussed earlier, timing bubble bursts is extremely challenging. Nevertheless, the great thing about long-term investing is that probabilities and valuations ultimately do matter, and therefore a diversified portfolio skewed away from extreme valuations and speculative sectors will pay handsome dividends over the long-run.

Many traders continue to daydream as they chase performance through speculative investment bubbles, looking to squeeze the last ounce of an easily identifiable trend. As the lead investment manager at Sidoxia Capital Management, I spend less time sucking the last puff out of a cigarette, and spend more time opportunistically devoting resources to less popular growth trends. As demonstrated with historical examples, following the trend du jour eventually leads to financial ruin and nightmares. Avoiding bubbles and pursuing fairly priced growth prospects is the way to achieve investment prosperity…and provide sweet dreams.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs) and are short TLT, but at the time of publishing SCM had no direct positions in AVP, MCD, XRX, IBM, DIS, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Equity Quicksand or Bond Cliff?

The markets are rigged, the Knight Capital Group (KCG) robots are going wild, and the cheating bankers are manipulating Libor. I guess you might as well pack it in…right? Well, maybe not. While mayhem continues, equity markets stubbornly grind higher. As we stand here today, the S&P 500 is up approximately +12% in 2012 and the NASDAQ market index has gained about +16%? Not bad when you consider 15 countries are offering negative yields on their bonds…that’s right, investors are paying to lose money by holding pieces of paper until maturity. As crazy as buying technology companies in the late 1990s for 100x’s or 200x’s earnings sounds today, just think how absurd negative yields will sound a decade from now? For heaven’s sake, buying a gun and stuffing money under the mattress is a cheaper savings proposition.

Priced In, Or Not Priced In, That is the Question?

So how can stocks be up in double digit percentage terms when we face an uncertain U.S. presidential election, a fiscal cliff, unsustainable borrowing costs in Spain, and S&P 500 earnings forecasts that are sinking like a buried hiker in quicksand (see chart below)?

I guess the answer to this question really depends on whether you believe all the negative news announced thus far is already priced into the stock market’s below average price-earnings (P/E) ratio of about 12x’s 2013 earnings. Or as investor Bill Miller so aptly puts it, “The question is not whether there are problems. There are always problems. The question is whether those problems are already fully discounted or not.”

While investors skeptically debate how much bad news is already priced into stock prices, as evidenced by Bill Gross’s provocative “The Cult of Equity is Dying” article, you hear a lot less about the nosebleed prices of bonds. It’s fairly evident, at least to me, that we are quickly approaching the bond cliff. Is it possible that we can be entering a multi-decade, near-zero, Japan-like scenario? Sure, it’s possible, and I can’t refute the possibility of this extreme bear argument. However with global printing presses and monetary stimulus programs moving full steam ahead, I find it hard to believe that inflation will not eventually rear its ugly head.

Again, if playing the odds is the name of the game, then I think equities will be a better inflation hedge than most bonds. Certainly, not all retirees and 1%-ers should go hog-wild on equities, but the bond binging over the last four years has been incredible (see bond fund flows).

While we may sink a little lower into the equity quicksand while the European financial saga continues, and trader sentiment gains complacency (Volatility Index around 15), I’ll choose this fate over the inevitable bond cliff.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in KCG or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Digesting the Anchovy Pizza Market

Article is an excerpt from previously released Sidoxia Capital Management’s complementary July 2012 newsletter. Subscribe on right side of page.

I love pizza, and most fellow connoisseurs have difficulty refusing a hot, fresh slice of heaven too. Pizza is so universally appreciated that people consider pizza like ice cream – it’s good even when it’s bad (I agree). However, even the biggest, diehard pizza-lover will sheepishly admit their fondness for the flat and circular cheesy delight changes when you integrate anchovies into the mix. Not many people enjoy salty, slimy, marine creatures layered onto their doughy mozzarella and marinara pizza paradise.

With all the turmoil and uncertainty going on in the global financial markets, prudently investing in a widely diversified portfolio, including a broad range of equity securities, is viewed as palatable as participating in an all-you-can-eat anchovy pizza contest. Why are investors’ appetites so salty now? Hmmm, let me think. Oh yes, here are a few things that come to mind:

- Presidential Election Uncertainty

- European Financial Crisis

- Impending Fiscal Cliff (tax cut expirations, automatic spending cuts, termination of stimulus, etc.)

- Unsustainable Fiscal Debt & Deficits

- Slowing Subpar Domestic Economic Growth

- Partisan Politics and Gridlock in Washington

- High Unemployment

- Fears of a Hard Economic Landing in China

Doesn’t sound too appealing, does it? So, what are most investors doing in this unclear market? Rather than feasting on a pungent pie of anchovies, investors are flocking to the perceived safety of low yielding asset classes, no matter the price. In other words, the short-term warmth and comfort of CDs, money market, checking, and fixed income assets are being gobbled up like nicotine-laced pepperoni pizzas selling for $29.95/each + tax. The anchovy alternative, like stocks, is much more attractively priced now. After accounting for dividends, earnings, and cash flows, the anchovy/stock option is currently offering a 2-for-1 special with breadsticks and a salad…quite the bargain!

Nonetheless, the plain and expensive pepperoni/bond option remains the choice du jour and there are no immediate signs of a pepperoni hangover just quite yet. However, this risk aversion addiction cannot last forever. The bond gorging buffet has gone on relatively unabated for the last three decades, as you can see from the chart below. In spite of this, the bond binging game is quickly approaching a mathematical terminal end-game, as interest rates cannot logically go below zero.

Since my firm (Sidoxia Capital Management) is based in Newport Beach, next to PIMCO’s global headquarters, we get to follow the progression of the bond binging game firsthand. I’ve personally learned that if I manage close to $2 trillion in assets under management, I too can construct a 23-story Taj Mahal-esque headquarters that overlooks the Pacific Ocean from a stones-throw away.

Beyond glorified headquarters, there is evidence of other low-risk appetite examples. Here are some reinforcing pictures:

The Bond Binge

Cash Hoarding

Source (Calafia Beach Pundit): Stuffing money under the mattress has accelerated in recent years as fear, uncertainty, and doubt have reigned supreme.

The Anchovy Special

Even though anchovy pizza, or a broadly diversified portfolio across asset class, size, geography, and style may not sound appealing, there are plenty of reasons to fight the urges of caving to fear and skepticism. Here are a few:

1) Growth Rolls On: Despite the aforementioned challenges occurring domestically and abroad, growth has continued unabated for 11 consecutive quarters, albeit at a rate less than desired. We are not immune to global recessionary forces, but regardless of European forces, the U.S. has been resilient in its expansion.

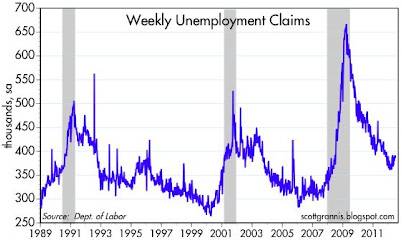

2) Jobs and Housing on the Upswing: Unemployment remains high, but our country has experienced 27 consecutive months of private creation, leading to more than 4 million new jobs being added to our workforce. As you can see from the clear longer-term downward trend in unemployment claims, we are moving in the right direction.

3) Eurozone Slowly Healing its Wounds: The Greek political and fiscal soap opera is grabbing all the headlines, but quietly in the background there are signs that the eurozone is slowly healing the wounds of the financial crisis. If you look at the 2-year borrowing costs of Europe’s troubled countries (ex-Greece), there is an unambiguous and beneficial decline. There is no doubt that Spain and Italy play a larger role than Portugal and Ireland, but at least some seeds of change have been planted for optimism.

4) Record Corporate Profits: Investors are not the only people reading uncertain newspaper headlines and watching CNBC business television. CEOs are reading the same gloomy sensationalistic stories, and as a result, corporations have been cautious about dipping their short arms into their deep pockets. Significant expense reductions and a reluctance to hire have led to record profits and cash hoards. As evidenced by the chart below, profits continue to rise, and these earnings are being applied to shareholder friendly uses like dividends, share buybacks, and accretive acquisitions.

5) Attractive Valuations (Pricing): We have already explored the lofty prices surrounding bonds and $30 pepperoni pizzas, but counter-intuitively, stock prices are trading at a discount to historical norms, despite record low interest rates. All else equal, an investor should pay higher prices for stocks when interest rates are at a record low (and vice versa), but currently we are seeing the opposite dynamic occur.

Even though the financial markets may look, smell, and taste like an anchovy pizza, the price, value, and return benefits may outweigh the fishy odor. And guess what…anchovies are versatile. If you don’t like them on your pizza, you can always take them off and put them on your Caesar salad or use them for bait the next time you go fishing. The gloom-filled headlines haven’t been spectacular, but if they were, the return opportunities would be drastically reduced. Therefore you are much better off by following investor legend Warren Buffett’s advice, which is to “buy fear and sell greed.”

Investing has never been more difficult with record low interest rates, and it has also never been more important. Excluding a small minority of late retirees and wealthy individuals, efficiently investing your retirement dollars has become even more critical. The safety nets of Social Security and Medicare are likely to be crippled, which will require better and more prudent investing by individuals. Inflation relating to food, energy, healthcare, gasoline, and entertainment is dramatically eroding peoples’ nest eggs.

Digesting a pepperoni pizza may sound like the most popular and best option given the gloomy headlines and uncertain outlook, but if you do not want financial heartburn you may consider alternative choices. Like the healthier and less loved anchovy pizza, a more attractively valued strategy based on a broadly diversified portfolio across asset class, size, geography, and style may be the best financial choice to satiate your long-term financial goals.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Rates Dance their Way to a Floor

The globe is awash in debt, deficits are exploding, and the Euro is about to collapse…right? Well, then why in the heck are six countries out of the G-7 seeing their 10-year sovereign debt trade at 2.5% or lower on a consistent downward long-term trajectory? What’s more, three of the six countries witnessing their rates plummet are from Europe, despite pundits continually calling for the demise of the eurozone.

Here is a snapshot of 10-year sovereign debt yields for the majority of the G-7 countries over the last few decades:

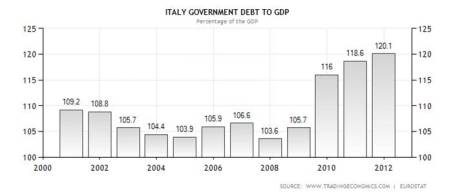

The sole G-7 member missing from the bond yield charts above? Italy. Although Italy’s deficits are not massive (Italy actually has a smaller deficit than U.S. as % of GDP: 3.9% in 2011), its Debt/GDP ratio has been large and rising (see chart below):

As the globe has plodded through the financial crisis of 2008-2009, investors have flocked to the perceived stability of these larger developed countries’ bonds, even if they are merely better homes in a bad neighborhood right now. PIMCO likes to call these popular sovereign bonds, “cleaner dirty shirts.” Buying sovereign debt from these less dirty shirt countries, without sensitivity to price or yield, has been a lucrative trade that has worked consistently for quite some time. Now, however, with sovereign bond yields rapidly approaching 0%, it becomes mathematically impossible to fall lower than the bottom rate floor that developed countries are standing on.

Bond bears have been wrong about the timing of the inevitable bond price reversal, myself included, but the bulls are skating on thinner and thinner ice as rates continue moving lower. The bears may prolong their bragging rights if interest rates continue downward, or persist at these lower levels for extended periods of time. Eventually the “buy the dips” mentality dies, as we so poignantly experienced in 2000 when the technology dips turned into outright collapse.

The Flies in the Bond Binging Ointment

As long as equities remain in a trading range, the “risk-off” bond binging arguments will continue holding water. If corporate earnings remain elevated and stock buybacks carry on, the pain of deflating real returns will eventually become too unbearable for investors. As the insidious rising prices of energy, healthcare, food, leisure, and general costs keep eating away everyone’s purchasing power, even the skeptics will become more impatient with the paltry returns they are currently earning. Earning negative real returns in Treasuries, CDs, money market accounts, and other conservative investments, is not going to help millions of Americans meet their future financial goals. Due to the laundry list of global economic concerns, large swaths of investors are still running and hiding, but this is not a sustainable strategy longer term. The danger from these so-called “safe,” low-yielding asset classes is actually riskier than the perceived risk, in my view.

With that said, I’ve consistently held there are a subset of investors, including a significant number of my Sidoxia Capital Management clients, who are in the later stage of retirement and have a rational need for capital preservation and income generating assets (albeit low yielding). For this investor segment, portfolio construction is not executed due to an opportunistic urge of chasing potential outsized rates of return, but more-so out of necessity. Shorter time horizons eliminate the prudence of additional equity exposure because of the extra associated volatility. Unfortunately, many of the 76 million Baby Boomers will statistically live another 20 – 30 years based on actuarial life expectations and under-save, so the risks of being too conservative can dramatically outweigh the risks of increasing equity exposure. This is all stated in the context of stocks paying a higher yield than long-term Treasuries – the first time in a generation.

Short-term risks and uncertainties remain high, with Greek election outcomes unknown; a U.S. Presidential election in flux; and an impending domestic fiscal cliff that needs to be addressed. But with interest rates accelerating towards 0% and investors’ fright-filled buying of pricey, low-yielding asset classes, many of these risks are already factored into current valuations. As it turns out, the pain of panic can be more detrimental than being stuck in over-priced assets, driven by rates dancing near an absolute floor.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.