Posts tagged ‘Ben Bernanke’

Bin Laden Killing Overshadows Royal Rally

Excerpt from No-Cost May Sidoxia Monthly Newsletter (Subscribe on right-side of page)

Before the announcement of the killing of the most wanted terrorist in the world, Osama bin Laden, the royal wedding of Prince William Arthur Philip Louis and Catherine Middleton (Duke and Duchess of Cambridge) grabbed the hearts, headlines, and minds of people around the world. As we exited the month, a less conspicuous royal rally in the U.S. stock market has continued into May, with the S&P 500 index climbing +2.8% last month as the economic recovery gained firmer footing from the recession of 2008 and early 2009. As always, there is no shortage of issues to worry about as traders and speculators (investors not included) have an itchy sell-trigger finger, anxiously fretting over the possibility of losing gains accumulated over the last two years.

Here are some of the attention-grabbing issues that occurred last month:

Powerful Profits: According to Thomson Reuters, first quarter profit growth as measured by S&P 500 companies is estimated at a very handsome +18% thus far. At this point, approximately 84% of companies are exceeding or meeting expectations by a margin of 7%, which is above the long-term average of a 2% surprise factor.

Powerful Profits: According to Thomson Reuters, first quarter profit growth as measured by S&P 500 companies is estimated at a very handsome +18% thus far. At this point, approximately 84% of companies are exceeding or meeting expectations by a margin of 7%, which is above the long-term average of a 2% surprise factor.

Debt Anchor Front & Center: Budget battles remain over record deficits and debt levels anchoring our economy, but clashes over the extension of our debt ceiling will occur first in the coming weeks. Skepticism and concern were so high on this issue of our fiscal situation that the Standard & Poor’s rating agency reduced its outlook on the sovereign debt rating of U.S. Treasury securities to “negative,” meaning there is a one-in-three chance our country’s debt rating could be reduced in the next two years. Democrats and Republicans have put forth various plans on the negotiating table that would cut the national debt by $4 – $6 trillion over the next 10-12 years, but a chasm still remains between both sides with regard to how these cuts will be best achieved.

Debt Anchor Front & Center: Budget battles remain over record deficits and debt levels anchoring our economy, but clashes over the extension of our debt ceiling will occur first in the coming weeks. Skepticism and concern were so high on this issue of our fiscal situation that the Standard & Poor’s rating agency reduced its outlook on the sovereign debt rating of U.S. Treasury securities to “negative,” meaning there is a one-in-three chance our country’s debt rating could be reduced in the next two years. Democrats and Republicans have put forth various plans on the negotiating table that would cut the national debt by $4 – $6 trillion over the next 10-12 years, but a chasm still remains between both sides with regard to how these cuts will be best achieved.

Inflation Heating Up: The global economic recovery, fueled by loose global central bank monetary policies, has resulted in fanning of the inflation flames. Crude oil prices have jumped to $113 per barrel and gasoline has spiked to over $4 per gallon. Commodity prices have jumped up across the board, as measured by the CRB (Commodity Research Bureau) BLS Index, which measures the price movements of a basket of 22 different commodities. The CRB Index has risen over +28% from a year ago. Although the topic of inflation is dominating the airwaves, this problem is not only a domestic phenomenon. Inflation in emerging markets, like China and Brazil, has also expanded into a dangerous range of 6-7%, and many of these governments are doing their best to slow-down or reverse loose monetary policies from a few years ago.

Inflation Heating Up: The global economic recovery, fueled by loose global central bank monetary policies, has resulted in fanning of the inflation flames. Crude oil prices have jumped to $113 per barrel and gasoline has spiked to over $4 per gallon. Commodity prices have jumped up across the board, as measured by the CRB (Commodity Research Bureau) BLS Index, which measures the price movements of a basket of 22 different commodities. The CRB Index has risen over +28% from a year ago. Although the topic of inflation is dominating the airwaves, this problem is not only a domestic phenomenon. Inflation in emerging markets, like China and Brazil, has also expanded into a dangerous range of 6-7%, and many of these governments are doing their best to slow-down or reverse loose monetary policies from a few years ago.

Expansion Continues but Slows: Economic expansion continued in the first quarter, but slowed to a snail’s pace. The initial GDP (Gross Domestic Product) reading for Q1 slowed down to +1.8% growth. Brakes on government stimulus and spending subtracted from growth, and high fuel costs are pinching consumer spending.

Expansion Continues but Slows: Economic expansion continued in the first quarter, but slowed to a snail’s pace. The initial GDP (Gross Domestic Product) reading for Q1 slowed down to +1.8% growth. Brakes on government stimulus and spending subtracted from growth, and high fuel costs are pinching consumer spending.

Ben Holds the Course: One person who is not overly eager to reverse loose monetary policies is Federal Reserve Chairman, Ben Bernanke. The Chairman vowed to keep interest rates low for an “extended period,” and he committed the Federal Reserve to complete his $600 billion QE2 (Quantitative Easing) bond buying program through the end of June. If that wasn’t enough news, Bernanke held a historic, first-ever news conference. He fielded a broad range of questions and felt the first quarter GDP slowdown and inflation uptick would be transitory.

Ben Holds the Course: One person who is not overly eager to reverse loose monetary policies is Federal Reserve Chairman, Ben Bernanke. The Chairman vowed to keep interest rates low for an “extended period,” and he committed the Federal Reserve to complete his $600 billion QE2 (Quantitative Easing) bond buying program through the end of June. If that wasn’t enough news, Bernanke held a historic, first-ever news conference. He fielded a broad range of questions and felt the first quarter GDP slowdown and inflation uptick would be transitory.

Skyrocketing Silver Prices: Silver surged ahead +28% in April, the largest monthly gain since April 1987, and reached a 30-year high in price before closing at around $49 per ounce at the end of the month. Speculators and investors have been piling into silver as evidenced by activity in the SLV (iShares Silver Trust) exchange traded fund, which on occasion has seen its daily April volume exceed that of the SPY (iShares SPDR S&P 500) exchange traded fund.

Obama-Trump Birth Certificate Faceoff: Real estate magnate and TV personality Donald Trump broached the birther issue again, questioning whether President Barack Obama was indeed born in the United States. President Obama produced his full Hawaiian birth certificate in hopes of putting the question behind him. If somehow Trump can be selected as the Republican presidential candidate for 2012, he will certainly try to get President Obama “fired!”

Obama-Trump Birth Certificate Faceoff: Real estate magnate and TV personality Donald Trump broached the birther issue again, questioning whether President Barack Obama was indeed born in the United States. President Obama produced his full Hawaiian birth certificate in hopes of putting the question behind him. If somehow Trump can be selected as the Republican presidential candidate for 2012, he will certainly try to get President Obama “fired!”

Charlie Sheen…Losing! The Charlie Sheen soap opera continues. Ever since Sheen has gotten kicked off the show Two and a Half Men, speculation has percolated as to whether someone would replace Sheen to act next to co-star John Cryer. Names traveling through the gossip circles include everyone from Woody Harrelson to Jeremy Piven to Rob Lowe. Time will tell whether the audience will laugh or cry, but regardless, Sheen will be laughing to the bank if he wins his $100 million lawsuit against Warner Brothers (TWX).

Charlie Sheen…Losing! The Charlie Sheen soap opera continues. Ever since Sheen has gotten kicked off the show Two and a Half Men, speculation has percolated as to whether someone would replace Sheen to act next to co-star John Cryer. Names traveling through the gossip circles include everyone from Woody Harrelson to Jeremy Piven to Rob Lowe. Time will tell whether the audience will laugh or cry, but regardless, Sheen will be laughing to the bank if he wins his $100 million lawsuit against Warner Brothers (TWX).

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain commodity and S&P 500 exchange traded funds, but at the time of publishing SCM had no direct position in SLV, SPY, TWX, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

QE2 Drowning TIPS Yields Below Water

The holiday season is creeping up on us, and the only question building up more anticipation than what gift kids are going to get from Santa Claus is what investors are going to get from Federal Reserve Chairman Ben Bernanke – in the form of QE2 (Quantitative Easing Part II)? The inevitable QE2 program is an effort designed by the Fed to keep interest rates low and reduce the threat of deflation. In addition, QE2 is structured to stimulate the meager 0.8% core inflation experienced over the last 12 months (Bloomberg) to a Goldilocks level – not too hot and not too cold. Some pundits suggest the Fed should target a 2% inflation rate. QE2 asset purchase estimates are all over the map, but I can safely guess somewhere between a few hundred billion and $2 trillion (very brave of me).

Treasuries Weigh Down TIPS Yields

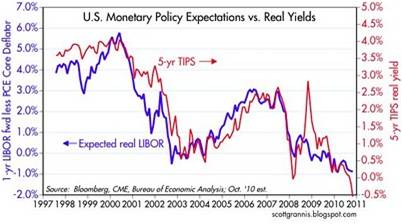

Ever since QE1 expired in the March timeframe, speculation began about the next potential slug of Treasuries and mortgage backed securities to be purchased by the Fed. As a consequence, this speculation became a contributing factor to 10-Year Treasury yields plummeting from around 4.0% to around 2.5%. Simultaneously, 5-Year TIPS (Treasury Inflation Protection Securities) yields have moved to negative territory.

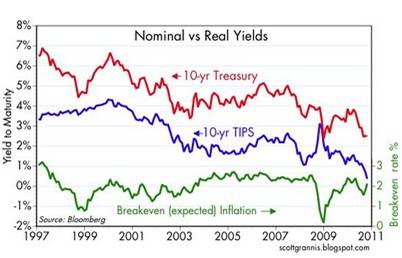

Scott Grannis at Calafia Beach Pundit has a great chart showing the relationship between nominal Treasury yields, real TIPS yields, and expected inflation for 10-year maturities. As you can see below, over the last ten years there has been a tight correlation between the 10-year Treasury bond versus TIPS, with the former 10-year declining yield acting as a weight drowning the latter TIPS yield:

Worth noting, absent the brief period in late-2008 and early-2009, inflation expectations have been remarkably stable in that 1.5% – 2.5% range.

Negative Yields…Who Cares?!

Unprecedented times have created an unprecedented appetite for bonds (see Bubblicious Bonds), and as a result, we just witnessed a historic $10 billion TIPS auction this week producing an eye-catching negative -0.55% yield. Sensationalist commentators characterize the negative yield dynamic as a money losing proposition, whereby investors are forced to pay the government. This assertion is quite a distortion and not quite true – we will review the mechanics of TIPS later.

If we’re not back to a panic filled environment of soup kitchen lines and bank runs, then why are TIPS paying a negative yield?

- QE2: As mentioned above, investor expectations are that Uncle Sam will come to the rescue and deliver lower interest rates (higher prices) through purchases of Treasuries and mortgage-backed securities.

- Rising Inflation Expectations: As fears surrounding future inflation increase, the price of TIPS will rise, and yields will fall.

- Sluggish Economy: Lackluster growth and fear of double dips have pressured rates lower as debates still linger about whether or not the U.S. will follow Japan (see Lost Decade).

Nuts & Bolts of TIPS

TIPS maturities come in terms of 5 years, 10 years and 30 years. Per the Treasury, 5-year TIPS are auctioned in April and October; 10-year TIPS in January, March, May (beginning in 2011), July, September, and November; and 30-year TIPS in February and August.

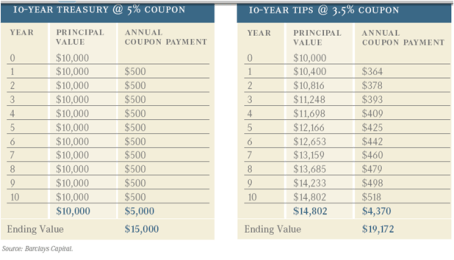

This table from Barclays Capital below does an excellent job of conceptually displaying the differences between vanilla Treasuries and TIPS.

Some Observations:

1) As you can see, the principal value of the TIPS security adjusts with inflation (Consumer Price Index). The price of the TIPS security, which we cannot see in the example, adjusts upwards (or downwards) with inflation expectations.

2) The TIPS security pays a lower coupon (3.5% vs. 5.0%), but you can see that under a 4% annual inflation assumption (principal value adjusts from $10,000 in Year 0 to $10,400 in Year 1), the ending value of the TIPS comes up significantly higher ($19,172 vs. $15,000).

3) The break-even inflation expectation rate is 1.5% (derived from 5% coupon minus 3.5% coupon). If you think inflation will average more than 1.5%, then buy the TIPS security. If you think inflation will average less than 1.5%, then buy the 10-year Treasury.

TIPS Advantages

- Inflation Protection: At the risk of stating the obvious, if you expect long-term inflation to average substantially more than about 2% (current inflation expectations), then TIPS are a great way of protecting your purchasing power.

- Deflation Protection: Perhaps TIPS should be called DIPS (Deflation Income Protection Securities)? What some investors do not realize is that even if our country were to spiral into long-term deflationary crisis, TIPS investors are guaranteed the original amount of principal. Yes, that’s right…guaranteed. Interest payments could conceivably decline to zero and the principal value could temporarily fall below par, but the government guarantees the original principal regardless of the scenario.

- No Credit or Default Risk: The advantage of the government owning its own printing press is that there is very little risk of default, so preservation of capital is not much of a risk.

TIPS Disadvantages

- Interest Rate Risk: It’s great to be indexed to inflation, but because TIPS include long-range maturities, investors face a significant amount of interest rate risk if the TIPS are not held until maturity. TIPS will likely outperform Treasuries under a rising rate scenario, but will be impacted nonetheless.

- CPI Risk: Even if you are not a conspiracy theorist who believes government CPI figures are artificially depressed, it is still quite possible your personal baskets of purchases do not perfectly align with the arbitrary CPI basket of goods.

- Negative Deflation Adjustments: Although a TIPS investor has an embedded “deflation floor” equivalent to original principal value, interest payments will be negatively impacted by declines in principal value during deflationary periods. Also, previously issued TIPS with accumulated principal values from inflationary adjustments run larger principal loss risks as compared to newly issued TIPS.

Although 5-year TIPS yields may have dunked below water into negative territory, the headline bark is much worse than the bite. There has been a massive rally in bond prices in front of the QE2 bond binge by the Fed. Nevertheless, inflation expectations have remained fairly stable and TIPS still provide defensive characteristics under both a future inflationary or deflationary scenario. If the Fed is indeed successful in manufacturing a reasonable Goldilocks range of inflation then TIPS yields should once again be able to come up for air.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds (including TIP), but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

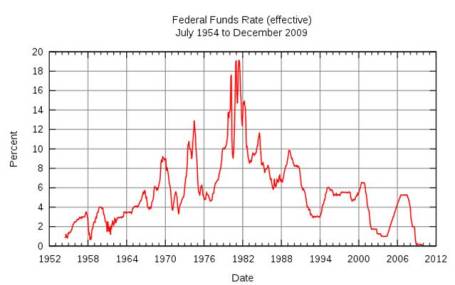

Fed Ponders New Surgical Tool

The Fed is closely monitoring the recovering patient (the U.S. economy) after providing a massive dose of monetary stimulus. The patient is feeling numb from the prescription, but if the Fed is not careful in weaning the subject off the medicine (dangerously low Federal Funds rate), dangerous side- effects such as a brand new bubble, rampant inflation, or a collapsing dollar could ensue.

In preparing for the inevitable pain of the Federal Reserve’s “exit strategy,” the institution is contemplating the use of a new tool – interest rates paid to banks on excess reserves held at the Fed. A likely by-product of any deposit-based rate increase will be higher rates charged on consumer loans.

Currently, the Federal Reserve primarily controls the targeted Federal funds rate (the rate at which banks make short-term loans to each other) through open market operations, such as the buying and selling of government securities. Specifically, repurchase agreements made between the Federal Reserve and banks are a common strategy used to control the supply and demand of money, thereby meeting the Fed’s interest rate objective.

Although a relatively new tool created from a 2006 law, paying interest on excess reserves can help in stabilizing the Federal Funds rate when the system is awash in cash – the Fed currently holds over $1 trillion in excess reserves. Failure to meet the inevitably higher Fed Funds target is a major reason policymakers are contemplating the new tool. The Fed started paying interest rates on reserves, presently 0.25%, in the midst of the financial crisis in late 2008. Rate policy implementation based on excess reserves would build a stable floor for Federal Funds rate since banks are unlikely to lend to each other below the set Fed rate. The excess reserve rate-setting tool, although a novel one for the United States, is used by many foreign central banks.

Watching the Fed

While the Fed discusses the potential of new tools, other crisis-originated tools designed to improve liquidity are unwinding. For example, starting February 1st, emergency programs supporting the commercial paper, money market, and central bank swap markets will come to a close. The closure of such program should have minimal impact, since the usage of these tools has either stopped or fizzled out.

Fed watchers will also be paying attention to comments relating to the $1 trillion+ mortgage security purchase program set to expire in March. A sudden repeal of that plan could lead to higher mortgage rates and hamper the fragile housing recovery.

When the Fed policy makers meet this week, another tool open for discussion is the rate charged on emergency loans to banks – the discount rate (currently at 0.50%). Unlike the interest rate charged on excess reserves, any change to the discount rate will not have an impact charged on consumer loans.

While the Fed’s exit strategy is a top concern, market participants can breathe a sigh of relief now that Federal Reserve Chairman Ben Bernanke has been decisively reappointed – lack of support would have resulted in significant turmoil.

The patient (economy) is coming back to life and now the extraordinary medicines prescribed to the subject need to be responsibly removed. As the Federal Reserve considers its range of options, old instruments are being removed and new ones are being considered. The health of the economy is dependent on these crucial decisions, and as a result all of us will be carefully watching the chosen prescription along with the patient’s vital signs.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds but at the time of publishing had no direct positions in securities mentioned in the article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Flogging the Financial Firefighter

There we were in the fall of 2008, our economic system burning up in flames, as we all watched century-old financial institutions falling like flies. At the center of the inferno was Federal Reserve Chairman Ben Bernanke. In coordination with other government agencies and officials, Bernanke managed to prevent the worse financial crisis since the Great Depression from completely scorching the economy into ruin. After successfully hosing down the flames (at least temporarily), Ben Bernanke is now being singled out as the scapegoat and getting flogged for being a major participant in the financial crisis.

Execution Threatened Water Damage

In hind-sight could Bernanke have made better decisions? Certainly. Despite the Federal Reserve dousing out the flames, politicians are pointing the finger at Bernanke for causing water damage. I’m going to go out on a limb and say water damage is preferable to the alternative – a whole community of properties burned down to a large pile of charred ash.

Democrats are now flailing in the wake of the Massachusetts Democratic Senate seat loss to Republican Scott Brown. Even though I question President Obama’s blame-game tax and overhaul tactics (see Surgery or Amputation article), to his credit Obama realizes the instability of mass proportion that would occur if the reappointment of Bernanke were to come to fruition. If the head of the globe’s largest financial system is going to be kicked to the curb after saving our economy at the edge of an abyss, then heaven please help us.

Politics Will Reign Supreme in 2010

“Change” was promised in the 2008 Presidential election and the impatient natives are not seeing results fast enough, given lofty unemployment rates and unsuccessful implementation of other initiatives (thus far). Needless to say, the media is going to be awash in an orgy of political mudslinging and campaign promises that will overwhelm the airwaves for the balance of the year.

From a market standpoint, Republicans and Democrats, alike, do share some common ground…jobs. As a countervailing trend to the forces dragging down the economy, the unified focus on job creation should provide some support to the financial markets.

Unfortunately, the independence of the Federal Reserve is being dragged into the political ring as Ben Bernanke’s reappointment process cannot escape the Capitol Hill circus. Berkshire Hathaway (BRKA/B) CEO Warren Buffett has likely handicapped the market’s reaction to a failed Bernanke reappointment when he recently stated, “Just tell me a day ahead of time so I can sell some stocks.” If the fires of 2008 concerned you, you may want to have your fire alarm and water hose ready for action if Chairman Bernanke is shown the exit.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, and at the time of publishing had no direct positions in BRKA/B. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Rogers: Fed Following in Path of Dodo

Jimmy Rogers, the bow-tie boss of Rogers Holdings and past co-founder of the successful Quantum Fund with George Soros, is no stranger to making outrageous predictions. His latest prophetic assessment is the Federal Reserve Bank is on the path of the Dodo bird to extinction:

“Don’t worry – the Fed is going to abolish itself. Between Bernanke and Greenspan, they’ve made so many mistakes that within the next few years the Fed will disappear.”

Given the shock and awe that transpired from the Lehman Brothers collapse, I can only wonder how investors might react to this scenario….hmmm. If this doozy of an outlandish call catches you off guard, please don’t be surprised – Rogers is not shy about sharing additional ones (Read other IC article on Rogers). For example, just six months ago Rogers said the Dow Jones could collapse to 5,000 (currently around 10,472) or skyrocket to 30,000, but “of course it would be in worthless money.” Oddly, the printing presses that Rogers keeps talking about have actually produced deflation (-0.2%) in the most recently reported numbers, not the same 79,600,000,000% inflation from Zimbabwe (Cato Institute), he expects.

I suppose Rogers will either point to a data conspiracy, or use the “just you wait” rebuttal. I eagerly await, with bated breath, the ultimate outcome.

Is U.S. Fed Alone?

If the U.S. Federal Reserve system is indeed about to disappear after over nine decades of operations, does that mean Rogers advocates shutting all of the other 166 global reserve banks listed by the Bank for International Settlement? Should the 3 ½ century old Swedish Riksbank (origin in 1668) and the Bank of England (1694) central banks also be terminated? Or does the U.S. Federal Reserve Bank have a monopoly on incompetence and/or corruption?

Sidoxia’s Report Card on Fed

I must admit, I believe we would likely be in a much better situation than we are today if the Federal Reserve board let Adam Smith’s “invisible hand” self adjust short-term interest rates. Rather, we drank from the spiked punch bowls filled with low interest rates for extended periods of time. The Federal Reserve gets too much attention/credit for the impact of its decisions. There is a much larger pool of global investors that are buying/selling Treasury securities daily, across a wide range of maturities along the yield curve. I think these market participants have a much larger impact on prices paid for new capital, relative to the central bank’s decision of cutting or raising the Federal funds rate a ¼ point.

Although I believe the Fed gets too much attention for its monetary policies, I think Bernanke and the Fed get too little credit for the global Armageddon they helped avoid. I agree with Warren Buffett that Bernanke acted “very promptly, very decisively, very big” in helping us avert a second depression while we were on the “brink of going into the abyss.”

Beyond the monetary policy of fractional rate setting, the Fed also has essential other functions:

- Supervise and regulate banking institutions.

- Maintain stability of the financial system and control systemic risk of financial markets.

- Act as a liaison with depository institutions, the U.S. government, and foreign institutions.

- Play a major role in operating the country’s payments system.

I will go out on a limb and say these functions play an important role, and the Fed has a good chance of being around for the 2012 London Olympic Games (despite Jimmy Rogers’ prediction).

Sidoxia’s Report Card on Rogers

As I have pointed out in the past, I do not necessarily disagree (directionally) with the main points of his arguments:

- Is inflation a risk? Yes.

- Will printing excessive money lower the value of our dollar? Yes.

- Is auditing the Federal Reserve Bank a bad idea? No.

My beef with Rogers is merely in the magnitude, bravado, and overconfidence with which he makes these outrageous forecasts. Furthermore, the U.S. actions do not happen in a vacuum. Although everything is not cheery at home, many other international rivals are in worse shape than we are.

From a media ratings and entertainment standpoint, Rogers does not disappoint. His amusing and outlandish predictions will keep the public coming back for more. Since according to Rogers, Bernanke will have no job at the Fed in a few years, I look forward to their joint appearance on CNBC. Perhaps they could discuss collaboration on a new book – Extinction: Lessons Learned from the Fed and Dodo Bird.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds (VFH) at the time of publishing, but had no direct ownership in BRKA/B. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

The Halloween Indicator Buried at Cemetery in 2009

Boo!

Statisticians, economists, speculators, and superstitious investors have been known to get spooked by scary patterns. Tomorrow marks the end of the menacing six month period of supposed underperformance that starts in May and ends on Halloween. The so-called “Halloween Indicator” has popularized the expression of “sell in May and walk away.” The indicator obviously has not followed the alleged tendency in 2009, as there has been more “treat” than “trick” for investors over the last six months. The S&P has rallied about +22% (excluding dividends) with only one day left in the trading period. Numerous academics have studied the phenomenon and not surprisingly there is some debate regarding the validity of various studies (see past study) – differing opinions have risen to the surface, depending on the number of years compiled in the data.

Here is what Mark Hulbert at MarketWatch had to say on the subject:

“Over the Dow’s history up until the last 12 months, there were no fewer than 17 occasions (15% of the years) in which both the winter months turned in a net loss for the stock market and the summer months produced a gain. There furthermore were 45 years (41% of the time) in which the stock market during the summer period did better than it did over the winter months that immediately preceded it. So the stock market’s performance over the last 12 months is hardly exceptional. It would take a lot more than the recent seasonal missteps to convince a statistician that this long-term pattern has stopped working for good. “

Other calendar effects besides the Halloween Indicator include, the January Effect, Monday Effect, and Presidential Cycle. Even though some pundits point to evidence supporting calendar effects, in many cases the data is proved to be statistically insignificant.

With Halloween just around the corner, here’s Sidoxia Capital Management wishing you a larger bag of treats rather than tricks in your quest in following calendar effects.

Wall Street Halloween Costume Ideas:

Short of ideas for Halloween costumes this year? No need to fear. Here are a few bloodcurdling Wall Street costume ideas with the help of Joshua Brown at The Reformed Broker and our friends at Forbes:

Top Ten Scariest Wall Street Halloween Costumes

Halloween Index:

For those that would rather get there treats from the stock market rather than a candy bowl, perhaps you may find a sweet idea from Stockerblog’s Halloween Stock Index.

Have a happy and safe Halloween!

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management and client accounts do not have direct positions in any of the Halloween Stock Index companies with the exception of long positions in WMT for some Sidoxia accounts. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page

Bernanke Portfolio Takes Painful Hit

As a former tenured economics professor at Princeton University, I would believe Ben Bernanke would understand and appreciate the power of diversification, but apparently not. The bulk of his $1.2 million to $2.5 million (only a broad range was disclosed) was invested in a large-cap stock fund and a fixed-rate annuity from TIAA-CREF. Some would say his portfolio could use a higher dosage of small-cap, mid-cap, international and alternative asset classes, including real estate. With arguably the highest ranking finance job in the universe, wouldn’t you expect him to have a smoking hot portfolio? The data paints a different picture.

According to publicly disclosed data, Bernanke’s assets were down -29% (about -$600,000) in 2008, better than the S&P 500, but not comparable since his portfolio also included fixed income securities like Canadian treasury bonds and an annuity fund. For whatever reason, the global money czar couldn’t or wouldn’t use his knowledge to outmaneuver the markets. Why didn’t he use the Yen carry trade to buy crude oil up to $140 per barrel, then short emerging markets during 2008 before going long technology stocks beginning on March 9, 2009?

Certainly, Bernanke does not want to create a conflict of interest, whether real or implied. I’m sure Bernanke is not day trading options and shorting levered Exchange Traded Funds (ETFs) on E-Trade, because the headaches it would create for him would undoubtedly outweigh any short-term financial benefits earned from his investment ideas. Even if Bernanke felt he could exploit profit opportunities, the real bucks will come from speaking events and consulting prospects after he leaves his position of Federal Reserve Chairman. If Bernanke does a better job with his portfolio, perhaps he can retire at a younger age…

Read Article on Bernanke Portfolio

Wade W. Slome CFA, CFP®

Plan. Invest. Prosper.