To Taper or Not to Taper…That is the Question?

It’s not Hamlet who is providing theatrical intrigue in the financial markets, but rather Federal Reserve Chairman Ben Bernanke. Watching Bernanke decide whether to taper or not to taper the $85 billion in monthly bond purchases (quantitative easing) is similar to viewing an emotionally volatile Shakespearean drama. The audience of investors is sitting at the edge of their seats waiting to see if incoming Fed Chief will be plagued with guilt like Lady Macbeth for her complicit money printing ways or will she score a heroic and triumphant victory for her hawkish stance on quantitative easing (QE). No need to purchase tickets at a theater box office near you, the performance is coming live to your living room as Yellen’s upcoming Senate confirmation hearings will be televised this upcoming week.

Bad News = Good News; Good News = Bad News?

In deciding whether to slowly kill QE, the Fed has been stricken with the usual stream of never-ending economic data (see current data from Barry Ritholtz). Most recently, investors have followed the script that says bad news is good news for stocks and good news is bad news. So-called pundits, strategists, and economists generally believe sluggish economic data will lead the Fed to further romance QE for a longer period, while robust data will force a poisonous death to QE via tapering.

Good News

Despite the recent, tragically-perceived government shutdown, here is the week’s positive news that may contribute to an accelerated QE stimulus tapering:

- Strong Jobs: The latest monthly employment report showed +204,000 jobs added in October, almost +100,000 more additions than economists expected. August and September job additions were also revised higher.

- GDP Surprise: 3rd quarter GDP registered in at +2.8% vs. expectations of 2%.

- IPO Dough: Twitter Inc (TWTR) achieved a lofty $25,000,000,000 initial public offering (IPO) value on its first day of trading.

- ECB Cuts Rates: The European Central Bank (ECB) lowered its key benchmark refinancing rate to a record low 0.25% level.

- Service Sector Surge: ISM non-manufacturing PMI data for October came in at 55.4 vs. 54.0 estimate.

Bad News

Here is the other side of the coin, which could assist in the delay of tapering:

- Mortgage Apps Decline: Last week the MBA mortgage application index fell -7%.

- Jobless # Revised Higher: Last week’s Initial jobless Claims were revised higher by 5,000 to 345,000.

- Investors Too Happy: The spread between Bulls & Bears is highest since April 2011 as measured by Investors Intelligence

Much Ado About Nothing

With the recent surge in the October jobs numbers, the tapering plot has thickened. But rather than a tragic death to the stock market, the inevitable taper and eventual tightening of the Fed Funds rate will likely be “Much Ado About Nothing.” How can that be?

As I have written in an article earlier this year (see 1994 Bond Repeat), the modest increase in 2013 yields (up +1.35% approximately) from the July 2012 lows pales in comparison to the +2.5% multi-period hike in the 1994 Federal Funds rate by then Fed Chairman Alan Greenspan. What’s more, inflation was a much greater risk in 1994 with GDP exceeding 4.0% and unemployment reaching a hot 5.5% level.

Given an overheated economy and job market in 1994, coupled with a hawkish Fed aggressively raising rates, the impact of these factors must have been disastrous for the stock market…right? WRONG. The S&P 500 actually finished the year essentially flat (~-1.5%) after experiencing some volatility earlier in the year, then subsequently stocks went on a tear to more than triple in value over the next five years.

To taper or not to taper may be the media question du jour, however the Fed’s ultimate decision regarding QE will most likely resemble a heroic Shakespearean finale or Much Ado About Nothing. Panicked portfolios may be in love with cash like Romeo & Juliet were with each other, but overreaction by investors to future tapering and rate hikes may result in poisonous or tragic returns.

Referenced article: 1994 Bond Repeat or 2013 Stock Defeat?

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing SCM had no direct position in TWTR, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page. Some Shakespeare references were sourced from Kevin D. Weaver.

Hunt for Red October Turns Green

This article is an excerpt from a previously released Sidoxia Capital Management complementary newsletter (November 1, 2013). Subscribe on the right side of the page for the complete text.

In the movie the Hunt for Red October, Sean Connery plays Marko Ramius, a Soviet Union submarine commander, who wants to defect to the United States. Jack Ryan, played by Alec Baldwin, plays a CIA analyst who attempts to prevent Ramius’ stealthy submarine from attacking American soil.

October has historically been viewed as a bloody period in the stock market, given the multiple October crashes occurring in 1929, 1987, and 2008. However, the large number of bears and skeptics who were on a hunt for red (losing) October were rudely surprised last month. Rather than plunging in value, stocks ascended to new record green heights. Specifically, the S&P 500 index rose +4.5% in October, bringing 2013’s total climb to +23.2% (NASDAQ +29.8% for the year).

While the Soviet “Cold War” may have ended in the early 1990s, when it comes to retirement and financial assets, the emotional war for a prosperous future seems to never end for those without an investment plan.

How Can it Be?!

As the financial markets have recently grinded to new all-time record highs, I still stumble across a vast number of skeptics and doubters. These cynical cats make comments and ask questions like:

- “You’re shorting the market, right?” (i.e., betting prices will go down)

- “I’ll just get in and buy when the market goes down.”

- “How can the stock market keep setting new highs when the economy is so weak?”

- “This country is going to hell in a handbasket…what are these politicians in Washington thinking?!”

- “The only reason the market is up is due to the Federal Reserve’s money printing and artificial manipulation of the financial system.” (see also Greatest Thing Since Sliced Bread)

These are but a few of the widespread concerns, and understandably so because fear, uncertainty, and doubt are exactly what media outlets shovel in the faces of the masses. However, unlike humans, the financial markets do not watch TV or listen to the radio. As famed investor Benjamin Graham notes, “In the short run, the market is a voting machine but in the long run it is a weighing machine.” Or in other words, emotions can rule the short-term, but positive or negative fundamentals will rule the day over the long-term.

While the concerns listed above may have some validity, here are some alternative perspectives to help explain why patient investors have been rewarded:

Record Profits

|

| Source: Ed Yardeni (Dr. Ed’s Blog) |

This isn’t the first or last time I’ve focused on earnings data. At the end of the day, my investment philosophy that “prices follow earnings” aligns with legend Peter Lynch’s views:

“People may bet on hourly wiggles of the market but it’s the earnings that waggle the wiggle long term.”

Stocks are Cheap (Not Expensive)

Despite the massive run-up in prices, stocks are cheap. There are some metrics that show equity prices as fairly valued, but there is plenty of data to support why stocks have and continue to be loved.

|

| Source: Ed Yardeni (Dr. Ed’s Blog) |

Although the Federal Reserve’s economic model above shows how overvalued technology stocks were during the late-1990s bubble, eventually the speculative period burst. On the flip side, you can see how attractively priced (undervalued) stocks look today (prices are significantly below the historical average).

If that’s not enough evidence for you, take a peek at strategist Don Hays’s “Rule of Twenty” chart below (see also Investing Caffeine article). If you go back multiple decades, you can see a fairly tight correlation between the blue line (stock valuation/prices) and red line (Rule of 20), which creates an estimated fair value target that integrates inflation. So as you can see, when the blue line rises above the red line, stock prices are overvalued. Once again, you can see that stocks currently are relatively cheap historically (blue line below the red line), based on Hays’s analysis.

|

| Source: Hays Advisory |

Economy Keeps Chugging Along

The job market has improved dramatically, housing prices have rebounded, and families have lowered the debt on their balance sheets. The net result of these developments is evidenced by record consumer spending at retail (see chart below):

|

The 15 out of 16 quarters of economic growth as measured by Gross Domestic Product (GDP) have also been assisted by record exports (see chart below). Even though growth in the U.S. remains sluggish, innovative companies have found creative ways to export unique goods and services abroad.

Source: Calculated Risk

Even though Halloween is behind us, there are still bound to be some scary tricks ahead of us, including heated debates over government shutdowns, debt ceilings, and sequestrations. The key to a successful financial future is having a balanced, diversified portfolio that meets your long-term objectives, while helping you avoid investment torpedoes. Investing based on emotional, knee-jerk reactions to noisy mainstream media headlines is a sure way to sink your portfolio. That’s advice I’m sure Jack Ryan could agree on. If investors follow this guidance, their Hunt for Red October can turn into green portfolios.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Sitting on the Sidelines: Fear & Selective Memory

Fear is a motivating (or demotivating) emotion that can force individuals into suboptimal actions. The two main crashes of the 2000s (technology & housing bubbles) coupled with the mini-crises (e.g., flash crash, European crisis, debt ceiling, sequestration, fiscal cliff, etc.) have scared millions of investors and trillions of dollars to sit on the sidelines. Financial paralysis may be great in the short-run for bruised psyches and egos, but for the passive onlookers, the damage to retirement accounts can be crippling.

Selective memory is a great coping mechanism for those investors sitting on the sidelines as well. Purposely forgetting your wallet at a group dinner may be beneficial in the near-term, but repeated incidents will result in lost friends over the long-run. Similarly, most gamblers frequenting casinos tend to pound their chests when bragging about their wins, however they tend to conveniently forget about all the losses. These same reality avoidance principles apply to investing.

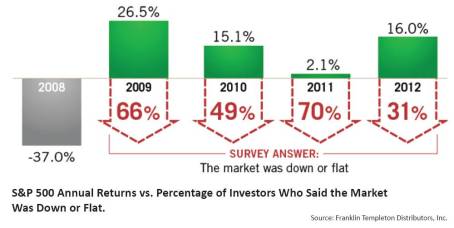

A recent piece written by CEO Bill Koehler at Tower Wealth Managers, entitled The Fear Bubble highlights a survey conducted by Franklin Templeton. In the study, investors were asked how the stock market performed in 2009-2012. As you can see from the chart below, perception is the polar opposite of reality (actual gains far exceeded perceived losses):

With so many investors sitting on the sidelines in cash or concentrated in low-yielding bonds and gold, I suppose the results shouldn’t be too surprising. Once again, selective memory serves as a wonderful tool to bury the regrets of missing out on a financial market recovery of a lifetime.

Humans also have a predisposition to seek out people who share similar views, even though accumulating different viewpoints ultimately leads to better decisions. Morgan Housel at The Motley Fool just wrote an article, Putting a Gap Between You and Stupid, explaining how individuals should seek out others who can help protect them from harmful biases. A scientific study referenced in the article showed how the functioning of biased brains literally shuts down:

“During the 2004 presidential election, psychologist Drew Westen of Emory University and his colleagues studied the brains of 15 “committed” Democrats and 15 “committed” Republicans with an MRI scanner. Each group was shown a collection of contradictory statements made by George W. Bush and John Kerry. Not surprisingly, the partisans were quick to call out contradictions made by the opposing party, and made up all kinds of justifications to rationalize quotes made by their own side’s candidate. But here’s what’s scary: The participants weren’t just being stubborn. Westen found that areas of their brains that control reasoning and logic virtually shut down when confronted with a conflicting view of their preferred candidate.”

Rather than letting emotions rule the day, the proper approach is to stick to unbiased numbers like valuations, yields, fees, and volatility. If you continually make mistakes; you aren’t disciplined enough; or you don’t like investing; then find a trusted advisor who uses an objective financial approach. Opportunistically taking advantage of volatility, instead of knee-jerk reactions is the preferred approach. For those people sitting on the sidelines and using selective memory, you may feel better now, but you will eventually have to get in the game, if you don’t want to lose the retirement account game.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing, SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is the information to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

The Teflon Market

At the pace of all this head-scratching going on, our population is likely to turn completely bald. One thing is for certain, nothing has scratched this Teflon stock market. If you want to have fun with a friend, family member or co-worker, just ask them how they feel about politics and then ask them how stocks have done this year? You’re bound to get some entertaining responses. Despite a Congress that has a lower favorability rating than cockroaches, lice, root canals, and colonoscopies , the S&P 500 index is up a whopping +22% and the NASDAQ index + 30% this year, both records. The USA Today ran with the Teflon theme and had this to say:

“This year alone the stock market has survived the recent brush with a U.S. debt default. It has also survived a government shutdown. Tax hikes. Government spending cuts. The threat of war. Terror at the Boston Marathon. A spike in interest rates. Plunging Apple shares. Stock exchange glitches. Fears of a less-friendly Federal Reserve. And a narrow escape from going over the “fiscal cliff.” Nothing bad seems to stick.”

The reason nothing is sticking to this Teflon market is because the market is more sensitive to reality rather than perception. Here are some come current discrepancies between these two states:

Perception: The economy is on the verge of a recession. Reality: The economy has grown GDP for 15 of the last 16 quarters. The private sector has added about 7.5 million jobs and the unemployment rate has been cut by about three percentage points.

Perception: Corporations are struggling. Reality: Corporations are actually posting record profits; increasing dividends significantly; buying back stock; and registering record profit margins.

Perception: The Federal Reserve controls the economy. Reality: Federal Reserve Chairman Ben Bernanke has little to no influence on decisions made by companies like Google Inc (GOOG), Facebook Inc (FB), McDonald’s Corp (MCD), Tesla Motors Inc (TSLA), and Target Corporation (TGT) (see also The Greatest Thing Since Sliced Bread). Interest rates are actually higher than when QE1 (quantitative easing) was first implemented, yet growth persists.

These types of mental mistakes occur outside the realm of financial markets as well. For example, most people fail to correctly answer the question, “Which animal is responsible for the greatest number of human deaths in the U.S.?”

A.) Alligator; B.) Bear; C.) Deer; D.) Shark; and E.) Snake

The ANSWER: C) Deer.

Deer colliding into cars trigger seven times more deaths than alligators, bears, sharks, and snakes combined, according to Jason Zweig at the Wall Street Journal (see also Alligators & Airplane Crashes). Other mental disconnects include the belief that planes are more dangerous than cars. In fact, people are 65 times more likely to get killed in your own car versus a plane. Also, misconceptions exist that guns are more dangerous than smoking, or that tornadoes are more dangerous than asthma – both beliefs wrong.

Party Not Over Yet

Long-time followers and readers of Investing Caffeine know that I’ve been an active participant in this bull market that started in 2009, evidenced by my critical views of Armageddonists like Peter Schiff, John Mauldin, Nouriel Roubini, Meredith Whitney, and other doom & gloomers.

I fully recognize there’s no honor in being Pollyannaish or a perma-bull just for the sake of it. However, it’s also very clear that excessive fear exercised by many investors proved very painful as S&P 500 level 666 has exploded to 1,744. The extreme panic that reached a pinnacle in 2009 has now morphed into an insidious skepticism (see Sentiment Pendulum ). Investor emotions continually swing from fear to greed, and with the political shenanigans going on in Washington DC, the skeptical pendulum has a long way before reaching euphoric levels. Or stated differently, the pre-party is over (see my article from earlier this year, Those Who Missed the Pre-Party), but the DJ is still playing and the cops aren’t here to break up the party yet.

I agree that we’ve had a Teflon market for a handful of years. There have been a few minimal scratches and a few hand burns along the way, but for the most part, those investors who have stayed invested and ignored the endless manufactured crisis headlines have been rewarded handsomely. Investing in stocks will always cause some heartburn, but if you don’t want your long-term retirement to get grilled, seared, pan-fried, or flambéed, then you want to make sure you still have some stocks in your Teflon pan.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), AAPL and GOOG, but at the time of publishing, SCM had no direct position in FB, TGT, TSLA, MCD, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is the information to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Nail Not in Emerging Market Coffin Yet

I wouldn’t say the nail is in the emerging market coffin quite yet. During the financial crisis, the EMSCI Emerging Market Index (EEM) was left for dead (down -50% in 2008) before resurrection in 2009 and 2010 (up +74% and +16%, respectively). For the last two years however, the EMSCI index has underperformed the S&P 500 Index massively by more than -30%. Included in this international index are holdings from China, Russia, India, Brazil, South Korea, and South Africa, among others.

The question now becomes, can the emerging markets resurrect themselves from the dead again? Recent signs are flashing “yes”. Over the last three months, the emerging markets have outperformed the S&P 500 by more than +8%, but these stocks still have a lot of ground to make up before reaching the peak levels of 2007. Last year’s slowing growth in China and a European recession, coupled with talks of the Federal Reserve’s “tapering” of monetary stimulus, didn’t provide the EMSCI index any help over the last few years.

With all the distracting drama currently taking place in Washington D.C., it’s a relief to see some other indications of improvement. For starters, China’s most recent PMI manufacturing index results showed continued improvement, reaching a level of 51.1 – up from August and signaling a reversal from contraction earlier this year (levels above 50 point to expansion). Chinese government leaders are continuing their migration from an externally export-driven economy to an internally consumer-driven economy. Despite the shift, China is still targeting a respectable +7.5% GDP economic growth target, albeit a slower level than achieved in the past.

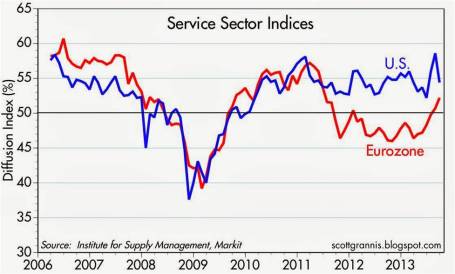

Adding to emerging market optimism is Europe’s apparent economic turnaround (or stabilization). As you can see from the chart below, the European Institute for Supply Management (ISM) service sector index has lately shown marked improvement. If the European and Chinese markets can sustain these recovering trends, these factors bode well for emerging market financial returns.

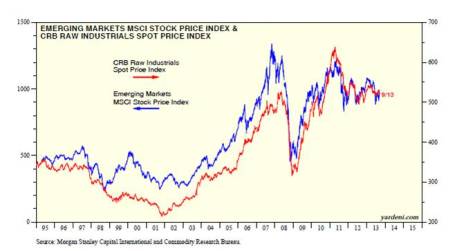

While it is clear these developments are helping the rebound in emerging market indices, it is also clear the supply-demand relationship in commodities will coincide with the next big up or down move in developing markets. Ed Yardeni, strategist and editor of Dr. Ed’s Blog, recently wrote a piece showing the tight correlation between emerging market stock prices and commodity prices (CRB Index). His conclusions come as no surprise to me given these resource-rich markets and their dependence on Chinese demand along with commodity needs from other developed countries. Expanding populations and rising standards of living in emerging market countries have and will likely continue to position these countries well for long-term commodity price appreciation. The development of new, higher-value service and manufacturing sectors should also lead to sustainably improved growth in these emerging markets relative to developed economies.

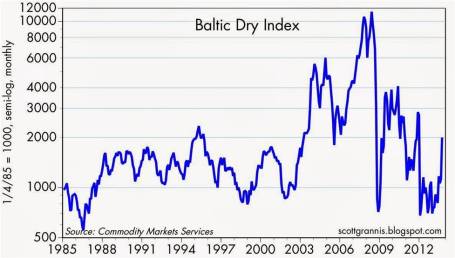

Adding fuel to the improving emerging market case is the advancement in the Baltic Dry Index (see chart below). The recent upward trajectory of the index is an indication that the price for moving major raw materials like coal, iron ore, and grains by sea is rising. This statistical movement is encouraging, but as you can see it is also very volatile.

While the emerging markets are quite unpredictable and have been out-of-favor over the last few years, a truly diversified portfolio needs a healthy dosage of this international exposure. You better check a pulse before you put a nail in the coffin – the emerging markets are not dead yet.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs) including emerging market ETFs, but at the time of publishing, SCM had no direct position in EEM, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is the information to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Take Me Out to the Stock Game

This article is an excerpt from a previously released Sidoxia Capital Management complementary newsletter (October 1, 2013). Subscribe on the right side of the page for the complete text.

The Major League Baseball playoffs are just about to start, and the struggling U.S. economy is also trying to score some more wins to make the postseason as well. In 2008 and early 2009, the stock market looked more like The Bad News Bears with the S&P 500 index losing -58% of its value from the peak to the trough. The overleveraged (debt-laden) financial system, banged by a speculative housing bubble, swung the global economy into recession and put a large part of the economic team onto the disabled list.

Since the lows of 2009, S&P 500 stocks have skyrocketed +152%, including an +18% gain in 2013, and a +3% jump in September alone. With that incredible track record, one might expect a euphoric wave of investors pouring into the stock market stadium, ready to open their wallets at the financial market concession stand. Au contraire. Despite the dramatic winning streak, investors remain complacent skeptics, analyzing and critiquing every political, economic, and financial market movement and gyration.

Unfortunately, as stock prices have scored massive gains, many market followers have been too busy eating peanuts and drinking beer, rather than focusing on the positive economic statistics in the scorebook, such as these:

15/16 Quarters of Positive GDP Growth:

|

| Source: Crossing Wall Street |

Precipitous Drop in Unemployment Claims: The lowest level since 2007 (7.5 million private sector jobs added since employment trough).

|

| Source: Bespoke |

All-Time Record Corporate Profits:

|

| Source: Ed Yardeni |

Financially Healthier Consumer – Lower Debt & Higher Net Worth:

|

| Source: Scott Grannis |

Improving Housing Market:

|

| Source: Scott Grannis |

While you can see a lot of financial momentum is propelling Team USA, there are plenty of observers concerned more about potential slumps and injuries emanating from a lineup of uncertainties. Currently, the fair-weather fans who are sitting in the bleachers are more interested in the uncertainty surrounding a government shutdown, debt ceiling negotiations, Syrian unrest, Iranian nuclear discussions, Obamacare defunding, and an imminent tapering of the Federal Reserve’s QE bond purchasing program (see Perception vs. Reality). The fearful skepticism of the fans has manifested itself in the form of a mountain of cash ($7 trillion), which is rapidly eroding to inflation and damaging millions of retirees’ long-term goals (see chart below). The fans sitting in the bleachers are less likely to buy long-term season tickets until some of these issues are settled.

|

| Source: Scott Grannis – $3 trillion added since crisis. |

The aforementioned list of worries are but a few of the concerns that have investors biting their nails. While there certainly is a possibility the market could be thrown a curve ball by one of these issues, veteran all-star investors understand there are ALWAYS uncertainties, and when the current list of concerns eventually gets resolved or forgotten, you can bet there will be plenty of new knuckle-balls and screw-balls (i.e., new list of worries) to fret over in the coming weeks, months, and years (see Back to the Future I, II,& III). Ultimately, the vast majority of concerns fade away.

Yoooouuuuuu’rrrreee Out!

The politicians in Washington are a lot like umpires, but what our country really needs are umpires who can change and improve the rules, especially the silly, antiquated ones (see also Strangest Baseball Rules). The problem is that bad rules (not good ones) often get put in place so the umpires/politicians can keep their jobs at the expense of the country’s best interest.

When umpires (politicians) cannot agree on how to improve the rules, gridlock actually is the next best outcome (see Who Said Gridlock is Bad?). The fact of the matter is that deficits and debt/GDP ratios have declined dramatically in recent years due in part to bitter political feuds (see chart below). When responsible spending is put into action, good things happen and a stronger economic foundation can be established to cushion future crises.

|

| Source: Scott Grannis |

There is plenty of room for improvement, but the statistics speak for themselves, which help explain why patient fans/investors have been handsomely rewarded with a homerun over the last four years. October historically has been a volatile month for the stock market, and the looming government shutdown and $16.7 trillion debt ceiling negotiations may contribute to some short-term strike-outs. However, if history proves to be a guide, stocks on average rise +4.26% during the last three months of the year (source: Bespoke), meaning the game may just not be over yet. With plenty of innings remaining for stocks to continue their upward trajectory, I still have ample time to grab my hot dog and malt during the 7th inning stretch.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing, SCM had no direct position in TSLA, PBI, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is the information to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Investing: Coin Flip or Skill?

The Sidoxia Monthly Newsletter will be released in a few days (subscribe on right side of the page), so here is an Investing Caffeine classic to tide you over until then:

Everyone believes they are above-average drivers and most investors believe successful investing can be attributed to skill. Michael Mauboussin, author and Chief Investment Strategist at Legg Mason Capital Management, tackles the issue of how important a role luck plays in various professional activities, including investing (read previous IC article on Mauboussin) in his meaty 42-page thought piece, Untangling Skill and Luck.

Skill Litmus Test

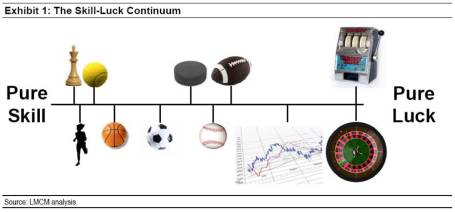

Whenever someone becomes successful or a sports team wins, doubters often respond with the response, “Well, they are just lucky.” For some, the intangible factor of luck can be difficult to measure, but for Mauboussin, he has a simple litmus test to evaluate the level of skill and luck credited to a professional activity:

“There’s a simple and elegant test of whether there is skill in an activity: ask whether you can lose on purpose. If you can’t lose on purpose, or if it’s really hard, luck likely dominates that activity. If it’s easy to lose on purpose, skill is more important.”

Mauboussin uses various sports and games as tools to explain the relative importance that skill (or lack thereof) plays in determining an outcome. At one extreme end of the spectrum you have a brain game like chess, in which a skillful chess pro could beat an amateur 1,000 times in a 1,000 matches. In the field of professional sports, at the other end of the spectrum, Mauboussin hammers home the relative significance luck contributes in professional baseball:

“In major league baseball the worst team will beat the best team in a best-of-five series about 15 percent of the time.“

Here is a skill-luck continuum provided by Mauboussin:

Streaks vs. Mean Reversion

Mr. Mauboussin spends a great deal of time exploring the implications of skill and luck in relation to streaks and mean reversion. In the streak department, Mauboussin uses Joe DiMaggio’s record 56-consecutive game hitting stretch. He acknowledges the presence of luck, but skill is a prerequisite:

“Not all skillful performers have streaks, but all long streaks of success are held by skillful performers.”

When detailing streaks, Mauboussin may also be defending his fellow Legg Mason colleague Bill Miller (see Revenge of the Dunce), who had an incredible 15 consecutive year of besting the S&P 500 index before mean reverting back to lousy human-like returns.

This is a nice transition into his discussion about mean reversion because Mauboussin basically states this reversion concept dominates activities laden with luck (as shown in the Skill-Luck Continuum chart above). Time will tell whether Miller’s streak was due to skill, if he can put together another streak, or whether his streak was merely a lucky fluke. Unlike the judicial world, investment managers are often treated as guilty until proven innocent. For now, Miller’s 1991-2005 streak is being treated as luck by many in the investment community, rather than skill.

Nobel-prize winner Paul Samuelson may believe differently since he concedes the existence of skillful investing:

“It is not ordained in heaven, or by the second law of thermodynamics, that a small group of intelligent and informed investors cannot systematically achieve higher mean portfolio gains with lower average variabilities. People differ in their heights, pulchritude, and acidity. Why not their P.Q. or performance quotient?”

Peter Lynch’s +29% annual return from 1977-1990 is another streak on which historians can chew (read more on Lynch). I, like Samuelson, will give Lynch the benefit of the doubt.

Creating a Skillful Analytical Edge

Unlike the process of mowing lawns, in which more applied work time generally equates to more lawns cut (i.e., more profits), the investment world doesn’t quite work that way. Many people could work all day, stare at their screen for 23 hours, trade off of useless information, and still earn lousy returns. When it comes to investing, more work does not necessarily produce better results. Mauboussin’s prescription is to create an analytical edge. Here is how he describes it:

“At the core of an analytical edge is an ability to systematically distinguish between fundamentals and expectations.”

Thinking like a handicapper is imperative to win in this competitive game, and I specifically addressed this in my previous Vegas-Wall Street article. Steven Crist sums up this indispensable concept beautifully:

“There are no “good” or “bad” horses, just correctly or incorrectly priced ones.”

A disciplined, systematic approach will incorporate these ideas, however all good investors understand the good processes can lead to bad outcomes in the short-run. By continually learning from mistakes, and refining the process with a constant feedback loop, the investment process can only get better. On the other hand, schizophrenically reacting to an endless flood of ever-changing information, or fearfully chasing the leadership du jour will only lead to pain and sorrow. Fortunately for you, you have skillfully completed this article, meaning financial luck should now be on your side.

Read full Mauboussin article (Untangling Skill and Luck) here

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing, SCM had no direct position in any other security referenced in this article. Radio interviews included opinions of Wade Slome – not advice. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is the information to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Sidoxia’s Slome Hits Airwaves

Sidoxia’s President & Founder Conducts Series of Radio Interviews Spanning Topics Ranging from the Stock Market & Syria to Financial Planning & Government Debt

Click on Interview Links Below:

Memphis

Memphis

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing, SCM had no direct position in any other security referenced in this article. Radio interviews included opinions of Wade Slome – not advice. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is the information to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Sports, Stocks, & the Magic Quadrants

Picking stocks is a tricky game and so is sports betting. With the NFL and NCAA football seasons swinging into full gear, understanding the complexity of making money in the stock market can be explained in terms of professional sports-betting. Anybody who has traveled to Las Vegas and bet on a sporting event, understands that choosing a winner of a game simply is not enough…you also need to forecast how many points you think a certain team will win by (see also What Happens in Vegas, Stays on Wall Street). In the world of sports, winning/losing is measured by point spreads. In the world of stocks, winning/losing is measured by valuation (e.g., Price/Earnings ratios).

To make my point, here is a sports betting example from a handful years back:

Florida Gators vs. Charleston Southern Buccaneers (September 2009): Without knowing a lot about the powerhouse Southern Buccaneers squad from South Carolina, 99% of respondents, when asked before the game who would win, would unanimously select Florida – a consistently dominant, national franchise, powerhouse program. The question becomes a little trickier when participants are asked, “Will the Florida Gators win by more than 63 points?” Needless to say, although the Buccs kept it close in the first half, and only trailed by 42-3 at halftime, the Gators still managed to squeak by with a 62-3 victory. Worth noting, had you selected Florida, the overwhelming favorite, the 59 point margin of victory would have resulted in a losing wager (see picture below).

If investing and sports betting were easy, everybody would do it. The reason sports betting is so challenging is due to very intelligent statisticians and odds-makers that create very accurate point spreads. In the investing world, a broad swath of traders, market makers, speculators, investment bankers, and institutional/individual investors set equally efficient valuations.

The goal in investing is very similar to sports betting. Successful professionals in both industries are able to consistently identify inefficiencies and then exploit them. Inefficiencies occur for a bettor when point spreads are too high or low, while investors identify inefficient prices in the marketplace (undervalued or overvalued).

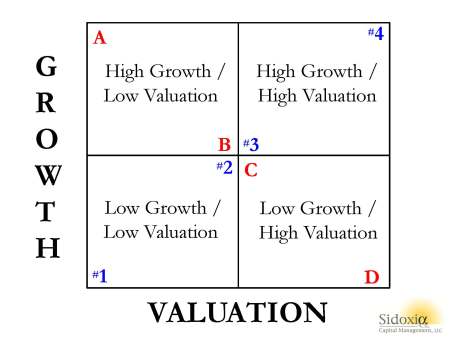

To illustrate my point, let’s take a look at Sidoxia’s “Magic Quadrant“:

What Sidoxia’s “Magic Quadrant” demonstrates is a framework for evaluating stocks. By devoting a short period of time reviewing the quadrants, it becomes apparent fairly quickly that Stock A is preferred over Stock B, which is preferred over Stock C, which is preferred over Stock D. In each comparison, the former is preferred over the latter because the earlier letters all have higher growth, and lower (cheaper) valuations. The same relative attractive relationships cannot be applied to stocks #1, #2, #3, and #4. Each successive numbered stock has higher growth, but in order to obtain that higher growth, investors must pay a higher valuation. In other words, Stock #1 has an extremely low valuation with low growth, while Stock #4 has high growth, but an investor must pay an extremely high valuation to own it.

While debating the efficiency of the stock market can escalate into a religious argument, I would argue the majority of stocks fall in the camp of #1, #2, #3, or #4. Or stated differently, you get what you pay for. For example, investors are paying a much higher valuation (~100x 2014 P/E) for Tesla Motors, Inc (TSLA) for its rapid electric car growth vs. paying a much lower valuation (~10x 2014 P/E) for Pitney Bowes Inc (PBI) for its mature mail equipment business.

The real opportunities occur for those investors capable of identifying companies in the upper-left quadrant (i.e., Stock A) and lower-right quadrant (i.e., Stock D). If the analysis is done correctly, investors will load up on the undervalued Stock A and aggressively short the expensive Stock D. Sidoxia has its own proprietary valuation model (Sidoxia Holy Grail Ranking – SHGR or a.k.a. “SUGAR”) designed specifically to identify these profitable opportunities.

The professions of investing and sports betting are extremely challenging, however establishing a framework like Sidoxia’s “Magic Quadrants” can help guide you to find inefficient and profitable investment opportunities.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing, SCM had no direct position in TSLA, PBI, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is the information to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Perception vs. Reality: Interest Rates & the Economy

There is a difference between perception and reality, especially as it relates to the Federal Reserve, the economy, and interest rates.

Perception: The common perception reflects a belief that Quantitative Easing (QE) – the Federal Reserve’s bond buying program – has artificially stimulated the economy and financial markets through lower interest rates. The widespread thinking follows that an end to tapering of QE will lead to a crash in the economy and financial markets.

Reality: As the chart below indicates, interest rates have risen during each round of QE (i.e., QE1/QE2/QE3) and fallen after the completion of each series of bond buying (currently at a pace of $85 billion per month in purchases). That’s right, the Federal Reserve has actually failed on its intent to lower interest rates. In fact, the yield on the 10-year Treasury Note stands at 2.94% today, while at the time QE1 started five years ago, on December 16, 2008, the 10-year rate was dramatically lower (~2.13%). Sure, the argument can be made that rates declined in anticipation of the program’s initiation, but if that is indeed the case, the recent rate spike of the 10-year Treasury Note to the 3.0% level should reverse itself once tapering begins (i.e., interest rates should decline). Wow, I can hardly wait for the stimulative effects of tapering to start!

Fact or Fiction? QE Helps Economy

Taken from a slightly different angle, if you consider the impact of the Federal Reserve’s actions on the actual economy, arguably there are only loose connections. More specifically, if you look at the jobs picture, there is virtually NO correlation between QE activity and job creation (see unemployment claims chart below). There have been small upward blips along the QE1/QE2/QE3 path, but since the beginning of 2009, the declining trend in unemployment claims looks like a black diamond ski slope.

Moreover, if you look at a broad spectrum of economic charts since QE1 began, including data on capital spending, bank loans, corporate profits, vehicle sales, and other key figures related to the economy, the conclusion is the same – there is no discernible connection between the economic recovery and the Federal Reserve’s quantitative easing initiatives.

I know many investors are highly skeptical of the stock market’s rebound, but is it possible that fundamental economic laws of supply and demand, in concert with efficient capital markets, could have something to do with the economic recovery? Booms and busts throughout history have come as a result of excesses and scarcities – in many cases assisted by undue amounts of fear and greed. We experienced these phenomena most recently with the tech and housing bubbles in the early and middle parts of last decade. Given the natural adjustments of supply and demand, coupled with the psychological scars and wounds from the last financial crisis, there is no clear evidence of a new bubble about to burst.

While it’s my personal view that many government initiatives, including QE, have had little impact on the economy, the Federal Reserve does have the ability to indirectly increase business and consumer confidence. Ben Bernanke clearly made this positive impact during the financial crisis through his creative implementation of unprecedented programs (TARP, TALF, QE, Twist, etc.). The imminent tapering and eventual conclusion of QE may result in a short-term hit to confidence, but the economy is standing on a much stronger economic foundation today. Making Ben Bernanke a scapegoat for rising interest rates is easy to do, but in actuality, an improving economy on stronger footing will likely have a larger bearing on the future direction of interest rates relative to any upcoming Fed actions.

Doubters remain plentiful, but the show still goes on. Not only are banks and individuals sitting on much sturdier and healthier balance sheets, but corporations are running lean operations that are reporting record profit margins while sitting on trillions of dollars in cash. In addition, with jobs on a slow but steady path to recovery, confidence at the CEO and consumer levels is also on the rise.

Despite all the negative perceptions surrounding the Fed’s pending tapering, reality dictates the impact from QE’s wind-down will likely to be more muted than anticipated. The mitigation of monetary easing is more a sign of sustainable economic strength than a sign of looming economic collapse. If this reality becomes the common perception, markets are likely to move higher.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing, SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is the information to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.