Why 0% Rates? Tech, Globalization & EM (Not QE)

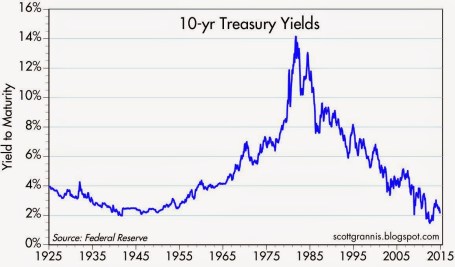

Recently I have written about the head-scratching, never-ending, multi-decade decline in long-term interest rates (see chart below). Who should care? Well, just about anybody, if you bear in mind the structure of interests rates impacts the cost of borrowing on mortgages, credit cards, automobiles, corporate bonds, savings accounts, and practically every other financial instrument you can possibly think of. Simplistic conventional thinking explains the race to 0% global interest rates by the loose monetary Quantitative Easing (QE) policies of the Federal Reserve. But validating that line of thinking becomes more challenging once you consider QE ended months ago. What’s more, contrary to common belief, rates declined further rather than climb higher after QE’s completion.

Source: Calafia Beach Pundit

More specifically, if you look at rates during this same time last year, the yield on the 10-Year Treasury Note had more than doubled in the preceding 18 months to a level above 3.0%. The consensus view then was that the eventual wind-down of QE would only add gasoline to the fire, causing bond prices to decline and rates to extend an indefinite upwards march. Outside of bond guru Jeff Gundlach, and a small minority of prognosticators, the herd was largely wrong – as is usually the case. As we sit here today, the 10-Year Note currently yields a paltry 2.26%, which has led to the long-bond iShares 20-Year Treasury ETF (TLT) jumping +22% year-to-date (contrary to most expectations).

The American Ostrich

Like an ostrich sticking its head in the sand, us egocentric Americans tend to ignore details relating to others, especially if the analyzed data is occurring outside the borders of our own soil. Unbeknownst to many, here are some key country interest rates below U.S. yields:

- Switzerland: 0.33%

- Japan: 0.34%

- Germany: 0.60%

- Finland: 0.70%

- Austria: 0.75%

- France: 0.88%

- Denmark: 0.89%

- Sweden: 0.98%

- Ireland: 1.29%

- Spain: 1.69%

- Canada 1.80%

- U.K: 1.85%

- Italy: 1.93%

- U.S.: 2.26% (are our rates really that low?)

Outside of Japan, these listed countries are not implementing QE (i.e., “Quantitative Easing”) as did the United States. Rather than QE being the main driver behind the multi-decade secular decline in interest rates, there are other more important disinflationary forces at work driving interest rates lower.

Technology, Globalization, and Emerging Market Competition (T.G.E.M.)

While tracking the endless monthly inflation statistics is a useful exercise to understand the tangible underlying pricing components of various industry segments (e.g., see 20 pages of CPI statistics), the larger and more important factors can be attributed to the somewhat more invisible elements of technology, globalization, and emerging market competition (T.G.E.M).

Starting with technology, to put these dynamics into perspective, consider the number of transistors, or the effective horsepower, on a semiconductor (a.k.a. computer “chip”) today. The overall impact on global standards of living is nothing short of astounding. Take an Intel chip for example – it had approximately 2,000 transistors in 1971. Today, semiconductors can cram over 10,000,000,000 (yes billions – 5 million times more) transistors onto a single semiconductor. Any individual can look no further than their smartphone to understand the profound implications this has not only on pricing in general, but society overall. To illustrate this point, I would direct you to a post highlighted by Professor Mark J. Perry, who observed the cost to duplicate an iPhone during 1991 would have been more than $3,500,000!

There are an infinite number of examples depicting how technology has accelerated the adoption of globalization. More recently, events such as the Arab Spring point out how Twitter (TWTR) displaced costly military engagement alternatives. The latest mega-Chinese IPO of Alibaba (BABA) was also emblematic of the hunger experienced in emerging markets to join the highly effective economic system of global capitalism.

I think New York Times journalist Tom Friedman said it best in his book, The World is Flat, when he made the following observations about the dynamics occurring in emerging markets:

“My mom told me to eat my dinner because there are starving children in China and India – I tell my kids to do their homework because Chinese and Indians are starving for their jobs”.

“France wants a 35 hour work week, India wants a 35 hour work day.”

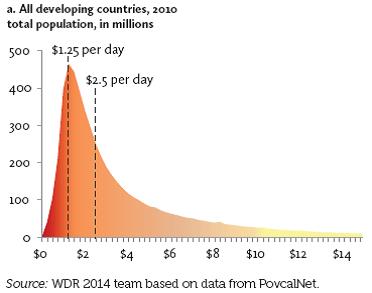

There may be a widening gap between rich and poor in the United States, but technology and globalization is narrowing the gap across the rest of the world. Consider nearly half of the world’s population (3 billion+ people) live in poverty, earning less than $2.50 a day (see chart below). Technology and globalization is allowing this emerging middle class climb the global economic ladder.

These impoverished individuals may not be imminently stealing our current jobs and driving general prices lower, but their children, and the countless educated millions in other international markets are striving for the same economic security and prosperity we have. The educated individuals in the emerging markets that have tasted capitalism are giving new meaning to the word “urgency”, which is only accelerating competition and global pricing pressures. It comes as no surprise to me that this generational migration from the poor to the middle class is putting a lid on inflation and interest rates around the world.

Declining costs of human labor from emerging markets however is not the only issue putting a ceiling on general prices. Robotics, an area in which Sidoxia holds significant investments, continues to be an area of fascination for me. With human labor accounting for the majority of business costs, it’s no wonder the C-suite is devoting more investment dollars towards automation. Rather than hire and train expensive workers, why not just buy a robot? This is not just happening in the U.S. – in fact the Chinese purchased more robots than Americans last year. And why not? An employer does not have to pay a robot overtime compensation; a robot never shows up late; robots never sue for discrimination or harassment; robots receive no healthcare or retirement benefits; and robots work 24 hours/day, 7 days/week, and 365 days/year.

While newspapers, bloggers, and talking heads like to point to the simplistic explanation of loose, irresponsible monetary policies of global central banks as the reason behind a four decade drop in interest rates that is only a small part of the story. Investors and policy makers alike should be paying closer attention to the factors of technology, globalization, and emerging market competition as the more impactful dynamics systematically driving down long term interest rates and inflation.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own a range of positions, including long positions in certain exchange traded fund positions and INTC (short position in TLT), but at the time of publishing SCM had no direct position in BABA, TWTR or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Santa and the Rate-Hike Boogeyman

Boo! … Rates are about to go up. Or are they? We’re in the fourth decade of a declining interest rate environment (see Don’t be a Fool), but every time the Federal Reserve Chairman speaks or monetary policies are discussed, investors nervously look over their shoulder or under their bed for the “Rate Hike Boogeyman.” While this nail-biting mentality has resulted in lost sleep for many, this mindset has also unfortunately led to a horrible forecasting batting average for economists. Santa and many equity investors have ignored the rate noise and have been singing Ho Ho Ho as stock prices hover near record highs.

A recent Deutsche Bank report describes the prognostication challenges here:

i.) For the last 10 years, professional forecasters have consistently been wrong on their predictions of rising interest rates.

ii.) For the last five years, investors haven’t fared any better. As you can see, they too have been continually wrong about their expectations for rising interest rates.

I’m the first to admit that rates have remained “lower for longer” than I guessed, but unlike many, I do not pretend to predict the exact timing of future rate increases. I strongly believe inevitable interest rate rises are not a matter of “if” but rather “when”. However, trying to forecast the timing of a rate increase can be a fool’s errand. Japan is a great case in point. If you take a look at the country’s interest rates on their long-term 10-year government bonds (see chart below), the yields have also been declining over the last quarter century. While the yield on the 10-Year U.S. Treasury Note is near all-time historic lows at 2.18%, that rate pales in comparison to the current 10-Year Japanese Bond which is yielding a minuscule 0.36%. While here in the states our long-term rates only briefly pierced below the 2% threshold, as you can see, Japanese rates have remained below 2% for a jaw-dropping duration of about 15 years.

There are plenty of reasons to explain the differences in the economic situation of the U.S. and Japan (see Japan Lost Decades), but despite the loose monetary policies of global central banks, history has proven that interest rates and inflation can remain stubbornly low for longer than expected.

The current pundit thinking has Federal Reserve Chairwoman Yellen leading the brigade towards a rate hike during mid-calendar 2015. Even if the forecasters finally get the interest rate right for once, the end-outcome is not going to be catastrophic for equity markets. One need look no further than 1994 when Federal Reserve Chairman Greenspan increased the benchmark federal funds rate by a hefty +2.5%. (see 1994 Bond Repeat?). Rather than widespread financial carnage in the equity markets, the S&P 500 finished roughly flat in 1994 and resumed the decade-long bull market run in the following year.

Currently 15 of the 17 Fed policy makers see 2015 median short-term rates settling at 1.125% from the current level of 0-0.25%. This hardly qualifies as interest rate Armageddon. With a highly transparent and dovish Janet Yellen at the helm, I feel perfectly comfortable the markets can digest the inevitable Fed rate hikes. Will (could) there be volatility around changes in Fed monetary policy during 2015? Certainly – no different than we experienced during the “taper tantrum” response to Chairman Ben Bernanke’s rate rise threats in 2013 (see Fed Fatigue).

As 2014 comes to an end, Santa has wrapped investor portfolios with a generous bow of returns in the fifth year of this historic bull market. Not everyone, however, has been on Santa’s “nice” list. Regrettably, many sideliners have received no presents because they incorrectly assessed the elimination impact of Quantitative Easing (QE). If you prefer presents over a lump of coal in your stocking, it will be in your best interest to ignore the Rate Hike Boogeyman and jump on Santa’s sleigh.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own a range of positions, including certain exchange traded fund positions, but at the time of publishing SCM had no direct position in DB or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Don’t Be a Fool, Follow the Stool

It’s the holiday season and with another year coming to an end, it’s also time for a wide range of religious celebrations to take place. Investing is a lot like religion too. Just like there are a countless number of religions, there are also a countless number of investing styles, whether you are talking about Value investing, Growth, Quantitative, Technical, Momentum, Merger-Arbitrage, GARP (Growth At a Reasonable Price), or a multitude of other derivative types. But regardless of the style followed, most professional managers believe their style is the sole answer to lead followers to financial nirvana. While I may not share the same view (I believe there are many ways to skin the stock market cat), each investing discipline (or religion) will have its own unique core tenets that drive expectations for future returns (outcomes).

As it relates to my firm, Sidoxia Capital Management, our investment process is premised on four key tenets. Much like the four legs of a stool, the following principles provide the foundation for our beliefs and outlook on the mid-to-long-term direction of the stock market:

- Profits

- Interest Rates

- Sentiment

- Valuations

Why are these the key components that drive stock market returns? Let’s dig a little deeper to clarify the importance of these factors:

Profits: Over the long-run there is a very significant correlation between stock prices and profits (see also It’s the Earnings, Stupid). I’m not the only one preaching this religious belief, investment legends Peter Lynch and William O’Neil think the same. In answer to a question by Dell Computer’s CEO Michael Dell about its stock price, Lynch famously responded , “If your earnings are higher in five years, your stock will be higher.” The same idea works with the overall stock market. As I recently wrote (see Why Buy at Record Highs? Ask the Fat Turkey), with corporate profits at all-time record highs, it should come as no surprise that stock prices are near all-time record highs. Regardless of the absolute level of profits, it’s also very important to have a feel for whether earnings are accelerating or decelerating, because investors will pay a different price based on this dynamic.

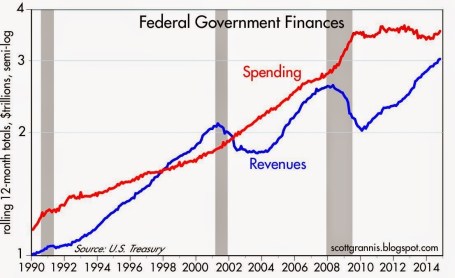

Interest Rates: When embarrassingly low CD interest rates of 0.08% are being offered on $10,000 deposits at Bank of America, do you think stocks look more or less attractive? It’s obviously a rhetorical question, because I can earn 20x more just by collecting the dividends from the S&P 500 index. Now in 1980 when the Federal Funds rate was set at 20.0% and investors could earn 16.0% on CDs, guess what? Stocks were logging their lowest valuation levels in decades (approximately 8x P/E ratio vs 17x today). The interest rate chart from Scott Grannis below highlights the near generational low interest rates we are currently experiencing.

Source: Calafia Beach Pundit

Sentiment: As I wrote in my Sentiment Indicators: Reading the Tea Leaves article, there are plenty of sentiment indicators (e.g., AAII Surveys, VIX Fear Gauge, Breadth Indicators, NYSE Bulls %, Put-Call Ratio, Volume), which traditionally are good contrarian indicators for the future direction of stock prices. When sentiment is too bullish (optimistic), it is often a good time to sell or trim, and when sentiment is too bearish (pessimistic), it is often good to buy. With that said, in addition to many of these short-term sentiment indicators, I realize that actions speak louder than words, therefore I like to also see the flows of funds into and out of stocks/bonds to gauge sentiment (see also Market Champagne Sits on Ice).

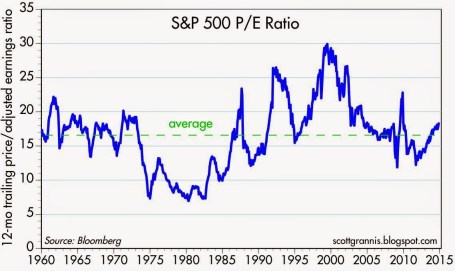

Valuations: As Fred Hickey, the lead editor of the High Tech Strategist noted, “Valuations do matter in the stock market, just as good pitching matters in baseball.” The most often quoted valuation metric is the Price/Earnings multiple or PE ratio. In other words, this ratio compares the price you would pay for an annual stream of profits. This can be tricky to determine because there are virtually an infinite number of factors that can impact the numerator and denominator. Currently P/E valuations are near historical averages (see below) – not nearly as cheap as 1980 and not nearly as expensive as 2000. If I only had one metric to choose, this would be a good place to start because the previous three legs of the stool feed into valuation calculations. In addition to P/E, at Sidoxia one of our other favorite metrics is Free-Cash-Flow Yield (annual cash generation after all expenses and expenditures divided by a company’s value). Earnings can be manipulated much easier than cold hard cash in our view.

Source: Calafia Beach Pundit

Nobody, myself and Warren Buffett included, can consistently predict what the stock market will do in the short-run. Buffett freely admits it. However, investing is a game of probabilities, and if you use the four tenets of profits, interest rates, sentiment, and valuations to drive your long-term investing decisions, your chances for future financial success will increase dramatically. This framework is just as relevant today as it is when studying the 1929 Crash, the 1989 Japan Bubble, or the 2008-2009 Financial Crisis. If your goal is to not become an investing fool, I highly encourage you to follow the legs of the Sidoxia stool.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own a range of positions, including BAC and certain exchange traded fund positions, but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Why Buy at Record Highs? Ask the Fat Turkey

This article is an excerpt from a previously released Sidoxia Capital Management complementary newsletter (December 1, 2014). Subscribe on the right side of the page for the complete text.

I’ve fulfilled my American Thanksgiving duty by gorging myself on multiple helpings of turkey, mash potatoes, and pumpkin pie. Now that I have loosened my belt a few notches, I have had time to reflect on the generous servings of stock returns this year (S&P 500 index up +11.9%), on top of the whopping +104.6% gains from previous 5 years (2009-2013).

Conventional wisdom believes the Federal Reserve has artificially inflated the stock market. Given the perceived sky-high record stock prices, many investors are biting their nails in anticipation of an impending crash. The evidence behind the nagging investor skepticism can be found in the near-record low stock ownership statistics; dismal domestic equity fund purchases; and apathetic investor survey data (see Market Champagne Sits on Ice).

Turkey-lovers are in a great position to understand the predicted stock crash expected by many of the naysayers. As you can see from the chart below, the size of turkeys over the last 50+ years has reached a record weight – and therefore record prices per turkey:

Does a record size in turkeys mean turkey meat prices are doomed for an imminent price collapse? Absolutely not. A key reason turkey prices have hit record levels is because Thanksgiving stomachs have been buying fatter and fatter turkeys every year. The same phenomenon is happening in the stock market. The reason stock prices have continued to move higher and higher is because profits have grown fatter and fatter every year (see chart below). Profits in corporate America have never been higher. CEOs are sitting on trillions of dollars of cash, and providing stock-investors with growing plump dividends (see also The Gift that Keeps on Giving), $100s of billions in shareholder friendly stock buybacks, while increasingly taking leftover profits to invest in growth initiatives (e.g., technology investments, international expansion, and job hiring).

Despite record turkey prices, I will make the bold prediction that hungry Americans will continue to buy turkey. More important than the overall price paid per turkey, the statistic that consumers should be paying more attention to is the turkey price paid per pound. Based on that more relevant metric, the data on turkey prices is less conclusive. In fact, turkey prices are estimated to be -13% cheaper this year on a per pound basis compared to last year ($1.58/lb vs. $1.82/lb).

The equivalent price per pound metric in the stock market is called the Price-Earnings (P/E) ratio, which is the price paid by a stock investor per $1 of profits (or earnings). Today that P/E ratio sits at approximately 17.5x. As you can see from the chart below, the current P/E ratio is reasonably near historical averages experienced over the last 50+ years. While, all else equal, anyone would prefer paying a lower price per pound (or price per $1 in earnings), any objective person looking at the current P/E ratio would have difficulty concluding recent stock prices are in “bubble” territory.

However, investor doubters who have missed the record bull run in stock market prices over the last five years (+210% since early 2009) have clung to a distorted, overpriced measurement called the CAPE or Shiller P/E ratio. Readers of my Investing Caffeine blog or newsletters know why this metric is misleading and inaccurate (see also Shiller CAPE Peaches Smell).

Don’t Be an Ostrich

While prices of stocks arguably remain reasonably priced for many Baby Boomers and retirees, the conclusion should not be to gorge 100% of investment portfolios into stocks. Quite the contrary. Everyone’s situation is unique, and every investor should customize a globally diversified portfolio beyond just stocks, including areas like fixed income, real estate, alternative investments, and commodities. But the exposures don’t stop there, because in order to truly have the diversified shock absorbers in your portfolio necessary for a bumpy long-term ride, investors need exposure to other areas. Such areas should include international and emerging market geographies; a diverse set of styles (e.g., Value, Growth, Blue Chip dividend-payers); and a healthy ownership across small, medium, and large equities. The same principles apply to your bond portfolio. Steps need to be taken to control credit risk and interest rate risk in a globally diversified fashion, while also providing adequate income (yield) in an environment of generationally low interest rates.

While I’ve spent a decent amount of time talking about eating fat turkeys, don’t let your investment portfolio become stuffed. The year-end time period is always a good time, after recovering from a food coma, to proactively review your investments. While most non-vegetarians love eating turkey, don’t be an investment ostrich with your head in the sand – now is the time to take actions into your own hands and make sure your investments are properly allocated.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own a range of positions in certain exchange traded fund positions, but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Airbag Protection from Pundit Backseat Drivers

Giving advice to a driver from the backseat of a car is quite easy and enjoyable for some, but whether that individual is actually qualified to give advice is another subject. In the financial blogosphere and media there is an unending mass of backseat drivers recklessly directing investors off cliffs and into walls, but unfortunately there are no consequences for these blabbers. It’s the investors who are driving their personal portfolios that ultimately suffer from crashed financial dreams.

Unlike drivers who mandatorily require a license to drive to the local grocery store, bloggers, journalists, economists, analysts, strategists (aka “pundits”), and any other charismatic or articulate individual can emphatically counsel investors without any credentials, education, or licenses. More importantly than a piece of paper or letters on a business card, many of these self-proclaimed experts have little or no experience of investing real money…the exact topic the pundits are using to direct peoples’ precious and indispensable lifesavings.

It’s easy for bearish pundits like Peter Schiff, Nouriel Roubini, John Mauldin, and David Rosenberg (see also The Fed Ate My Homework) to throw economic hand grenades with their outlandishly gloomy predictions and fear mongering. However, more important than selling valuable advice, the pundit’s #1 priority is selling a convincing story, whether the story is grounded in reality or not. The pundit’s story is usually constructed by looking into the rearview mirror by creatively connecting current event dots in a way that may seem reasonable on the surface.

Crusty investors who have invested through various investment cycles know better than to pay attention to these opinions. As the saying goes, “Opinions are like ***holes. Everybody has one.” Stated differently, the great growth investor William O’Neil said the following:

“I would say 95% of all these people you hear on TV shows are giving you their personal opinion. And personal opinions are almost always worthless … facts and markets are far more reliable.”

Successful long-time investors like Warren Buffett rarely make predictions about the short-term directions of the market. Long-term investors know the only certainty in the market is uncertainty. At the core, investing is a game of probabilities. The objective of the game is to place your bets on those investments that establish the odds in your favor. As in many professions, however, the right process can have a negative outcome in the short-run. Those talented investors who have experience consistently applying a probabilistic approach generally do quite well in the long-run.

There is an endless multitude of investing advice, regardless of whether you choose to consume it over the TV, in newspapers, or through blogs. That’s why it’s so important to be discerning in your financial media consumption by focusing on experience…experience is the key. If you were to undergo a heart surgery, would you want a nurse or experienced doctor who had performed 2,000 successful heart surgeries? When you fly cross-country, do you want a flight attendant to fly the plane or a 20-year veteran pilot? I think you get the point.

The other factor to consider when comparing advice from a media pundit vs. experienced investor is skin in the game. Investment advisers who have their personal dollars at stake typically have spent a significantly larger amount of time formulating an investment thesis or strategy as compared to a loose-cannon TV journalist or inexperienced, maverick blogger.

There is a lot to consider as you maneuver your investment portfolio through volatile markets. With all the dangerous advice out there from backseat drivers, make sure you have experienced investment advice installed as protective airbags because listening to inexperienced air bags (pundits) could crash your portfolio into a wall.

Related Content: Financial Blogging Interview on Charlie Rose w/ Joe Weisenthal, Josh Brown, Felix Salmon, and Megan Murphy

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own a range of positions in certain exchange traded fund positions, but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Sector Weightings: Another Financial Toolbox Gizmo

The ever-elusive $64,000 question of “Where does the stock market go from here?” is as popular a question today as it was a century ago. All you have to do is turn on CNBC to find an endless number of analysts, strategists, journalists, economists, and other talking heads guessing on the direction of stock prices. So many people are looking to make a quick buck or get a hot tip, but unfortunately investing is like dieting…it takes hard work and there are no simple solutions. As much as the pundits would like to make this investment game sound like a scientific certainty, in reality there is a lot of subjective art, experience, and luck that goes into successful investment outcomes. Consistent followers of Investing Caffeine understand there are a number of tools I use to guide me on the direction and level of stock prices, and three of my toolbox gizmos include the following:

- Earnings (Stock prices positively correlated)

- Interest Rates (Stock prices inversely correlated)

- Sentiment (Stock prices inversely correlated)

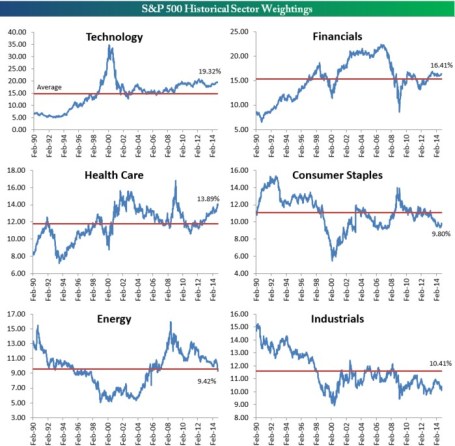

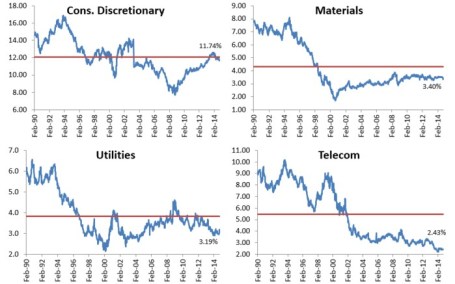

While these and other devices (see SHGR Holy Grail) are great for guesstimating the direction of longer-term stock prices, sector weightings are also great tools for identifying both overheated and unloved segments of the market. Take an extreme example, such as the S&P 500 Technology historical sector weighting in the year 2000. As you can see from the Bespoke Investment charts, the Technology sector went from about a 5% weighting of the overall market in the early 1990s to around 36% at the 2000 peak before dropping back down to 15% after the Tech Bubble burst. If you fast forward to the 2008-2009 Financial Crisis, we saw a similar “bubblicious” phenomenon rupture in the Financial sector. During 1980 the Financial segment accounted for approximately 5% of the total S&P 500 Index market capitalization in 1980 and skyrocketed to a peak of 23% in 2007, thanks in large part to a three decade bull-run in declining interest rates coupled with financial regulators asleep at the oversight switch.

While some segment weightings are currently above and below historical averages, the chart shows there is a tendency for mean reversion to occur over time. As I’ve written in the past, while I believe the broader market can be objectively be interpreted as reasonably priced in light of record earnings, record low interest rates, and a broader skeptical investing public ( see Markets Soar and Investors Snore), I’m still finding expensive, frothy sub-sectors in areas like money losing biotech and social media companies. The reverse can be said if you examined the 2000 period – the overall stock market was overpriced at its 3/24/00 peak (P/E ratio of about ~31x), but within the S&P 500 stocks there were bargains of a lifetime if you looked outside the Tech sector. Consider many of the unloved “Old Economy” stocks that got left behind in the 1990s. Had you invested in these forgotten stocks at the peak of the 2000 market (March 24, 2000), you would have earned an equal-weighted average return of +430% (and significantly higher than that if you included dividends):

Caterpillar Inc (CAT): +416%

Deere & Co (DE): +367%

FedEx Corp (FDX): +341%

Ingersoll-Rand Co (IR): +260%

Lockheed Martin Corp (LMT): +811%

Three M Company (MMM): +254%

Schlumberger Ltd (SLB): +158%

Union Pacific Corp (UNP): +1,114%

Exxon Mobil Corp (XOM): +148%

Average +430%

That +430% compares to a much more modest +36% return for the S&P 500 over the same period. What this data underscores are the perils of pure index investing and highlights the room for active investment managers like Sidoxia Capital Management to generate alpha.

There are many ways of analyzing “Where does the stock market go from here?,” but whatever methods you use, the power of examining sector weightings and mean reversion gizmos should be readily accessible in your investment toolbox.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own FDX; non-discretionary positions in DE, LMT, MMM, SLB, XOM, and a range of positions in certain exchange traded fund positions, but at the time of publishing SCM had no direct position in CAT, IR, UNP, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Ebola Trick Turns into October Treat

This article is an excerpt from a previously released Sidoxia Capital Management complementary newsletter (November 3, 2014). Subscribe on the right side of the page for the complete text.

Boo! The month of October is notorious for creating terrifyingly spooky volatility. Whether you are talking about 1929’s Great Crash, 1987’s Black Monday, or 2008’s Great Financial Crisis, the wickedest damage has occurred during this ghoulish month of the year. The financial market witches and goblins did not disappoint fear-hunting investors in 2014. Sparked by the spread of the deadly, West African Ebola virus and concerns over deteriorating European economic conditions, the Dow Jones Industrial Average stock index “tricked” investors into a -1,200 point (or roughly -8%) loss in the first two weeks of October. What initially felt like an empty Trick-or-Treat bucket turned into a candy-filled +10% advance in the subsequent two weeks of the month, ultimately resulting in an all-time record high reached by the Dow (17,380).

If you had taken a one-month nap, and slept through October, the late-month surge resulted in an impressive, but less thrilling, record monthly advance of +2.3% for the S&P 500 index. The Dow rose +2.0% and the Nasdaq Composite index added +3.1% for the month. For 2014, the S&P, Dow, and Nasdaq have earned sweet and sugary returns of up +9.2%, +4.9%, +10.9%, respectively.

The Ebola statistics are alarming, but the roughly 5,000 deaths in Africa should be put into proper perspective (see chart below). The number of deaths on American soil are even more miniscule, if you consider that there have been fewer Ebola deaths in the United States than Larry King has had wives (Larry has been married eight times to seven different women).

|

| Source: Vox |

Besides concerns over Ebola, the eurozone boogeyman has spooked investors too. Europe has been in a continual economic funk, while the U.S. has decoupled and adapted to global sluggishness as seen from the industrial production statistics below (via Scott Grannis).

|

| Source: Calafia Beach Pundit |

Fed Stimulus R.I.P.

A lot has been written and discussed about the Federal Reserve’s controversial QE (Quantitative Easing) bond buying stimulus program, but the fact remains stock prices are at record highs and the U.S. economy has been the best economic house in a bad developed country neighborhood. Contrary to popular opinion, long-term interest rates have not spiked higher with the wind-down of the nearly 6-year QE program. In actuality, interest rates have drifted lower with the 10-Year Treasury Note currently yielding 2.34%.

|

| Source: Calafia Beach Pundit |

With the QE stimulus training wheels off the economic bicycle, the focus is returning to the real engine driving this 5-1/2 year bull market…corporate profits. Despite all the scary news headlines, S&P 500 corporate earnings continue to chug along as stock prices have tripled since early 2009. More specifically, 78% of companies who have reported their third quarter results thus far have exceeded Wall Street forecasts, which nets out to a respectable +7.3% earnings growth rate. As the 10-year chart below shows, stock prices (green line) generally follow corporate profit growth (blue line) – see also It’s the Earnings, Stupid. Eventually, profit growth flattens out and turns negative during a recession, which will lead to a bear market in stocks.

|

| Source: FactSet |

Currently there is no evidence of a recessionary slowdown. Recessions usually occur when there is a correction in some area of economic excess (e.g., too much technology or housing investment) – that is not the case currently. In reality, the economy has added more than 10 million private jobs since the nadir of the 2009 recession and consumers are feeling more confident (see chart of 7-year high in Consumer Confidence). What’s more, the U.S. economy just posted a very respectable +3.5% GDP growth rate for the third quarter as an encore to the +4.6% growth achieved last quarter. The roughly -25% reduction in oil prices to $80 per barrel is also providing an effective tax cut for consumers, as money saved at the gas pump leaves more holiday shopping dollars to be poured back into the economy.

|

| Source: Bespoke Investment |

Monkey See, Monkey Do

Central banks are not sitting on their hands either as they watch lethargic global growth. Other international central banks are enviously looking at the U.S.’s relative strength and beginning to play a game of “QE monkey see, monkey do.” Last Friday, Japan’s central bank (Bank of Japan) announced a plan to ratchet up their annual QE program of bond buying to 80 trillion Yen (~$726 billion), while Japan’s Government Pension Investment Fund (GPIF) simultaneously announced their proposal to double its stock ownership allocation. These decisions, coupled with the European Central Bank’s President Mario Draghi’s initiative to buy covered bonds is more evidence of global central bank coordination designed to kick-start more respectable economic growth. The hope is that circulating more money through the economy through QE will lead to more growth. If and when inflation rears its ugly head will be the time the central bank monkeys will have to reverse QE course.

|

| Source: Yardeni Research |

While October and 2014 have created sweet tasting returns in the major stock indexes, volatility is certain to eventually come back and spook investors. The midterm elections are just around the corner and there are plenty of other geopolitical uncertainties around the world capable of frightening financial markets. There will continue to be plenty of surprising tricks, even though Halloween has passed, but patient investors with diversified, low-cost, tax-efficient strategies should be rewarded with long-term treats.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

The Gift that Keeps on Giving

There have been numerous factors contributing to this bull market, even in the face of a slew of daunting and exhausting headlines. Contributing to the advance has been a steady stream of rising earnings; a flood of price buoying stock buybacks; and the all-important gift of growing dividends that keep on giving. Bonds have benefited to a lesser extent than stocks over the last five years in part because bonds lack the gift of rising dividend payouts. Life would be grander for bondholders, if the issuers had the heart to share generous news like this:

“Good day Mr. & Mrs. Jones. As your bond issuer, we value our mutually beneficial relationship so much that we would like to reward you as a bond investor. In addition to the 2.5% we are paying you now, we have decided to increase your annual payments by 6% per year for the next 20 years. In other words, we will increase your $2,500 in annual interest payments to over $8,000 per year. But wait…there’s more! You are such great people, we are going to increase the value of your initial $100,000 investment to $450,000.”

Does this sound too good to be true? Well, it’s not…sort of. However, the scenario is absolutely true, if you invested $100,000 in S&P 500 stocks during 1993 and held that investment until today. Unfortunately, the gift giving conversation above would be unattainable and the furthest from the truth, if you invested $100,000 into bonds. Today, if you decided to invest $100,000 in 20-year government bonds paying 2.5%, your $2,500 in annual payments will never increase over the next two decades. What’s more, by 2034 your initial principal of $100,000 won’t increase by a penny, while inflation slowly but surely crushes your investment’s purchasing power.

To illustrate the magical power of dividend compounding at a 6% CAGR, here is a chart of the S&P 500 dividend stream over the 21-year period of 1993 – 2014:

The trend of increasing dividends doesn’t appear to be slowing either. Here is a table showing the number of S&P 500 companies increasing their dividend payouts:

| COUNT OF DIVIDEND ACTIONS YEAR-TO-DATE | INCREASING THEIR DIVIDEND |

| 2014 YTD | 292 |

| 2013 | 366 |

| 2012 | 333 |

| 2011 | 320 |

| 2010 | 243 |

| 2009 | 151 |

Source: Standard and Poor’s

As I mentioned before, while dividends have more than tripled over the last twenty years, stock prices have gone up even more – appreciating about 4.5x’s (see chart below):

With aging demographics increasing retirement income needs, it comes as no surprise to me that the percentage of S&P 500 companies paying dividends has increased from 71% (351 companies) in 2001 to 84% (423 companies) at the end of Q3 – 2014. Interestingly, all 30 members of the Dow Jones Industrial Average currently pay a dividend. If you broaden out the perspective to all S&P Dow Jones Indices, you will discover the strength of dividends is particularly evident over the last 12 months. During this period, dividends increased by a whopping +27%, or $55 billion.

This trend in increasing dividends can also be seen through the lens of the dividend payout ratio. It is true that over longer timeframes the dividend payout ratio has been coming down (see Dividend Floodgates Widen) because of share buyback tax efficiency. Nevertheless, more recently the dividend payout ratio has drifted upwards to a range of about 32% of profits since 2011 (see chart below):

There’s no disputing the benefit of rising stock dividends. Baby Boomers, retirees, and other long-term investors are increasingly reaping the rewards of these dividend gifts that keep on giving.

Other Investing Caffeine articles on dividends:

Dividends: From Sapling to Abundant Fruit Tree

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs) including SPY, but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.