Ignoring Economics and Vital Signs

As stock prices sit near all-time record highs, and as we enter year nine of the current bull market, I remain amazed and amused at the brazen disregard for important basic economic concepts like supply & demand, interest rates, and rising profits.

If the stock market was a doctor’s patient, over the last decade, bloggers, pundits, talking heads, and pontificators have been ignoring the improving, healthy patient’s vital signs, while endlessly predicting the death of the resilient stock market.

However, let’s be clear – it has not been all hearts and flowers for stocks – there have been numerous -10%, -15%, and -20% corrections since the Financial Crisis nine years ago. Those corrections included the Flash Crash, debt downgrade, Arab Spring, sequestration, Taper Tantrum, Iranian Nuclear Threat, Ukrainian-Crimea annexation, Ebola, Paris/San Bernardino Terrorist Attacks, multiple European & Chinese slowdowns and more.

Despite the avalanche of headlines and volatility, we all know the net result of these events – a more than tripling of stock prices (+259%) from March 2009 to new all-time record highs. With the incessant stream of negative news, how could prices appreciate so dramatically?

Over the years, the explanations by outside observers have changed. First, the recovery was explained as a “dead cat bounce” or a short-term cyclical bull market within a long-term secular bear market. Then, when stock prices broke to new records, the focus shifted to Quantitative Easing (QE1, QE2, QE3, and Operation Twist). The QE narrative implied the bull advance was temporary due to the non-stop, artificial printing presses of the Fed. Now that the Fed has not only ended QE but reversed it (the Fed is actually contracting its balance sheet) and hiked interest rates (no longer cutting), outsiders are once again at a loss. Now, the bears are left clinging to the flawed CAPE metric I wrote about three years ago (see CAPE Smells Like BS), and using political headlines as a theory for record prices (i.e., record stock prices stem from inflated tax cut and infrastructure spending expectations).

It’s unfortunate for the bears that all the conspiracy theory headlines and F.U.D. (fear, uncertainty, and doubt) over the last 10 years have failed miserably as predictors for stock prices. The truth is that stock prices don’t care about headlines – stock prices care about economics. More specifically, stock prices care about profits, interest rates, and supply & demand.

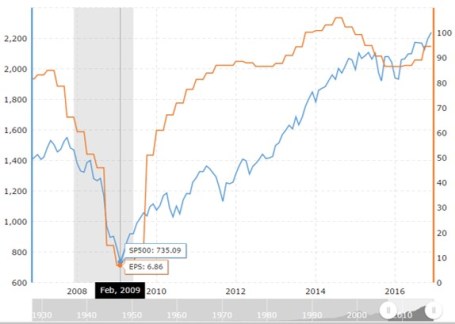

Profits

It’s quite simple. Stock prices have more than tripled since early 2009 because profits have more than tripled since 2009. As you can see from the Macrotrends chart below, 2009 – 2016 profits for the S&P 500 index rose from $6.86 to $94.54, or +1,287%. It’s no surprise either that stock prices stalled for 18 months from 2015 to mid-2016 when profits slowed. After profits returned to growth, stock price appreciation also resumed.

Source: Macrotrends

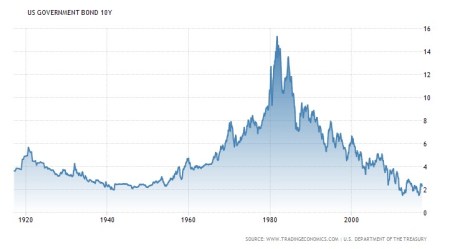

Interest Rates

When you could earn a +16% on a guaranteed CD bank rate in the early 1980s, do you think stocks were a more or less attractive asset class? If you can sense the rhetorical nature of my question, then you can probably understand why stocks were about as attractive as rotten milk or moldy bread. Back then, stocks traded for about 8x’s earnings vs. the 18x-20x multiples today. The difference is, today interest rates are near generational lows (see chart below), and CDs pay near +0%, thereby making stocks much more attractive. If you think this type of talk is heresy, ignore me and listen to the greatest investor of all-time, Warren Buffett who recently stated:

“Measured against interest rates, stocks are actually on the cheap side.”

Source: Trading Economics

Supply & Demand

Another massively ignored area, as it relates to the health of stock prices, is the relationship of new stock supply entering the market (e.g., new dilutive shares via IPOs and follow-on offerings), versus stock exiting the market through corporate actions. While there has been some coverage placed on the corporate action of share buybacks – about a half trillion dollars of stock being sucked up like a vacuum cleaner by cash heavy companies like Apple Inc. (AAPL) – little attention has been paid to the trillions of dollars of stock vanishing from mergers and acquisition activities. Yes, Snap Inc. (SNAP) has garnered a disproportionate amount of attention for its $3 billion IPO (Initial Public Offering), this is a drop in the bucket compared to the exodus of stock from M&A activity. Consider the trivial amount of SNAP supply entering the market ($3 billion) vs. $100s of billions in major deals announced in 2016 – 2017:

- Time Warner Inc. merger offer by AT&T Inc. (T) for $85 billion

- Monsanto Co. merger offer by Bayer AG (BAYRY) for $66 billion

- Reynolds American Inc. merger offer by British American Tobacco (BTI) for $47 billion

- NXP Semiconductors merger offer by Qualcomm Inc. (QCOM) for $39 billion

- LinkedIn merger offer by Microsoft Corp. (MSFT) for $28 billion

- Jude Medical, Inc. merger offer by Abbott Laboratories (ABT) for $25 billion

- Mead Johnson Nutrition merger offer by Reckitt Benckiser Group for $18 billion

- Mobileye merger offer by Intel Corp. (INTC) for $15 billion

- Netsuite merger offer by Oracle Corp. (ORCL) for $9 billion

- Kate Spade & Co. merger offer by Coach Inc. (COH) for $2 billion

While these few handfuls of deals represent over $300 billion in disappearing stock, as long as corporate profits remain strong, interest rates low, and valuations reasonable, there will likely continue to be trillions of dollars in stocks being purchased by corporations. This continued vigorous M&A activity should provide further healthy support to stock prices.

Admittedly, there will come a time when profits will collapse, interest rates will spike, valuations will get stretched, sentiment will become euphoric, and/or supply of stock will flood the market (see Don’t be a Fool, Follow the Stool). When the balance of these factors turn negative, the risk profile for stock prices will obviously become less desirable. Until then, I will let the skeptics and bears ignore the healthy economic vital signs and call for the death of a healthy patient (stock market). In the meantime, I will continue focus on the basics of math and offer my economics textbook to the doubters.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own AAPL, ABT, INTC, MSFT, T, and certain exchange traded funds, but at the time of publishing SCM had no direct position in SNAP, TWX, MON, KATE, N, MBLY, MJN, STJ, LNKD, NXPI, BAYRY, BTI, QCOM, ORCL, COH, RAI, Reckitt Benckiser Group, any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

The Fallacy Behind Populism and Automation Fears

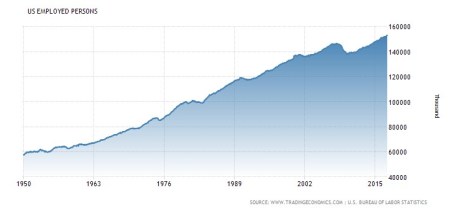

The rise of global populism and anti-immigration sentiments, coupled with the perpetual rising trend of automation and robotics has stoked the fear fires of job security. Many stories perpetuate erroneous stereotypes and falsehoods. The news reports and blog articles come in various flavors, but in a nutshell the stories state the U.S. is hemorrhaging jobs due to the thieves of illegal immigration and heartless robotics. The job displacement theory is built upon the idea that these two sources of labor (immigrants & robots) are cheaper and more productive than traditional blue collar and white collar American workers.

Although these logical beliefs make for great soundbites, and may sell subscriptions and advertising, unfortunately the substance behind the assertions holds little water. Let’s take a look at the facts. In the most recent April jobs report, nonfarm payrolls employment increased by 211,000 jobs, according to the U.S. Bureau of Labor Statistics. Since early 2009 the unemployment rate has plummeted from 10.0% down to a historically low level of 4.4%. Over the similar timeframe, the economy has added over 15,000,000 new jobs. Does this sound like an environment in which immigrants and robots are killing all American jobs?

Sounds like a bunch of phoney-baloney, if you ask me. Just look at the employed person chart below, which shows a rising employment trend over the last seven decades, with the exception of some brief recessionary periods.

As I point out in a previous article (see Rise of the Robots), from the beginning of the United States, the share of the largest segment of the economy (agriculture) dropped by more than 98%, yet the standard of living and output in the agriculture sector have still exploded. There may not have been robots two and a half centuries ago, but technology and automation were alive and well, just as they are today. Although there were no self-driving cars, no internet, no biotech drugs, and no mobile phones, there were technological advances like the cotton gin, plow, scythe, chemical fertilizers, tractors, combine harvesters, and genetically engineered seeds over time.

Source: Carpe Diem

And while there most certainly were farmers who regrettably were displaced by these technologies, there were massive new industries fostered by the industrial revolution, which redeployed labor to new burgeoning industries like manufacturing, aerospace, transportation, semiconductors, medicine, and many more.

While it may be difficult to fathom what industries will replace the workers displaced by self-service kiosks at restaurants, airports, and retail stores, famed economist Milton Friedman summed it up best when he stated:

“Human wants & needs are infinite, and so there will always be new industries, there will always be new professions.”

As globalization and technology continue permeating through society, it is true, the importance of education becomes more critical. Billions of people around the globe in developing markets, along with automation technology, will be stealing lower-paying American jobs that require repetitive processes. Educating our workforce up the value-add food chain is imperative.

The bottom-line is that integration of technology and automation will improve the standard of living for the masses. Sure, immigration will displace some workers, but if legislative policy can be designed to cherry-pick (attract) the cream of the skilled foreign crop (and retrain displaced workers), skilled immigrants will keep on innovating and creating higher valued jobs. Just consider a recent study that shows 51% of U.S. billion-dollar startups were founded by immigrants.

The populist drum may continue to pound against immigration, and horror stories of job-stealing robots may abound, however the truth cannot be erased. Over the long-run, the fallacies behind populism and automation will be uncovered. The benefits and truths surrounding highly skilled immigrants and robots will be realized, as these dynamics dramatically improve the standard of living and productivity of our great economy.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Glass Half Full or Half Empty?

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (May 1, 2017). Subscribe on the right side of the page for the complete text.

We live in a time of confusing dichotomies, which makes deciphering the flood of daily data quite challenging. In that context, determining whether the current economic fundamentals should be viewed from a glass half empty of glass half full perspective can be daunting.

More specifically, stock markets have again recently hit new all-time record highs, yet if you read the newspaper headlines, you might think we’re in the midst of Armageddon. Last month, the Dow Jones Industrial Average stock index eclipsed 21,000 and the technology-heavy NASDAQ index surpassed the psychologically important 6,000 threshold. In spite of the records, here’s a sampling of the steady stream of gloomy feature stories jamming the airwaves:

- French Elections – Danger of European Union Breakup

- Heightened Saber Rattling by U.S. Towards North Korea

- Threat of U.S. Government Shutdown

- First 100 Days – Obamacare repeal failure, tax reform delays, no significant legislation

- NAFTA Trade Disputes

- Russian Faceoff Over Syrian Civil War & Terrorism

- Federal Reserve Interest Rate Hikes Could Derail Stock Market

- Slowing GDP / Economic Data

Given all this doom, how is it then that stock markets continue to defy gravity and continually set new record highs? Followers of my writings understand the crucial, driving dynamics of financial markets are not newspaper, television, magazine, and internet headlines. The most important factors are corporate profits, interest rates, valuations, and investor sentiment. All four of these elements will bounce around, month-to-month, and quarter-to-quarter, but for the time being, these elements remain constructive on balance, despite the barrage of negative, gut-wrenching headlines.

Countering the perpetual flow of gloomy, cringe-worthy headlines, we have seen a number of positive developments:

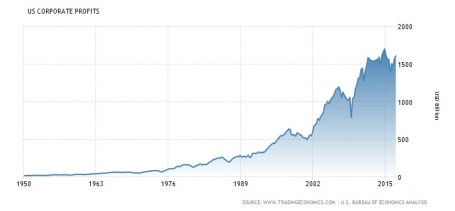

- Record Breaking Corporate Profits: Profits are the chief propellant for higher stock prices, and so far, for the 1st quarter, S&P 500 company profits are estimated to have risen +12.4% – the highest rate since 2011, according to Thomson Reuters I/B/E/S. As I like to remind my readers, stock prices follow profits over the long-run, which is evidenced by the chart below.

Source: Trading Economics

- Interest Rates Low: With interest rate levels still near generational lows (10-Year Treasury @ 2.28%), and inflation relatively stable around 2%, this augurs well for most asset prices. For U.S. consumers there are many stimulative effects to lower interest rates, whether you are buying a house, purchasing a car, paying off a school loan, and/or reducing credit card debt. Lower rates equal lower payments.

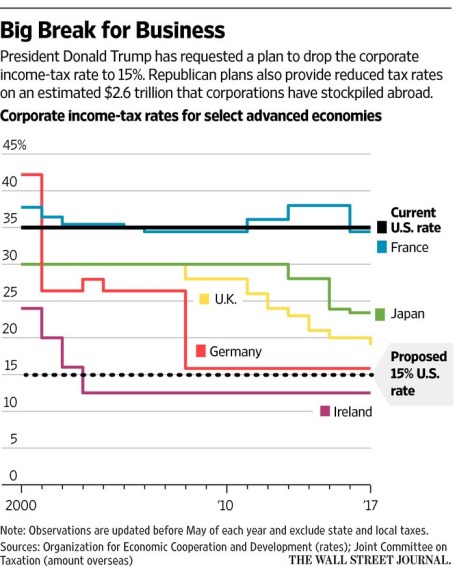

- Potential Tax Reform: There are numerous stimulative components to the largest planned tax-cut in history. First of all, cutting the tax rate from 35% to 15% for corporations and small businesses (i.e. pass-through entities like LLCs and S-Corps) would place a lot of dollars back in the pockets of taxpayers and should stimulate economic growth. Other components of the White House proposal include the termination of the estate tax, the elimination of the AMT (Alternative Minimum Tax) targeted at wealthier households, and the doubling of the standard deduction to help middle-income families. All of this sounds great on paper, but not a lot of details have been provided yet on how these benefits will be paid for – removing state tax deductions alone is unlikely to fully offset revenue declines. The chart below highlights how high U.S. corporate income tax rates are relative to other foreign counterparts.

Source: The Wall Street Journal

- Business Spending & Confidence on the Rise: Ever since the 2008-09 Great Recession, the U.S. has been a better house in a bad neighborhood relative to other global developed economies. However, the recovery has been gradual and muted due to tight-fisted companies being slow to hire and invest. Although recent Q1 GDP economic data came in at a sluggish +0.7% growth rate, the bright spot embedded in the data was a +12% annualized increase in private fixed investment. This is consistent with the spike we’ve seen in recent business and consumer confidence surveys (see chart below). Although this confidence has yet to translate into an acceleration in broader economic data, the ramp in capital spending and positive business sentiment could be a leading indicator for faster economic growth to come. Stimulative legislation enacted by Congress (i.e., tax reform, infrastructure spending, foreign repatriation, etc.) could add further fuel to the economic growth engine.

Source: Trading Economics

- Economy Keeps Chugging Along: As the wealthiest country on the planet, we Americans can become a little spoiled with success, which helps explain the media’s insatiable appetite for growth. Nevertheless, the broader economic data show a continuing trend of improvement. Simply consider the trend occurring in these major areas of the economy:

- Unemployment – The jobless rate has been chopped by more than half from a 10.0% cycle peak to 4.5% today.

- Housing – The number of annual existing home sales has increased by more than +60% from the cycle low to 5.7 million units, which still leaves plenty of headroom for growth before 2006 peak sales levels are reached.

- Consumer Spending – This segment accounts for roughly 70% of our country’s economic activity. Although we experienced a soft patch in Q1 of 2017, as you can see from the chart below, we Americans have had no problem spending more to keep our economy functioning.

Source: Trading Economics

While key economic statistics remain broadly constructive, there will come a time when prudence will dictate the pursuit of a more defensive investment strategy. When will that be? In short, the time to become more cautious will be when we see a combination of the following occur:

- Sharp increase in interest rates

- Signs of a significant decline in corporate profits

- Indications of an economic recession (e.g., an inverted yield curve)

- Spike in stock prices to a point where valuation (prices) are at extreme levels and skeptical investor sentiment becomes euphoric

To date, there is no objective evidence indicating these dynamics are in place, so until then, I will remain thirsty and grab my half glass full of water.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Managing the Chaos – Investing vs. Gambling

How does one invest amid the slew of palm sweating, teeth grinding headlines of Syria, North Korea, Brexit, expanding populism, Trumpcare, French candidate Marine Le Pen, and a potential government shutdown? Facing a persistent mountain of worries can seem daunting to many. With so many seemingly uncontrollable factors impacting short-term interest rates, foreign exchange rates, and equity markets, it begs the question of whether investing is a game of luck (gambling) or a game of skill?

The short answer is…it depends. Professional gambler Alvin “Titanic” Thompson captured the essence when someone asked him whether poker was a game of chance. Thompson responded by stating, “Not the way I play it.”

If you go to Las Vegas and gamble, most games are generally a zero sum-game, meaning there are an equal number of winners and losers with the house (casino) locking in a guaranteed spread (profit). For example, consider a game like roulette – there are 18 red slots, 18 black slots, and 2 green slots (0 & 00), so if you are betting on red vs. black, then the casino has a 5.26% advantage. If you bet long enough, the casino will get all your money – there’s a reason Lost Wages Las Vegas can build those extravagantly large casinos.

The same principles of money-losing bets apply to speculative short-term trading. Sure, there are examples of speculators hitting it big in the short-run, but most day traders lose money (see Day Trading Your House) because the odds are stacked against them. In order to make an accretive, profitable trade, not only does the trader have to be right on the security they’re selling (i.e. that security must underperform in the future), but they also have to be right on the security they are buying (i.e. that security must outperform in the future). But the odds for the speculator get worse once you also account for the trading fees, taxes, bid-ask spreads, impact costs (i.e., liquidity), and informational costs (i.e., front running, high frequency traders, algorithms, etc.).

The key to winning at investing is to have an edge, and the easiest way to have an investing edge is to invest for the long-run – renowned Professor Jeremy Siegel agrees (see Stocks for the Long Run). It’s common knowledge the stock market is up about two-thirds of the time, meaning the odds and wind are behind the backs of long-term investors. Short-term trading is the equivalent of going fishing, and then continually pulling your fishing line out of the water (you’re never going to catch anything). The fisherman is better off by researching a good location and then maintaining the lure in the water for a longer period until success is achieved.

Although most casino games are based on pure luck, there are some games of skill, like poker, that can produce consistent long-term positive results, if you are a patient professional with an advantage or edge (see Dan Harrington article ). Having an edge in investing is crucial, but an edge is not the only aspect of successful investing. How you structure a portfolio to control risk (i.e., money management), and reducing your personal behavioral biases are additional components to a winning investment strategy. Professional poker player Walter Clyde “Puggy” Pearson summed it up best when he described the three critical components to winning:

“Knowing the 60-40 end of a proposition, money management, and knowing yourself.”

At Sidoxia Capital Management, we have also achieved long-term success by following a systematic, disciplined process. A large portion of our investment strategy is focused on identifying market leading franchises with a long runway of growth, and combining those dynamics with positions trading at attractive or fair values. As part of this process, we rank our stocks based on multiple factors, primarily using data from our proprietary SHGR ranking (see Investing Holy Grail) and free cash flow yield analysis, among other important considerations. Based on the risk-reward profiles of our existing holdings and the pool of targeted investments, we can appropriately size our positions accordingly (i.e., money management). As valuations rise, or risk profiles deteriorate, we can make the corresponding portfolio positions cuts, especially if we find more attractive alternative investments. Having a proven, systematic, unbiased process has helped us tremendously in minimizing behavioral pitfalls (i.e., knowing yourself) when we construct client portfolios.

The world is under assault…but that has always been the case. Throughout investment history, there have been wars, assassinations, unexpected election outcomes, banking crises, currency crises, natural disasters, health epidemics, and more. Unfortunately, millions have gambled and bet their money away based on these frivolous, ever-changing, short-term headlines. On the other hand, those investors who understand the 60-40 end of a proposition, coupled with the importance of money management and controlling personal biases, will be the skillful winners to prosper over the long-run.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Investing in a World of Black Swans

In the world of modern finance, there has always been the search for the Holy Grail. Ever since the advent of computers, practitioners have looked to harness the power of computing and direct it towards the goal of producing endless profits. Today the buzz words being used across industries include, “AI – Artificial Intelligence,” “Machine Learning,” “Neural Networks,” and “Deep Learning.” Regrettably, nobody has found a silver bullet, but that hasn’t slowed down people from trying. Wall Street has an innate desire to try to turn the ultra-complex field of finance into a science, just as they do in the field of physics. Even banking stalwart JPMorgan Chase (JPM) and its renowned CEO/Chairman Jamie Dimon suffered billions in losses in the quest for infinite income, due in large part to their over-reliance on pseudo-science trading models.

Preceding JPM’s losses, James Montier of Grantham Mayo van Otterloo’s asset allocation team gave a keynote speech at a CFA Institute Annual Conference in Chicago, where he gave a prescient talk explaining why bad models were the root cause of the financial crisis. Montier noted these computer algorithms essentially underappreciate the number and severity of Black Swan events (low probability negative outcomes) and the models’ inability to accurately identify predictable surprises.

What are predictable surprises? Here’s what Montier had to say on the topic:

“Predictable surprises are really about situations where some people are aware of the problem. The problem gets worse over time and eventually explodes into crisis.”

When Dimon was made aware of the 2012 rogue trading activities, he strenuously denied the problem before reversing course and admitting to the dilemma. Unfortunately, many of these Wall Street firms and financial institutions use value-at-risk (VaR) models that are falsely based on the belief that past results will repeat themselves, and financial market returns are normally distributed. Those suppositions are not always true.

Another perfect example of a Black Swan created by a bad financial model is Long Term Capital Management (LTCM) – see also When Genius Failed. Robert Merton and Myron Scholes were world renowned Nobel Prize winners who single-handedly brought the global financial market to its knees in 1998 when LTCM lost $500 million in one day and required a $3.6 billion bailout from a consortium of banks. Their mathematical models worked for a while but did not fully account for trading environments with low liquidity (i.e., traders fleeing in panic) and outcomes that defied the historical correlations embedded in their computer algorithms. The “Flash Crash” of 2010, in which liquidity evaporated due to high-frequency traders temporarily jumping ship, is another illustration of computers wreaking havoc on the financial markets.

The problem with many of these models, even for the ones that work in the short-run, is that behavior and correlations are constantly changing. Therefore any strategy successfully reaping outsized profits in the near-term will eventually be discovered by other financial vultures and exploited away.

Another pundit with a firm hold on Wall Street financial models is David Leinweber, author of Nerds on Wall Street. As Leinweber points out, financial models become meaningless if the data is sliced and diced to form manipulated and nonsensical relationships. The data coming out can only be as good as the data going in – “garbage in, garbage out.”

In searching for the most absurd data possible to explain the returns of the S&P 500 index, Leinweiber discovered that butter production in Bangladesh was an excellent predictor of stock market returns, explaining 75% of the variation of historical returns. By tossing in U.S. cheese production and the total population of sheep in Bangladesh, Leinweber was able to mathematically “predict” past U.S. stock returns with 99% accuracy. To read more about other financial modeling absurdities, check out a previous Investing Caffeine article, Butter in Bangladesh.

Generally, investors want precision through math, but as famed investor Benjamin Graham noted more than 50 years ago, “Mathematics is ordinarily considered as producing precise, dependable results. But in the stock market, the more elaborate and obtuse the mathematics, the more uncertain and speculative the conclusions we draw therefrom. Whenever calculus is brought in, or higher algebra, you can take it as a warning signal that the operator is trying to substitute theory for experience.”

If these models are so bad, then why do so many people use them? Montier points to “intentional blindness,” the tendency to see what one expects to see, and “distorted incentives” (i.e., compensation structures rewarding improper or risky behavior).

Montier’s solution to dealing with these models is not to completely eradicate them, but rather recognize the numerous shortcomings of them and instead focus on the robustness of these models. Or in other words, be skeptical, know the limits of the models, and build portfolios to survive multiple different environments.

Investors seem to be discovering more financial Black Swans over the last few years in the form of events like the Lehman Brothers bankruptcy, Flash Crash, and Greek sovereign debt default. Rather than putting too much faith or dependence on bad financial models to identify or exploit Black Swan events, the over-reliance on these models may turn this rare breed of swans into a large bevy.

See Full Article on Montier: Failures of Modern Finance

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own JPM and certain exchange traded funds, but at the time of publishing SCM had no direct position in Lehman Brothers, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

You Can’t Kiss All the Beauties

When I was in high school and college, kissing all the pretty girls was not a realistic goal. The same principle applies to stock picking – you can’t buy all the outperforming stocks. As far as I’m concerned, there will always be some people who are smarter, better looking, and wealthier than I am, but that has little to do with whether I can continue to outperform, if I stick to my systematic, disciplined process. In fact, many smart people are horrible investors because they overthink the investing process or suffer from “paralysis by analysis.” When it comes to investing, the behavioral ability to maintain independence is more important than being a genius. If you don’t believe me, just listen to arguably the smartest investor of all-time, Warren Buffett:

“Success in investing doesn’t correlate with I.Q. once you’re above the level of 125. Once you have ordinary intelligence, what you need is the temperament to control the urges that get other people into trouble in investing.”

Even the best investors and stock pickers of all-time are consistently wrong. When selecting stocks, a worthy objective is to correctly pick three outperforming stocks out of five stocks. And out of the three winning stocks, the rationale behind the outperformance should be correct in two out of those three stocks. In other words, you can be right for the wrong reason in one out of three outperforming stocks. The legendary investor Peter Lynch summed it up when he stated, “If you’re terrific in this business you’re right six times out of 10.”

Yes, it’s true, luck does play a role in stock selection. You just don’t want luck being the major driving force behind your success because luck cannot be replicated consistently over the long-run. There are so many unpredictable variables that in the short-run can work for or against the performance of your stock. Consider factors like politics, monetary policy, weather, interest rates, terrorist attacks, regulations, tax policy, and many other influences that are challenging or impossible to forecast. Over the long-run, these uncontrollable and unpredictable factors should balance out, thereby allowing your investing edge to shine.

Although I have missed some supermodel stocks, I have kissed some pretty stocks in my career too. I wish I could have invested in more stocks like Amazon.com Inc. (AMZN) that have increased more than 10x-fold, but other beauties like Apple Inc. (AAPL), Alphabet Inc. (GOOG), and Facebook Inc. (FB), haven’t hurt my long-term performance either. As is the case for most successful long-term investors, winning stocks generally more than compensate for the stinkers, if you can have the wherewithal to hold onto the multi-baggers (i.e., stocks that more than double), which admittedly is much easier said than done. Peter Lynch emphasized this point by stressing a focus on the long-term:

“You don’t need a lot of good hits every day. All you need is two to three goods stocks a decade.”

Sticking to a process of identifying and investing in well-managed companies at attractive valuations is a much better approach to investing than chasing every beauty you see or read about. If you stick to this simple formula, you can experience lovely, long-term results.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in AAPL, FB, GOOG, AMZN, and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

No April Fool’s Joke – Another Record

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (April 3, 2017). Subscribe on the right side of the page for the complete text.

Having children is great, but a disadvantage to having younger kids are the April Fool’s jokes they like to play on parents. Fortunately, this year was fairly benign as I only suffered a nail-polish covered bar of soap in the shower. However, what has not been a joke has been the serious series of new record highs achieved in the stock market. While it is true the S&P 500 index finished roughly flat for the month (-0.0%) after hitting new highs earlier in March, the technology-laden NASDAQ index continued its dominating run, advancing +1.5% in March contributing to the impressive +10% jump in the first quarter. For 2017, the NASDAQ supremacy has been aided by the stalwart gains realized by leaders like Apple Inc. (up +24%), Facebook Inc. (up +23%), and Amazon.com Inc. (up +18%). The surprising fact to many is that these records have come in the face of immense political turmoil – most recently President Trump’s failure to deliver on a campaign promise to repeal and replace the Obamacare healthcare system.

Like a broken record, I’ve repeated there are much more important factors impacting investment portfolios and the stock market other than politics (see also Politics Schmolitics). In fact, many casual observers of the stock market don’t realize we have been in the midst of a synchronized, global economic expansion, helped in part by the stabilization in the value of the U.S. dollar over the last couple of years.

Source: Investing.com

As you can see above, there was an approximate +25% appreciation in the value of the dollar in late-2014, early-2015. This spike in the value of the dollar suddenly made U.S. goods sold abroad +25% more expensive, resulting in U.S. multinational companies experiencing a dramatic profitability squeeze over a short period of time. The good news is that over the last two years the dollar has stabilized around an index value of 100. What does this mean? In short, this has provided U.S. multinational companies time to adjust operations, thereby neutralizing the currency headwinds and allowing the companies to return to profitability growth.

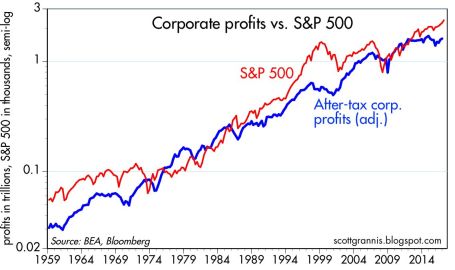

Source: Calafia Beach Pundit

And profits are back on the rise indeed. The six decade long chart above shows there is a significant correlation between the stock market (red line – S&P 500) and corporate profits (blue line). The skeptics and naysayers have been out in full force ever since the 2008-2009 financial crisis – I profiled these so-called “sideliners” in Get out of Stocks!.

As the stock market continues to hit new record highs, the doubters continue to scream danger. There will always be volatility, but when the richest investor of all-time, Warren Buffett, continues to say that stocks are still attractively priced, given the current interest rate environment, that goes a long way to assuage investor concerns.

Politically, a lot could still go wrong as it relates to healthcare, tax reform, and infrastructure spending, to name a few issues. However, it’s still early, and it’s possible positive surprises could also occur. More importantly, as I’ve noted before, corporate profits, interest rates, valuations, and investor sentiment are much more important factors than politics, and on balance these factors are on the favorable side of the ledger. These factors will have a larger impact on the long-term direction of stock prices.

With approval ratings of Congress and the President at low levels, investors have had trouble finding humor in politics, even on April Fool’s Day. Another significant factor more important than politics is the issue of retirement savings by Americans, which is no joke. As you finalize your tax returns in the coming weeks, it behooves you to revisit your retirement plan and investment portfolio. Inefficiently investing your money or outliving your savings is no laughing matter. I’ll continue with my disciplined financial plan and leave the laughing to my kids, as they enjoy planning their next April Fool’s Day prank.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in AAPL, FB, AMZN, and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

What’s Important? Moving on Beyond Politics…

On a daily basis we turn on the TV or read about Democrats screaming at Republicans, or vice versa. Despite screams from the opposition, a Democratically-led Congress was able to successfully push Obamacare through the House and Senate in 2010 in a partisan fashion. The Republicans, however, were unable to jam repeal Obamacare legislation seven years later – at least on their first attempt.

While many Americans who sit at the opposite end of the political spectrum continue to scream at each other until they’re purple in the face, data indicates it is the Independents who are controlling the outcomes of elections. More specifically, a recent Gallup poll shows that 43% of voters identify as political independents, while over the last decade the percentage of voters identifying themselves with the traditional parties of Democrats and Republicans have declined to 30% and 26%, respectively.

It is true, President Trump potentially has a very limited party majority window before next year’s midterm elections. While Republicans do currently have an advantage over Democrats, as I’ve stated before, there are more important issues than these political ones, especially when it relates to your finances.

Whether the discussion revolves around healthcare, tax reform, defense spending, or immigration, the amount of influence you as a voter have on the political outcomes pales in comparison to the amount of control you ultimately have over your personal financial situation. As I’ve written in the past (see also Getting to Your Number), creating a secure financial plan will impact your long-term monetary success much more than senseless cheering or screaming for Obamacare’s long-run success or failure.

More critical than focusing on politics, the importance of calculating your budget, income sources, time horizon, and risk tolerance should be higher priorities. Everybody’s personal situation is different, therefore it is essential to explore a variety of other essential questions, including the following:

- How many more years do you plan to work?

- How much income will you need in retirement?

- What is your expected return on investments, given your asset allocation?

- How much debt do you presently have, and what are your plans to reduce it?

- What are the probabilities of you gaining an inheritance, and at what estimated value?

- Do you have an estate plan in place?

- Do you have children, and if so, what are your educational goals, and what type of inheritance or financial support are you looking to provide your children?

Since every investor’s situation is unique, there are plenty of other items to investigate. Politics is a state of mind, so don’t let the vicissitudes of Washington DC affect your long-term financial well-being.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Double Dip Expansion?

Ever since the 2008-2009 financial crisis, every time the stock market has experienced a -5%, -10%, or -15% correction, industry pundits and media talking heads have repeatedly sounded the “Double Dip Recession” alarm bells. As you know, we have yet to experience a technical recession (two reported quarters of negative GDP growth), and stock prices have almost quadrupled from a 2009 low on the S&P 500 of 666 to 2,378 today (up approximately +257%).

Over the last nine years, so-called experts have been warning of an imminent stock market collapse from the likes of PIIGS (Portugal/Italy/Ireland/Greece/Spain), Cyprus, China, Fed interest rate hikes, Brexit, ISIS, U.S. elections, North Korea, French elections, and other fears. While there have been plenty of “Double Dip Recession” references, what you have not heard are calls for a “Double Dip Expansion.”

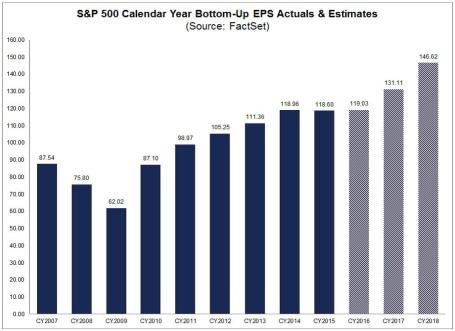

Is it possible that after the initial 2010-2014 economic expansionary rebound, and subsequent 2015-2016 earnings recession caused by sluggish global growth and a spike in the value of the U.S. dollar, we could possibly be in the midst of a “Double Dip Expansion?” (see earnings chart below)

Source: FactSet

Whether you agree or disagree with the new political administration’s politics, the economy was already on the comeback trail before the November 2016 elections, and the momentum appears to be continuing. Not only has the pace of job growth been fairly consistent (+235,000 new jobs in February, 4.7% unemployment rate), but industrial production has been picking up globally, along with a key global trade index that accelerated to 4-5% growth in the back half of 2016 (see chart below).

Source: Calafia Beach Pundit

This continued, or improved, economic growth has arisen despite the lack of legislation from the new U.S. administration. Optimists hope for an improved healthcare system, income tax reform, foreign profit repatriation, and infrastructure spending as some of the initiatives to drive financial markets higher.

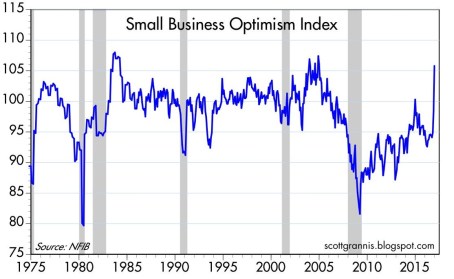

Pessimists, on the other hand, believe all these proposed initiatives will fail, and cause financial markets to fall into a tailspin. Regardless, at least for the period following the elections, investors and companies have perceived the pro-business rhetoric, executive orders, and regulatory relief proposals as positive developments. It’s widely understood that small businesses supply the largest portion of our nation’s jobs, and the upward spike in Small Business Optimism early in 2017 is a welcome sign (see chart below).

Source: Calafia Beach Pundit

Yes, it is true our new president could send out a rogue tweet; start a trade war due to a tariff slapped on a critical trading partner; or make a hawkish military remark that isolates our country from an ally. These events, along with other potential failed campaign promises, are all possibilities that could pause the trajectory of the current bull market. However, more importantly, as long as corporate profits, the mother’s milk of stock price appreciation, continue to march higher, then the stock market fun can continue. If that’s the case, there will likely be less talk of “Double Dip Recessions,” and more discussions of a “Double Dip Expansion.”

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Munger: Buffett’s Wingman & the Art of Stock Picking

Simon had Garfunkel, Batman had Robin, Hall had Oates, Dr. Evil had Mini Me, Sonny had Cher, and Malone had Stockton. In the investing world, Buffett has Munger. Charlie Munger is one of the most successful and famous wingmen of all-time – evidenced by Berkshire Hathaway Corporation’s (BRKA/B) outperformance of the S&P 500 index by approximately +624% from 1977 – 2009, according to MarketWatch. Munger not only provides critical insights to his legendary billionaire boss, Warren Buffett, but he was also Chairman of Berkshire’s insurance subsidiary, Wesco Financial Corporation from 1984 until 2011. The magic of this dynamic duo began when they met at a dinner party 58 years ago (1959).

In an article he published in 2006, the magnificent Munger describes the “Art of Stock Picking” in a thorough review about the secrets of equity investing. We’ll now explore some of the 93-year-old’s sage advice and wisdom.

Model Building

Charlie Munger believes an individual needs a solid general education before becoming a successful investor, and in order to do that one needs to study and understand multiple “models.”

“You’ve got to have models in your head. And you’ve got to array your experience both vicarious and direct on this latticework of models. You may have noticed students who just try to remember and pound back what is remembered. Well, they fail in school and in life. You’ve got to hang experience on a latticework of models in your head.”

Although Munger indicates there are 80 or 90 important models, the examples he provides include mathematics, accounting, biology, physiology, psychology, and microeconomics.

Advantages of Scale

Great businesses in many cases enjoy the benefits of scale, and Munger devotes a good amount of time to this subject. Scale advantages can be realized through advertising, information, psychological “social proofing,” and structural factors.

The newspaper industry is an example of a structural scale business in which a “winner takes all” phenomenon applies. Munger aptly points out, “There’s practically no city left in the U.S., aside from a few very big ones, where there’s more than one daily newspaper.”

General Electric Co. (GE) is another example of a company that uses scale to its advantage. Jack Welch, the former General Electric CEO, learned an early lesson. If the GE division is not large enough to be a leader in a particular industry, then they should exit. Or as Welch put it, “To hell with it. We’re either going to be # 1 or #2 in every field we’re in or we’re going to be out. I don’t care how many people I have to fire and what I have to sell. We’re going to be #1 or #2 or out.”

Bigger Not Always Better

Scale comes with its advantages, but if not managed correctly, size can weigh on a company like an anchor. Munger highlights the tendency of large corporations to become “big, fat, dumb, unmotivated bureaucracies.” An implicit corruption also leads to “layers of management and associated costs that nobody needs. Then, while people are justifying all these layers, it takes forever to get anything done. They’re too slow to make decisions and nimbler people run circles around them.”

Becoming too large can also create group-think, or what Munger calls “Pavlovian Association.” Munger goes onto add, “If people tell you what you really don’t want to hear what’s unpleasant there’s an almost automatic reaction of antipathy…You can get severe malfunction in the high ranks of business. And of course, if you’re investing, it can make a lot of difference.”

Technology: Benefit or Burden?

Munger recognizes that technology lowers costs for companies, but the important question that many managers fail to ask themselves is whether the benefits from technology investments accrue to the company or to the customer? Munger summed it up here:

“There are all kinds of wonderful new inventions that give you nothing as owners except the opportunity to spend a lot more money in a business that’s still going to be lousy. The money still won’t come to you. All of the advantages from great improvements are going to flow through to the customers.”

Buffett and Munger realized this lesson early on when productivity improvements gained from technology investments in the textile business all went to the buyers.

Surfing the Wave

When looking for good businesses, Munger and Buffett are looking to “surf” waves or trends that will generate healthy returns for an extended period of time. “When a surfer gets up and catches the wave and just stays there, he can go a long, long time. But if he gets off the wave, he becomes mired in shallows,” states Munger. He notes that it’s the “early bird,” or company that identifies a big trend before others that enjoys the spoils. Examples Munger uses to illustrate this point are Microsoft Corp. (MSFT), Intel Corp. (INTC), and National Cash Register from the old days.

Large profits will be collected by those investors that can identify and surf those rare large waves. Unfortunately, taking advantage of these rare circumstances becomes tougher and tougher for larger investors like Berkshire. If you’re an elephant trying to surf a wave, you need to find larger and larger waves, and even then, due to your size, you will be unable to surf as long as small investors.

Circle of Competence

Circle of competence is not a new subject discussed by Buffett and Munger, but it is always worth reviewing. Here’s how Munger describes the concept:

“You have to figure out what your own aptitudes are. If you play games where other people have the aptitudes and you don’t, you’re going to lose. And that’s as close to certain as any prediction that you can make. You have to figure out where you’ve got an edge. And you’ve got to play within your own circle of competence.”

For Munger and Buffett, sticking to their circle of competence means staying away from high-technology companies, although more recently they have expanded this view to include International Business Machines (IBM), which they are now a large investor.

Market Efficiency or Lack Thereof

Munger acknowledges that financial markets are quite difficult to beat. Since the markets are “partly efficient and partly inefficient,” he believes there is a minority of individuals who can outperform the markets. To expand on this idea, he compares stock investing to the pari-mutuel system at the racetrack, which despite the odds stacked against the bettor (17% in fees going to the racetrack), there are a few individuals who can still make decent money.

The transactional costs are much lower for stocks, but success for an investor still requires discipline and patience. As Munger declares, “The way to win is to work, work, work, work and hope to have a few insights.”

Winning the Game – 10 Insights / 20 Punches

As the previous section implies, outperformance requires patience and a discriminating eye, which has allowed Berkshire to create the bulk of its wealth from a relatively small number of investment insights. Here’s Munger’s explanation on this matter:

“How many insights do you need? Well, I’d argue: that you don’t need many in a lifetime. If you look at Berkshire Hathaway and all of its accumulated billions, the top ten insights account for most of it….I don’t mean to say that [Warren] only had ten insights. I’m just saying, that most of the money came from ten insights.”

Chasing performance, trading too much, being too timid, and paying too high a price are not recipes for success. Independent thought accompanied with selective, bold decisions is the way to go. Munger’s solution to these problems is to provide investors with a Buffett 20-punch ticket:

“I could improve your ultimate financial welfare by giving you a ticket with only 20 slots in it so that you had 20 punches ‑ representing all the investments that you got to make in a lifetime. And once you’d punched through the card, you couldn’t make any more investments at all.”

The great thing about Munger and Buffett’s advice is that it is digestible by the masses. Like dieting, investing can be very simple to understand, but difficult to execute, and legends like these always remind us of the important investing basics. Even though Charlie Munger may be slowing down a tad at 93-years-old, Warren Buffett and investors everywhere are blessed to have this wingman around spreading his knowledge about investing and the art of stock picking.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, BRKA/B, GE, MSFT, INTC, IBM but at the time of this 3/12/17 updated publishing, SCM had no direct position in National Cash Register, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.