Posts filed under ‘Themes – Trends’

Cash Security Blanket Turns Into Tourniquet

Article is an excerpt from Sidoxia Capital Management’s April 2012 newsletter. Subscribe on right side of page.

That warm safety blanket of cash that millions of Americans have clutched on to during the 2008-09 financial crisis; the 2010 “Flash Crash”; and the 2011 U.S. credit downgrade felt cozy during the bumpy ride we experienced over the last three years. Now with domestic stocks (S&P 500) up +12% in the first quarter of 2012, that same comfy blanket of CDs, money market, and checking accounts is switching into a painful tourniquet, cutting off the lucrative blood and oxygen supply to millions of Americans’ future retirement plans.

Earning next to nothing by stuffing your money under the mattress (0.7% average CD rate – Bankrate.com) isn’t going to make many financial dreams a reality. The truth of the matter is that due to inflation (running +2% to +3% per year), blanket holders are losing about -2% per year in the true value of their savings.

Your Choice: 3 Years or 107 years?

If you like to accumulate money, would you prefer doubling your money in 3 years or 107 years? Although the S&P 500 has more than doubled over the last three years, based on fund flows data and cash balances at the banks, apparently more individuals prefer waiting until the year 2119 (107 years from now) for their money to double – SEE CHART BELOW.

Obviously the massive underperformance of CDs cherry picks the time-period a bit, given the superb performance of stocks from 2009 – 2012 year-to-date. Over 1999-2012 stock performance hasn’t been as spectacular, but what we do know is that despite the lackluster performance of stocks over the last 12 years, corporate profits have about doubled in a similar timeframe, making equity prices that much more attractive relative to 1999.

With the economy and employment picture improving, some doomsday scenarios have temporarily been put on the backburner. As the recovery has gained some steam, many people are opening their bank statements with the painful realization, “I just made $31.49 on my checking maximizer account last year! Wow, how incredible…I can now go out and buy a half-tank of gas.” Never mind that healthcare premiums are exploding, food costs are skyrocketing, and that vacation you were planning is now out of reach. If you’re a mega-millionaire, perhaps you can make these stingy rates work for you, but for most of the other people, successful retirements will require more efficient use of their investment dollars. Or of course you can always work at Wal-Mart (WMT) as a greeter in your 80s.

Rationalizing with a Teen

Some people get it and some don’t. Trying to time the market, by getting in and out at the right times is a losing battle (see Getting Off the Market Timing Treadmill). Even the smartest professionals in the industry have little accuracy and cannot consistently predict the direction of the markets. Rationalizing the ups and downs of the financial markets is equivalent to rationalizing the actions of a teenager. Sometimes the outcomes are explainable, but most of the times they are not.

What an astute investor does know is that higher long-term returns come with higher volatility. So while the last four years have been a bumpy ride for investors, this is nothing new for an experienced investor who has studied the history of financial markets. There have been a dozen or so recessions since World War II, and we’ll have a dozen or so more over the next 50-60 years. Wars, banking crises, currency crises, and political turmoil have been a constant over history. Despite all these setbacks, the equity markets have climbed over +1,300% over the last 30 years or so. The smartest financial minds on the planet (e.g., the Ben Bernankes and Alan Greenspans of the world) haven’t been able to figure it out, so if they couldn’t do it, how is an average Joe supposed to be able to time the market? The answer is nobody can predict the direction of the market reliably.

As my clients and Investing Caffeine followers know, for those individuals with adequate savings and shorter time horizons, much of this conversation is irrelevant. However, based on our country’s low savings rate and the demographics of longer Baby Boomer life expectancies, most individuals can’t afford to stuff all their money under the mattress. As famous investor Sir John Templeton stated, “The only way to avoid mistakes is not to invest – which is the biggest mistake of all.” Earning 0.7% on your nest egg is difficult to call investing.

Ignoring the Experts

Why is the investing game so difficult? For starters, individuals are constantly bombarded by so-called experts through television, radio, and newspapers. Not only did Federal Reserve Chairmen Alan Greenspan and Ben Bernanke get the economy, financial markets, and housing markets wrong, the most powerful and smart financial institution CEOs were dead wrong as well. Look no further than Lehman Brothers (Dick Fuld), Citigroup Inc. (Chuck Prince), and American International Group (Martin Sullivan), which were believed to house some of the shrewdest executives – they too completely missed the financial crisis.

Rather than listening to shoddy predictions from pundits who have little to no investing experience, it makes more sense to listen to successful long-term investors who have survived multiple investment cycles and lived to tell the tale. Those people include the great fund manager Peter Lynch who said it is better to “assume the market is going nowhere and invest accordingly,” rather than try to time the market.

What You Hear

As the market has more than doubled over the last 37 months, here are some clouds of pessimism that these same shoddy economists, strategists, and analysts have described for investors:

* Europe and Greece’s impending fiscal domino collapse

* Excessive money printing at the Federal Reserve through quantitative easing and other programs

* Imminent government disintegration due to unresolved structural debts and deficits

* Elevated unemployment rates and pathetic job creation statistics

* Rigged high frequency trading and “Flash Crash”

* Credit downgrade and political turmoil in Washington

* Looming Chinese real estate bubble and subsequent hard economic landing

Unfortunately, many investors got sucked up in these ominous warnings and missed most, if not all, of the recent doubling in equity markets.

What You Don’t Hear

What you haven’t heard from the popular press are the following headlines:

* 10 consecutive quarters of GDP growth

* Record corporate profits and profit margins

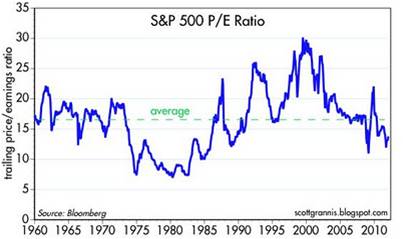

* Equity valuations attractively priced below 50-year average (14.4 < 16.6 via Calafia Beach Pundit)

* Rising dividends with yields approaching 3%, if you consider recent bank announcements

* Record low interest rates and moderate inflation make earnings streams and dividends that much more valuable

* Four million new jobs created over the last three years

* S&P Smallcap near all-time highs (21 years); S&P Midcap index near all-time highs (20 years); NASDAQ is at 11-year highs; Dow Jones Industrials and S&P 500 near 4-year-highs.

* Record retail sales with a consumer that has reduced household debt

Given the massive upward run in the stock market over the last few years (and a complacent short-term VIX reading of 15), stocks are ripe for a breather. With that said, I would advise any blanket holders to not get too comfy with that money decaying away in a CD, money market, or savings account. Waiting too long may turn that security blanket into a tourniquet – forcing investors to amputate a portion of their future retirement savings.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds and WMT, but at the time of publishing SCM had no direct position in C, AIG, RATE, Lehman Brothers, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Happy Birthday Bull Market!

Birthdays are always fun, but they are always more fun when more people come to the party. The birthday of the current bull market started on March 9, 2009, and as many bears point out, volume has been low, with a relatively small number of investors joining the party with hats and horns. This skepticism is not unusual in typical bull markets because the psychological scars from the previous bear market are still fresh in investors’ minds. How can investors get excited about investing when we are surrounded by record deficits, political gridlock, a crumbling European Union, slowing China, and peak corporate margins?

Bears Receive Party Invite but Stay Home

Perma-bears like Peter Schiff, Nouriel Roubini, John Mauldin, Mohamed El-Erian, and David Rosenberg have been consistently wrong over the last three years with their advice, but in some instances can sound smart shoveling it out to unassuming investors.

While nervous investors and bears have missed the 125%+ rally (see table below) over the last three years (mitigated by upward but underperforming gold prices), what many observers have not realized is that the so-called “Lost Decade” (see also Can the Lost Decade Strike Twice?) has actually been pretty spectacular for shrewd investors. Even if you purchased small and mid cap stocks at the peak of the market in March 2000, that large swath of stocks is up over +100%…yes, that’s right, more than doubled over the last 12 years. If you consider dividends, the numbers look significantly better.

Doubters of the equity market rally also ignore the three-year +135% advance in the NASDAQ (see also Ugly Stepchild) in part because the 11-year highs being registered still lag the peak levels reached in March 2000. Even though the NASDAQ increased 9-fold in the 1990s, if you bought the NASDAQ index in the first half of 1999, you would have still outperformed the S&P 500 index through the 2012 year-to-date period. Irrespective of how anyone looks at the performance of the NASDAQ index, it still has outperformed the S&P 500 index by more than +200% over the last 25 years, even if you include the bursting of the 2000 technology bubble.

The point of all these statistics is to show that if you didn’t buy technology stocks at the climax of late 1999 or early 2000 prices, then the amount and type of available opportunities have been plentiful. The table above does not include emerging markets like Brazil, Mexico, and India (to name a few) that have also about doubled in price from the 2000 timeframe to 2012.

Heartburn can Accompany Sweet Treats

Being Pollyannaish after a doubling in market prices is never a wise decision. After three years of massive appreciation, those participating in the bull market run have eaten a lot of tasty cake. Now the question becomes, will investors also get some ice cream and a gift bag to go before the party ends? With the sweetness of the cake still being digested, there are still plenty of scenarios that can create investor heartburn. Obviously, the sovereign debt pig still needs to work its way through the European snake, and that could still take some time. In addition, although macroeconomic data (including employment data) generally have been improving, the trajectory of corporate profits has been decelerating – due in part to near record profit margins getting pressured by rising input costs. Domestically, structural debt and deficit issues have not gone away, and perpetual neglect will only exacerbate the current problems. On the psychology front, even though investors remain skittish, those still in the game are getting more complacent as evidenced by the VIX index now falling to the teens (a negative contrarian indicator).

Despite some of these cautionary signals, the good news is that many of these issues have been known for some time and have been reflected in valuations of the overall large cap indexes. Moreover, trillions of dollars remain idle in low yielding strategies as investors wait on the sidelines. Once prices move higher and there is more comfort surrounding the sustainability of an economic recovery, then capital will come pouring back into equity markets. In other words, investors will have to pay a premium cherry price if they wait for a comforting consensus to coalesce.

Limited Options

The other advantage working in investors’ favor is the lack of other attractive investment alternatives. Where are you going to invest these days when 10-year Treasuries and short-term CDs are yielding next to nothing? How about investing in risky, leveraged, illiquid real estate, just as banks unload massive numbers of foreclosures and process millions of short sales? If those investments don’t tickle your fancy, then how about pricey insurance and annuity products that nobody can understand? Cash was comforting in 2008-2009 and during volatility in recent summers, but with spiking food, energy, leisure, and medical costs, when does that cash comfort turn to cash pain?

Easy money and low interest rate policies being advocated by Federal Reserve Chairman Ben Bernanke and other global central bankers have sucked up available investment opportunities and compelled investors to look more closely at riskier assets like equities. With the large run in equities, I have been trimming back my winners and redeploying proceeds into higher dividend paying stocks and underperforming sectors of the market. Skepticism still abounds, and we may be ripe for a short-term pullback in the equity markets. For those rare birthday party attendees who are called long-term investors, opportunities still remain despite the large run in equities. The cake has been sweet so far, but if you are patient, some ice cream and a gift bag may be coming your way as well.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds (including emerging market, international, and bond/treasury ETFs), but at the time of publishing SCM had no direct position in VXX, MXY, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Investors Sit on Fence and Watch New Highs

Article includes excerpts from Sidoxia Capital Management’s 3/1/2012 newsletter. Subscribe on right side of page.

We’ve seen some things jump during this 2012 Leap Year (mainly stock prices), but investors have not been jumping – rather they have been doing a lot of fence sitting. Despite the NASDAQ index hitting 11+ year highs (+14% in 2012 excl. dividends), and the S&P 500 index approaching 4-year highs, investors have been pulling cash out in droves from equities. Just last month, Scott Grannis at Calafia Beach Pundit highlighted that $355 billion in equity outflows has occurred since September 2008, including $155 billion since April 2011 and $6 billion siphoned out at the beginning of 2012.

Once again, listening to the vast majority of TV talking heads has decimated investor portfolios. However, ignoring the dreadful, horrific news over the last three years would have made an equity investor 100%+ (yes, that’s right…double). Somehow, the facts have escaped the psyches of millions of average Americans as the train is leaving the station. Certainly in 2008, a generational decline in equity markets was accompanied by horrific headlines. Those who were positioned too aggressively suffered about 15 months of severe pain, but those who capitulated with knee-jerk reactions after the collapse did incredibly more damage by selling near the bottom and locking in losses. Only now, after the Dow has exploded from 6,500 to 13,000 over the last three years have investors begun to ask whether now is the time to buy stocks.

Of course, making decisions by reacting to news headlines is a horrible way to manage one’s money and will only lead to a puddle of tears in the long-run. Psychological studies have shown that losses are 2.5x’s as painful as the pleasure experienced from gains. The wounds from the 2000 technology bubble and 2008-2009 financial crisis are still too fresh in investors’ minds, and until the scars heal, millions of investors will remain on the sidelines. As usual, average investors unfortunately get more excited after much of the gains have already been garnered.

Investing should be treated like an extended game of chess that requires long-term thinking. As in investing, there are many strategies that can be used in chess. Shadowing your opponent’s every move generally is not a winning strategy. Rather than defensively reacting to an opponent’s every move, proactively planning for the future is a healthier strategy. Don’t be a pawn, but instead create a long-term, low-cost investment plan that accounts for your current balance sheet, future goals, and risk tolerance in order to achieve your retirement checkmate. But before you can do that, you must first get that rump off the fence and put a plan into action.

Hot News Bites

How Do You Like Them Apples? Apple Inc. (AAPL) has become the most valuable company on the planet as it has surpassed a half-trillion dollars in market value at the end of February. Thanks to record sales of new iPhones, iPads, and Mac computers, Apple has managed to stuff away close to $100 billion in cash in its coffers. What’s next for Apple? Besides introducing new versions of existing products, Apple is expected to innovate its television platform later this year.

Greece Dips into Euro Purse Again: Euro-zone ministers approved a $172 billion rescue package for Greece to avoid default for the second time in less than two years. In addition to the Greek citizens, private bondholders are sharing in the pain. The deal calls for debt holders to write down their Greek debt by 74%; demands stark austerity measures (Debt/GDP ratio of 120.5% by 2020); and a continuous monitoring of Greece’s fiscal standing by a European task force.

Taxes-Schmaxes: There’s nothing more exciting in politics than the discussion of taxes. OK, maybe former Speaker Newt Gingrich’s moon colony proposal is a tad more interesting. Nonetheless, Congress voted to extend the payroll-tax cut through December, and both President Obama and presidential candidate Mitt Romney unveiled their new tax plans. Although Obama’s plan hopes to tax the rich, both politicians have plenty of tax-cuts embedded in their plans. In an election year, apparently debt and deficit amnesia have set in.

Investors “Like” Facebook: Although investors appear to be “Like”-ing Facebook in advance of its initial public offering (IPO), employees and owners seem to be even happier, considering the company is estimated to reach up to $100 billion in value once shares begin trading. I can’t wait to read CEO Mark Zuckerberg’s status update when he cashes in on a portion of his stake of $25 billion or so.

Gas Prices Empty Wallet: Improving global economic data is not the only reason behind escalating gasoline prices (currently averaging $3.73 per gallon for Regular). Iran reduced its sales of crude oil to Britain and France after those countries stopped importing Iranian oil, and Iran stated it has made progress on its nuclear-development program. Can’t we just all get along?!

Plan. Invest. Prosper.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, FB and AAPL, but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

NASDAQ: The Ugly Stepchild Index

All the recent media focus has been fixated on whether the Dow Jones Industrial Average index (“The Dow”) will close above the 13,000 level. In the whole scheme of things, this specific value doesn’t mean a whole lot, but it does make for a great topic of conversation at a cocktail party. Today, the Dow is trading at 12,983, a level not achieved in more than three and a half years. Not a bad accomplishment, given the historic financial crisis on our shores and the debacle going on overseas, but I’m still not so convinced a miniscule +0.1% move in the Dow means much. While the Dow and the S&P 500 indexes garner the hearts and minds of journalists and TV reporters, the ugly stepchild index, the NASDAQ, gets about as much respect as Rodney Dangerfield (see also No Respect in the Investment World).

While the S&P 500 hundred has NOT even reached the level from one year ago, the technology-heavy NASDAQ index has hit a 11+ year record high. Yes that’s right; the NASDAQ has not reached these levels since December 2000. Sure, the NASDAQ receives a lot of snickers since the technology bubble burst in 2000, when the index peaked at over 5,100 and subsequently plummeted to 1,108 (-78%) over the ensuing 31 months. But now the ugly stepchild index is making an extraordinary comeback into maturity. Since September 2002, near the lows, the NASDAQ has outperformed both the Dow and the S&P 500 indexes by more than a whopping 80%+, excluding dividends.

With the NASDAQ (and NASDAQ 100) hitting a new decade-plus high, are we approaching bubble-esque P/E ratios (price-earnings) of the 2000 era? Not even close. According to Birinyi Associates, the NASDAQ 100 index (QQQ) forward P/E ratio is priced at a reasonable 14x level – much lower than the 100x+ ratios we experienced right before the NASDAQ crash of 2000 and close to the P/E of the S&P 500.

With these NASDAQ indexes hitting new highs, does this tell us they are going to go significantly higher? No, not necessarily…just ask buyers of the NASDAQ in the late 1990s how that strategy worked then. Trying to time the market is a fruitless cause, and will always remain so. A few people will be able to do it occasionally, but doing so on a sustained basis is extremely difficult (if not impossible). If you don’t believe me, just ask Alan Greenspan, former Federal Reserve Chairman, who in 1996 said the tech boom had created “irrational exuberance.” When he made this infamous statement in 1996, the NASDAQ was trading around 1,300 – I guess Greenspan was only off by about another 3,800 points before the exuberance exhausted.

While a significantly outperforming index may not give you information on future prices, leadership indexes and sectors can direct you to fertile areas of research. Trends can be easy to identify, but the heavy lifting and sweat lies in the research of determining whether the trends are sustainable. With the significant outperformance of the NASDAQ index over the last decade it should be no surprise that technology has been leading the index brigade. The NASDAQ composite data is difficult to come by, but with the Technology sector accounting for 65% of the NASDAQ 100 index weighting, it makes sense that this index and sector should not be ignored. Cloud computing, mobility, e-commerce, alternative energy, and nanotechnology are but just a few of the drivers catapulting technology’s prominence in financial markets. Globalization is here to stay and technology is flattening the world so that countries and their populations can participate in the ever-expanding technology revolution.

Investors can continue to myopically focus on the narrow group of 30 Dow stocks and its arbitrary short-term target of 13,000, however those ignoring the leadership of the ugly stepchild index (NASDAQ) should do so at their own peril. Ugliness has a way of turning to beauty when people are not paying attention.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, including SPY, but at the time of publishing SCM had no direct position in QQQ, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Box Wine, Facebook and PEG Ratios

I’m no wine connoisseur, but I do know I would pay more for a bottle of Dom Pérignon champagne than I would pay for a container of Franzia box wine. In the world of stocks, the quality disparity is massive too. In order to navigate the virtually infinite number of stocks, we need to have an instrument in our toolbox that can assist us in accurately comparing stocks across the quality spectrum. Thank goodness we have the handy PEG ratio (Price/Earnings to Growth) that elegantly marries the price paid for a stock (as measured by the P/E ratio) with the relative quality of the stock (as measured by its future earnings growth rate).

Famed investor Peter Lynch (see Inside the Brain of an Investing Genius) understood the PEG concept all too well as he used this tool religiously in valuing and analyzing different companies. Given that Lynch earned a +29% annual return from 1977-1990, I’ll take his word for it that the PEG ratio is a useful tool. As highlighted by Lynch (and others), the key factor in using the PEG ratio is to identify companies that trade with a PEG ratio of less than 1. All else equal, the lower the ratio, the better potential for future price appreciation. Facebook Vs. Eastman Kodak

To illustrate the concept of how a PEG ratio can be used to compare stocks with two completely different profiles, let’s start by answering a few questions. Would a rational investor pay the same price (i.e., Price-Earnings [P/E] ratio) for a company with skyrocketing profits as they would for a company going into bankruptcy? Look no further than the lofty expected P/E multiple to be afforded to the shares of the widely anticipated Facebook (FB) initial public offering (IPO). That same rational investor is unlikely to pay the same P/E multiple for a money losing company like Eastman Kodak Co. (EKDKQ.PK) that faces product obsolescence. The contrasting values for these two companies are stark. Some pundits are projecting that Facebook shares could fetch upwards of a 100x P/E ratio, while not too long ago, Kodak was trading at a P/E ratio of 4x. Plenty of low priced stocks have outperformed expensive ones, but remember, just because a “value” stock may have a lower absolute P/E ratio in the recent past, does not mean it will be a better investment than a “growth” stock sporting a higher P/E ratio (see Fallacy of High P/Es).

Price, Earnings, and Dividends

As I’ve written in the past, a key determinant of future stock prices is future earnings growth (see It’s the Earnings Stupid). The higher the P/E multiple, the more important future earnings growth becomes. The lower the future growth, the more important valuation and dividends become.

We can look at various money-making scenarios that incorporate these factors. If my goal were to double my money in 5 years (i.e., earn a 100% return), there are numerous ways to skin the profit-making cat. Here are four examples:

1) Buy a non-dividend paying stock of a company that achieves earnings growth of 15%/year and maintains its current P/E ratio over time.

2) Buy a stock of a company that has a 5% dividend and achieves earnings growth of 11%/year and maintains its current P/E ratio over time.

3) Buy a value stock with a 5% dividend that achieves earnings growth of 5%/year and increase its P/E ratio by 10% each year.

4) Buy a non-dividend paying growth stock that achieves earnings growth of 20%/year and decreases its P/E ratio by about 5% each year.

I think you get the idea, but as you can see, in addition to earnings growth, dividends and valuation do play a significant role in how an investor can earn excess returns.

Lynch’s Adjusted PEG

Peter Lynch added a slight twist to the traditional PEG analysis by accounting for the role of dividends in the denominator of the PEG equation:

PEG (adjusted by Lynch) = PE Ratio/(Earnings Growth Rate + Dividend Yield)

This “adjusted PEG” ratio makes intuitive sense under various perspectives. For starters, if two different companies both had a PEG ratio of 0.8, but one of the two stocks paid a 3% dividend, Lynch’s adjusted PEG would register in at a more attractive level of 0.6 for the dividend paying stock.

Looked at under a different lens, let’s suppose there are two lemonade stands that IPO their stocks at the same time, and both companies use the exact same business model. Moreover, let us assume the following:

• Lemonade stand #1 has a P/E of 14x and growth rate of 15%.

• Lemonade stand #2 has a P/E of 12x and growth rate of 8%, but it also pays a dividend of 3%.

Given this information, which one of the two lemonade stands would you invest in? Many investors see the lower P/E of Lemonade stand #2, coupled with a nice dividend, as the more attractive opportunity of the two. But as we can see from Lynch’s “adjusted PEG” ratio, Lemonade stand #1 actually has the lower, more attractive value (.9 or 14/15 vs 1.1 or 12/(8+3)).

This analysis may be delving into the weeds a bit, but this framework is critical nonetheless. Valuation and earnings projections should be essential components of any investment decision, and with record low interest rates, dividend yields are playing a much more important role in the investment selection process. Regardless of your purchase decision thought process, whether deciding between Dom Perignon and box wine, or Facebook and Kodak shares, having the PEG ratio at your disposal should help you make wise and lucrative decisions.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in FB, EKDKQ.PK, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Markets Race Out of 2012 Gate

Article includes excerpts from Sidoxia Capital Management’s 2/1/2012 newsletter. Subscribe on right side of page.

Equity markets largely remained caged in during 2011, but U.S. stocks came racing out of the gate at the beginning of 2012. The S&P 500 index rose +4.4% in January; the Dow Jones Industrials climbed +3.4%; and the NASDAQ index sprinted out to a +8.0% return. Broader concerns have not disappeared over a European financial meltdown, high U.S. unemployment, and large unsustainable debts and deficits, but several key factors are providing firmer footing for financial race horses in 2012:

• Record Corporate Profits: 2012 S&P operating profits were recently forecasted to reach a record level of $106, or +9% versus a year ago. Accelerating GDP (Gross Domestic Product Growth) to +2.8% in the fourth quarter also provided a tailwind to corporations.

• Mountains of Cash: Companies are sitting on record levels of cash. In late 2011, U.S. non-financial corporations were sitting on $1.73 trillion in cash, which was +50% higher as a percentage of assets relative to 2007 when the credit crunch began in earnest.

• Employment Trends Improving: It’s difficult to fall off the floor, but since the unemployment rate peaked at 10.2% in October 2009, the rate has slowly improved to 8.5% today. Data junkies need not fret – we have fresh new employment numbers to look at this Friday.

• Consumer Optimism on Rise: The University of Michigan’s consumer sentiment index showed optimism improved in January to the highest level in almost a year, increasing to 75.0 from 69.9 in December.

• Federal Reserve to the Rescue: Federal Reserve Chairman, Ben Bernanke, and the Fed recently announced the extension of their 0% interest rate policy, designed to assist economic expansion, through the end of 2014. In addition, Bernanke did not rule out further stimulative asset purchases (a.k.a., QE3 or quantitative easing) if necessary. If executed as planned, this dovish stance will extend for an unprecedented six year period (2008 -2014).

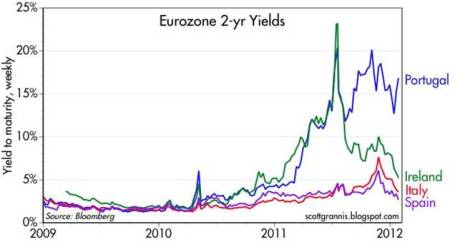

Europe on the Comeback Trail?

Europe is by no means out of the woods and tracking the day to day volatility of the happenings overseas can be a difficult chore. One fairly easy way to track the European progress (or lack thereof) is by following the interest rate trends in the PIIGS countries (Portugal, Ireland, Italy, Greece, and Spain). Quite simply, higher interest rates generally mean more uncertainty and risk, while lower interest rates mean more confidence and certainty. The bad news is that Greece is still in the midst of a very complex restructuring of its debt, which means Greek interest rates have been exploding upwards and investors are bracing for significant losses on their sovereign debt investments. Portugal is not in as bad shape as Greece, but the trends have been moving in a negative direction. The good news, as you can see from the chart above (Calafia Beach Pundit), is that interest rates in Ireland, Italy and Spain have been constructively moving lower thanks to austerity measures, European Central Bank (ECB) actions, and coordination of eurozone policies to create more unity and fiscal accountability.

Political Horse Race

The other horse race going on now is the battle for the Republican presidential nomination between former Massachusetts governor Mitt Romney and former House of Representatives Speaker Newt Gingrich. Some increased feistiness mixed with a little Super-Pac TV smear campaigns helped whip Romney’s horse to a decisive victory in Florida – Gingrich ended up losing by a whopping 14%. Unlike traditional horse races, we don’t know how long this Republican primary race will last, but chances are this thing should be wrapped up by “Super Tuesday” on March 6th when there will be 10 simultaneous primaries and caucuses. Romney may be the lead horse now, but we are likely to see a few more horses drop out before all is said and done.

Flies in the Ointment

As indicated previously, although 2012 has gotten off to a strong start, there are still some flies in the ointment:

• European Crisis Not Over: Many European countries are at or near recessionary levels. The U.S. may be insulated from some of the weakness, but is not completely immune from the European financial crisis. Weaker fourth quarter revenue growth was suffered by companies like Exxon Mobil Corp (XOM), Citigroup Inc. (C), JP Morgan Chase & Co (JPM), Microsoft Corp (MSFT), and IBM, in part because of European exposure.

• Slowing Profit Growth: Although at record levels, profit growth is slowing and peak profit margins are starting to feel the pressure. Only so much cost-cutting can be done before growth initiatives, such as hiring, must be implemented to boost profits.

• Election Uncertainty: As mentioned earlier, 2012 is a presidential election year, and policy uncertainty and political gridlock have the potential of further spooking investors. Much of these issues is not new news to the financial markets. Rather than reading stale, old headlines of the multi-year financial crisis, determining what happens next and ascertaining how much uncertainty is already factored into current asset prices is a much more constructive exercise.

Stocks on Sale for a Discount

A lot of the previous concerns (flies) mentioned is not new news to investors and many of these worries are already factored into the cheap equity prices we are witnessing. If everything was all roses, stocks would not be selling for a significant discount to the long-term averages.

A key ratio measuring the priceyness of the stock market is the Price/Earnings (P/E) ratio. History has taught us the best long-term returns have been earned when purchases were made at lower P/E ratio levels. As you can see from the 60-year chart above (Calafia Beach Pundit), stocks can become cheaper (resulting in lower P/Es) for many years, similar to the challenging period experienced through the early 1980s and somewhat analogous to the lower P/E ratios we are presently witnessing (estimated 2012 P/E of approximately 12.4). However, the major difference between then and now is that the Federal Funds interest rate was about 20% back in the early-’80s, while the same rate is closer to 0% currently. Simple math and logic tell us that stocks and other asset-based earnings streams deserve higher prices in periods of low interest rates like today.

We are only one month through the 2012 financial market race, so it much too early to declare a Triple Crown victory, but we are off to a nice start. As I’ve said before, investing has arguably never been as difficult as it is today, but investing has also never been as important. Inflation, whether you are talking about food, energy, healthcare, leisure, or educational costs continue to grind higher. Burying your head in the sand or stuffing your money in low yielding assets may work for a wealthy few and feel good in the short-run, but for much of the masses the destructive inflation-eroding characteristics of purported “safe investments” will likely do more damage than good in the long-run. A low-cost diversified global portfolio of thoroughbred investments that balances income and growth with your risk tolerance and time horizon is a better way to maneuver yourself to the investment winner’s circle.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in XOM, MSFT, JPM, IBM, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

2011: Beating Batter into Flat Pancake

As it turns out, 2011 can be characterized as the year of the pancake…the flat pancake. While the Dow Jones Industrial Average (Dow) rose about 6% this year (its third consecutive annual gain), the S&P 500 ended the year flat at 1257.6 (-0.003%), the smallest yearly move in more than four decades. Along the way in 2011, there was plenty of violent beating and whipping of the lumpy pancake batter before the flat cake was cooked for the year. With respect to the financial markets, the 2011 lumps came in the form of various unsavory events:

* Never-Ending Eurozone Financial Saga: After Ireland and Portugal sought bailouts, Greece added its negligent financial storyline to the financial soap opera. Whether European government leaders can manage out-of-control deficits and debt loads will determine if Greece and other peripheral countries will topple larger countries like Italy and Spain.

* Credit Rating Downgrade: Standard & Poor’s, the highest profile credit rating agency, downgraded the U.S.’s long-term debt rating to AA+ from AAA due to high debt levels and Congressional legislators inability to hammer out a deficit-reduction plan during the debt ceiling negotiations.

* Japanese Earthquake and Tsunami: Japan and the global economy were rocked by a magnitude 9.0 earthquake and tsunami on March 11, 2011, which resulted in 15,844 people dead and 3,451 people missing. The ripple effects are still being felt through large industries like the automobile and electronics industries.

* Arab Spring Protests: Protesters throughout the Middle East and North Africa provided additional uncertainty to the global political map as demonstrators demanded regime change and more political freedoms. In the long-run, removing oppressive leaders like Hosni Mubarak (Egypt’s leader for 30 years), Muammar Gadaffi (Libya’s leader for 42 years), and Zine al-Abidine Ben Ali (Tunisia’s president for 23 years) should be beneficial for global stability, but in the short-run, how the new leadership vacuum will be filled remains ambiguous.

* Occupy Movement Voices Disapproval: The Occupy Wall Street movement began on September 17, 2011 in Liberty Square in Manhattan’s Financial District, and spread to over 100 cities in the U.S. There has not been a cohesive articulated agenda, but a common thread underlying all the Occupy movements is a sense that 99% of the population is being treated unfairly due to a flawed corrupt system controlled by Wall Street that is feeding the richest 1%.

All these lumps experienced in 2011 were not settling to investors’ stomachs. As a result individuals continued the trend of piling into bonds, in hopes of soothing their investment tummies. Long-term Treasury prices spiked upwards in 2011 (+29% as measured by TLT Treasury ETF) and soaring 10-year Treasury note prices pushed yields (1.87%) below yields on S&P 500 equities (2.1%). Despite a more than 3,400 point increase in the Dow (+39%) since the end of 2008, investors have still poured $774 billion into bonds versus $33 billion yanked from equities, according to EPFR Global. Over-weighting bonds makes sense for some, including retirees on fixed budgets, but many investors should brace for an inevitable reversal in bond prices. Eventually, the sweet taste of safety achieved from bond appreciation will turn to heartburn, once interest rates reverse their 30 year trend of declines.

Syrupy Factors Help Sweeten Pancakes

Although the aforementioned factors lead to historically high volatility and flat flavors in 2011, there are also some countering sweet reasons that make equities look more palatable for 2012. Here are some of the factors:

* Record Corporate Profits: Even with the constant barrage of fear, uncertainty, and doubt distributed via the media channels, corporations posted record profits in 2011, with an estimated increase of +16% over last year (and another forecasted +10% rise in 2012 – Source: S&P).

* Historic Levels of Cash: Record profits mean record cash, and all those riches have been piling up on non-financial corporate balance sheets at historic levels. At the beginning of Q4 the figure stood at $2.12 trillion. Companies have generally been stingy, but as the recovery progresses, they have increasingly been spending on technology, equipment, international expansion, and even the beginnings of hiring.

* Interest Rates at 60 Year Lows: Interest rates are at record lows and home affordability has never been better with 30-year fixed rate mortgages hovering below 4%. Housing may not come screaming back, but the foundation for a recovery is being laid.

* Improving Economic Variables: Whether you’re looking at broader economic activity (Gross Domestic Product up for nine consecutive quarters); employment growth (declining unemployment rate and 21 consecutive months of private job creation), or consumer spending (consumer confidence approaching multi-year highs), all major signs are currently pointing to an improving outlook.

* Near Record Exports: While the U.S. dollar has made some recent gains against foreign currencies because of the financial crisis in Europe, the relative value of the dollar remains historically low versus the major global currencies. The longer-term depreciation of the dollar has buoyed exports of U.S. goods to near record levels despite the global uncertainty.

* Unprecedented Central Bank Support Globally: Ben Bernanke and the U.S. Federal Reserve is committed to keeping exceptionally low levels of lending interest rates at least through mid-2013, while also implementing “Operation Twist” and potential further quantitative easing (QE3). Translation: Ben Bernanke is going to do everything in his power to keep interest rates low in order to stimulate economic growth. The European Central Bank (ECB) has pulled out its lending fire trucks too, with an unparalleled three-year lending program to extinguish liquidity fires in the European banking sector.

* Improving Mergers & Acquisitions Environment: We may not be back to the 2006 buyout “hay-days,” but U.S. mergers and acquisitions activity increased +24% in 2011. What’s more, high profile potential IPOs like an estimated $100 billion Facebook offering may help kick-start the new equity issuance market in 2012.

* Tasty Fat Dividends: Rarely have S&P 500 dividend yields (currently 2.1%) outpaced the interest rates earned on 10-year Treasury note yields, but now happens to be one of those times. Typically S&P 500 stock dividends have averaged about 40% of the yield on 10-year Treasury notes, and now it is 112%. In Q3 of 2011, dividend increases rose +17% and expectations are for nearly a +11% increase in 2012, said Howard Silverblatt, senior index analyst at S&P.

Any way you cut it (or beat the batter), 2011 was a volatile year. And despite all the fear, uncertainty, and doubt, profits continue to grow and sovereign nations are being forced to deal with their fiscal problems. Unforeseen risks always exist, but if Europe can contain its financial crisis and the U.S. recovery can continue into this new election year, then opportunities in the 2012 attractively priced equity markets should sweeten the flat equity pancake we ate in 2011.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, including a short position in TLT, but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

2011 Sidoxia – IC Greatest Hits

There was some entertaining dancing going on early in 2011, but for the most part, the year brought a lot of rock ‘n’ roll on its way to what looks like a flattish year on a return basis. Sidoxia Capital Management and Investing Caffeine (IC) followed everything from the Royal Wedding and Charlie Sheen to the debt ceiling debate and the Arab Spring. Amongst all the celebration and chaos, IC pounded away at the keyboard and reported on the financial markets and the virtues of investing. Out of the 80 or so postings at IC this year, here are my top 11 favorites of 2011:

• Spoonfuls of Investment Knowledge: Classic investment quotes and tenets.

• 10 Ways to Destroy Your Portfolio: Investment mistakes to avoid.

• Solving Europe and Your Deadbeat Cousin: Putting the European financial crisis in context.

• A Serious Situation in Jackson Hole: The “Situation” meets Ben Bernanke.

• It’s the Earnings, Stupid: Stock prices and the inextricable ties with earnings.

• Innovative Bird Keeps All the Worms: Innovative not first mover gains the prize.

• Snoozing Your Way to Investment Prosperity: How to invest and sleep well during financial market mayhem.

• The Fallacy of High P/E’s: Sustainably high earnings growth can trump high P/E ratios.

• Gospel from 20th Century Investment King: Investment maxims from legend Sir John Templeton.

• The 10 Investment Commandments: Charles Ellis passes down key laws to investment disciples.

• Share Buybacks and Bathroom Violators: Pet peeves in the bathroom and share repurchase.

Happy Holidays and Happy New Year from Investing Caffeine and Sidoxia Capital Management!

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Buying Bathing Suits in Winter

Buying fire insurance when your neighbor’s house is on fire or flood insurance as your car floats down your driveway can be a very expensive proposition. Stuffing money under the mattress in money market accounts, savings accounts, CDs, and low-yielding bonds can be a very expensive proposition too, as inflation eats away at the value and the auspice of higher interest rates looms. However, buying things when they are out of favor, like bathing suits in the winter, is an opportunistic way of cashing in on bargains when others are uninterested.

Speaking of uninterested, CNBC recently conducted a survey regarding the attractiveness of stock investing, and according to the participants, there has never been a worst time to invest (as long as the survey has been conducted). Despite consumers planning to spend +22% more on gifts this year, the national mood has not been worse since the financial crisis began in earnest during 2008. Specifically, as it pertains to stocks, 53% of Americans believe it is a bad time to invest in the stock market (SEE VIDEO BELOW).

Vodpod videos no longer available.

Not a very happy picture. The study filtered through 4,600,000,000 expressions posted by 63 million unique Twitter social media users and graphically displayed people’s happiness (or lack thereof).

Endless Number of Concerns

There is no shortage of concerns, whether one worries about the collapse of Europe, declining home values, or an uncertain employment picture. But is now the time to give up and follow the scared herd? The best time to follow the herd is never. As the old saying goes, “the herd is led to the slaughterhouse.” Investing is game like chess where one has to anticipate and be forward looking multiple moves in advance – not reacting to every shift and move of your competitor.

Certainly, investing in stocks may not be appropriate for those investors needing access to liquid funds over the next year or two. Also, retirees needing steady income may not be in a position to handle the volatility of equities. However, for many millions of investors who are planning for the next 5, 10, or 20+ years, what happens over the next few months or next few years in Italy, Greece, or Spain is likely to be meaningless. As far as our economy goes, the U.S. averages about two recessions a decade, and has done quite well over the long-run despite that fact – thank you very much. Investors need to understand that investing is a marathon, and not a sprint.

December may not be the best time to head the beach in your swim trunks, bikini, or thong, but winter is now upon us and incredible deals abound (see deals for women & men). It may also be windy outside with frigid conditions in the water for stock investors too, but with winter beginning this week, the amount of bargains for long-term investors continue to heat up no matter how chilly the sentiment remains.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in Twitter, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Innovative Bird Keeps All the Worms

As the old saying goes, “The early bird gets the worm,” but in the business world this principle doesn’t always apply. In many cases, the early bird ends up opening a can of worms while the innovative, patient bird is left with all the spoils. This concept has come to light with the recent announcement that social networking site MySpace is being sold for a pittance by News Corp. (NWS) to Specific Media Inc., an advertising network company. Although Myspace may have beat Facebook to the punch in establishing a social network footprint, Facebook steamrolled Myspace into irrelevance with a broader more novel approach. Rather than hitting a home run and converting a sleepy media company into something hip, Rupert Murdoch, CEO of News Corp. struck out and received crumbs for the Myspace sale (News Corp. sold it for $35 million after purchasing for $540 million in 2005, a -94% loss).

Other examples of “winner takes all” economics include:

Kindle vs. Book Stores: Why are Borders and Waldenbooks (BGPIQ.PK) bankrupt, and why is Barnes and Noble Inc. (BKS) hemorrhaging in losses? One explanation may be people are reading fewer books and reading more blogs (like Investing Caffeine), but the more credible explanation is that Amazon.com Inc. (AMZN) built an affordable, superior digital mousetrap than traditional books. I’ll go out on a limb and say it is no accident that Amazon is the largest bookseller in the world. Within three years of Kindle’s introduction, Amazon is incredibly selling more digital books than they are selling physical hard copies of books.

iPod vs. Walkman/MP3 Players: The digital revolution has shaped our lives in so many ways, and no more so than in the music world. It’s hard to forget how unbelievably difficult it was to fast-forward or rewind to a particular song on a Sony Walkman 30 years ago (or the hassle of switching cassette sides), but within a matter of a handful of years, mass adoption of Apple Inc.’s (AAPL) iPod overwhelmed the dinosaur Walkman player. Microsoft Corp.’s (MSFT) foray into the MP3 market with Zune, along with countless other failures, have still not been able to crack Apple’s overpowering music market positioning.

Google vs. Yahoo/Microsoft Search: Google Inc. (GOOG) is another company that wasn’t the early bird when it came to dominating a new growth industry, like search engines. As a matter of fact, Yahoo! Inc (YHOO) was an earlier search engine entrant that had the chance to purchase Google before its meteoric rise to $175 billion in value. Too bad the Yahoo management team chose to walk away…oooph. Some competitive headway has been made by the likes of Microsoft’s Bing, but Google still enjoys an enviable two-thirds share of the global search market.

Dominance Not Guaranteed

Dominant market share may result in hefty short-term profits (see Apple’s cash mountain), but early success does not guarantee long-term supremacy. Or in other words, obsolescence is a tangible risk in many technology and consumer related industries. Switching costs can make market shares sticky, but a little innovation mixed with a healthy dose of differentiation can always create new market leaders.

Consider the number one position American Online (AOL) held in internet access/web portal business during the late nineties before its walled gardens came tumbling down to competition from Yahoo, Google, and an explosion of other free, advertisement sponsored content. EBay Inc. (EBAY) is another competition casualty to the fixed price business model of Amazon and other online retailers, which has resulted in six and a half years of underperformance and a -44% decline in its stock price since the 2004 peak. Despite questionable execution, and an overpriced acquisition of Skype, eBay hasn’t been left for complete death, thanks to a defensible growth business in PayPal. More recently, Research in Motion Ltd. (RIMM) and its former gargantuan army of “CrackBerry” disciples have felt the squeeze from new smart phone clashes with Apple’s iPhone and Google’s Android operating system.

With the help of technology, globalization, and the internet, never in the history of the world have multi-billion industries been created at warp speed. Being first is not a prerequisite to become an industry winner, but evolutionary innovation, and persistently differentiated products and services are what lead to expanding market shares. So while the early bird might get the worm, don’t forget the patient and innovative second mouse gets all the cheese.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Performance data from Morningstar.com. Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, AAPL, AMZN, and GOOG, but at the time of publishing SCM had no direct position in BGPIQ.PK, NWS, YHOO, MSFT, SNE, AOL, EBAY, RIMM, Facebook, Skype, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.