Posts filed under ‘Themes – Trends’

Perception vs. Reality: Interest Rates & the Economy

There is a difference between perception and reality, especially as it relates to the Federal Reserve, the economy, and interest rates.

Perception: The common perception reflects a belief that Quantitative Easing (QE) – the Federal Reserve’s bond buying program – has artificially stimulated the economy and financial markets through lower interest rates. The widespread thinking follows that an end to tapering of QE will lead to a crash in the economy and financial markets.

Reality: As the chart below indicates, interest rates have risen during each round of QE (i.e., QE1/QE2/QE3) and fallen after the completion of each series of bond buying (currently at a pace of $85 billion per month in purchases). That’s right, the Federal Reserve has actually failed on its intent to lower interest rates. In fact, the yield on the 10-year Treasury Note stands at 2.94% today, while at the time QE1 started five years ago, on December 16, 2008, the 10-year rate was dramatically lower (~2.13%). Sure, the argument can be made that rates declined in anticipation of the program’s initiation, but if that is indeed the case, the recent rate spike of the 10-year Treasury Note to the 3.0% level should reverse itself once tapering begins (i.e., interest rates should decline). Wow, I can hardly wait for the stimulative effects of tapering to start!

Fact or Fiction? QE Helps Economy

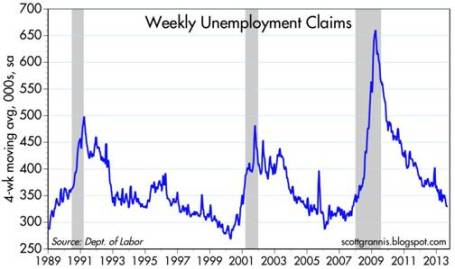

Taken from a slightly different angle, if you consider the impact of the Federal Reserve’s actions on the actual economy, arguably there are only loose connections. More specifically, if you look at the jobs picture, there is virtually NO correlation between QE activity and job creation (see unemployment claims chart below). There have been small upward blips along the QE1/QE2/QE3 path, but since the beginning of 2009, the declining trend in unemployment claims looks like a black diamond ski slope.

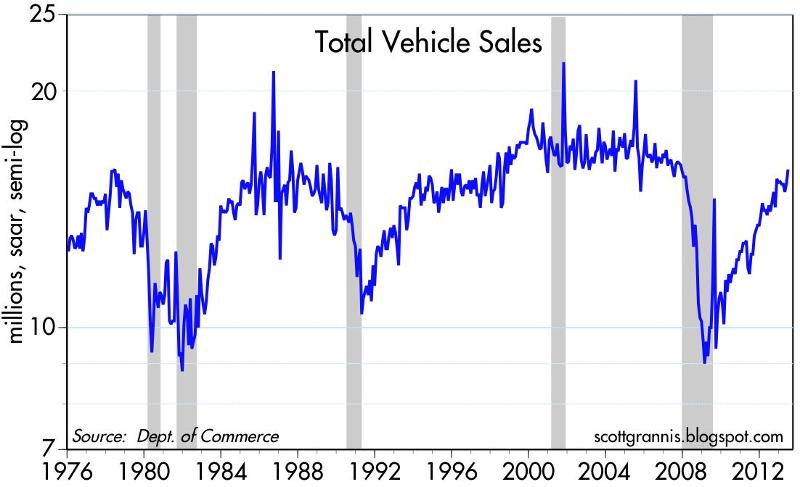

Moreover, if you look at a broad spectrum of economic charts since QE1 began, including data on capital spending, bank loans, corporate profits, vehicle sales, and other key figures related to the economy, the conclusion is the same – there is no discernible connection between the economic recovery and the Federal Reserve’s quantitative easing initiatives.

I know many investors are highly skeptical of the stock market’s rebound, but is it possible that fundamental economic laws of supply and demand, in concert with efficient capital markets, could have something to do with the economic recovery? Booms and busts throughout history have come as a result of excesses and scarcities – in many cases assisted by undue amounts of fear and greed. We experienced these phenomena most recently with the tech and housing bubbles in the early and middle parts of last decade. Given the natural adjustments of supply and demand, coupled with the psychological scars and wounds from the last financial crisis, there is no clear evidence of a new bubble about to burst.

While it’s my personal view that many government initiatives, including QE, have had little impact on the economy, the Federal Reserve does have the ability to indirectly increase business and consumer confidence. Ben Bernanke clearly made this positive impact during the financial crisis through his creative implementation of unprecedented programs (TARP, TALF, QE, Twist, etc.). The imminent tapering and eventual conclusion of QE may result in a short-term hit to confidence, but the economy is standing on a much stronger economic foundation today. Making Ben Bernanke a scapegoat for rising interest rates is easy to do, but in actuality, an improving economy on stronger footing will likely have a larger bearing on the future direction of interest rates relative to any upcoming Fed actions.

Doubters remain plentiful, but the show still goes on. Not only are banks and individuals sitting on much sturdier and healthier balance sheets, but corporations are running lean operations that are reporting record profit margins while sitting on trillions of dollars in cash. In addition, with jobs on a slow but steady path to recovery, confidence at the CEO and consumer levels is also on the rise.

Despite all the negative perceptions surrounding the Fed’s pending tapering, reality dictates the impact from QE’s wind-down will likely to be more muted than anticipated. The mitigation of monetary easing is more a sign of sustainable economic strength than a sign of looming economic collapse. If this reality becomes the common perception, markets are likely to move higher.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing, SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is the information to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Stocks Take a Breather after Long Sprint

Like a sprinter running a long sprint, the stock market eventually needs to take a breather too, and that’s exactly what investors experienced this week as they witnessed the Dow Jones Industrial Average face its largest drop of 2013 (down -2.2%) – and also the largest weekly slump since 2012. Runners, like financial markets, sooner or later suffer fatigue, and that’s exactly what we’re seeing after a relatively unabated +27% upsurge over the last nine months. Does a -2% hit in one week feel pleasant? Certainly not, but before the next race, the markets need to catch their breath.

By now, investors should not be surprised that pitfalls and injuries are part of the investment racing game – something Olympian Mary Decker Slaney can attest to as a runner (see 1984 Olympic 3000m final against Zola Budd). As I have pointed out in previous articles (Most Hated Bull Market), the almost tripling in stock prices from the 2009 lows has not been a smooth, uninterrupted path-line, but rather investors have endured two corrections averaging -20% and two other drops approximating -10%. Instead of panicking by locking in damaging transaction costs, taxes, and losses, it is better to focus on earnings, cash flows, valuations, and the relative return available in alternative asset classes. With generationally low interest rates occurring over recent periods, the available subset of attractive investment opportunities has narrowed (see Confessions of a Bond Hater), leaving many investing racers to default to stocks.

Recent talk of potential Federal Reserve bond purchase “tapering” has led to a two-year low in bond prices and caused a mini spike in interest rates (10-year Treasury note currently yielding +2.83%). At the margin, this trend makes bonds more attractive (lower prices), but as you can see from the chart below, interest rates are still relatively close to historically low yields. For the time being, this still makes domestic equities an attractive asset class.

Source: Yahoo! Finance

Price Follows Earnings

The simple but true axiom that stock prices follow earnings over the long-run is just as true today as it was a century ago. Interest rates and price-earnings ratios can also impact stock prices. To illustrate my argument, let’s talk baseball. Wind, rain, and muscle (interest rates, PE ratios, political risk, etc.) are factors impacting the direction of a thrown baseball (stock prices), but gravity is the key factor influencing the ultimate destination of the baseball. Long-term earnings growth is the equivalent factor to gravity when talking about stock prices.

To buttress my point that stock prices following long-term earnings, consider the fact that S&P 500 annualized operating earnings bottomed in 2009 at $39.61. Since that point, annualized earnings through the second quarter of 2013 (~94% of companies reported results) have reached $99.30, up +151%. S&P 500 stock prices bottomed at 666 in 2009, and today the index sits at 1655, +148%. OK, so earnings are up +151% and stock prices are up +148%. Coincidence? Perhaps not.

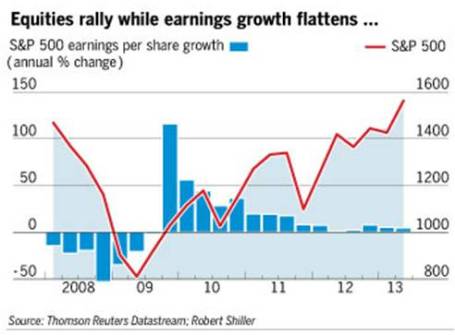

If we take a closer look at earnings, the deceleration of earnings growth is unmistakable (see Financial Times chart below), yet the S&P 500 index is still up +16% this year, excluding dividends. In reality, predicting multiple expansion or contraction is nearly impossible. For example, earnings in the S&P 500 grew an incredible +15% in 2011, yet stock prices were anemically flat for that year, showing no price appreciation (+0.0%). Since the end of 2011, earnings have risen a meager +3%, however stock prices have catapulted +32%. Is this multiple expansion sustainable? Given stock P/E ratios remain in a reasonable 15-16x range, according to forward and trailing earnings, there is some room for expansion, but the low hanging fruit has been picked and further double-digit price appreciation will require additional earnings growth.

Source: Financial Times

But stocks should not be solely looked through a domestic lens…there is another 95% of the world’s population slowly embracing capitalism and democracy to fuel future dynamic earnings growth. At Sidoxia (www.Sidoxia.com), we are finding plenty of opportunities outside our U.S. borders, including alternative asset classes.

The investment race continues, and taking breathers is part of the competition, especially after long sprints. Rather than panic, enjoy the respite.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing, SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Markets Soar and Investors Snore

This article is an excerpt from a previously released Sidoxia Capital Management complementary newsletter (August 1, 2013). Subscribe on the right side of the page for the complete text.

If you haven’t been paying close attention, or perhaps if you were taking a long nap, you may not have noticed that the stock market was up an astounding +5% in July (+78% if compounded annualized), pushing the S&P 500 index up +18% for the year to near all-time record highs. Wait a second…how can that be when that bald and grey-bearded man at the Federal Reserve has hinted at bond purchase “tapering” (see also Fed Fatigue)? What’s more, I thought the moronic politicians were clueless about our debt and deficit-laden economy, jobless recovery, imploding eurozone, Chinese real estate bubble, and impending explosion of inflation – all of which are expected to sink our grandchildren’s grandchildren into a standard of living not seen since the Great Depression. Okay, well a dash of hyperbole and sarcasm never hurt anybody.

This incessant stream of doom-and-gloom pouring over our TVs, newspapers, and internet devices has numbed Americans’ psyches. To prove my point, the next time you are talking to somebody at the water cooler, church, soccer game, or happy hour, gauge how excited your co-worker, friend, or acquaintance gets when you bring up the subject of the stock market. If my suspicions are correct, they are more likely to yawn or pass out from boredom than to scream in excitement or do cartwheels.

You don’t believe me? Reality dictates the wounds from the 2008-2009 financial crisis are still healing. Panic and fear may have disappeared, but skepticism remains in full gear, even though stocks have more than doubled in price in recent years. Here is some data to support my case there are more stock detractors than defenders:

Record Savings Deposits

|

| Source: Calafia Beach Pundit |

Although there are no signs of an impending recession, defensive cash hoarded in savings deposits has almost increased by $3 trillion since the end of the financial crisis.

Blah Consumer Confidence

|

| Source: Calafia Beach Pundit |

As you can see from the chart above, Consumer Confidence has bounced around quite a bit over the last 30+ years, but there is no sign that consumer sentiment has turned euphoric.

15-Year Low Stock Market Participation

|

|

Source: Gallup Poll

|

There has been a trickling of funds into stocks in 2013, yet participation in the stock market is at a 15-year low. Investors remain nervous.

Lack of Equity Fund Buying

|

| Source: ICI & Calafia Beach Pundit |

After a short lived tax-driven purchase spike in January, the buying trend quickly turned negative in the ensuing months. Modest inflows resumed into equity funds during the first few weeks of July (source: ICI), but the meager stock fund investments represent < 95% of 2012 positive bond flows ($15 billion < $304 billion, respectively). Moreover, these modest stock inflows pale in comparison to the hundreds of billions in investor withdrawals since 2008. See also Fund Flows Paradox – Investing Caffeine.

Decline in CNBC Viewership

In spite of the stock market more than doubling in value from the lows of 2009, CNBC viewer ratings are the weakest in about 20 years (source: Value Walk). Stock investing apparently isn’t very exciting when prices go up.

The Hater’s Index:

And if that is not enough, you can take a field trip to the hater’s comment section of my most recent written Seeking Alpha article, The Most Hated Bull Market Ever. Apparently the stock market more than doubling creates some hostile feelings.

JOLLY & JOVIAL MEMO

Keeping the previous objective and subjective data points in mind, it’s clear to me the doom-and-gloom memo has been adequately distributed to the masses. Less clear, however, is the dissemination success of the jolly-and-jovial memo. I think Ron Bailey, an author and science journalist at Reason.com (VIDEO), said it best, “News is always bad news. Good news is simply not news…that is our [human] bias.” If you turn on your local TV news, I think you may agree with Ron. Nevertheless, there are actually plenty of happier news items to report, so here are some positive bullet points to my economic and stock market memo:

16th Consecutive Positive GDP Quarter*

|

| Source: Quartz.com |

The broadest measure of economic activity, GDP (Gross Domestic Product), was reported yesterday and came in better than expected in Q2 (+1.7%) for the 16th straight positive reported quarter (*Q1-2011 was just revised to fractionally negative). Obviously, the economists and dooms-dayers who repeatedly called for a double-dip recession were wrong.

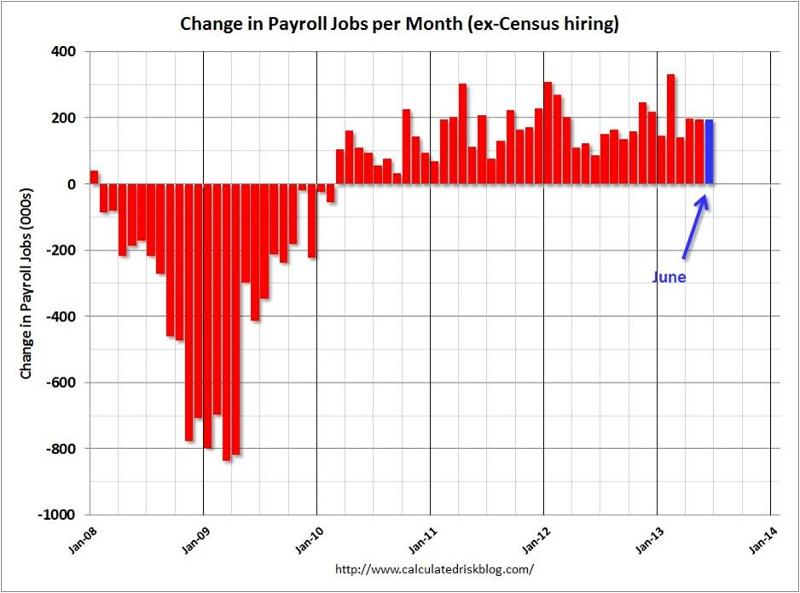

40 Consecutive Months & 7 Million Jobs

Source: Calculated Risk

The economic recovery has been painfully slow, but nevertheless, the U.S. has experienced 40 consecutive months of private sector job additions, representing +7.2 million jobs created. With about -9 million jobs lost during the most recent recession, there is still plenty of room for improvement. We will find out if the positive job creation streak will continue this Friday when the July total non-farm payroll report is released.

Housing on the Mend

|

| Source: Calafia Beach Pundit |

New home sales are up significantly from the lows; housing starts have risen about 40% over the last two years; and Case Shiller home prices rose by +12.2% in the latest reported numbers. The housing market foundation is firming.

Auto Sales Rebound

|

| Source: Calafia Beach Pundit |

Auto sales remain on a tear, reaching an annualized level of 15.9 million vehicles, the highest since November 2007, and up +12% from June 2012. Car sales have almost reached pre-recessionary levels.

Record Corporate Profits

|

| Source: Dr. Ed’s Blog |

Optimistic forecasts have been ratcheted down, nonetheless corporate profits continue to grind to all-time record highs. As you can see, operating earnings have more than doubled since 2003. Given reasonable historical valuations in stocks, as measured by the P/E (Price Earnings) ratio, persistent profit growth should augur well for stock prices.

Bad Banks Bounce Back

Europe on the Comeback Trail

|

| Source: Calafia Beach Pundit |

There are signs of improvement in the Eurozone after years of recession. Talks of a European Armageddon have recently abated, in part because of Markit manufacturing manager purchasing statistics that are signaling expansion for the first time in two years.

Overall, corporations are achieving record profits and sitting on mountains of cash. The economy is continuing on a broad, steady recovery, however investors remain skeptical. Domestic stocks are at historic levels, but buying stocks solely because they are going up is never the right reason to invest. Alternatively, bunkering away excessive cash in useless, inflation depreciating assets is not the best strategy either. If nervousness and/or anxiety are driving your investment strategy, then perhaps now is the time to create a long-term plan to secure your financial future. However, if your goal is to soak up the endless doom-and-gloom and watch your money melt away to inflation, then perhaps you are better off just taking another nap.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing, SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Jobs and the DMV Economy

If you have ever gone to get your driver’s license at the Department of Motor Vehicles (DMV)…you may still be waiting in line? It’s a painful but often a mandatory process, and in many ways the experience feels a lot like the economic recovery we currently have been living through over the last four years. Steady progress is being made, but in general, people hardly notice the economy moving forward.

My geographic neighbor and blogger here in Orange County, California (Bill McBride – Calculated Risk) has some excellent visuals that compare our sluggish DMV economy with previous economic cycles dating back to 1948:

As you can see from the chart above, the current economic recovery (red-line), as measured by job losses, is the slowest comeback in more than a half-century. Basically, over a two year period, the U.S. lost about nine million jobs, and during the following three years the economy regained approximately seven million of those jobs – still digging out of the hole. Last Friday’s June jobs report was welcomed, as it showed net jobs of +195,000 were added during the month, and importantly the previous two months were revised higher by another +70,000 jobs. These data points combined with last month’s Fed’s QE3 tapering comments by Ben Bernanke help explain why the continued rout in 10 year Treasury rates has continued in recent weeks, propelling the benchmark rate to 2.71% – almost double the 1.39% rate hit last year amidst continued European financial market concerns.

As with most recessions or crashes, the bursting of the bubble (i.e., damage) occurs much faster than the inflation (i.e., recovery), and McBride’s time series clearly shows this fact:

While pessimists point to the anemic pace of the current recovery, the glass half-full people (myself included) appreciate that the sluggish rebound is likely to last longer than prior recoveries. There are two other key dynamics underlying the reported employment figures:

- Continued Contraction in Government Workers: Excessive government debt and deficits have led to continued job losses – state and local job losses appear to be stabilizing but federal cuts are ongoing.

- Decline in the Labor Force Participation Rate: Discouraged workers and aging Baby Boomer demographics have artificially lowered the short-term unemployment figures because fewer people are looking for work. If economic expansion accelerates, the participation contraction trend is likely to reverse.

Skepticism Reigns Supreme

Regardless of the jobs picture and multi-year expansion, investors and business managers alike remain skeptical about the sustainability of the economic recovery. Anecdotally I encounter this sentiment every day, but there are other data points that bolster my assertion. Despite the stock market more than doubling in value from the lows of 2009, CNBC viewer ratings are the weakest in about 20 years (see Value Walk) and investments in the stock market are the lowest in 15 years (see Gallup poll chart below):

Why such skepticism? Academic research in behavioral finance highlights innate flaws in human decision-making processes. For example, humans on average weigh losses twice as much as gains as economist and Nobel prizewinner Daniel Kahneman explains in his book Thinking Fast and Slow (see Investing Caffeine article: Decision Making on Freeways and in Parking Lots). Stated differently, the losses from 2008-2009 are still too fresh in the minds of Americans. Until the losses are forgotten, and/or the regret of missing gains becomes too strong, many investors and managers will fearfully remain on the sideline.

The speed of our economic recovery is as excruciatingly agonizing, and so is waiting in line at the DMV. The act of waiting can be horrific, but obtaining a driver’s license is required for driving and investing is necessary for retirement. If you don’t want to go to investing jail, then you better get in the investing line now before job growth accelerates, because you don’t want to be sent to the back of the line where you will have to wait longer.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing, SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Hammering Heads with Circular Conversations

This article is an excerpt from a previously released Sidoxia Capital Management complementary newsletter (July 1, 2013). Subscribe on the right side of the page for a complete monthly update.

Deciphering what is driving the markets on a day-to-day, week-to-week, or month-to-month basis can feel like repeatedly hammering your head. In order to grasp the reasons why financial markets go up and down, one must have a conversation with your brain explaining that good news can be bad for asset prices, and bad news can be good for asset prices. Huh…how can that be? These circular conversations are what keep newspapers, magazines, media commentators, and bloggers in business… and what baffle many investors.

For example, headlines often reflect sentiments such as these:

- “Unemployment Figures Disappoint…Dow Jones Rallies +200 Points on QE3 Continuation Hopes”

- “Unemployment Figures Delight…Dow Jones Tanks -200 Points on QE3 Discontinuation Fears”

- “Economic Figures Revised Lower by -0.2%…Dow Jones Skyrockets +200 Points as Lower Interest Rates Propel Stock Prices.”

- “Economic Figures Revised Higher by +0.2%…Dow Jones Plummets -200 Points as Higher Interest Rates Deflate Stock Prices.”

On rare occasions these headlines make sense, but often online media outlets are frantically changing the headlines as the markets whip back and forth from positive to negative. News-producing editors are continually forced to create ludicrous and absurd explanations that usually make no sense to informed long-term investors.

It’s important to recognize that if the financial markets made common sense, then investing for retirement would be simple and everyone would be billionaires. Unfortunately, financial markets frequently make no sense in the short-run. Stocks are volatile (often times for no rational reason), which is why stocks offer higher returns over the long-run relative to more stable asset classes.

Explaining the latest spike in stock/bond price volatility has been exacerbated in recent weeks as a result of the nation’s banker (the Federal Reserve) and its boss, Ben Bernanke, attempting to explain their future monetary policy plans. In theory, bringing light to a traditionally mysterious, closed-door Washington process should be a good thing…right?

Well, ever since a few weeks ago when Ben Bernanke and the FOMC (Federal Open Market Committee) disclosed that the stimulative bond buying program (QE3) could be slowed in 2013 and halted in 2014, financial markets globally experienced a sharp jolt of volatility – stock prices dropped and interest rates spiked. Counter-intuitively, Bernanke’s belief that the economy is on a sustained recovery path (expected GDP growth of +3.25% in both 2014 & 2015) spooked investors. More specifically, in the month of June, the S&P 500 index declined -1.5% in June; Dow Jones Industrial Index -1.4%; and the 10-year Treasury note’s yield jumped +0.3% to 2.5%. Greedy investors, however, should not forget that the stock market just posted its 2nd best quarter since 2009 – the S&P 500 climbed +2.4%. What’s more, the S&P 500 is up +13% and the Dow up +14% in the first half of 2013.

Bernanke Threatening to Take Away Investor Lollipops

Another way of looking at the recent volatility is by equating investors to kids and stimulative QE bond buying programs (Quantitative Easing) to lollipops. If the economy continues on this improvement trajectory (i.e., unemployment falls to 7% by next year) and inflation remains benign (below 2.5%), then Bernanke said he will take away investors’ QE lollipops. But like a pushover dad being pressured by kids at the candy store, Bernanke acknowledged that he could continue supplying investors QE lollipops, if the economic data doesn’t improve at the forecasted pace. At face value, receiving a specific timeline given by the Fed should be appreciated and normally people are happy to hear the Chairman speak rosily about the economy’s future. However, the mere thought of QE lollipops being taken away next year was enough to push investors into a “taper tantrum” (see also Investing Caffeine – Fed Fatigue article).

With scary headlines constantly circulating, a large proportion of investors are sitting on their hands (and cash) while staring like deer in headlights at these developments. Rather than a distracted driver texting, investors should be watching the road and mapping out their future investment destinations – not paying attention to irrelevant diversions. Astute investors realize that uncertainty surrounding Greece, Cyprus, fiscal cliff, sequestration, presidential elections, Iran, N. Korea, Syria, Turkey, taxes, QE3, etc., etc., etc., have been a constant. Regrettably the fear mongers paying attention to these useless headlines have witnessed their cash, gold, and Treasuries get trounced by equity returns since early 2009 (the S&P 500 index is up about +150%, including dividends). Optimists and realists, on the other hand, have seen their investment plans thrive. While the aforementioned list of concerns has dangled in front of our noses over the last year, we will have a complete new list of concerns to decipher over the coming weeks, months, and years. That’s the price a long-term investor pays if they want to earn higher returns in the volatile equity markets.

As strategist Don Hays points out, “Nothing is certain. Good investors love uncertainty.” Rather than getting consumed by fear with the endless number of changing uncertainties, the real risk for investors is outliving your savings. Paychecks are being stretched by inflationary pressures across all categories (e.g., healthcare, gasoline, utilities, food, movies, travel, etc.) and entitlements like Social Security and Medicare will likely not mean the same thing to us as it did for our parents. Unless investors plan on working into their 80s as greeters at Wal-Mart, and/or enjoy clipping Top Ramen coupons in a crammed apartment, then they should do themselves a favor by taking a deep breath and turning off the television, so they can be insulated from the constant doom and gloom.

So as intimidating, circular conversations about good news being bad news, and bad news being good news continue to swirl around, focus instead on building a diversified investment plan that can adjust and adapt to the never-ending list of uncertainties. Your head will feel a lot better than it would after repetitive hammer strikes.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs) and WMT, but at the time of publishing, SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Fed Fatigue Setting In

Uncle…uncle! There you have it – I have finally cried “uncle” because I cannot take it anymore. I don’t think I can listen to another panel or read another story debating about the timing of Fed “tapering”, or heaven forbid the Fed actually “tighten” the Federal Funds rate (i.e., increasing the targeted rate for inter-bank lending). Type in the words “Bernanke” and “tapering” into Google and you will get back more than 41,000,000 results. The build up to the 600-word FOMC (Federal Open Market Committee) statement was almost deafening, so much so that live coverage of Federal Reserve Chairman Ben Bernanke was available at your fingertips:

Like a toddler (or a California-based, investment blog writer) going to the doctor’s office to receive an inoculation, the anxiety and mental anguish caused in anticipation of the event is often more painful than the actual injection. As I highlighted in a previous Investing Caffeine article, the 1994 interest rate cycle wasn’t Armageddon for equity markets, and the same can be said for the rate hikes from 1.0% to 5.25% in the 2004-20006 period (see chart below). Even if QE3 ends in mid-2014 and the new Federal Reserve Chairman (thank you President Obama) raises rates in 2015, this scenario would not be the first (or last) time the Federal Reserve has tightened monetary policy.

Short Memories – What Have You Done for Me Lately?

People are quick to point out the one-day -350 Dow point loss earlier this week, but many of them forget about the +3,000 point moon shot in the Dow Jones Industrial index that occurred in six short months (November 2012 – May 2013). The same foggy recollection principle applies to interest rates. The recent rout in 10-year Treasury prices is easily recalled as rates have jumped from 1.5% to 2.5% over the last year, however amnesia often sets in for others if you ask them where rates were a few years ago. It’s easy to forget that 30-year fixed rate mortgages exceeded 5% and the 10-year reached 4% just three short years ago.

Bernanke: The Center of the Universe?

Does Ben Bernanke deserve credit for implementing extraordinary measures during extraordinary times during the 2008-09 financial crisis? Absolutely. But should every man, women, and child wait with bated breath to see if a word change or tonal adjustment is made in the eight annual FOMC meetings?

Like the public judging Ben Bernanke, my Sidoxia clients probably give me too much credit when things go well and too much blame when things don’t. I love how Bernanke gets blamed/credited for the generational low interest rates caused by his money printing ways and QE punch bowl tactics. Last I checked, the interest rate downtrend has been firmly in place over the last three decades, well before Bernanke came into the Fed and worked his monetary magic. How much credit/blame are we forgetting to give former Federal Reserve Chairmen Paul Volcker, Alan Greenspan, and other government policy-makers? Regardless of what happens economically for the remainder of 2013, Bernanke will do whatever he can to solidify his legacy in the waning sunset months of his term.

Another forgotten fact I like to point out: There is more than one central banker living on this planet. If you haven’t been asleep over the last few decades, our financial markets have increasingly become globally interconnected with the assistance of technology. I know our 10-year Treasury rates are hovering around 2.50%, and our egotistical patriotism leads us to hail Bernanke as a monetary god, but don’t any other central bankers or government officials around the world deserve any recognition for achieving yields even lower than ours? Here’s a partial list (June 22, 2013 – Financial Times):

- Japan – 0.86%

- Germany – 1.67%

- Canada – 2.33%

- U.K. – 2.31%

- France – 2.27%

- Sweden – 2.15%

- Austria – 2.09%

- Switzerland – 0.92%

- Netherlands – 2.07%

Although it may be fun to look at Ben Bernanke as our country’s financial Superman who is there to save the day, there are a lot more important factors to consider than the 47 words added and 19 subtracted from the latest FOMC statement. If investing was as easy as following central bank monetary policy, everyone would be continually jet setting to their private islands. Rather than wasting your time listening to speculative blathering about direction of Fed monetary policy, why not focus on finding solid investment ideas and putting a long-term investment plan in place. Now please excuse me – Fed fatigue has set in and I need to take a nap.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs) and GOOG, but at the time of publishing, SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

U.S. Small-Caps Become Global Big Dog

With the emerging market currencies and financial markets under attack; Japan’s Nikkei index collapsing in the last three weeks; and the Federal Reserve hinting about its disciplinarian tapering of $85 billion in monthly QE3 bond purchases, one would expect higher beta small cap stocks to get hammered in this type of environment.

Before benchmarking results in the U.S., let’s take a closer look at some of the international carnage occurring from this year’s index value highs:

- Japan: -19% (Nikkei 225 index)

- Brazil: -22% (IBOVESPA index)

- Hong Kong: -12% (Hang Seng index)

- Russia: -19% (MICEX/RTS indexes)

Not a pretty picture. Given this international turmoil and the approximately -60% disintegration in U.S. small-cap stock prices during the 2007-2009 financial crisis, surely these economically sensitive stocks must be getting pummeled in this environment? Well…not necessarily.

Putting the previously mentioned scary aspects aside, let’s not forget the higher taxes, Sequestration, and ObamaCare, which some are screaming will push us off a ledge into recession. Despite these headwinds, U.S. small-caps have become the top dog in global equity markets. Since the March 2009 lows, the S&P 600 SmallCap index has more than tripled in value ( about +204%, excluding dividends), handily beating the S&P 500 index, which has advanced a respectable +144% over a similar timeframe. Even during the recent micro three-week pullback/digestion phase, small cap stocks have retreated -2.8% from all-time record highs (S&P 600 index). Presumably higher dividend, stable, globally-diversified, large-cap stocks would hold up better than their miniature small-cap brethren, but that simply has not been the case. The S&P 500 index has underperformed the S&P 600 by about -80 basis points during this limited period.

How can this be the case when currencies and markets around the world are under assault? Attempting to explain short-term moves in any market environment is a hazardous endeavor, but that has never slowed me down in trying. I believe these are some of the contributing factors:

1) No Recession. There is no imminent recession coming to the U.S. As the saying goes, we hear about 10 separate recessions before actually experiencing an actual recession. The employment picture continues to slowly improve, and the housing market is providing a slight tailwind to offset some the previously mentioned negatives. If you want to fill that half-full glass higher, you could even read the small-cap price action as a leading indicator for a pending acceleration in a U.S. cyclical recovery.

2) Less International. The United States is a better house in a shaky global neighborhood (see previous Investing Caffeine article), and although small cap companies are expanding abroad, their exposure to international markets is less than their large-cap relatives. Global investors are looking for a haven, and U.S. small cap companies are providing that service now.

3) Inflation Fears. Anxiety over inflation never seems to die, and with the recent +60 basis point rise in 10-year Treasury yields, these fears appear to have only intensified. Small-cap stocks cycle in and out of favor just like any other investment category, so if you dig into your memory banks, or pull out a history book, you will realize that small-cap stocks significantly outperformed large-caps during the inflationary period of the 1970s – while the major indexes effectively went nowhere over that decade. Small-cap outperformance may simply be a function of investors getting in front of this potential inflationary trend.

Following the major indexes like the Dow Jones Industrials index and reading the lead news headlines are entertaining activities. However, if you want to become a big dog in the investing world and not get dog-piled upon, then digging into the underlying trends and market leadership dynamics of the market indexes is an important exercise.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs) including emerging market ETFs, IJR, and EWZ, but at the time of publishing, SCM had no direct position in Hong Kong ETFs, Japanese ETFs, Russian ETFs, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

1994 Bond Repeat or 2013 Stock Defeat?

Interest rates are moving higher, bond prices are collapsing, and fear regarding a stock market plunge is palpable. Sound like a recent news headline or is this a description of a 1994 financial market story? For those with a foggy, double-decade-old memory, here is a summary of the 1994 economic environment:

- The economy registered its 34th month of expansion and the stock market was on a record 40-month advance

- The Federal Reserve embarked on its multi-hike, rate-tightening monetary policy

- The 10-year Treasury note exhibited an almost 2.5% jump in yields

- Inflation was low with a threat of rising inflation lurking in the background

- An upward sloping yield curve encouraged speculative bond carry-trade activity (borrow short, invest long)

- Globalization and technology sped up the pace of price volatility

Many of these listed items resemble factors experienced today, but bond losses in 1994 were much larger than the losses of 2013 – at least so far. At the time, Fortune magazine called the 1994 bond collapse the worst bond market loss in history, with losses estimated at upwards of $1.5 trillion. The rout started with what might have appeared as a harmless 0.25% increase in the Federal Funds rate (the rate that banks lend to each other) from 3% to 3.25% in February 1994. By the time 1994 came to a close, acting Federal Reserve Chairman Alan Greenspan had jacked up this main monetary tool by 2.5%.

Rising rates may have acted as the flame for bond losses, but extensive use of derivatives and leverage acted as the gasoline. For example, over-extended Eurobond positions bought on margin by famed hedge fund manager Michael Steinhardt of Steinhardt Partners lead to losses of about-30% (or approximately $1.5 billion). Renowned partner of Omega Partners, Leon Cooperman, took a similar beating. Cooperman’s $3 billion fund cratered -24% during the first half of 1994. Insurance company bond portfolios were hit hard too, as collective losses for the industry exceeded $20 billion, or more than the claims paid for Hurricane Andrew’s damage. Let’s not forget the largest casualty of this era – the public collapse of Orange County, California. Poor derivatives trades led to $1.7 billion in losses and ultimately forced the county into bankruptcy.

There are plenty of other examples, but suffice it to say, the pain felt by other bond investors was widespread as a massive number of margin calls caused a snowball of bond liquidations. The speed of the decline was intensified as bond holders began selling short and using derivatives to hedge their portfolios, accelerating price declines.

Just as the accommodative interest rate punch bowl was eventually removed by Greenspan, so too is Ben Bernanke (current Fed Chairman) threatening to do today. Even if Bernanke unleashes a cold-turkey tapering of the $85 billion per month in bond-purchases, massive losses in bond values won’t necessarily mean catastrophe for stock values. For evidence, one needs to look no further than this 1994-1995 chart of the stock market:

Volatility for stocks definitely increased in 1994 with the S&P 500 index correcting about -10% early in the year. But as you can see, by the end of the year the market was off to the races, tripling in value over the next five years. Volatility has been the norm for the current bull market rally as well. Despite the more than doubling in stock prices since early 2009, we have experienced two -20% corrections and one -10% pullback.

What’s more, the onset of potential tapering is completely consistent with core economic principles. Capitalism is built on free trading markets, not artificial intervention. Extraordinary times required extraordinary measures, but the probabilities of a massive financial Armageddon have been severely diminished. As a result, the unprecedented scale of quantitative easing (QE) will eventually become more harmful than beneficial. The moral of the story is that volatility is always a normal occurrence in the equity markets, therefore any significant stock pullback associated with potential bond tapering (or fed fund rate hikes) shouldn’t be viewed as the end of the world, nor should a temporary weakening in stock prices be viewed as the end to the bull market in stocks.

Why have stocks historically provided higher returns than bonds? The short answer is that stocks are riskier than bonds. The price for these higher long-term returns is volatility, and if investors can’t handle volatility, then they shouldn’t be investing in stocks.

If you are an investor that thinks they can time the market, you wouldn’t be wasting your time reading this article. Rather, you’d be spending time on your personal island while drinking coconut drinks with umbrellas (see Market Timing Treadmill).

Although there are some distinct similarities between the economic backdrop of 1994 and 2013, there are quite a few differences also. For starters, the economy was growing at a much healthier clip then (+4.1% GDP growth), which stoked inflationary fears in the mind of Greenspan. Moreover, unemployment was quite low (5.5% by year-end vs. 7.6% today) and the Fed did not communicate forward looking Fed policy back then.

It’s unclear if the recent 50 basis point ascent in 10-year Treasury rates was just an appetizer for what’s to come, but simple mathematics indicate there is really only one direction left for interest rates to go…higher. If history repeats itself, it will likely be bond investors choking on higher rates (not stock investors). For the sake of optimistic bond speculators, I hope Ben Bernanke knows the Heimlich maneuver. Studying history may help bond bulls avoid indigestion.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Time to Trade in the Investment Tricycle

This article is an excerpt from a previously released Sidoxia Capital Management’s complementary newsletter (May 1, 2013). Subscribe on the right side of the page for an entire monthly update.

As the stock market continues to set new, all-time record highs and the Dow Jones Industrial index nears another historic milestone (15,000 level), investors remain cautiously skeptical of the rebound – like a nervous toddler choosing to ride a tricycle instead of a bicycle. Investors have been moving slowly, but stock prices have not – the Dow has risen +13% in 2013 alone. What’s more, over the last four years the S&P 500 index (which represents large companies) has climbed +140%; the S&P 400 (mid-sized companies) +195%; and the S&P 600 (small-sized companies) +200%.

The gains have been staggering, but like the experience of riding a bicycle, the bumps, scrapes, and bruises suffered during the 2008-2009 financial crash have caused investors to abandon their investment bikes for a perceived safer vehicle…a tricycle. What do I mean by that? Well, over the last six years, investors have pulled out more than -$521,000,000,000 from stock funds and piled those proceeds into bonds (Calafia Beach Pundit chart below). For retirees and billionaires this strategy may make sense in certain instances. But for millions of others, interest rate risk, inflation risk, and the risk of outliving your money can be more hazardous to financial well-being, than the artificially perceived safety expected from bonds. The fact of the matter is investing inefficiently in cash, money markets, CDs, and low-yielding fixed income securities can be riskier in the long-run than a globally diversified portfolio invested across a broad set of asset classes (including equities). The latter should be the strategy of choice, unless of course you are someone who yearns to work at Wal-Mart (WMT) as a greeter in your 80s!

Investor Training Wheels

I don’t want to irresponsibly flog everyone, because investing attitudes have begun to change a little in 2013, as investors have added $66 billion to stock funds (data from ICI). Effectively, some investors have gone from riding their tricycle to hopping on a bike with training wheels. With this change in mindset, surely people have commenced selling bonds to buy stocks, right? Wrong! Investors have actually bought more bonds (+$69 billion) than stocks in the first three months of the year, which helps explain why interest rates on the 10-year Treasury are only yielding a paltry 1.67% (near last year’s record summer low) – remember, bond buying causes interest rates to go down. If you really want to do research, you could ask your parents when rates were ever this low, but some readers’ parents may not even had been born yet. The previous record low in interest rates, according to Bloomberg, at 1.95% was achieved in 1941.

I don’t want to irresponsibly flog everyone, because investing attitudes have begun to change a little in 2013, as investors have added $66 billion to stock funds (data from ICI). Effectively, some investors have gone from riding their tricycle to hopping on a bike with training wheels. With this change in mindset, surely people have commenced selling bonds to buy stocks, right? Wrong! Investors have actually bought more bonds (+$69 billion) than stocks in the first three months of the year, which helps explain why interest rates on the 10-year Treasury are only yielding a paltry 1.67% (near last year’s record summer low) – remember, bond buying causes interest rates to go down. If you really want to do research, you could ask your parents when rates were ever this low, but some readers’ parents may not even had been born yet. The previous record low in interest rates, according to Bloomberg, at 1.95% was achieved in 1941.

Over the last five years the news has been atrocious, and as we have proven, investing based off of current headlines is a horrible investment strategy. As we’ve seen firsthand, there can be very long, multi-year periods when stock performance has absolutely no correlation with the positive or negative nature of news reports. To better make my point, I ask you, what types of headlines have you been reading over the last four years? I can answer the question for you with a few examples. For starters, we’ve endured financial collapses in Iceland, Ireland, Dubai, Greece, and now Cyprus. At home domestically, we’ve experienced a “flash crash” that temporarily evaporated about $1 trillion dollars in value (and 1,000 Dow points) within a few minutes due to high frequency algorithmic traders. How about unemployment data? We’ve witnessed the slowest, jobless U.S. recovery in a generation (since World War II), and European countries have it much worse than we do (e.g., Spain just registered a 27% unemployment rate). What about political gridlock and brinksmanship? We’ve seen debt ceiling stand-offs lead to a historic loss of our country’s AAA debt status; a partisan presidential election; a deafening fiscal cliff debate; and now mindless sequestration. Nevertheless, large cap stocks and small cap stocks have more than doubled and tripled, respectively.

Fear sells advertising, and sounds smarter than “everything is rosy,” but the fact remains, things are not as bad as many bears claim. Corporations are earning record profits, and hold trillions in cash (e.g., Apple Inc.’s recent announcement of more than $50 billion in share repurchase and $11 billion in annual dividend payments are proof). Moreover, central banks around the globe are doing whatever it takes to stimulate growth – most recently the Bank of Japan promised to inject $1.4 trillion into its economy by the end of 2014, in order to kick-start expansion. Lastly, the U.S. employment picture continues to improve, albeit slowly (7.6% unemployment in March), allowing consumers to pay down debt, buy more homes, and spend money to spur economic growth.

Dangers of Being Informed

Hopefully this clarifies how useless and futile newspaper headlines are when it comes to effective investing. As Mark Twain astutely noted, “If you don’t read the newspaper, you are uninformed. If you do read the newspaper, you are misinformed.” It’s perfectly fine to remain in tune with current events, but shuffling around your life’s savings based on this information is a foolish plan.

Hopefully this clarifies how useless and futile newspaper headlines are when it comes to effective investing. As Mark Twain astutely noted, “If you don’t read the newspaper, you are uninformed. If you do read the newspaper, you are misinformed.” It’s perfectly fine to remain in tune with current events, but shuffling around your life’s savings based on this information is a foolish plan.

If the concerns and worries du jour have you nervously riding a tricycle, just realize that you may not reach your investment destination with this mode of transportation. I understand that it is not all hearts and flowers in the financial markets, and there are plenty of legitimate risks to consider. However, excessive exposure in low-rate asset classes may be riskier than many realize. If you’re still riding your investment tricycle, you’re probably better off by grabbing a helmet and pads (i.e., globally diversified portfolio) and jumping on a bike – you are more likely to reach your financial destination.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), WMT and AAPL, but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.