Posts filed under ‘Themes – Trends’

Hunting for Tennis Balls and Dead Cats

When it comes to gravity, people understand what goes up, must come down. But the reverse is not always true for stocks. What goes down, does not necessarily need to come back up. Since the 2008-09 financial crisis there have been a large group of multi-billion dollar behemoth stocks that have defied gravity, but over the last few months, many of these highfliers have come back to earth. Despite the pause in some of these major technology, consumer, and internet stocks, the overall stock market appears relatively calm. In fact, the Dow Jones Industrials index is currently sitting at all-time record highs and the S&P 500 index is hovering around -1% from its peak. But below the surface, there is a large undercurrent resulting in an enormous rotation out of pricier momentum and growth stocks into more defensive and yield-heavy sectors of the market, like utilities and real estate.

To expose this concealed trend I have highlighted a group of 20 stocks below, valued at close to half a trillion dollars. Over the last 12 months, this selective group of technology, consumer, and internet stocks have lost over -$200,000,000,000 from their peak values. Here’s a look at the highlighted stocks:

With respect to all the punished stocks, the dilemma for investors amidst this depreciating price carnage is how to profitably hunt for the bouncing tennis balls while avoiding the dead cat bounces. By hunting bouncing tennis balls, I am referring to the identification of those companies that have crashed from indiscriminate selling, even though the companies’ positive business fundamentals remain fully intact. The so-called dead cats reflect those overpriced companies that lack the earnings power or trajectory to support a rebounding stock price. Like a cat falling from a high-rise building, there may exist a possibility of a small rebound, but for many severely broken momentum stocks, minor bounces are often short-lived.

For long-term investors, much of the recent rotation is healthy. Some of the froth I’ve been writing about in the biotech, internet, and technology has been mitigated. As a result, in many instances, outrageous or rich stock valuations have now become fairly priced or attractive.

Profiting from Collapses

Many investors do not realize that some of the greatest stocks of all-time have suffered multiple -50% drops before subsequently doubling, tripling, quadrupling or better. History provides many rebounding tennis ball examples, but let’s take a brief look at the Apple Inc. (AAPL) chart from 1980 – 2005 to drive home the point:

As you can see, there were at least five occasions when the stock got chopped in half (or worse) over the selected timeframe and another five occasions when the stock doubled (or better), including a +935% explosion in the 1997–2000 period, and a +503% advance from 2002–2005 when shares reached $45. The numbers get kookier when you consider Apple’s share price eventually reached $700 and closed early last week above $600.

These feast and famine patterns can be discovered for virtually all of the greatest all-time stocks. The massive volatility explains why it’s so difficult to stick with theses long-term winners. A more recent example of a tennis ball bounce would be Facebook Inc (FB). The -58% % plummet from its $42 IPO peak has been well-documented, and despite the more recent -21% pullback, the stock is still up +223% from its $18 lows.

On the flip side, an example of a dead cat bounce would include Cisco Systems Inc (CSCO). After the bursting of the 2000 technology bubble, Cisco has never fully recovered from its $82 peak value. There have been many fits and starts, including some periods of 50% declines and 100% gains, but due to excessive valuations in the late 1990s and changing competitive trends, Cisco still sits at $23 today (see chart below).

It is important to remember that just because a stock goes down -50% in value doesn’t mean that it’s going to double or triple in value in the future. Price momentum can drive a stock in the short run, but in the long run, the important variables to track closely are cash flows and earnings (see It’s the Earnings, Stupid) . The level and direction of these factors ultimately correlate best with the ultimate fair value of stock prices. Therefore, if you are fishing in the growth or momentum stock pond, make sure to do your homework after a stock price collapses. It’s imperative that you carefully hunt down rebounding tennis balls and avoid the dead cat bounces.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold long positions in certain exchange traded funds (ETFs), AMZN, long NFLX bond, short NFLX stock, short LULU, and long CSCO (in a non-discretionary account), but at the time of publishing SCM had no direct position in TWTR, GRPN, YELP, ATHN, AVP, P, LNKD, BBY, ZNGA, WDAY, WFM, N, SSYS, JDSU, COH, CRM, FB or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Buy in May and Tap Dance Away

This article is an excerpt from a previously released Sidoxia Capital Management complementary newsletter (May 1, 2014). Subscribe on the right side of the page for the complete text.

The proverbial Wall Street adage that urges investors to “Sell in May, and go away” in order to avoid a seasonally volatile period from May to October has driven speculative trading strategies for generations. The basic premise behind the plan revolves around the idea that people have better things to do during the spring and summer months, so they sell stocks. Once the weather cools off, the thought process reverses as investors renew their interest in stocks during November. If investing was as easy as selling stocks on May 1 st and then buying them back on November 1st, then we could all caravan in yachts to our private islands while drinking from umbrella-filled coconut drinks. Regrettably, successful investing is not that simple and following naïve strategies like these generally don’t work over the long-run.

Even if you believe in market timing and seasonal investing (see Getting Off the Market Timing Treadmill ), the prohibitive transaction costs and tax implications often strip away any potential statistical advantage.

Unfortunately for the bears, who often react to this type of voodoo investing, betting against the stock market from May – October during the last two years has been a money-losing strategy. Rather than going away, investors have been better served to “Buy in May, and tap dance away.” More specifically, the S&P 500 index has increased in each of the last two years, including a +10% surge during the May-October period last year.

Nervous? Why Invest Now?

With the weak recent economic GDP figures and stock prices off by less than 1% from their all-time record highs, why in the world would investors consider investing now? Well, for starters, one must ask themselves, “What options do I have for my savings…cash?” Cash has been and will continue to be a poor place to hoard funds, especially when interest rates are near historic lows and inflation is eating away the value of your nest-egg like a hungry sumo wrestler. Anyone who has completed their income taxes last month knows how pathetic bank rates have been, and if you have pumped gas recently, you can appreciate the gnawing impact of escalating gasoline prices.

While there are selective opportunities to garner attractive yields in the bond market, as exploited in Sidoxia Fusion strategies, strategist and economist Dr. Ed Yardeni points out that equities have approximately +50% higher yields than corporate bonds. As you can see from the chart below, stocks (blue line) are yielding profits of about +6.6% vs +4.2% for corporate bonds (red line). In other words, for every $100 invested in stocks, companies are earning $6.60 in profits on average, which are then either paid out to investors as growing dividends and/or reinvested back into their companies for future growth.

Source: Dr. Ed’s Blog

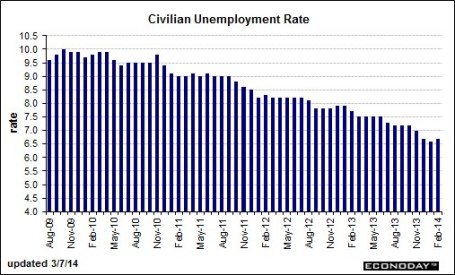

Hefty profit streams have resulted in healthy corporate balance sheets, which have served as ammunition for the improving jobs picture. At best, the economic recovery has moved from a snail’s pace to a tortoise’s pace, but nevertheless, the unemployment rate has returned to a more respectable 6.7% rate. The mended economy has virtually recovered all of the approximately 9 million private jobs lost during the financial crisis (see chart below) and expectations for Friday’s jobs report is for another +220,000 jobs added during the month of April.

Source: Bespoke

Wondrous Wing Woman

Investing can be scary for some individuals, but having an accommodative Fed Chair like Janet Yellen on your side makes the challenge more manageable. As I’ve pointed out in the past (with the help of Scott Grannis), the Fed’s stimulative ‘Quantitative Easing’ program counter intuitively raised interest rates during its implementation. What’s more, Yellen’s spearheading of the unprecedented $40 billion bond buying reduction program (a.k.a., ‘Taper’) has unexpectedly led to declining interest rates in recent months. If all goes well, Yellen will have completed the $85 billion monthly tapering by the end of this year, assuming the economy continues to expand.

In the meantime, investors and the broader financial markets have begun to digest the unwinding of the largest, most unprecedented monetary intervention in financial history. How can we tell this is the case? CEO confidence has improved to the point that $1 trillion of deals have been announced this year, including offers by Pfizer Inc. – PFE ($100 billion), Facebook Inc. – FB ($19 billion), and Comcast Corp. – CMCSA ($45 billion).

Source: Entrepreneur

Banks are feeling more confident too, and this is evident by the acceleration seen in bank loans. After the financial crisis, gun-shy bank CEOs fortified their balance sheets, but with five years of economic expansion under their belts, the banks are beginning to loosen their loan purse strings further (see chart below).

The coast is never completely clear. As always, there are plenty of things to worry about. If it’s not Ukraine, it can be slowing growth in China, mid-term elections in the fall, and/or rising tensions in the Middle East. However, for the vast majority of investors, relying on calendar adages (i.e., selling in May) is a complete waste of time. You will be much better off investing in attractively priced, long-term opportunities, and then tap dance your way to financial prosperity.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in PFE, CMCSA, and certain exchange traded funds (ETFs), but at the time of publishing SCM had no direct position in FB or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

You Can’t Kiss Every Pretty Girl (…or Handsome Boy)

There are a lot of pretty girls in the world, and there are a lot of sexy stocks in the stock market, but not even the most eligible bachelor (or bachelorettes) are able to kiss all the beautiful people in the world. The same principle applies to the stock market. The most successful investors have a disciplined process of waiting for the perfect mate to cross their path, rather than chasing every tempting mistress.

Happily married to my current portfolio, I continually bump into attractive candidates that try to seduce me into buying. For me, these sexy equities typically come in the shape of high P/E ratios (Price/Earnings) and rapid sales growth rates. It’s fun to date (or rent) these sexy stocks, but the novelty often wears off quickly and the euphoric sensation can disappear rapidly – just like real-world dating. Case in point is the reality dating shows, the Bachelor and Bachelorette. Over 27 combined seasons, of which I sheepishly admit seeing a few, only five of the couples remain together today. While it may be enjoyable to vicariously watch bevies of beautiful people hook-up, the harsh reality is that the success rate is abysmal, similar to the results in chasing darling stocks (see also Riding the Wave).

Well-known strategist and investor Barton Biggs once said, “A bull market is like sex. It feels best just before it ends.” The same goes with chasing pricey momentum stocks – what looks pretty in the short-run can turn ugly in a blink of the eye. For example, if you purchased the following basket of top 10 performing stocks of 2012 (+118% average return excluding dividends), you would have underperformed the market by -16% if you owned until today.

Warren Buffett understands hunting for short-term relationships may be thrilling, but this strategy often leads to tears and heartbreak. Buffett summarized the importance of selectivity here:

“I could improve your ultimate financial welfare by giving you a ticket with only twenty slots in it so that you had twenty punches – representing all the investments that you got to make in a lifetime. And once you’d punched through the card, you couldn’t make any more investments at all. Under those rules, you’d really think carefully about what you did, and you’d be forced to load up on what you’d really thought about. So you’d do so much better.”

Rather than hungering for the spiciest stocks, it’s best to find a beauty before she becomes Miss America, because at that point, everybody wants to date her and the price is usually way too expensive. If you stay selective and patient while realizing you can’t kiss every pretty girl, then you can prevent the stock market from breaking your heart.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold long positions in certain exchange traded funds (ETFs), but at the time of publishing SCM had no direct position in PHM, MHO, CVI, EXPE, HFS, DDS, LEN, MPC. TSO, GPS, BRKA/B, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Lewis Sells Flash Boys Snake Oil

I know what you’re saying, “Please, not another article on Michael Lewis’s Flash Boys book and high frequency trading (HFT),” but I can’t resist putting in my two cents after the well-known author emphatically proclaimed the stock market as “rigged.” Lewis is not alone with his outrageous claims… Clark Stanley (“The Rattlesnake King”) made equally outlandish claims in the early 1900s when he sold lucrative Snake Oil Liniment to heal the ailments of the masses. Ultimately Stanley’s assets were seized by the government and the healing assertions of his snake oil were proven fraudulent. Like Stanley, Lewis’s over-the-top comments about HFT traders are now being scrutinized under a microscope by more thoughtful critics than Steve Kroft from 60 Minutes (see television profile). For a more detailed counterpoint, see the Reuters interview with Manoj Narang (Tradeworx) and Haim Bodek (Decimus Capital Markets).

While Lewis may not be selling snake oil, the cash register is still ringing with book sales until the real truth is disseminated. In the meantime, Lewis continues to laugh to the bank as he makes misleading and deceptive claims, just like his snake oil selling predecessors.

The Inside Perspective

Regardless of what side of the fence you fall on, the debate created by Lewis’s book has created deafening controversy. Joining the jihad against HFT is industry veteran Charles Schwab, who distributed a press release calling HFT a “growing cancer” and stating the following:

“High-frequency trading has run amok and is corrupting our capital market system by creating an unleveled playing field for individual investors and driving the wrong incentives for our commodity and equities exchanges.”

What Charles Schwab doesn’t admit is that their firm is receiving about $100 million in annual revenues to direct Schwab client orders to the same HFT traders at exchanges in so called “payment-for-order-flow” contracts. Another term to describe this practice would be “kick-backs”.

While Michael Lewis screams bloody murder over investors getting fraudulently skimmed, some other industry legends, including the godfather of index funds, Vanguard founder Jack Bogle, argue that Lewis’s views are too extreme. Bogle reasons, “Main Street is the great beneficiary…We are better off with high-frequency trading than we are without it.”

Like Jack Bogle, other investors who should be pointing the finger at HFT traders are instead patting them on the back. Cliff Asness, managing and founding principal of AQR Capital Management, an institutional investment firm managing about $100 billion in assets, had this to say about HFT in his Wall Street Journal Op-Ed:

“How do we feel about high-frequency trading? We think it helps us. It seems to have reduced our costs and may enable us to manage more investment dollars… on the whole high-frequency traders have lowered costs.”

Is HFT Good for Main Street?

Many investors today have already forgotten, or were too young to remember, that stocks used to be priced in fractions before technology narrowed spreads to decimal points in the 1990s. Who has benefited from all this technology? You guessed it…everyone.

Lewis makes the case that the case that all investors are negatively impacted by HFT, including Main Street (individual) investors. Asness maintains costs have been significantly lowered for individual investors:

“For the first time in history, Main Street might have it rigged against Wall Street.”

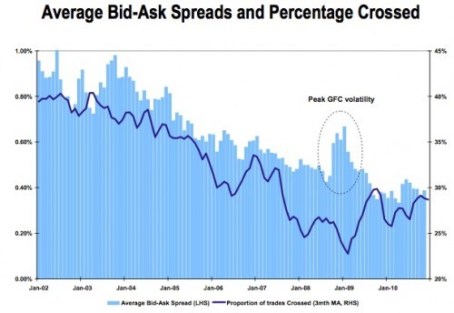

In Flash Boys, Lewis claims HFT traders unscrupulously scalp pennies per share from retail investor pockets by using privileged information to jump in front of ordinary investors (“front-run”). The reality, even if you believe Lewis’s contentions are true, is that technology has turned any perceived detrimental penny-sized skimming scheme into beneficial bucks for ordinary investors. For example, trades that used to cost $40, $50, $100, or more per transaction at the large wirehouse brokerage firms can today be purchased at discount brokerage firms for $7 or less. What’s more, the spread (i.e., the profits available for middlemen) used to be measured in increments of 1/8, 1/4, and 1/2 , when today the spreads are measured in pennies or fractions of pennies. Without any rational explanation, Lewis also dismisses the fact that HFT traders add valuable liquidity to the market. His argument of adding “volume and not liquidity” would make sense if HFT traders only transacted solely with other HFT traders, but that is obviously not the case.

Regardless, as you can see from the chart below, the trend in spreads over the last decade or so has been on a steady, downward, investor-friendly slope.

Source: Business Insider

How Did We Get Here? And What’s Wrong with HFT?

Similarly to our country’s 73,954 page I.R.S. tax code, the complexity of our financial market trading structure rivals that of our government’s money collection system. The painting of all HFT traders as villains by Lewis is no truer than painting all taxpayers as crooks. Just as there are plenty of crooked and deceitful individuals that push the boundaries of our income tax system, so too are there traders that try to take advantage of an inefficient, Byzantine exchange system. The mere presence of some tax dodgers doesn’t mean that all taxpayers should go to jail, nor should all HFT traders be crucified by the SEC (Securities and Exchange Commission) police.

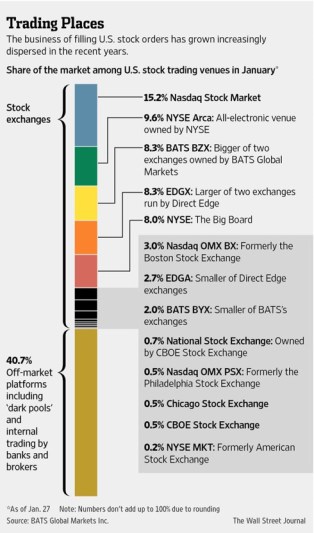

The heightened convoluted nature to our country’s exchange-based financial system can be traced back to the establishment of Regulation NMS, which was passed by the SEC in 2005 and implemented in 2007. The aim of this regulatory structure was designed to level the playing field through fairer trade execution and the creation of equal access to transparent price quotations. However, rather than leveling the playing field, the government destroyed the playing field and fragmented it into many convoluted pieces (i.e., exchanges) – see Wall Street Journal article and chart below.

Source: Wall Street Journal

The new Reg NMS competition came in the form of exchanges like BATS and Direct Edge (now merging), but the new multi-faceted structures introduced fresh loopholes for HFT traders to exploit – for both themselves and investors. More specifically, HFT traders used expensive, lightning-fast fiber optic cables; privileged access to data centers physically located adjacent to trading exchanges; and then they integrated algorithmic software code to efficiently route orders for best execution.

Are many of these HFT traders and software programs attempting to anticipate market direction? Certainly. As the WSJ excerpt below explains, these traders are shrewdly putting their capitalist genes to the profit-making test:

Computerized firms called high-frequency traders try to pick up clues about what the big players are doing through techniques such as repeatedly placing and instantly canceling thousands of stock orders to detect demand. If such a firm’s algorithm detects that a mutual fund is loading up on a certain stock, the firm’s computers may decide the stock is worth more and can rush to buy it first. That process can make the purchase costlier for the mutual fund.

Like any highly profitable business, success eventually attracts competition, and that is exactly what has happened with high frequency trading. To appreciate this fact, all one need to do is look at Goldman Sachs’s actions, which is to leave the NYSE (New York Stock Exchange), shutter its HFT dark pool trading platform (Sigma X), and join IEX, the dark pool created by Brad Katsuyama, the hero placed on a pedestal by Lewis in Flash Boys. Goldman is putting on their “we’re doing what’s best for investors” face on, but more experienced veterans understand that Goldman and all the other HFT traders are mostly just greedy S.O.B.s looking out for their best interests. The calculus is straightforward: As costs of implementing HFT have plummeted, the profit potential has dried up, and the remaining competitors have been left to fend for their Darwinian survival. The TABB Group, a financial markets’ research and consulting firm, estimates that US equity HFT revenues have declined from approximately $7.2 billion in 2009 to about $1.3 billion in 2014. As costs for co-locating HFT hardware next to an exchange have plummeted from millions of dollars to as low as $1,000 per month, the HFT market has opened their doors to anyone with a checkbook, programmer, and a pulse. That wasn’t the case a handful of years ago.

The Fixes

Admittedly, not everything is hearts and flowers in HFT land. The Flash Crash of 2010 highlighted how fragmented, convoluted, and opaque our market system has become since Reg NMS was implemented. And although “circuit breaker” remedies have helped prevent a replicated occurrence, there is still room for improvement.

What are some of the solutions? Here are a few ideas:

- Reform complicated Reg NMS rules – competition is good, complexity is not.

- Overhaul disclosure around “payment-for-order-flow” contracts (rebates), so potential conflicts of interest can be exposed.

- Stop inefficient wasteful “quote stuffing” practices by HFT traders.

- Speed up and improve the quality of the SIP (Security Information Processor), so the gaps between SIP and the direct feed data from exchanges are minimized.

- Improve tracking and transparency, which can weed out shady players and lower probabilities of another Flash Crash-like event.

These shortcomings of HFT trading do not mean the market is “rigged”, but like our overwhelmingly complex tax system, there is plenty of room for improvement. Another pet peeve of mine is Lewis’s infatuation with stocks. If he really thinks the stock market is rigged, then he should write his next book on the less efficient markets of bonds, futures, and other over-the-counter derivatives. This is much more fertile ground for corruption.

As a former manager of a $20 billion fund, I understand the complications firsthand faced by large institutional investors. In an ever-changing game of cat and mouse, investors of all sizes will continue looking to execute trades at the best prices (lowest possible purchase and highest possible sales price), while middlemen traders will persist with their ambition to exploit the spread (generate profits between the bid and ask prices). Improvements in technology will always afford a temporary advantage for a few, but in the long-run the benefits for all investors have been undeniable. The same undeniable benefits can’t be said for reading Michael Lewis’s Flash Boys. Like Clark Stanley and other snake oil salesmen before him, it will only take time for the real truth to come out about Lewis’s “rigged” stock market claims.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold long positions in certain exchange traded funds (ETFs), but at the time of publishing SCM had no direct position in GS, SCHW, ICE, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

The Treadmill Market – Jogging in Place

This article is an excerpt from a previously released Sidoxia Capital Management complementary newsletter (April 1, 2014). Subscribe on the right side of the page for the complete text.

After the stock market raced ahead to about a +30% gain last year, it became clear this meteoric trend was not sustainable into perpetuity. Correct investing should be treated more like a marathon than a sprint. After dashing ahead by more than +100% over the last handful of years, 2014 stock prices took a breather by spending the first quarter jogging in place. Like a runner on the treadmill, year-to-date returns equated to a -0.7% for the Dow Jones Industrial Average index, and +1.3% for the S&P index. Digesting the large gains from previous years, despite making no discernable forward progress this quarter, is a healthy exercise that builds long-term portfolio endurance. As far as I’m concerned, nothing in life worthwhile comes easy, and the first three months of the year have demonstrated this principle.

As I’ve written in the past (see Series of Unfortunate Events), there is never a shortage of issues to worry about. The first few months of 2014 have been no exception. Vladimir Putin’s strong armed military backed takeover of Crimea, coupled with the Federal Reserve’s unwinding $30 billion of the $85 billion of its “Quantitative Easing” bond buying program (i.e. tapering) have contributed to investors’ nervousness. When the “Fairy Godmother of the Bull Market,” Federal Reserve Chair Janet Yellen, hinted at potentially raising interest rates in about 12 months, the mood soured further.

The unseasonably cold winter back east (a.k.a., Polar Vortex) has caused some additional jitters due to the dampening effects on economic conditions. More specifically, economic growth as measured by GDP (Gross Domestic Product) is expected to come in around a meager +2.0% rate during the first quarter of 2014, before picking up later in the year.

And if that isn’t enough, best-selling author Michael Lewis, whose books include Money Ball, The Blind Side, and Liar’s Poker, just came out on national television and sparked a debate with his controversial statement that the “stock market is rigged.” (read and listen more here)

Runners High

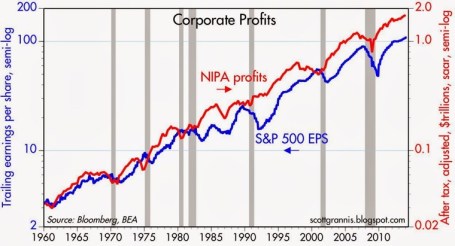

But as always, not everything is gloom and doom. Offsetting the temporary price fatigue, resilient record corporate profits have supported the surprising market stamina. Like a runner’s high, corporations are feeling elated about historically elevated profit margins. As you can see from the chart below, the reason it’s prudent for most to have some U.S. equity exposure is due to the clear, upward multi-decade trend of U.S. corporate earnings.

While the skeptics wait for these game-ending dynamics to take root, core economic fundamentals in areas like these remain strong:I didn’t invent the idea of profits impacting the stock market, but the concept is simple: stock prices generally follow earnings over long periods of time (see It’s the Earnings, Stupid). In other words, as profits accelerate, so do stock prices – and the opposite holds true (decelerating earnings leads to price declines). This direct relationship normally holds over the long-run as long as the following conditions are not in place: 1) valuations are stretched; 2) a recession is imminent; and/or 3) interest rates are spiking. Fortunately for long-term investors, there is no compelling evidence of these factors currently in place.

Employment Adrenaline

The employment outlook received a boost of adrenaline last month. Despite the slight upward nudge in the unemployment rate to 6.7%, total nonfarm payroll jobs increased by +175,000 in February versus a +129,000 gain in January and an +84,000 gain in December. Not only was last month’s increase better than expectations, but the net figures calculated over the previous two months were also revised higher by +25,000 jobs. As you can see below, the improvement since 2009 has been fairly steady, but as the current rate flirts with the Fed’s 6.5% target, Chair Yellen has decided to remove the quantitative objective. The rising number of discouraged workers (i.e., voluntarily opt-out of job searching) and part-timers has distorted the numbers, rendering arbitrary numeric targets less useful.

Source: Barron’s Online

Housing Holding Strong

In the face of the severe winter weather, the feisty housing market remains near multi-year highs as shown in the 5-month moving average housing start figure below. With the spring selling season upon us, we should be able to better gauge the impact of cold weather and higher mortgage rates on the housing market.

Source: Barron’s Online

Even though stock market investors found themselves jogging in place during the first quarter of the year, long-term investors are building up endurance as corporate profits and the economy continue to consistently grow in the background. Successful investors must realize stock prices cannot sustainably sprint for long periods of time without eventually hitting a wall and collapsing. Those who recognize investing as a marathon sport, rather than a mad dash, will be able to jump off the treadmill and ultimately reach their financial finish line.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold long positions in certain exchange traded funds (ETFs), but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Investing, Housing, and Speculating

We all know there was a lot of speculation going on in the housing market during 2005-2007 as risk-loving adventurists loaded up on NINJA loans (No Income, No Job, and No Assets) and subprime CDS (Credit Default Swap) securities. But there is a different kind of speculation going on now, and it isn’t tied directly to housing. Instead of buying a house with no down payment and a no interest loan, speculators are leaping into other hazardous areas of danger. Like a frog jumping from lily pad to lily pad, speculators are now hopping around onto money-chasing industries, including biotech, social media, Bitcoin, and alternative energy.

As French novelist Jean-Baptise Alphonse Karr noted, “The more things change, the more they stay the same.” Irrespective of the painful consequences of the bubble-bursting aftermaths, human behavior and psychology addictively succumb to the ever-seductive emotion of greed. Over the last 15 years, massive fortunes have been gained and lost while chasing frothy financial dreams in areas like technology, housing, and gold.

Most get-rich-quick dream chasers have no idea of how to invest in or value a stock, but they sure know a good story when they hear one. Chasing top performing stocks is lot like jumping off a bridge – anyone can do it, and it feels exhilarating until you hit the ground. However, there is a better way to create wealth. Despite rampant speculation, most individuals understand the principles behind buying a house, which if applied to stocks, can make you a superior investor, and assist you in avoiding dangerous, speculative investments.

Here are some valuable housing insights to improve your stock buying:

#1.) Price is the Almighty Variable: Successful real estate investors don’t make their fortunes by chasing properties that double or triple in value. Buying a rusty tool shed for $1 million makes about as much sense as Facebook paying $19 billion (1,000 x’s the estimated 2013 annual revenues) for a money-losing company, WhatsApp. Better to buy real estate when there is blood in the street. Like the stock market, housing is cyclical. Many traders believe that price patterns are more important than the actual price. If squiggly, technical price moving averages (see Technical Analysis article) make so much money for stock-renting speculators, then how come day traders haven’t used their same crossing-lines and Point & Figure software in the housing market? Yes, it’s true that the real estate transactions costs and illiquidity can be costly for real estate buyers, but 6% load fees, lockup periods, 20% hedge fund fees, and 9% margin rates haven’t stopped stock speculators either.

#2). Cash is King: It doesn’t take a genius to purchase a rental property – I know because practically half the people I know in Southern California own rental properties. For example, if I buy a rental property for $1 million cash, is it a good purchase? Well, it depends on how much after-tax cash I can collect by renting it out? If I can only net $3,000 per month (3.6% annualized return), and be responsible for replacing roofs, fixing toilets, and evicting tenants, then perhaps I would be better off by collecting 6.5% from a low-cost, tax-efficient exchange traded real estate fund, without having to suffer from all the headaches that physical real estate investing brings. Forecasting future asset price appreciation is tougher, but the point is, understanding the underlying cash flow dynamics of a company is just as important as it is for housing purchases.

#3). Debt/Leverage Cuts in Both Directions: Adding debt (or leverage) to a housing or stock investment can be fantastic if prices go up, and disastrous if prices go down. Putting a 20% down payment on a $1 million house works out wonderfully, if the price of the house increases to $1.2 million. My $200,000 down payment is now worth $400,000, or up +100%. The same math works in reverse. If the price of the home drops to $800,000, then my $200,000 down payment is now worth $0, or down -100% (ouch). Margin debt on an equity brokerage account works in a similar fashion, but usually a 50% down payment is needed (less risky than real estate). That’s why I always chuckle when many real estate investors tell me they steer clear of stocks because they are “too risky”.

#4). Growth Matters: If you buy a home for $1 million, is it likely to be worth more if you add a kitchen, tennis court, swimming pull, third floor, and putting green? In short, the answer is yes. The same principle applies to stocks. All else equal, if a company based in Los Angeles, establishes new offices in New York, London, Beijing, and Rio de Janeiro, and then acquires a profitable competitor at a discounted price, chances are the company will be much more valuable after the additions. The key concept here is that asset values are not static. Asset valuations are impacted in both directions, whether we are talking about positive growth opportunities or negative disruptions.

Overall, speculatively chasing performance is tempting, but if you don’t want your financial foundation to crumble, then build your successful investment future by sticking to the fundamentals and financial basics.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold long positions in certain exchange traded funds (ETFs), but at the time of publishing SCM had no direct discretionary position in FB, Bitcoin, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Market Expands and So Does Sidoxia’s Team

This article is an excerpt from a previously released Sidoxia Capital Management complementary newsletter (March 3, 2014). Subscribe on the right side of the page for the complete text.

After a brief pause at the beginning of the year, the stock market built on the tremendous gains of 2013 (S&P 500 up +30%) by reaching record highs again in February by expanding another +4.3% for the month. My investment management and financial planning firm, Sidoxia Capital Mangement, LLC, has been expanding as well. Just this last month, we added a key investment and financial planning professional (Keith C. Bong, CFA, CPA Press Release) with more than 25 years of experience in the fields.

The Record Setting Advance Continues

Now entering the sixth year of this record setting bull market, many investors and pundits have been surprised by the strength and duration of the advance. At the nadir of the financial crisis, the stock market reached a multi-year low of 666 on March 9, 2009. For comparison purposes, the S&P 500 recently closed at 1,845, almost tripling in value since the crisis lows. Pessimists and skeptics, who locked in losses during the crisis plunge, have watched the explosive gains while sitting on their hands. While I freely admit, the low-hanging fruit has been picked, many of the doubters are still calling for a collapse as “troubling news continues to pour in from all over the planet.” However, what the naysayers neglect to acknowledge is the fact that S&P 500 reported profits, the lifeblood of bull markets, have also tripled in value. Despite what the bears say, not everything is a speculative house of cards.

Late to the Party Because of Uncertainty

Although the stock party has lasted five years thus far, individuals have only begun buying for about one year (see ICI fund flows data in Here Comes the Dumb Money) – about +$28 billion of new money in 2013 and another +$12 billion so far this year (ICI data through February 19th). After approximately six years and -$600 billion in stock sales (2007-2012), it’s no wonder investors have been slow to reverse course. Adding to the angst, investors have been bombarded with an endless stream of political and economic concerns on a daily basis, leading to the late arrival of most individuals to the stock investing party. While it’s true that more people have joined the party in recent months, floods of investors are still waiting outside in the cold. Here are a few reasons for the tardiness:

- Geopolitical Concerns: Most recently it was Syria, Iran, and Argentina that got short-term traders chewing their fingernails…now it’s the Ukraine. Just yesterday, I had to spend about 10 minutes locating the Ukranian province of Crimea on a map. For those who have not been keeping track, after days of civil unrest that left some 75 protesters dead, Ukrainian President Viktor Yanukovych fled the capital city of Kiev and agreed with opposition leaders to reduce his powers and hold early presidential elections later this year. For context, in 1954, the former Soviet Union leader Nikita Khrushchev transferred Crimea from the Russian Soviet republic to Ukraine on the basis of economic ties that were closer with Kiev than with Moscow. Prior to that transfer, Russia seized Crimea from the declining Ottoman Empire in the 18th century. Fast forward to today, and fresh off a successful Olympics in Sochi, Russia, Russian President Vladimir Putin hasn’t been happy about the citizen uprising in neighboring Ukraine, so he has decided to flex his muscles and move Russian troops into Crimea. The situation is very fluid and the U.S., along with other global leaders, are crying foul. Time will tell if this situation escalates into a military conflict like the 2008 Georgia-Russia crisis, or if cooler heads prevail.

- Fed Policy Concerns: Federal Reserve Chair Janet Yellen gave her inaugural address last month before Congress, where she signaled continuity in policy with former Fed Chair Ben Bernanke. Indications remain strong that the reduction of bond buying stimulus (i.e., “tapering”) will continue in the months ahead, despite mixed economic results. The “Polar Vortex” occurring on the East Coast, coupled with a record draught on the West Coast contributed to the recent reduction of Q4-2013 GDP growth figures, which were revised lower to +2.4% growth (from +3.2%).

- Domestic Politics: In a sharply politically divided country like the U.S., is there ever a complete hugs & kisses consensus? In short, “no”. How can there be 100% agreement when sharply divisive issues like Obamacare, immigration, tax reform, entitlements, budgets, and foreign affairs are always in flux? Layer on a Congressional midterm election this November and you have a recipe for uncertainty.

Because of all this uncertainty, there are still literally trillions of dollars in cash sitting on the sidelines, waiting to come join the fun. But uncertainty is a relative term because there is always doubt surrounding geopolitics, economics, and Washington D.C. Sentiment moves like a pendulum from fear to greed. Eventually panic/fear sways back the other direction as business/consumer confidence overshadow the deep scarred emotions of 2008-09. As the stock markets have grinded to record highs, fear and skepticism have slowly begun to erode.

Sidoxia Uncertainty

Speaking of uncertainty, I too encountered many doubters and skeptics when I started my firm, Sidoxia Capital Management, LLC in early 2008. Great timing, I thought at the time, as our economy entered the worst recession and financial crisis in a generation and the walls of our nation’s financial system were caving in.

With virtually no company assets or revenues at the time, this was the backdrop as I embarked on my entrepreneurial journey. Seemingly secure investment banking pillars like Bear Stearns and Lehman Brothers, which each had been around for more than a century, crumbled within the blink of an eye. As bailouts were occurring left and right, in conjunction with recurring multi-hundred point collapses in the Dow Jones Industrial index, cynics would repeatedly ask me, “Wade it’s great that you have a lot of experience, but how are you going to gain clients?” It was a fair and reasonable question at the time, but perseverance and hard work have allowed Sidoxia to beat the odds. Publishing several books, conducting numerous media appearances, and gaining thousands of social media followers (InvestingCaffeine.com) hasn’t hurt in building Sidoxia’s brand either.

After achieving record growth in the first five years of the firm, Sidoxia more than doubled its assets under management again in 2013. More important than all of the previously mentioned achievements has been our ability to service our clients with a disciplined, customized process that has demonstrated strong long-term results and helped solidify our valued relationships.

A Few Party Animals Getting Reckless at the Stock Party

Success for Sidoxia or any investor has not come easy over the last six years. As I wrote in a Series of Unfortunate Events, we’ve had to navigate our clients’ investment assets through the following events and more:

- Flash Crash

- Debt Ceiling Debates-Brinksmanship

- U.S. Debt Downgrade

- European Recession

- Arab Spring – Tunisia, Libya, Egypt

- Greek Crisis and Potential Exit from EU

- Uncertain U.S. Presidential Elections

- Sequestration

- Cyprus Financial Crisis

- Income Tax Hikes

- Federal Reserve Tapering

- Syrian Civil War / Military Threat

- Government Shutdown

- Obamacare & Its Glitches

- Iranian Nuclear Threat

- Argentinian Currency Collapse

- Polar Vortex

- Ukrainian Instability

It is no small feat that stock markets have made new records in the face of these daunting concerns. But simply ignoring scary headlines won’t earn you an investing trophy. Successful investing also requires controlling temptation and greed. At a celebratory bash, there are always irresponsible party animals, just like there are always reckless speculators gambling in the financial markets. It certainly is possible to party responsibly without getting crazy during festivities and still have fun. Even though the majority of investors currently are behaving well, as substantiated by the reasonable P/E ratio being paid (15x’s estimated 2014 profits) there are a few foolish players. Pockets of speculative fervor can be found in several areas of the financial markets. Here are a few:

- Bitcoin Breakdown: The world’s largest Bitcoin exchanged filed for bankruptcy after it lost 750,000 Bitcoin units, worth about $477,000,000, based on current exchange rates. The popularity of this speculative virtual currency seems eerily similar to the great Dutch Tulip-Mania of the 1630s.

- Biotech Bliss: Ignorance is a bliss, and apparently so is buying biotech stocks. There’s no need to speculate on gold or Bitcoins when you can invest in the Biotechnology Index (BTK), which has already advanced +21% this year on top of a 51% gain in 2013. Over the last 5+ years, the index has more than quadrupled.

- Facebook Folly: WhatsApp with Facebook Inc’s (FB) $19 billion acquisition of the cellphone texting company? CEO Mark Zuckerberg is claiming he got a bargain by paying almost 1,000x’s the estimated annual revenue of WhatsApp ($20 million). When only a fraction of the 450 million users are paying for the service, I’m OK going out on a limb and calling this deal kooky.

- High Ticket Tesla: Tesla Motors Inc (TSLA) has become a cult stock. The company has a price tag of $30 billion despite burning $7 million in cash last year. The announcement of a $4-5 billion battery “Gigafactory” added to the company’s recent hype. To put things into perspective, General Motors (GM) has revenues 75x’s larger than Tesla and GM generated over $5 billion in 2013 free cash flow. Nevertheless, GM is only valued at 1.9x’s the market value of Tesla…head scratch.

- Social Media Silliness: Maybe not quite as wacky as the $19 billion price tag paid for WhatsApp, but the $30 billion value placed on Twitter Inc (TWTR) for a company that burned $30 million of cash in their most recent financial report is silly too. Yelp Inc (YELP) is another multi-billion valued company that is losing money. I love all these services, but great services don’t always make great stocks. Investors from the dot-com era vividly remember what happened to those overvalued stocks once the bubble burst.

Fear and greed are omnipresent, and some of these speculative areas may continue to appreciate in value. However, controlling or ignoring the powerful emotions of fear and greed will help you in achieving your financial goals. As the markets (and Sidoxia’s team) expand, our disciplined investment process should allow us to objectively identify attractive investment opportunities without succumbing to the pitfalls of panic-selling or performance-chasing.

Other Recent Investing Caffeine Articles:

Retirement Epidemic: Poison Now or Later?

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing SCM had no direct position in FB, TWTR, YELP, TSLA, BTK, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

NASDAQ and the R&D-Tech Revolution

It’s been a bumpy start for stocks so far in 2014, but the fact of the matter is the NASDAQ Composite Index is up this year and hit a 14-year high in the latest trading session (highest level since 2000). The same cannot be said for the Dow Jones Industrial and S&P 500 indices, which are both lagging and down for the year. Not only did the NASDAQ outperform the Dow by almost +12% in 2013, but the NASDAQ has also trounced the Dow by over +70% over the last five years.

Is this outperformance a fluke or random coincidence? I’d beg to differ, and we will explore the reasons behind the NASDAQ being treated like the Rodney Dangerfield of indices. Or in other words, why the NASDAQ gets “no respect!” (see also NASDAQ Ugly Step Child).

Compared to the “bubble” days of the nineties, today’s discussions more rationally revolve around profits, cash flows, and valuations. Many of us old crusty veterans remember all the crazy talk of the “New Economy,” “clicks,” and “eyeballs” that took place in the mid-to-late 1990s. Those metrics and hyperbole are used less today, but if NASDAQ’s dominance extends significantly, I’m sure some new and old descriptive euphemisms will float to the conversational surface.

The technology bubble may have burst in 2000, and scarred memories of the -78% collapse in the NASDAQ (5,100 to 1,100) from 2000-2002 have not been forgotten. Despite that carnage, technology has relentlessly advanced through Moore’s Law, while internet connectivity has proliferated in concert with globalization. FedEx’s (FDX) Chief Information Officer Rob Carter summed it up nicely when he noted, “The sound we heard wasn’t the [tech] bubble bursting; it was the big bang.”

Even with the large advance in the NASDAQ index in recent years, valuations of the tech-heavy index remain within reasonable ranges. Accurate gauges of the NASDAQ Composite price-earnings ratio (P/E) are scarce, but just a few months ago, strategist Ned Davis pegged the index P/E at 21, well below the peak of 49 at the end of 1999. For now, the scars and painful memories of the 2000 crash have limited the amount of frothiness, although pockets of it certainly still exist (greed will never be fully eradicated).

Why NASDAQ & Technology Continue to Flourish

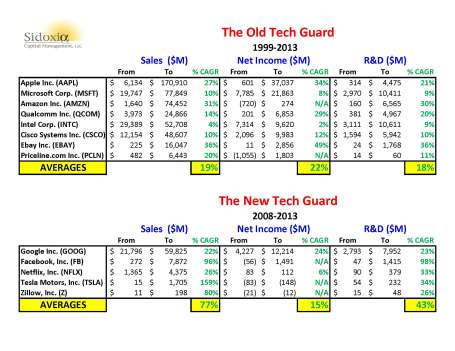

Regardless of how one analyzes the stock market, ultimately long-term stock prices follow the direction of profits and cash flows. Profits and cash flows don’t however grow out of thin air. Sustainable growth requires competitiveness. For most industries, a long-term competitive advantage requires a culture of innovation and technology adoption. As you can see from the NASDAQ listed companies BELOW, there is no shortage of innovation.

CLICK TO ENLARGE

I’ve divided the largest technology companies in the NASDAQ 100 index that survived the bursting of the 2000 technology bubble into “The Old Tech Guard.” This group of eight stocks represents a total market value of about $1.5 trillion – equivalent to almost 10% of our country’s Gross Domestic Product (GDP). Incredibly, this select collection of companies achieved an average sales growth rate of +19%; income growth of +22%; and research & development growth of +18% over a 14-year period (1999-2013).

The second group of younger stocks (a.k.a., The New Tech Guard) that launched their IPOs post-2000 have accomplished equally impressive results. Together, these handful of companies have earned a market value of over $625 billion. There’s a reason investors are gobbling up these stocks. Over the last five years, The New Tech Guard companies have averaged an unbelievable +77% sales growth rate, coupled with a remarkable +43% expansion in average annual R&D expenditures.

Innovation Dead?

Who said innovation is dead? Not me. Combined, these 13 companies (Old Guard + New Guard) are spending about $55,000,000,000 on research and development…annually! If you consider the hundreds and thousands of other technology companies that are also investing aggressively for the future, it should come as no surprise that the pace of innovation is only accelerating.

While newscasters, bloggers, and newspapers will continue to myopically focus on the Dow and S&P 500 indices, do your investment portfolio a favor by not forgetting about the relentless R&D and tech revolution taking place within the innovative and often overlooked NASDAQ index.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold long positions in certain exchange traded funds (ETFs), AAPL, GOOG, AMZN, FDX, QCOM, and a short position in NFLX, but at the time of publishing SCM had no direct discretionary position in MSFT, INTC, CSCO, EBAY, PCLN, FB, TSLA, Z, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.