Posts filed under ‘Profiles’

The Big Short: The Silent Ticking Bomb

A bomb was ticking for many years before the collapse of Bear Stearns in March of 2008, but unfortunately for most financial market participants, there were very few investors aware of the looming catastrophe. In The Big Short: Inside the Doomsday Machine, author Michael Lewis manages to craft a detailed account of the financial crisis by weaving in the exceptional personal stories of a handful of courageous capitalists. These financial sleuths manage not only to discover the explosive and toxic assets buried on the balance sheets of Wall Street giants, but also to realize massive profits for their successful detective skills.

Lewis was not dabbling in virgin territory when he decided to release yet another book on the financial crisis of 2008-2009. Nonetheless, even after slogging through Andrew Ross Sorkin’s Too Big to Fail and Gregory Zuckerman’s The Greatest Trade Ever (see my reviews on Too Big to Fail and The Greatest Trade Ever), I still felt obligated to add Michael Lewis’s The Big Short to my bookshelf (OK…my e-reader device). After all, he was the creator of Liar’s Poker, The New New Thing, Moneyball, and The Blind Side, among other books in his distinguished collection.

Genesis of the Bomb Creations

Like bomb sniffing dogs, the main characters that Lewis describes in The Big Short (Michael Burry/Scion Capital; Steve Eisman/Oppenheimer and Co. & FrontPoint Partners; Gregg Lippman/Deutsche Bank (DB); and Jamie Mai & Charlie Ledley/Cornwall Capital) demonstrate an uncanny ability to smell the inevitable destruction, and more importantly have the conviction to put their professional careers and financial wellbeing at risk by making a gutsy contrarian call on the demise of the subprime mortgage market.

How much dough did the characters in the book make? Jamie Mai and Charlie Ledley (Cornwall Capital) exemplify the payoff for those brave, and shrewd enough to short the housing market (luck never hurts either). Lewis highlights the Cornwall crew here:

“Cornwall Capital, started four and a half years earlier with $110,000, had just netted from a million-dollar bet, more than $80 million.”

Lewis goes on to describe the volatile period as “if bombs of differing sizes had been placed in virtually every major Western financial institution.” The size of U.S. subprime bombs (losses) exploding was estimated at around $1 trillion by the IMF (International Monetary Fund). When it comes to some of the large publicly traded financial institutions, these money bombs manifested themselves in the form of about $50 billion in mortgage-related losses at Merrill Lynch (BAC), $60 billion at Citigroup (C), $9 billion at Morgan Stanley (MS), along with many others.

The subprime market, in and of itself, is actually not that large in the whole scheme of things. Definitions vary, but some described the market at around 7-8 million subprime mortgages outstanding during the peak of the market, which is a small fraction of the overall U.S. mortgage industry. The relatively small subprime market became a gargantuan problem when millions of lucrative subprime side-bets were created through investment banks and unregulated financial behemoths like AIG. The spirits of greed added fuel to the fire as the construction of credit default swap market and synthetic mortgage-backed CDOs (Collateralized Debt Obligations) were unleashed.

Triggering the Bomb

Multiple constituents, including the rating agencies (S&P [MHP], Moodys [MCO], Fitch) and banks, used faulty assumptions regarding the housing market. Since the subprime market was a somewhat new invention the mathematical models did not know how to properly incorporate declining (and/or moderating) national home prices, since national price declines were not consistent with historical housing data. These models were premised on the notion of Florida subprime price movements not being correlated (moving in opposite directions) with California subprime price movements. This thought process allowed S&P to provide roughly 80% of CDO issues with the top AAA-rating, despite a large percentage of these issues eventually going belly-up.

Lewis punctuated the faulty correlation reasoning underlying these subprime assumptions that dictated the banks’ reckless actions:

“The correlation among triple-B-rated subprime bonds was not 30 percent; it was 100 percent. When one collapsed, they all collapsed, because they were all driven by the same broader economic forces. In the end, it made little sense for a CDO to fall from 100 to 95 to 77 to 70 and down to 7. The subprime bonds beneath them were either all bad or all good. The CDOs were worth either zero or 100.”

Steve Eisman adds his perspective about subprime modeling:

“Just throw the model in the garbage can. The models are all backward looking.”

Ignorance, greed, and other assumptions, such as the credibility of VAR (Value-at-Risk) metrics, accelerated the slope of the financial crisis decline.

Eisman had some choice words about many banking executives’ lack of knowledge, including his gem about Ken Lewis (former CEO of Bank of America):

“I had an epiphany. I said to myself, ‘Oh my God he’s dumb!’ A lightbulb went off. The guy running one of the biggest banks in the world is dumb!”

Or Eisman’s short fuse regarding the rating agency’s refusal to demand critical information from the investment banks due to fear of market share loss:

“Who’s in charge here? You’re the grown up. You’re the cop! Tell them to f**king give it to you!!!…S&P was worried if they demanded the data from Wall Street, Wall Street would just go to Moody’s for their ratings.”

A blatant conflict of interest exists between the issuer and rating agency, which needs to be rectified if credibility will ever return to the rating system. At a minimum, all fixed income investors should wake up and smell the coffee by doing more of their own homework, and relying less on the rubber stamp rating of others. The credit default swap market played a role in the subprime bubble bursting too. Without regulation, it becomes difficult to explain how AIG’s tiny FP (Financial Products) division could generate $300 million in profits annually, or at one point, 15% of AIG’s overall corporate profits.

My Take

The Big Short may simply be recycled financial crisis fodder regurgitated by countless observers, but regardless, there are plenty of redeeming moments in the book. Getting into the book took longer than I expected, given the pedigree and track record of Lewis. Nonetheless, after grinding slowly through about 2/3 of the book, I couldn’t put the thing down in the latter phases.

Lewis chose to take a micro view of the subprime mortgage market, with the personal stories, rather than a macro view. In the first 95% of the book, there is hardly a mention of Bear Stearns (JPM) Lehman Brothers, Citigroup, Goldman Sachs (GS), Fannie Mae (FNM), Freddie Mac (FRE), etc. Nevertheless, at the very end of the book, in the epilogue, Lewis attempts to put a hurried bow around the causes of and solutions to the financial crisis.

There is plenty of room to spread the blame, but Lewis singles out John Gutfreund’s (former Salomon Brothers) decision to take Solly public as a key pivotal point in the moral decline of the banking industry. For more than two decades since the publishing of Liar’s Poker, Lewis’s view on the overall industry remains skeptical:

“The incentives on Wall Street were all wrong; they’re still all wrong.”

His doubts may still remain about the health in the banking industry, and regardless of his forecasting prowess, Michael Lewis will continue sniffing out bombs and writing compelling books on a diverse set of subjects.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

*DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds and AIG subsidiary debt, but at the time of publishing SCM had no direct positions in BAC, JPM, FRE, FNM, DB, MS, GS, C, MCO, MHP, Fitch, any security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Kass: Triple Lindy Redux

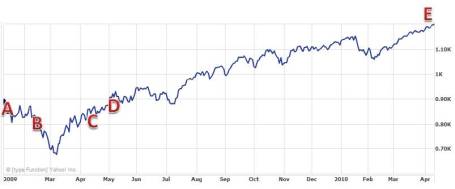

About a year ago, I wrote about Doug Kass (founder and president of Seabreeze Partners) and his attempt at pulling off the famous “Triple Lindy” dive, which was made famous in the classic movie Back to School starring Rodney Dangerfield. If I were a judge, I would say Kass’s landing wasn’t a perfect 10, but rather closer to a 6.5. After successfully nailing the bear market in 2008, and subsequently declaring the “generational low” of March 2009, Kass became cautious in June 2009. At the time, Kass pulled in his horns by pronouncing a consumer-led double dip in late 2009 or in the first half 2010 from a consumption binge hangover, while declaring his previous 1050 S&P 500 index target as overly ambitious. What actually transpired is the S&P 500 went from around 942 to 1220 over the next ten months, or up about +30%.

Today, Kass is trying to make another large splash, but now he is reversing course and once more calling for a rally…at least a mini one. Rather than speaking in terms of his previous generational low (S&P 666), Kass sees the recent lows around 1,010 being the “bottom for the year” and his new 2010 target is based on climbing to positive territory for the year, implying a +10% to +12% move from the beginning of July.

View Doug Kass Interview and Prediction

View Doug Kass Interview and Prediction

Kass is not your traditional investor, and he admits as much:

“I’m not a perma-bear, I’m not a perma-bull. I try to be flexible and eclectic in my view, and this is especially necessary in a market, which is so volatile as it’s been for the last several years.”

In explaining his upbeat rationale, Kass highlights nuanced aspects to employment data, payroll growth, moderate economic expansion, and an attractive valuation for the overall market:

“I’m not technically based, therefore I’m not sentiment based, I’m fundamental based….The markets are traveling on a path of fear and share prices have significantly disconnected from fundamentals.”

Even if Kass didn’t nail the “Triple Lindy,” he still deserves special attention as a practitioner, in addition to his side job as a market prognosticator. Additional recognition is warranted solely based on the potshots he aimed at rent-a-strategists like Nouriel Roubini, CNBC celebrity, (see Roubini articles #1 or #2) and Robert Prechter, long-running technician who is currently predicting Dow destruction to unfathomable level of 1,000. I’m not in the business of predicting short-term market gyrations, but I’ll enjoy watching Kass’s next dive to see whether he’ll make a splash or not.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

*DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct positions in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

LeBron James’s Stock: Buy, Sell, or Hold? (Ticker: LBJ)

The world is watching. With the National Basketball Association (NBA) free agency period officially kicking off on July 1st, frothing-mouthed NBA owners have been released to attack LeBron “King” James in hopes of dragging him back to their home teams. Don’t be surprised to see extensive media footage of paparazzi chasing around a Cadillac Escalade with tinted windows or LeBron’s custom logo’d Ferrari – at least until James officially announces his new team of choice (or reasserts his loyalty to his hometown Cleveland Cavaliers). Stalking one of the greatest professional basketball players of all-time may be fascinating to many, but in the high stakes business of professional sports, LeBron is nothing more than a financial asset being shopped around everywhere from Los Angeles and New Jersey to Miami and New York. So, if LeBron James was a stock, would he be a buy, sell, or hold? And if so, at what price? By the way, his bud, and fellow biased posse member, Warren Buffett, is not eligible to answer these important questions.

Hot IPO Season

Although LeBron is the talk of the town these days, there is a flood of other new contract issuances coming to market. Unlike the stock market, the IPO (Initial Public Offering) and Secondary Offering markets for NBA players is flaming hot this year, with some fresher faces mixing it up with some steely veterans. Beyond LeBron James, you have an incredibly talented cast of characters chasing big bucks, including Dwyane Wade, Chris Bosh, Amar’e Stoudemire, Joe Johnson, Paul Pierce, Ray Allen, Dirk Nowitzki, Yao Ming, Carlos Boozer, Manu Ginobili, Richard Jefferson, and Michael Redd.

Valuation

James is not an unknown commodity like a private start-up company with a limited track record, so valuing LeBron is much easier than sizing up a rookie. What is a 25 year old, two-time MVP phenom, who averages 27.8 points per game, 7.0 rebounds, and 7.0 assists worth?

Well, what kind of coin are other illustrious players making…for example Kobe Bryant of the Los Angeles Lakers? Even with Bryant’s slightly less dazzling stats (25.3 points per game, 5.3 rebounds, and 4.7 assists), in April he signed a three-year contract extension worth almost $90 million that will keep him in Los Angeles through the 2013-14 season. The comparison isn’t exactly fair, since Bryant, a 12-time All-Star, has been in the league twice as long as James (14 years vs. 7 years) and Bryant also just secured his fifth golden championship ring (versus zero for James).

To get an even better feel on LBJ stock’s comparable analysis, let’s look at the green that other premier players in the league pulled in last season:

1. Tracy McGrady (Houston Rockets): $23.4 million

2. Kobe Bryant (LA Lakers): $23.2 million

3. Jermaine O’Neal (Miami Heat): $22.8 million

4. Tim Duncan (San Antonio Spurs): $22.2 million

5. Shaquille O’Neal (Cleveland Cavaliers): $20 million

6. Dirk Nowitzki (Dallas Mavericks) $19.8 million

Paul Pierce (Boston Celtics): $19.8 million

8. Ray Allen (Boston Celtics): $19.75 million

9. Rashard Lewis (Orlando Magic): $18.9 million

10. Michael Redd (Milwaukee Bucks): $17 million

Big bucks all these players make, but so sad what they do with it (read Hidden Pro Athlete Train Wreck)

M & A Perspective

Another way of looking at the LBJ free agency circus is from a mergers and acquisition standpoint. Unfortunately, the vast majority of mergers fail (see CNET article). One major reason is the culture dynamics that need to align between the coach, LeBron, and the other supporting cast on the team. Golden state Warrior Latrell Sprewell’s choking of Coach P.J. Carlesimo in 1997 is proof positive of what can go wrong when cultures collide. Another aspect of deal-busters is the tendency for suitors to overpay for acquisition deals, and bake in too optimistic assumptions regarding the target’s capabilities to perform.

On the flip side, some obvious complementary skill-set synergies could mesh nicely if a multi-player deal could be constructed between Chris Bosh (Toronto Raptors), Dwyane Wade…cool name (Miami Heat), and resurrected Coach Pat Riley, also of the Heat.

The Buck Stops in ???

When all is said and done, LeBron’s choice is simple – join the team that offers the best hope of winning a championship. The dollars and cents component of the deal are pretty formulaic due to salary caps and league maximums mandated through the Collective Bargaining Agreement (CBA) between owners and players. As the Associated Press points out, the difference between staying in Cleveland and going elsewhere is around a measly $30 million (easy for me to say):

“James can get perhaps $125 million over six years by staying in Cleveland; $96 million over five years if he goes.”

My bottom line is that LBJ’s stock is pricey right now, but well worth the BUY if he ends up in Miami with Wade and Bosh. Unfortunately, a restructuring or 1-time charge in Cleveland will not get the job done (Shaq proved that point), so in the Cavs’ hands James is a sell. On the speculative BUY side, let us please forget I am a biased California native, and not fully dismiss the possibility of the Los Angeles Clippers landing LeBron. Billy Crystal is no iconic Laker fan like Jack Nicholson, but nonetheless with LBJ dressed up in red, white, and blue, Billy would have no trouble recruiting some of his celeb pals to hang courtside with him.

Given all the suitors and scenarios, determining a precise Buy, Sell, or Hold rating can be quite challenging. Information in this epic story is changing by the hour, but based on the current data, I am selling LeBron short in Cleveland, and buying him long in Los Angeles. Kobe, don’t confirm your 6th celebration parade next June just quite yet.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

*DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct positions in MSG, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

The Accomplished Mole – Seth Klarman

I do quite a bit of reading and in my spare time I came across something very interesting. Here are some of the characteristics that describe this unique living mammal: 1) You will rarely see this creature in the open; 2) It roams freely and digs in deep, dark areas where many do not bother looking; and 3) This active being has challenged eyesight.

If you thought I was talking about a furry, burrowing mole (Soricomorpha Talpidae) you were on the right track, but what I actually was describing was legendary value investor Seth Klarman. He shares many of the same features as a mole, but has made a lot more money than his very distant evolutionary cousin.

The Making of a Legend

Before becoming the President of The Baupost Group, a Boston-based private investment partnership which manages about $22 billion in assets on behalf of wealthy private families and institutions, he worked for famed value investors Max Heine and Michael Price of the Mutual Shares (purchased by Franklin Templeton Investments). Klarman also published a classic book on investing, Margin of Safety, Risk Averse Investing Strategies for the Thoughtful Investor, which is now out of print and has fetched upwards of $1,000-2,000 per copy in used markets like Amazon.com (AMZN).

Klarman chooses to keep a low public profile, but recently his negative views on stock market and inflation risk have filtered out into the public domain. Nonetheless, he is still optimistic about certain distressed opportunities and believes the financial crisis has cultivated a more favorable, less competitive environment for investment managers due to the attrition of weaker investors.

Philosophy

Klarman despises narrow mandates – they are like shackles on potential returns. Opportunities do not lay dormant in one segment of the financial markets. Investors are fickle and fundamentals change. He believes superior results are achieved through a broadening of mandates. He prefers to invest in areas off the proverbial beaten path – the messier and more complicated the situation, the better. Currently his funds have significant investments in distressed debt instruments, many of which were capitulated forced sales by funds that are unable to hold non-investment grade debt.

In order to make his wide net point to investing, Klarman uses real estate as an illustration device. For example, investors do not need to limit themselves to publicly traded REITs (Real Estate Investment Trusts) – they can also invest in the debt of a REIT, convertible real estate debt, equity of property (such as own building), bank loan on a building, municipal bond that’s backed by real estate, or commercial/residential mortgage backed securities.

Klarman summarizes his thoughts by saying:

“If you have a broader mandate, they let you own all kinds of debt, all kinds of equity. Perhaps some private assets, like real estate. Perhaps hold cash when you can’t find anything great to do. You now have more weapons at your disposal to take advantage of conditions in the market.”

Klarman’s 3 Underlying Investment Pillars

Besides mentors Heine and Price, Klarman is quick to highlight his investment philosophy has been shaped by the likes of Warren Buffett and Benjamin Graham, among others. In addition to many of the basic tenets espoused by these investment greats, Klarman adds these three main investment pillars to his repertoire:

1) Focus on risk first (the probability of loss) before return. Determine how much capital you can lose and what the probability of that loss is. Also, do not confuse volatility with risk. Volatility creates opportunities.

2) Absolute performance, not relative performance, is paramount. The world is geared towards relative performance because of asset gathering incentives. Wealthy investors and institutions are more focused on absolute returns. Focus on benchmarks will insure mediocrity.

3) Concentrate on bottom-up research, not top down. Accurately forecasting macroeconomic trends and also profiting from those predictions is nearly impossible to do over longer periods of time.

These are great, but represent just a few of his instructional nuggets.

Performance

I did some digging regarding Klarman’s performance, and given the range of markets experienced over the last 25+ years, the results are nothing short of spectacular. Here is what I dug up from the Outstanding Investor Digest:

“Since its February 1, 1983 [2008] inception through December 31st, his Baupost Limited Partnership Class A-1 has provided its limited partners an average annual return of 16.5% net of fees and incentives, versus 10.1% for the S&P 500. During the “lost decade”, Baupost obliterated the averages, returning 14.8% and 15.9% for the 5 and 10-year periods ending December 31st versus -2.2% and -1.4%, respectively, for the S&P.”

Here is some additional color from Market Folly on Klarman’s incredible feats:

“Despite Klarman’s typically high levels of cash [sometimes in excess of 50%], Baupost has still generated astonishing performance. It was up 22% in 2006, 54% in 2007, and around 27% in 2009. During the crisis in 2008, Klarman’s funds lost “between 7% and the low teens.” Still though, he certainly outperformed the market indices and much of his investment management brethren in a time of panic.”

Although Seth Klarman has plowed over the competition and remained underground from the mass media, it’s still extremely difficult to ignore the long-term record of success of this accomplished mole. In the short-run, volatility may hurt his performance – especially if holding 20-30% cash. But as I was told at a young age by my grandmother, it is not prudent to make mountains out of molehills. Apparently, Klarman’s grandma taught her mole-like grandson how to make mountains of money from hills of opportunities. Klarman’s investors certainly stand to benefit as he continues to dig for value-based gems.

Watch interesting but lengthy presentation video given by Seth Klarman

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

*DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, and AMZN, but at the time of publishing SCM had no direct positions in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Soros & Reflexivity: The Tail Wagging the Dog

Billionaire investor George Soros, who is also Chairman of Soros Fund Management and author of The Crash of 2008¸ is well known for his theory on reflexivity, which broadly covers political, social, financial, and economic systems. Soros built upon this concept (see also Soros Super Bubble), which was influenced by philosopher Karl Popper. With all the fear and greed rippling through global geographies as diverse as Iceland, California, Dubai, and Greece, now is an ideal time to visit Soros’s famous reflexivity theory, which may allow us to put the recent chaos in context. With the recent swoon in the market, despite domestic indicators trending positively, a fair question to ask is whether the dog is wagging the tail or the tail wagging the dog?

The Definition of Reflexivity

Simply stated, reflexivity can be explained as the circular relationship that exists between cause and effect. Modern financial theory teaches you these lessons: 1) Financial markets are efficient; 2) Information flows freely; 3) Investors make rational decisions; and 4) Markets eventually migrate towards equilibrium. Reflexivity challenges these premises with the claims that people make irrational and biased decisions with incomplete information, while the markets trend toward disequilibrium, evidenced by repeated boom and bust cycles.

Let’s use the housing market as an example of reflexivity. By looking at the housing bubble in the U.S., we can shed some light on the theory of reflexivity. Americans initial buying love affair with homes pushed prices of houses up, which led to higher valuations of loans on the books of banks, which allowed the banks to lend more money to buyers, which meant more home buying and pushed prices up even higher. To make matters worse, even the government joined the game by adding incentives for people who could not afford homes. As you can see, the actions and decisions of an observer can have a direct impact on other observers and the system itself, thereby creating a spiraling upward (or downward) effect.

Now What?

Now, the reflexivity tail that is wagging the dog is Europe…specifically Greece. The bear case goes as follows: the Greek financial crisis will brew into a stinky contagion, eventually spreading to Spain and Italy, thus hammering shut a U.S. export market. The double dip recession in the U.S. will not only exacerbate the pricking of the Chinese real estate bubble, but also topple all other global economies into ruin.

Certainly, the excessive sovereign debt levels across the globe have grown like cancer. Fortunately, we have identified the problem and politicians are being forced by voters to address the fiscal problems. More importantly, capital flows are an unbiased arbiter of economic policies. Over time – not in the short-run necessarily – capital will move to where it is treated best. Meaning those countries that harness responsible debt loads, institute pro-business growth policies, remove unsustainable and insolvent entitlements, and incentivize education and innovation will be the countries that earn the honor of holding their fair share of vital capital. If the politicians don’t make the correct decisions, the hemorrhaging of capital to foreigners and the painfully high unemployment levels will force Washington into making the tough but right decisions (usually in the middle of a crisis).

Reflexivity, as it pertains to financial markets, has been a concept the 79 year old George Soros has passionately espoused since his 1987 book, The Alchemy of Finance. Perhaps a better understanding of reflexivity will help us better take advantage of the tail wagging disequilibriums experienced in the current financial markets. Time will tell how long this disequilibrium will last.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

*DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct positions in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Stocks…Bonds on Steroids

With all the spooky headlines in the news today, it’s no wonder everyone is piling into bonds. The Investment Company Institute (ICI), which tracks mutual fund data, showed -88% of the $14 billion in weekly outflows came from equity funds relative to bonds and hybrid securities. With the masses flocking to bonds, it’s no wonder yields are hovering near multi-decade historical lows. Stocks on the other hand are the Rodney Dangerfield (see Doug Kass’s Triple Lindy attempt) of the investment world – they get “no respect.” By flipping stock metrics upside down, we will explore how hated stocks can become the beloved on steroids, if viewed in the proper context.

Davis on Debt Discomfort

Chris Davis, head of the $65 billion in assets at the Davis Funds, believes like I do that navigating the “bubblicious” bond market will be a treacherous task in the coming years. Davis directly states, “The only real bubble in the world is bonds. When you look out over a 10-year period, people are going to get killed.” In the short-run, inflation is not a real worry, but it if you consider the exploding deficits coupled with the exceedingly low interest rates, bond investors are faced with a potential recipe for disaster. Propping up the value of the dollar due to sovereign debt concerns in Greece (and greater Europe) has contributed to lower Treasury rates too. There’s only one direction for interest rates to go, and that’s up. Since the direction of bond prices moves the opposite way of interest rates, mean reversion does not bode well for long-term bond holders.

Earnings Yield: The Winning Formula

Average investors are freaked out about the equity markets and are unknowingly underestimating the risk of bonds. Investors would be in a better frame of mind if they listened to Chris Davis. In comparing stocks and bonds, Davis says, “If people got their statement and looked at the dividend yield and earnings yield, they might do things differently right now. But you have to be able to numb yourself to changes in stock prices, and most people can’t do that.” Humans are emotional creatures and can find this a difficult chore.

What us finance nerds learn through instruction is that a price of a bond can be derived by discounting future interest payments and principle back to today. The same concept applies for dividend paying stocks – the value of a stock can be determined by discounting future dividends back to today.

A favorite metric for stock jocks is the P/E (Price-Earnings) ratio, but what many investors fail to realize is that if this common ratio is flipped over (E/P) then one can arrive at an earnings yield, which is directly comparable to dividend yields (annual dividend per share/price per share) and bond yields (annual interest/bond price).

Earnings are the fuel for future dividends, and dividend yields are a way of comparing stocks with the fixed income yields of bonds. Unlike virtually all bonds, stocks have the ability to increase dividends (the payout) over time – an extremely attractive aspect of stocks. For example, Procter & Gamble (PG) has increased its dividend for 54 consecutive years and Wal-Mart (WMT) 37 years – that assertion cannot be made for bonds.

As stock prices drop, the dividend yields rise – the bond dynamics have been developing in reverse (prices up, yields down). With S&P 500 earnings catapulting upwards +84% in Q1 and the index trading at a very reasonable 13x’s 2010 operating earnings estimates, stocks should be able to outmuscle bonds in the medium to long-term (with or without steroids). There certainly is a spot for bonds in a portfolio, and there are ways to manage interest rate sensitivity (duration), but bonds will have difficulty flexing their biceps in the coming quarters.

Read the full article on Chris Davis’s bond and earnings yield comments

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

*DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds and WMT, but at the time of publishing SCM had no direct positions in PG, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

King of Controversy Reveals Maverick Solution

Mark Cuban, provocative and brash owner of the Dallas Mavericks basketball team and #400 wealthiest person in the world ($2.4 billion net worth), according to Forbes, has never been shy about sharing his opinion. In fact, this multi-billionaire’s opinions have been discouraged on multiple occasions, as evidenced by the NBA (National Basketball Association) slapping Cuban with more than $1.6 million in fines for his outbursts.

Cuban doesn’t only provide his views on basketball, as a serial entrepreneur who cashed in his former company Broadcast.com to Yahoo! (YHOO) for $5.9 billion, he also is providing his thoughts on Wall Street and the 1,000 point “fat finger” trading meltdown from last week. What does Cuban say is the answer to the rampant speculation conducted by idiot financial engineers? “Tax the Hell Out of Wall Street,” says Cuban in his recent blog flagged by TRB’s Josh Brown.

A Taxing Solution

Specifically, Cuban wants to tax investors 25 cents per share (and 5 cents per share for stocks trading at $5 per share or less) in hopes of encouraging myopic speculating traders to become longer-term shareholders. Cuban believes this approach will weed out the day traders and investment renters who in reality “don’t add anything to the markets.” Seems like a reasonable belief to me.

According to Cuban’s math, here are some of the benefits the tax would bring to the financial system:

“If the NYSE, Nasdaq, Amex and OTC are trading 2 Billion shares a day or more, like today, thats $ 500 Million Dollars PER DAY. If there are 260 trading days a year. Thats about 130 Billion dollars a year. If volumes drop because of the tax. It is still 10s of Billions of dollars per year. Thats real money for the US Treasury. Thats also an annual payment towards the next time Wall Street screws up and we have a black swan event that no one planned on.”

Practically speaking, a flat rate 25 cent tax per share is probably not the best way to go if you were to introduce a transaction tax, but the crux of Cuban’s argument essentially would not change. Creating a flat percentage tax (e.g., 1%) would likely make more sense, even if complexity may increase relative to the 25 cent tax. Take for example Citigroup (C) and Berkshire Hathaway Class A (BRKA). Cuban’s plan would result in paying 1.2% tax on a $4.17 share of Citigroup versus only 0.00022% tax for a $116,000.00 share of Berkshire Hathaway. Simple accounting maneuvers such as reverse stock splits and slowing of stock dividends, along with reducing company dilution through share and option issuance, may be methods of circumventing some of the tax burden created under Cuban’s described proposal.

Politically, adding any tax to investing voters could be re-election suicide, so rather than calling it a trading tax, I suppose the politicians would have to come up with some other euphemism, such as “charitable administrative fee for speculative trading.” The financial industry has already become experts in taxing investors with fees (read Fees, Exploitation and Confusion), so maybe Congress could give the banks and fund companies a call for some marketing ideas.

Step 1: Transparency

The murkiness and lack of transparency across derivatives markets is becoming more and more evident by the day. Some recent events that bolster the argument include: a) New CDO (Collateralized Debt Obligation) derivative allegations surfacing against Morgan Stanley (MS); b) The SEC (Securities and Exchange Commission) charges against Goldman Sachs (GS) in the Abacus synthetic CDO deal (see Goldman Sachs article); c) The collapse of AIG’s Credit Default Swap (CDS) department and subsequent push to transfer trading to open exchanges; and d) Now we’re dealing with last week’s cascading collapse of the equity markets within minutes. The brief cratering of multiple indexes points to a potential order entry blunder and/or absence of adequate and consistent circuit breakers across a web of disparate exchanges and ECNs (Electronic Communication Networks).

The mere fact we stand here five days later with no substantive explanation for the absurd trading anomalies (see Making Megabucks 13 Minutes at a Time) is proof positive changes in derivative and exchange transparency are absolutely essential.

Step 2: Incentives

In Freakonomics, the best-selling book authored by Steven Levitt, we learn that “Incentives are the cornerstone of modern life,” and “Economics is, at root, the study of incentives.” Incentives are crucial in that they permeate virtually all aspects of financial markets, not only in assisting economic growth, but also the negative aspects of bursting financial bubbles.

Michael Mauboussin, the Chief Investment Strategist at Legg Mason (read more on Mauboussin), also expands on the role incentives played in the housing collapse:

“Many, if not most, of the parties involved in the mortgage meltdown were doing what makes sense for them—even if it wasn’t good for the system overall. Homeowners got to live in fancier homes, mortgage brokers earned fees on the mortgages they originated without having to worry about the quality of the loans, investment banks earned tidy fees buying, packaging, and selling these loans, rating agencies made money, and investors earned extra yield on so-called AAA securities. So it’s a big deal to watch and unpack incentives.”

Regulation, penalties, and fines are means of creating preventative incentives against improper or unfair behavior. Just as people have no incentive to wash a rental car, nor do high frequency traders have an incentive to invest in equity securities for any extended period of time. Adding a Cuban tax may not be a cure-all for all our country’s financial woes, but as the regulatory reform debate matures in Congress, this taxing idea emanating from the King of Controversy may be a good place to start.

Read full blog article written by Mark Cuban

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

*DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds and an AIG subsidary structured security, but at the time of publishing SCM had no direct positions in YHOO, C, AIG, LM, GS, BRKA, or any security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

John Mauldin: The Man Who Cries Wolf

We have all heard about the famous Aesop fable about The Boy Who Cried Wolf. In that story, a little boy amuses himself by tricking others into falsely believing a wolf is attacking his flock of sheep. After running to the boy’s rescue multiple times, the villagers became desensitized to the boy’s cries for help. The boy’s pleas ultimately get completely ignored by the villagers despite an eventual real wolf attack that kills the boy’s flock of sheep.

Mauldin: The Man Who Cries Bear

John Mauldin, former print shop professional and current perma-bear investment strategist, unfortunately seems to have taken a page from Aesop’s book by consistently crying for a market collapse. After spending many years wrongly forecasting a bear market, his dependable pessimism eventually paid dividends in 2008. Unfortunately for him, rather than reverse his downbeat outlook, he stepped on the pessimism pedal just as the equity markets have exploded upwards more than +80% from the March lows of last year. Mauldin is widely followed in part to his thoughtful pieces and intriguing contributing writers, but as some behavioral finance students have recognized, being bearish or cautious on the markets always sounds smarter than being bullish. I’m not so sure how smart Mauldin will sound if he’s wrong on the direction of the next 80% move?

The Challenged Predictor

I find it interesting that a man who freely admits to his challenged prediction capabilities continues to make bold assertive forecasts. Mauldin freely confesses in his writings about his inability to manage money and make correct market forecasts, but that hasn’t slowed down the pessimism express. Just two years ago as the financial crisis was unfolding, Mauldin admits to his poor fortune telling skills with regards to his annual forecast report each January:

“ I was wrong (as usual) about the stock markets.”

Here’s Mauldin explaining why he decided to switch from investing real money to the simulated version of investment strategy and economic analysis:

“I wanted to begin to manage money on my own… I found out as much about myself as I did about market timing. What I found out was that I did not have the emotional personality (the stomach?) to directly time the markets with someone else’s money… I simply worried too much over each move of the tape.”

Apparently timing the market is not so simple? Readers of Investing Caffeine understand my feelings about market timing (read Market Timing Treadmill piece) – it’s a waste of time. Market followers are much better off listening to investors who have successfully navigated a wide variety of market cycles (see Investing Caffeine Profiles), rather than strategists who are constantly changing positions like a flag in the wind. I wonder why you never hear Warren Buffett ever make a market prediction or throw out a price target on the Dow Jones or S&P 500 indexes? Maybe buying good businesses or investments at good prices, and owning them for longer than a nanosecond is a strategy that can actually work? Sure seems to work for him over the last few years.

When You’re Wrong

Typically a strategist utilizes two approaches when they are wrong:

1) Convert to Current Consensus: Most strategists change their opinion to match the current consensus thinking. Or as Mauldin described last year, “I expect that this year will bring a few surprises that will cause me to change my opinions yet again. When the facts change, I will try and change with them.” The only problem is…the facts change every day (see also Nouriel Roubini).

2) Push Prediction Out: The other technique is to ignore the forecasting mistake and merely push out the timing (see also Peter Schiff). A simple example would be of Mr. Mauldin extending his recession prediction made last April, “We are going to pay for that with a likely dip back into a recession in 2010,” to his current view made a few weeks ago, “I put the odds of a double-dip recession in 2011 at better than 50-50.”

More Mauldin Mistake Magic

Well maybe I’m just being overly critical, or distorting the facts? Let’s take a look at some excerpts from Mauldin’s writings:

A. January 10, 2009 (S&P @ 890):

Prediction: “I now think we will be in recession through at least 2009 before we begin a recovery….We could see a tradable rally in the next few months, but at the very least test the lows this summer, if not set new lows….It takes a lot of buying to make a bull market. It only takes an absence of buying to make a bear market.”

Outcome: S&P 500 today at 1,179, up +32%. Oops, maybe the timing of his recovery forecast was a little off?

B. February 14, 2009 (S&P @ 827):

Prediction/Advice: “Let me reiterate my continued warning: this is not a market you want to buy and hold from today’s level. This is just far too precarious an economic and earnings environment.”

Outcome: S&P 500 up +45%. You pay a cherry price for certainty and consensus.

C. April 10, 2009 (S&P @ 856):

Prediction: “All in all, the next few years are going to be a very difficult environment for corporate earnings. To think we are headed back to the halcyon years of 2004-06 is not very realistic. And if you expect a major bull market to develop in this climate, you are not paying attention.” On the economy he adds, “We are going to pay for that with a likely dip back into a recession in 2010.”

Outcome: S&P 500 up +38%, with the economy currently in recovery. Interestingly, his comments on corporate earnings in February 2009 referenced an estimate of $55 in S&P 2010. Now that we are 14 months closer to the end of 2010, not only is the consensus estimate much firmer, but the 2010 S&P estimate presently stands at approximately $75 today, about +36% higher than Mauldin was anticipating last year.

D. May 2, 2009 (S&P @ 878):

Prediction: “This rally has all the earmarks of a major short squeeze. ..When the short squeeze is over, the buying will stop and the market will drop. Remember, it takes buying and lot of it to move a market up but only a lack of buying to create a bear market.”

Outcome: S&P 500 up +36%.

Now that we have entered a new year and experienced an +80% move in the market, certainly Mauldin must feel a little more comfortable about the current environment? Apparently not.

E. April 2, 2010 (S&P @ 1178):

Prediction: “ I think it is very possible we’ll see another lost decade for stocks in the US. If we do have a recession next year, the world markets are likely to fall in sympathy with ours.”

Outcome: ????

Previous Mauldin Gems

Here are few more gloomy gems from Mauldin’s bearish toolbox of yester-year:

2005: “The market is a sideways to down market, with the risk to the downside as we get toward the end of the year and a possible recession on the horizon in 2006. And not to put too fine a point on it, I still think we are in a long term secular bear market.” Reality: S&P 500 up +5% for the year and up a few more years after that.

2006: “This year I think the market actually ends the year down, and by at least 10% or more during the year. Reality: S&P 500 up +14% (excluding dividends).

2007: Mauldin’s rhetoric was tamed in light of poor predictions, so rhetoric switches to a “Goldilocks recession” and a mere -10-20% range correction. He goes on to dismiss a deep bear market, “In future letters we will look at why a deep (the 40% plus that is typical in recession) stock market bear is not as likely.” Reality: S&P 500 up +5%. Looks like the writing on the wall for 2008 turned out a bit worse than he expected.

2008: Sticking to soft landing outlook Mauldin states, “I think this will be a mild recession … I don’t think we are looking at anything close to the bear market of 2000-2001.” Uggh. Ultimately, the bear market turned out to be the worst market since 1973-1974 – his prediction was just off by a few decades. Reality: S&P 500 down -37%.

Lessons Learned from Market Strategists

I certainly don’t mean to demonize John Mauldin because his writings are indeed very thoughtful, interesting and include provocative financial topics. But put in the wrong hands, his opinions (and dozens of other strategists’ views) can be extremely dangerous for the average investor trying to follow the ever-changing judgments of so-called expert strategists. To Mauldin’s credit, his writings are archived publicly for everyone to sift through – unfortunately the media and many average investors have short memories and do not take the time to hold strategists accountable for their false predictions. Although, Iike Warren Buffett, I do not make market timing predictions or forecast short-term market trends, I see no problem in strategists making bold or inaccurate forecasts, as long as they are held responsible. Every investor makes mistakes, unfortunately, strategist predictions are usually not readily available for analysis, unlike tangible investment manager performance numbers. When forecasting lightning strikes and extreme bets win, every newspaper, radio show, and media outlet has no problem of placing these soothsayers on a pedestal. Thanks to the law of large numbers and the constantly shifting markets, there will always be a few outliers making correct calls on bold predictions. Who knows, maybe Mauldin will be the next CNBC guru du jour in the future for predicting another lost decade of equity market performance (see Lost Decade article)?

Regardless of your views on the market, the next time you hear a financial strategist make a bold forecast, like John Mauldin crying wolf, I urge you to not go running with the motivation to alter your investment portfolio. I suppose the time to become frightened and drive the REAL wolf (bear market) away will occur when consistently pessimistic strategists like Mauldin turn more optimistic. Until then, tread lightly when it comes to acting on financial market forecasts and stick to listening to long-term, successful investors that have invested their own money through all types of market cycles.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

*DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct positions in any security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Shanking Your Way to Success: Tiger Woods & Roger McNamee

Spring has sprung and that means golf is back in full swing with the Masters golf tournament kicking off next week in Augusta, Georgia. Next week also marks the return of Tiger Woods in his first competition since news of Tiger’s sex scandal and car crash originally broke. As an avid golf fan (and occasional frustrated player), I must admit I do find a devilish sense of guilty pleasure every time I see a pro golfer shank a ball into the thick of the woods or plop one in the middle of the drink. I mean, how many hundreds of balls have I donated to golf courses across this great nation? Let’s face it, no matter how small, people derive some satisfaction from seeing others commit similar mistakes…misery loves company. Even the world’s elite, including Tiger Woods, slip up periodically.

For quite possibly the worst, nightmarish, meltdown classic of all-time, you may recall Frenchman John van de Velde’s 18th hole collapse at the 1999 British Open in Carnoustie, Scotland.

Investment Pros Shank Too

Investment legend Peter Lynch (see Investment Caffeine profile on Lynch), who trounced the market with a +29% annual return average from 1977-1990, correctly identified the extreme competitiveness of the stock-picking world when he stated, “If you’re terrific in this business you’re right six times out of ten.” Even with his indelible record, Lynch had many disastrous stocks, including American International Airways, which went from $11 per share down to $0.07 per share. Famous early 20th Century trader Jesse Livermore puts investment blundering into context by adding, “If a man didn’t make mistakes he’d own the world in a month.”

Mistakes, plain and simply, are a price of playing the investment game. Or as the father of growth investing Phil Fisher noted (see Investment Caffeine profile on Fisher), “Making mistakes is an inherent cost of investing just like bad loans are for the finest lending institutions.”

McNamee’s Marvelous Misfortune

Since the investment greats operate under the spotlight, many of their poor decisions cannot be swept under the rug. Take Roger McNamee, successful technology investor and co-founder of Elevation Partners (venture capital) and Silver Lake Partners (private equity). His personal purchase of 2.3 million shares ($37 million) in smartphone and handheld computer manufacturer Palm Inc. (PALM) has declined by more than a whopping -75% since his personal purchase just six months ago at $16.25 share price (see also The Reformed Broker). McNamee is doing his best to recoup some of his mojo with his hippy-esque band Moonalice – keep an eye out for tour dates and locations.

Lessons Learned

More important than making repeated mistakes is what you do with those mistakes. “Insanity is doing the same thing over and over again, and expecting different results,” observed Albert Einstein. Learning from your mistakes is the most important lesson in hopes of mitigating the same mistakes in the future. Phil Fisher adds, “I have always believed that the chief difference between a fool and a wise man is that the wise man learns from his mistakes, while the fool never does.” As part of my investment process, I always review my errors. By explicitly shaming myself and documenting my bad trades, I expect to further reduce the number of poor investment decisions I make in the future.

With the Masters just around the corner, I must admit I eagerly wait to see how Tiger Woods will perform under extreme pressure at one of the grandest golf events of the year. I will definitely be rooting for Tiger, although you may see a smirk on my face if he shanks one into the trees.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

*DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing had no direct positions in PALM or any security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

![steve_jobs[2]](https://investingcaffeine.com/wp-content/uploads/2010/07/steve_jobs21.jpg?w=455)