Posts filed under ‘Banking’

Wall Street Meets Greed Street

For investors, the emotional pendulum swings back and forth between fear and greed. Wall Street and large financial institutions, however, are driven by one single mode…and that is greed. This is nothing new and has been going on for generations. Over the last few decades, cheap money, loose regulation, and a relatively healthy economy have given Wall Street and financial institutions free rein to take advantage of the system.

Not only did the financial industry explode, but the large got much larger. The FCIC (Financial Crisis Inquiry Commission), a government appointed commission, highlighted the following:

“By 2005, the 10 largest U.S. commercial banks held 55% of the industry’s assets, more than double the level held in 1990. On the eve of the crisis in 2006, financial sector profits constituted 27% of all corporate profits in the United States, up from 15% in 1980.”

What’s more, the obscene profits were achieved with obscene amounts of debt:

“From 1978 to 2007, the amount of debt held by the financial sector soared from $3 trillion to $36 trillion, more than doubling as a share of gross domestic product.”

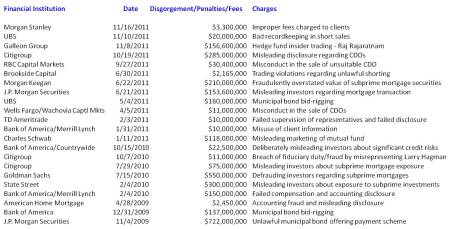

Times have changed, and financial institutions have gone from victors to villains. Sluggish economic growth in developed countries and choking levels of debt have transitioned political policies from stimulus to austerity. This in turn has created social unrest. Who’s to blame for all of this? Well if you watch the evening news and Occupy Wall Street movement, it becomes very easy to blame Wall Street. Certainly, fat cat bankers deserve a portion of the blame. As one can see from the following list, over the last few years, the financial industry has paid for its sins with the help of a checkbook:

The disgusting amount of inequitable excess is smeared across the whole industry in this tiny, partial list. Billions of dollars in penalties and disgorged assets isn’t insignificant, but besides Bernie Madoff and Raj Rajaratnam, very little time has been scheduled behind bars for the perpetrators.

Whom Else to Blame?

Are the greedy bankers and financial institution operators the only ones to blame? Without doubt, lack of government enforcement and adequate regulation, coupled with a complacent, debt-loving public, contributed to the creation of this financial crisis monster. When the economy was rolling along, there was no problem in turning a blind-eye to subversive activity. Now, the greed cannot be ignored.

At the end of the day, voters have to correct this ugly situation. The general public and Occupy Wall Street-ers need to boycott corrupt institutions and vote in politicians who will institute fair and productive regulations (NOT more regulations). Sure corporate financial lobbyists will try to tip the scales to their advantage, but a vote from a lobbyist attending a $10,000 black-tie dinner carries the same weight as a vote coming from a Occupy Wall Street-er paying $5 for a foot-long sandwich at Subway. As Thomas Jefferson stated, “A democracy is nothing more than mob rule, where fifty-one percent of the people may take away the rights of the other forty-nine.”

Investor Protocol

Besides boycotting greedy institutions and using the voting booth, what else should individuals do with their investments in this structurally flawed system? First of all, find independent firms with a fiduciary duty to act in your best interest, like an RIA firm (Registered Investment Advisor). Brokers, financial consultants, financial advisors, or whatever euphemism-of-the-day is being used for an investment product pusher, may not be evil, but their incentives typically are not aligned to protect and grow your financial future (see Fees, Exploitation, and Confusion and Letter Shell Game).

There is a lot of blame to be spread around for the financial crisis, and the intersection of Wall Street and Greed Street is a major contributing factor. However, investors and voters need to wake up to the brutal realities of our structurally flawed system and take matters into their own hands. Only then can Main Street and Wall Street peacefully coexist.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in MS, UBS, C, JPM, WFC, SCHW, AMTD, BAC, GS, STT, Galleon, RBC, Subway, Amer Home, Brookside Captl, Morgan Keegan, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Reality More Fascinating than Fiction

Make-believe is fun, but reality is often more fascinating than fiction. The same can be said for the books I read. Actually, all the books reviewed at Investing Caffeine have been non-fiction. My movie-viewing preferences happen to be quite similar – comedies and dramas are terrific, but I’m also a documentary fanatic. As a matter of fact, I have rented or watched more than 125 documentaries (and mockumentary, This is Spinal Tap) over the last six years.

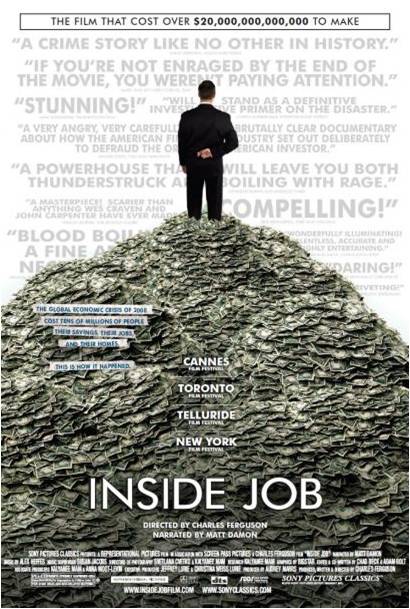

There have been a slew of non-fiction books written about the recent global financial crisis, including the ones I reviewed: Too Big to Fail, The Greatest Trade Ever, and The Big Short. When it comes to videos, I have seen several TV-based documentaries covering various aspects of the global meltdown, but the Inside Job did an exceptionally good job of providing a global perspective of the financial collapse. The film was produced, written, and directed by Charles Ferguson (you can call him “doctor” thanks to the Ph.D he earned at MIT) and also narrated by Academy Award winner Matt Damon. The Inside Job provided a comprehensive worldly view by filming on location in the United States, Iceland, England, France, Singapore, and China. Not only did Ferguson break down the complex facets of the crisis into easily digestible pieces for the audience, but he also features prominent journalists, politicians, and academics who describe the complicated global events from a birds-eye view. Hedge fund manager George Soros, former Federal Reserve Chairman Paul Volcker, former New York Governor Eliot Spitzer, and economist Nouriel Roubini, are a small subset of the heavy-hitters interviewed in the movie.

A wide range of causes and effects were explored – everything from derivatives, lack of regulation, excessive banker compensation, and the pervasive conflicts of interest throughout the financial system. Bankers and politicians shoulder much of the blame for the global crisis, and Ferguson does not go out of his way to present their side of the story. Ferguson does a fairly decent job of keeping his direct personal political views out of the film, but based on his undergraduate Berkeley degree and his non-stop Goldman Sachs (GS) bashing, I think someone could profitably prevail in wagering on which side of the political fence Ferguson resides.

Although I give Inside Job a “thumbs-up,” I wasn’t the only person who liked the movie. The Inside Job in fact won numerous awards, including the 2010 Academy Award for Best Documentary, Best Documentary from the New York Film Critics Circle, and the Best Documentary Screenplay from the Writers Guild.

Slome’s Oscar Nominees

As I mentioned previously, I am somewhat fanatical when it comes to documentaries, although I have yet to see Justin Bieber’s Never Say Never. Besides the Inside Job, here is a varied list of must-see documentaries. There may be a conflict of personal tastes on a few of these, but I will provide you a hand-written apology for anybody that falls asleep to more than one of my top 15:

1) Murderball

5) Hoop Dreams

6) Lewis and Clark: The Journey (Ken Burns)

8) Enron: The Smartest Guys in the Room

10) Paradise Lost

11) The Endurance

14) The Devil Came on Horseback

15) Emmanuel’s Gift

I’m obviously biased about the quality of my recommended documentaries, but you can even the score by sharing some of your favorite documentaries in the comment section below or by emailing me directly. I will be greatly indebted for any suggestions offered. Regardless, whether watching a truth-revealing thought-piece like the Inside Job or A Crude awakening, or an inspirational story like Murderball or Touching the Void, I’m convinced that these reality based stories are much more fascinating than the vast majority of recycled fiction continually shoveled out by Hollywood. For those adventurous movie-watchers, check out a documentary or two – who knows…there may be an inner-documentary fanatic in you too?

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in GS, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Membership Privileges: Cheese Tubs & Space Travel

With Senate proposals pushing to cap debit card fees earned by the credit card companies (Visa Inc. [V] and MasterCard Inc. [MA]), you better hurry up and take advantage of underappreciated membership privileges while you still can. The card companies are not too happy, but maybe they deserve some legitimate sympathy. I mean, supporting banks that gouge customers at rates reaching upwards of 20% can be challenging for any card network oligopoly to handle. So before Congress strips away the card companies’ God-given right to siphon away fees from millions of Americans, you have the obligation to utilize the membership privileges of your credit card – even if those benefits include using Visa’s concierge services for purchasing a giant tub of nacho cheese or booking a space travel trip. Unfortunately, many cardholders are unaware they carry the power of a personal servant in their wallet or purse. Tim Ferriss, creator of Experiments in Life Design, on the other hand chose to repeatedly use his personal servant to handle some of the most mission critical responsibilities you could imagine…for example:

1) Punch Bowl Tub of Cheese: Ferriss didn’t make his request for a tub of cheese completely uncompromising, but rather he was flexible in his demands. When the Visa concierge, David, asked Ferris what size cheese container he wanted, Ferriss reasonably responded, “Can, jar, tub, I don’t care. I just want liquid cheese, and a lot of it.”

2) Crossword Magicians: Why get flustered with a USA Today crossword clue (“Blue Grotto Locale”) when you can simply ring Maurice, your trusty Visa crossword concierge to solve the puzzle? Ferris used this approach and found the method much classier than using a computer or phone to find the answer. The answer to 62 across: ISLE OF CAPRI.

3) Feeling Blue? No problem, daily affirmations are just a few keypad strokes away from your fingertips. Getting told he was “good enough” by Jamie the concierge was a little ambitious, but Ferriss was satisfied by receiving a third party affirmation service along with a gratuitous note from Jamie letting him know what a good person he was.

4) Going Galactic: Now that he was getting warmed up, Ferriss had loftier goals (no pun intended). Specifically he requested the concierge to “book a trip to space.” Ferriss was not let down – the Visa Signature concierge came through with a $200,000 price quote from Virgin Galactic.

5) Looking at Limitations: Overall, the concierge service delivered on its mission of fielding random requests and answering questions. Nonetheless, Visa Signature needed a little more time to complete a self assessment of the services Visa could NOT perform (e.g., plan a wedding, call a friend, or write an article). Eventually Ferriss received an adequate response and went on to complete his prank-a-thon.

Believe it or not, some financial institutions provide services to you without charging you an arm and a leg. Maybe the card companies already have enough arms and legs to keep themselves content, but given political pressure on Visa and MasterCard, you better book that space flight and place that cheese tub order ASAP.

Read Full Tim Ferriss Article on Concierge Services (post was originally published on Credit Card Chaser)

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

*DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct positions in V, MA, Virgin, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Goldman Cheat? Really?

Really? Am I supposed to be surprised that the SEC (Securities and Exchange Commission) has dug up a CDO (Collateralized Debt Obligation) deal with $1 billion in associated Goldman Sachs (GS) losses? The headline number may sound large, but the billion dollars is not much if you consider banks are expected to lose about $3 trillion dollars (according to an International Monetary Fund report) from toxic assets and bad loans related to the financial crisis. Specifically, Goldman is being charged for defrauding investors for not disclosing the fact that John Paulson (see Gutsiest Trade), a now-famous hedge fund manager who made billions by betting against the subprime mortgage market, personally selected underlying securities to be included in a synthetic CDO (a pool of mortgage derivatives rather than a pool of mortgage securities).

Hurray for the SEC, but surely we can come up with more than this after multiple years? More surprising to me is that it took the SEC this long to come up with any dirt in the middle of a massive financial pigpen. What’s more, the estimated $1 billion in investor losses associated with the Goldman deal represents about 0.036% of the global industry loss estimates. These losses are a drop in the bucket. If there is blood on Goldman’s hand, my guess is there’s enough blood on the hands of Wall Street bankers to paint the White House red (two coats). The Financial Times highlighted a study showing Goldman was a relative small-fry among the other banks doing these type of CDO deals. For 2005-2008, Goldman did a little more than 5% of the total $100+ billion in similar deals, earning them an unimpressive ninth place finish among its peers. As a matter of fact, Paulson also hocked CDO garbage selections to other banks like Deutsche Bank, Bear Stearns, and Credit Suisse. The disclosure made in those deals will no doubt play a role in determining Goldman’s ultimate culpability.

Context, with regard to the fees earned by Goldman, is important too. Goldman earned less than 8/100th of 1% of their $20 billion in pretax profits from the Abacus deal. Not to mention, unless other charges pile up, Goldman’s roughly $850 billion in assets, $170 billion in cash and liquid securities, and $71 billion in equity should buttress them in any future litigation. These particular SEC charges feel more like the government trying to convict Goldman on a technicality – like the government did with Al Capone on tax evasion charges. At the end of the day, the evidence will be presented and the courts will determine if fraud indeed occurred. If so, there will be consequences.

Demonize Goldman?

How bad can Goldman really be, especially considering their deep philanthropic roots (the firm donated $500 million for small business assistance), and CEO Lloyd Blankfein was kind enough to let us know he is doing “God’s work,” by providing Goldman’s rich menu of banking services to its clients.

Certainly, if Goldman broke securities laws, then there should be hell to pay and heads should roll. But if Goldman was really trying to defraud investors in this particular structured deal (called Abacus 2007-ACI), then why would they invest alongside the investors (Goldman claims to have lost $90 milllion in this particular deal)? I suppose the case could be made that Goldman only invested for superficial reasons because the fees garnered from structuring the deals perhaps outweighed any potential losses incurred by investing the firm’s own capital in these deals. Seems like a stretch if you contemplate the $90 million in losses overwhelmed the $15 million in fees earned by Goldman to structure the deal.

Maybe this will be the beginning of the debauchery flood gates opening in the banking industry, but let’s not fully jump on the Goldman Scarlet Letter bandwagon just quite yet. Politics may be playing a role too. The Volcker rule was conveniently introduced right after Senator Scott Brown’s Senate victory in Massachusetts, and political coincidence has reared its head again in light of the financial regulatory reform fury swelling up in Washington.

Waiting for More teeth

There is a difference between intelligent opportunism and blatant cheating. There is also a difference between immorally playing a game within the rules versus immorally breaking laws. Those participants breaking the law should be adequately punished, but before jumping to conclusions, let’s make sure we first gather all the facts. While the relatively minute Abacus deal may be very surprising to some, given the trillions in global losses caused by toxic assets, I am not. Surely the SEC can dig up something with more teeth, but until then I will be more surprised by Jesse Jame’s cheating on Sandra Bullock (with Michelle “Bombshell” McGee) than by Goldman Sachs’s alleged cheating in CDO disclosure.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

*DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct positions in GS, DB, Bear Stearns (JPM), and CSGN.VX/CS.N or any security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Banking Crisis Broken Record (1907 vs. 2007)

Like a spinning and skipping broken record, our history has been filled with an endless number of banking crises. And unfortunately, the financial crisis of 2008-2009 will not be our last (read more about rhyming history). Robert F. Bruner, professor and Dean at the Darden Graduate School of Business Administration, has studied the repetitive nature of banking crises and identified core foundational aspects present in these vicious financial events.

In a period spanning 105 years (1900 – 2005) Bruner references 31 separate crises occurring across the world in various countries. Just in the last handful of decades, Americans have experienced the seizure of the Continental Illinois National Bank and Trust Company (1984), the S&L crisis (Savings & Loan – late 1980s), the disintegration of Long-Term Capital Management (1998), followed by the recent falling of dominoes in the first decade of the 21st Century (Bear Stearns, Lehman Brothers, Wamu, AIG, etc.). What do many of these crises have in common?

In comparing the recent global financial crisis, Bruner compares the recent events to the “Panic of 1907” – the last financial crisis before the creation of the Federal Reserve System in 1913. The last few years have been rough, but a century ago San Franciscans endured the mother of all crises. This is how Bruner described the time period:

“The San Francisco earthquake of 18 April 1906 triggered a massive call on global gold reserves and a liquidity crunch in the United States. A recession commenced in June 1907. Security prices declined. In September, New York City narrowly averted a failure to refinance outstanding bonds. Then, on 16 October, a “bear squeeze” speculation failed and rendered two brokerage firms insolvent. The next day, depositors began a run on Knickerbocker Trust Company…Runs spread to other trust companies and banks in New York City. And the panic rippled across the United States.”

Bruner highlights four key factors inherent in these, and other, financial crises. Here is a summary of the four elements:

Existence of Systemic Structure: In order for a crisis to occur, an economy needs a collection of linked financial intermediaries to form a system. Throughout history, transactions and deposits have connected to multiple systems around the globe.

Systemic Instability: Hyman Minsk, a renowned 20th Century economist, was known for his thoughts on his “Financial Instability Hypothesis.” At the core of Minsky’s crisis beliefs was the idea that economic slumps were caused by the credit cycle. At the late stages of an economic cycle there is a larger appetite to assume additional risk and debt. A spiraling vortex can occur as “Easy credit amplifies the boom, and tight credit amplifies the contraction,” Minsky states.

Systemic Shock: Beyond an unstable system, a crisis needs a spark. For Bruner that spark must have four characteristics:

- Real, Not Apparent: The shock must be “real, not apparent.” The disturbance must be disruptive enough to shake the trust of the financial system and be large enough to have a real economic impact (e.g., new technologies, massive labor strike, deregulation, or even an earthquake).

- Large: The trigger of a financial crisis must be large enough to shift the outlook of investors.

- Unambiguous and Difficult to Repeat: The shock must unambiguously stand out from the standard marketplace news.

- Surprising: The event must be unanticipated and cause a shift in thinking.

Response and Intervention: Effectively, the response to a shock converts an overconfident boom into fear and pessimism. The reply can often be an overreaction to the existing fundamentals, which flies in the face of efficient markets and rational decision making.

According to Bruner, crises including the one triggered by the earthquake of 1906 carry the four previously mentioned elements.

Solution = Leadership

At the vortex of any financial crisis lies fear and panic, which require leadership to mitigate the damage. John Pierpont “J.P.” Morgan, semi-retired banking executive, orchestrated leadership in 1907 by organizing a rescue of “trust companies, banks, the New York Stock Exchange, New York City, and the brokerage firm of Moore and Schley.”

Time will tell and history will judge whether Federal Reserve Chairman Ben Bernanke and Treasury Secretaries Hank Paulson and Timothy Geithner provided the necessary leadership to sustainably lead us out of the financial crisis. Of course, decisions made by the key U.S. leadership figures are not made in a vacuum, so choices made by our international brethren can impact the success of our monetary and fiscal policies too.

There have been 18 substantial global bank crises since World War II and the recent credit-induced collapse will not be the last as long as Bruner’s four elements of a crisis exist (structure, instability, shock, and intervention). The ultimate outcome of a crisis will be dependent on the nature of leadership, coordinated government intervention, and regulation. The global economic record will continue spinning, but with Robert Bruner’s lessons learned from the Panic of 1907, hopefully the music will last for a very long time before skipping on a crisis again.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds and a derivative security of an AIG insurance subsidiary, but at time of publishing had no direct positions in JPM. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

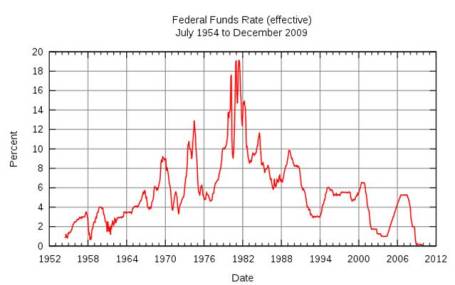

Fed Ponders New Surgical Tool

The Fed is closely monitoring the recovering patient (the U.S. economy) after providing a massive dose of monetary stimulus. The patient is feeling numb from the prescription, but if the Fed is not careful in weaning the subject off the medicine (dangerously low Federal Funds rate), dangerous side- effects such as a brand new bubble, rampant inflation, or a collapsing dollar could ensue.

In preparing for the inevitable pain of the Federal Reserve’s “exit strategy,” the institution is contemplating the use of a new tool – interest rates paid to banks on excess reserves held at the Fed. A likely by-product of any deposit-based rate increase will be higher rates charged on consumer loans.

Currently, the Federal Reserve primarily controls the targeted Federal funds rate (the rate at which banks make short-term loans to each other) through open market operations, such as the buying and selling of government securities. Specifically, repurchase agreements made between the Federal Reserve and banks are a common strategy used to control the supply and demand of money, thereby meeting the Fed’s interest rate objective.

Although a relatively new tool created from a 2006 law, paying interest on excess reserves can help in stabilizing the Federal Funds rate when the system is awash in cash – the Fed currently holds over $1 trillion in excess reserves. Failure to meet the inevitably higher Fed Funds target is a major reason policymakers are contemplating the new tool. The Fed started paying interest rates on reserves, presently 0.25%, in the midst of the financial crisis in late 2008. Rate policy implementation based on excess reserves would build a stable floor for Federal Funds rate since banks are unlikely to lend to each other below the set Fed rate. The excess reserve rate-setting tool, although a novel one for the United States, is used by many foreign central banks.

Watching the Fed

While the Fed discusses the potential of new tools, other crisis-originated tools designed to improve liquidity are unwinding. For example, starting February 1st, emergency programs supporting the commercial paper, money market, and central bank swap markets will come to a close. The closure of such program should have minimal impact, since the usage of these tools has either stopped or fizzled out.

Fed watchers will also be paying attention to comments relating to the $1 trillion+ mortgage security purchase program set to expire in March. A sudden repeal of that plan could lead to higher mortgage rates and hamper the fragile housing recovery.

When the Fed policy makers meet this week, another tool open for discussion is the rate charged on emergency loans to banks – the discount rate (currently at 0.50%). Unlike the interest rate charged on excess reserves, any change to the discount rate will not have an impact charged on consumer loans.

While the Fed’s exit strategy is a top concern, market participants can breathe a sigh of relief now that Federal Reserve Chairman Ben Bernanke has been decisively reappointed – lack of support would have resulted in significant turmoil.

The patient (economy) is coming back to life and now the extraordinary medicines prescribed to the subject need to be responsibly removed. As the Federal Reserve considers its range of options, old instruments are being removed and new ones are being considered. The health of the economy is dependent on these crucial decisions, and as a result all of us will be carefully watching the chosen prescription along with the patient’s vital signs.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds but at the time of publishing had no direct positions in securities mentioned in the article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Banking Surgery or Amputation?

Deciding whether to sever the proprietary trading arms of the commercial banks, rather than instituting regulation, seems a lot like deciding whether amputation is a healthier path for those suffering terrible frostbite cases. Even if this legislation is unlikely to pass, I find the recommendations severe in relation to other measured alternatives. I’m no right-wing conspiracy theorist, but I don’t think the timing of the Obama administration’s announcement is coincidental. Why is this proposal surfacing two years into the financial crisis and a whole year after the President entered office?

Politicians have always been masterful at introducing coincidental distractions at opportune times, in order to generate patriotic voter sympathies. Some examples include, Margaret Thatcher in the Falkand Islands; George Bush #41 in the Iraqi war; and President Obama’s current ant-banker populist brigade. Perhaps miserable and declining approval ratings and a healthcare bill on the verge of collapse may have something to do with the timing? I want President Obama to succeed, and he may have good intentions, but let’s not rush to an overzealous knee-jerk reactions before other less-draconian solutions are thoroughly explored.

Glass-Steagall Redux

Theoretically, the argument of forcing banks to adopt lower risk sounds great on paper. Overall, I think this initiative is a worthy one Americans could buy into. As a matter of fact, investment guru Jeremy Grantham makes the same argument in my Investing Caffeine article (“Too Big to Sink”). However, I think a more relevant question is, “How do we implement more responsible risk taking by the banks, without a massive overhaul to the system?” Certainly there were some regulators asleep at the switch, and some financial institutions that pushed the envelope on risk assumption, but I’m not convinced a return to Glass-Steagall (or Glass-Steagall Lite) is going to bring miracles. If the regulators cannot adequately curb risk taking by the banks, then cross the more dangerous bridge later. The economy is presently in the midst of a fragile recovery and we do not want to change the airplane engine during mid-flight.

Political Pendulum Swings

This isn’t the first time Washington has reversed previous decisions. If the cries of voters reach a feverish pitch, and these wishes coincide with a politician’s re-election agenda, then the probabilities of sub-optimal, rushed legislation increases. Consider AT&T (T), which because of antitrust concerns was forced to split operations in 1982. Lo and behold, some twenty years later, we witnessed the re-consolidation of the “Baby Bells” back into AT&T. Now, Glass-Steagall is the topic of conversation and with an unambiguous scapegoat needed by politicians, Washington is targeting the banks with taxes and operations splitting.

Hasty legislation is nothing new with the populist flames fanning in the background. Sarbanes-Oxley is another example of less-than-ideal legislation introduced in the wake of relatively low number of corporate scandals, such as Enron, WorldCom, and Tyco (TYC).

Regulation Reform Solution

Here are 3 constructive steps:

1) Institute transparent trading of derivatives (i.e., Credit default Swaps) over exchanges with adequately capitalized clearing houses.

2) Require higher capital requirements for banks conducting proprietary trading and mandate adequate disclosure.

3) Consolidation of regulators, thereby creating a more simplified, accountable structure (see also Regulatory Web article). Savings from redundant costs could be used to hire additional regulatory oversight staff.

Blood is in the streets and with mid-term elections just around the corner, the Obama administration is looking to salvage anything they can bring back to the voters. Frost bite (and greedy bankers) is a painful and horrible predicament, however if healthy functioning limbs can be saved with targeted surgery rather than amputation, then I vote for this solution.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds (including VFH), and at the time of publishing had no direct positions in T, TYC. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

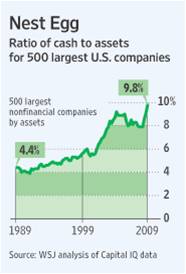

Cash Pile Still Growing

Despite the sluggish economic reports, corporate cash piles have been expanding (see “Nest Egg” chart), thanks to aggressive cost-cutting, stabilization in GDP numbers, and meager capital programs. As part of stingy CFOs and executives controlling expenses, companies have been slow to hire despite an expected two quarters of economic growth. Job hiring is likely to remain scarce since capacity utilization and capital expenditures will probably remain priorities before job payrolls expand. It may be that jobs were the first area cut as the crisis unfolded and the last aspect to rebound in the economic expansion.

As the saying goes, “A bank only lends to those people whom do not need it.” Common knowledge has it that most jobs are created from small and medium sized businesses (SMBs). Unfortunately, the inaccessibility of loans for these SMBs has contributed to the lackluster job recovery. The hemorrhaging of jobs has slowed to a trickle, but sustainable recovery will eventually require new, substantive job creation. Rather than fund what appear to be risky loans to SMBs, banks are choosing to repair their weary balance sheets to reap the benefits of a very steep yield curve (borrowing at low short-term interest rates and lending at relatively high long-term interest rates). Bankers are not the only people stockpiling cash (see other article on cash). On the capital raise side, larger corporations have had more success in tapping the capital credit markets since bond issuance has been flowing nicely.

As multi-national corporations continue to benefit from a relatively weak dollar and Wall Street persists to underestimate the trajectory of the U.S. corporate profit rebound, banks are hoarding more capital, which is leading to a larger cash pile. When will all this cash reflow back into the marketplace? The timing is unclear, but if the profitability and hoarding trends continue, the low-yielding cash piles spoiling on the balance sheets are likely to be released into the economy in the form of capital expenditures and rehiring. Job seekers will breathe a sigh of relief once these corporate wallets become too uncomfortably fat.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds (such as VFH), but at time of publishing had no direct position in any company mentioned in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Too Big to Fail (Review)

Some call Andrew Ross Sorkin’s new behind-the-scenes book about the financial crisis of 2008-2009 “Too Big to Read” due to its meaty page count at 624 pages (a tad more than my book). But actually, once you crack the first chapter of Too Big to Fail you become immediately sucked in. In creating the “fly on the wall” perspective covering the elite power brokers of Wall Street and Washington, Sorkin utilizes 500 hours of interviews with more than 200 individuals.

Through the detailed and vivid conversations, you get the keen sense of overwhelming desperation and self-preservation that overtakes the executives of the sinking financial system. Some of the chief participants failed, some were triumphant, and some were pathetically bailed out. History will ultimately be the arbiter of whether government and Wall Street averted, mitigated, postponed, or contributed to the financial collapse. Regardless, Sorkin brilliantly encapsulates this emotionally panicked period in our history that will never be erased from our memories.

Here are a few passages that capture the feeling and mood of the book:

Merger Musical Chairs

The terror-induced insanity of merger musical chairs is best depicted through the notepad of Timothy Geithner, then the president of the New York Federal Reserve Bank:

“On a pad that morning, Geithner started writing out various merger permutations: Morgan Stanley and Citigroup. Morgan Stanley and JP Morgan Chase. Morgan Stanley and Mitsubishi. Morgan Stanley and CIC. Morgan Stanley and Outside Investor. Goldman Sachs and Citigroup. Goldman Sachs and Wachovia. Goldman Sachs and Outside Investor. Fortress Goldman. Fortress Morgan Stanley. It was the ultimate Wall Street chessboard.”

AIG Bombshell

The book is also laced with financial nuggets to put the scope of the crisis in perspective. Here Sorkin examines the distressed call of assistance from AIG CEO, Bob Willumstad, to Timothy Geithner:

“A bombshell that Willumstad was confident would draw Geithner’s attention-was a report on AIG’s counterparty exposure around the world, which included ‘$2.7 trillion of notional derivative exposures, with 12,000 individual contracts.” About halfway down the page, in bold, was the detail that Willumstad hoped would strike Geithner as startling: “$1 trillion of exposures concentrated with 12 major financial institutions.’”

Bernanke’s Bumbled Spelling Bee

In setting the stage for the drama that unfolds, Sorkin also provides a background on the key players in the book. For example in describing Ben Bernanke you learn he was

“born in 1953 and grew up in Dillon South Carolina, a small town permeated by the stench of tobacco warehouses. As an eleven-year-old, he traveled to Washington to compete in the national spelling championship in 1965, falling in the second round, when he misspelled ‘Edelweiss.’”

TARP Tidbits

On how the precise $700 billion TARP (Troubled Asset Relief Program) figure was created, Sorkin describes the scattered thought process of the program designer Neel Kashkari:

“They knew they could count on Kashkari to perform some sort of mathematical voodoo to justify it: ‘There’s around $11 trillion of residential mortgages, there’s around $3 trillion of commercial mortgages, that leads to $14 trillion, roughly five percent of that is $700 billion.’ As he plucked numbers from thin air even Kashkari laughed at the absurdity of it all.”

Mercedes Moment

Mixed in with the facts and downbeat conversations are a series of humorous anecdotes and one-liners. Here is one exchange between Goldman Sachs CEO, Lloyd Blankfein, and his Chief of Staff Russell Horwitz:

“’I don’t think I can take another day of this,’ Horowitz said wearily. Blankfein laughed. ‘You’re getting out of a Mercedes to go to the New York Federal Reserve – you’re not getting out of a Higgins boat* on Omaha Beach! Keep things in perspective.’”

*Blankfein’s quote: A reference to the bloody D-Day battle.

Too Big to Fail is an incredible time capsule for the history books. Let’s hope we do not have to relive a period like this in our lifetimes. I wouldn’t mind reading another Andrew Ross Sorkin book…just not another one about a future financial crisis.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but did not have any direct positions in any stock mentioned in this article at time of publication (including GS, AIG, WFC, MS, and C). No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.